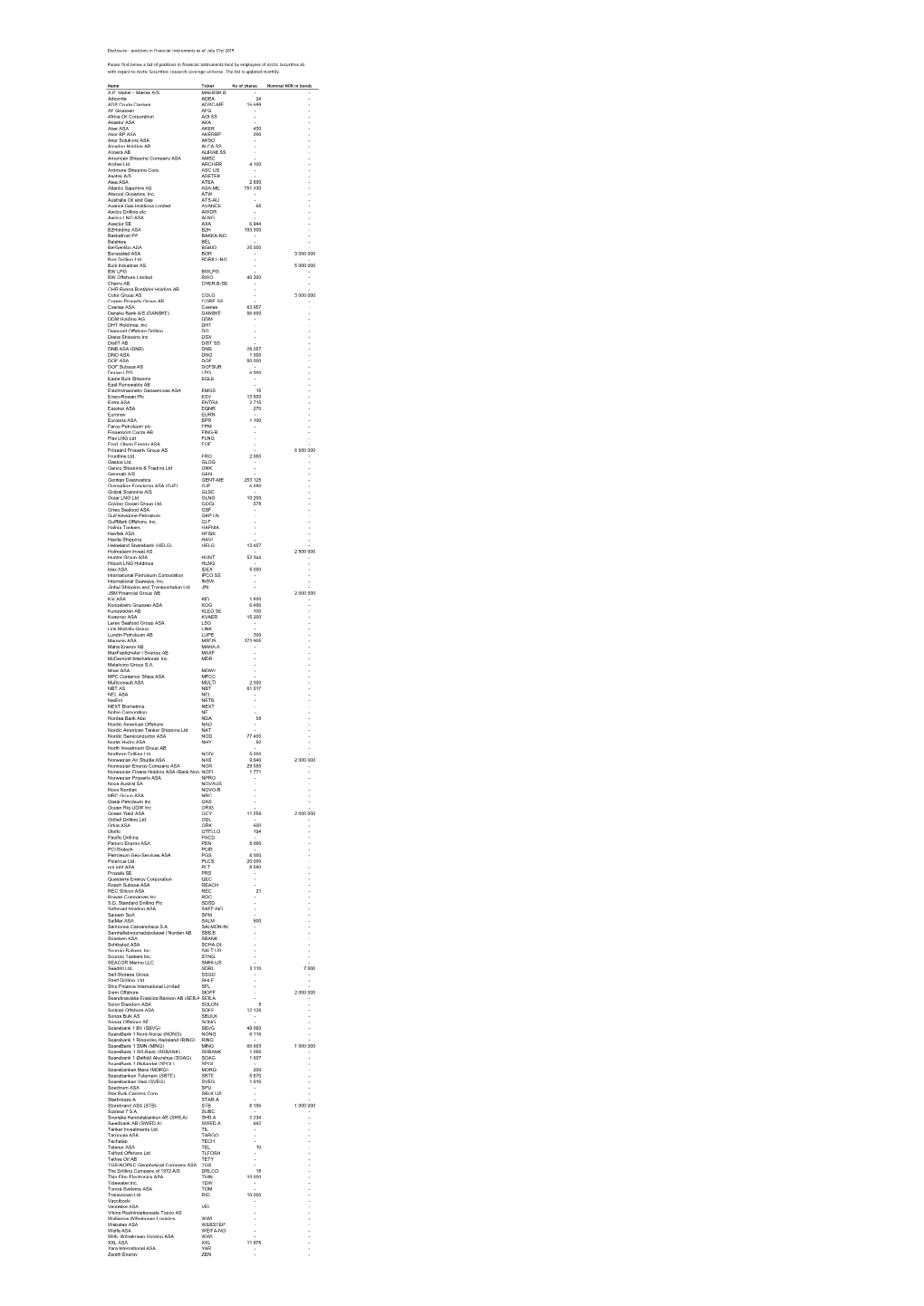

Disclosure - Positions in Financial Instruments As of July 31St 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2020.Pdf

