New York City Real Estate Development Report Q1/20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Concept Update | July 24, 2019

HUDSON RIVER PARK GANSEVOORT PENINSULA CONCEPT UPDATE | JULY 24, 2019 GANSEVOORT PENINSULA | HUDSON RIVER PARK, NY 07.24.2019 | FIELD OPERATIONS WHO WE ARE CLIENT stakeholder + HUDSON RIVER + LOCAL GROUPS park TRUST COMMUNITY PROJECT LEAD JAMES CORNER FIELD operations LANDSCAPE ARCHITECTURE, URBAN DESIGN, PROJECT MANAGEMENT, PUBLIC ENGAGEMENT TEAM NARCHITECTS PHILIP HABIB & altieri SEIBOR LANGAN PLUSGROUP SILMAN E-DESIGN ASSOCIATES WEIBER DYNAMICS BUILDING CIVIL ENGINEERING SITE MEP MARINE & BUILDING MEP, SITE BUILDING AND NATURAL ARCHITECTURE TRAFFIC ELECTRICAL GEOTECHNICAL ELECTRICAL SITE STRUCTURAL RESOURCES ENGINEERING ENGINEERING, ENGINEERING TOPOGRAPHIC SURVEY CAS GROUP KS ENGINEERS CRAUL LAND DHARAM northern horton LEES HOLMES/ TMS SCIENTISTS consulting DESIGNS BRODGEN KEOGH ASSOC. Waterfront HYDROLOGY BathyMETRIC SOIL SCIENCE COST ESTIMating irrigation LIGHTING DESIGN CODE & LIFE SAFETY EXPEDITING, & SEDIMENT SURVEY CONSULTING PERMITTING & MODELING Waterfront REVIEW GANSEVOORT PENINSULA | HUDSON RIVER PARK, NY 07.24.2019 | FIELD OPERATIONS WHERE WE ARE ANALYSIS CONCEPT DESIGN SCHEMATIC DESIGN DESIGN DEVELOPMENT 03/06/19 03/26/19 07/24/19 EARLY fall late FALL early WINTER COMMUNITY COMMUNITY presentation COMMUNITY COMMUNITY COMMUNITY BOARD INPUT AND INPUT INPUT INPUT MEETING WORKSHOP 2 DISCUSSION WORKSHOP WORKSHOP WORKSHOP GANSEVOORT PENINSULA | HUDSON RIVER PARK, NY 07.24.2019 | FIELD OPERATIONS What WE’VE HEARD SO FAR GANSEVOORT PENINSULA | HUDSON RIVER PARK, NY 07.24.2019 | FIELD OPERATIONS PART OF A VIBRANT NEIGHBORHOOD 03/06 -

Take Advantage of Dog Park Fun That's Off the Chain(PDF)

TIPS +tails SEPTEMBER 2012 Take Advantage of Dog Park Fun That’s Off the Chain New York City’s many off-leash dog parks provide the perfect venue for a tail-wagging good time The start of fall is probably one of the most beautiful times to be outside in the City with your dog. Now that the dog days are wafting away on cooler breezes, it may be a great time to treat yourself and your pooch to a quality time dedicated to socializing, fun and freedom. Did you know New York City boasts more than 50 off-leash dog parks, each with its own charm and amenities ranging from nature trails to swimming pools? For a good time, keep this list of the top 25 handy and refer to it often. With it, you and your dog will never tire of a walk outside. 1. Carl Schurz Park Dog Run: East End Ave. between 12. Inwood Hill Park Dog Run: Dyckman St and Payson 24. Tompkins Square Park Dog Run: 1st Ave and Ave 84th and 89th St. Stroll along the East River after Ave. It’s a popular City park for both pooches and B between 7th and 10th. Soft mulch and fun times your pup mixes it up in two off-leash dog runs. pet owners, and there’s plenty of room to explore. await at this well-maintained off-leash park. 2. Central Park. Central Park is designated off-leash 13. J. Hood Wright Dog Run: Fort Washington & 25. Washington Square Park Dog Run: Washington for the hours of 9pm until 9am daily. -

A Report by the New York City Chapter of the Right to the City Alliance About the Authors: Rttc-Nyc Member Organizations

