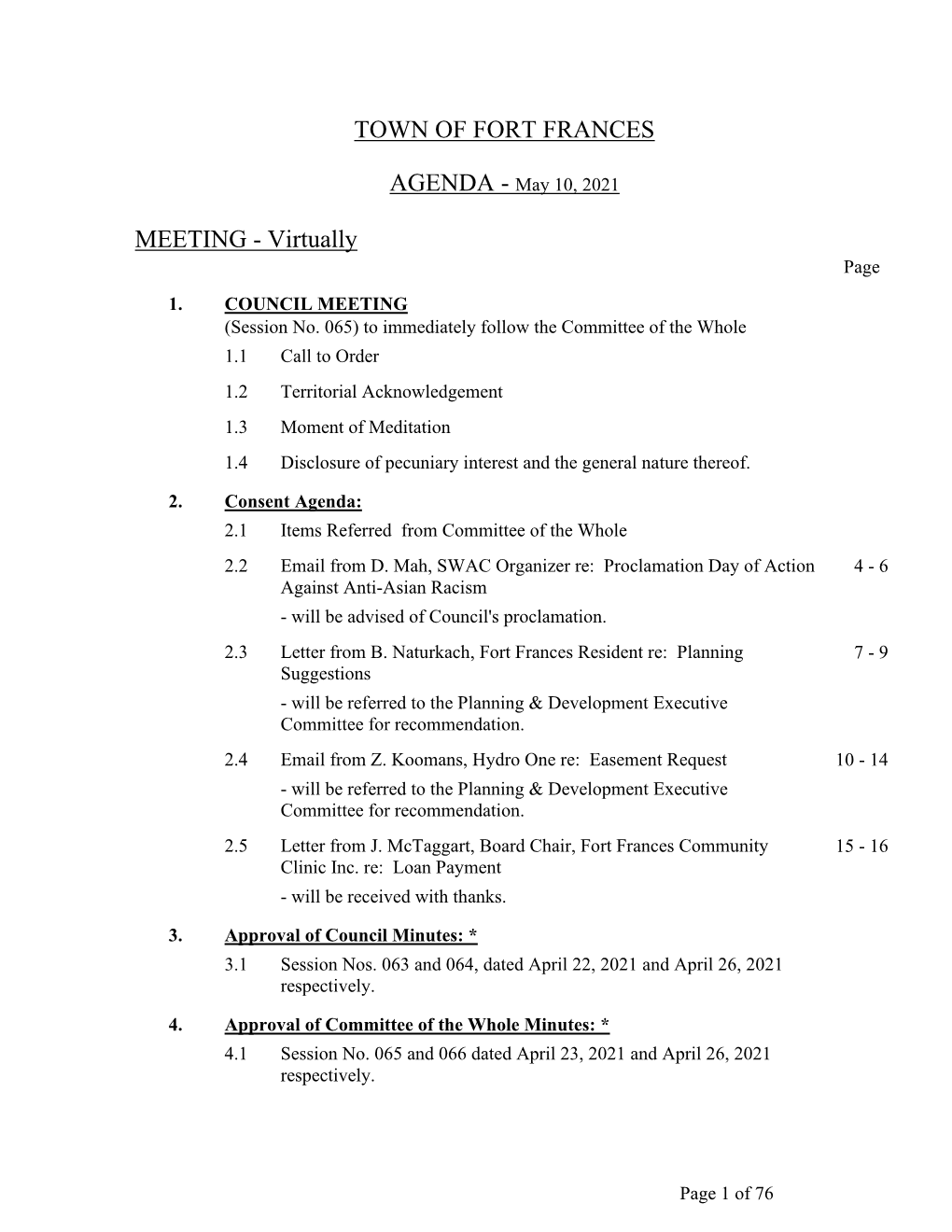

Regular Council Meeting - 10 May 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Evidence of the Standing Committee on Industry, Science and Technology

