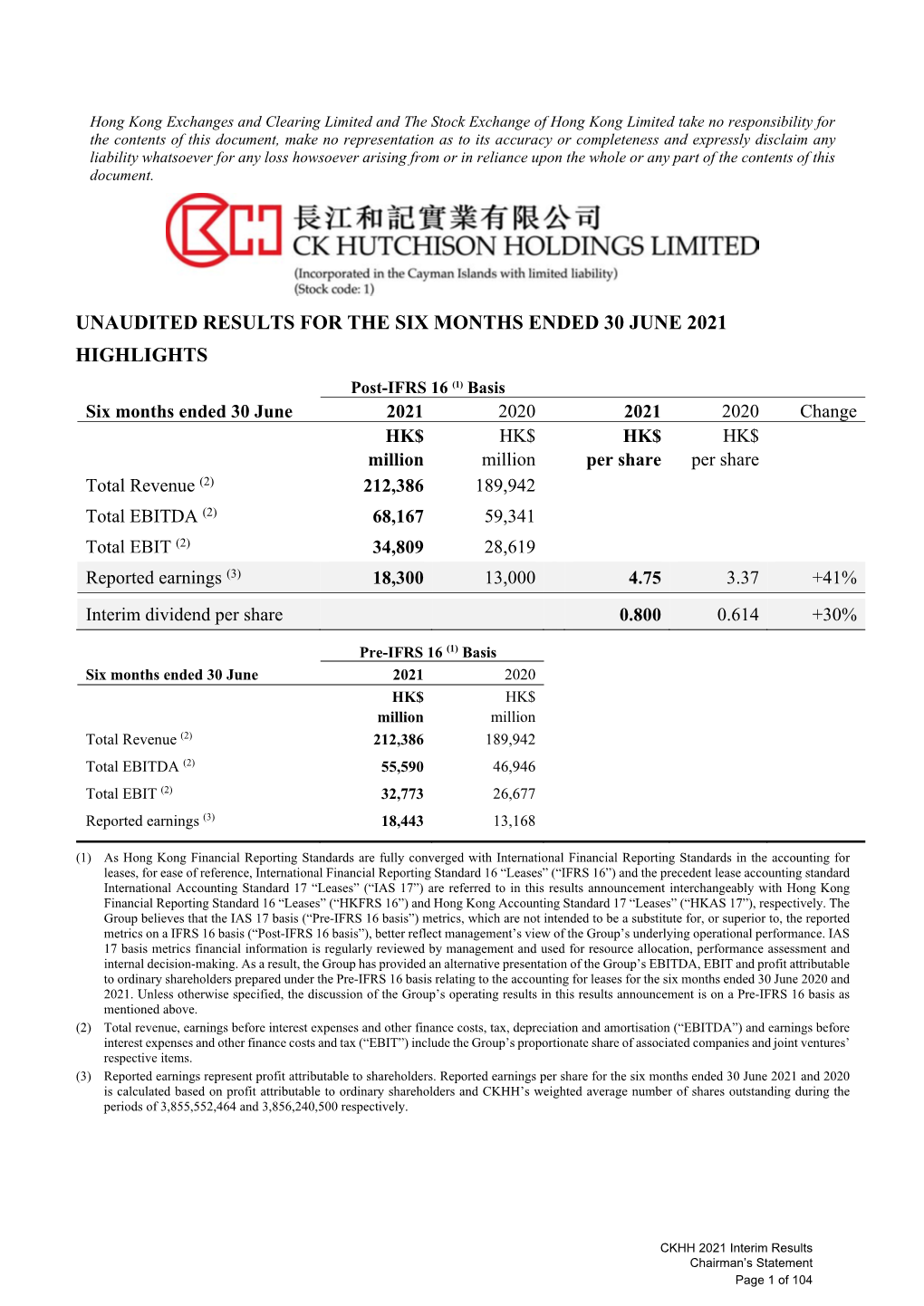

Unaudited Results for the Six Months Ended 30 June 2021 Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case No COMP/M.2951 - A.S

