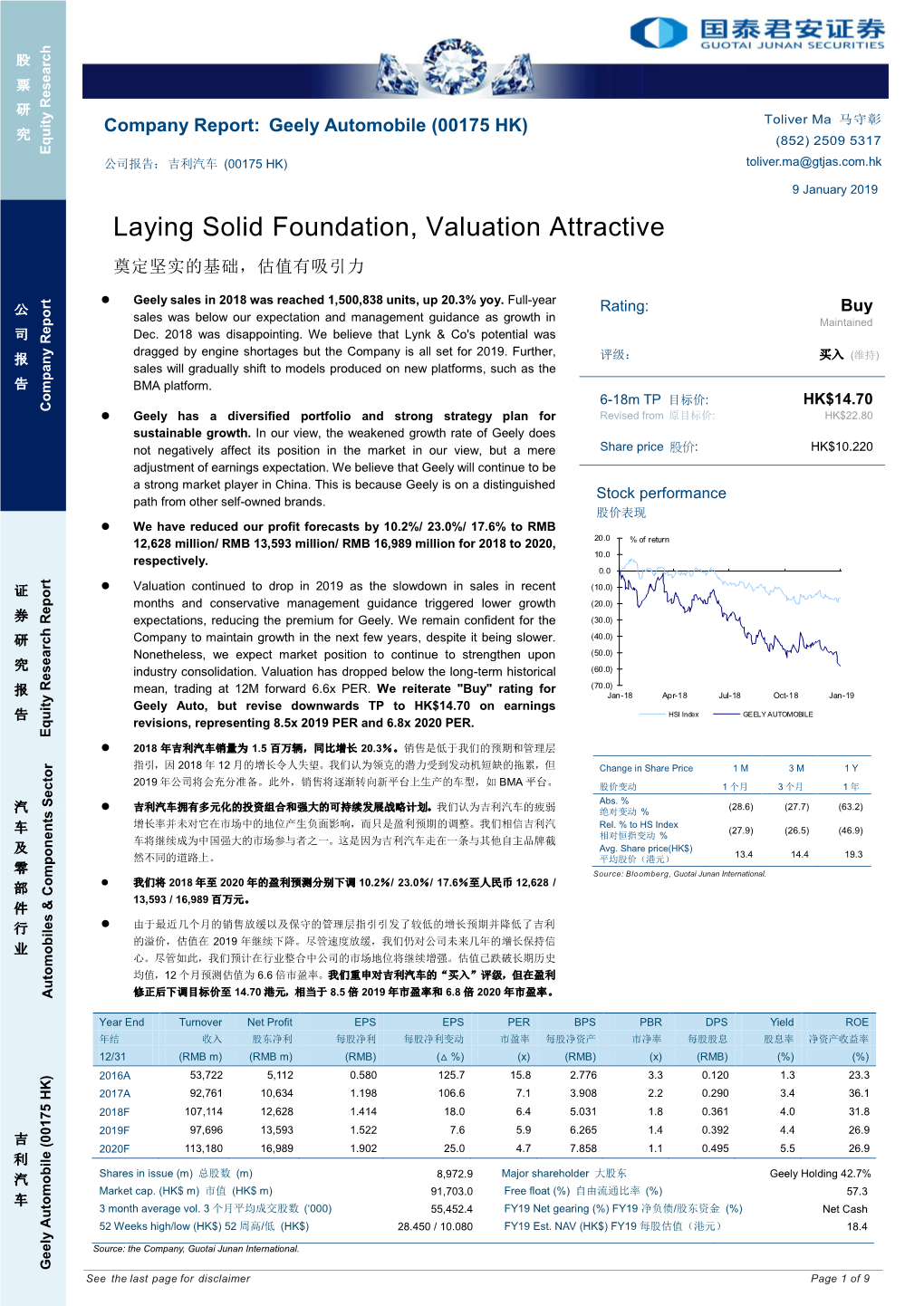

Laying Solid Foundation, Valuation Attractive 奠定坚实的基础,估值有吸引力

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Personal Use Only Use Personal for Beijing National Battery Technology Co., Ltd

