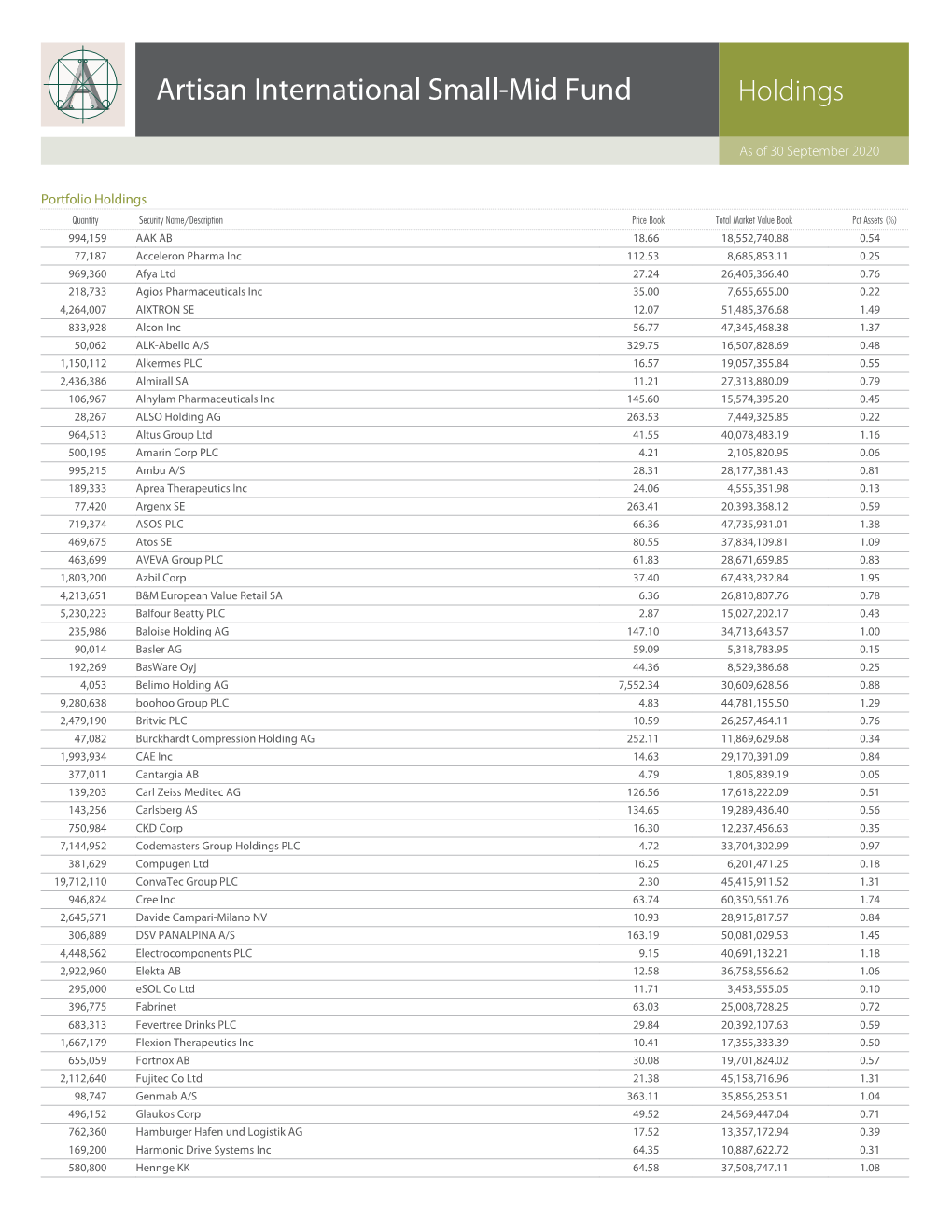

Holdings—Artisan International Small-Mid Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kion Group Ag 2016 [Pdf, 1.4