Annual Report 2020 The time for change is now. #PowerTheChange #PowerTheChange The time for change is now. In our common quest to create a cleaner, safer Content and more sustainable future, we must take ownership and accountability. Key figures 3 Where we are 6 Highlights 7 CEO Introduction 8 Board of Directors' Report 10 Consolidated Financial Statements 25 Parent Company Financial Statements 104 Independent Auditor's Report 121 Alternative Performance Measures 126 3 AKER SOLUTIONS ANNUAL REPORT 2020 KEY FIGURES MENU Key figures* 2020 2019 ORDERS AND RESULTS Order backlog December 31 NOK million 37,979 33,083 Order intake NOK million 34,163 26,155 Revenue NOK million 29,396 38,163 34,163 29,396 EBITDA NOK million 1,539 2,711 ORDER INTAKE REVENUE EBITDA margin Percent 5.2 7.1 NOK million NOK million EBITDA margin ex. special items Percent 4.3 7.3 EBIT NOK million -776 988 EBIT margin Percent -2.6 2.6 1,539 5.2 EBIT margin ex. special items Percent -0.2 3.6 Net income NOK million -1,520 283 EBITDA EBITDA MARGIN NOK million Percent CASHFLOW Cashflow from operational activities NOK million 501 360 BALANCE SHEET 4.3 -776 Net interest-bearing debt NOK million -456 -986 EBITDA MARGIN EBIT Equity ratio Percent 29.5 32.2 EXCL. SPECIAL ITEMS NOK million Percent Liquidity reserve NOK million 8,171 8,883 SHARE Share price December 31 NOK 16.45 n/a* Basic earnings per share NOK -3.13 0.49 -2.6 -0.2 EBIT MARGIN EBIT MARGIN EXCL. -

Board Statement on Corporate Governance Pdf 2 Mb

2015 Board Statement on Corporate Governance This publication is the Statoil Board of Directors’ statement on corporate governance, part of the Statutory report. © Statoil 2016 STATOIL ASA BOX 8500 NO-4035 STAVANGER NORWAY TELEPHONE: +47 51 99 00 00 www.statoil.com Cover photo: Øyvind Hagen Board statement on corporate governance To ensure sound corporate practice, Statoil's organisation is structured and managed in accordance with the Norwegian Code of Practice for Corporate Governance. Statoil's board of directors actively adheres to good corporate governance standards and will at all times ensure that Statoil either complies with the Norwegian Code of Practice for Corporate Governance (the "Code") or explains possible deviations from the Code. The topic of corporate governance is subject to regular assessment and discussion by the board, which has also considered the text of this chapter at a board meeting. The Code can be found at www.nues.no. The Code covers 15 topics, and the board statement covers each of these topics and describes Statoil's adherence to the Code. The statement describes the foundation and principles for Statoil's corporate governance structure, more detailed factual information can be found on our website, in our Annual Report on Form 20-F and in our Sustainability Report. The information concerning corporate governance required to be disclosed according to the Accounting Act Section 3-3b is included in this statement as follows: 1. "An overview of the recommendations and regulations concerning corporate governance that the enterprise is subject to or otherwise chooses to comply with": Described in this introduction as well as in section 1 below, "Implementation and reporting". -

Offer to All Non-Us Shareholders of Smedvig Asa to Acquire All Outstanding Shares

Dear shareholder of Smedvig ASA OFFER TO ALL NON-US SHAREHOLDERS OF SMEDVIG ASA TO ACQUIRE ALL OUTSTANDING SHARES SeaDrill Limited (“SeaDrill”) is pleased to extend an offer to all non-US shareholders to acquire all your class A and class B shares in Smedvig ASA (“Smedvig Shares”) (the “Offer”). · The offered price is NOK 205 per Smedvig class A share (“SME”) and NOK 165 per Smedvig class B share (“SMEB”). · The Offer is subject to only one condition which is that a total acceptance level of more than 50 % of the SME (class A share) is attained. The Offer will be withdrawn if this condition is not either met or waived prior to completion of the Offer. If the Offer is successful, SeaDrill will proceed with a mandatory offer in accordance with the Norwegian Securities Trading Act. · The offer period (“Offer Period”) will last until 18.00 CET on Wednesday 18 January 2006. · Shareholders in Smedvig ASA (“Smedvig”) submitting an acceptance form (the “Acceptance Form”) to Carnegie by 18.00 CET on Wednesday 18 January 2006, by fax +47 22 00 99 60, hand delivery or post will receive cash settlement on or about Monday 23 January 2006 provided they submit necessary settlement details as described in the Acceptance Form. · SeaDrill reserves the right, at its sole discretion, at any time to waive the condition referred to above, and/or to withdraw the Offer at any time if it seems clear that the acceptance level of the Offer will not be achieved, and/or to extend the Offer Period to CET 16.30 on 20 January 2006. -