AVZ Minerals Limited 21 March 2018 Beijing National Battery Technology Co., Ltd to visit the Manono Lithium Project AVZ Minerals Limited (ASX: AVZ) (“AVZ” or “Company”) is pleased to advise that it is actively progressing the Memorandum of Understanding (“MOU") with Beijing National Battery Technology Co., Ltd (“BNB”) for potential investment and off-take opportunities. As previously advised, discussions with BNB have been on-going for a number of months, and as part of BNB’s already-in-progress due diligence, the Company extended an invitation to visit the Manono Lithium Project in the Democratic Republic of Congo (“DRC”). Discussions have recently been held between BNB’s Chairman and AVZ Executive Management around working together to accelerate the development and production of the Manono Lithium Project. AVZ is pleased to confirm that the Chairman of BNB and their due diligence team will be attending site at Manono in the DRC next week with AVZ Management and its strategic advisor, Airguide International Pte Limited. Beijing National Battery Technology Co., Ltd (www.nationalpower.com.cn) is headquartered in Beijing, China, and holds the dominant market position for the supply of batteries to China's bus industry and is the 7th largest battery maker globally with a focus on rapidly expanding its production facilities. AVZ’s Executive Chairman Klaus Eckhof commented: “We are very excited by the pace and professionalism demonstrated by BNB as they move through their due diligence process with AVZ. Their ambition to be a dominant player in the global battery market is an excellent match for AVZ given the size of Manono. -

Pengyuan Credit Rating (Hong Kong) Co.,Ltd

Corporate China Weichai Power Co., Ltd. Ratings Overview Issuer Rating ▪ Pengyuan International has assigned a first-time global scale long-term issuer LT Issuer Credit Rating BBB+ credit rating (LTICR) of ‘BBB+’ to Weichai Power Co., Ltd. (Weichai). The outlook is stable. Outlook Stable ▪ The rating reflects Weichai’s position as the leading domestic heavy-duty truck player with increasing business diversification through an expanded product portfolio, its presence in KION Group and an exceptional leverage profile with Contents strong cash flow. On the other hand, Weichai’s rating is constrained by its relatively high exposure to cyclical heavy-duty truck market in China. Key Rating Drivers .........................2 ▪ Weichai primarily engages in the development and manufacturing of vehicles and components, mainly powertrains such as engines, gearboxes and axles, Business Profiles ...........................3 forklift trucks and the provision of warehouse technology services. In 2020, Financial Profile .............................5 24% of its revenue came from engines, 43% from automobiles and automobile components and 33% from intelligent logistics. Liquidity .........................................6 Company Background ...................6 Rating Outlook Peer comparison ...........................6 ▪ The stable outlook for Weichai reflects our expectation that the Company will Rating Scores Summary ................8 continuously maintain its leading market position in the Chinese powertrain Related Criteria ..............................8 market given its extensive track record of technological innovation in the development of powertrain products such as diesel engines, gearboxes and axles. ▪ We would consider upgrading Weichai’s issuer credit rating if its credit profile improves substantially, which could be caused by: 1) a remarkable increase in market share in the key markets; and 2) a significant improvement in business diversity through successful overseas business expansion or business diversification to non-heavy-duty truck related business. -

