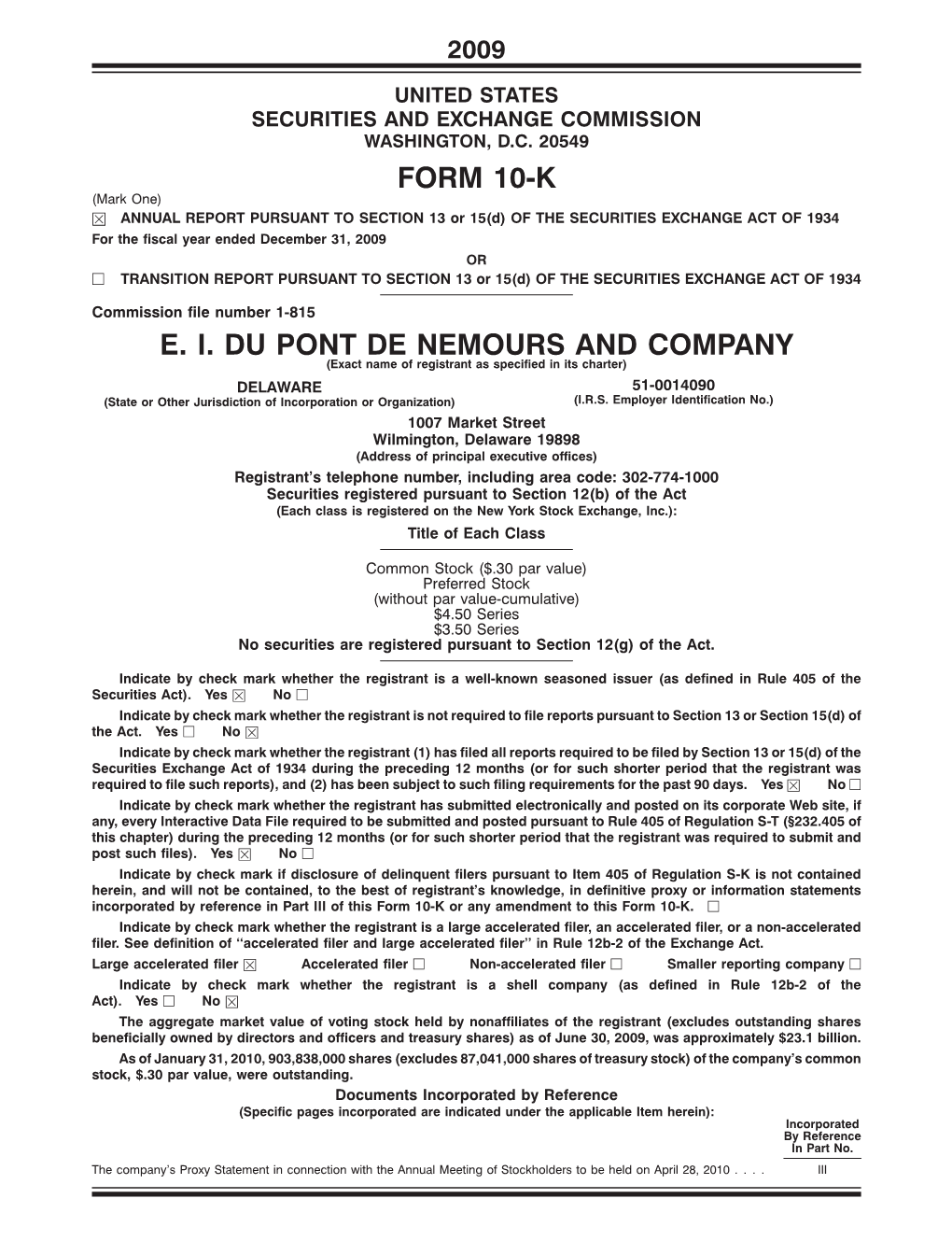

E. I. Dupont De Nemours & Company, Form 10-K Annual Report for FY

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DUPONT DATA BOOK SCIENCE-BASED SOLUTIONS Dupont Investor Relations Contents 1 Dupont Overview