Annual Report 2020 Contents

ANNUAL REPORT 2020 CONTENTS LETTER FROM THE CEO 4 BOARD OF DIRECTORS 44 KEY FIGURES 2020 8 EXECUTIVE MANAGEMENT TEAM 48 HIGHLIGHTS 2020 10 BOARD OF DIRECTORS’ REPORT 52 THE VALHALL AREA 16 REPORTING OF PAYMENTS TO GOVERNMETS 72 IVAR AASEN 20 BOD’S REPORT ON CORPORATE GOVERNANCE 74 THE SKARV AREA 24 FINANCIAL STATEMENTS WITH NOTES 88 THE ULA AREA 28 THE ALVHEIM AREA 32 JOHAN SVERDRUP 36 THE NOAKA AREA 40 COMPANY PROFILE Aker BP is an independent exploration and production Aker BP is headquartered at Fornebu outside Oslo and has company conducting exploration, development and produ- offices in Stavanger, Trondheim, Harstad and Sandnessjøen. ction activities on the Norwegian continental shelf (NCS). Aker BP ASA is owned by Aker ASA (40%), bp p.l.c. (30%) Measured in production, Aker BP is one of the largest and other shareholders (30%). independent oil and gas companies in Europe. Aker BP is the operator of Alvheim, Ivar Aasen, Skarv, Valhall, Hod, Ula The company is listed on the Oslo Stock Exchange with and Tambar, a partner in the Johan Sverdrup field and holds ticker “AKRBP”. a total of 135 licences, including non-operated licences. As of 2020, all the company’s assets and activities are based in Norway and within the Norwegian offshore tax regime. OUR ASSETS arstad AND OFFICES andnessen ar Trondei lei orne taaner ar asen oan erdrp operated inor laTaar alallod · ESG IN AKER BP SUSTAINABILITY REPORT 2020 Aker BP’s Sustainability report 2020 describes the ESG in Aker BP company’s management approach and performance to environment, social and governance. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Personal Reflections

8 Personal reflections In 2013, we – the shareholders in Aker – became NOK 2 billion richer, measured in net asset value and paid dividends. My goal was to double Aker’s net asset value, including dividends, in five years. The result was a 50 percent increase in the period from 1 January 2009 to 31 December 2013. Aker grew on average by 8.8 per cent per year period. The OSEBX achieved 18 the OSEBX companies. During the same main Oslo Stock Exchange index. However, year during the period, while my target was per cent. period, Aker’s net asset value increased the performance behind the figures varies 15 per cent. ■ The development of our share price from NOK 250 to NOK 332 per share and considerably. I can only quote crosscountry skier Pet this past year: In 2013 alone, the Aker dividends totalling NOK 46 per share were Aker Solutions has been the strongest Beskjæres 76 mm fra venstre før trykk >> ter Northug Jr. who, after failing to win a share generated a return of 10 per cent, paid. My aim was to exceed NOK 500 per value driver during the period: the return on medal at the Sochi Winter Olympics, com while OSEBX rose by 24 per cent. Net share, including dividends, in five years. Aker’s holdings in Aker Solutions shares mented: “I felt I was in good shape, but I asset value per share increased by 3.5 In other words, in five years, NOK 250 of has on average increased by 40 per cent didn’t win the gold.” per cent in 2013, and dividends paid to shareholder value in Aker has been turned annually (IRR). -

WELL POSITIONED for the FUTURE Who We Are

Subsea 7 S.A. Annual Report 2012 WELL POSITIONED FOR THE FUTURE WHO WE ARE Subsea 7 is a seabed-to-surface engineering, construction and services contractor to the offshore energy industry worldwide. Our vision is to be acknowledged by our clients, our people and our shareholders as the leading strategic partner in our market. We provide integrated services and have a proven track record of safely and reliably executing offshore projects of all sizes and complexity in all water depths. Our operating principles define the way we conduct our operations and shape our approach to business: Safety is at the heart of our operations – we are committed to an incident-free workplace, every day, everywhere. Projects are core to our business – our people are motivated to ensure that our projects deliver exceptional performance. Engineering is at the heart of our projects – we create technical solutions and sustainable value for our stakeholders. People are central to our success – we build our business around a valued and motivated workforce. We make long-term investments in our people, assets and know-how – we build strong relationships with clients and suppliers, based on mutual trust and respect. We operate in a consistent manner on a worldwide basis – we are locally sensitive and globally aware. Subsea 7 S.A. Annual Report and Consolidated Financial Statements 2012 2012 Financial Highlights Overview Overview 1 2 Chairman’s Statement Revenue Revenue by Territory 4 What We Do AFGOM $2,182m 6 Where We Operate 8 Chief Executive Offi cer’s Review $6,297m -