PEOPLE WITHOUT HOMES & HOMES WITHOUT PEOPLE: A COUNT OF VACANT CONDOS IN SELECT NYC NEIGHBORHOODS A REPORT BY THE NEW YORK CITY CHAPTER OF THE RIGHT TO THE CITY ALLIANCE ABOUT THE AUTHORS: RTTC-NYC MEMBER ORGANIZATIONS CAAAV ORGANIZING ASIAN COMMUNITIES works to build grassroots GOLES is a neighborhood housing and community power across diverse poor and preservation organization that serves the working-class Asian immigrant and refugee Lower East Side (LES) of Manhattan and is NEW YORK CITY AIDS HOUSING communities in NYC. CAAAV led canvassing dedicated to tenants’ rights, homelessness NETWORK (NYCAHN)/VOCAL is a efforts in the Lower East Side. prevention, economic development and membership organization comprised of community revitalization. GOLES supported and led by low-income people living canvassing efforts in the Lower East Side. with HIV/AIDS. NYCAHN led canvassing efforts in the South Bronx. COMMUNITY VOICES HEARD (CVH) organizes low-income people of color in New York City, Yonkers and the Mid-Hudson Valley, focusing on welfare reform, job creation, and public housing. CVH led JEWS FOR RACIAL AND ECONOMIC PICTURE THE HOMELESS (PTH) canvassing efforts in Harlem. JUSTICE (JFREJ) is a membership-based is an organization founded on the principle organization that engages Jews to pursue that people who are homeless must become and win racial and economic justice in an organized, effective voice for systemic partnership with Jewish and allied people change. PTH led canvassing efforts in the of color, low-income, and immigrant com- South Bronx. munities in New York City. JFREJ supported canvassing efforts in the Lower East Side. FABULOUS INDEPENDENT EDUCATED RADICALS FOR COMMUNITY EMPOWERMENT (FIERCE) is a membership-based organiza- TEACHERS UNITE is the only membership tion building the leadership of lesbian, gay, organization of public school educators bisexual, transgender, and queer (LGBTQ) building power to demand that our union youth of color in NYC. -

Realizing the Benefits of Hudson River Park the Promise of Hudson River Park

ing the Be ealiz nef ts R of Hudson River Park This report was prepared by Regional Plan Association for Friends of Hudson River Park Photo: Hudson River Park Trust 2 | Realizing the Benefits of Hudson River Park The Promise of Hudson River Park By the 1980s, Manhattan’s Hudson River waterfront was largely a troubled landscape of barbed wire and decaying warehouses. Faced with sharp declines in maritime commerce, New Yorkers were given an opportunity to reimagine the city’s post-industrial waterfront. Through the efforts of the West Side Task Force (1986), the West Side Waterfront Panel (1990), the Hudson River Park Conservancy (1992), and a historic agreement between New York City and New York State (1998), New Yorkers committed to establishing a new waterfront park on the Hudson River. Today, at around seventy percent complete, Hudson River Park offers visitors iconic parkland, boat launches, sports facilities, and greenways. The park provides our region with a major public amenity and anchors the growing neighborhoods of Manhattan’s Far West Side. Though the park sustains its operations and maintenance costs through rents, concessions, grants, and donations, the park’s capital funding comes almost entirely from government appropriations – a source of funding that declined considerably following the Great Recession. Building off a previous 2008 study, The Impact of Hudson River Park on Property Values, this report shows that the critical investments made to build and sustain Hudson River Park have already generated significant dividends for New York City and New York State – beyond simply increasing property values – and helped to transform the entire Far West Side of Manhattan. -

Hudson River Park Case Study.Indd

Hudson River Park Jordan Bell David Tomlinson Above: Boardwalk; from Hudson River Park .org Photo Left: people using the park from DPD study Hudson River Park is largest park in manhattan to be built since Central Park was built in mid 19th century. The park consists of a fi ve mile long strip covering 550 acres running up the western side of manhattan from the northern end of Battery Park City at the south end to 59th street at the northern end. The park includes renovation of over a dozen derelict piers, the creation of a bikeway, and a pedestrian promenade. A mix of pubic functions are incorporated into the design such as ball fi elds and large recreational lawns as well as interspersed commercial space. After the west side Highway was closed in 1972 the space has been in need of revitalization and local neighborhoods have been advocating for a new roadway and parks. The park planning process really got underway starting in the early 90’s with plans for a bike and pedestrian path. PAGE # 1 NEW YORK CITY HUDSON RIVER PARK “This is the Central Park of the 21st Century... an innovative design that preserves the ecology of the Hudson and creates a world class venue from which to experience all the New York waterfront has to offer” -Governor Pataki Planning approach Early planning for the project began in early nineties with the formation of the Hudson River Park Conservancy in 1992. Through the 90’s the Conservancy worked to construct new bike and pedestrian connections and started a public planning process that created a concept and fi nancial plan. -