EN Case No COMP/M.2951 - A.S. WATSON / KRUIDVAT Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 27/09/2002 Also available in the CELEX database Document No 302M2951 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 27.09.2002 SG (2002) D/231850 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EEC) No 4064/89 concerning non-disclosure of business secrets and other confidential information. The omissions are MERGER PROCEDURE shown thus […]. Where possible the information ARTICLE 6(1)(b) DECISION omitted has been replaced by ranges of figures or a general description. To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.2951 - A.S. Watson/Kruidvat Notification of 29.08.2002 pursuant to Article 4 of Council Regulation No 4064/891 1. On 29 August 2002, the Commission received a notification of a proposed concentration whereby A.S. Watson & Co., Limited (“A.S. Watson”), which belongs to the Hong Kong based group Hutchison Whampoa Limited (“Hutchison”), intends to acquire within the meaning of Article 3(1)(b) of the Council Regulation (EEC) No 4064/89 (“the Merger Regulation”) control over Dutch companies Kruidvat Holding B.V., and Kruidvat Superdrug B.V. (hereinafter ”Kruidvat”). The companies are presently controlled by Kruidvat Beheer B.V. (”Kruidvat Beheer”). 2. After examination of the notification, the Commission has concluded that the notified operation falls within the scope of the Merger Regulation and does not raise serious doubts as to its compatibility with the common market and the functioning of the EEA Agreement. -

ITU Operational Bulletin

ITU Operational Bulletin www.itu.int/itu-t/bulletin No. 1161 1.XII.2018 (Information received by 21 November 2018) ISSN 1564-5223 (Online) Place des Nations CH-1211 Standardization Bureau (TSB) Radiocommunication Bureau (BR) Genève 20 (Switzerland) Tel: +41 22 730 5211 Tel: +41 22 730 5560 Tel: +41 22 730 5111 Fax: +41 22 730 5853 Fax: +41 22 730 5785 E-mail: [email protected] E-mail: [email protected] / [email protected] E-mail: [email protected] Table of Contents Page GENERAL INFORMATION Lists annexed to the ITU Operational Bulletin: Note from TSB ...................................................................... 3 Approval of ITU-T Recommendations ............................................................................................................ 4 The International Public Telecommunication Numbering Plan (Recommendation ITU-T E.164 (11/2010)): Notes from TSB .................................................................... 5 The International Identification Plan for Public Networks and Subscriptions (Recommendation ITU-T E.212 (09/2016)): Notes from TSB .................................................................... 6 Telephone Service: Gambia (Public Utilities Regulatory Authority (PURA), Serrekunda) ........................................................ 7 Service Restrictions ........................................................................................................................................ 11 Call – Back and alternative calling procedures (Res. 21 Rev. PP – 2006) ...................................................... -

ELENCO TELEFONIA FISSA E MOBILE Con PEC Per Internet

MINISTERO DELLO SVILUPPO ECONOMICO COMUNICAZIONI Direzione Generale per i Servizi di Comunicazione Elettronica, di Radiodiffusione e Postali Viale America, 201 – 00144 ROMA Elenco delle autorizzazioni generali di cui al decreto legislativo 1 agosto 2003 n. 259 per il servizio di installazione e fornitura di reti pubbliche di comunicazione elettronica e per l’espletamento del servizio telefonico accessibile al pubblico (ex licenze individuali d.m. 25 novembre 1997) 03/07/2018 Sig la Num Rete - Im ero Provi Voce - Società Indirizzo Cap Città Regione Tipo di provvedimento Data Partita Iva PEC pie d’ord ncia Mobil gat ine e o 10993 S.r.l. Via Pontaccio, 20121 Milano (MI) Lombardia Autorizzazione generale per servizio 13/06/2008 14 telefonico accessibile al pubblico. G 350 13212040151 [email protected] AREA DI COPERTURA: Regione Lombardia. Voce 12H AG Hardturmstrasse 08005 Zurich Svizz Lombardia Autorizzazione generale per 10/01/2017 , 201 era l'installazione e fornitura di una rete G 588 pubblica di comunicazione [email protected] elettronica. AREA DI COPERTURA: Settimo Milanese. Rete 2 S.r.l. Loc. Ponte alla 52100 Arezzo (AR) Toscana Autorizzazione generale per servizio 05/08/2013 Chiassa, 330 telefonico accessibile al pubblico. AREA DI COPERTURA: Comune di DIGITALMEDIAITALIAS Z 437 01986800512 Arezzo, Monte Savino, Castiglion [email protected] Fiorentino, Cortona, San Giovanni Valdarno, Montevarchi Voce 2BITE S.r.l. Via Saragat, 24 67100 L'Aquila (AQ) Abruzzo Autorizzazione generale per servizio 14/03/2016 di installazione e fornitura di una rete pubblica di comunicazione M 551 01610050666 [email protected] elettronica. AREA DI COPERTURA: Abruzzo, Marche, Lazio, Molise Rete 3P SYSTEM Via Matteotti, 3 30032 Fiesso (VE) Veneto Autorizzazione generale per servizio 17/05/2016 S.r.l. -

