IMPACT INVESTING 2.0 the WAY FORWARD – Insight from 12 Outstanding Funds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Received by the Regents May 21, 2015

THE UNIVERSITY OF MICHIGAN REGENTS COMMUNICATION ITEM FOR INFORMATION Subject: Alternative Asset Commitments Background and Summary: Under a May 1994 Request for Action, the University may commit to follow-on investments in a new fund sponsored by a previously approved partnership provided the fund has the same investment strategy and core investment personnel as the prior fund. Pursuant to that policy, this item reports on the University's follow-on investments with the previously approved partnerships listed below. Sequoia Capital U.S. Venture Fund XV, L.P., a venture capital fund headquartered in Menlo Park, CA, will invest in early and growth stage technology companies located in the U.S. The focus will be on technology companies formed in the western part of the country, particularly California's Silicon Valley. The University committed $6 million to Sequoia Capital U.S. Venture Fund XV, L.P., in January 2015. Related Real Estate Fund II, L.P., is a New York, NY, based fund sponsored by The Related Companies that will invest in assets where the firm will leverage its extensive capabilities and resources in development, construction and real estate management to add value to the investments. The acquisitions will include underperforming assets in need of operational or development expertise, assets or companies with structural ownership issues, foreclosed multi-family assets, and special situations. It is expected the fund will be diversified by property type and geographic location. The University committed $35 million to Related Real Estate Fund II, L.P., in February 2015. GSO European Senior Debt Feeder Fund LP., a New York, NY, based fund sponsored by GSO Capital Partners LP, focuses on privately originated debt investments in healthy mid to large cap European companies with EBITDAs in the range of €50 million to €150 million (-$57 million to $170 million). -

Corporate Venturing Report 2019

Tilburg University 2019 Corporate Venturing Report Eckblad, Joshua; Gutmann, Tobias; Lindener, Christian Publication date: 2019 Document Version Publisher's PDF, also known as Version of record Link to publication in Tilburg University Research Portal Citation for published version (APA): Eckblad, J., Gutmann, T., & Lindener, C. (2019). 2019 Corporate Venturing Report. Corporate Venturing Research Group, TiSEM, Tilburg University. General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Download date: 24. sep. 2021 Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. -

Annual Report 2018 – 2019 Contents a Letter to Our Community

AnnuAl RepoRt 2018 – 2019 Contents A Letter to Our Community Dear Friends of Yale Center Beijing, Yale Center Beijing (YCB) is proud to celebrate its fifth anniversary this fall. Since its establishment on October 27, 2014, YCB is Yale University’s first and only university-wide center outside of the United States and continues to serve as an intellectual hub that draws luminaries from China, the U.S., and beyond. During 2018-2019, YCB hosted a variety of events and programs that advanced Yale's mission to improve our world and develop global leaders for all sectors, featuring topics ranging from health and medicine, technology and entrepreneurship, environment and sustainability, to politics, economics, and the arts and humanities. Over the past half-decade, YCB has become a prominent convening space that engages scholars and thought leaders in dialogues that foster openness, connectedness, and innovation. Today, the Center 1 is a key hub for Yale’s global activities, as programming that features Yale faculty, students, and alumni increased from A Letter to Our Community 33% of the Center’s activities in 2014-2015 to nearly 70% in 2018-2019. 2 Looking forward, as YCB aims to maintain and advance its standing as one of the most vibrant foreign university Yale Center Beijing Advisory Committee centers in China, the Center will facilitate and organize programming that: ± Enlighten—Promote interdisciplinary and transnational discourse, through the Yale Starlight Science Series, 4 the Greenberg Distinguished Colloquium, etc., and; Highlights of the Year ± Engage—Convene emerging and established leaders, whether from academia, business, government, or 8 nonprofit organizations, to discuss and tackle important issues in an ever-changing world, through programs Celebrating Five Years at Yale Center Beijing such as the Yale-Sequoia China Leadership Program and the Women’s Leadership Program. -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

