The Free Port of Vladivostok. Special Investment Regime

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Attention Wal-Mart Shoppers How Wal-Mart’S Sourcing Practices Encourage Illegal Logging and Threaten Endangered Species Contents © Eia

ATTENTION WAL-MART SHOPPERS HOW WAL-MART’S SOURCING PRACTICES ENCOURAGE ILLEGAL LOGGING AND THREATEN ENDANGERED SPECIES www.eia-global.org CONTENTS © EIA ACKNOWLEDGEMENTS 1 EXECUTIVE SUMMARY Copyright © 2007 Environmental Investigation Agency, Inc. No part of this publication may be 2 INTRODUCTION: WAL-MART IN THE WOODS reproduced in any form or by any means without permission in writing from the Environmental 4 THE IMPACTS OF ILLEGAL LOGGING Investigation Agency, Inc. Pictures on pages 8,10,11,14,15,16 were published in 6 LOW PRICES, HIGH CONTROL: WAL-MART’S BUSINESS MODEL The Russian Far East, A Reference Guide for Conservation and Development, Josh Newell, 6 REWRITING THE RULES OF THE SUPPLIER-RETAILER RELATIONSHIP 2004, published by Daniel & Daniel, Publishers, Inc. 6 SQUEEZING THE SUPPLY CHAIN McKinleyville, California, 2004. ENVIRONMENTAL INVESTIGATION AGENCY 7 BIG FOOTPRINT, BIG PLANS: WAL-MART’S ENVIRONMENTAL IMPACT 7 THE FOOTPRINT OF A GIANT PO Box 53343, Washington DC 20009, USA 7 STEPS FORWARD Tel: +1 202 483 6621 Fax: +1 202 986 8626 Email: [email protected] 8 GLOBAL REACH: WAL-MART’S SALE OF WOOD PRODUCTS Web: www.eia-global.org 8 A SNAPSHOT INTO WAL-MART’S WOOD BUYING AND RETAIL 62-63 Upper Street, London N1 ONY, UK 8 WAL-MART AND CHINESE EXPORTS 8 THE RISE OF CHINA’S WOOD PRODUCTS INDUSTRY Tel: +44(0)20 7354 7960 Fax: +44(0)20 7354 7961 10 CHINA IMPORTS RUSSIA’S GREAT EASTERN FORESTS Email: [email protected] 10 THE WILD WILD FAR EAST 11 CHINA’S GLOBAL SOURCING Web: www.eia-international.org 10 IRREGULARITIES FROM FOREST TO FRONTIER 14 ECOLOGICAL AND SOCIAL IMPACTS 15 THE FLOOD OF LOGS ACROSS THE BORDER 17 LONGJIANG SHANGLIAN: BRIEFCASES OF CASH FOR FORESTS 18 A LANDSCAPE OF WAL-MART SUPPLIERS: INVESTIGATION CASE STUDIES 18 BABY CRIBS 18 DALIAN HUAFENG FURNITURE CO. -

Catalogue of Exporters of Primorsky Krai № ITN/TIN Company Name Address OKVED Code Kind of Activity Country of Export 1 254308