A NEW ERA This annual report is available in German and English. Only the content of the German version is authoritative. KION GROUP AG, Wiesbaden STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2016 € Notes 31/12/2016 31/12/2015 A. Non-Current Assets (3) Property, plant and equipment 145,428.39 216,259.58 Investments in affiliated companies 4,474,412,891.16 2,005,932,650.00 4,474,558,319.55 2,006,148,909.58 B. Current Assets I. Receivables and other assets (4) 1. Receivables from affiliated companies 965,752,435.23 243,601,512.08 2. Receivables from related companies 174,664.14 0.00 3. Other assets 8,119,209.80 5,205,087.06 974,046,309.17 248,806,599.14 II. Credit balances with banks 56,715,095.93 12,203.61 Total assets 5,505,319,724.65 2,254,967,712.33 € Notes 31/12/2016 31/12/2015 A. Equity (5) I. Subscribed capital 108,790,000.00 98,900,000.00 Treasury shares -164,486.00 -160,050.00 Issued capital 108,625,514.00 98,739,950.00 II. Capital reserves 2,465,553,486.47 2,015,727,529.03 III. Retained earnings 139,053,326.98 9,903,326.98 IV. Distributable profit 129,236,004.00 76,100,000.00 2,842,468,331.45 2,200,470,806.01 B. Provisions 1. Retirement benefit obligation (6) 20,319,088.00 13,515,388.00 2. Tax provisions 4,138,079.75 54.49 3. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Media R Elease

Frankfurt/Main, 5 December 2018 Carl Zeiss Meditec AG to be included in MDAX Three changes in SDAX/ Changes to be effective as of 27 December 2018 On Wednesday, Deutsche Börse announced changes to its selection indices, which will become effective on 27 December 2018. The shares of Carl Zeiss Meditec AG will be included in the MDAX index and will replace the shares of CTS Eventim AG & CO. KGaA, which will be included in the SDAX index. The exclusion of CTS Eventim AG & CO. KGaA is based on the fast exit rule; Carl Zeiss Meditec AG is eligible for the index inclusion due to its market capitalisation and order book turnover. MDAX tracks the 60 largest and most liquid companies below DAX. The following changes will apply to SDAX: CTS Eventim AG & CO. KGaA, Knorr- Bremse AG and VARTA AG will be included. The shares of BayWa AG and DMG Mori AG will be deleted from the index, according to the fast exit rule. SDAX tracks the 70 next biggest and most actively traded companies after the MDAX. The constituents of the indices DAX and TecDAX remain unchanged. The next scheduled index review is 5 March 2019. DAX®, MDAX®, SDAX® and TecDAX® are registered trademarks of Deutsche Börse AG. Media Release About Deutsche Börse – Market Data + Services In the area of data, Deutsche Börse Group is one of the world’s leading service providers for the securities industry with products and services for issuers, investors, intermediaries, and data vendors. The Group’s portfolio covers the entire value chain in the financial business. -

Incoming Letter: QIAGEN N.V

WACHTELL, LIPTON , ROSEN & KATZ MARTIN LIPTON STEVEN A. COHEN 51 W E S T 52N D S T R E E T DAVID E. SHAPIRO SABASTIAN V. NILES HERBERT M. WACHTELL DEBORAH L. PAUL DAMIAN G. DIDDEN ALISON ZIESKE PREISS THEODORE N. MIRVIS DAVID C. KARP NEW YORK, N.Y. 1 0 0 1 9 - 6 1 5 0 IAN B OC Z K O TIJANA J. DVORNIC EDWARD D. HERLIHY RICHARD K. KIM MATTHEW M. GUEST JENNA E. LEVINE DANIEL A. NEFF JOSHUA R. CAMMAKER TELEPHONE: (212) 403 -1000 DAVID E. KAHAN RYAN A. McLEOD ANDREW R. BROWNSTEIN MARK GORDON DAVID K. LAM ANITHA REDDY MARC WOLINSKY JOSEPH D. LARSON FACSIMILE: (212) 403 -2000 BENJAMIN M. ROTH JOHN L. ROBINSON STEVEN A. ROSENBLUM JEANNEMARIE O’BRIEN JOSHUA A. FELTMAN JOHN R. SOBOLEWSKI JOHN F. SAVARESE WAYNE M. CARLIN GEORGE A. KATZ (1965 -1 9 8 9) ELAINE P. GOLIN STEVEN WINTER SCOTT K. CHARLES STEPHEN R. D iPRIMA JAMES H. FOGELSON (1967 - 1 9 91) EMI L A. KLEINHAUS EMILY D. JOHNSON JODI J. SCHWARTZ NICHOLAS G. DEMMO LEONARD M. ROSEN (1965 - 2 0 14 ) KARESSA L. CAIN JACOB A. KLING ADAM O. EMMERICH IGOR KIRMAN RONALD C. CHEN RAAJ S. NARAYAN RALPH M. LEVENE JONATHAN M. MOSES OF C O UN S EL GORDON S. MOODIE VIKTOR SAPEZHNIKOV RICHARD G. MASON T. EIKO STANGE DONGJU SONG MICHAEL J. SCHOBEL MARTIN J.E. ARMS ERIC S. ROBINSON DAVID M. SILK JOHN F. LYNCH BRADLEY R. WILSON ELINA TETELBAUM MICHAEL H. BYOWITZ PATRICIA A. ROBINSON* ROBIN PANOVKA WILLIAM SAVITT GRAHAM W. -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