43rd PARLIAMENT, 2nd SESSION Standing Committee on Industry, Science and Technology EVIDENCE NUMBER 034 Tuesday, April 27, 2021 Chair: Mrs. Sherry Romanado 1 Standing Committee on Industry, Science and Technology Tuesday, April 27, 2021 ● (1120) With that, we will start with Professor O'Callaghan. You have the [English] floor for five minutes. The Chair (Mrs. Sherry Romanado (Longueuil—Charles- LeMoyne, Lib.)): I now call this meeting to order. Mr. Brian O'Callaghan (Lead of the Economic Recovery Project, Smith School of Enterprise and the Environment, Uni‐ Welcome to meeting number 34 of the House of Commons versity of Oxford, As an Individual): Thank you very much, Ms. Standing Committee on Industry, Science and Technology. Chair. Today’s meeting is taking place in a hybrid format, pursuant to the House order of January 25. The proceedings will be made avail‐ Thank you to the standing committee for the humbling invitation able via the House of Commons website. Just so that you are aware, to testify. the webcast will always show the person speaking, rather than the entire committee. I'm speaking today in my role as lead of the Oxford University To ensure an orderly meeting, I would like to outline a few rules economic recovery project here at the Smith School of Enterprise to follow. Members and witnesses may speak in the official lan‐ and the Environment in Oxford. guage of their choice. Interpretation services are available for this meeting. You have the choice at the bottom of your screen of either the floor, English or French. Please select your preference now. -

Impacts of the Covid-19 Pandemic on the Arts, Culture, Heritage and Sport Sectors

IMPACTS OF THE COVID-19 PANDEMIC ON THE ARTS, CULTURE, HERITAGE AND SPORT SECTORS Report of the Standing Committee on Canadian Heritage Scott Simms, Chair APRIL 2021 43rd PARLIAMENT, 2nd SESSION Published under the authority of the Speaker of the House of Commons SPEAKER’S PERMISSION The proceedings of the House of Commons and its Committees are hereby made available to provide greater public access. The parliamentary privilege of the House of Commons to control the publication and broadcast of the proceedings of the House of Commons and its Committees is nonetheless reserved. All copyrights therein are also reserved. Reproduction of the proceedings of the House of Commons and its Committees, in whole or in part and in any medium, is hereby permitted provided that the reproduction is accurate and is not presented as official. This permission does not extend to reproduction, distribution or use for commercial purpose of financial gain. Reproduction or use outside this permission or without authorization may be treated as copyright infringement in accordance with the Copyright Act. Authorization may be obtained on written application to the Office of the Speaker of the House of Commons. Reproduction in accordance with this permission does not constitute publication under the authority of the House of Commons. The absolute privilege that applies to the proceedings of the House of Commons does not extend to these permitted reproductions. Where a reproduction includes briefs to a Standing Committee of the House of Commons, authorization for reproduction may be required from the authors in accordance with the Copyright Act. Nothing in this permission abrogates or derogates from the privileges, powers, immunities and rights of the House of Commons and its Committees. -

Debates of the House of Commons

43rd PARLIAMENT, 2nd SESSION House of Commons Debates Official Report (Hansard) Volume 150 No. 086 Thursday, April 22, 2021 Speaker: The Honourable Anthony Rota CONTENTS (Table of Contents appears at back of this issue.) 5997 HOUSE OF COMMONS Thursday, April 22, 2021 The House met at 10 a.m. government's position on it, diplomatic representations it has made with respect to that issue, as well as the government's intention with respect to raising the genocide investigation specifically. Prayer The response that was tabled to that question makes no mention of any genocide investigation. In fact, it does not address the ques‐ tion at all. It refers broadly to Sri Lanka, but it makes no mention of ROUTINE PROCEEDINGS the substance of the question. I know that it is practice for the Speaker not to be asked to evalu‐ ● (1005) ate the particulars of the quality of the response. However, in this [English] case, given that the alleged response does not in any way acknowl‐ COMMISSIONER OF THE ENVIRONMENT AND edge or respond to the question, I would submit that this makes a SUSTAINABLE DEVELOPMENT total mockery of the expectation in the Standing Orders for the gov‐ The Speaker: It is my duty to lay upon the table, pursuant to ernment to table a response. subsection 23(5) of the Auditor General Act, the spring 2021 re‐ There have to be some constraints on the response the govern‐ ports of the Commissioner of the Environment and Sustainable De‐ ment presents. After all, if the government were to present a re‐ velopment to the House of Commons. -