2626667.Pdf (1.837Mb)

BI Norwegian Business School - campus Oslo GRA 19703 Master Thesis Thesis Master of Science Evaluating the Predictive Power of Leading Indicators Used by Analysts to Predict the Stock Return for Norwegian Listed Companies Navn: Amanda Marit Ackerman Myhre Hadi Khaddaj Start: 15.01.2020 09.00 Finish: 01.09.2020 12.00 GRA 19703 0981324 0983760 Evaluating the Predictive Power of Leading Indicators Used by Analysts to Predict the Stock Return for Norwegian Listed Companies Supervisor: Ignacio Garcia de Olalla Lopez Programme: Master of Science in Business with Major in Accounting and Business Control Abstract This paper studies the predictive power of leading indicators used by interviewed analysts to predict the monthly excess stock returns for some of the most influential Norwegian companies listed on the Oslo Stock Exchange. The thesis primarily seeks to evaluate whether a multiple factor forecast model or a forecast combination model incorporating additional explanatory variables have the ability to outperform a five common factor (FCF) benchmark forecast model containing common factors for the Norwegian stock market. The in-sample and out-of- sample forecasting results indicate that a multiple factor forecast model fails to outperform the FCF benchmark model. Interestingly, a forecast combination model with additional explanatory variables for the Norwegian market is expected to outperform the FCF benchmark forecast model. GRA 19703 0981324 0983760 Acknowledgements This thesis was written as the final piece of assessment after five years at BI Norwegian Business School and marks the completion of the Master of Science in Business program. We would like to thank our supervisor Ignacio Garcia de Olalla Lopez for his help and guidance through this process. -

Offshore Blow-Out Accidents - an Analysis of Causes of Vulnerability Exposing Technological Systems to Accidents

Offshore Blow-out Accidents - An Analysis of Causes of Vulnerability Exposing Technological Systems to Accidents Thomas G Sætren [email protected] Univesity of Oslo Universite Louis Pasteur Assessing and communicating risks Wordcount: 24983 Preface This thesis is about understanding causes of vulnerabilities leading to specific type of accidents on offshore oil and gas installations. Blow-out accidents have disastrous potential and exemplify accidents in advanced technological systems. The thesis aims to reveal dysfunctional mechanisms occurring within high reliability systems whether in organization or socio –technical interaction. Technological systems form a central place in technological development and as such this thesis is placed in the technology and society group part of the STS- field, though describing technological risks and accidents at group, organizational and industrial sector level. The contents are description on developments in offshore technological design, theories on how organisational vulnerabilities occur, empirical analysis on three major blow-out accidents, empirical analysis on one normal project for reference, sosio-technological historic description on development in Norwegian offshore industry and final analysis Keywords Blow-out, Offshore, Vulnerabilities, Accident causes, Technological development, Social construction of technology, Bravo – accident, West Vanguard, Snorre A, Ormen Lange Acknowledgments I am grateful for the help and advice I received from the researchers Ger Wackers (Univ of Maastricht/Univ of Oslo) and Knut Haukelid (Univ of Oslo) during the later stages of the project. I am also indebt to my two fellow students Marius Houm and for assistance and advice during the process The 14 interviewees I owe big thanks for the time they spent talking to me a novice in the offshore industry. -