Annual Report 2019

DIGITALISATION ENERGY AUTOMATION INNOVATION ANNUAL REPORT 2019 PERFORMANCE KION Group 2 Key figures for 2019 KION Group overview Change in € million 2019 2018 2017 * 2019 / 2018 Order intake 9,111.7 8,656.7 7,979.1 5.3% Revenue 8,806.5 7,995.7 7,598.1 10.1% Order book ¹ 3,631.7 3,300.8 2,614.6 10.0% Financial performance EBITDA 1,614.6 1,540.6 1,457.6 4.8% Adjusted EBITDA ² 1,657.5 1,555.1 1,495.8 6.6% Adjusted EBITDA margin ² 18.8% 19.4% 19.7% – EBIT 716.6 642.8 561.0 11.5% Adjusted EBIT ² 850.5 789.9 777.3 7.7% Adjusted EBIT margin ² 9.7% 9.9% 10.2% – Net income 444.8 401.6 422.5 10.7% Financial position ¹ Total assets 13,765.2 12,968.8 12,337.7 6.1% Equity 3,558.4 3,305.1 2,992.3 7.7% Net financial debt 1,609.3 1,869.9 2,095.5 – 13.9% ROCE ³ 9.7% 9.3% 9.3% – Cash flow Free cash flow 4 568.4 519.9 474.3 9.3% Capital expenditure 5 287.4 258.5 218.3 11.2% Employees 6 34,604 33,128 31,608 4.5% 1 Figures as at balance sheet date 31/12/ 2 Adjusted for PPA items and non-recurring items 3 ROCE is defined as the proportion of adjusted EBIT to capital employed 4 Free cash flow is defined as cash flow from operating activities plus cash flow from investing activities 5 Capital expenditure including capitalised development costs, excluding right-of-use assets 6 Number of employees (full-time equivalents) as at balance sheet date 31/12/ * Key figures for 2017 were restated due to the initial application of IFRS 15 and IFRS 16 All amounts in this annual report are disclosed in millions of euros (€ million) unless stated otherwise. -

Turquoise Liquidity Provision Scheme Registrations

Turquoise Liquidity Provision Scheme Registrations Updated: 25/06/2015 Symbol Name Schedule A Schedule B A2Am A2A SPA BNP Paribas Arbitrage Société Générale SA Virtu Financial Ireland Ltd Citadel Securities (Europe) Ltd AALBa AALBERTS INDUSTRIES NV Virtu Financial Ireland Ltd AALl ANGLO AMERICAN PLC Virtu Financial Ireland Ltd ABBNz ABB LTD-REG Société Générale SA Virtu Financial Ireland Ltd ABEe ABERTIS Société Générale SA INFRAESTRUCTURAS SA Virtu Financial Ireland Ltd ABFl ASSOCIATED BRITISH Virtu Financial Ireland Ltd FOODS PLC ABGe ABENGOA SA Virtu Financial Ireland Ltd ABIb ANHEUSER-BUSCH INBEV BNP Paribas Arbitrage Société Générale SA NV Virtu Financial Ireland Ltd ACAp CREDIT AGRICOLE SA BNP Paribas Arbitrage BNP Paribas Arbitrage Société Générale SA Virtu Financial Ireland Ltd Citadel Securities (Europe) Ltd ACKBb ACKERMANS & VAN HAAREN Virtu Financial Ireland Ltd ACp ACCOR SA BNP Paribas Arbitrage Société Générale SA Virtu Financial Ireland Ltd Citadel Securities (Europe) Ltd ACSe ACS ACTIVIDADES CONS Y Société Générale SA SERV Virtu Financial Ireland Ltd ACXe ACERINOX SA Virtu Financial Ireland Ltd ADENz ADECCO SA-REG Société Générale SA Virtu Financial Ireland Ltd ADMl ADMIRAL GROUP PLC Virtu Financial Ireland Ltd ADNl ABERDEEN ASSET MGMT Virtu Financial Ireland Ltd Symbol Name Schedule A Schedule B PLC ADPp ADP BNP Paribas Arbitrage Société Générale SA Virtu Financial Ireland Ltd Citadel Securities (Europe) Ltd ADSd ADIDAS AG Société Générale SA Virtu Financial Ireland Ltd AFp AIR FRANCE-KLM BNP Paribas Arbitrage Virtu Financial -