August 5, 2020 Kevin Quinn, AIA Senior

CITY OF NEW YORK MANHATTAN COMMUNITY BOARD FOUR 330 West 42nd Street, 26th floor New York, NY 10036 tel: 212-736-4536 fax: 212-947-9512 www.nyc.gov/mcb4 Lowell D. Kern Chair Jesse R. Bodine District Manager August 5, 2020 Kevin Quinn, AIA Senior Vice President, Design and Construction Hudson River Park Trust 353 West Street Pier 40, 2nd Floor New York, NY 10014 Jonathan Dryfus, AIA/LEED AP CDR Studio Architects, PC 120 Walker Street, Suite 6E New York, NY 10013 Terri-Lee Burger, RLA Abel Bainnson Butz, LLP 80 8th Avenue, Suite 1105 New York, NY 10011 Re: Chelsea Waterside Park Redesign Dear Mr. Quinn, Mr. Dryfus, and Ms. Burger: Thank you for your participation in Manhattan Community Board 4’s (MCB4) Waterfront, Parks and Environment Committee’s Zoom meeting on Thursday, July 7, at which you presented your current thinking regarding the redesign of Chelsea Waterside Park (CWP). The Committee was delighted with the progress you have made in the park’s design. Almost every committee speaker stated their comments with praise for the redesign. Public attendees also praised the project, including members of the Chelsea Waterside Park Association. As a group, the committee thinks the design looks great. At its July 22nd Full Board meeting, the Full Board voted with 47 in favor, 0 opposed, 0 abstaining, and 0 present but not eligible to vote, to approve this letter. With that said, the committee would like to offer the following comments, concerns and suggestions: • The committee particularly liked the overall layout of the design. -

Procurement Report for Hudson River Park Trust Fiscal Year Ending

Procurement Report for Hudson River Park Trust Run Date: 03/10/2015 Fiscal Year Ending: 03/31/2014 Status: CERTIFIED Procurement-Information: Question Response URL (if applicable) 1. Does the Authority have procurement guidelines? Yes http://www.hudsonriverpark.org/about-us/hrpt/park- policies/#procurement 2. Are the procurement guidelines reviewed annually, amended if Yes needed, and approved by the Board? 3. Does the Authority allow for exceptions to the procurement No guidelines? 4. Does the Authority assign credit cards to employees for Yes travel and/or business purchases? 5. Does the Authority require prospective bidders to sign a Yes non-collusion agreement? 6. Does the Authority incorporate a summary of its procurement Yes policies and prohibitions in its solicitation of proposals, bid documents or specifications for procurement contracts?. 7. Did the Authority designate a person or persons to serve as Yes the authorized contact on a specific procurement, in accordance with Section 139-j(2)(a) of the State Finance Law, "The Procurement Lobbying Act"? 8. Did the Authority determine that a vendor had impermissible No contact during a procurement or attempted to influence the procurement during the reporting period, in accordance with Section 139-j(10) of the State Finance Law? If Yes, was a record made of this impermissible contact? 9. Does the Authority have a process to review and investigate No allegations of impermissible contact during a procurement, and to impose sanctions in instances where violations have occurred, in accordance with Section 139-j(9) of the State Finance Law? 10. As required by Section 2880 of the Public Authorities Law, Yes Attachment Included has the Authority prepared a statement on its prompt payment policy? 11. -