Debates of the House of Commons

43rd PARLIAMENT, 2nd SESSION House of Commons Debates Official Report (Hansard) Volume 150 No. 092 Friday, April 30, 2021 Speaker: The Honourable Anthony Rota CONTENTS (Table of Contents appears at back of this issue.) 6457 HOUSE OF COMMONS Friday, April 30, 2021 The House met at 10 a.m. Bibeau Bittle Blaikie Blair Blanchet Blanchette-Joncas Blaney (North Island—Powell River) Blois Boudrias Boulerice Prayer Bratina Brière Brunelle-Duceppe Cannings Carr Casey Chabot Chagger GOVERNMENT ORDERS Champagne Champoux Charbonneau Chen ● (1000) Cormier Dabrusin [English] Damoff Davies DeBellefeuille Desbiens WAYS AND MEANS Desilets Dhaliwal Dhillon Dong MOTION NO. 9 Drouin Dubourg Duclos Duguid Hon. Chrystia Freeland (Minister of Finance, Lib.) moved Duncan (Etobicoke North) Duvall that a ways and means motion to implement certain provisions of Dzerowicz Easter the budget tabled in Parliament on April 19, 2021 and other mea‐ Ehsassi El-Khoury sures be concurred in. Ellis Erskine-Smith Fergus Fillmore The Deputy Speaker: The question is on the motion. Finnigan Fisher Fonseca Fortier If a member of a recognized party present in the House wishes to Fortin Fragiskatos request either a recorded division or that the motion be adopted on Fraser Freeland division, I ask them to rise in their place and indicate it to the Chair. Fry Garneau Garrison Gaudreau The hon. member for Louis-Saint-Laurent. Gazan Gerretsen Gill Gould [Translation] Green Guilbeault Hajdu Hardie Mr. Gérard Deltell: Mr. Speaker, we request a recorded divi‐ Harris Holland sion. Housefather Hughes The Deputy Speaker: Call in the members. Hussen Hutchings Iacono Ien ● (1045) Jaczek Johns Joly Jones [English] Jordan Jowhari (The House divided on the motion, which was agreed to on the Julian Kelloway Khalid Khera following division:) Koutrakis Kusmierczyk (Division No. -

Canada Gazette, Part I

EXTRA Vol. 153, No. 12 ÉDITION SPÉCIALE Vol. 153, no 12 Canada Gazette Gazette du Canada Part I Partie I OTTAWA, THURSDAY, NOVEMBER 14, 2019 OTTAWA, LE JEUDI 14 NOVEMBRE 2019 OFFICE OF THE CHIEF ELECTORAL OFFICER BUREAU DU DIRECTEUR GÉNÉRAL DES ÉLECTIONS CANADA ELECTIONS ACT LOI ÉLECTORALE DU CANADA Return of Members elected at the 43rd general Rapport de député(e)s élu(e)s à la 43e élection election générale Notice is hereby given, pursuant to section 317 of the Can- Avis est par les présentes donné, conformément à l’ar- ada Elections Act, that returns, in the following order, ticle 317 de la Loi électorale du Canada, que les rapports, have been received of the election of Members to serve in dans l’ordre ci-dessous, ont été reçus relativement à l’élec- the House of Commons of Canada for the following elec- tion de député(e)s à la Chambre des communes du Canada toral districts: pour les circonscriptions ci-après mentionnées : Electoral District Member Circonscription Député(e) Avignon–La Mitis–Matane– Avignon–La Mitis–Matane– Matapédia Kristina Michaud Matapédia Kristina Michaud La Prairie Alain Therrien La Prairie Alain Therrien LaSalle–Émard–Verdun David Lametti LaSalle–Émard–Verdun David Lametti Longueuil–Charles-LeMoyne Sherry Romanado Longueuil–Charles-LeMoyne Sherry Romanado Richmond–Arthabaska Alain Rayes Richmond–Arthabaska Alain Rayes Burnaby South Jagmeet Singh Burnaby-Sud Jagmeet Singh Pitt Meadows–Maple Ridge Marc Dalton Pitt Meadows–Maple Ridge Marc Dalton Esquimalt–Saanich–Sooke Randall Garrison Esquimalt–Saanich–Sooke -

