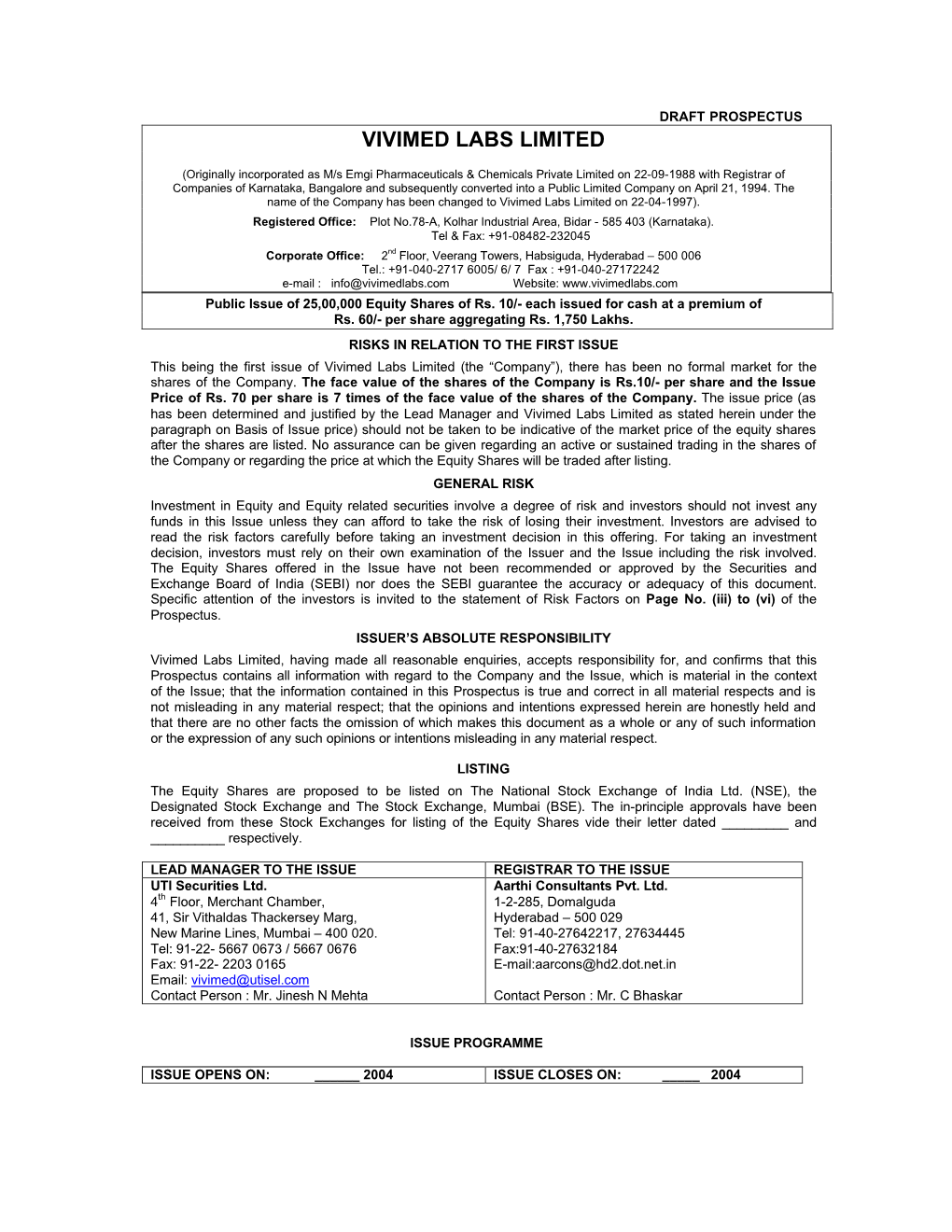

Vivimed Labs Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vivimed Labs Ltd Result Update: Q3 FY 12