Green Competitiveness Research on Chinese Automotive Enterprises

Journal of Industrial Engineering and Management JIEM, 2014 – 7(2): 559-572 – Online ISSN: 2014-0953 – Print ISSN: 2014-8423 http://dx.doi.org/10.3926/jiem.1032 Green competitiveness research on Chinese automotive enterprises Yuanhui Li School of Economics and Management, Beijing Jiaotong University (China) [email protected] Abstract: Purpose: More and more executives of automobile industry in China start to recognize the concept of green competitiveness recently. However, relatively less research attention has been devoted to the consideration of measurement. This paper aims to find empirical approach to quantify green competitiveness for automotive enterprises. The connotation of green competitiveness is explored and one suite of evaluation index system has been proposed with four dimensions including environmental, resource, capability and knowledge. Design/methodology/approach: By introducing the factor analysis method, green competitiveness has been measured through an empirical analysis of 24 automotive enterprises within China. Findings: The results indicate that those elements, such as enterprise resource possession and utilization; environment, responsibility and knowledge; profitability; management efficiency, have significant effect on the green competitiveness for automotive enterprises. The further analysis also unveils the advantages and disadvantages of green competitiveness for each company and the direction for improvement. Research limitations/implications: Guide regulators and managers of automobile industry to take some measures to enhance their green competitive advantage. Practical implications: Provide practical methods to measure green competitiveness for automotive enterprises. -559- Journal of Industrial Engineering and Management – http://dx.doi.org/10.3926/jiem.1032 Originality/value: This paper proposes an evaluation index system of green competitiveness for automotive enterprises. -

China Automotive Industry Study Report for the Swedish Energy Agency August 2019

BUSINESS SWEDEN CHINA AUTOMOTIVE INDUSTRY STUDY REPORT FOR THE SWEDISH ENERGY AGENCY AUGUST 2019 www.eqtpartners.com An assignment from the Swedish Energy Agency Göran Stegrin, email [email protected] Disclaimer: This report reflects the view of the consultant (Business Sweden) and is not an official standpoint by the agency. BUSINESS SWEDEN | CHINA AUTOMOTIVE IND USTRY STUDY | 2 SUMMARY Economic slowdown and an ongoing trade war with the United States have impacted the Chinese automotive market. In 2018, new vehicle sales declined for the first time in 20 years. Sales totaled 28,08 million units, reflecting a -2.8% y/y. Electric vehicles remain a promising segment, as the government still provides substantial subsidies to manufacturers, while customers are offered incentives and favorable discounts for purchasing. In order to guide the industry, the Chinses government is gradually reducing subsidies. Stricter rules are also set to raise the subsidy threshold, which will force both OEMs and suppliers along the value chain to increasingly convert themselves into hi-tech companies with core competencies. The evolution is driven by solutions addressing the three main issues created by the last decade’s market boom: energy consumption, pollution and traffic congestion. The Chinese government has shifted its attention from total volume to engine mix and is progressively creating incentives to small and low emission vehicles, while supporting investment in new energy vehicles, mainly electric. In this direction, technologies surrounding new energy vehicles such as power cell materials, fuel cell and driving motor will receive strong support and offer more opportunities. In the light weight area, structure optimization is still the primary ways for OEMs the achieve the weight reduction goal. -

China Autos Asia China Automobiles & Components

Deutsche Bank Markets Research Industry Date 18 May 2016 China Autos Asia China Automobiles & Components Vincent Ha, CFA Fei Sun, CFA Research Analyst Research Analyst (+852 ) 2203 6247 (+852 ) 2203 6130 [email protected] [email protected] F.I.T.T. for investors What you should know about China's new energy vehicle (NEV) market Many players, but only a few are making meaningful earnings contributions One can question China’s target to put 5m New Energy Vehicles on the road by 2020, or its ambition to prove itself a technology leader in the field, but the surge in demand with 171k vehicles sold in 4Q15 cannot be denied. Policy imperatives and government support could ensure three-fold volume growth by 2020, which would make China half of this developing global market. New entrants are proliferating, with few clear winners as yet, but we conclude that Yutong and BYD have the scale of NEV sales today to support Buy ratings. ________________________________________________________________________________________________________________ Deutsche Bank AG/Hong Kong Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 057/04/2016. Deutsche Bank Markets Research Asia Industry Date China 18 May 2016 Automobiles & China -

