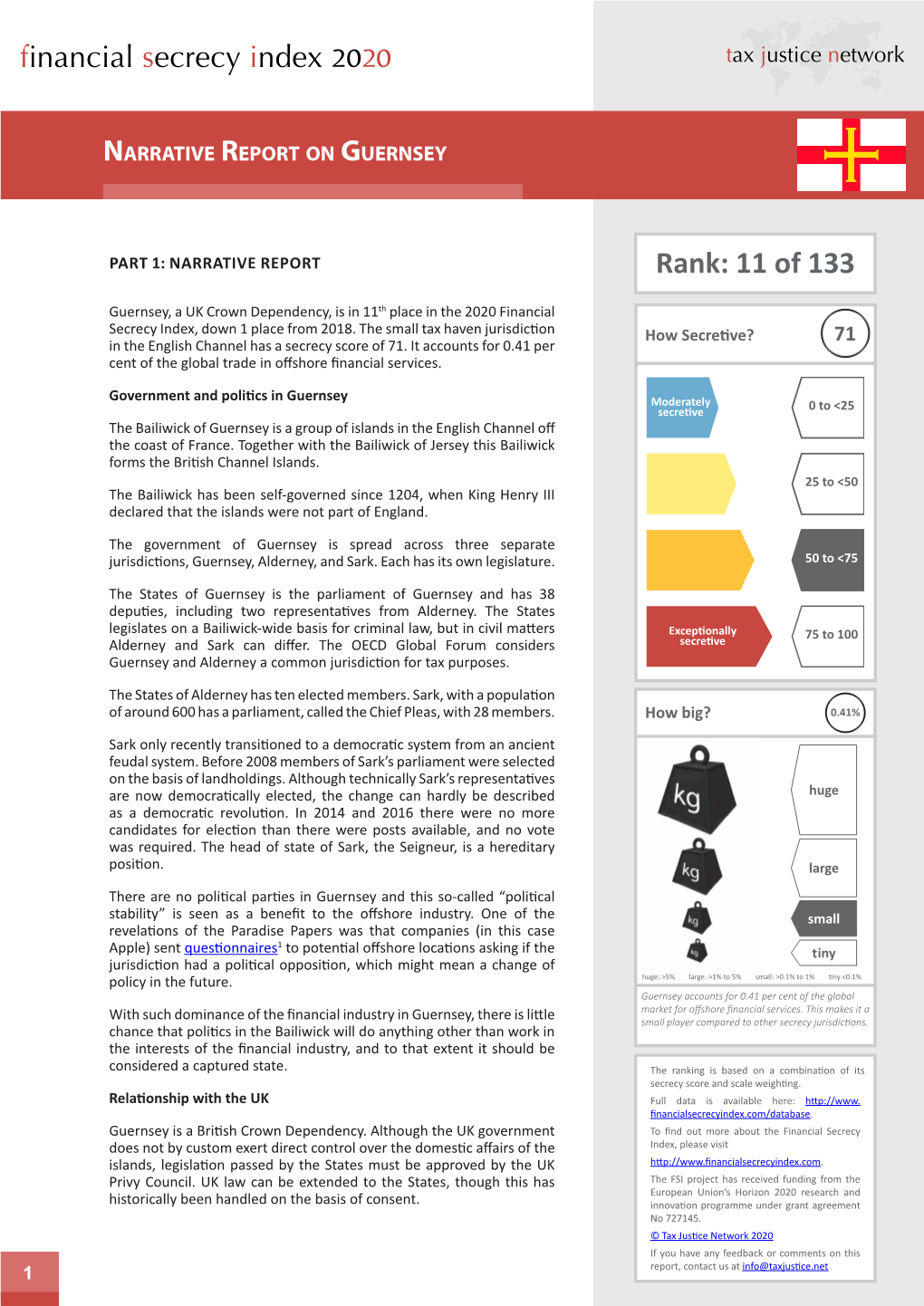

Narrative Report on Guernsey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Avoidance Due to the Zero Capital Gains Tax

