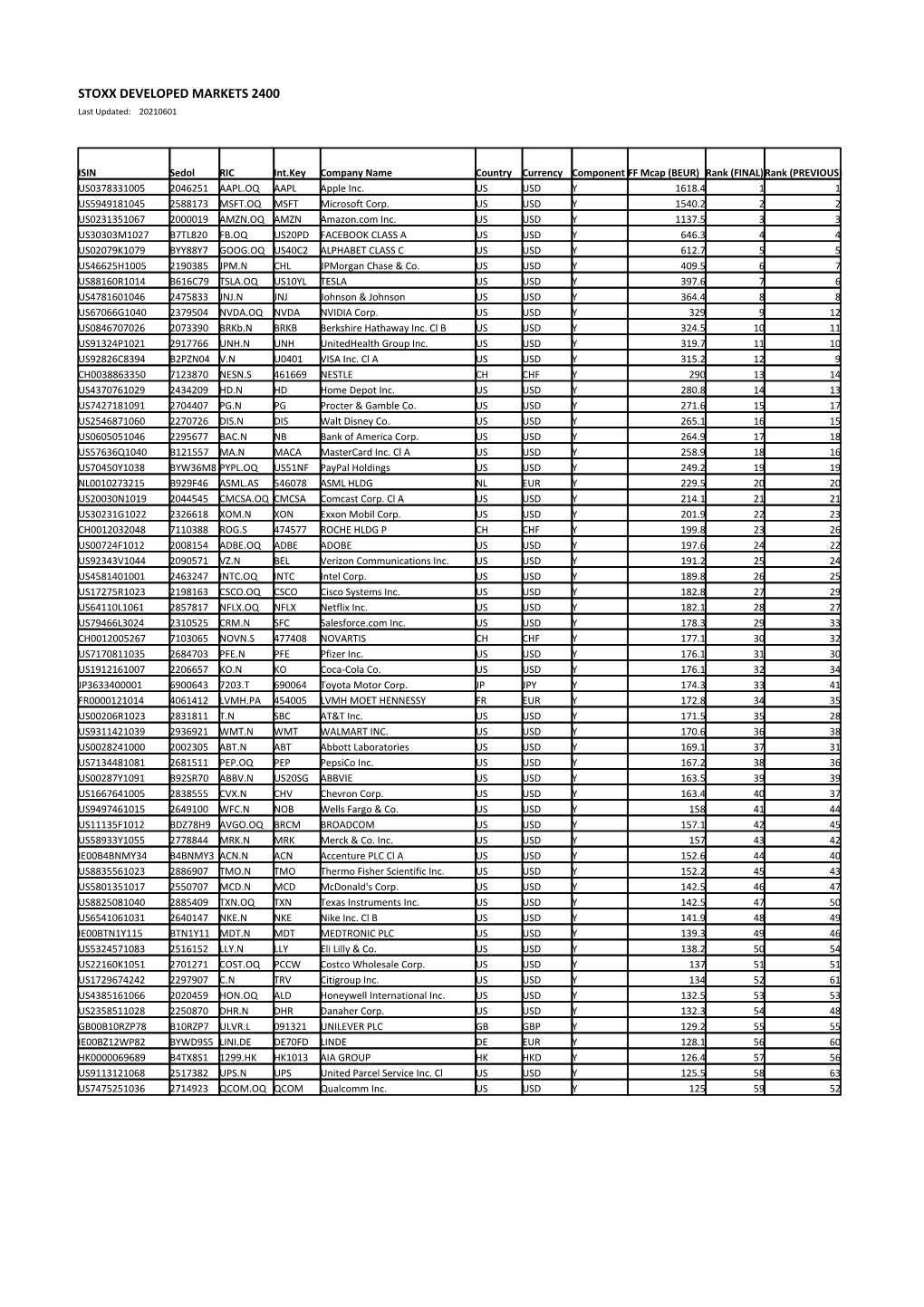

STOXX DEVELOPED MARKETS 2400 Selection List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quarterly Fiscal Holdings

