Return of Organization Exempt from Income Tax .V. Lb M

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ASSESSMENT of the SAFETY NET in Fairfax County, Virginia

AN ASSESSMENT OF THE SAFETY NET in Fairfax County, Virginia Urgent Matters The George Washington University Medical Center School of Public Health and Health Services Department of Health Policy Acknowledgments The Urgent Matters safety net assessment team would like to thank our community partner, the Fairfax County Community Access Program, for its help in identifying key safety net issues in Fairfax County and connecting us with stakeholders in the community. At the Fairfax County Community Access Program, Elita Christiansen and Martine Charles were instrumental in coordi- nating our site visits, interviews and focus groups and an essential resource through the course of the project. The Fairfax County Community Access Program is charged with the development of a culturally competent integrated delivery system in Fairfax County, Fairfax City and Falls Church through community partnerships with over 50 organizations. We would also like to acknowledge Thom Mayer, MD, FACEP, FAAP, at the Inova Fairfax Hospital, for providing us with important information and resources regarding the emergency department at Inova Fairfax Hospital. The Urgent Matters team would also like to recognize the many individuals in the Fairfax health care community, who gave generously of their time and provided important and useful insights into the local safety net system. The Fairfax, Virginia, Safety Net Assessment would not have been possible without their participation. We are especially grateful to Pam Dickson, MBA, Minna Jung, JD, Chinwe Onyekere, MPH, John Lumpkin, MD, MPH, Calvin Bland, MS, and Risa Lavizzo-Mourey, MD, MBA, of The Robert Wood Johnson Foundation for their support and guidance throughout this project. -

Administrative Complaint in the Matter of Inova Health Systems

0610166 UNITED STATES OF AMERICA BEFORE THE FEDERAL TRADE COMMISSION COMMISSIONERS: William E. Kovacic, Chairman Pamela Jones Harbour Jon Leibowitz J. Thomas Rosch __________________________________________ ) In the Matter of ) ) Inova Health System Foundation, ) a corporation, and ) Docket No. 9326 ) [Public Record Version] Prince William Health System, Inc. ) a corporation. ) __________________________________________) COMPLAINT Pursuant to the provisions of the Federal Trade Commission Act, and by virtue of the authority vested in it by said Act, the Federal Trade Commission, having reason to believe that Respondents Inova Health System Foundation (“Inova”) and Prince William Health System, Inc. (“PWHS”), having entered into a merger agreement, which if consummated would violate Section 7 of the Clayton Act, as amended, 15 U.S.C. § 18, and it appearing to the Commission that a proceeding by it in respect thereof would be in the public interest, hereby issues its complaint pursuant to Section 11(b) of the Clayton Act, 15 U.S.C. § 21(b), stating its charges as follows: NATURE OF THE CASE 1. The merger of Inova and PWHS (“the Merger”) will reduce vital competition and result in higher prices and reduced non-price competition for general, acute care inpatient hospital services in Northern Virginia. Although health plans are the direct customers of Respondents, higher prices for hospital services are passed on to employers, unions, and other group purchasers of health insurance plans and - ultimately - are borne by the individuals and families residing in Northern Virginia. 1 2. Both Inova and PWHS provide high quality general, acute care inpatient hospital services to health care consumers in Northern Virginia.1 Inova already is the dominant hospital system in Northern Virginia. -