Private Equity Holdings Disclosure 06-30-2019

The Regents of the University of California Private Equity Investments as of June 30, 2019 (1) Capital Paid-in Capital Current Market Capital Distributed Total Value Total Value Description Vintage Year (2) Net IRR (3) Committed (A) Value (B) (C) (B+C) Multiple (B+C)/A) Brentwood Associates Private Equity II 1979 3,000,000 3,000,000 - 4,253,768 4,253,768 1.42 5.5% Interwest Partners I 1979 3,000,000 3,000,000 - 6,681,033 6,681,033 2.23 18.6% Alta Co Partners 1980 3,000,000 3,000,000 - 6,655,008 6,655,008 2.22 13.6% Golder, Thoma, Cressey & Rauner Fund 1980 5,000,000 5,000,000 - 59,348,988 59,348,988 11.87 30.5% KPCB Private Equity (Legacy Funds) (4) Multiple 142,535,631 143,035,469 3,955,643 1,138,738,611 1,142,694,253 7.99 39.4% WCAS Capital Partners II 1980 4,000,000 4,000,000 - 8,669,738 8,669,738 2.17 14.0% Brentwood Associates Private Equity III 1981 3,000,000 3,000,000 - 2,943,142 2,943,142 0.98 -0.2% Mayfield IV 1981 5,000,000 5,000,000 - 13,157,658 13,157,658 2.63 26.0% Sequoia Private Equity (Legacy Funds) (4) Multiple 293,200,000 352,355,566 167,545,013 1,031,217,733 1,198,762,746 3.40 30.8% Alta II 1982 3,000,000 3,000,000 - 5,299,578 5,299,578 1.77 7.0% Interwest Partners II 1982 4,008,769 4,008,769 - 6,972,484 6,972,484 1.74 8.4% T V I Fund II 1982 4,000,000 4,000,000 - 6,744,334 6,744,334 1.69 9.3% Brentwood Associates Private Equity IV 1983 5,000,000 5,000,000 - 10,863,119 10,863,119 2.17 10.9% WCAS Capital Partners III 1983 5,000,000 5,000,000 - 9,066,954 9,066,954 1.81 8.5% Golder, Thoma, Cressey & Rauner Fund II 1984 -

Financial Technology Sector Summary

Financial Technology Sector Summary September 30, 2015 Financial Technology Sector Summary Financial Technology Sector Summary Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics V. Healthcare / Insurance 2 Financial Technology Sector Summary I. GCA Savvian Overview 3 Financial Technology Sector Summary GCA Savvian Overview An independent investment bank focused on the growth sectors of the global economy 7+ A R E A S O F TECHNOLOGY EXPERTISE . Provider of mergers and acquisitions, private capital agency and capital markets Financial Technology Business & Tech Enabled Services advisory services, and private funds services Media & Digital Media Industrial Technology . Headquarters in San Francisco and offices in Telecommunications Healthcare New York, London, Tokyo, Osaka, Singapore, Mumbai, and Shanghai . Majority of U.S. senior bankers previously with Goldman Sachs, Morgan Stanley, Robertson Stephens, and JPMorgan 100+ CROSS - BORDER TRANSACTIONS . Senior level attention and focus, extensive transaction experience and deep domain insight 20+ REPRESENTATIVE COUNTRIES . Focused on providing strategic advice for our clients’ long-term success 580+ CLOSED TRANSACTIONS . 225+ professionals $145BN+ OF TRANSACTION VALUE 4 Financial Technology Sector Summary GCA Savvian Overview Financial Technology Landscape . GCA Savvian divides Financial Technology Financial Technology into three broad categories − Payments & Banking − Securities & Capital Markets Payments & Banking Securities & Capital Markets Healthcare & Insurance − Healthcare & Analytics Insurance Crowd Funding BPO / IT Services ATMs Bill Payment Digital Media Brokerage Collections e-Brokerage Claims Processing Core Processing Exchanges Collections Financial Outsourcing Hedge Fund Administration CRM Information Processing Index Businesses Document Management Issuer Processing Mutual Fund Processing eCommerce Marketing / Offers Merchant Acquiring Personal Financial Mgmt. -

The 58 Most Active Venture Capital Firms for Startups in India

The 58 Most Active Venture Capital Firms For Startups In India (and their investing patterns) ©2018 Inc42 All Rights Reserved Feel free to share this ebook without modification. 1 Introduction Once a startup has reached the growth stage, its most important requirement is undoubtedly the backing by reliable investors and an ample amount of funding to scale up. Though the concept of starting up has gained momentum recently, the small number of investors willing to show their trust and invest in new ventures has been a problem for startups. Many startups find it difficult to approach venture capitalists and quite a few times the investment structure of the investor is inadequate for the startup. So in this document, we bring to you the much needed list of the most active institutional investors and capital funds in India along with their investment capacity, investment structure, investment industries and some of their most notable portfolio startups. 2 Helion Venture Partners Investing in technology-powered and consumer service businesses, Helion Ventures Partners is a $605 Mn Indian- focused, an early to mid-stage venture fund participating in future rounds of financing in syndication with other venture partners. People You Should Know: Sandeep Fakun, Kanwaljit Singh. Investment Structure: Invests between $2 Mn to $10 Mn in each company with less than $10 Mn in revenues. Industries: Outsourcing, Mobile, Internet, Retail Services, Healthcare, Education and Financial Services. Startups Funded: Yepme, MakemyTrip, NetAmbit, Komli, TAXI For Sure, PubMatic. Contact Details: 8040183333, 01244615333, 3 Accel Partners Accel Partners founded in 1983 has global presence in Palo Alto, London , New York, China and India. -