American Century Investments® Quarterly Portfolio Holdings International Opportunities Fund February 28, 2021 International Opportunities - Schedule of Investments FEBRUARY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.8% Australia — 5.0% carsales.com Ltd. 282,310 4,050,225 Kogan.com Ltd. 371,882 3,989,587 NEXTDC Ltd.(1) 828,534 7,124,934 Nickel Mines Ltd. 5,003,216 5,403,048 Redbubble Ltd.(1) 875,103 3,432,522 Seven Group Holdings Ltd.(2) 555,298 9,290,379 Temple & Webster Group Ltd.(1)(2) 394,541 2,813,313 36,104,008 Brazil — 2.4% Locaweb Servicos de Internet SA 1,122,552 5,704,700 Movida Participacoes SA 929,000 2,950,680 Pet Center Comercio e Participacoes SA 1,162,648 4,306,872 Randon SA Implementos e Participacoes, Preference Shares 1,998,200 4,649,464 17,611,716 Canada — 9.4% Alamos Gold, Inc., Class A, (New York) 492,638 3,497,730 BRP, Inc. 97,867 7,071,248 CAE, Inc. 296,094 7,836,277 Descartes Systems Group, Inc. (The)(1) 62,715 3,671,927 Element Fleet Management Corp. 561,739 5,508,803 Finning International, Inc. 221,950 5,792,047 FirstService Corp. 25,638 3,890,022 Innergex Renewable Energy, Inc. 168,931 3,196,494 Kinaxis, Inc.(1) 13,585 1,836,099 Nuvei Corp.(1) 115,727 6,082,611 Parex Resources, Inc.(1) 435,371 6,958,547 Stantec, Inc. 46,123 1,814,693 TFI International, Inc. 146,226 10,213,759 67,370,257 China — 6.3% 21Vianet Group, Inc., ADR(1) 173,844 6,334,875 China Lesso Group Holdings Ltd. -

Registration Document

Translation from Bulgarian language ALLTERCO JSCo REGISTRATION DOCUMENT Part II of the Prospectus for public offering of 3,000,000 (three million) ordinary dematerialized shares from the capital increase of Allterco JSCo, ISIN BG1100003166 This Registration Document is part of the Prospectus for public offering of shares of Allterco JSCo consisting of this document, the Securities Note and the Summary. This Registration document comprises consolidated texts, reflecting the supplements and amendments to it, pursuant to the Supplements thereto. The Registration Document, the Securities Note and the Summary include all Supplements, approved by the Financial Supervision Commission, which represent an integral part of these documents. This Registration Document has been drawn up in accordance with the requirements of Annex No 3 to Delegated Regulation (EU) 2019/980 as part of a simplified prospectus in accordance with article 14 of Regulation (EU) 2017/1129. The Registration Document contains the relevant reduced information which is necessary to enable investors to understand Allterco JSCo’s development prospects and the significant changes in its business and financial position that have occurred since the end of the last financial year, including the main risks associated with the Company and its business. The reduced information regarding the rights attached to the shares offered and the reasons for the issue and its impact on Allterco JSCo is presented in the Securities Note. It is in potential investors’ best interests to become familiar with the Registration Document and the Securities Note in full detail, giving particular attention to the risk factors described in the respective parts of the Prospectus. -

Riverpark Large Growth Fund June 30, 2021 (Unaudited) Description Shares Value (000) Schedule of Investments Common Stock — 98

