San Jose New Construction & Proposed Multifamily Projects

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

San Jose | Silicon Valley Q3 2019

Research & Forecast Report SAN JOSE | SILICON VALLEY Q3 2019 Silicon Valley Commercial Property Market Sees Gains for All Product Types > Confidence in Silicon Valley commercial property remained strong in Q3 2019 with gross absorption reaching 4.9 million square feet for Market Indicators - Santa Clara County all tracked commercial product. Santa Clara County Population Growth Santa Clara County > For the second consecutive quarter, net absorption surpassed 1.0 Median Household Income Unemployment Rate million square feet across all product types, making Silicon Valley one of the strongest markets in the United States. 4.7% 2.6% > Across all product types, the vacancy space rate fell to 4.4 percent, down 100 basis points from Q3 2018. $107,000 CA Unemployment Rate Silicon Valley’s economy continues to fire on all cylinders. According 2013-18 to California’s Employment Development Department (EDD), the 3.5% unemployment rate in Santa Clara County rose slightly quarter over quarter to 2.6 percent, however, remains below the national average of Source: EMSI & EDD 3.5 percent. EDD reports that Santa Clara County added 28,800 jobs between August 2018 and August 2019, led by the information sector. Given that job growth is a proxy for commercial real estate demand, the growing economy is boosting confidence in Silicon Valley’s commercial real estate market. And despite an influx of new construction entering the Market Trends market, demand is still very much overshadowing supply, evidenced by Relative to prior quarter Q3 2019 Q4 2019* rising rents and record-low vacancy rates. Vacancy In September, California lawmakers approved a statewide rent cap on Net Absorption multifamily properties which would limit annual rent increases to 5.0 percent plus the local inflation rate. -

Santa Clara County Certified Farmers' Markets Tuesday Wednesday

Santa Clara County Certified Farmers’ Markets Schedule during Covid-19 (changes in red) Tuesday Stanford CFM Temporarily closed due to Covid-19 Operator: West Coast FMA Tressider Memorial Union (White Plaza) 59 Lagunita Drive, Stanford, CA 95035 Wednesday Almaden Via Valiente Plaza Farmers’ Market Start date TBD 9 a.m. – 1 p.m Operator: Tomas Pascual Almaden Via Valiente Plaza Shopping Center 6946 Almaden Express Way., San Jose, CA 95120 . Cambrian Park Farmers' Market May 5 – September 27 4 p.m. - 8 p.m. Operator: Urban Village FMA Cambrian Park Plaza Camden Ave. & Union Ave., San Jose, CA 95124 Evergreen Farmers’ Market January 8 – December 30 9 a.m. – 1 p.m. Operator: Pacific Coast FMA 4055 Evergreen Village Square, San Jose, CA 95121 Revised 4/6/2021 Princeton Plaza CFM Year-round 9 a.m.—1 p.m Operator: Hector Mora, Certified Producer 1375 Blossom Hill Rd., San Jose, CA 95118 Santana Row CFM May 19 – September 29 4 p.m. – 8 p.m. Operator: California FMA Santana Row between Olin Ave. and Olsen Dr., San Jose, 95128 Saratoga, Prince of Peace, CFM Year-round 2 p.m. – 6 p.m. Operator: Jose Reynoso, Certified Producer 12770 Saratoga Ave., Saratoga, CA 95070 San Jose Government Center CFM Temporarily closed due to Covid-19 Operator: West Coast FMA 70 West Hedding Street San Jose California 95110 Santa Clara Valley Medical Center CFM Temporarily closed due to Covid-19 Operator: Pacific Coast FMA 751 South Bascom Avenue, San Jose, CA 95051 VA Palo Alto Health Care CFM Temporarily closed due to Covid-19 Operator: Pacific Coast FMA 3801 Miranda Ave., Palo Alto, CA 94304 Revised 4/6/2021 Thursday Los Altos CFM April 29th-Sept. -