Financial Information at September 30, 2020

FINANCIAL INFORMATION AT SEPTEMBER 30, 2020 This document has been translated into English for the convenience of the readers. In the event of discrepancy, the Italian language version prevails. CONTENTS HIGHLIGHTS __________________________________________________________________________________ 3 INTRODUCTION _______________________________________________________________________________ 7 MAIN CHANGES IN THE SCOPE OF CONSOLIDATION OF THE TIM GROUP _____________________________ 8 RESULTS OF THE TIM GROUP FOR THE FIRST NINE MONTHS OF 2020 ________________________________ 9 RESULTS OF THE BUSINESS UNITS _____________________________________________________________ 14 AFTER LEASE INDICATORS _____________________________________________________________________ 18 BUSINESS OUTLOOK FOR THE YEAR 2020 _______________________________________________________ 19 EVENTS SUBSEQUENT TO SEPTEMBER 30, 2020 __________________________________________________ 19 MAIN RISKS AND UNCERTAINTIES ______________________________________________________________ 19 ATTACHMENTS ______________________________________________________________________________ 21 TIM GROUP – FINANCIAL HIGHLIGHTS ___________________________________________________________ 21 TIM GROUP – RECLASSIFIED STATEMENTS _______________________________________________________ 22 SEPARATE CONSOLIDATED INCOME STATEMENTS OF THE TIM GROUP _____________________________ 22 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME OF THE TIM GROUP ____________________ 23 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION -

Wind Tre S.P.A

http://www.oblible.comOFFERING MEMORANDUM Wind Tre S.p.A. 13OCT201721560609 E2,250,000,000 Senior Secured Floating Rate Notes due 2024 E1,625,000,000 25⁄8% Senior Secured Notes due 2023 E1,750,000,000 31⁄8% Senior Secured Notes due 2025 $2,000,000,000 5% Senior Secured Notes due 2026 Wind Tre S.p.A., a joint stock company (societa` per azioni) incorporated and existing under the laws of the Republic of Italy (‘‘Italy’’), having its registered office at Via Leonardo da Vinci, 1, Trezzano sul Naviglio, Milan, Italy (‘‘Wind Tre’’ or the ‘‘Issuer’’), is offering (the ‘‘Offering’’) (i) A2,250 million aggregate principal amount of euro-denominated Senior Secured Floating Rate Notes due 2024 (the ‘‘Floating Rate Notes’’), (ii) A1,625 million aggregate principal amount of euro-denominated 25⁄8% Senior Secured Notes due 2023 (the ‘‘2023 Fixed Rate Euro Notes’’), (iii) A1,750 million aggregate principal amount of euro-denominated 31⁄8% Senior Secured Notes due 2025 (the ‘‘2025 Fixed Rate Euro Notes,’’ and together with the 2023 Fixed Rate Euro Notes, the ‘‘Fixed Rate Euro Notes,’’ and the Fixed Rate Euro Notes together with the Floating Rate Notes, the ‘‘Euro Notes’’), and (iv) $2,000 million aggregate principal amount of U.S. dollar-denominated 5% Senior Secured Notes due 2026 (the ‘‘Dollar Notes,’’ together with the Fixed Rate Euro Notes, the ‘‘Fixed Rate Notes,’’ and the Floating Rate Notes, together with the Fixed Rate Notes, the ‘‘Notes’’). Interest on the Floating Rate Notes will accrue at a rate per annum, reset quarterly, equal to three-month EURIBOR (subject to a 0% floor) plus 275 basis points. -