Catalogue of exporters of Primorsky krai № ITN/TIN Company name Address OKVED Code Kind of activity Country of export 690002, Primorsky KRAI, 1 2543082433 KOR GROUP LLC CITY VLADIVOSTOK, PR-T OKVED:51.38 Wholesale of other food products Vietnam OSTRYAKOVA 5G, OF. 94 690001, PRIMORSKY KRAI, 2 2536266550 LLC "SEIKO" VLADIVOSTOK, STR. OKVED:51.7 Other ratailing China TUNGUS, 17, K.1 690003, PRIMORSKY KRAI, VLADIVOSTOK, 3 2531010610 LLC "FORTUNA" OKVED: 46.9 Wholesale trade in specialized stores China STREET UPPERPORTOVA, 38- 101 690003, Primorsky Krai, Vladivostok, Other activities auxiliary related to 4 2540172745 TEK ALVADIS LLC OKVED: 52.29 Panama Verkhneportovaya street, 38, office transportation 301 p-303 p 690088, PRIMORSKY KRAI, Wholesale trade of cars and light 5 2537074970 AVTOTRADING LLC Vladivostok, Zhigura, 46 OKVED: 45.11.1 USA motor vehicles 9KV JOINT-STOCK COMPANY 690091, Primorsky KRAI, Processing and preserving of fish and 6 2504001293 HOLDING COMPANY " Vladivostok, Pologaya Street, 53, OKVED:15.2 China seafood DALMOREPRODUKT " office 308 JOINT-STOCK COMPANY 692760, Primorsky Krai, Non-scheduled air freight 7 2502018358 OKVED:62.20.2 Moldova "AVIALIFT VLADIVOSTOK" CITYARTEM, MKR-N ORBIT, 4 transport 690039, PRIMORSKY KRAI JOINT-STOCK COMPANY 8 2543127290 VLADIVOSTOK, 16A-19 KIROV OKVED:27.42 Aluminum production Japan "ANKUVER" STR. 692760, EDGE OF PRIMORSKY Activities of catering establishments KRAI, for other types of catering JOINT-STOCK COMPANY CITYARTEM, STR. VLADIMIR 9 2502040579 "AEROMAR-ДВ" SAIBEL, 41 OKVED:56.29 China Production of bread and pastry, cakes 690014, Primorsky Krai, and pastries short-term storage JOINT-STOCK COMPANY VLADIVOSTOK, STR. PEOPLE 10 2504001550 "VLADHLEB" AVENUE 29 OKVED:10.71 China JOINT-STOCK COMPANY " MINING- METALLURGICAL 692446, PRIMORSKY KRAI COMPLEX DALNEGORSK AVENUE 50 Mining and processing of lead-zinc 11 2505008358 " DALPOLIMETALL " SUMMER OCTOBER 93 OKVED:07.29.5 ore Republic of Korea 692183, PRIMORSKY KRAI KRAI, KRASNOARMEYSKIY DISTRICT, JOINT-STOCK COMPANY " P. -

Russian Federation As Central Planner: Case Study of Investments Into the Russian Far East in Anticipation of the 2012 Asia-Pacific Economic Cooperation Conference

Russian Federation as Central Planner: Case Study of Investments into the Russian Far East in Anticipation of the 2012 Asia-Pacific Economic Cooperation Conference Anne Thorsteinson A thesis submitted in partial fulfillment of the requirements for the degree of Master of Arts in International Studies: Russia, East Europe and Central Asia University of Washington 2012 Committee: Judith Thornton, Chair Craig ZumBrunnen Program Authorized to Offer Degree: Jackson School of International Studies TABLE OF CONTENTS Page List of Figures ii List of Tables iii Introduction 1 Chapter 1: An Economic History of the Russian Far East 6 Chapter 2: Primorsky Krai Today 24 Chapter 3: The Current Federal Reform Program 30 Chapter 4: Economic Indicators in Primorsky Krai 43 Chapter 5: Conclusion 54 Bibliography 64 LIST OF FIGURES Page 1. Primorsky Krai: Sown Area of Crops 21 2. Far East Federal Region: Sown Area of Crops 21 3. Primorye Agricultural Output 21 4. Russian Federal Fisheries Production 22 5. Vladivostok: Share of Total Exports by Type, 2010 24 6. Vladivostok: Share of Total Imports by Type, 2010 24 7. Cost of a Fixed Basket of Consumer Goods and Services as a Percentage of the All Russian Average 43 8. Cost of a Fixed Basked of Consumer Goods and Services 44 9. Per Capita Monthly Income 45 10. Per Capita Income in Primorsky Krai as a Percentage of the All Russian Average 45 11. Foreign Direct Investment in Primorsky Krai 46 12. Unemployed Proportion of Economically Active Population in Primorsky Krai 48 13. Students in State Institutions of Post-secondary Education in Primorsky Krai 51 14. -