St. Catharines City Council Approved the Following Motion

September 01, 2020 Page 1 of 2 August 17, 2020 Ulli S. Watkiss City Clerk City of Toronto 100 Queen St. W. Toronto, ON M5H 2N2 Sent via email: [email protected] Re: Support to the City of Toronto in their Legal Challenge of the Amendments made under Bill 184, Section 83 Our File 35.2.2 Dear Ms. Watkiss, At its meeting held on August 10, 2020, St. Catharines City Council approved the following motion: WHEREAS the COVID-19 pandemic has caused much financial strain to residents of St. Catharines; and WHEREAS many residents without income supports face the reality of evictions under the July 26, 2020 amendment of Provincial Bill 184 Section 83; and WHEREAS Section 83 of Bill 184 states: “Refusal for certain arrears of rent” If a hearing is held in respect of an application under section 69 for an order evicting a tenant based on arrears of rent arising in whole or in part during the period beginning on March 17, 2020 and ending on the prescribed date, in determining whether to exercise its powers under subsection the Board shall consider whether the landlord has attempted to negotiate an agreement with the tenant including terms of payment for the tenant’s arrears; and WHEREAS the City Council of Toronto voted 22-2 in support of a legal challenge of Bill 184 Section 83; THEREFORE BE IT RESOLVED that the City of St. Catharines, City Council show support to the City of Toronto in their legal challenge of the amendments made under Bill 184, Section 83; and September 01, 2020 Page 2 of 2 BE IT FURTHER RESOLVED that this resolution be provided to the Premier's Office; the Honourable Steve Clark, Minister of Municipal Affairs and Housing; and Niagara MPPs and MPs; and BE IT FURTHER RESOLVED that a copy of this resolution be circulated to all Ontario municipalities requesting their support. -

Le 24 Mai 2021 Le Très Honorable Justin Trudeau Premier Ministre Du

3250 Bloor St. West, Suite 200 416-231-5931 1-800-268-3781 Toronto, Ontario F: 416-231-3103 M8X 2Y4 Canada www.united-church.ca Le 24 mai 2021 Le très honorable Justin Trudeau Premier ministre du Canada Bureau du premier ministre 80, rue Wellington Ottawa (Ontario) K1A 0A2 Monsieur le premier ministre, Recevez les salutations de l’Église Unie du Canada. La COVID-19 a sans aucun doute changé le monde. Plus que jamais, nous prenons conscience que nous sommes toutes et tous dans le même bateau, que nous ne sommes pas seuls. Dans un même temps, nous sommes de plus en plus conscients de l’écart entre les riches et les pauvres quant à l’accès aux vaccins. À l’heure où les citoyennes et les citoyens d’un bout à l’autre du pays reçoivent leur première et leur deuxième doses de vaccins contre la COVID-19, je souhaite, en tant que modérateur de l’Église Unie du Canada, attirer votre attention sur un grave problème, celui de la distribution inégale des vaccins à travers le monde. Selon les Nations Unies, les pays nantis ont reçu 87 % des vaccins, alors que les pays à plus faibles revenus en ont reçu que 0,2 %. Cette énorme disparité illustre tristement l’écart croissant quant aux ressources économiques, à la qualité des soins de santé, à l’accès à l’eau potable et aux autres droits précisés dans la Déclaration universelle des droits de l’homme des Nations Unies. Le Canada, comme de nombreux autres pays occidentaux, a acheté une quantité de vaccins qui excède les besoins et prévoit vacciner la majorité de sa population cette année. -