BEWARE of CHINESE BEARING GIFTS: Why China's Direct

Last working version before publication in Julien Chaisse ed., CHINA'S THREE-PRONG INVESTMENT STRATEGY: BILATERAL, REGIONAL, AND GLOBAL TRACKS (London: Oxford University Press, February 2019) BEWARE OF CHINESE BEARING GIFTS: Why China’s Direct Investment Poses Political Challenges in Europe and the United States Sophie Meunier* From a non-existent player fifteen years ago, China has now become one of the largest senders of Foreign Direct Investment (FDI) flows in the world. By and large, this new provenance of capital has been welcomed by host countries, especially given the drop in other sources of FDI in the wake of the American financial crisis in the late 2000s. This new investment has created jobs locally, it has enabled to keep some troubled firms afloat, and it has often opened up the Chinese market for local companies. FDI is indeed the backbone of economic globalization and a crucial source of transmission of capital, technology, and people across borders. The exponential growth of Chinese direct investment, however, has also been accompanied in some cases by controversy and even resistance, both in developing and in developed economies. Around the world, critics have expressed fears and denounced some of the potential dangers of this investment, such as lowering of local labor standards, hollowing out of industrial core through repatriation of assets, and acquisition of dual use technology. Alarmist media headlines have warned against a Chinese takeover of national economies one controversial investment deal at a time. The ensuing political backlash has often received considerable media attention and increased scrutiny over subsequent deals. What explains the political challenges posed by the recent explosion of Chinese direct investment in the United States (U.S.) and the European Union (EU)? How and why have attitudes and policies in the West changed over the past decade towards Chinese FDI? This chapter considers two alternative explanations for the political challenges triggered by Chinese investment in Western countries. -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE -

Prof. Dr. Sc. Nat. Michael Kaschke President and CEO of the ZEISS Group

Carl Zeiss AG Carl-Zeiss-Straße 22 73447 Oberkochen Prof. Dr. sc. nat. Michael Kaschke President and CEO of the ZEISS Group Michael Kaschke is President and CEO of the ZEISS Group rates, the first in 1986 (Dr. rer. nat.) and the second in 1988 and oversees Strategy & Corporate Development, Brand & (Dr. sc. nat.). As part of his scientific work, he conducted Communications, Legal & Compliance and Human Resour- research into the generation and application of ultra-short ces. In addition, he is responsible for the Asia Pacific sales laser pulses. region. Michael Kaschke became Member of the Executive Board of the ZEISS Group in 2000, and has served as Presi- Milestones in his career dent and CEO since 2011. • 2011 President and CEO of the ZEISS Group In addition to his offices as Chairman of the Supervisory • 2008 – 2010 President and CEO of Carl Zeiss Meditec Board of Carl Zeiss Meditec AG, a company listed on the AG while also serving on the Board of Management of Frankfurt Stock Exchange (TecDax), and of other ZEISS com- Carl Zeiss AG panies, he is Member of the Supervisory Boards of Henkel • 2000 Appointment to the Board of Management of AG & Co. KGaA, Deutsche Telekom AG and Robert Bosch Carl Zeiss AG GmbH. • 1999 Executive Vice President & General Manager, Medical Technology business group, and Member of the In 2014 Michael Kaschke was appointed to the German Executive Management Committee Council of Science and Humanities, one of the country’s • 1998 Vice President & General Manager, Surgical most important scientific-political advisory boards. Products division • 1995 Vice President & General Manager, Surveying In 2009 Kaschke was made an honorary professor of the Instruments division Faculty of Electrical Engineering and Information Technology • 1992 Joins ZEISS as a research scientist, subsequently at the Karlsruhe Institute of Technology. -

