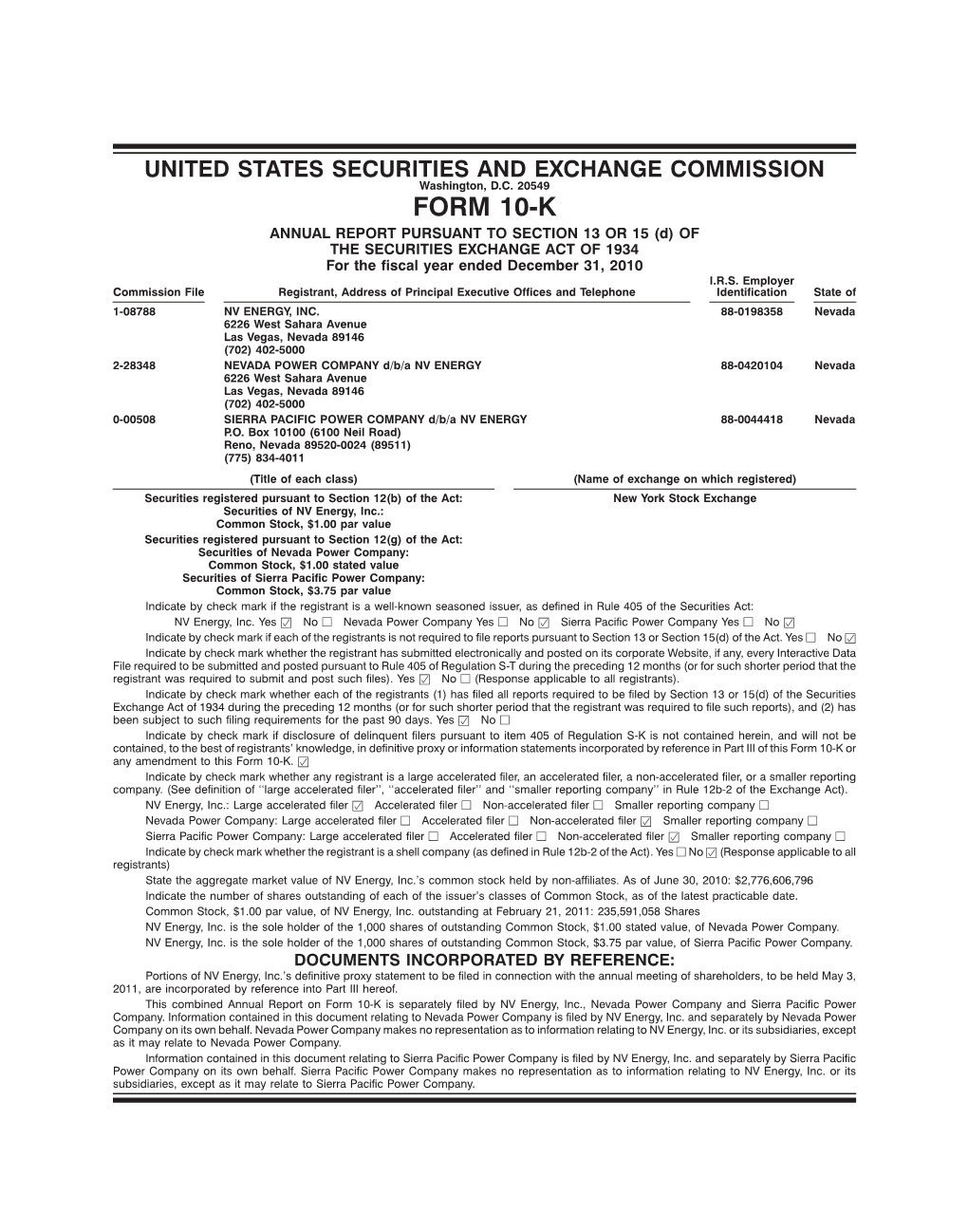

Nv Energy, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nevada Statewide Greenhouse Gas Emissions Inventory and Projections, 1990-2020