RiverPark Large Growth Fund June 30, 2021 (Unaudited) Description Shares Value (000) Schedule of Investments Common Stock — 98.4%** Communication Services – 19.5% Alphabet, Cl A * 746 $ 1,822 Alphabet, Cl C * 741 1,857 Facebook, Cl A * 6,736 2,342 Pinterest, Cl A * 39,940 3,153 Snap, Cl A * 42,398 2,889 Twitter * 32,472 2,234 Walt Disney 12,362 2,173 Zillow Group, Cl A * 10,515 1,289 17,759 Consumer Discretionary – 10.0% Amazon.com * 1,080 3,716 Booking Holdings * 886 1,939 Farfetch, Cl A * 24,747 1,246 NIKE, Cl B 14,159 2,187 9,088 Financials – 12.7% Apollo Global Management, Cl A 33,304 2,072 Blackstone Group, Cl A (a) 42,380 4,117 Charles Schwab 36,195 2,635 KKR 46,627 2,762 11,586 Health Care – 17.9% DexCom * 5,490 2,344 Exact Sciences * 15,358 1,909 Illumina * 5,548 2,625 Intuitive Surgical * 2,451 2,254 IQVIA Holdings * 8,899 2,157 UnitedHealth Group 5,088 2,038 Zoetis, Cl A 16,238 3,026 16,353 Industrials – 2.0% Uber Technologies * 35,443 1,776 Information Technology – 33.3% Adobe * 3,232 1,893 Apple 23,111 3,165 Autodesk * 6,917 2,019 Mastercard, Cl A 5,635 2,057 Microsoft 13,808 3,741 PayPal Holdings * 8,063 2,350 RingCentral, Cl A * 6,531 1,898 ServiceNow * 3,444 1,893 Shopify, Cl A * 2,188 3,197 Description Shares Value (000) Snowflake, Cl A * 7,068 $ 1,709 Square, Cl A * 8,344 2,034 Twilio, Cl A * 5,883 2,319 Visa, Cl A 8,727 2,040 30,315 Real Estate – 3.0% American Tower REIT, Cl A 5,351 1,445 Equinix REIT 1,656 1,329 2,774 Total Common Stock (Cost $44,046) (000) 89,651 Total Investments — 98.4% (Cost $44,046) (000) $ 89,651 As of June 30, 2021, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. -

Software Equity Group Flash Report

Software Equity Group Flash Report 2014 Select M&A Transactions and Valuations and Financial and Valuation Performance of 250+ Publicly Traded Software, SaaS and Internet Companies by Product Category November LEADERS IN SOFTWARE M&A • Industry leading boutique investment bank, founded in 1992, representing public and private software and We Do Deals. internet companies seeking: • Strategic exit • Growth capital • Buyout • Inorganic growth via acquisition • Buy and sell-side mentoring • Fairness opinions and valuations • Sell-side client revenue range: $5 - 75 million • Buy-side clients include private equity firms and NASDAQ, NYSE and foreign exchange listed companies • Clients span virtually every software technology, product category, delivery model and vertical market • Global presence providing advice and guidance to more than 2,000 private and public companies throughout US, Canada, Europe, Asia-Pacific, Africa and Israel • Strong cross-functional team leveraging transaction, operating, legal and engineering experience • Unparalleled software industry reputation and track record. • Highly referenceable base of past clients Copyright © 2014 by Software Equity Group, L.L.C., All Rights Reserved EXTENSIVE GLOBAL REACH Current Sell-side Representation • SEG currently represents software companies in the United States, Canada, France, Germany, Australia & Saudi Arabia Recent Sell-side Representation • In addition to the countries listed above, SEG has recently represented software companies in the United Kingdom, France, Netherlands, Israel, and South Africa SEG Research Distribution • SEG’s Quarterly and Annual Software Industry Equity Reports and Monthly Flash Reports are distributed to an opt-in list of 50,000 public software company CEOs, software entrepreneurs, private equity managing directors, VCs, high tech corporate lawyers, public accountants, etc. -