Rapport Annuel 2020 La Fondation Lionel- Groulx

Rapport annuel 2020 La Fondation Lionel- Groulx Table des matières Mot du président 2 Mot de la directrice générale 3 Chapitre 1 Promouvoir la connaissance et l’enseignement de l’histoire nationale 4 Chapitre 2 Défendre la langue française 10 Chapitre 3 Faire rayonner la culture québécoise 12 Chapitre 4 Le financement : pérenniser la mission 14 États financiers résumés 16 Annexes Conseil d’administration 23 Comité consultatif des historiens 23 Compagnie des cinq cents associés 24 Ministres et députés donateurs 25 Partenaires 26 Mot du président L’année 2020 était la troisième de notre plan d’action triennal visant l’atteinte de quatre grands objectifs nécessaires à la réalisation de notre mission : la promotion de la connaissance et de l’enseignement de l’histoire nationale du Québec et du fait français en Amérique ; la promotion de la langue française ; la contribution au rayonnement de la culture québécoise ; ainsi que le financement à long terme de notre fondation. Malgré la pandémie qui a bouleversé la vie de notre organisme comme celle de bien d’autres, nous sommes très fiers d’avoir su nous adapter au contexte sanitaire et d’avoir poursuivi la réalisation de nos activités avec succès. Cette fierté du travail accompli à ce jour est d’autant plus grande que ce dernier est le fruit des efforts d’une petite équipe d’employés et des membres de notre conseil d’administration, que je remercie chaleureusement pour leur généreuse implication. Je suis heureux de présider un conseil aussi engagé envers notre mission, compétent, rigoureux et paritaire. Je salue l’embauche de Myriam D’Arcy, nouvelle directrice générale de la Fondation, entrée en poste en juin dernier. -

AGRI - Biographies - Mai 2020 Comparution Devant Le Comité Permanent De L'agriculture Et De L'agroalimentaire

AGRI - Biographies - Mai 2020 Comparution devant le Comité permanent de l'agriculture et de l'agroalimentaire Citiue picipale e atie d’iigatio Conservateur Peter Kent BQ Christine Normandin NPD Jenny Kwan Coit peaet de l’agicultue et de l’agoalietaie AGRI Conservateurs John Barlow (Vice-Président) Richard Lehoux Lianne Rood Gerald Soroka BQ Yves Perron (Vice- Président) NPD Alistair MacGregor Libérals Pat Finnigan (Président) Lyne Bessette Kody Blois Francis Drouin Neil Ellis Tim Louis Conservateur Hon. Peter Kent Thornhill, AB Ministre du cabinet fantôme pour l'immigration, les réfugiés et la citoyenneté Membre du comité Comité permanent de la citoyenneté et de l'immigration (CIMM) de février 2020 à ce jour Itevetios lies à l’IRCC au Paleet 8 mai 2020 – HUMA - Réponse du gouvernement à la pandémie de COVID-19 Travailleurs étrangers temporaires « L'an dernier, près de 100 000 travailleurs étrangers temporaires sont venus au Canada. Vous nous avez dit que 11 000 sont arrivés le mois dernier et 10 000 ont été approuvés. Nous savons que de nombreux travailleurs n'ont pas pu venir au pays pour diverses raisons. J'aimerais savoir quel est le nombre total de travailleurs étrangers qui pourront venir au Canada pour le reste de la saison jusqu'aux récoltes selon les estimations du ministère. » « Monsieur le ministre, il semble que de nombreux travailleurs étrangers temporaires approuvés se sont vu refuser l'entrée à la frontière en raison d'une reconnaissance inégale ou d'un refus de leur statut par les agents des services frontaliers. Que fait-on pour corriger la situation? » « La province du Nouveau-Brunswick est la seule à avoir imposé la fermeture de ses frontières, si vous voulez, aux travailleurs temporaires étrangers. -

May 12, 2021 the Right Hon. Justin Trudeau, P.C., M.P. Prime Minister

May 12, 2021 The Right Hon. Justin Trudeau, P.C., M.P. Prime Minister of Canada [email protected] The Hon. Marco Mendicino, P.C., M.P. Minister of Immigration, Refugees and Citizenship [email protected] The Hon. Patty Hajdu, P.C., M.P. Minister of Health [email protected] The Hon. Bill Blair, P.C., M.P. Minister of Public Safety [email protected] Dear Prime Minister Trudeau and Ministers Mendicino, Hajdu, and Blair, I’m writing to express Mennonite Central Committee Canada’s concern about the continued lack of travel possibilities for refugees to resettle to Canada. Currently, only those refugees with a permanent residence visa issued before pandemic travel restrictions were introduced in March 2020 are being admitted. There are more than 25 million refugees globally. Resettlement has been a small but important tool to provide a durable solution for some of these refugees and we encourage Canada to continue to play a leadership role in resettlement. As the first organization to sign a Sponsorship Agreement in March 1979, MCC is proud to be a part of that work. Since 1979 we have helped resettle more than 12,500 refugees in many communities across Canada. Last March, when arrivals of refugees were cut to almost none, it was devastating for the many sponsors we work with. In 2020, MCC welcomed 118 refugees through Privately Sponsored Refugee (PSR) and Blended Visa Office Referred (BVOR) programs. That is only 20% of the number we resettled the previous year. We encourage the Canadian government to resume issuing visas for refugees approved for resettlement in Canada. -