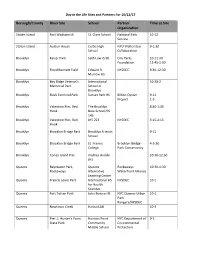

Day Life Site List Press 2017 FINAL Copy

Day in the Life Sites and Partners For 10/12/17 Borough/County River Site School Partner Time at Site Organization Staten Island Fort Wadsworth St. Clare School National Park 10-12 Service Staten Island Austen House Curtis High NYU Wallerstein 9-1:30 School Collaborative Brooklyn Kaiser Park Seth Low IS 96 City Parks 10-11:30 Foundation 11:45-1:30 Brooklyn Floyd Bennett Field Edward R. NYSDEC 9:30-12:30 Murrow HS Brooklyn Bay Ridge Veteran’s International 10:30-2 Memorial Park School of Brooklyn Brooklyn Bush Terminal Park Sunset Park HS Billion Oyster 9-11 Project 1-3 Brooklyn Valentino Pier, Red The Brooklyn 8:30-1:30 Hook New School/PS 146 Brooklyn Valentino Pier, Red JHS 223 NYSDEC 3:15-4:15 Hook Brooklyn Brooklyn Bridge Park Brooklyn Friends 9-11 School Brooklyn Brooklyn Bridge Park St. Francis Brooklyn Bridge 4-5:30 College Park Conservancy Brooklyn Coney Island Pier Andries Hudde 10:30-12:30 JHS Queens Bayswater Park, Queens Rockaways 10:30-1:30 Rockaways Alternative Waterfront Alliance Learning Center Queens Francis Lewis Park International HS NYSDEC 10-1 for Health Sciences Queens Fort Totten Park John Bowne HS NYC Queens Urban 10-1 Park Rangers/NYSDEC Queens Newtown Creek HarborLAB 10-3 Queens Pier 1, Hunter's Point Hunters Point NYC Department of 9-2 State Park Community Environmental Middle School Protection Day in the Life Sites and Partners For 10/12/17 Queens Gantry Plaza State Park PS IS 78Q 9-1:30 Bronx Ferry Point Park West Bronx NYSDEC 12-2 Academy for the Future Bronx Ferry Point Park Renaissance HS NYSDEC 9:30-11:30 -

Dear Ms. Gallent: in Accordance with Your Request, We Have Prepared an Appraisal Report of the Above Captioned 200,000 Square Fe

JAMES L LEVY, MAI, ?.IRICS, ASA APPRAISERS AND PLANNERS INC 9 EAST 40TH STREET NEW YORK, NY 10016 CHRISI1N L PHILLIPS, MAI (212) 683-1122 FAX (212) 213-6120 EOWARDLEWASA(1907-2004) www.appralsersandplanners.com RUTH A. AGNESE. MAI. MRICS 1962-2013) April 29, 2016 Hudson River Park Trust do Judith M. Gallent, Esq. Bryan Cave LLP 1290 Avenue of the Americas New York, New York 10104 Re: 200,000 Square Feet of Air Rights Generated by Hudson River Park Pier 40 Block 656, Lot 1 New York, New York For Use by 550 Washington Street Block 596, Lot 1 New York, New York Dear Ms. Gallent: In accordance with your request, we have prepared an appraisal report of the above captioned 200,000 square feet of air rights, henceforth referred to as the “subject property air rights.” This report has been prepared in accordance with the Uniform Standards of Professional Appraisal Practice and Code of Ethics of the Appraisal Institute. The air rights that are the subject of this report are those air rights generated by Pier 40, legally identified as Block 656 Lot I on the NYC Assessor’s map, and available to be transferred to those eligible properties located along West Street including 550 Washington Street. The client of this report, the Hudson River Park Trust (HRPT), may enter into negotiations to transfer air rights from Pier 40 to 550 Washington Street. Based on our review of the eligible receiving sites under the Hudson River Park Act, as later detailed within this appraisal, only 550 Washington Street would be eligible to receive a transfer of air rights. -

New York City

A One grid square represents B C D approximately a 25-minute walk 1 Major Deegan Expressway Bronx River Parkway North Botanical 1 Jerome Garden W 231 Street Park Lehman Reservoir College Bedford Destinations W 230 Street Waring Avenue Spuyten Park Metro-North Duyvil Bronx (Times Square E 198 Street River Astor Avenue Marble Road Boston Goulden Avenue inset map on reverse) New York Southern Boulevard Greenway Spuyten Marble Hill Kingsbridge New York Pelham Parkway North Duyvil Lydig Avenue Hill Broadway Botanical Garden 9/11 Memorial & Museum B14 Pelham Parkway South White Plains Road Broadway W 225 St 9/11 Tribute Center B14 Bridge Paulding AvenueMorris Metro-North Jerome Avenue Metro-North Poe Bainbridge Avenue Fordham Fordham American LydigMuseum Avenue of ParkB9 Cottage E 194 S University treet Bronx NaturalBronx Park East History W Kingsbridge Road City Henry Park Apollo Theater B6 Hudson Metro-North Sedgwick Avenue 2 Bridge W 218 Street E Fordham Road Southern Boulevard Battery Park B14 2 9 Avenue Bronxdale Avenue Trusted by Fordham Morris Park Avenue 3 Avenue Brookfi eld Place Bronxdale B14Avenue Over 3.5M Henry Hudson Parkway W 215 Street Kingsbridge Belmont Customers Inwood White Plains Road E 188 Street Brooklyn Bridge Rhinelander Avenue C13 Valentine Avenue Heights Webster Avenue Hill Park Arthur Avenue Bronx River Parkway Park Avenue E 187 Street Enrico Fermi Bryant Park B10 Seaman Avenue Cultural Center Inwood E FordhamAqueduct Road 10 Avenue University Walk Carnegie Hall B10 W 207 St Heights Arthur Avenue Bridge Market Bronx Zoo Dyckman Farmhouse University E 183 Street Cathedral Church of A7 Heights St. -