2 Capital gains tax regimes abroad—countries without capital gains taxes Tax avoidance due to the zero capital gains tax Some indirect evidence from Hong Kong BERRY F. C . H SU AND CHI-WA YUEN Consistent with its image as a free-market economy with minimal government intervention, Hong Kong is a city with low and simple taxation. Unlike most industrial and developed economies with full-fledged tax structures, Hong Kong has a relatively narrow tax base. It has direct taxes, which account for about 60% of the total tax revenue. These direct levies fall on earnings and profits and in- clude an estate duty. Hong Kong also has indirect taxes, which ac- count for the remaining 40%. These consist of rates, duties, and taxes on motor vehicles and so on.1 Nonetheless, Hong Kong has neither a sales or value-added tax nor a capital gains tax. In this paper, we explain the absence of the capital gains tax and provide some indirect evidence on the tax-avoidance effects induced by this fact. Notes will be found on pages 51–53. 39 40 International evidence on capital gains taxes Why is there no capital gains tax in Hong Kong? Under the British colonial rule, no tax was levied on capital gains in Hong Kong.2 This continues to be the case since the Chinese gov- ernment took over in 1997. During the pre-1997 (colonial) period, the tax structure in Hong Kong was based on the British tax system, which uses the source concept of income for the taxation of different kinds of in- come. -

The Sovereignty of the Crown Dependencies and the British Overseas Territories in the Brexit Era

Island Studies Journal, 15(1), 2020, 151-168 The sovereignty of the Crown Dependencies and the British Overseas Territories in the Brexit era Maria Mut Bosque School of Law, Universitat Internacional de Catalunya, Spain MINECO DER 2017-86138, Ministry of Economic Affairs & Digital Transformation, Spain Institute of Commonwealth Studies, University of London, UK [email protected] (corresponding author) Abstract: This paper focuses on an analysis of the sovereignty of two territorial entities that have unique relations with the United Kingdom: the Crown Dependencies and the British Overseas Territories (BOTs). Each of these entities includes very different territories, with different legal statuses and varying forms of self-administration and constitutional linkages with the UK. However, they also share similarities and challenges that enable an analysis of these territories as a complete set. The incomplete sovereignty of the Crown Dependencies and BOTs has entailed that all these territories (except Gibraltar) have not been allowed to participate in the 2016 Brexit referendum or in the withdrawal negotiations with the EU. Moreover, it is reasonable to assume that Brexit is not an exceptional situation. In the future there will be more and more relevant international issues for these territories which will remain outside of their direct control, but will have a direct impact on them. Thus, if no adjustments are made to their statuses, these territories will have to keep trusting that the UK will be able to represent their interests at the same level as its own interests. Keywords: Brexit, British Overseas Territories (BOTs), constitutional status, Crown Dependencies, sovereignty https://doi.org/10.24043/isj.114 • Received June 2019, accepted March 2020 © 2020—Institute of Island Studies, University of Prince Edward Island, Canada. -

H. Brecqhou Autonomy

Dawes: Brecqhou’s Autonomy BRECQHOU’S AUTONOMY A Response to Henry Johnson’s ‘Sark and Brecqhou: Space, Politics and Power’ (2014) GORDON DAWES Mourant Ozanes <[email protected]> Key Words: Brecqhou, Sark, Barclay Brothers As detailed below, Henry Johnson’s article ‘Sark and Brecqhou, Space Politics and Power’ (2014) published in Shima v8 n1: 9-33 contains a number of factual errors and erroneous interpretations of the issues concerned. There is also a significant problem with the comparators used to refer to matters concerning Sark and Brecqhou since the micronations selected are bogus, recent conceits, as opposed to islands with ancient histories and real status, such as Sark and, separately, Brecqhou. The crucial distinction is that there is no external challenge to the status of either Sark or Brecqhou. The principal shortcomings of Johnson’s chacterisations and argument are as follows: Page 10 – Johnson states that Sark and Brecqhou form one jurisdiction. This is too simplistic a statement. Brecqhou is certainly not a part of Sark, and I return to this issue later. Sark's parliament and court claim jurisdiction over Brecqhou. However, that jurisdiction is itself contentious and the concession made in a statement to the Royal Court of Guernsey in private law proceedings in 2000 referred to by Johnson was itself wrongly made and/or not binding as a matter of public law. In practice the jurisdiction is rarely exercised and, when it is, dispute generally follows. Whatever legislative jurisdiction is claimed is itself limited by convention as to how it is exercised and when. Page 12 – Johnson states that Sir Frederick and Sir David Barclay are tenants of La Moinerie de Haut, one of the original Sark tenements, and repeats a claim that Brecqhou became a tenement of Sark in 1929 when Dame Sybil Hathaway sold Brecqhou to one Angelo Clarke. -