Vivimed Labs Ltd Result Update: Q3 FY 12 C.M.P: Rs. 405.00 Target Price: Rs. 466.00 Date: March 24 th 2012 BUY Stock Data: SYNOPSIS Sector: Pharmaceutical Face Value Rs. 10.00 Vivimed Labs Ltd engages in the specialty chemicals & pharmaceuticals 52 wk. High/Low (Rs.) 413.00/212.50 Volume (2 wk. Avg.) 34000 businesses in India. BSE Code 532660 During the quarter ended, the robust Market Cap (Rs. in mn) 5643.27 growth of revenue is increased by 8.20% to Rs.928.50 million. Share Holding Pattern Vivimed Labs Ltd has acquired Uquifa, a 75-year-old manufacturer of pharma APIs and intermediates with operations in Spain and Mexico. Vivimed has offices in India, China, Europe & USA, with manufacturing 1 Year Comparative Graph facilities focused around Hyderabad city in India. Vivimed Labs has floated three overseas subsidiaries, either directly/ through its subsidiary companies. Net Sales and PAT of the company are expected to grow at a CAGR of 32% and 44% over 2010 to 2013E BSE SENSEX Vivimed Labs respectively. Years Net sales EBITDA Net Profit EPS P/E FY 11 3100.97 556.30 277.63 27.32 14.83 FY 12E 4034.73 815.85 395.91 28.41 14.25 FY 1 3E 4841.68 985.28 496.86 35.66 11.36 1 Peer Group Comparison Market Cap. Name of the company CMP(Rs.) (Rs. mn.) EPS(Rs.) P/E(x) P/Bv(x) Dividend (%) Vivimed Labs 405.00 5643.27 27.32 14.83 2.84 20.00 Dr. -

Nutraconsensus Emerging Insights on Nutraceuticals - Players and Policy Makers

Nutraconsensus Emerging insights on Nutraceuticals - players and policy makers A whitepaper prepared by Grant Thornton and FICCI FICCI-HADSA Nutraceuticals 2012 “Regulation, Categorisation and Commercialisation” 6 November 2012, Mumbai Nutraconsensus 1 Disclaimer: The information and opinions contained in this document have been compiled or arrived at from published sources believed to be reliable, but no representation or warranty is made to their accuracy, completeness or correctness. This document is for information purposes only. The information contained in this document is published for the assistance of the recipient but is not to be relied upon as authoritative or taken in substitution for the exercise of judgment by any recipi- ent. This document is not intended to be a substitute for professional, technical or legal advice. All opinions expressed in this document are subject to change without notice. Whilst due care has been taken in the preparation of this document and in- formation contained herein, neither Grant Thornton nor FICCI nor other legal enti- © Grant Thornton India LLP. All rights reserved. ties in the group to which they belong, accept any liability whatsoever, for any direct Member firm of Grant Thornton International Ltd Offices in Bengaluru, Chandigarh, Chennai, Gurgaon, Hyderabad,or consequential Kolkata, Mumbai, New loss Delhi howsoeverand Pune arising from any use of this document or its con- tents or otherwise arising in connection herewith. Nutraconsensus 2 Contents Page Foreword – FICCI 3 Foreword – Grant -

Specialty Chemicals & Pharmaceuticals

Initiating Coverage Vivimed Labs Limited November 12, 2010 BUY HIGH RISK PRICE Rs.338 TARGET Rs. 450 STRENGTH: High Entry Barriers, Early mover advantage, Growing end user industry, Strong Specialty Clientele, Consistent Past Performance WEAKNESS: Difficult to make inroads to acquire Chemicals & new customers. OPPORTUNITIES: Foray into branded formulations space in the Russia/CIS region; Capacity Expansion in Specialty chemicals & Pharmaceuticals. THREAT: Pharmaceuticals Exchange rate volatility, Dilution risk. High Entry Barriers to become a preferred supplier SHARE HOLDING (%) Customer qualification norms are complicated, stringent, and costly making the registration Promoters 52.2 a time consuming process. It takes around 3-5 years for a company to make inroads to FII 6.4 become a preferred supplier for major global companies. Business is normally not done on FI / MF 0.2 “price” but on relationships, product portfolio, service levels and quality standards. Body Corporates 5.8 However, quality of the product takes the topmost level in the pyramid for clients since they Public & Others 32.6 invest a lot of time and money to get in a new supplier as any compromise on the quality front could tarnish the brand value of the product and the company as well. STOCK DATA Strong clientele base Reuters Code VVMD.BO Vivimed is an approved supplier to global personal care giants like L’Oreal, Unilever, P&G, Bloomberg Code VILA IN and Johnson & Johnson etc., wherein the contracts are generally long-term in nature. In the specialty pharmaceuticals division, it supplies to major pharmaceutical companies like BSE Code 532660 Merck, Lupin, Novartis, Cipla, and AstraZeneca etc. -