Nevada Statewide Greenhouse Gas Emissions Inventory and Projections, 1990-2020 Nevada Division of Environmental Protection Updated - December 2008 Nevada Statewide Greenhouse Gas Inventory and Projections,1990-2020 Updated - December 2008 DISCLAIMER The information contained in the Nevada Statewide Greenhouse Gas Inventory and Projections, 1990-2020 report is for public use; every effort has been made to ensure its accuracy. The information presented is as timely and accurate as practicable; no expressed or implied guarantees are made. Scenarios of potential future electrical generation that are presented in the section on Electrical Generation Sector Emissions are for informational purposes only and do not constitute any endorsement or implied preference. Information contained herein may be freely distributed and used for noncommercial, scientific, and educational purposes. Inquiries made in reference to this report should be directed to: Bureau of Air Quality Planning 901 South Stewart Street, Suite 4001 Carson City, Nevada 89701-5249 Telephone: (775) 687-4670 i Nevada Statewide Greenhouse Gas Inventory and Projections,1990-2020 Updated - December 2008 TABLE OF CONTENTS DISCLAIMER................................................................................................................................i LIST OF TABLES .......................................................................................................................iii LIST OF FIGURES .................................................................................................................... -

179IBLA051.Pdf

BRISTLECONE ALLIANCE, ET AL. 179 IBLA 51 Decided April 14, 2010 United States Department of the Interior Office of Hearings and Appeals Interior Board of Land Appeals 801 N. Quincy St., Suite 300 Arlington, VA 22203 BRISTLECONE ALLIANCE, ET AL. IBLA 2009-104, 2009-105 Decided April 14, 2010 Appeal from a record of decision approving rights-of-way and a subsequent land sale for construction and operation of the White Pine Energy Station, a coal- fired power plant. NV-040-07-5101-ER-F344 (N-78091, et al.). Affirmed. 1. Federal Land Policy and Management Act of 1976: Rights- of-Way--Rights-of-Way: Applications--Rights-of-Way: Federal Land Policy and Management Act of 1976 Under section 501(a)(6) of FLPMA, 43 U.S.C. § 1761(a)(6) (2006), a decision to issue a right-of-way is discretionary and will be affirmed where the record shows the decision to be based on a reasoned analysis of the facts involved, made with due regard for the public interest, and appellants have not shown error in the decision. 2. Environmental Quality: Environmental Statements-- National Environmental Policy Act of 1969: Environmental Statements BLM properly decides to approve rights-of-way and the eventual sale of public land for construction and operation of a coal-fired power plant, following preparation of an EIS, where, in accordance with section 102(2)(C) of NEPA, 42 U.S.C. § 4332(2)(C) (2006), it has taken a hard look at the potentially significant environmental consequences of doing so, including the reasonably foreseeable and calculable impacts on climate change caused by greenhouse gas emissions from the project. -

David Mcintosh/DC/USEPA/US Wrote:

Release 3 - HQ-FOI-01268-12 All emails sent by "Richard Windsor" were sent by EPA Administrator Lisa Jackson 01268-EPA-1763 David To thompson.diane, perciasepe.bob, mccarthy.gina, fulton.scott, McIntosh/DC/USEPA/US heinzerling.lisa, oster.seth, sussman.bob 02/21/2010 11:45 AM cc Richard Windsor, Joseph Goffman bcc Subject Here is the draft reply to Rockefeller et al Ex. 5 - Deliberative Thanks, David -----David McIntosh/DC/USEPA/US wrote: ----- To: Richard Windsor/DC/USEPA/US@EPA From: David McIntosh/DC/USEPA/US Date: 02/19/2010 07:45PM cc: Bob Perciasepe/DC/USEPA/US@EPA, Bob Sussman/DC/USEPA/US@EPA, Diane Thompson/DC/USEPA/US@EPA, Gina McCarthy/DC/USEPA/US@EPA, Joseph Goffman/DC/USEPA/US@EPA, Lisa Heinzerling/DC/USEPA/US@EPA, Scott Fulton/DC/USEPA/US@EPA, Seth Oster/DC/USEPA/US@EPA Subject: Re: Here is the delivered letter from the Senators Ex. 5 - Deliberative Richard Windsor---02/19/2010 07:19:52 PM---I'm available all weekend. ----- Original Message ----- Fro Richard Windsor/DC/USEPA/US m: To: David McIntosh/DC/USEPA/US@EPA, Diane Thompson/DC/USEPA/US@EPA, Bob Perciasepe/DC/USEPA/US@EPA, Gina McCarthy/DC/USEPA/US@EPA, Joseph Goffman/DC/USEPA/US@EPA, Lisa Heinzerling/DC/USEPA/US@EPA, Bob Sussman/DC/USEPA/US@EPA, Scott Fulton/DC/USEPA/US@EPA, Seth Oster/DC/USEPA/US@EPA Dat 02/19/2010 07:19 PM e: Sub Re: Here is the delivered letter from the Senators ject : I'm available all weekend. David McIntosh Release 3 - HQ-FOI-01268-12 All emails sent by "Richard Windsor" were sent by EPA Administrator Lisa Jackson ---- Original Message --- From: David Mc int osh Sent : 02/19/2010 07 : 08 PM EST To: Richar d Windsor; Diane Thompson; Bo b Per ciasepe; Gina McCar thy; Joseph Goffman; Lisa Heinzerling ; Bo b Sussman; Scott Fulton; Seth Oster Subject : Her e is the delivered lette r f r om t he Senato r s Ex. -

Resource Planning 2007

RESOURCE PLANNING Several key legislative initiatives are 2007 currently being debated before Congress that Nevada’s Electricity Future: could affect the economics of coal for power A Portfolio-Focused Approach generation by penalizing greenhouse gas emissions. As the debate of greenhouse gas emissions unfolds, the interests of Nevada and its 1.0 INTRODUCTION ratepayers is to ensure that adequate and affordable supplies of electricity are available Providing adequate supplies of affordable today based on technologies that are both proven electricity with acceptable environmental on a utility scale and commercially viable. impacts is a critical challenge facing the country. Nevada seeks to have a dialogue with its The western United States, and specifically the neighbors to discuss how these ends can be State of Nevada, now faces crucial strategic realized. choices regarding the identification and development of new electric generation capacity 2.0 NEVADA'S ENERGY CHALLENGE to meet existing and forecasted demand. 2.1 Nevada Resources and Demographics Southern Nevada has a large capacity deficit and unless this need is addressed immediately, Nevada’s electricity challenges are shaped this deficit will escalate. Southern Nevada is by its land, natural resources and demographics. dependent on natural gas and purchased power to The state of Nevada covers 110,567 square meet existing demand. As a result of this deficit miles, making it the 7th largest in terms of land Nevada has some of the highest rates in the area of the 50 states; however, over 80 percent of region. the state is owned by the federal government. Nevada is the driest state in the nation, averaging 1 Nevada’s answer to these challenges is only 9 inches of precipitation annually ; portfolio-focused planning. -

6 Analysis of Blm's Solar Energy Development

1 6 ANALYSIS OF BLM’S SOLAR ENERGY DEVELOPMENT ALTERNATIVES 2 3 4 Through this programmatic environmental impact statement (PEIS), the U.S. Department 5 of the Interior (DOI) Bureau of Land Management (BLM) is evaluating three alternatives for 6 managing utility-scale solar energy development on BLM-administered lands in the six-state 7 study area. These alternatives, which are described in Section 2.2, include two action 8 alternatives—a solar energy development program alternative and a solar energy zone (SEZ) 9 program alternative—and a no action alternative. 10 11 Under the action alternatives, the BLM would establish a new Solar Energy Program 12 to replace certain elements of its existing Solar Energy Policies (BLM 2007, 2010a,b; 13 see Appendix A, Section A.1).1 The action alternatives identify lands that would be excluded 14 from utility-scale solar energy development and, on the basis of those exclusions, the lands that 15 would be available for solar right-of-way (ROW) application.2 Both action alternatives also 16 identify SEZs where the agency would prioritize solar energy and associated transmission 17 infrastructure development. Final SEZs would be identified in the Record of Decision (ROD) for 18 the Solar Programmatic Environmental Impact Statement (PEIS). Under the solar energy 19 development program alternative, the SEZs would constitute a subset of the total lands available 20 (i.e., applications would be accepted within the SEZs and on specific lands outside the SEZs). 21 Under the SEZ program alternative, applications would only be accepted within the SEZs, and 22 no additional lands would be available outside the SEZs. -