SAN JOSE Food Works FOOD SYSTEM CONDITIONS & STRATEGIES for a MORE VIBRANT RESILIENT CITY

SAN JOSE Food Works FOOD SYSTEM CONDITIONS & STRATEGIES FOR A MORE VIBRANT RESILIENT CITY NOV 2016 Food Works SAN JOSE Food Works ■ contents Executive Summary 2 Farmers’ markets 94 Background and Introduction 23 Food E-Commerce Sector 96 San Jose Food System Today 25 Food and Agriculture IT 98 Economic Overview 26 Food and Agriculture R & D 101 Geographic Overview 41 Best Practices 102 San Jose Food Sector Actors and Activities 47 Summary of Findings, Opportunities, 116 County and Regional Context 52 and Recommendations Food Supply Chain Sectors 59 APPENDICES Production 60 A: Preliminary Assessment of a San Jose 127 Market District/ Wholesale Food Market Distribution 69 B: Citywide Goals and Strategies 147 Processing 74 C: Key Reports 153 Retail 81 D: Food Works Informants 156 Restaurants and Food Service 86 End Notes 157 Other Food Sectors 94 PRODUCED BY FUNDED BY Sustainable Agriculture Education (SAGE) John S. and James L. Knight Foundation www.sagecenter.org 11th Hour Project in collaboration with San Jose Department of Housing BAE Urban Economics Santa Clara Valley Open Space Authority www.bae1.com 1 San Jose Executive Summary What would San Jose look like if a robust local food system was one of the vital frameworks linking the city’s goals for economic development, community health, environmental stewardship, culture, and identity as the City’s population grows to 1.5 million people over the next 25 years? he Food Works report answers this question. The team engaged agencies, businesses, non- T profits and community groups over the past year in order to develop this roadmap for making San Jose a vibrant food city and a healthier, more resilient place. -

