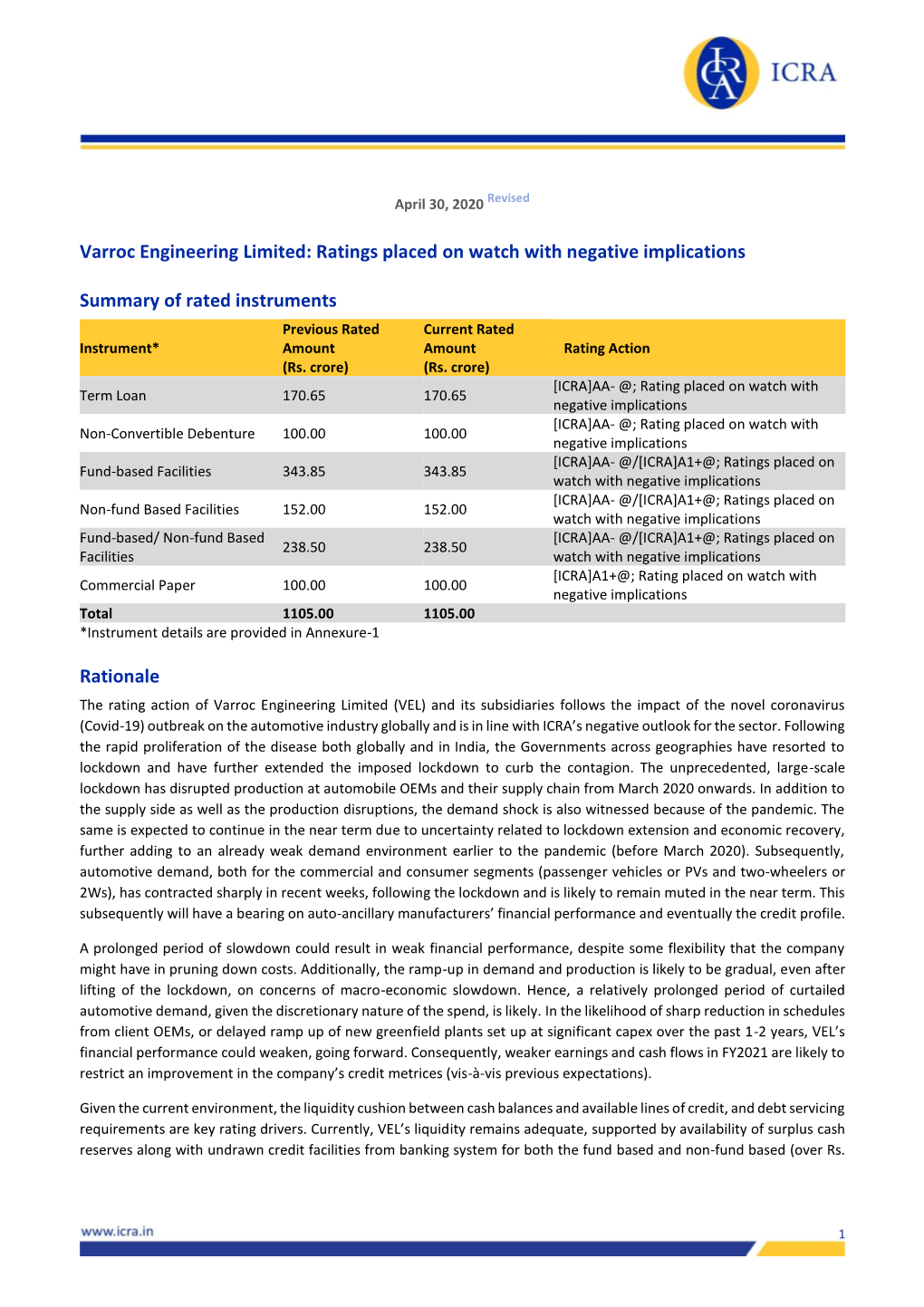

Varroc Engineering Limited: Ratings Placed on Watch with Negative Implications

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Intimation Regarding Investor Conference