Témoignages Du Sous-Comité Des Affaires Émanant Des Députés Du

43e LÉGISLATURE, 2e SESSION Sous-comité des affaires émanant des députés du Comité permanent de la procédure et des affaires de la Chambre TÉMOIGNAGES NUMÉRO 003 Le jeudi 11 mars 2021 Présidente : L’honorable Ginette Petitpas Taylor 1 Sous-comité des affaires émanant des députés du Comité permanent de la procé‐ dure et des affaires de la Chambre Le jeudi 11 mars 2021 ● (1330) Nous pouvons maintenant passer à l'examen des affaires récem‐ [Traduction] ment inscrites à l'ordre de priorité. Nous pouvons passer en revue La présidente (L’hon. Ginette Petitpas Taylor (Moncton—Ri‐ chaque affaire ou, si quelqu'un veut discuter de certaines affaires, verview—Dieppe, Lib.)): Bonjour à tous. nous pouvons les présenter. S'il n'y a pas de questions, nous pour‐ rions peut-être procéder par consentement unanime. La séance est ouverte. Bienvenue à la troisième séance du Sous- comité des affaires émanant des députés. Je vous remercie de vous Je vais demander aux membres du Comité s'il y a des projets de être joints à nous aujourd'hui. loi qui posent des problèmes ou des enjeux dont les membres veulent discuter. Je vais offrir des salutations particulières à M. Charlie Angus, [Français] qui remplace un membre du Comité aujourd'hui. Nous sommes heureux de vous accueillir parmi nous. Mme Christine Normandin (Saint-Jean, BQ): Nous considé‐ rons que tous les projets de loi peuvent faire l'objet d'un vote. Conformément au paragraphe 91.1(1) du Règlement, nous nous réunissons pour examiner les affaires inscrites à l'ordre de priorité La présidente: C'est bien. -

Debates of the House of Commons

43rd PARLIAMENT, 2nd SESSION House of Commons Debates Official Report (Hansard) Volume 150 No. 087 Friday, April 23, 2021 Speaker: The Honourable Anthony Rota CONTENTS (Table of Contents appears at back of this issue.) 6077 HOUSE OF COMMONS Friday, April 23, 2021 The House met at 10 a.m. The hon. parliamentary secretary to the government House lead‐ er. Mr. Kevin Lamoureux (Parliamentary Secretary to the Presi‐ Prayer dent of the Queen’s Privy Council for Canada and Minister of Intergovernmental Affairs and to the Leader of the Govern‐ ment in the House of Commons, Lib.): Madam Speaker, much like we saw the Conservatives do a lot of back-flipping on the price GOVERNMENT ORDERS on pollution, ultimately they understood what Canadians expected. ● (1000) I wonder if the member would acknowledge that the public wants to see this issue move forward. Will the Conservatives do some [English] back-flipping on this issue and ultimately recognize the safety of CRIMINAL CODE Canadians? The House resumed from February 26 consideration of the mo‐ Mrs. Shannon Stubbs: Madam Speaker, I literally just said that tion that Bill C-21, An Act to amend certain Acts and to make cer‐ residents in cities like Toronto and other places, where gangs are tain consequential amendments (firearms), be read the second time shooting up their streets, deserve action from the government to and referred to a committee. keep them safe. However, this is what the Liberals are doing. They The Assistant Deputy Speaker (Mrs. Carol Hughes): The hon. are repealing minimum penalties for unauthorized possession of a member for Lakeland has three minutes left for questions and com‐ prohibited firearm, a prohibited or restricted firearm with ammuni‐ ments.