A Sustainable Path Meeting Nevada’S Water and Energy Demands Western Resource Advocates’ Mission Is to Protect the West’S Land, Air, and Water

A SUSTAINABLE PATH Meeting Nevada’s Water and Energy Demands Western Resource Advocates’ mission is to protect the West’s land, air, and water. Our lawyers, scientists, and economists: 1) advance clean energy to reduce pollution and global cli- mate change 2) promote urban water conservation and river restoration 2260 Baseline Road, Suite 200 3) defend special public lands from energy development Boulder, CO 80302 and unauthorized off-road vehicle travel. Tel: (303) 444-1188 Fax: (303) 786-8054 We collaborate with other conservation groups, hunters www.westernresourceadvocates.org and fishermen, ranchers, American Indians, and others to © 2008 ensure a sustainable future for the West. This report is one of a series prepared by Western Resource Advocates on the competing water demands of growing cit- ies, agriculture, electricity generation, and the environment. It was funded by grants from the National Renewable En- ergy Lab and the Robert Z. Hawkins Foundation. The report was prepared by Stacy Tellinghuisen with assis- tance from David Berry, Bart Miller, Taryn Hutchins-Cabibi, Charles Benjamin, and Nicole Theerasatiankul (Western Re- source Advocates). A SUSTAINABLE PATH: Meeting Nevada’s Water and Energy Demands Executive Summary 4 Introduction 8 Municipal Water Use 10 Population Growth 10 Economy 12 Scenarios and Water Use: 2030 12 Summary 16 Agricultural Water Use 17 Potential Ethanol Production 17 Legal Limitations of Nevada’s Water Rights System 18 Climate Change’s Impacts on Water Resources 18 Summary 22 Water Use in Electricity -

AIA Nevada Position Statement

AIA Nevada A Chapter of The American Institute of Architects Position Statement Date: October 11, 2007 Subject: Position on New Power Plants in Nevada AIA Nevada opposes the implementation of coal-fired power plants in Nevada and throughout the world, and instead endorses all future power production to be developed using only clean, non-polluting, renewable sources. Nevada currently receives approximately 50 percent of its electricity from coal-fired power plants and plans are in place to build more. While technological progress toward cleaner burning plants has come about, coal-fired power plants are still the largest producer of mercury releases into the atmosphere, and contribute billions of tons of carbon dioxide to the air annually. Mercury is a potent neurotoxin that has been shown to cause developmental delays, decreased IQ and memory, Attention Deficit Disorders in children, and fertility, heart and neurological problems in adults. The basic pollution problems with coal plants have not changed and will not change with these newer technologies. Currently, three coal fired power plants are considered for eastern Nevada near Ely and the Toquop Indian Reservation. Plans for a fourth plant, Sempra Energy’s Granite Fox Power Project, a 1,200 megawatt (MW) coal-fired power plant for northern Nevada, were recently withdrawn. A public hearing regarding the proposed plants that occurred on March 8, 2007, in Ely, drew a number of local residents who were worried about the negative impacts from this coal-fired power production. In April 2007, the U.S. Bureau of Land Management issued a Draft Environmental Impact Statement (DEIS), assessing the environmental impacts from the White Pine Energy Station Project near Ely. -