l Varroc Engineering Limited Regd. & Corp. Office L-4, MIDC, Industrial Area I Tel +91 240 6653600 email: [email protected] Waluj, Aurangabad 431 136 fax +91 240 2564540 www.varroc.-...r.com Maharashtra, India CIN: L28920MH 1988PLC047335 vcrroc VARROC/SE/INT/2020-21/70 February 19, 2021 To, The Manager- Listing The Manager - Listing The Listing Department, The Corporate Relation National Stock Exchange of India Department, Limited Bombay Stock Exchange Exchange Plaza, Plot No. Cf 1, G Block, Limited Bandra-Kurla Complex, Phiroze Jeejeebhoy Towers, Bandra (East), Mumbai-400051. Dalal Street, Fort, Mumbai-400001 . .NSE Symbol: VARROC BSE Security Code: 541578 Sub.: Intimation regarding participation in Investor Conference Ref.: Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 ('Listing Regulations') Dear Sir/Madam, Pursuant to Regulation 30 of the Listing Regulations, tliis is to inform you that, the Company will be participating in ongoing "Kotak : Chasing Growth Conference, 2021" which is being held till February 23, .2021, organized by Kotak Securities Limited. It may be noted that the schedule will be subject to changes on the part of the investors / organizers/ management team. · The attached presentation will be presented at the said Conference. We request you to take this on record, and to treat the same as compliance with the applicable provisions of the Listing Regulations, as amended. Yours faithfully, For Varroc Engineering Limited Ajay Sharma Group General Counsel and Company Secretary Varroc Engineering Limited Corporate Presentation Varroc is a leading Indian auto component groupwith a global footprint • Founded in 1988 in Aurangabad, India by the Jain family • Successful listing on the Indian Stock Exchanges in July 2018 Leading Two primary business lines: Tier-1 manufacturer and supplier to 1. -

Mid & Small Cap Top Picks

Mid & Small Cap Top Picks - Auto & Auto Anc. Given the recent SEBI circular on minimum sector allocation criteria for MultiCap Fund, there will be a shift of fund from large cap to Mid and Small Cap companies. Given recovery in 2W/PV OEMs volume and acceleration in Abhishek Jain replacement segment demand, we expect B2B and B2C auto component Analyst players to witness recovery in earnings. We expect B2B players with higher +9122 40969739 exposure to 2W/PVs (Sandhar Technologies, Suprajit Eng, Minda Corp, [email protected] Subros, Asahi India, JBM Auto and Lumax Auto Tech) to be better placed in Auto and Ancillary space. Among B2C players, we expect Amara Raja Ketul Dalal Batteries, Exide Industries and CEAT to benefit. Associate +91 22 40969770 In Midcap space we prefer Escorts, Ashok Leyland, Exide and Amara Raja [email protected] Batteries. Kripashankar Maurya In the Small Cap space, we prefer Asahi India Glass, CEAT, JBM Auto, Lumax Associate Auto Tech, Minda Corp, Sandhar tech, Sterling Tools, Subros, Suprajit Eng, +91 22 40969741 Varroc Eng. kripashankarm@dolat Selling pressure may be seen in – MSIL and Eicher Motors due to rich valuations. Top Picks in Mid and Small Cap - Auto Universe P/E Debt Debt/ Net D/E Total FCF Total FCF Company MCap CMP EPS (Rs/sh) EPS gr (%) (x) (Rs mn) EBITDA (x) (Rs mn) (3yr)/Mcap (Rs bn) (Rs) FY21E FY22E FY23E FY21-23E FY23E FY20 FY20 FY20 FY21-23E (%) Escorts 146 1192 52.7 63.8 80.7 15 14.8 483 0.07 -0.08 14,246 10 B2B Players Asahi India Glass 53 217 2.2 7.8 11.1 71 19.5 17,617 4.05 1.09 11,559 22 Bharat Forge 214 460 6.1 15.7 21.7 53 21.2 38,784 3.48 0.43 11,071 5 Jamna Auto Ind 18 46 0.3 1.2 2.2 95 20.7 1,557 1.36 0.29 1,490 8 JBM Auto 11 231 14.6 20.6 30.7 28 7.5 5,459 2.37 0.76 3,184 29 Lumax Auto Tech 6 93 4.4 7.1 8.8 26 10.5 949 1.04 -0.03 670 11 Lumax Inds. -