Announcement Discloseable Transaction Further

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. ANNOUNCEMENT DISCLOSEABLE TRANSACTION FURTHER INTRODUCTION OF STRATEGIC INVESTORS TO A SUBSIDIARY The Board is pleased to announce that subsequent to the publishing of the voluntary announcement on the introduction of four First Round Strategic Investors to a subsidiary of the Company, AAC Optics (Changzhou) Co., Ltd.* ( 誠瑞光學(常州)股份有限公司 ) (AAC Optics) (previously known as AAC Communication Technologies (Changzhou) Co., Ltd.* (瑞聲通訊科技(常州)有限公司)) on 22 July 2020, AAC Optics, AAC Optics Controlling Shareholders and 18 new independent strategic investors entered into the Capital Increase Agreement and the Shareholders Agreement to further introduce strategic investors to the same subsidiary on 9 October 2020. Pursuant to the terms and conditions of the Capital Increase Agreement, the registered capital of AAC Optics will increase from RMB6,017,638,706 to RMB6,633,518,025, and, AAC Optics has agreed to issue to the Current Round Strategic Investors, and the Current Round Strategic Investors have agreed to subscribe for such entire increase in share capital, an aggregate of 615,879,319 newly issued shares, representing approximately 9.2845% of the equity interest of AAC Optics after the capital increase, at a consideration of RMB1,658,000,000. Upon completion of the Introduction of the Current Round Strategic Investors, the Company will hold 82.0219% of AAC Optics’ equity interest. -

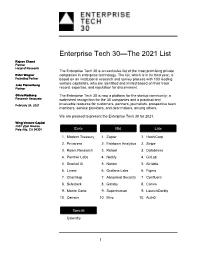

Enterprise Tech 30—The 2021 List

Enterprise Tech 30—The 2021 List Rajeev Chand Partner Head of Research The Enterprise Tech 30 is an exclusive list of the most promising private Peter Wagner companies in enterprise technology. The list, which is in its third year, is Founding Partner based on an institutional research and survey process with 103 leading venture capitalists, who are identified and invited based on their track Jake Flomenberg Partner record, expertise, and reputation for discernment. Olivia Rodberg The Enterprise Tech 30 is now a platform for the startup community: a Research Associate watershed recognition for the 30 companies and a practical and February 24, 2021 invaluable resource for customers, partners, journalists, prospective team members, service providers, and deal makers, among others. We are pleased to present the Enterprise Tech 30 for 2021. Wing Venture Capital 480 Lytton Avenue Palo Alto, CA 94301 Early Mid Late 1. Modern Treasury 1. Zapier 1. HashiCorp 2. Privacera 2. Fishtown Analytics 2. Stripe 3. Roam Research 3. Retool 3. Databricks 4. Panther Labs 4. Netlify 4. GitLab 5. Snorkel AI 5. Notion 5. Airtable 6. Linear 6. Grafana Labs 6. Figma 7. ChartHop 7. Abnormal Security 7. Confluent 8. Substack 8. Gatsby 8. Canva 9. Monte Carlo 9. Superhuman 9. LaunchDarkly 10. Census 10. Miro 10. Auth0 Special Calendly 1 2021 The Curious Case of Calendly This year’s Enterprise Tech 30 has 31 companies rather than 30 due to the “curious case” of Calendly. Calendly, a meeting scheduling company, was categorized as Early-Stage when the ET30 voting process started on January 11 as the company had raised $550,000. -