Watsons Experience Launches in Russia Focus Story

103 Watsons Experience Launches in Russia Focus Story Watsons Experience Launches in Russia Watsons is delighted to have opened its first Russian store in St.Petersberg. The launch of Asia’s No.1 health and beauty brand will deliver an unprecedented range of world-class products to the increasingly sophisticated Russian market. This is a country where people take great care over their appearance, and by introducing the products and advanced skincare regimens of Asia, Watsons taps into what it sees as huge market potential. WatsON 103 • Quarter 2 • 2018 01 Focus Story Russia will be the 12th market to host Watsons stores. In every market where it operates, Watsons sets the highest global standards in the health, wellness and beauty market. Putting customers first is what Watsons is all about. It offers customers real value, good service and expert advice – and St.Petersberg this is what Watsons will present to Russian customers. The launch of the first store in Russia is a significant step in the expansion of the Watsons brand. Watsons “cares deeply about its customers around the globe, addressing their health and beauty needs both instore and online. We are dedicated to making our customers Look Good and Feel Great and putting a smile on their faces. Andrei Melnikov ” General Manager Watsons Russia WatsON 103 • Quarter 2 • 2018 02 Focus Story Emerging Market, Golden Opportunity Russian customers are seeking out both new experiences Beauty trends from Asia and especially from Korea and new products in health and beauty. Russian is a – hugely popular across Asia but underdeveloped in Russia magnet for sophisticated travellers from across Europe, Digital and eCommerce solutions, which are well and it has significant potential for future growth. -

Business Highlights

Business Highlights 3 Hong Kong, 3 Sweden, 3 Denmark and Italy’s Hutchison Ports announces US$730 million Wind Tre launch 5G service in their respective investment in collaboration with Egyptian Navy to markets. develop new container terminal in Abu Qir, Egypt. A.S. Watson Group (“ASW”) has transformed part ASW signs its first-ever franchise agreement with of its Watsons Water plant in Hong Kong into dust- Al-Futtaim and opens its first store in the Middle free clean room for producing own brand face East at the Dubai Mall. masks to cope with the unstable global supply during the COVID-19 pandemic. In Mainland China, Hutchison Ports Yantian achieves new monthly throughput record of over Polynoma LLC, a US subsidiary of CK Life Sciences 1.46 million TEU. engaging in the research of cancer vaccines, is granted Fast Track designation by the US Food and Husky Energy and Cenovus Energy announce to Drug Administration (“US FDA”) for seviprotimut-L combine their businesses and create the third for the adjuvant treatment of post-resection Stage largest Canadian oil and natural gas producer and IIB/IIC melanoma patients to improve recurrence- the second largest Canadian-based refiner and free survival. upgrader. The transaction is completed on 1 January 2021. Vodafone Hutchison Australia and TPG Corporation Limited complete the merger and the new company, TPG Telecom Limited, starts trading on the Australian Security Exchange on 14 July. 3 8 CK Hutchison Holdings Limited CK Hutchison Group Telecom sells its European Hutchison Ports Stockholm’s new container tower assets and businesses to Cellnex for terminal at Norvik Port in Sweden commences €10 billion. -

Carta Intestata Wind Tre S.P.A

Milan, May 29th 2019 ANNOUNCEMENT 1. VOLUNTARY ANNOUNCEMENT OF CK HUTCHISON HOLDINGS LIMITED IN RELATION TO 2019 FIRST QUARTER RESULTS OF WIND TRE S.P.A. 2. BOND ACQUISITION BY CK HUTCHISON HOLDINGS LIMITED Wind Tre S.p.A. (the “Company” and, together with its subsidiaries, the “Group”) has noted that CK Hutchison Holdings Limited, (“CKHH” and, together with its subsidiaries, the “CKHH Group”) of which the Company is an indirect subsidiary, has made a voluntary announcement in relation to the 2019 first quarter results of the Group on its website as follows: Wind Tre S.p.A. con Socio Unico - Direzione e Coordinamento VIP-CKH Luxembourg S.à r.l. Sede Legale: Largo Metropolitana, 5 – 20017 Rho (MI) Italia - Reg. Imp/C.F.: 02517580920 Partita IVA: 13378520152 - RAEE IT08020000002813 – Cap. sociale EURO 474.303.795,00 i.v. Milan, May 29th 2019 The Company has also been informed that since 31 December 2018, CKHH, through a wholly-owned subsidiary, has acquired €118 million in aggregate principal amount of the Company’s €1,625,000,000 2.625% senior secured notes due 2023 (the “Notes Due 2023”), €125 million in aggregate principal amount of the Company’s €2,250,000,000 senior secured floating rate notes due 2024 (the “Notes Due 2024”), €103 million in aggregate principal amount of the Company’s €1,750,000,000 3.125% senior secured notes due 2025 (the “Notes Due 2025”) and US$149 million in aggregate principal amount of the Company’s US$2,000,000,000 5.000% senior secured notes due 2026 (the “Notes Due 2026”), thereby bringing the total acquisition by CKHH Group of bonds issued by the Company to €206 million in aggregate principal amount of the Notes Due 2023, €349 million in aggregate principal of the Notes Due 2024, €277 million in aggregate principal amount of the Notes Due 2025 and US$306 million in aggregate principal amount of the Notes Due 2026. -