The Cutty Sark

The Cutty Sark Greetings to all who read this article from Wayne R Makin fellow Clan member in Melbourne Australia. I write this document having been inspired by Ken McNaughton whose storytelling and historical works are second to none. He is a fellow countryman and we share similar local Australian experiences. I lived in Port Melbourne Australian on Port Philip Bay in my early years and now in my latter years have our family property on Westernport Bay. Both of these bays were where the Cutty Sark would have delivered and had taken on cargo. As a child I was always interested in 'Windjammers' and sailing ships of all kinds. From my childhood days they spoke of the Cutty Sark and my ears used to prick up every time I heard the name mentioned. I have always been drawn to the sea and all things seawards unlike most of my forebears who were miners and farmers. In 1957, fully restored, the ship was installed in a concrete dry berth near the River Thames at Greenwich, London, and was opened to the public by Queen Elizabet 11 as a maritime relic and sailing museum. In 2006 the Cutty Sark was closed for extensive renovations. The following year it was severely damaged by fire, but renovation work continued toward the goal of reopening the ship to the public in time for the 2012 Summer Olympic Games in London. There she sits today as the pride and joy in playing its part in some of Britain’s finest glory days on the High Seas. -

FINANCE Offshore Finance.Pdf

This page intentionally left blank OFFSHORE FINANCE It is estimated that up to 60 per cent of the world’s money may be located oVshore, where half of all financial transactions are said to take place. Meanwhile, there is a perception that secrecy about oVshore is encouraged to obfuscate tax evasion and money laundering. Depending upon the criteria used to identify them, there are between forty and eighty oVshore finance centres spread around the world. The tax rules that apply in these jurisdictions are determined by the jurisdictions themselves and often are more benign than comparative rules that apply in the larger financial centres globally. This gives rise to potential for the development of tax mitigation strategies. McCann provides a detailed analysis of the global oVshore environment, outlining the extent of the information available and how that information might be used in assessing the quality of individual jurisdictions, as well as examining whether some of the perceptions about ‘OVshore’ are valid. He analyses the ongoing work of what have become known as the ‘standard setters’ – including the Financial Stability Forum, the Financial Action Task Force, the International Monetary Fund, the World Bank and the Organization for Economic Co-operation and Development. The book also oVers some suggestions as to what the future might hold for oVshore finance. HILTON Mc CANN was the Acting Chief Executive of the Financial Services Commission, Mauritius. He has held senior positions in the respective regulatory authorities in the Isle of Man, Malta and Mauritius. Having trained as a banker, he began his regulatory career supervising banks in the Isle of Man. -

Cutty Sark: the Fastest Sailing Ship of All Time

Day 10_Reading ● Let’s Practise! Reading 1 You should spend about 20 minutes on Questions 1-13, which are based on Reading Passage 1 below. Cutty Sark: the fastest sailing ship of all time The nineteenth century was a period of great technological development in Britain, and for shipping the major changes were from wind to steam power, and from wood to iron and steel. The fastest commercial sailing vessels of all time were clippers, three-masted ships built to transport goods around the world, although some also took passengers. From the 1840s until 1869, when the Suez Canal opened and steam propulsion was replacing sail, clippers dominated world trade. Although many were built, only one has survived more or less intact: Cutty Sark, now on display in Greenwich, southeast London. Cutty Sark’s unusual name comes from the poem Tam O’Shanter by the Scottish poet Robert Burns. Tam, a farmer, is chased by a witch called Nannie, who is wearing a ‘cutty sark’ – an old Scottish name for a short nightdress. The witch is depicted in Cutty Sark’s figurehead – the carving of a woman typically at the front of old sailing ships. In legend, and in Burns’s poem, witches cannot cross water, so this was a rather strange choice of name for a ship. Cutty Sark was built in Dumbarton, Scotland, in 1869, for a shipping company owned by John Willis. To carry out construction, Willis chose a new shipbuilding firm, Scott & Linton, and ensured that the contrast with them put him in a very strong position. -