DUPONT DATA BOOK SCIENCE-BASED SOLUTIONS DuPont Investor Relations Contents 1 DuPont Overview 2 Corporate Financial Data Consolidated Income Statements Greg Friedman Tim Johnson Jennifer Driscoll Consolidated Balance Sheets Vice President Director Director Consolidated Statements of Cash Flows (302) 999-5504 (515) 535-2177 (302) 999-5510 6 DuPont Science & Technology 8 Business Segments Agriculture Electronics & Communications Industrial Biosciences Nutrition & Health Performance Materials Ann Giancristoforo Pat Esham Manager Specialist Safety & Protection (302) 999-5511 (302) 999-5513 20 Corporate Financial Data Segment Information The DuPont Data Book has been prepared to assist financial analysts, portfolio managers and others in Selected Additional Data understanding and evaluating the company. This book presents graphics, tabular and other statistical data about the consolidated company and its business segments. Inside Back Cover Forward-Looking Statements Board of Directors and This Data Book contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “believes,” “intends,” “estimates,” “anticipates” or other words of similar meaning. All DuPont Senior Leadership statements that address expectations or projections about the future, including statements about the company’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward looking statements. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. -

Dupont Company Engineering Department Photographs 1982.300

DuPont Company Engineering Department photographs 1982.300 This finding aid was produced using ArchivesSpace on September 14, 2021. Description is written in: English. Describing Archives: A Content Standard Audiovisual Collections PO Box 3630 Wilmington, Delaware 19807 [email protected] URL: http://www.hagley.org/library DuPont Company Engineering Department photographs 1982.300 Table of Contents Summary Information .................................................................................................................................... 8 Historical Note ............................................................................................................................................... 8 Scope and Content ......................................................................................................................................... 9 Administrative Information .......................................................................................................................... 11 Controlled Access Headings ........................................................................................................................ 11 Collection Inventory ..................................................................................................................................... 11 Alabama Ordnance Works ........................................................................................................................ 11 Argentine Rayon Construction ................................................................................................................. -

Evidence from My Hometown by Leo E. Strine

Corporate Power is Corporate Purpose I: Evidence From My Hometown By Leo E. Strine, Jr.* † The Oxford Review of Economic Policy Seminar on Responsible Business Draft of December 9, 2016 Please do not cite * Chief Justice, Delaware Supreme Court; Adjunct Professor of Law, University of Pennsylvania Law School; Austin Wakeman Scott Lecturer in Law, Harvard Law School; Senior Fellow, Harvard Program on Corporate Governance; and Henry Crown Fellow, Aspen Institute. † The author is grateful to Christine Balaguer, Jacob Fedechko, Peter Fritz, Alexandra Joyce, Fay Krewer, and Peggy Pfeiffer for their help. The author also thanks Stephen Bainbridge, Lawrence Hamermesh, David Katz, Marty Lipton, Andy Lubin, Sarah Lubin, and the two anonymous referees for excellent feedback and incisive comments on the draft. Electronic copy available at: https://ssrn.com/abstract=2906875 One of the most tired debates in American corporate law has been about the ends of corporate governance. Must, within the limits of their legal discretion, boards of directors act for the best interests of stockholders? Or may they exercise their discretion to advance, as an end in itself, the best interests of other corporate constituencies, such as the corporation’s employees, home communities, and consumers? The reason this debate is a bit tired is because it is not about whether corporate statutes should be amended to give equal credence to other constituencies than stockholders, it is about arguing that corporate laws that give only rights to stockholders somehow implicitly empower directors to regard other constituencies as equal ends in governance. In other words, the debate involves large doses of wish fulfillment, with advocates for other constituencies arguing that the law already is what they in fact think it ought to be. -