Performance Evaluation of Listed Companies in New-Energy Automotive Industry

Open Journal of Energy Efficiency, 2014, 3, 98-107 Published Online December 2014 in SciRes. http://www.scirp.org/journal/ojee http://dx.doi.org/10.4236/ojee.2014.34011 Performance Evaluation of Listed Companies in New-Energy Automotive Industry Zexuan Lu, Hongsheng Xia Management College, Jinan University, Guangzhou, China Email: [email protected] Received 20 October 2014; revised 15 November 2014; accepted 24 November 2014 Copyright © 2014 by authors and Scientific Research Publishing Inc. This work is licensed under the Creative Commons Attribution International License (CC BY). http://creativecommons.org/licenses/by/4.0/ Abstract As one of the national strategic emerging industries, new-energy-automobile industry has been caused people’s attention increasingly. Therefore, improving the new energy industry listing cor- poration performance, not only can alleviate the pressure on energy and the environment, but also can conducive to accelerating the transformation and upgrading of the automotive industry. More- over, it can foster new economic point of growth and international competitiveness. This essay uses the super efficiency DEA model and Malmquist index method to analyze the performance of new-energy-automotive industry listing corporation. The data is from Year 2011 to 2013. Finally according to the conclusion of the empirical research, this paper made several suggestions to im- prove the operational efficiency of China’s new energy automobile enterprises and promote new- energy-automobile industry. Keywords New-Energy-Automobile Industry, Performance Evaluation, Super-Efficiency DEA Model, Malmquist Index 1. Introduction As the pollution of world becomes more and more serious, the energy crisis is coming. Moreover, along with the sustainable development of low carbon economy, new energy automobile industry has get more attention be- cause of its energy saving and environmental protection. -

AS of 03-Sep-2021 Solactive China Automobile Performance-Index

FACTSHEET - AS OF 24-Sep-2021 Solactive China Automobile Performance-Index DESCRIPTION The Solactive China Automobile Index tracks the performance of the biggest Chinese Companies active in the automobile sector. The index is calculated as a total return index in Euro and adjusted annually. HISTORICAL PERFORMANCE 500 400 300 200 100 Jan-2011 Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Jan-2018 Jan-2019 Jan-2020 Jan-2021 Solactive China Automobile Performance-Index CHARACTERISTICS ISIN / WKN DE000SLA0CA9 / SLA0CA Base Value / Base Date 100 Points / 25.10.2010 Bloomberg / Reuters SOLCA Index / .SOLCA Last Price 417.28 Index Calculator Solactive AG Dividends Reinvested (Total Return Index) Index Type Industry / Sector Calculation 09:00am to 10:30pm (CET), every 60 seconds Index Currency EUR History Available daily back to 25.10.2010 Index Members 14 FACTSHEET - AS OF 24-Sep-2021 Solactive China Automobile Performance-Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -11.05% -10.11% 2.64% 46.01% -6.04% 315.08% Performance (p.a.) - - - - - 13.93% Volatility (p.a.) 29.21% 36.07% 31.25% 36.66% 34.70% 31.36% High 485.13 485.13 485.13 491.81 491.81 491.81 Low 417.28 417.28 363.82 285.78 363.82 56.41 Sharpe Ratio -2.58 -0.96 0.19 1.29 -0.22 0.46 Max. Drawdown -13.99% -13.99% -14.00% -26.02% -26.02% -50.32% VaR 95 \ 99 -57.3% \ -93.4% -49.5% \ -82.7% CVaR 95 \ 99 -76.9% \ -120.7% -70.2% \ -108.8% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES KY 46.7% HKD 80.2% CN 39.7% USD 19.8% US 13.6% TOP COMPONENTS AS OF 24-Sep-2021 -