The High Burden of State and Federal Capital Gains Tax Rates in the United FISCAL FACT States Mar

The High Burden of State and Federal Capital Gains Tax Rates in the United FISCAL FACT States Mar. 2015 No. 460 By Kyle Pomerleau Economist Key Findings · The average combined federal, state, and local top marginal tax rate on long-term capital gains in the United States is 28.6 percent – 6th highest in the OECD. · This is more than 10 percentage points higher than the simple average across industrialized nations of 18.4 percent, and 5 percentage points higher than the weighted average. · Nine industrialized countries exempt long-term capital gains from taxation. · California has the 3rd highest top marginal capital gains tax rate in the industrialized world at 33 percent. · The taxation of capital gains places a double-tax on corporate income, increases the cost of capital, and reduces investment in the economy. · The President’s FY 2016 budget would increase capital gains tax rates in the United States from 28.6 percent to 32.8, the 5th highest rate in the OECD. 2 Introduction Saving is important to an economy. It leads to higher levels of investment, a larger capital stock, increased worker productivity and wages, and faster economic growth. However, the United States places a heavy tax burden on saving and investment. One way it does this is through a high top marginal tax rate on capital gains. Currently, the United States’ top marginal tax rate on long-term capital gains income is 23.8 percent. In addition, taxpayers face state and local capital gains tax rates between zero and 13.3 percent. As a result, the average combined top marginal tax rate in the United States is 28.6 percent. -

Capital Gains) Above $250,000 Per Year

Members of the Washington State Senate have an historic opportunity to create a more just state tax code while bolstering and sustaining our state’s fiscal and economic recovery long after federal recovery funds fade away. Senate Bill 5096 would create a new 7% excise tax on extraordinary profits from the sale of financial assets (capital gains) above $250,000 per year. If approved, this would be the most equitable change to Washington state’s upside-down tax code in nearly 90 years. And it would generate over $500 million per year in permanent new resources for child care and investments to help correct the upside-down nature of our tax code. Below are three reasons why Senators should act now and pass SB 5096 off the Senate floor. 1. Taxing capital gains would begin to address longstanding economic and racial injustices in our state tax code and economy We have the most upside-down or regressive state and local tax code in the nation, in which the poorest households face average tax rates that are six times higher than the rates paid by those at the very top of the income and wealth ladders. This regressive tax code is especially damaging to Washingtonians who are Black, Indigenous, or people of color, who face considerably higher average tax rates than wealthy white households. Because financial assets are so heavily concentrated among the very wealthiest householdsi in our state, SB 5096 would be paid only by those who can afford to pay more for investments in schools and other priorities that benefit us all. -

ISO Country Codes

COUNTRY SHORT NAME DESCRIPTION CODE AD Andorra Principality of Andorra AE United Arab Emirates United Arab Emirates AF Afghanistan The Transitional Islamic State of Afghanistan AG Antigua and Barbuda Antigua and Barbuda (includes Redonda Island) AI Anguilla Anguilla AL Albania Republic of Albania AM Armenia Republic of Armenia Netherlands Antilles (includes Bonaire, Curacao, AN Netherlands Antilles Saba, St. Eustatius, and Southern St. Martin) AO Angola Republic of Angola (includes Cabinda) AQ Antarctica Territory south of 60 degrees south latitude AR Argentina Argentine Republic America Samoa (principal island Tutuila and AS American Samoa includes Swain's Island) AT Austria Republic of Austria Australia (includes Lord Howe Island, Macquarie Islands, Ashmore Islands and Cartier Island, and Coral Sea Islands are Australian external AU Australia territories) AW Aruba Aruba AX Aland Islands Aland Islands AZ Azerbaijan Republic of Azerbaijan BA Bosnia and Herzegovina Bosnia and Herzegovina BB Barbados Barbados BD Bangladesh People's Republic of Bangladesh BE Belgium Kingdom of Belgium BF Burkina Faso Burkina Faso BG Bulgaria Republic of Bulgaria BH Bahrain Kingdom of Bahrain BI Burundi Republic of Burundi BJ Benin Republic of Benin BL Saint Barthelemy Saint Barthelemy BM Bermuda Bermuda BN Brunei Darussalam Brunei Darussalam BO Bolivia Republic of Bolivia Federative Republic of Brazil (includes Fernando de Noronha Island, Martim Vaz Islands, and BR Brazil Trindade Island) BS Bahamas Commonwealth of the Bahamas BT Bhutan Kingdom of Bhutan -