Q3 FY21 Financial Presentation

Click to edit Master title style Varroc Engineering Limited Financial Results Q3 FY21 ::9th February 2021:: Disclaimers This presentationClickmay include tostatements editwhich may constitute Masterforward-looking statements title. All statements stylethat address expectations or projections about the future, including, but not limited to, statements about the strategy for growth, business development, market position, expenditures, and financial results, are forward looking statements. Forward looking statements are based on certain assumptions and expectations of future events and involves known and unknown risks, uncertainties and other factors. The Company cannot guarantee that these assumptions and expectations are accurate or exhaustive or will be realised. The actual results, performance or achievements, could thus differ materially from those projected in any such forward-looking statements. No obligation is assumed by the Company to update the forward-looking statements contained herein. The information contained in these materials has not been independently verified. None of the Company, its Directors, Promoter or affiliates, nor any of its or their respective employees, advisers or representatives or any other person accepts any responsibility or liability whatsoever, whether arising in tort, contract or otherwise, for any errors, omissions or inaccuracies in such information or opinions or for any loss, cost or damage suffered or incurred howsoever arising, directly or indirectly, from any use of this document or its contents or otherwise in connection with this document, and makes no representation or warranty, express or implied, for the contents of this document including its accuracy, fairness, completeness or verification or for any other statement made or purported to be made by any of them, or on behalf of them, and nothing in this document or at this presentation shall be relied upon as a promise or representation in this respect, whether as to the past or the future. -

Varroc-Corporate-Presentation-1.Pdf

Corporate Presentation May 2019 Varroc is the 2nd Largest Indian Auto Component Group1 with a Global Footprint Founded in 1988 in Aurangabad, India by the Jain family Successful listing on the Indian Stock Exchanges in July 2018 Leading Two primary business lines: tier-1 manufacturer and supplier to 1. Varroc Lighting Systems (“VLS”): global supplier of exterior lighting the Indian 2W and 3W OEMs(4) systems to passenger car OEMs 2. Varroc India Business: manufacturer and supplier of diverse range of auto components primarily to 2W, 3W and 4W OEMs 6th Strong, long-lasting, growing customer relationships with Largest(2), fastest growing among marquee auto OEMs globally and in India top six global exterior auto lighting Well-diversified global auto component business across geographies, products and customers suppliers Low cost, strategically located global manufacturing footprint 41 Operating plus 2 Upcoming Manufacturing Facilities and 16 R&D Centres across 5 continents In-house R&D capabilities in India, Czech Republic, China(5), USA, INR 120 bn Mexico, Germany, Italy, Romania and Poland FY19 revenue(3) ~1,500 R&D engineers(6); 185 patents granted globally(6) Experienced management team supported by reputed Board ~14,000 employees across the globe(6) Note: (1) Based on CRISIL Report - By revenue for FY17. Excludes TVS Motors revenues for Sundaram Clayton and Bosch Ltd. part of Robert Bosch GmbH (Germany). (2) Based on Yole Report – By revenue for CY16. For passenger and light commercial vehicles. (3) Based on Yole Report for Revenue CAGR from 2014 – 2016. (4) Based on CRISIL report; by revenue for CY16 – Sum of Varroc Engineering Pvt. -

Varroc Engineering IPO – an Auto-Matic BUY 25 June 2018 Mid Cap of Rs

A quality report by JainMatrix Investments th Varroc Engineering IPO – An Auto-matic BUY 25 June 2018 Mid Cap of Rs. 13,000 cr. Industry – Auto Ancillary; IPO Opens 26-28th June at Rs. 965-967 Valuations: P/E 28.9 times TTM Advice: SUBSCRIBE Overview: Varroc Engineering is a global tier-1 auto component firm. They design, make and supply exterior lighting systems, plastic and polymer, electricals-electronics and precision metallic components to passenger car, CV, 2W, 3W and off highway vehicle OEMs directly worldwide. India and global revenues are split 35:65 so they have good international presence. Varroc’s FY18 revenue, EBITDA and PAT were Rs. 10,417 cr., Rs. 985 cr. and Rs. 451 cr. resp. Their revenues, EBITDA and PAT grew at 13.1%, 12.9% and 18.2% CAGR in 4 years. At a FY18 PE of 28.9x, valuations appear fair. It has a healthy balance sheet with conservative financials. It has good Indian and global presence. Key Risks: 1) High Competition 2) Currency Risks 3) Downturn in macro-economic environment. Opinion: Investors can SUBSCRIBE to this IPO with a 2 year perspective. Other automotive sector reports from JainMatrix Investments Endurance Technologies (IPO) – The Firm Has Stamina Eicher Motors – It’s Firing On Both Engines Motherson Sumi Systems – Global Auto Ancillary Growth GNA Axles Ltd IPO – The Globe Beckons Here is a note on Varroc Engineering (Varroc) IPO. IPO highlights The IPO opens: 26-28th June 2018 with the Price band: Rs. 965-967 per share. Shares offered to public number 2.01 cr. -