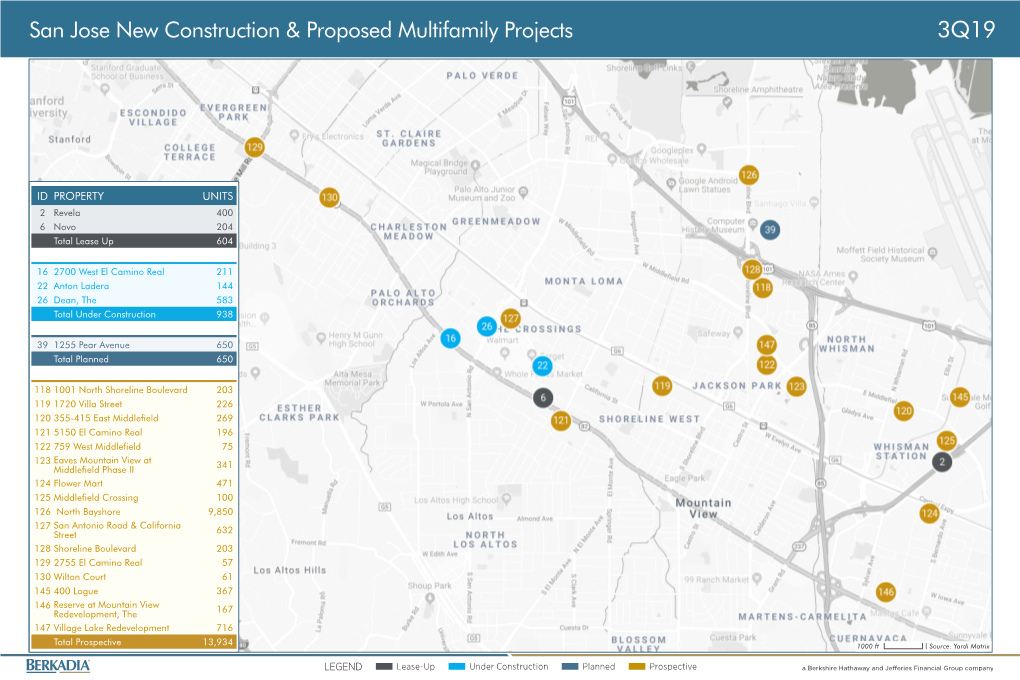

San Jose New Construction & Proposed Multifamily Projects

San Jose New Construction & Proposed Multifamily Projects 1Q19 ID PROPERTY UNITS 132 1 Santa Clara Square 1,840 5 Flats at Cityline, The 198 Total Lease Up 2,038 10 1130 Kifer Road 520 11 Nuevo 537 15 Dean, The 583 20 Novo 204 21 Gateway Village 476 22 500 Ferguson Drive 394 131 24 Anton Mountain View 144 46 Total Under Construction 2,858 133 121 42 City Place Santa Clara 1,360 104 43 1250 Lakeside Drive 250 130 129 114 44 Atria 108 15 144 42 45 Flats at Cityline Phase II, The 94 123 24 142 107 46 North Bayshore 9,850 126 143 Total Planned 11,662 20 122 127 49 124 128 118 49 5150 El Camino Real 196 22 103 2232 - 2240 El Camino Real 151 43 106 104 2233 Calle Del Mundo 57 125 106 Intel Land 950 1 107 Kylli 100 117 5 108 Laguna Clara Phase II 407 125 525 Evelyn 471 10 11 109 Lawrence Square 701 126 759 West Middlefield 75 119 45 110 Mariani's Inn 392 127 Eaves Mountain View at Middlefield Phase II 341 116 112 Moonlite Lanes 158 128 Middlefield Crossing 100 114 Tasman East 50 129 San Antonio Road & California 116 1155 Aster Avenue 412 Street 632 117 311 South Mathilda Avenue 75 130 Shoreline Boulevard 203 118 370 San Aleso 63 131 2755 El Camino Real 60 109 120 119 403 South Mathilda Avenue 100 132 Light Tree 100 44 21 112 110 103 120 Butcher's Corner 153 133 Wilton Court 61 121 1255 Pear Avenue 650 142 1139 Karlstad Drive 250 122 1696 Villa Street 226 143 400 Logue 412 123 2700 West El Camino Real 211 144 Village Lake Redevelopment 716 108 124 355-415 East Middlefield 269 Total Prospective 8,742 2000 ft Source: Yardi Matrix LEGEND Lease-Up -

Silicon Valley | Campus Guide

Northeastern University – Silicon Valley Campus Guide Northeastern University Mission Founded in 1898, Northeastern is a global, experiential, research university built on a tradition of engagement with the world, creating a distinctive approach to education and research. The university offers a comprehensive range of undergraduate and graduate programs leading to degrees through the doctorate in nine colleges and schools, and select advanced degrees at graduate campuses in Charlotte, North Carolina, Silicon Valley, Silicon Valley, and Toronto. Silicon Valley Campus Mission Northeastern University – Silicon Valley is based on a distinctive new model for higher education: educational hubs embedded directly in select companies across the Bay Area that offer sector-specific degree programs and research collaborations to benefit the entire region. These hubs will be located within partnering companies, such as IDT, and be open to learners and professionals across the region—a powerful way to boost workforce talent and promote innovation in high-growth sectors of regional economies. Northeastern University – Silicon Valley | Campus Guide Dear Student, Welcome to Northeastern University’s Silicon Valley Graduate Campus. Our mission is to provide you with the learning and experience you need to move ahead in your career and bring new value to your workplace and our community. The Silicon Valley Campus Guide is a toolbox of sorts, that answers many of the questions you may have and point you to resources and services that are often needed. Our topmost priority is to offer you a quality educational experience and great service. Do not hesitate to contact me or anyone on our team to help in any way. -

Thursday, April 6, 2017

BOARD OF DIRECTORS MEETING Thursday, April 6, 2017 5:30 PM Board of Supervisors’ Chambers County Government Center 70 West Hedding Street San Jose, CA 95110 AGENDA To help you better understand, follow, and participate in the meeting, the following information is provided: . Persons wishing to address the Board of Directors on any item on the agenda or not on the agenda are requested to complete a blue card located at the public information table and hand it to the Board Secretary staff prior to the meeting or before the item is heard. Speakers will be called to address the Board when their agenda item(s) arise during the meeting and are asked to limit their comments to 2 minutes. The amount of time allocated to speakers may vary at the Chairperson's discretion depending on the number of speakers and length of the agenda. If presenting handout materials, please provide 25 copies to the Board Secretary for distribution to the Board of Directors. The Consent Agenda items may be voted on in one motion at the beginning of the meeting. The Board may also move regular agenda items on the consent agenda during Orders of the Day. If you wish to discuss any of these items, please request the item be removed from the Consent Agenda by notifying the Board Secretary staff or completing a blue card at the public information table prior to the meeting or prior to the Consent Agenda being heard. AGENDA BOARD OF DIRECTORS Thursday, April 06, 2017 . Disclosure of Campaign Contributions to Board Members (Government Code Section 84308) In accordance with Government Code Section 84308, no VTA Board Member shall accept, solicit, or direct a contribution of more than $250 from any party, or his or her agent, or from any participant, or his or her agent, while a proceeding involving a license, permit, or other entitlement for use is pending before the agency. -