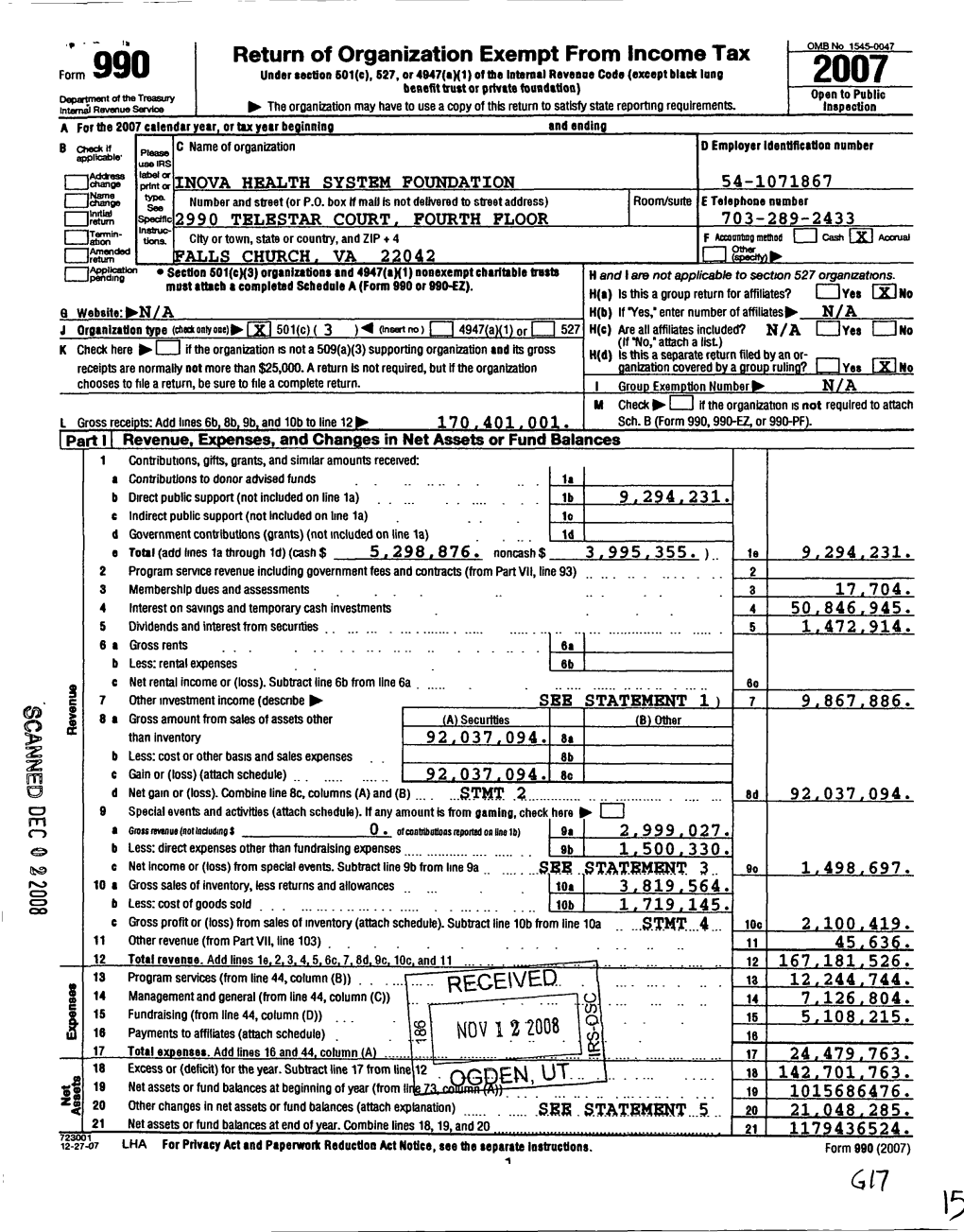

Return of Organization Exempt from Income

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93490319004586 Return of Organization Exempt From Income Tax OMB No 1545-0047 Form 990 Under section 501 (c), 527, or 4947( a)(1) of the Internal Revenue Code ( except black lung benefit trust or private foundation) 2 00 5_ Department of the Open Iµ The organization may have to use a copy of this return to satisfy state reporting requirements Treasury Inspection Internal Revenue Service A For the 2005 calendar year, or tax year beginning 01 -01-2005 and ending 12-31-2005 C Name of organization D Employer identification number B Check if applicable Please INOVA HEALTH CARE SERVICES 54-0620889 1 Address change use IRS l a b el or Number and street (or P 0 box if mail is not delivered to street address) Room/suite F Name change print or type. See 2990 TELESTAR COURT FOURTH FLOOR TA 1 Initial return Specific E Telep hone number Instruc - City or town, state or country, and ZIP + 4 (703) 289 2433 F_ Final return tions . FALLS CHURCH, VA 22042 (- Amended return rj' F_ Application pending fl Other ( specify) lµ * Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable H and I are not applicable to section 527 organizations trusts must attach a completed Schedule A (Form 990 or 990-EZ). H(a) Is this a group return for affiliates? F Yes F No H(b) If "Yes" enter number of affiliates lµ G Website :lr INOVAORG H(c) Are all affiliates included? F Yes F No (If "No," attach a list See instructions ) I Organization type (check only one) lµ ?!+ 501(c) ( 3) -4 (insert no ) (- 4947(a)(1) or F_ 527 H(d) Is this a separate return filed by an organization K Check here lµ F- if the organization's gross receipts are normally not more than $25,000 The covered by a group ruling? (- Yes No organization need not file a return with the IRS, but if the organization received a Form 990 Package in the mail, it should file a return without financial data Some states require a complete return. -