CB2 Report on 550 Washington and Pier 40 ULURP

Tobi Bergman, Chair Antony Wong, Treasurer Terri Cude, First Vice Chair Keen Berger, Secretary Susan Kent, Second Vice Chair Daniel Miller, Assistant Secretary Bob Gormley, District Manager COMMUNITY BOARD NO. 2, MANHATTAN 3 W ASHINGTON SQUARE VILLAGE N EW YORK, NY 10012-1899 www.cb2manhattan.org P: 212-979-2272 F: 212-254-5102 E : [email protected] Greenwich Village v Little Italy v SoHo v NoHo v Hudson Square v Chinatown v Gansevoort Market July 22, 2016 Carl Weisbrod, Chairman City Planning Commission 22 Reade Street New York, NY 10007 Dear Mr. Weisbrod: At its Full Board meeting on July 21, 2016, CB#2, Manhattan (CB2, Man.), adopted the following resolution: 550 Washington Street (Manhattan Block 596, Lot 1) and Pier 40 (Manhattan Block 656, Lot 1) N160309ZMM. 160310ZSM, 160311ZSM, 160312ZSM, 160313ZSM, N160314ZAM, N160315ZAM, N160316ZAM, N160317ZCM This is a ULURP action including two land use applications to the City Planning Commission as follows: (1) a zoning map amendment (a) to rezone a property at 550 Washington Street consisting of a single zoning lot from an Ml-5 and M2-4 district to a C6-4, C6-3, and Ml-5 district, and (b) to map the the property and Pier 40, located at West Houston Street in Hudson River Park, as part of the proposed Special Hudson River Park District, which Special District is proposed to be created by an application for a Zoning Text Amendment (N 160308 ZRM) filed separately by the Department of City Planning; (2) a special permit pursuant to proposed Zoning Resolution Section 89-21 to allow the transfer of floor area from Pier 40 to 550 Washington Street, and to allow certain bulk waivers for the proposed development at 550 Washington Street; (3) three special permits pursuant to Zoning Resolution Section 13-45 and 13-451 for accessory parking garages; (4) three authorizations pursuant to Zoning Resolution Section 13-441 for curb cuts on a wide street; and (5) a Chairperson's certification pursuant to proposed Zoning Resolution Section 89- 21(d). -

Financing Plan Fy20-21

FINANCING PLAN FY20-21 Important Background Information The Hudson River Park Act mandates that the Hudson River Park Trust (the “Trust”) prepare an annual Financing Plan, before either the New York State or New York City budget is adopted for the coming fiscal year. The New York State fiscal year begins on April 1, while the New York City fiscal year begins on July 1. As a result, the Trust’s annual Financing Plan is a projection based on information, including the availability of State and City budget funds, as of January 30. The Trust has been very fortunate to receive large commitments from both the State and City in each of the past two fiscal years. Each identified $50 million for Hudson River Park construction in their FY18-19 budgets, as well as an additional $23 million each in FY19-20. In addition, Governor Cuomo has proposed a bond act for consideration by NYS voters in November 2020 to support oyster restoration and other environmental enhancements, some of which may be used in Hudson River Park. In the following report, the Trust indicates the positive effect the possible Bond Act, if adopted, would have on park construction; however, the Trust cannot at this time assume that these monies will be available. Coupled with private air rights funds and donations that the Trust has received from sources identified below, State and City funds are enabling the Trust to advance planning and construction on all of the public recreational park areas except those intended for Pier 40 and Pier 76. Such funding is also facilitating a critical repair program to the piles and other basic infrastructure at Pier 40.