Delivering Sustainable Value Across the Energy Lifecycle

DELIVERING SUSTAINABLE VALUE ACROSS THE ENERGY LIFECYCLE SUBSEA 7 SUSTAINABILITY REPORT 2020 OUR PROGRESS INSIDE THIS REPORT CEO’s letter 2 In 2020 we made good progress Materiality assessment 3 on our sustainability journey Sustainability priorities Health, safety and wellbeing 4 REINFORCED OUR CORPORATE Energy transition 6 GOVERNANCE AROUND SUSTAINABILITY Labour practices and human rights 8 Business ethics 10 Operational eco-efficiency 12 Ecological impacts 14 ESTABLISHED WORK GROUPS OF SENIOR Additional sustainability topics 16 MANAGEMENT TO FOCUS ON OUR Covid-19 19 SUSTAINABILITY PRIORITIES Data summary 20 Report abbreviations 24 EU Non-Financial Reporting Directive 24 CONTINUED TO DEVELOP METRICS AND TARGETS KEY METRICS WE MADE SIGNIFICANT PROGRESS WITH EACH OF OUR SUSTAINABILITY PRIORITIES: Employee health, Energy transition DEVELOPED A CARBON ESTIMATING TOOL TO safety and wellbeing CALCULATE THE CARBON FOOTPRINT OF OUR WORK INCREASED THE NUMBER OF EMPLOYEES COMPLETING 0.07 6.0 GW COMPLIANCE AND ETHICS E-LEARNING Lost-time incident Cumulative power capacity frequency rate per of renewables projects 200,000 hours worked supported to end of 2020 FOCUSED ON THE WELLBEING OF OUR EMPLOYEES WITH DEDICATED RESOURCES TO SUPPORT THEM STARTED ELIMINATION OF SINGLE-USE PLASTICS Labour practices Business ethics EMBEDDED THE PRINCIPLES OF BUILDING and human rights RESPONSIBLY AND THE UN GLOBAL COMPACT COMMITTED TO PROACTIVE PARTICIPATION 6,660 5,153 IN ENERGY TRANSITION Number of suppliers Number of employees with a contract that who have completed -

Appendix 1: Firm & Industry Data

Appendix 1: Firm & Industry Data NORWAY ROYAL SALMON Appendix 1.1: Diverse Information RegionRegion North (NRS Q4 North 2016 Report) – Troms Two new sites in a new area approved ° Lubben and Korsnes ° Improve possibilities for split of each generation to reduce biological risks ° Improve growth possibilities New hatchery – NRS Settefisk ° Purchased land in Karlsøy municipality, Troms ° Planned production capacity of 10 million smolts NORWAY ROYAL SALMON ° Construction starts when necessary approvals have been given, Region South estimated within 1,5 to 2 years Region South (NRS Q4 2016 Report) ° Provide NRS with predictable ° planningOperates with in theregards Haugesund to smolts area, both in Rogaland and Hordaland county ° Region South holds a total of 6 licenses ° Owned 100 % through NRS Feøy AS 8 ° One single MAB Zone ° Enables smoother and better utilization of MAB ° Harvesting at Espevær Laks 35 02 Position of salmon 2.8 Supply of farmed and wild salmonids Wild & Farmed Salmon, historical annual supply (Marine Harvest, 2017) 2 400 Wild Farmed 2 200 2 000 1 800 1 600 1 400 1 200 1 000 800 Thousand Thousand tonnes GWE 600 400 200 - 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 The general supply of seafood in the world is shifting more towards aquaculture as the supply from wild catch is stagnating in several regions and for many important species. Wild catch of salmonids is varying04 between 700Salmon 000 and 1 000 Supply000 tonnes GWE, whereas farmed salmonids are increasing. The first year the total supply of salmonids was dominated by farmed, was in 1999. -

Specification Table - Stocks CFD, ETF CFD

Specification Table - Stocks CFD, ETF CFD Table of contents Stock CFDs page 1 ETF CFDs page 61 Stock CFDs Minimum Minimum Commission (% of XTB mark-up on Instrument Description Currency transaction Trading Hours commission transaction value) commission value 1COV.DE Covestro AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 A.US Agilent Technologies Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 A3M.ES Atresmedia Corp de Medios de Comunicacion SA CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AA.US* CLOSE ONLY / Alcoa Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAD.DE Amadeus Fire AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAL.UK Anglo American PLC CFD GBP 100 GBP 8 EUR 0.08% 100% - 200% 9:00 - 17:30 AAL.US American Airlines CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AALB.NL Aalberts Industries NV CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAN.US Aaron's Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAP.US Advance Auto Parts Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAPL.US Apple Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 ABB.SE ABB Ltd CFD SEK 1000 SEK 8 EUR 0.08% 100% - 430% 9:00 - 17:25 ABBN.CH ABB Ltd CFD CHF 150 CHF 8 EUR 0.08% 100% - 375% 9:00 - 17:20 ABBV.US Abbvie Inc.