Varroc Engineering Limited.Cdr

VARROC ENGINEERING LIMITED June 22, 2018 SMC Ranking (2/5) Issue Highlights About the Company Industry Auto Ancillary Varroc Engineering Limited is a global tier-1 automotive component group. The company Offer for sale (Shares) 20,221,730 designs, manufactures and supplies exterior lighting systems, plastic and polymer Employee reservation 100,000 components, electricals-electronics components, and precision metallic components to various automobile companies worldwide. It is the second largest Indian auto component Net Offer to the Public 20,121,730 group and a leading tier-1 manufacturer and supplier to Indian two-wheeler and three- Issue Size (Rs. Cr.) 1951-1955 wheeler OEMs. The company has expanded in India through acquisitions, mergers, joint- Price Band (Rs.) 965-967 ventures and has expanded its manufacturing and R&D footprint by investing in nine Offer Date 26-Jun-18 manufacturing plants and an additional R&D center in India since 2012. The company has Close Date 28-Jun-18 two primary business lines: (1) the “Global Lighting Business” under which it design, Face Value 1 manufacture and supply of exterior lighting systems to passenger cars OEMs worldwide Lot Size 15 Equity Share and (2) the “India Business” under which serves India, primarily two-wheelers and three- wheelers. At present, the company has a global footprint of 36 manufacturing facilities spread across seven countries, with six facilities for Global Lighting Business, 25 for India Business and five for Other Businesses. Companies like Bajaj, Honda, Yamaha, KTM, etc. Issue Composition In shares constitute the client base of the company. The company’s goal is to bring leading technologies to the mainstream markets with high quality, cost competitive solutions. -

Varroc Polymers Private Limited: Ratings Downgraded; Outlook Revised to Stable

June 23, 2021 Varroc Polymers Private Limited: Ratings downgraded; outlook revised to Stable Summary of rating action Previous Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) [ICRA]A+(Stable); Ratings downgraded from [ICRA]AA- Term Loan 125.00 65.00 and outlook revised to Stable from Negative [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Fund-based Facilities 20.00 20.00 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from Negative [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Non-fund Based 5.00 3.00 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from Facilities Negative [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Fund-based/ Non- 190.00 155.00 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from fund Based Facilities Negative Commercial Paper 75.00 75.00 [ICRA]A1; Ratings downgraded from [ICRA]A1+ [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Unallocated 0.00 97.00 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from Negative Total 415.00 415.00 *Instrument details are provided in Annexure-1 Rationale For arriving at the ratings, ICRA has considered the consolidated financials of Varroc Engineering Limited (VEL) along with its subsidiaries/step-down subsidiaries together (including Varroc Polymers Private Limited (VPPL)), henceforth referred to as The Group/ Varroc. The rating revision factors in the continued weakening of Varroc’s financial profile as reflected by moderation in profitability, debt protection metrics and capital structure in FY2020 and FY2021. The Group’s operations and profitability were adversely impacted by the Covid-19 pandemic-related lockdown in Q4 FY2020, Q1 and Q3 FY2021 resulting in subdued profitability as reflected by contraction in earnings (adjusted for income from JV) from Rs 397 crore in FY2019 to Rs 12 crore in FY2020 and further down to net losses of Rs 664 crore in FY2021 (of this Rs 110 crore is as a result of non-cash tax asset write off in Czech). -

The Automotive Research Association of India Research Lnstitution of the Automotive Industry with the Ministry of Heavy Industries & Public Enterprises, Govt