Solid Foundation Fosters Long-Term Development

20 1 7 Annual Report Solid Foundation Fosters Long-term Development 22nd Floor, Hutchison House, 10 Harcourt Road, Hong Kong Telephone: +852 2128 1188 2017 Annual Report Facsimile: +852 2128 1705 www.ckh.com.hk WorldReginfo - 7a0610cc-4251-4d12-8195-61d40b71508e Corporate Information CK Hutchison Holdings Limited BOARD OF DIRECTORS EXECUTIVE DIRECTORS NON-EXECUTIVE DIRECTORS Chairman CHOW Kun Chee, Roland, LLM LI Ka-shing, GBM, KBE, LLD (Hon), DSSc (Hon) CHOW WOO Mo Fong, Susan, BSc Commandeur de la Légion d’Honneur Grand Officer of the Order Vasco Nunez de Balboa LEE Yeh Kwong, Charles, GBM, GBS, OBE, JP Commandeur de l’Ordre de Léopold LEUNG Siu Hon, BA (Law) (Hons), LL.D. (Hon) Group Co-Managing Director and George Colin MAGNUS, OBE, BBS, MA Deputy Chairman LI Tzar Kuoi, Victor, BSc, MSc, LLD (Hon) INDEPENDENT NON-EXECUTIVE DIRECTORS Group Co-Managing Director KWOK Tun-li, Stanley, BSc (Arch), AA Dipl, LLD (Hon), ARIBA, MRAIC FOK Kin Ning, Canning, BA, DFM, FCA (ANZ) CHENG Hoi Chuen, Vincent, GBS, OBE, JP Frank John SIXT, MA, LLL The Hon Sir Michael David KADOORIE, GBS, LLD (Hon), DSc (Hon) Group Finance Director and Deputy Managing Director Commandeur de la Légion d’Honneur Commandeur de l’Ordre des Arts et des Lettres IP Tak Chuen, Edmond, BA, MSc Commandeur de l’Ordre de la Couronne Deputy Managing Director Commandeur de l’Ordre de Leopold II (William Elkin MOCATTA, FCA as his alternate) KAM Hing Lam, BSc, MBA Deputy Managing Director LEE Wai Mun, Rose, JP, BBA LAI Kai Ming, Dominic, BSc, MBA William SHURNIAK, S.O.M., M.S.M., LLD -

Carta Intestata Wind Tre S.P.A

Milan, August 1tst 2019 ANNOUNCEMENT 2019 INTERIM RESULTS OF CK HUTCHISON HOLDINGS LIMITED Wind Tre S.p.A. (the “Company” and, together with its subsidiaries, the “Group”) has noted that CK Hutchison Holdings Limited, of which the Company is an indirect wholly owned subsidiary (“CKHH” and, together with its subsidiaries, the “CKHH Group”) has announced on its website the annual results of the CKHH Group for the six months ended 30 June 2019, which include financial information relating to the results of the Group as shown below: CKHH Chairman’s Statement In July 2019, CKHH Group formed a new wholly-owned telecommunication holding company, CK Hutchison Group Telecom Holdings (“CK Hutchison Telecom”), which consolidates CKHH Group’s European operations and HTHKH under one holding entity, providing a diversified telecommunication asset platform across eight geographical locations. The CK Hutchison Telecom Group will refinance all the existing external debt of Wind Tre of approximately €10 billion and be separately rated with an expected investment grade rating from all three credit rating agencies. Correspondingly, the CK Hutchison Telecom Group will also set up a new telecommunication infrastructure company, CK Hutchison Networks Holdings (“CK Hutchison Networks”) which will group the 28,500 tower asset interests into a separately managed wholly-owned subsidiary of CK Hutchison Telecom. The new organization structure and the refinancing transaction will allow CKHH Group to generate significant financing cost savings from 2020 onwards, as well as rationalize its investments in light of the expected need for harmonization of network, IT platform, and infrastructure configurations to meet new transnational business opportunities going forward. -