Cloudera Whatsapp

LOS ANGELES | SAN FRANCISCO | NEW YORK | BOSTON | SEATTLE | MINNEAPOLIS | MILWAUKEE August 13, 2013 Michael Pachter Steve Koenig (213) 688-4474 (415) 274-6801 [email protected] [email protected] PRISM … Progress Report for Internet and Social Media In This Issue: Cloudera, WhatsApp Cloudera Big Data analysis firm founded by four tech veterans from Facebook, Yahoo, Google and Oracle. Developed applications based on open source Apache Hadoop to process large data sets. Has raised $141 million over five rounds of funding. Annual revenue estimated at $100 million. Market expected to grow at 54% CAGR over next five years. WhatsApp Mobile instant messaging service with 250 million global monthly active users. Subscription-based revenue model; no advertisements or virtual goods. Mostly self-funded, with only $8 million raised in four years. STRATEGIES GROUP THE INFORMATION HEREIN IS ONLY FOR ACCREDITED INVESTORS AS DEFINED IN RULE 501 OF REGULATION D UNDER THE SECURITIES ACT OF 1933 OR INSTITUTIONAL INVESTORS. WEDBUSH PRIVATE COMPANY Wedbush Securities does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Please see page 10 of this report for analyst certification and important disclosure information. Cloudera Cloudera offers scalable and efficient data storage and analytics solutions to companies in the enterprise, Internet and government sectors. The company, based in Palo Alto, was launched in 2008 by three top engineers from Google, Yahoo, and Facebook (Christophe Bisciglia, Amr Awadallah, and Jeff Hammerbacher, respectively) who joined former Oracle executive Michael Olson to address problems inherent in analyzing large volumes of data quickly. -

Sequoia Capital U.S. Venture Partners Fund XVI, L.P. Form D Filed 2018

SECURITIES AND EXCHANGE COMMISSION FORM D Official notice of an offering of securities that is made without registration under the Securities Act in reliance on an exemption provided by Regulation D and Section 4(6) under the Act. Filing Date: 2018-09-27 SEC Accession No. 0001753105-18-000001 (HTML Version on secdatabase.com) FILER Sequoia Capital U.S. Venture Partners Fund XVI, L.P. Mailing Address Business Address 2800 SAND HILL ROAD, 2800 SAND HILL ROAD, CIK:1753105| IRS No.: 000000000 | State of Incorp.:E9 | Fiscal Year End: 1231 SUITE 101 SUITE 101 Type: D | Act: 33 | File No.: 021-322351 | Film No.: 181091885 MENLO PARK CA 94025 MENLO PARK CA 94025 650.854.3927 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL OMB Number: 3235-0076 Washington, D.C. 20549 June 30, Expires: FORM D 2012 Estimated average burden hours per 4.00 Notice of Exempt Offering of Securities response: 1. Issuer's Identity CIK (Filer ID Number) Previous Name(s) ☒ None Entity Type 0001753105 ☐Corporation Name of Issuer ☒ Limited Partnership Sequoia Capital U.S. Venture Partners ☐ Limited Liability Company Fund XVI, L.P. Jurisdiction of Incorporation/ ☐ General Partnership Organization ☐ Business Trust CAYMAN ISLANDS ☐Other Year of Incorporation/Organization ☐ Over Five Years Ago ☒ Within Last Five Years (Specify Year) 2018 ☐ Yet to Be Formed 2. Principal Place of Business and Contact Information Name of Issuer Sequoia Capital U.S. Venture Partners Fund XVI, L.P. Street Address 1 Street Address 2 2800 SAND HILL ROAD, SUITE 101 City State/Province/Country ZIP/Postal Code Phone No. -

Capital Market Structure

STRUCTURE OF CAPITAL MARKET JK SHAH CLASSES WHAT IS SHARES? 100 600 CR CR 680 SHARE IS SMALL PART OF CR SHARE CAPITAL SHARE CAPITAL J.K.SHAH CLASSES SHARES SHARES EQUITY PERFERENCE SHARES SHARES J.K.SHAH CLASSESNVR DVR J.K.SHAH CLASSES WHAT IS DVR? J.K.SHAH CLASSES J.K.SHAH CLASSES J.K.SHAH CLASSES Section 43(a)(ii) of the Companies Act, 2013, authorized equity share capital with differential rights as to dividend, voting or otherwise in accordance with rule 4 of Companies (Share Capital and Debentures) Rules, 2014 which prescribes the following conditions for issue of DVRs ➢ the articles of association of the company authorizes the issue of shares with differential rights ➢ the issue of shares is authorized by ordinary resolution passed at a general meeting of the shareholders. Where the equity shares of a company are listed on a recognized stock exchange, the issue of such shares shall be approved by the shareholders through postal ballot at a general meeting; ➢ the shares with differential rights shall not exceed twenty-six percent of the total post-issue paid up equity share capital including equity shares with differential rights issued at any point of time; ➢ the company having consistent track record of distributable profit for the last three years; J.K.SHAH CLASSES ➢ the company has not defaulted in filing financial statements and annual returns for three financial years immediately preceding the financial year in which it is decided to issue such shares; ➢ the company has no subsisting default in the payment of a declared dividend