Progress through Research ars 50 Ye of To ing ge at the br rn le e e ss “C ” YEARS OF BUILDING AUTOMOTIVE EXCELLENCE 1966 - 2016 46th ANNUAL REPORT 2015-2016 TheAutomotiveResearchAssociationofIndia Progress through Research Vision and Mission Statement ARAI has a strong base of state-of-the-art technology equipment, laboratory facilities and highly qualified and experienced personnel. With these assets, ARAI has goals, strategies and action plans to Vision achieve the fullest customer satisfaction. These are:- (a) to compete in service with excellence (b) to obtain recognition and accreditation (c) to cover global market (d) to build commitment of all personnel (e) to develop team spirit and sense of belonging amongst all. ● ARAI has been providing various services to the Indian Automotive Industry in the areas of design & development and know-how for Mission manufacture & testing of components/ system to national/ international standards. ARAI shall strive to achieve international recognition in these areas. ● ARAI shall seek the valuable guidance and support from our members, from time to time to achieve growth and stability. ● With the globalisation of economy and business, ARAI shall enlarge its scope of services to meet the requirements of automotive industries anywhere in the world. ● ARAI strongly believes that satisfaction of customer needs on continuing basis, is of prime importance to earn the loyalty of the customers. Therefore, emphasis shall be on meeting and exceeding the customer needs through continuing quality improvement with active participation of employees and also customers. Progress through Research Celebrating 50 Years of Togetherness We The People YEARS OF BUILDING AUTOMOTIVE EXCELLENCE 1966 - 2016 Our Team Today 1966-2016 Celebrating Progress through Research GOLDEN JUBILEE The Automotive Research Association of India Research lnstitution of the Automotive Industry with the Ministry of Heavy Industries & Public Enterprises, Govt. -

Varroc Engineering Limited: Ratings Downgraded; Outlook Revised to Stable

June 23, 2021 Varroc Engineering Limited: Ratings downgraded; outlook revised to Stable Summary of rating action Previous Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) [ICRA]A+(Stable); Ratings downgraded from [ICRA]AA- Term Loan 605.37 504.00 and outlook revised to Stable from Negative [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Fund-based Facilities 22.35 17.35 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from Negative [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Non-fund Based 132.50 35.0 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from Facilities Negative [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Fund-based/ Non- 280.00 339.55 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from fund Based Facilities Negative [ICRA]A+(Stable)/[ICRA]A1; Ratings downgraded from Fund-based/ Non- 0.0 144.32 [ICRA]AA-/[ICRA]A1+ and outlook revised to Stable from fund – Unallocated Negative Commercial Paper 100.00 100.00 [ICRA]A1; Ratings downgraded from [ICRA]A1+ Total 1140.22 1140.22 *Instrument details are provided in Annexure-1 Rationale For arriving at the ratings, ICRA has considered the consolidated financials of Varroc Engineering Limited (VEL) along with its subsidiaries/step-down subsidiaries together, henceforth referred to as The Group/ Varroc. The rating revision factors in the continued weakening of Varroc’s financial profile as reflected by moderation in profitability, debt protection metrics and capital structure in FY2020 and FY2021. The Group’s operations and profitability were adversely impacted by the Covid-19 pandemic-related lockdown in Q4 FY2020, Q1 and Q3 FY2021 resulting in subdued profitability as reflected by contraction in earnings (adjusted for income from JV) from Rs 397 crore in FY2019 to Rs 12 crore in FY2020 and further down to net losses of Rs 664 crore in FY2021 (of this Rs 110 crore is as a result of non-cash tax asset write off in Czech). -

Q2 FY21 Financial Presentation

Click to edit Master title style Varroc Engineering Limited Financial Results Q2 FY21 ::10th November 2020:: 1 Disclaimers This presentationClickmay include tostatements editwhich may constitute Masterforward-looking statements title. All statements stylethat address expectations or projections about the future, including, but not limited to, statements about the strategy for growth, business development, market position, expenditures, and financial results, are forward looking statements. Forward looking statements are based on certain assumptions and expectations of future events and involves known and unknown risks, uncertainties and other factors. The Company cannot guarantee that these assumptions and expectations are accurate or exhaustive or will be realised. The actual results, performance or achievements, could thus differ materially from those projected in any such forward-looking statements. No obligation is assumed by the Company to update the forward-looking statements contained herein. The information contained in these materials has not been independently verified. None of the Company, its Directors, Promoter or affiliates, nor any of its or their respective employees, advisers or representatives or any other person accepts any responsibility or liability whatsoever, whether arising in tort, contract or otherwise, for any errors, omissions or inaccuracies in such information or opinions or for any loss, cost or damage suffered or incurred howsoever arising, directly or indirectly, from any use of this document or its contents or otherwise in connection with this document, and makes no representation or warranty, express or implied, for the contents of this document including its accuracy, fairness, completeness or verification or for any other statement made or purported to be made by any of them, or on behalf of them, and nothing in this document or at this presentation shall be relied upon as a promise or representation in this respect, whether as to the past or the future. -