China Bus Industry Report, 2019-2025

China Bus Industry Report, 2019-2025 June 2019 STUDY GOAL AND OBJECTIVES METHODOLOGY This report provides the industry executives with strategically signifisignificantcant Both primary and secondary research methodologies were used competitor information, analysis, insight and projection on the in preparing this study. Initially, a comprehensive and exhaustive competitive pattern and key companies in the industry, crucial to the search of the literature on this industry was conducted. These development and implementation of effective business, marketing and sources included related books and journals, trade literature, R&D programs. marketing literature, other product/promotional literature, annual reports, security analyst reports, and other publications. REPORT OBJECTIVES Subsequently, telephone interviews or email correspondence TtblihTo establish a compre hiftlhensive, factual, annua lldtddtlly updated and cost- was conducted with marketing executives etc. Other sources effective information base on market size, competition patterns, included related magazines, academics, and consulting market segments, goals and strategies of the leading players in the companies. market, reviews and forecasts. To assist potential market entrants in evaluating prospective INFORMATION SOURCES acquisition and joint venture candidates. The primary information sources include Company Reports, To complement the organizations’ internal competitor information and National Bureau of Statistics of China etc. gathering efforts with strategic analysis, data -

Study on Value Chain and Manufacturing Competitiveness Analysis for Hydrogen and Fuel Cells Technologies FCH Contract 192

Study on Value Chain and Manufacturing Competitiveness Analysis for Hydrogen and Fuel Cells Technologies FCH contract 192 Evidence Report E4tech (UK) Ltd for FCH 2 JU in partnership with Ecorys and Strategic Analysis Inc. September 2019 Incorporated in England and Wales E4tech (UK) Ltd 83 Victoria Street Company no. 4142898 London SW1H 0HW Registered address: United Kingdom 133-137 Alexandra Road, Wimbledon, London SW19 7JY Tel: +44 20 3008 6140 United Kingdom Fax: +44 20 7078 6180 www.e4tech.com This report was prepared for the Fuel Cells and Hydrogen 2 Joint Undertaking. Copies of this document can be downloaded from fch.europa.eu The report and supporting study was undertaken by E4tech for FCH 2 JU in partnership with Ecorys and Strategic Analysis Inc. The research underpinning the study was undertaken between January to October 2018 ©FCH 2 JU, 2019. Reproduction is authorised provided that the source is acknowledged. “The information and views set out in this study are those of the author(s) and do not necessarily reflect the official opinion of the FCH 2 JU. The FCH 2 JU does not guarantee the accuracy of the data included in this study. Neither the FCH 2 JU nor any person acting on the FCH 2 JU’s behalf may be held responsible for the use which may be made of the information contained therein.” Contents 1 Introduction ......................................................................................................................... 15 1.1 This ‘Evidence’ report ........................................................................................................................................... -

Annual Report 2020

CONTENTS Financial Figures 002 Definitions 003 Corporate Information 007 Organisation Structure 009 The Group 010 Shareholder Information 011 Chairman’s Statement 013 Management Discussion and Analysis 016 Directors and Senior Management 038 Corporate Governance Report 047 Report of the Directors 062 Independent Auditor’s Report 084 Consolidated Statement of Profit or Loss 089 Consolidated Statement of Comprehensive Income 090 Consolidated Statement of Financial Position 091 Consolidated Statement of Changes in Equity 093 Consolidated Statement of Cash Flows 095 Notes to the Consolidated Financial Statements 098 Five Years Financial Summary 203 002 SINOTRUK (HONG KONG) LIMITED | ANNUAL REPORT 2020 FINANCIAL FIGURES 2020 2019 Increase/(Decrease) % Operating results (RMB million) Revenue 98,198 62,613 35,585 56.8 Gross profit 19,585 12,219 7,366 60.3 Profit attributable to owners of the Company 6,851 3,474 3,377 97.2 Profitability and Liquidity Gross profit ratio (%) 19.9 19.5 0.4 2.1 Net profit ratio (%) 7.6 6.3 1.3 20.6 Current ratio (time) 1.1 1.3 (0.2) (15.4) Trade receivable turnover (days) 41.9 71.2 (29.3) (41.2) Trade payable turnover (days) 186.1 174.2 11.9 6.8 Sales volume (units) HDTs — Domestic 247,454 129,424 118,030 91.2 — Export (including affiliated export) 30,961 40,009 (9,048) (22.6) Total 278,415 169,433 108,982 64.3 LDTs 181,013 109,280 71,733 65.6 Buses 228 1,187 (959) (80.8) Trucks sold under auto financing services 69,300 34,133 35,167 103.0 Per share data Earnings per share - basic (RMB) 2.48 1.26 1.22 96.8 2020 final dividend per share HKD 1.04 0.39 0.65 166.7 or RMB 0.88 0.36 0.52 144.4 Note: In April 2020, the Group acquired the entire equity interests in Datong Gear from CNHTC. -