China Russia

1 1 1 1 Acheng 3 Lesozavodsk 3 4 4 0 Didao Jixi 5 0 5 Shuangcheng Shangzhi Link? ou ? ? ? ? Hengshan ? 5 SEA OF 5 4 4 Yushu Wuchang OKHOTSK Dehui Mudanjiang Shulan Dalnegorsk Nongan Hailin Jiutai Jishu CHINA Kavalerovo Jilin Jiaohe Changchun RUSSIA Dunhua Uglekamensk HOKKAIDOO Panshi Huadian Tumen Partizansk Sapporo Hunchun Vladivostok Liaoyuan Chaoyang Longjing Yanji Nahodka Meihekou Helong Hunjiang Najin Badaojiang Tong Hua Hyesan Kanggye Aomori Kimchaek AOMORI ? ? 0 AKITA 0 4 DEMOCRATIC PEOPLE'S 4 REPUBLIC OF KOREA Akita Morioka IWATE SEA O F Pyongyang GULF OF KOREA JAPAN Nampo YAMAJGATAA PAN Yamagata MIYAGI Sendai Haeju Niigata Euijeongbu Chuncheon Bucheon Seoul NIIGATA Weonju Incheon Anyang ISIKAWA ChechonREPUBLIC OF HUKUSIMA Suweon KOREA TOTIGI Cheonan Chungju Toyama Cheongju Kanazawa GUNMA IBARAKI TOYAMA PACIFIC OCEAN Nagano Mito Andong Maebashi Daejeon Fukui NAGANO Kunsan Daegu Pohang HUKUI SAITAMA Taegu YAMANASI TOOKYOO YELLOW Ulsan Tottori GIFU Tokyo Matsue Gifu Kofu Chiba SEA TOTTORI Kawasaki KANAGAWA Kwangju Masan KYOOTO Yokohama Pusan SIMANE Nagoya KANAGAWA TIBA ? HYOOGO Kyoto SIGA SIZUOKA ? 5 Suncheon Chinhae 5 3 Otsu AITI 3 OKAYAMA Kobe Nara Shizuoka Yeosu HIROSIMA Okayama Tsu KAGAWA HYOOGO Hiroshima OOSAKA Osaka MIE YAMAGUTI OOSAKA Yamaguchi Takamatsu WAKAYAMA NARA JAPAN Tokushima Wakayama TOKUSIMA Matsuyama National Capital Fukuoka HUKUOKA WAKAYAMA Jeju EHIME Provincial Capital Cheju Oita Kochi SAGA KOOTI City, town EAST CHINA Saga OOITA Major Airport SEA NAGASAKI Kumamoto Roads Nagasaki KUMAMOTO Railroad Lake MIYAZAKI River, lake JAPAN KAGOSIMA Miyazaki International Boundary Provincial Boundary Kagoshima 0 12.5 25 50 75 100 Kilometers Miles 0 10 20 40 60 80 ? ? ? ? 0 5 0 5 3 3 4 4 1 1 1 1 The boundaries and names show n and t he designations us ed on this map do not imply of ficial endors ement or acceptance by the United N at ions. -

Modern Specialization of Industry in Cities of the Russian Far East: Innovation Factor of Dynamics

ISSN 0798 1015 HOME Revista ESPACIOS ! ÍNDICES ! A LOS AUTORES ! Vol. 38 (Nº 62) Year 2017. Páge 29 Modern Specialization of Industry in Cities of the Russian Far East: Innovation Factor of Dynamics Especialización moderna de la industria en las ciudades del Lejano Oriente ruso: factor de innovación dinámica Viktor Alekseevich OSIPOV 1; Elena Viktorovna KRASOVA 2 Received: 06/10/2017 • Approved: 30/10/2017 Contents 1. Introduction 2. Methods 3. Results 4. Discussion 5. Conclusion References ABSTRACT: RESUMEN: Industrial specialization of the Russian Far Eastern cities is one La especialización industrial de las ciudades rusas del Lejano of the most urgent topics of the Russian researches in such Oriente es uno de los temas más urgentes de las areas as industry economy, efficiency of using industrial investigaciones rusas en áreas como la economía industrial, la productive sources, regional economy, and innovation eficiencia en el uso de fuentes productivas industriales, la economy. The main science and practice challenge of the economía regional y la economía de la innovación. El principal research is the problems that restrain the transition of industry desafío científico y práctico de la investigación son los in Russian Far Eastern cities to the innovation economy. The problemas que restringen la transición de la industria en las goal of the article is to update on the problems of the modern ciudades rusas del Lejano Oriente hacia la economía de la specialization of Far Eastern cities taking into account the innovación. El objetivo del artículo es actualizar los problemas innovation factor of the regional economy development. de la especialización moderna de las ciudades del Lejano Methodologically the article is based on general provisions of Oriente tomando en cuenta el factor de innovación del the modern economic science, particularly, the theory of desarrollo de la economía regional. -