Chemours Company, Llc

CHEMOURS COMPANY, LLC FORM 10-12B/A (Amended Registration Statement) Filed 02/12/15 Address 1007 MARKET STREET WILMINGTON, DE 19898 Telephone 302 774 9843 CIK 0001627223 SIC Code 2800 - Chemicals & Allied Products Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2015, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. As filed with the U.S. Securities and Exchange Commission on February 12, 2015 File No. 001-36794 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 AMENDMENT NO. 1 TO FORM 10 GENERAL FORM FOR REGISTRATION OF SECURITIES PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 The Chemours Company, LLC (Exact name of registrant as specified in its charter) Delaware 46 -4845564 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 1007 Market Street, Wilmington, Delaware 19898 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (302) 774-1000 Securities to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which to be so registered each class is to be registered Common Stock, par value $0.01 per share New York Stock Exchange Securities to be registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. -

E. I. Dupont De Nemours and Company, Form 10-K for Fiscal Year Ending December 31, 2005

UNITED STATES SECURITIES AND EXCHANGE COMMISSION 4s$yo> WASHINGTON, D.C. 20549 FORM 10-K Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-815 f( @3~-30“ E. I. DU PONT DE: NEMOURS ,yp3 AND COMPANY (Exact name of registrant as specified in its charter) DELAWARE 51-0014090 (State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.) 1007 Market Street Wilmington, Delawari: 19898 (Address of principal executive offices) Registrant’s telephone number, including area code: 302 774-1000 Securities registered pursuant to Section 12(b) of the Act (Each class is registered on the New York. Stock Exchange, Inc.): Title of Each Claiss Common Stock ($.30 par value) Preferred Stock (without par value-cumulative) $4.50 Series $3.50 Series No securities are registered pursuant to Section 12(g) of the Act. - Indicate by check mark whether the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes No 0 Indicate by check mark whether the registrant is not reqluired to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes 0 No w Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Dupont Celebrates 50Th Anniversary of Dupont™ Tyvek®

News Release DuPont Protection Solutions DuPont Celebrates 50 th Anniversary of DuPont™ Tyvek® Marking 50 Years of Scientific Innovation Across Industries with a Focus on the Future WILMINGTON, Del., April 6, 2017 – DuPont Protection Solutions today announced the 50 th anniversary of DuPont™ Tyvek® , a unique nonwoven material that has enabled new dimensions of protection, security and safety in a wide variety of industries and applications. To mark this major milestone, celebratory events will be held throughout the year to not only pay tribute to the past, but to focus on the future. In addition, a series of communications and special activities are planned to inform, inspire and involve customers, end-users and others around the world during this celebration year and beyond. “We are proud of the role Tyvek® has played during the past 50 years in making a world of greater good possible,” said Christian Marx, global business director for DuPont™ Tyvek®. “From helping to protect medical personnel during the West Africa Ebola crisis, to serving as a weather barrier for the pavilion housing the Liberty Bell in Philadelphia along with countless homes and commercial buildings around the globe, to helping protect the health of millions of patients around the world by maintaining the sterility of medical devices and supplies, Tyvek® provides the trusted protection people need to accomplish bigger things,” explained Marx. “We are pleased to celebrate the past but remain focused on the future, collaborating worldwide to innovate with Tyvek® and help solve the challenges of the next half century and beyond.” Lightweight and durable, Tyvek® is breathable, yet resistant to water, abrasion, bacterial penetration and aging, making it ideal for a wide variety of applications across diverse industries. -