Convention and Cultural District San José State University St James Park

N M o n t g o m e r y S t t Clin tumn C ton Au A B C D E F G H I J d v l v B N S A n Market Center VTA Light Rail t Guadalupe Gardens Mineta San José Japantown African A e t o e u S North c d m e k t a 1 mile to Mountain View 1.1 miles a 0.8 miles International Airport n American u t i o m a D m r l r + Alum Rock n 1 e n e A 3.2 miles Community t r A T Avaya Stadium t S S v N o St James t Services h t N 2.2 miles 5 Peralta Adobe Arts + Entertainment Whole Park 0.2 miles N Foods Fallon House St James Bike Share Anno Domini Gallery H6 Hackworth IMAX F5 San José Improv I3 Market W St John St Little Italy W St John St 366 S 1st St Dome 201 S Market St 62 S 2nd St Alum Rock Alum Food + Drink | Cafés St James California Theatre H6 Institute of H8 San José G4 Mountain View 345 S 1st St Contemporary Art Museum of Art Winchester Bike Share US Post Santa Teresa 560 S 1st St 110 S Market St Oce Camera 3 Cinema I5 One grid square E St John St 288 S 2nd St KALEID Gallery J3 San José Stage Co. H7 Center for the E5 88 S 4th St 490 S 1st St Trinity represents approx. -

San Jose Storm Sewer System Annual Report FY 2015-2016 CONTENTS

Attachment A SANCITY OF ffr JOSE CAPITAL OF SILICON VALLEY STORM SEWER SYSTEM ANNUAL REPORT FY 2015-2016 Installation of Large Trash Capture Device October 2016 City of San Jose Storm Sewer System Annual Report FY 2015-2016 CONTENTS . 1 1 I. HISTORY AND BACKGROUND 3 II. PROGRAM FUNDING 5 A. Adopted FY 2015-2016 CIP Budget Revenue 5 B. Adopted FY 2015-2016 CIP Budget Expenditures 5 C. Adopted FY 2015-2016 Operations and Maintenance Budget Expenditures 5 III. PROGRAM ACTIVITY 6 A. Storm Sewer Improvement Projects 6 B. Rehabilitation Projects 8 C. Existing Storm Pump Stations 9 D. Non-Construction Activities 10 E. System Management and Planning 10 1. Master Planning 10 a. Alviso and North San Jose Master Plan 10 b. Modeling for Flooding Areas 12 c. DOT Portable Pumping Operation for 2015-16 El Nino Season 15 d. Flow Monitoring 15 e. Modeling Coordination with Water District and Alameda County 15 f. Citywide Storm Drain System Master Plan Initial Results 16 2. Support Economic Development 23 3. Coordination with Santa Clara Valley Water District (District) 23 4. Neighborhood/Special Corridors 24 5. Rehabilitation of Pump Stations 24 6. Improving Annexation Areas 24 7. San Jose-Santa Clara Regional Wastewater Facility . 25 E. Sustainability/Green Vision 25 VI. OPERATIONS AND MAINTENANCE 27 V. CONCLUSION 28 Storm Sewer System Annual Report - FY 2015-2016 2 I. HISTORY AND BACKGROUND The City of San Jose drains to two main water shed/drainage basin areas, Coyote Creek and Guadalupe River. Within the tributary areas to these watersheds, the majority of the City's storm sewer collection system benefits from the generally uniform topography of the Santa Clara Valley, allowing the majority of the water to be conveyed to the waterways using gravity lines with minimal use of pump stations. -

Martech® West 2019: Do You Know the Way to (Enjoy) San Jose?

MarTech® West 2019: Do You Know the Way to (Enjoy) San Jose? 1 Are you on your way to the 2019 Martech® Conference? Wondering how to spend your time outside of the San Jose Convention Center? Sure, you’ll be immersed in marketing, technology, and management insight for three days at Martech, but why stop there? We’ve uncovered a number of local hotspots that not only beg you to grab your camera, but also encourage you to stay in the right marketing mindset and “be your best, brilliant self” during your entire stay in San Jose. Before you go, don’t forget to check out our list of the 10 sessions we can’t wait to see. Ten Ways to Spend Time in San Jose Whether you’re unwinding after a thought-provoking panel or killing time before your flight out, these local attractions don’t disappoint. 1. San Pedro Square Market Located conveniently by the major roads leading into downtown San Jose, San Pedro Square Market gives patrons a place to eat, drink, and unwind after a long day walking through the conference halls. It’s just a few blocks from the San Jose Convention Center, and from beer fridge to barbershop, sushi to crepes, the popular watering hole is an ideal location to share drinks and dishes with colleagues. Enjoy Every Day in San Jose MarTech® West 2019 may be 2. The Tech Museum why you’re in San Jose, but there are plenty of other reasons to Technology isn’t just changing marketing—it’s changing everything. -