EXTEL 2018 Investor Relations Rankings for Germany

EXTEL 2018 Investor Relations rankings for Germany June 2018 1. EXECUTIVE OVERVIEW & COMMENTARY This year marks the 13th Anniversary of the partnership between DIRK – Deutsche Investor Relations Verband - and Extel, an Institutional Investor Company. Every year, this successful collaboration produces the highly lauded Investor Relations Study, which takes its data from Extel’s comprehensive annual Pan-European Survey. The survey measures IR excellence and includes insightful views and trend information from investment professionals globally who are either invested in or cover the German equity market. The results of the study form the basis of the ‘Deutsche Investor Relations Preis’, presented during the DIRK annual conference in Frankfurt in June 2018. As part of its annual Pan-European Survey, year. The leading MDAX IR Professional Extel undertook this study from 14th March to was Burkhard Sawazki of LEG Immobilien 27th April, 2018; seeking ratings and rankings where 136 individuals received for IR excellence, at a company level and nominations. separately for IR professionals. From the In the SDAX category Hapag-Lloyd moved overall sector contributions, we derived up from 11th last year to 1st place. For the distinct rankings for the main German equity individual IR Professional ranking in SDAX, indices constituents – DAX30, MDAX, SDAX and Stephan Haas of SAF-HOLLAND was TecDAX. The study was undertaken almost ranked 1st, out of 61 individuals receiving exclusively through direct online votes. nominations. Telefonica Deutschland held on to top Since the beginning of the Extel and DIRK’s spot as the highly regarded TecDAX partnership in 2006, responses have increased company for IR. -

EURO STOXX 50 Last Updated: 02.07.2018

EURO STOXX 50 Last Updated: 02.07.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) FR0000120271 B15C557 TOTF.PA 490541 TOTAL FR EUR Y 138.8 1 1 DE0007164600 4846288 SAPG.DE 476361 SAP DE EUR Y 106.9 2 2 DE0007236101 5727973 SIEGn.DE 480710 SIEMENS DE EUR Y 96.2 3 3 DE000BAY0017 5069211 BAYGn.DE 408530 BAYER DE EUR Y 88.0 4 4 DE0008404005 5231485 ALVG.DE 401632 ALLIANZ DE EUR Y 77.9 5 6 FR0000120578 5671735 SASY.PA 477518 SANOFI FR EUR Y 77.7 6 8 FR0000121014 4061412 LVMH.PA 454005 LVMH MOET HENNESSY FR EUR Y 76.8 7 5 DE000BASF111 5086577 BASFn.DE 408348 BASF DE EUR Y 75.2 8 7 ES0113900J37 5705946 SAN.MC 407228 BCO SANTANDER ES EUR Y 74.1 9 9 NL0010273215 B929F46 ASML.AS 546078 ASML HLDG NL EUR Y 73.2 10 11 NL0000009355 B12T3J1 UNc.AS 491207 UNILEVER NV NL EUR Y 72.3 11 10 BE0974293251 BYYHL23 ABI.BR 475531 ANHEUSER-BUSCH INBEV BE EUR Y 65.7 12 13 FR0000131104 7309681 BNPP.PA 413366 BNP PARIBAS FR EUR Y 61.3 13 12 NL0000235190 4012250 AIR.PA 401225 AIRBUS FR EUR Y 57.3 14 14 FR0000120321 4057808 OREP.PA 453478 L'OREAL FR EUR Y 52.1 15 16 DE0007100000 5529027 DAIGn.DE 425240 DAIMLER DE EUR Y 49.2 16 15 NL0011821202 BZ57390 INGA.AS 448816 ING GRP NL EUR Y 48.0 17 17 FR0000120073 B1YXBJ7 AIRP.PA 401140 AIR LIQUIDE FR EUR Y 46.2 18 19 FR0000125486 B1XH026 SGEF.PA 481808 VINCI FR EUR Y 45.8 19 18 FR0000120628 7088429 AXAF.PA 458887 AXA FR EUR Y 43.8 20 20 DE0005557508 5842359 DTEGn.DE 511938 DEUTSCHE TELEKOM DE EUR Y 43.0 21 21 ES0113211835 5501906 BBVA.MC 550190 BCO BILBAO VIZCAYA