Call for Papers the Competition for the Practical Application of ICV Has Already Started in the Global Automotive Industry

Call for papers www.cicv.org.cn The competition for the practical application of ICV has already started in the global automotive industry. A sound environment for ICV are taking into shape, as China is embracing a clear trend of multi-industrial coordination and innovation and taking planned steps to make top-level policies and standards. As a national strategy, the development of ICV helps to create opportunities for cross-industrial innovation. In order to promote the development of ICV in China and build a world-class platform for technology exchange, China SAE, Tsinghua University Suzhou Automotive Research Institute and China Intelligent and Connected Vehicles (Beijing) Research Institute Co. Ltd jointly initiated an annual congress “International Congress of Intelligent and Connected Vehicles Technology (CICV)”. It is a world-class technology exchange platform for automotive, IT/Internet, communications and transportation industry. At the same time, as an important sign for policies, leading technologies showcases, and industry integration accelerator, CICV serves as a platform for communication and exchange between enterprises, universities and industrial research institutes and provide references for them. The 6th International Congress of Intelligent and Connected Vehicles Technology (CICV 2019) is to be held in June, 2019. Focusing on ADAS and key technologies of automated driving as well as ICV policies and regulations, CICV 2019 will invite about 80 experts and technical leaders to share new technology results and ideas on hot topics including Environment Perception and, Development and Testing, V2X, AI, Cyber Security, HD Map, Intelligent and Connected Transportation, Co-pilot and HMI. The concurrent activities including technical exhibition, promotional tours for innovative technologies and entrepreneurship programs. -

Global Compreed Natural Gas Vehicles Market 2018 | Industry Overview, Sales, Supply and Demand Analysis and Forecast 2023

2018-09-26 10:14 CEST Global Compreed Natural Gas Vehicles Market 2018 | industry overview, sales, supply and demand analysis and forecast 2023 Global Compreed Natural Gas Vehicles report offers the latest industry trends, technological innovations and forecast market data. A deep-dive view of Compreed Natural Gas Vehicles industry based on market size, Compreed Natural Gas Vehicles growth, development plans, and opportunities is offered by this report. The forecast market information, SWOT analysis, Compreed Natural Gas Vehicles barriers, and feasibility study are the vital aspects analyzed in this report. Get FREE Sample Report Copy @ https://www.globalmarketers.biz/report/automotive-and- transportation/world-compreed-natural-gas-vehicles-market-research-report- 2022(covering-usa,-eu,-china,-south-east-asia,-japan-and- etc)/16548#request_sample Compreed Natural Gas Vehicles market segmentation by Players: • Faw-Volkswagen • DPCA • Beijing Hyundai • Saic-Volkswagen • DYK • Changan-Suzuki • Cherry • BYD • Lifan • Yutong • JAC • Shudu Bus • Zhongtong Bus • King Long • SG Automotive Group • Asiastar • Yangtse • Foton • Brilliance Auto • Haima • Shaolin Bus • Geely • Changan The up-to-date, comprehensive product knowledge, industry growth curve, end users will drive the revenue and profitability. Compreed Natural Gas Vehicles report studies the present state of the industry to analyze the future growth opportunities and risk factors. Compreed Natural Gas Vehicles report aims at providing a 360-degree market scenario. Initially, the report offers Compreed Natural Gas Vehicles introduction, fundamental overview, objectives, market definition, Compreed Natural Gas Vehicles scope, and market size estimation. Compreed Natural Gas Vehicles report helps the readers in understanding the growth factors, industry plans, policies and development strategies implemented by leading Compreed Natural Gas Vehicles players.