Varroc Lighting Systems India Private Limited

Varroc Lighting Systems India Private Limited Instrument Amount Rating Action Term Loan 38.0 [ICRA]AA- (Stable) assigned Fund Based 32.0 [ICRA]AA- (Stable)/[ICRA]A1+ assigned Amount in Rs crore; ICRA has assigned long term rating of [ICRA]AA- (pronounced ICRA double A minus) to Rs 38.0 crore term loan bank facility of Varroc Lighting Systems India Private Limited (VLSIPL). ICRA has also assigned ratings of [ICRA]AA- and short term rating of [ICRA]A1+ (pronounced ICRA A One plus) to Rs 32.0 crore fund based long term/short term bank limits of VLSIPL. For arriving at the ratings, ICRA has taken combined view of Varroc Engineering Private Limited (VEPL) along with its Indian subsidiaries Varroc Polymers Private Limited (VPPL), Durovalves India Private Limited (DIPL), Varroc Exhaust Systems India Private Limited (VESPL), Varroc Lighting Systems India Private Limited (VLSIPL) as well as its overseas operations. The assigned ratings take into account VEPL’s large scale of operations; diversified presence across various products, automotive segments and geographies; longstanding relationship with reputed OEMs and strong share in their order book and comfortable debt coverage indicators. The rating strengths are partially offset by its dependence on cyclical automotive industry; stiff competition in global lighting industry with entrenched and much larger players; subdued performance of European forging business and sizeable investments plans in the medium term which will keep pressure on cash flows in the interim. While ICRA expects the company to maintain its credit profile through its organic or inorganic investment plans, the impact of any such investments, on the credit profile would be evaluated by ICRA on a case by case basis. -

Varroc Engineering Limited Regd

Varroc Engineering Limited Regd. & Corp. Office email: [email protected] L-4. MIDC, Industrial Area Tel +91 240 6653600 I www.varrocarouo.com Waluj, Aurangabad 431 136 Fax +91 240 2564540 v~rroc: 1 CIN: L28920MH1988PLC047335 Maharashtra, India IXCILLINCII VARROC/SE/1 NT /2018-19/29 October 27, 2018 ;_cy .Jll ~he Manager- Listing (2) The Manager Li sting The Listing Department, The Corpo te Relation Department, National Stock Exchange of India Limited BSE Lim· ed Exchange Plaza, Plot No. C/1, G Block, Phiro e Jeejeebhoy Towers, Bandra-Kurla Complex, Da I Street, Fort, Sandra (East), Mumbai-400051 umbai-400001 NSE Symbol: VARROC BSE Security Code: 541578 Security ID: VARROC Dear Sirs, Sub: Corporate Presentation Ref.: Disclosure under Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirement) Regulations, 2015 Pursuant to the Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 ("Listing Regulations") we enclosed herewith the "Corporate Presentation" of the company. This presentation is also available on the website of the company at www.varrocgroup.com. You are requested to take note of the same. Thanking you, Yours faithfully, For Varr:oc Engineering Limited ~ Rakesh Darji Company Secretary and Compliance officer Encl: Corporat~ Presentation October 2018 Corporate Presentation Varroc is the 2nd Largest Indian Auto Component Group(1) with a Global Footprint • Founded in 1988 in Aurangabad, India by the Jain family • Successful listing on the Indian Stock Exchanges in July 2018 Leading Two primary business lines: tier-1 manufacturer and supplier to 1. Varroc Lighting Systems (“VLS”): global supplier of exterior lighting the Indian 2W and 3W OEMs(4) systems to passenger car OEMs 2.