Seaports in Russia

SEAPORTS IN RUSSIA FLANDERS INVESTMENT & TRADE MARKET SURVEY Russian seaports November 2015 André DE RIJCK, Vlaams Economisch Vertegenwoordiger in Moskou Economic Representation of Flanders c/o Embassy of Belgium Mytnaya st. 1, bld.1, entrance 2, 119049 Moscow, RUSSIA T: +7 499 238 60 85/96 | F: +7 499 238 51 15 [email protected] Table of Contents Introduction .............................................................................................................................................................................................. 3 Russian largest seaports top-7 by cargo turnover ........................................................................................................... 4 Brief analysis of seaport infrastructure in Russia............................................................................................................. 4 Dynamics of cargo turnover of Russian seaports (2010-2014 yy in mln.tons) ................................................. 5 Cargo turnover structure in 2014 (mln tons, “%” year–on–year changes compared to 2013) ............... 6 The dynamics of cargo turnover by essentials categories in 2013-2014 yy. (in mln.tons) ......................... 7 Structure of the cargo turnover by category in 2014 ..................................................................................................... 8 The cargo turnover structure by Russian ports in 2014 in mln.tons ..................................................................... 9 Russian seaports market share structure -

Ricken and Artificial Selection on Primorsky Krai Territory

Gukov, G.V, Rozlomiy, N.G. /Vol. 8 Núm. 18: 432- 437/ Enero-febrero 2019 432 Articulo de investigación Biological and environmental peculiarities of tricholoma caligatum (viv) ricken and artificial selection on Primorsky Krai territory Particularidades biológicas y ambientales de tricholoma caligatum (viv) ricken y selección artificial en el territorio de Primorsky Krai Particularidades biológicas e ambientais do tricomaloma caligatum (vida) e seleção artificial no território do Krai de Primorsky Recibido: 16 de enero de 2019. Aceptado: 06 de febrero de 2019 Written by: Gukov G.V. (Corresponding Author)133 Rozlomiy N.G.134 Abstract Resumen Matsutake mushroom is unique in many ways - it El hongo Matsutake es único en muchos has several names, including two Latin ones, aspectos: tiene varios nombres, entre ellos dos mycorhiza developer, and selects individual latinos, desarrollador de micorhiza, y selecciona conifers or hardwood specifically as the partners coníferas individuales o madera dura from woody plant species in different countries. específicamente como socios de especies de It is hidden and very shy - the main part of its fruit plantas leñosas en diferentes países. Es oculto y body (leg) is hidden in soil, and the small compact muy tímido: la parte principal de su cuerpo frutal cap of the fungus is not always visible in forest (pierna) está oculta en el suelo, y la pequeña capa among the fallen autumn needles and leaves. The compacta del hongo no siempre es visible en el mushroom is also unique as it has exceptional bosque entre las hojas y las agujas otoñales nutritional and medicinal properties, therefore caídas. El hongo también es único ya que tiene the price for this unique species exceeds all propiedades nutricionales y medicinales reasonable limits. -