Institute for Law and Economics

ISSN 1936-5349 (print) ISSN 1936-5357 (online) HARVARD JOHN M. OLIN CENTER FOR LAW, ECONOMICS, AND BUSINESS CORPORATE POWER IS CORPORATE PURPOSE I: EVIDENCE FROM MY HOMETOWN Leo E. Strine, Jr. Forthcoming in Oxford Review of Economic Policy Discussion Paper No. 895 01/2017 Harvard Law School Cambridge, MA 02138 This paper can be downloaded without charge from: The Harvard John M. Olin Discussion Paper Series: http://www.law.harvard.edu/programs/olin_center The Social Science Research Network Electronic Paper Collection: https://ssrn.com/abstract=2906875 This paper is also Discussion Paper 2017-1 of the Harvard Law School Program on Corporate Governance University of Pennsylvania Law School ILE INSTITUTE FOR LAW AND ECONOMICS A Joint Research Center of the Law School, the Wharton School, and the Department of Economics in the School of Arts and Sciences at the University of Pennsylvania RESEARCH PAPER NO. 16-34 Corporate Power is Corporate Purpose I: Evidence from My Hometown Leo E. Strine, Jr. GOVERNMENT OF THE STATE OF DELAWARE - SUPREME COURT OF DELAWARE; HARVARD LAW SCHOOL; UNIVERSITY OF PENNSYLVANIA LAW SCHOOL This paper can be downloaded without charge from the Social Science Research Network Electronic Paper Collection: https://ssrn.com/abstract=2906875 Electronic copy available at: https://ssrn.com/abstract=2906875 Corporate Power is Corporate Purpose I: Evidence From My Hometown By Leo E. Strine, Jr.* † The Oxford Review of Economic Policy Seminar on Responsible Business Draft of December 9, 2016 Please do not cite * Chief Justice, Delaware Supreme Court; Adjunct Professor of Law, University of Pennsylvania Law School; Austin Wakeman Scott Lecturer in Law, Harvard Law School; Senior Fellow, Harvard Program on Corporate Governance; and Henry Crown Fellow, Aspen Institute. -

(Microsoft Powerpoint

ǘὪņਕ, ȴȴȴ ƇƇ සසසස ᄶᄶᄶᄶ ņਕᢧᢧᢧᢧ ΟΟΟΟ 5555 ˄˄˄˄ – “ ” DuPont Building Innovation – Provide “Green” Building Materials and Solutions Peter Huang August, 2009 2 DuPont Market Plastics and uØՈNŖ ɭChem^iĚca1ls : 14% ϹϹEϹϹ leƄƄƄƄ ctronics : 9% ̑̑M̑̑ oḪḪḪḪ tor Vehicle : 26% Textiles/Home ൾFuඋrn˅ishǪǪǪǪ inͣͣͣͣ gs / : 1% DuPont operates in more than 70 countries and regions, has 250 institutions, 60,000 employees, Construction Materials 37000 kinds of products, 25000 customers and ņņņņ ਕਕਕਕ njnjnjnj 60000 vendors. The income of 2005: US$26.6 : 14% billion. ǘὪ¥ἑO̶ ę Ǫ ʐ Ō ľ ʼn ƅ ƶ Ȁ 3 ΈΈAΈΈ g ric ul˅˅˅˅ ture/Food #$%ȑ &ɜ 13'()* +3,-& ! " ʐ / : 28% ͢͢O͢͢ tÂÂÂÂher : 8% 3 dzdzSdzdz uťťťť stනනනන aiසසnසස aᄶᄶᄶᄶ blņņņņe Bਕਕਕਕ uᢧᢧᢧᢧ ildΟΟΟΟ in5555 g ˄˄˄˄ Solutions 2 ࿁࿁࿁࿁ ļļļļ ˊˊˊˊ 7 Energy management 8 Energy energy energy efficiency generation storage ᅆᅆᅆᅆ ൪൪൪൪ ࿁࿁࿁࿁ ļļļļ ࿁࿁࿁࿁ ļļļļ ϣϣϣϣ ࿁࿁࿁࿁ ļļļļ ʔʔʔʔ ƌƌƌƌ 5 4 1. DuPont™ Tyvek®7 B8 re9 atha: bl;e M< e= m> br?an@ e &ி A Flashing Systems ® 2 3 ࿁ 4 5 6 2. DuPont Photovoltaic Solutions , - . / 0 1 3 3. DuPont™ Energain® ɳɳɳɳ ࿁࿁࿁࿁ ᪂᪂᪂᪂ ᩥᩥᩥᩥ 1 Performance based design Aes๒๒๒๒ thᢆᢆᢆᢆ etics Sƽƽƽƽ a͔͔͔͔ fe Comზზზზ foỆỆỆỆ rtable Heɑaălthy % & ' ( ) * + 6 10 4. DuPont™ Corian® ! ®" # $ 5. DuPont™ SentryGlas® 9 6. DuPontɳ ™lj AǑ lesȸ ta୍ ®Ƨ Ar. ch itectural Powder Coatings ⓶ ̗ ɴ ǻ ต O ඃ 7. DuPont Cabling Solutions ǘ Ὢ ʌ ɳ ࿁ ̙ ̗ F 8. DuPont Fire Extinguisǘ haὪ ntɳ s lj : Σ F ி 9. DuPont Refrigerants àϬϣĭä 10. DuPont™ Sorona® 4 DuPont™ Tyvek® Breathable Membrane ǘanὪd FlaĽĽ shůů inƆƆ g Sydzdzdzdz stʀʀʀʀ emȼȼȼȼ ၠၠၠၠ ʐʐʐʐ ⓶⓶⓶⓶ ˈˈˈˈ ிிிி ඣඣඣඣ ™ ® • ʺRe¤duʨceǺ aɳir leakage • ljPrĈoteƽ ctញ edr inՈ stඡ allො edĿ R-vȨalue of insulation R • ȴproƇ vŗideᱎ sՈupĐ erĈior weather protection • ΝImẟ prẔovňedி lifඣ e £cyάcleՈ aẔ ndᜐ oɬveƛ ra ll d! ur" abɳility of operational system efficiency • Ẕlowᜐ o# pe$ ra% tin&g' coň st(, e) as&y *to + m,ain- tain, provide better comfort year round • ʺPr¤ote. -