Community Health Needs Assessments

Community Health Needs Assessment Prepared for Inova Fairfax Medical Campus By Verité Healthcare Consulting, LLC Board Approved June 29, 2016 1 TABLE OF CONTENTS ABOUT VERITÉ HEALTHCARE CONSULTING ..................................................................... 4 EXECUTIVE SUMMARY ............................................................................................................ 5 Introduction ................................................................................................................................. 5 Methodology Summary ............................................................................................................... 6 Community Served by the Hospital ............................................................................................ 8 Significant Community Health Needs......................................................................................... 9 METHODOLOGY ....................................................................................................................... 15 Data Sources .............................................................................................................................. 15 Collaboration ............................................................................................................................. 16 Prioritization Process................................................................................................................. 16 Information Gaps...................................................................................................................... -

Advancing the Future of Health in Our Community

Advancing the Future of Health in Our Community 2014 Report to the Community TABLE OF CONTENTS 2 Our Mission 3 Message from Inova’s CEO 4 Inova by the Numbers 7 Investing in Our Community 8 Inova Alexandria Hospital Women’s Tower 9 Inova Dwight and Martha Schar Cancer Institute at Inova Fair Oaks Hospital 10 Inova Women’s Hospital and Inova Children’s Hospital – Room to Grow 11 Inova Loudoun Hospital – Healthcare on the Front Lines 12 Inova Mount Vernon Hospital – Families Taking Care of Families 13 Inova Center for Wellness and Metabolic Health 14 Inova Transitional Services 15 Inova Kellar Center 17 Inova Partnership for Healthier Kids 18 Life with Cancer® 20 Donor Profile: Inova Grateful Patient Program Physician Alfred Khoury, MD 21 Inova Center for Personalized Health 22 Inova Health Foundation 23 2014 Honor Roll of Donors 61 2014 Board of Trustees and Officers 63 Inova Locations 64 Locations Map Inova 2014 I Report to the Community I 1 TITLEMISSION GOES STATEMENT HERE Inova’s mission is to improve the health of the diverse community it serves through excellence in patient care, education and research. 2 I Advancing the Future of Health in Our Community TITLEMESSAGE GOES FROM HERE INOVA’S CEO Knox Singleton Dear Neighbor, In every corner of the region, from McLean to Dumfries, This report introduces a vision fast becoming reality from Ballston to Purcellville, and at dozens of locations that will benefit and be a transformative fixture to our in between, Inova brings its world-class healthcare, community for decades. I am speaking of the emerging education and wellness programming to area residents. -

Inova Health System

INOVA HEALTH SYSTEM Audited Consolidated Financial Statements and Other Supplementary Information Relating to the IHS Obligated Group, and Management’s Discussion and Analysis of Results of Operations and Financial Position Fiscal Year Ended December 31, 2020 Inova Health System Management’s Discussion and Analysis of Results of Operations and Financial Position As of and for the Year Ended December 31, 2020 Introduction Inova Health System (“IHS”) is an integrated, not-for-profit health care delivery system that owns, operates and manages clinical, educational, research, and hospital facilities located in northern Virginia, serving northern Virginia, the Washington, D.C. metropolitan area, and contiguous counties in Virginia and Maryland. The principal line of business for IHS is the delivery of acute care hospital services at locations in northern Virginia. IHS also operates an integrated network of health services including ambulatory care, home health care, senior services, assisted living, and other health related services. IHS maintains a group of primary care and specialty physicians, including Signature Partners, a clinically integrated physician network, and Innovation Health (“Innovation”), a joint venture with Aetna offering commercial health insurance plans. The following discussion and analysis provides information that IHS management believes is relevant to an assessment and understanding of IHS’ results of operations and financial position. This analysis should be read in conjunction with IHS’ financial statements for the years ended December 31, 2020 and 2019. The discussion and analysis focuses on the consolidated results of IHS, which management believes provides a fair description and analysis, in all material respects, of the Obligated Group’s results of operations and financial condition, insofar as the Obligated Group represents approximately 92.9% of total operating revenues and 100% of unrestricted net assets of IHS as of and for the year ended December 31, 2020. -