Cretaceous Deposits and Flora of the Muravyov Amurskii Peninsula

ISSN 08695938, Stratigraphy and Geological Correlation, 2015, Vol. 23, No. 3, pp. 281–299. © Pleiades Publishing, Ltd., 2015. Original Russian Text © E.B. Volynets, 2015, published in Stratigrafiya. Geologicheskaya Korrelyatsiya, 2015, Vol. 23, No. 3, pp. 50–68. Cretaceous Deposits and Flora of the MuravyovAmurskii Peninsula (Amur Bay, Sea of Japan) E. B. Volynets Institute of Biology and Soil Science, Far East Branch, Russian Academy of Sciences, pr. 100letiya Vladivostoka 159, Vladivostok, 690022 Russia email: [email protected] Received August 21, 2013; in final form, March 24, 2014 Abstract—The Cretaceous sections and plant macrofossils are investigated in detail near Vladivostok on the MuravyovAmurskii Peninsula of southern Primorye. It is established that the Ussuri and Lipovtsy forma tions in the reference section of the Markovskii Peninsula rest with unconformity upon Upper Triassic strata. The continuous Cretaceous succession is revealed in the Peschanka River area of the northern Muravyov Amurskii Peninsula, where plant remains were first sampled from the lower and upper parts of the Korkino Group, which are determined to be the late Albian–late Cenmanian in age. The taxonomic composition of floral assemblages from the Ussuri, Lipovtsy, and Galenki formations is widened owing to additional finds of plant remains. The Korkino Group received floral characteristics for the first time. The Cretaceous flora of the peninsula is represented by 126 taxa. It is established that ferns and conifers are dominant elements of the Ussuri floral assemblage, while the Lipovtsy Assemblage is dominated by ferns, conifers, and cycadphytes. In addition, the latter assemblage is characterized by the highest taxonomic diversity. The Galenki Assemblage is marked by the first appearance of rare flowering plants against the background of dominant ferns and coni fers. -

Research Journal of Pharmaceutical, Biological and Chemical Sciences

ISSN: 0975-8585 Research Journal of Pharmaceutical, Biological and Chemical Sciences Concentration of Gold from Ash and Slag Wastes of Energy Sector Enterprises of The Primorsky Territory. Evgeny Ivanovich Shamray1*, Andrey Vasilyevich Taskin2, Sergey Igorevich Ivannikov1, and Alexander Alekseevich Yudakov1. 1 Institute of chemistry FEB RAS, 690022, Russia, Vladivostok, Prosp. 100-letya Vladivostoka, 159. 2Far Eastern Federal University, 690091, Russia, Vladivostok, Sukhanova str., 8. ABSTRACT The study of a large array of ash waste from landfills of energy sector enterprises in Primorsky Territory was made. Data on the content of gold and silver in the ash and slug waste of some energy enterprises in Primorsky Territory was given. Group of samples with high content of gold and silver was found. Silver content was found within 0.5-29.7 g/t limits. Gold content was found within 0.004–0.45 g/t limits. The information on the chemical composition of the investigated slag samples was given. Based on these data, the method of separation of ash and slag waste in the individual mineral fractions was proposed. The possibility of gold concentration in the non-magnetic fraction of the slag cleared of silt, clay, black charcoal and magnetic minerals was shown. Keywords: technogenic deposits, wastes of energy enterprises, ash and slag waste (ASW), gold, silver, atomic and absorption analysis, neutron-activation analysis, X-ray fluorescence analysis. *Corresponding Author November – December 2016 RJPBCS 7(6) Page No. 156 ISSN: 0975-8585 INTRODUCTION Ash and slag waste (ASW) is formed during coal combustion process in energy producing enterprises. For example, in recent years, yearly inflow of ASW into the ash and slag disposal areas of Primorsky Territory is up to 3.0 million tons. -

The Russian-Chinese Oil Politik

China-Russia Relations: The Russian-Chinese Oil Politik Yu Bin Associate Professor, Wittenberg University The specter of oil is haunting the world. The battle of oil, however, is not just being waged by oilmen from Texas and done with “shock-and-awe” in the era of preemption. Nor does it have anything to do with the billion-dollar contract awarded to the U.S. firm Halliburton for the reconstruction of postwar Iraq. This time, oil, or lack of it, is clogging the geostrategic pipeline between the world’s second largest oil producer (Russia) and second largest oil importing state (China) as they haggle over the future destination of Siberia’s vast oil reserves. To be sure, the “oil politik” between Moscow and Beijing is far from a full-blown crisis. Indeed, China-Russia relations during the third quarter were marked by dynamic interactions and close coordination over multilateral issues of postwar Iraq, the Korean nuclear crisis, and institution building for the SCO (Shanghai Cooperation Organization). Russia’s energy realpolitik, however, has led to such a psychological point that for the first time, a generally linear, decade-long emerging Russian-Chinese strategic partnership, or honeymoon, seems arrested and is being replaced by a routine, boring, or even jolting marriage of necessity in which quarrels and conflicts are part normal. Business still as Usual Unlike the more turbulent and/or spectacular second quarter, the post-Iraq and post- SARS (severe acute respiratory syndrome) third quarter seemed normal for Russia and China, at least on the surface. All border checkpoints were reopened with busier transactions to make up for the losses suffered during the SARS epidemic. -