View Annual Report

2016 DUPONT ANNUAL REPORT A world leader in science and innovation, DuPont continues to work toward sustainable, renewable and market-driven solutions for some of our biggest global challenges. We are helping to provide healthy food for people everywhere, decreasing dependence on fossil fuels, and protecting life and the environment. For more than two centuries, our ability to meet the changing needs of our customers and society through world-class science and innovation has been the key to our success. DuPont’s current transformation will position each of our businesses with a clear focus and allow us to deliver superior solutions and choices for our customers. For additional information about DuPont and its commitment to inclusive innovation, please visit dupont.com. 2016 SEGMENT NET SALES 2016 TOTAL SEGMENT [U.S. DOLLARS IN MILLIONS] OPERATING EARNINGS AND TOTAL SEGMENT OPERATING MARGINS [1] $147 $6,000 19.5% $2,954 19.0% $5,000 18.5% $4,000 18.0% $5,249 $9,516 $3,000 17.5% MARGIN 17.0% $2,000 $ IN MILLIONS 16.5% $1,000 $3,268 16.0% $1,960 $0 15.5% 2015 2016 $1,500 AGRICULTURE NUTRITION & HEALTH ELECTRONICS & COMMUNICATIONS PERFORMANCE MATERIALS INDUSTRIAL BIOSCIENCES PROTECTION SOLUTIONS OTHER 2016 OPERATING MARGINS BY SEGMENT 30% 25% 20% 15% 10% 5% 0% RE TRIAL ALTH 2015 US AGRICULTU PROTECTIONSOLUTIONS 2016 ELECTRONICS & IND NUTRITION & HE PERFORMANCE COMMUNICATIONS BIOSCIENCES MATERIALS Dear DuPont Shareowners, 2016 was a year of transformation and accomplishment for DuPont. We made meaningful progress improving the fundamentals of the business and significantly strengthened our competitive position, so that we started 2017 operating at a new standard of excellence. -