2011 Biodiversity Snapshot. Guernsey Appendices

UK Overseas Territories and Crown Dependencies: 2011 Biodiversity snapshot. Guernsey: Appendices. Author: Dr Charles David Guernsey Biological Records Centre, States of Guernsey Environment Department & La Societe Guernesiaise. More information available at: www.biologicalrecordscentre.gov.gg This section includes a series of appendices that provide additional information relating to that provided in the Guernsey chapter of the publication: UK Overseas Territories and Crown Dependencies: 2011 Biodiversity snapshot. All information relating to Guernsey is available at http://jncc.defra.gov.uk/page-5743 The entire publication is available for download at http://jncc.defra.gov.uk/page-5821 Commissioned by the States of Guernsey Environment Department for the Joint Nature Conservation Committee Prepared by Dr C T David Guernsey Biological Records Centre August 2010 1 Contents Appendix 1: Bailiwick of Guernsey – Location and Introduction ............................. 3 Location, Area, Number of Islands, Population 3 Topography 4 Main economic sectors 4 Constitutional Position 4 Appendix 2: Multilateral Environmental Agreements. ............................................... 5 Appendix 3: National Legislation ................................................................................ 8 Planning 8 Ancient Monuments 8 Coast and beaches 8 Land 8 Fauna 8 Flora 9 Trees 9 Import/export 9 Marine environment 9 Waste 9 Water 9 Appendix 4: National Strategies ................................................................................ 11 Appendix -

Reform of U.S. International Taxation: Alternatives

Reform of U.S. International Taxation: Alternatives Jane G. Gravelle Senior Specialist in Economic Policy August 1, 2017 Congressional Research Service 7-5700 www.crs.gov RL34115 Reform of U.S. International Taxation: Alternatives Summary A striking feature of the modern U.S. economy is its growing openness—its increased integration with the rest of the world. The attention of tax policymakers has recently been focused on the growing participation of U.S. firms in the international economy and the increased pressure that engagement places on the U.S. system for taxing overseas business. Is the current U.S. system for taxing U.S. international business the appropriate one for the modern era of globalized business operations, or should its basic structure be reformed? The current U.S. system for taxing international business is a hybrid. In part, the system is based on a residence principle, applying U.S. taxes on a worldwide basis to U.S. firms while granting foreign tax credits to alleviate double taxation. The system, however, also permits U.S. firms to defer foreign-source income indefinitely—a feature that approaches a territorial tax jurisdiction. In keeping with its mixed structure, the system produces a patchwork of economic effects that depend on the location of foreign investment and the circumstances of the firm. Broadly, the system poses a tax incentive to invest in countries with low tax rates of their own and a disincentive to invest in high-tax countries. In theory, U.S. investment should be skewed toward low-tax countries and away from high-tax locations. -

Capital Gains Taxation

58 Capital gains taxation Capital gains taxation joint returns). The new exclusion can be claimed whenever the taxpayer meets the eligibility require- Gerald Auten ment of owning and occupying the residence for at Department of the Treasury least two of the previous five years and using the exclusion only once in a two-year period. Prior law Treatment of the changes in value of capital had been criticized as being complex, distorting assets such as corporate stock, real estate, certain housing decisions, and generating little tax or a business interest. revenue. When appreciated assets are transferred by be- quest, the basis is stepped up to the value of the as- Under a pure net accretion (Haig-Simons) approach sets on the date of death. Thus, the accrued gains on to income taxes, real capital gains would be taxed assets held at death are not taxed under the income each year as they accrued and real capital losses tax, although they may be subject to the estate tax. would be deducted. Capital gains are generally A 50 percent exclusion for capital gains from taxed only when “realized” by sale or exchange, the sale of certain small business stocks purchased however, because it would be difficult to estimate at the time of issue and held for at least five years the value of many assets, it would be viewed as un- was introduced in 1993. Eligible businesses must fair to tax income that had not been realized, and it have less than $50 million in assets (including the could force the liquidation of assets to pay the proceeds of the stock issue) and meet certain other tax on accruals.