The Historic Copper National Bank, Built in 1910, Located in Ely, NV

The historic Copper National Bank, built in 1910, located in Ely, NV Located in Ely, Nevada a historic mining town experiencing a renaissance with renewed mining activity, the Copper National Bank, built in 1910, affords owners the unique convenience of urban shops, restaurants and services while enjoying a rural lifestyle. Fresh air and clean water are abundant in the scenic Steptoe Valley. The Copper National Bank is located two blocks from the recently renovated East Ely Railroad Depot, which houses the Nevada Northern Railway Museum. The White Pine Historical Foundation operates a “Ghost Train” from the East Ely Depot in the summer months and during holidays. Steptoe Valley Steptoe Valley is a long valley located in White Pine County, in northeastern Nevada. From the historic community of Currie, the valley runs south for approximately 100 miles. To the west are the high Egan Range and the Cherry Creek Range, while to the east is the even higher Schell Creek Range. Highway 93 passes through the valley, past the historic mining town of Cherry Creek and the communities of McGill and Ely, before crossing the Schell Creek Range at Connor’s Pass. Also found in this valley are the Ward Charcoal Ovens State Historic Park, the Steptoe Valley Wildlife Management Area, and Cave Lake State Park. At Egan Canyon and Schellbourne Pass (near Cherry Creek), the Overland Stage Line and the subsequent Pony Express and Transcontinental Telegraph made their way through the mountains of central Nevada in the 1860s. The valley is named after Colonel Edward Steptoe, who explored the region in 1854. -

Tri-State: Coal Expansion Poses Risks to Electricity Consumers November 2008

Tri-State: Coal Expansion Poses Risks to Electricity Consumers November 2008 Authored by: Drew Freyer, Senior Analyst, [email protected], Eric Kane, Senior Analyst, [email protected], Mario Lopez-Alcala, Senior Analyst, [email protected] No part of this report may be reproduced in any manner without the written permission of Innovest Strategic Value Advisors, Inc. The information herein has been obtained from sources which we believe to be reliable, but we do not guarantee its accuracy or completeness. All opinions expressed herein are subject to change without notice. Innovest Strategic Value Advisors, Inc., its affiliated companies, or their respective shareholders, directors, officers and/or employees, may have a position in the securities discussed herein. The securities mentioned in this document may not be eligible for sale in some states or countries, nor suitable for all types of investors; their value and the income they produce may fluctuate and/or be adversely affected by exchange rates. © 2007 Innovest Strategic Value Advisors, Inc. All rights reserved. New York Toronto San Francisco Tokyo Mr. Peter Wilkes Ms. Michelle McCulloch Mr. Pierre Trevet Mr. Hiromichi Soma Managing Director Director Managing Director Director +1 212 421 2000 ext. 216 +1 905 707 0876 +1 415 332 3506 +81 3 5976 8337 [email protected] [email protected] [email protected] [email protected] Paris London Sydney Mrs. Perrine Dutronc Mr. Andy White Mr. Bill Hartnett Innovest Uncovering Hidden Value Managing Director Managing Director Managing Director for Strategic Investors +33 (0)1 44 54 04 89 +44 (0) 20 7073 0469 +61 2 9940 2688 [email protected] [email protected] [email protected] www.innovestgroup.com Innovest Strategic Value Advisors Tri-State: Coal Expansion Poses November 2008 Risks to Electricity Consumers INTRODUCTION Tri-State Generation and Transmission Association (Tri-State) is a wholesale electric power supplier owned by the 44 electric cooperatives that it serves. -

State of Nevada Public Utilities Commission of Nevada 2009 Biennial Report July 1, 2006 Through June 30, 2008

State of Nevada Public Utilities Commission of Nevada 2009 Biennial Report July 1, 2006 through June 30, 2008 STATE OF NEVADA JIM GIBBONS PUBLIC UTILITIES COMMISSION OF NEVADA Governor http://pucweb1.state.nv.us/PUCN NORTHERN NEVADA OFFICE SOUTHERN NEVADA OFFICE 1150 East William Street 101 Convention Center Drive, Suite 250 Carson City, Nevada 89701-3109 Las Vegas, Nevada 89109 (775) 684-6101 • Fax (775) 684-6110 (702) 486-7210 • Fax (702) 486-7206 February 13, 2009 Hon. Jim Gibbons Governor of Nevada Executive Chamber State Capitol Carson City, NV 89701 Governor Gibbons: On behalf of the Public Utilities Commission of Nevada (“Commission”), I am pleased to present you with the 2009 Biennial Report. The report is published pursuant to Nevada Revised Statutes 703.180 and is a detailed description of the most significant cases, decisions and other Commission activities from July 1, 2006, through June 30, 2008. During this biennium, the Commission has been tasked with deciding several major utility cases and has also addressed a number of other important utility issues. The Commission has worked with the utilities to lessen the effects of rising energy costs and price volatility on consumers. The Commission has also been actively involved with regulatory matters before the Federal Energy Regulatory Commission and the Federal Communications Commission. In addition, the Commission has continued its commitment to administrative efficiencies with the implementation of the Electronic Filings and Records Management System. This system allows the Commission to accept and process documents and fees electronically. Public records are now available and accessible 24 hours a day, seven days a week. -