Jadhav Case: Big Win for India At

c m y k c m y k THE LARGEST CIRCULATED ENGLISH DAILY IN SOUTH INDIA HYDERABAD I THURSDAY I 18 JULY 2019 WEATHER Max: 35.0OC WORLD SPORTS Min: 24.3OC RH: 57% House vote condemns Kapil Dev-led panel to pick R’fall: 1.1 mm Trump’s ‘racist’ tweets coach, could divide COA Forecast: Cloudy sky. 10 15 Rain, thundershowers deccanchronicle.com, facebook.com/deccannews, twitter.com/deccanchronicle, google.com/+deccanchronicle Vol. 82 No. 198 Established 1938 | 32 PAGES | `4.00 likely. Max/Min 34/23ºC KARNATAKA CRISIS ASTROGUIDE Vikari; Uttarayana Jadhav case: Big win for India at ICJ Tithi: Ashada Bahula SC order gives a Vidiya whole day ■ Pak told to review conviction, allow consular access; Pak says will go as per law Star: Sravanam till 1.34 SRIDHAR am (Friday) big jolt to HDK KUMARASWAMI | DC Indian friends Varjyam: Nil NEW DELHI, JULY 17 FINAL of Kulbhushan PAK ARRESTS Jadhav, cele- Durmuhurtam: 10.13 am VERDICT brate verdict of to 11.04 am; 3.23 pm ■ Can’t force MLAs to be In a major victory for India in the high-profile International HAFIZ TO to 4.15 pm ICJ President in Assembly: Apex court Kulbhushan Jadhav case, Abdulqawi Ahmed Court of Justice the International Court of in Mumbai on Rahukalam: 1.30 pm Yusuf delivered the judgment. to 3 pm DC CORRESPONDENTS Justice (ICJ) at The Hague Wednesday. PLACATE U.S. NEW DELHI/BENGALURU, in the Netherlands on Fifteen other judges have con- — AP HIJRI CALENDAR JULY 17 Wednesday held Pakistan curred with the final verdict. -

Vivimed Labs Ltd

Vivimed Labs Ltd. BUY Target Price ` 468 CMP ` 343 FY14 PE 5.5x Index Details We initiate coverage on Vivimed Labs Ltd as a BUY with a Price Sensex 18,154 Objective of ` 468 (target 7.5x FY14 EPS). At CMP of ` 343, the stock is Nifty 5,522 trading at 6.0x and 5.5x its estimated earnings for FY13 & FY14 representing a potential upside of ~36% over a period of 24 months. BSE 100 9,568 Vivimed Labs Ltd is a diversified global company with a unique Industry Pharma portfolio of products in the Specialty Chemicals and Pharmaceuticals categories. Niche product portfolio in specialty chemicals coupled with Scrip Details significant inorganic growth through its recent acquisitions in the Mkt Cap (` cr) 348 pharma space should help the company post an earnings growth of BVPS (`) 194 31.7% CAGR over the period FY11 to FY14. O/s Shares (Cr) 1.4 Niche product portfolio and expansions to drive future growth AvgVol Lacs) 0.7 52 Week H/L 354/213 The matured Home and Personal care (H&PC) global markets are expected to Div Yield (%) 0.6 grow at CAGR of 3.2% to USD 368 bn by 2015 while in India the H&PC markets are expected to grow at a faster pace of 12.2% to USD 8 bn by 2015. Vivimed FVPS (`) 10.0 being well embedded as a global quality supplier of active ingredient to the H&PC industry is best placed to benefit from this growth. We expect Vivimed’s overall Shareholding Pattern revenues to grow at a CAGR of 39.9% to ` 1139.9 crore over the forecast period of Shareholders % FY11-14 with 50.0% of the revenues coming for the specialty chemicals product portfolio and the balance from the capacity expansions and inorganic growth in the Promoters 43.6 pharmaceutical space. -

ON TRACK Annual Report 2017-18

ON TRACK Annual Report 2017-18 On track… We have relied on strong, decisive actions to overcome significant challenges in the last few years. To fast-track growth at Vivimed Labs Limited (Vivimed), we hived off our non-focus areas in both pharmaceutical and specialty chemicals segments. We reduced the debt in our books in a consistent manner and focussed on identifying and correcting the major bottlenecks in our business. Along with this much-needed cleanup exercise, we have formed long-term, strategic joint ventures in our pharmaceuticals business to achieve higher visibility on revenues and to tap into newer, high-potential markets. We also made synergistic acquisitions that will enable us to provide end-to-end solutions to customers across the entire value chain of our contract development and manufacturing organisation (CDMO) segment. We believe these efforts will start yielding rich dividends from here on. Our focus and foresight are an outcome of the able guidance of our management and strong execution capabilities of our people. After clearly identifying our growth opportunities, we are on track to take our Company to the next level of value creation. Net revenues Net worth `11,857 MILLION `12,387 MILLION EBITDA Profit after tax `2,216 MILLION `779 MILLION VIVIMED LABS LIMITED ABOUT VIVIMED Addressing opportunities with a leaner business model Ever since incorporation in 1988 as a contract manufacturer We have proven ourselves in the sphere of chemistry for bulk drugs, we, at Vivimed, have transformed ourselves and are a global leader in the development of innovative into an integrated pharmaceutical company with focus on photochromic dyes. -