A Region with Special Needs the Russian Far East in Moscow’S Policy

65 A REGION WITH SPECIAL NEEDS THE RUSSIAN FAR EAST IN MOSCOW’s pOLICY Szymon Kardaś, additional research by: Ewa Fischer NUMBER 65 WARSAW JUNE 2017 A REGION WITH SPECIAL NEEDS THE RUSSIAN FAR EAST IN MOSCOW’S POLICY Szymon Kardaś, additional research by: Ewa Fischer © Copyright by Ośrodek Studiów Wschodnich im. Marka Karpia / Centre for Eastern Studies CONTENT EDITOR Adam Eberhardt, Marek Menkiszak EDITOR Katarzyna Kazimierska CO-OPERATION Halina Kowalczyk, Anna Łabuszewska TRANSLATION Ilona Duchnowicz CO-OPERATION Timothy Harrell GRAPHIC DESIGN PARA-BUCH PHOTOgrAPH ON COVER Mikhail Varentsov, Shutterstock.com DTP GroupMedia MAPS Wojciech Mańkowski PUBLISHER Ośrodek Studiów Wschodnich im. Marka Karpia Centre for Eastern Studies ul. Koszykowa 6a, Warsaw, Poland Phone + 48 /22/ 525 80 00 Fax: + 48 /22/ 525 80 40 osw.waw.pl ISBN 978-83-65827-06-7 Contents THESES /5 INTRODUctiON /7 I. THE SPEciAL CHARActERISticS OF THE RUSSIAN FAR EAST AND THE EVOLUtiON OF THE CONCEPT FOR itS DEVELOPMENT /8 1. General characteristics of the Russian Far East /8 2. The Russian Far East: foreign trade /12 3. The evolution of the Russian Far East development concept /15 3.1. The Soviet period /15 3.2. The 1990s /16 3.3. The rule of Vladimir Putin /16 3.4. The Territories of Advanced Development /20 II. ENERGY AND TRANSPORT: ‘THE FLYWHEELS’ OF THE FAR EAST’S DEVELOPMENT /26 1. The energy sector /26 1.1. The resource potential /26 1.2. The infrastructure /30 2. Transport /33 2.1. Railroad transport /33 2.2. Maritime transport /34 2.3. Road transport /35 2.4. -

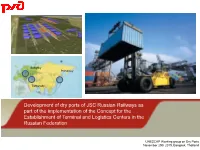

Primorsky Railway Port

Baltiysky Primorsky Tamansky Development of dry ports of JSC Russian Railways as part of the implementation of the Concept for the Establishment of Terminal and Logistics Centers in the Russian Federation UNESCAP Working group on Dry Ports November 25th 2015, Bangkok, Thailand In 2012, the Board of Directors of JSC Russian Railways approved the Concept for the Establishment of Terminal and Logistics Centers (TLC) in the Russian Federation Priority arrangements to establish a TLC network TLC Kaliningrad Baltiysky Railway Port TLC Bely Rast TLC Doskino Tamansky Railway Port Primorsky Railway Port Grodekovo Nakhodka Artem-Primorsky-I Legend: Facilities of the first phase of the development of the TLC network Key satellites of the first phase 2 A railway port as a comprehensive solution Main functions: . Removal of non-core operations from seaports (storage, stripping, etc.); . Consolidation (of shipload lots, train lots, etc.); . Distribution (port, region, continent, transit, etc.); . Storage (including exchange storage); . Provision of a package of services with added value; . Customs clearance of cargoes. Implementation of transportation technologies with the use of a railway port makes it possible to: . Increase the processing capacity of seaports; . Increase the efficiency of the transportation process; . Cut transport costs; . Reduce the investment burden on port infrastructure, ensure a more rapid commissioning of facilities; . Reduce the likelihood of the emergence of idle trains; . Reduce the environmental footprint and traffic load. 3 Engagement between JSC Russian Impact Railways and seaports • Involvement of JSC . Establishment of a systemic transport Russian Railways in infrastructure facility to implement the just-in-time principle; the management and capital of seaports .