Kevin J. Paprocki Project Scientist

Kevin J. Paprocki Project Scientist Mr. Paprocki has been working in the environmental field since EDUCATION 2006, working primarily as a Project Scientist and recently . B.S. Environmental Science, State promoted to Project Manager. He is responsible for collecting University of New York at the data from the field and analyzing the data to organize and Fredonia, 2006 archive in an efficient manner to ultimately produce a database REGISTRATIONS/CERTIFICATIONS and report for the client. He is familiar with a variety of water . Asbestos Abatement Consultant sampling techniques and is responsible for the oversight of the (IM-1883) field technicians. He has worked on low-flow monitoring wells, . Building Inspector geotechnical/hydrologic investigations, lake water sampling, . Contractor/Supervisor opacities, Phase I site assessments, hazardous materials . 40-Hour HAZWOPER Certified surveying and monitoring, drilling oversight, and GIS mapping. (#754788771) . EPA Method 9 Visible Emissions Trained Relevant Experience Basic Remediation Company (BRC) Sitewide Sampling, Henderson, Nevada – Converse provided support to collect water samples for 140 monitoring wells. Mr. Paprocki’s role was to collect water samples using a low flow pump (grundfos for deep wells, portable, & dedicated). After collecting the data using In-Situ equipment and stabilizing the well, he collected the water samples designated for numerous tests for the laboratory. The samples were then packed sufficiently into iced coolers and sent overnight to Test America Laboratory. The Clark County School District, Arville Bus Yard, Las Vegas, Nevada – Six underground USTs were excavated and removed from the site as part of CCSD’s UST upgrade program. During tank removal activities, fuel hydrocarbon impacts were observed adjacent to the USTs and dispenser islands. -

Ely Energy Center Transmission Line Components

UNITED STATES ENVIRONMENTAL PROTECTION AGENCY REGION IX 75 Hawthorne Street San Francisco, CA 94105 April 3, 2009 Joe Incardine EEC Project Manager Bureau of Land Management Ely Field Office HC 33 Box 33500 Ely, Nevada 89301-9408 Subject: Transmission Line Components of the Draft Environmental Impact Statement for the Ely Energy Center, Nevada [CEQ# 20080537] Dear Mr. Incardine: The U.S. Environmental Protection Agency (EPA) has reviewed the transmission line components of the Bureau of Land Management’s (BLM) Draft Environmental Impact Statement (DEIS) for the Ely Energy Center. Our review and comments are provided pursuant to the National Environmental Policy Act (NEPA), the Council on Environmental Quality (CEQ) Regulations (40 CFR Parts 1500-1508), and Section 309 of the Clean Air Act (CAA). The proposed project, as described in the DEIS, would include the construction of the Ely Energy Center (EEC) -- a 1,500 megawatt (MW) coal-fired power plant -- and ancillary facilities. The Notice of Availability for the DEIS was published in the Federal Register on January 2, 2009. On February 9, 2009, however, the project proponent Nevada Energy announced that it has postponed plans to construct the EEC due to increasing environmental and economic uncertainties, and will not proceed with the construction of the coal plant until the technologies that capture and store greenhouse gases are commercially feasible. It is EPA’s understanding that, rather than postpone the entire project, Nevada Energy plans to proceed with one component of the project: the construction of the 250-mile 500 kilovolt (kV) transmission line linking northern and southern Nevada.