Vivimed Labs Limited | Annual Report 2012-13

[email protected] • Product A Registered Office harnessing growth 78/A, Kolhar Industrial Area, Bidar – 585403, Karnataka Vivimed Labs Limited | Annual Report 2012-13 www.vivimedlabs.com PDF processed with CutePDF evaluation edition www.CutePDF.com Safe Harbour In this annual report may contain such statements by any discussion believe we have or uncertainties report we have forward-looking using words such on future been prudent in materialise, or disclosed forward- statements that as ‘anticipates’, performance. our assumptions. should underlying looking information set out anticipated ‘estimates’, We cannot The achievement of assumptions prove to enable investors results based on ‘expects’, ‘projects’, guarantee that results is subject to inaccurate, actual to comprehend the management’s ‘intends’, ‘plans’, these forward- risks, uncertainties results could vary our prospects and plans and ‘believes’, and looking statements and estimates taken materially from take informed assumptions. We words of similar will be realised, as assumptions. those anticipated, investment have tried wherever substance in although we Should known estimated or decisions. This possible to identify connection with or unknown risks projected. Contents 02 Corporate 14 The CEO’s 20 Management 42 Directors’ report 65 Financial section snapshot statement discussion and 49 Corporate 116 Notice 12 2012-13 in 18 Chemistry at analysis Governance report retrospect the core 41 Corporate information Vivimed invested strategically in building assets and capabilities across its global and Indian businesses over the past 24 months. Vivimed’s focus for the next 24 months will be in extracting synergies of integration and capitalising on a larger addressable market. Reflected in a number of prospective results. -

Reverse Knowledge Transfer in Indian Mnes ===

Reverse Knowledge Transfer in Indian MNEs ===================================== Smitha Ravindranathan Nair Thesis submitted to The University of Sheffield in partial fulfilment of the requirement of the degree of Doctor of Philosophy Management School The University of Sheffield November 2013 ACKNOWLEDGMENTS I would like to thank my supervisors, Professor Mehmet Demirbag and Professor Kamel Mellahi for their support and guidance during my doctoral research. I am grateful for the time and effort they spent towards my research and for my publications. It would have been almost impossible for me to complete this journey without their continuous support and encouragement. I would also like to thank my family; my husband, parents and brother who have always been there for me when I needed them. Their belief in me was a constant source of inspiration that kept me going on this journey. I am also thankful to all the managers who spent their valuable time to respond to my questionnaire. I really appreciate their thoughtfulness and the consideration they have shown towards my research. Last but not the least; I am thankful to God Almighty who gave me the required strength and perseverance. 1 ABSTRACT Emerging Market Multinational Enterprises (EM MNEs) and their growing importance in the current global economic and business scenario has attracted much scholarly attention. An important aspect in the growth of these EM MNEs is their rapid catching up strategies which has been discussed extensively in the international business (IB), management and strategy literature. Indian MNEs, one of the prominent amongst EM MNEs, have had their share of overseas acquisitions, more so in the last decade.Their international expansions along with the subsequent knowledge transactions and associated learning have played a vital role when it comes to their catching up strategies as latecomers in the international scene. -

Q3 FY 18 Investor Presentation

Vivimed Labs Ltd / Active Pharma Branded Specialty Ingredient Formulations Chemicals Investor Presentation February 2018 1 1 Safe Harbor / This presentation and the accompanying slides (the “Presentation”), which have been prepared by Vivimed Labs Limited (the “Company”), have been prepared solely for information purposes and do not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment what so ever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. This Presentation may not be all inclusive and may not contain all of the information that you may consider material. Any liability in respect of the contents of, or any omission from, this Presentation is expressly excluded. Certain matters discussed in this Presentation may contain statements regarding the Company’s market opportunity and business prospects that are individually and collectively forward-looking statements. Such forward-looking statements are not guarantees of future performance and are subject to -