CK Hutchison Holdings Limited (CKHH) Facts and Figures

CK Hutchison Holdings Limited (CKHH) Facts and Figures. The company. CK Hutchison Holdings Limited (CKHH) is not only one of the largest companies that are listed at the Hong Kong stock exchange, it is also one of the oldest trade companies in Hong Kong – its roots go back to the year 1820. The various business sectors and around 290,000 employees in over 50 countries make the conglomerate one of the world´s leading companies. Business sectors. HWL operates in 5 core businesses: Ports and related services. Hutchison Port Holdings runs all the company‘s ports and related services in 25 countries. Currently, HPH holds a share of 269 berths in 48 ports. Retail. AS Watson is the largest international health and beauty retailer in Asia and Europe and runs more than 13,300 retail stores in 22 countries worldwide, counting more than 130,000 employees. In Hong Kong and on the Chinese mainland, AS Watson is responsible for the production, distribution and bottling of different mineral waters and other drinks. In Europe, the Group operates a number of health & beauty retail brands, chains - Drogas, including Kruidvat, Superdrug, Rossmann, Savers, Trekpleister, Spektr and Watsons. In addition, it also owns two luxury perfumeries and cosmetics retail brands ICI PARIS XL and The Perfume Shop. Infrastructure. The company operates in Hong Kong, the Chinese mainland, Great Britain, the Netherlands, Portugal, Australia, New Zealand and Canada. Its core fields are energy infrastructure, water infrastructure, transportation infrastructure, waste management and aircraft leasing. Energy. HWL holds about 40,2 % of Canadian Husky Energy, an energy-related company listed on the Toronto Stock Exchange. -

Retail and Manufacturing Hutchison Whampoa Limited Annual Report 2004

34 Operations Review Retail and Manufacturing Hutchison Whampoa Limited Annual Report 2004 35 716,000,000 Distilled water production capacity in litres 91,000,000 Total units of toys manufactured 14,000,000 Total retail space in square feet 1 The Philippines 7 Singapore 12 Lithuania 17 Switzerland 2 South Korea 8 Malaysia 13 Poland 18 Luxembourg 3 Taiwan 9 Thailand 14 Hungary 19 The Netherlands 4 Hong Kong 10 Turkey 15 Czech Republic 20 Belgium 5 Macau 11 Latvia 16 Germany 21 United Kingdom 6 Mainland China 36 Operations Review Retail and Manufacturing The retail and manufacturing division A S Watson consists of the A S Watson group, The health and beauty businesses in Europe reported Hutchison Whampoa (China), listed combined sales 24% above and EBIT 8% above last subsidiary Hutchison Harbour Ring and year, mainly due to the better sales performance of Kruidvat and the contributions from Drogas and Dirk listed associate TOM Group. The A S Rossmann which were acquired in 2004. This division Watson group is one of the world's largest continued to expand its presence in Europe by adding and most diversified retailers, operating 216 stores and acquiring 869 stores during the year. To seven retail chains in Europe and three further enhance its presence in Europe, in June, the major retail chains in Asia, currently with Group acquired Drogas, a health and beauty retail more than 4,800 stores worldwide that chain in the Baltic States with a total of 83 retail outlets. provide high quality personal care, health In August, the Group exercised an option obtained in and beauty products; food, wine and the Kruidvat acquisition in 2002, to acquire a 40% stake general merchandise; and consumer in Dirk Rossmann, a health and beauty retail chain with 786 outlets in Germany.