2006 Dupont Data Book Contents Dupont Investor Relations

2006 DuPont Data Book Contents DuPont Investor Relations 1 2006 Summary 2 2006 At a Glance 4 Corporate Financial Data Corporate Highlights Carl Lukach Karen Fletcher Vice President Director Segment Information (302) 774-0001 (302) 774-1125 Consolidated Income Statements Consolidated Balance Sheets Consolidated Statements of Cash Flows Selected Additional Data 14 DuPont Core Values, Sustainability, and Six Sigma Laurie Conslato Jim Jacobson Pam Schools Manager Manager Investor Relations 15 Industries, Regions, and Ingredients (302) 774-6088 (302) 774-0017 Coordinator (302) 774-9870 16 DuPont Science & Technology 18 Business Segments DuPont Data Book has been prepared to assist financial analysts, portfolio managers Agriculture & Nutrition and others in understanding and evaluating the company. This book presents graphics, tabular, and other statistical data about the consolidated company and its business Coatings & Color Technologies segments. The information presented in this book is generally included in—or can be calculated from—previously issued press releases and published company reports on Electronic & Communication Technologies Forms 10K, 10Q, and 8K. In particular, segment data is consistent with the 8K furnished Performance Materials on April 4, 2007. Dollars are in millions except per share or where otherwise indicated. Most notes to financial statements are not included. This information is only a summary Safety & Protection and should be read in conjunction with the company’s audited consolidated financial Pharmaceuticals statements and “Management’s Discussion and Analysis,” which is located in the 2006 Form 10K filed with the Securities and Exchange Commission. Use of Non-GAAP Measures 39 Major Global Sites and Principal Products This data book presents certain non-GAAP (U.S. -

E. I. Du Pont De Nemours and Company

2007 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) ¥ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 n TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-815 E. I. DU PONT DE NEMOURS AND COMPANY (Exact name of registrant as specified in its charter) Delaware 51-0014090 (State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.) 1007 Market Street Wilmington, Delaware 19898 (Address of principal executive offices) Registrant’s telephone number, including area code: 302-774-1000 Securities registered pursuant to Section 12(b) of the Act (Each class is registered on the New York Stock Exchange, Inc.): Title of Each Class Common Stock ($.30 par value) Preferred Stock (without par value-cumulative) $4.50 Series $3.50 Series No securities are registered pursuant to Section 12(g) of the Act. Indicate by check mark whether the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ¥ No n Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes n No ¥ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2012 SUSTAINABILITY PROGRESS REPORT the Global Collaboratory™ Welcomeleading with Innovation

2012 SUSTAINABILITY PROGRESS REPORT The Global Collaboratory™ WelcomeLeading with Innovation. to As a world leader in science and innovation, DuPont is creating solutions to address global challenges of the future DuPont has reported our sustainability progress for the last twenty years. During this time our sustainability focus has grown from managing our operational footprint to helping our customers lighten their environmental footprint across the value chain. Our long-standing commitment is to sustainable growth — creating shareholder and societal value while reducing the environmental footprint in the value chains in which we operate. Today, we are looking toward the future and asking ourselves the question: How can we meet the challenges that accompany a growing population? We are working together with customers, partners, academics, governments, NGOs and other organizations to find new and better ways to provide for the world’s food, energy and protection needs. DuPont brings science and the collective ingenuity of collaboration to the table to create scalable solutions for complex global challenges. FOOD ENERGY PROTECTION Together, we can Together, we can Together, we can feed the world. build a secure energy future. protect what matters most. DuPont is pioneering innovation in DuPont is aggressively working DuPont is committed to protecting food science, devoting 62 percent to find ways of helping the world people and the environment. of our research and development consume energy more efficiently. We work with customers, local budget to unlocking solutions to This will mean steadily reducing government and industry to help end hunger. We are invested our use of fossil fuels and using develop materials and services in getting more food to more them more cleanly, while producing that conserve the environment and people, and providing healthier energy from alternative sources.