Urban Planning Area Strategies CHAPTER 5______

Urban Planning Area Strategies CHAPTER 5_____________________________________________________________________________________________________________________ CHAPTER 5 Urban Planning Area Strategies This chapter describes the Planning Areas within the Service Level Objectives Urban Service Area and their future need for The City’s General Plan service level objective is neighborhood/community serving parkland, to provide 3.5 acres per 1,000 population of community centers, community gardens, dog parks, neighborhood/community serving parkland within skate parks, aquatic facilities, sports fields, trails, a reasonable walking distance. Of the 3.5 acres, a and improvements to regional parks. There are 15 minimum of 1.5 acres is to be City-owned Planning Areas as defined in the City’s General parkland and/or trails while public schools can Plan: Almaden, Alum Rock, Alviso, Berryessa, provide up to 2 acres of recreation school grounds, Calero, Cambrian/Pioneer, Central/Downtown, all of which are within a reasonable walking Coyote, Edenvale, Evergreen, North San José, San distance. Physical barriers, such as major arterials, Felipe, South San José, West Valley, and Willow creeks, rivers and architectural barriers, are seen as Glen. Calero, Coyote and San Felipe Planning impediments to this walking distance strategy, and Areas are outside of the Urban Service Area and, the plan attempts to mitigate such conditions. therefore, are not discussed in this report. In the Neighborhood parks, community parks, trails and Coyote Planning Area, only the northern industrial recreation school grounds are counted toward this portion has been approved by the City. No urban service level (excluding high schools without joint residential development will occur in the North and use agreements). -

Strong Neighborhoods Initiative (SNI)

San Jose State University SJSU ScholarWorks Master's Projects Master's Theses and Graduate Research Fall 12-2015 Strong Neighborhoods Initiative (SNI) Oscar Inzunza San Jose State University Follow this and additional works at: https://scholarworks.sjsu.edu/etd_projects Part of the Public Administration Commons, Public Policy Commons, and the Urban Studies Commons Recommended Citation Inzunza, Oscar, "Strong Neighborhoods Initiative (SNI)" (2015). Master's Projects. 461. DOI: https://doi.org/10.31979/etd.ux4g-gzr8 https://scholarworks.sjsu.edu/etd_projects/461 This Master's Project is brought to you for free and open access by the Master's Theses and Graduate Research at SJSU ScholarWorks. It has been accepted for inclusion in Master's Projects by an authorized administrator of SJSU ScholarWorks. For more information, please contact [email protected]. Strong Neighborhoods Initiative (SNI) By Oscar Inzunza Research Paper Submitted in Partial Fulfillment of the Requirements for the Master of Public Administration Frances Edwards, Ph.D. Adviser The Graduate School San Jose State University December, 2015 Strong Neighborhoods Initiative 2 TABLE OF CONTENTS Introduction ................................................................................................................ 6 Research Question/ Problem Statement................................................ 6 Methodology ………………........................................................................................ 13 Methods to obtain data.......................................................................... -

Santa Clara County Tricolored Blackbird Nesting and Foraging Monitoring Project 2017-2018 Final Report

Santa Clara County Tricolored Blackbird Nesting and Foraging Monitoring Project 2017-2018 Final Report Final Report Prepared for: California Department of Fish and Wildlife & Santa Clara Valley Habitat Agency Prepared by: Ryan Phillips, Andrew Bradshaw, Katie Smith and Claire Ackland Talon Ecological Research Group 421 N. 19th Street San Jose, California 95112 Contact: Ryan Phillips Email: [email protected] Prepared on: September 2019 ABSTRACT During 2017 and 2018, Talon Ecological Research Group (Talon) conducted a comprehensive survey of Tricolored Blackbirds (Agelaius tricolor) throughout Santa Clara County. Financial support for this project was provided by a Natural Community Conservation Program Local Assistance Grant with a matching grant from the Santa Clara Valley Habitat Agency. The goal of the project was to determine the breeding status of the species and better understand their local ecology. Tricolored blackbirds have declined at an alarming rate throughout their range. Recent surveys have shown an 80% decline over the past 90 years and a 63% decline between 2008 and 2014. Within the past 40 years, seven historical nesting colonies were recorded in Santa Clara County. Talon monitoring during the 2017 breeding season found only two of those seven sites had nesting Tricolored Blackbirds. This is a 71.4% decline of nesting colonies in Santa Clara County. This study found that 29 sites had adequate breeding habitat. However, only 4 of those 29 sites (9%) had Tricolored Blackbirds present. Two historic sites and one newly identified site (75% of occupied sites) successfully fledged young in 2017. Two nesting colonies were located on private property (Del Puerto Canyon Road and Highway 130 in San Antonio Valley) and one on public property (Cañada de Los Osos Ecological Reserve).