County of Fairfax, Virginia

County of Fairfax, Virginia MEMORANDUM Office of the County Attorney Suite 549, 12000 Government Center Parkway Fairfax, Virginia 22035-0064 Phone: (703) 324-2421; Fax: (703) 324-2665 www.fairfaxcounty.gov DATE: September 19, 2019 TO: Sharon Williams, Staff Coordinator Zoning Evaluation Division Department of Planning and Zoning FROM: Jo Ellen Groves, Paralega Office of the County Attorney SUBJECT: Affidavit Application No.: PCA/CDPA/FDPA 74-7-047-02-02 Applicant: Inova Health Care Services PC Hearing Date: 10/2/19 BOS Hearing Date: 10/15/19 REF.: 149227 Attached is an affidavit which has been approved by the Office of the County Attorney for the referenced case. Please include this affidavit dated 9/18/19, which bears my initials and is numbered 149227a, when you prepare the staff report. Thank you for your cooperation. Attachment cc: (w/attach) Julia Nichols, Planning Technician I (Sent via e-mail) Zoning Evaluation Division Department of Planning and Zoning \\SI 7PROLAWPGC01 \Documents\ 149227 \JEG \Affidavits\ 1224630.docx REZONING AFFIDAVIT 11-Ki2Z:rct. DATE: September 18, 2019 (enter date affidavit is notarized) 1, Timothy S. Sampson, Esq. , do hereby state that I am an (enter name of applicant or authorized agent) (check one) [ applicant [v] applicant's authorized agent listed in Par. 1(a) below in Application No.(s): PCA 74-7-047-02-02/CDPA 74-7-047-02-02/FDPA 74-7-047-02-02 (enter County-assigned application number(s), e.g. RZ 88-V-001) and that, to the best of my knowledge and belief, the following information is true: 1(a). -

County of Fairfax, Virginia

County of Fairfax, Virginia MEMORANDUM Office of the County Attorney Suite 549, 12000 Government Center Parkway Fairfax, Virginia 22035-0064 Phone: (703) 324-2421; Fax: (703) 324-2665 www. fairfaxcounty. gov DATE: January 6, 2017 TO: William O'Donnell, Staff Coordinator Zoning Evaluation Division Department of Planning and Zoning FROM: Jo Ellen Groves, Paralegal Office of the County Attorney SUBJECT: Affidavit Application No.: PCA 74-7-047-02 Applicant: Inova Health Care Services PC Hearing Date: 12/8/16 BOS Hearing Date: 1/24/17 REF. 136001 Attached is an affidavit which has been approved by the Office of the County Attorney for the referenced case. Please include this affidavit dated 1/4/17, which bears my initials and is numbered 136001b, when you prepare the staff report. Thank you for your cooperation. Attachment cc: (w/attach) Domenic Scavuzzo, Planning Technician I (Sent via e-mail) Zoning Evaluation Division Department of Planning and Zoning \\sl7PROLAWPGC01\Documents\136001\JEG\Affidavits\871264.doc REZONING AFFIDAVIT l£bOO\b DATE: January 4, 2017 (enter date affidavit is notarized) I Timothy S. Sampson, Esq. do hereby state that I am an (enter name of applicant or authorized agent) (check one) [ ] applicant [•] applicant's authorized agent listed in Par. 1(a) below in Application No.(s): PCA 74-7-047-02/CDPA 74-7-047-02/FDPA 74-7-047-02-01/CSP 74-7-047-02 (enter County-assigned application number(s), e.g. RZ 88-V-001) and that, to the best of my knowledge and belief, the following information is true: 1 (a). -

Advancing the Future of Health in Our Community

ADVANCING THE FUTURE OF HEALTH IN OUR COMMUNITY 2016 Inova Report to the Community TABLE OF CONTENTS 3 INTRODUCTION 3 Inova Locations 4 Message from Inova’s CEO 5 Inova by the Numbers 7 PREVENTATIVE AND WELLNESS CARE 8 Diabetes and Obesity-Related Concerns 8 Inova Center for Wellness and Metabolic Health 9 Inova’s Healthy Plate Club 10 Solutions for Vulnerable Populations 10 Forensic Assessment and Consultation Teams 11 Inova Juniper Program 12 Inova in the Community Impact Spotlight: Health Goes Local 12 Inova HealthSource 12 SNAP Double Dollars Program 13 ACCESS TO PRIMARY CARE 14 Children’s Health 14 Inova Cares Clinic for Children 15 Care Connection for Children 15 Inova in the Community Impact Spotlight: Care Connection for Children 16 Inova’s Partnership for Healthier Kids 17 Women’s Health 18 Inova Cares Clinic for Women 18 Philanthropy Spotlight: Women In Need Fund 19 Aging Population 19 InovaCares for Seniors PACE Center 20 Inova in the Community Impact Spotlight: Finding New Purpose 21 Hospital Elder Life Program 21 ElderLink 21 Inova in the Community Impact Spotlight: Meeting High-Need Populations Where They Are 21 Simplicity Health 22 BEHAVIORAL AND PSYCHOSOCIAL SUPPORT 23 Substance Abuse and Mental Health Services 23 Substance and Alcohol Focused Education 23 Comprehensive Addiction Treatment Services 24 Inova Kellar Center 24 Philanthropy Spotlight: Grateful Patient Story 25 Cancer Support 25 Inova Life with Cancer® 26 2016 Honor Roll of Donors 38 2017 Board of Trustees and Officers INOVA LOCATIONS • Inova Emergency Care