Speciality Chemicals

F cused to deliver. Vivimed Labs Limited I Annual Report, 2011-12 Cautionary statement In this annual report we have disclosed forward-looking information to enable investors to comprehend our prospects and take informed investment decisions. This report may contain forward-looking statements that set out anticipated results based on the management’s plans and assumptions. We have tried wherever possible to identify such statements by using words such as ‘anticipates’, ‘estimates’, ‘expects’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, and words of similar substance in connection with any discussion on future performance. We cannot guarantee that these forward-looking statements will be realised, although we believe we have been prudent in our assumptions. The achievement of results is subject to risks, uncertainties and estimates taken as assumptions. Should known or unknown risks or uncertainties materialise, or should underlying assumptions prove inaccurate, actual results could vary materially from those anticipated, estimated or projected. Readers should bear this in mind. Glossary of Abbreviation is detailed in page number 112 n the last five years, significant Iattainments of Vivimed Labs include: Developing unique products. Enlisting marquee clients. Acquiring new businesses. Strengthening its domestic presence. Bringing a global balance to its business. Going forward, the Company expects to leverage these initiatives to enhance organisational value. m 1: The corporate snapshot 4: 2011-12 in retrospect 10: Performance insight -

Five Years Into the Product Patent Regime: India's Response

IMAGE U nited Nations Development Programme POV ERTY REDUCTION AND AIHIV/ DS FI A VE YE RS INTO THE PRODUCT PATENT REGIME: INDIA’S RESPONSE FIVE YEARS INTO THE PRODUCT PATENT REGIME: INDIA’S RESPONSE Sudip Chaudhuri, Chan Park and K. M. Gopakumar December 2010 Copyright © December 2010 United Nations Development Programme One United Nations Plaza New York, NY 10017 U.S.A. Website: www.undp.org/poverty UNDP is the UN’s global development network, advocating for change and connecting countries to knowledge, experience, and resources to help people build a better life. Cover Photo: Mohammad Moniruzzaman / UNDP Picture This. Design: Alex Majumder. Printing: Consolidated Graphics, New York, USA. Disclaimer: The views expressed in this publication are those of the authors and do not necessarily represent those of the United Nations, including UNDP, or their Member States. ABOUT THIS STUDY This study was commissioned by the United Nations Development Programme (UNDP) under the auspices of the Intellectual Property and Access to Medicines Capacity Building Initiative, a cross-practice project between UNDP’s Poverty Group and the HIV/AIDS Group. The project initiated in 2004 seeks to support the building of developing country and broader Southern capacity to sustainably access affordable HIV/AIDS drugs in the context of the implementation of the World Trade Organization (WTO) Agreement on Trade-related Aspects of Intellectual Property Rights (TRIPS) and intellectual property provisions in other trade agreements (e.g. bilateral and regional trade arrangements). Since 2009, the project has broadened its focus in understanding various dimensions and policy interventions to direct health innovation towards meeting long term public health goals, including sustainable access to affordable medicines. -

Vivimed Labs Target Price: `600 Good Times Ahead, Attractive Valuations; Initiating, with a Buy Share Price: `366

Pharmaceuticals India I Equities Initiating Coverage 13 April 2015 Rating: Buy Vivimed Labs Target Price: `600 Good times ahead, attractive valuations; initiating, with a Buy Share Price: `366 We initiate coverage on Vivimed Labs with a Buy rating and a target price of `600. We expect strong growth in its pharmaceutical Key data VILA IN / VVMD.BO business—driven by US generics and branded formulations—and an 52-week high/low `425/ `191 improved balance sheet. The API segment is likely to report better Sensex/Nifty 29044 / 8834 profitability led by higher utilisation and an improved product mix. We 3-m average volume US$0.52m estimate a 29% PAT CAGR over FY15-17. Successful monetisation of its Market cap ₹5.9bn/ US$ 0.1bn land at the Vizag SEZ could offer further upside. Shares outstanding 16.2m Ingredients in place to boost the pharmaceuticals business. Vivimed has built its pharma business chiefly through acquisitions. We expect the API segment to report a 9.5% CAGR in revenue over FY15-17, powered primarily Shareholding pattern (%) Dec ‘14 Sep‘14 Jun ‘14 by customised manufacturing operations (CMO) for innovators where Promoters 38.1 38.1 38.1 capacity is available and orders are in place. The formulations segment is - of which, Pledged 25.2 19.2 17.0 likely to report a 37% CAGR in revenue, fuelled by the start of US generics Free Float 61.9 61.9 61.9 - Foreign Institutions supplies (with five products in FY16), higher-than-industry growth in 27.7 27.7 27.6 - Domestic Institutions 0.1 0.3 2.3 domestic branded formulations and a steady increase in contract formulations - Public 34.1 33.9 31.9 manufacturing for the domestic market, in our view.