Newsnreleases News, Press Releases, Analysts' Reports

LINK Mobility Group acquires Tismi B.V in the Netherlands for EUR 20 million - Ne... Page 1 of 6 ABOUT US CONTACT US PRIVACY POLICY NewsnReleases News, Press Releases, Analysts' Reports LONDON EXCHANGE EURONEXT NASDAQ NORDIC OSLO BOURSE CANADIAN EXCHANGE AUSTRALIAN EXCHANGE NEWS WIRE LISTED COMPANIES Oslo Bourse LINK Mobility Group acquires Tismi B.V in the Netherlands for EUR 20 million LINK Mobility Group acquires Tismi B.V in the Netherlands for EUR 20 million Press Release February 12, 2021 https://newsnreleases.com/2021/02/12/link-mobility-group-acquires-tismi-b-v-in-the-n... 19-3-2021 LINK Mobility Group acquires Tismi B.V in the Netherlands for EUR 20 million - Ne... Page 2 of 6 OSLO: LINK Mobility Group Holding ASA has entered into a definitive agreement for the acquisition of the Dutch CPaaS enabler Tismi B.V at an enterprise value of EUR 20 million. Tismi was established in 2008 in the Netherlands and is today headquartered in Bunnik, Netherlands. Tismi is a provider of telecommunication services and products and holds licensed operator status in 8 European countries. The company’s main business comprises of providing virtual mobile phone numbers, smart traffic routing and signaling services to Enterprise customers and CPaaS providers. “I’m very happy to announce the acquisition of Tismi, a company which will enable LINK to further expand our CPaaS offering, providing more high valued services to our global customer portfolio of more than 40,000 customers”, says Guillaume Van Gaver, CEO of LINK. “Our acquisition by LINK is a significant step into a new chapter for Tismi. -

Quarterly Fiscal Holdings

American Century Investments® Quarterly Portfolio Holdings NT International Small-Mid Cap Fund February 28, 2021 NT International Small-Mid Cap - Schedule of Investments FEBRUARY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.4% Australia — 5.9% carsales.com Ltd. 197,901 2,839,233 Mineral Resources Ltd. 33,622 983,490 NEXTDC Ltd.(1) 592,629 5,096,282 Nickel Mines Ltd. 3,790,792 4,093,733 NRW Holdings Ltd. 845,057 1,311,176 OZ Minerals Ltd. 372,965 6,440,122 Redbubble Ltd.(1) 626,448 2,457,192 Seven Group Holdings Ltd.(2) 461,872 7,727,321 30,948,549 Belgium — 0.8% D'ieteren SA 47,529 4,009,420 Canada — 9.7% BRP, Inc. 72,333 5,226,324 CAE, Inc. 212,817 5,632,309 Colliers International Group, Inc. (Toronto)(2) 72,668 7,530,611 Descartes Systems Group, Inc. (The)(1) 44,818 2,624,068 Element Fleet Management Corp. 539,690 5,292,575 FirstService Corp. 17,712 2,687,420 Innergex Renewable Energy, Inc. 131,864 2,495,116 Jamieson Wellness, Inc. 57,384 1,560,181 Nuvei Corp.(1) 83,001 4,362,533 Parex Resources, Inc.(1) 310,404 4,961,195 TFI International, Inc. 117,504 8,207,552 50,579,884 China — 0.9% Minth Group Ltd. 1,132,000 4,966,137 Denmark — 2.5% ALK-Abello A/S(1) 14,579 6,132,655 Netcompany Group A/S(1) 5,794 517,466 Pandora A/S 31,437 3,048,023 Royal Unibrew A/S 30,918 3,182,152 12,880,296 Finland — 2.8% Huhtamaki Oyj 56,824 2,555,551 Metso Outotec Oyj 745,927 8,374,240 Musti Group Oyj(1) 122,200 3,938,826 14,868,617 France — 3.0% APERAM SA 117,132 4,902,388 Elis SA(1) 236,096 4,083,108 SOITEC(1) 31,439 6,623,706 15,609,202 Germany — 4.9% Dermapharm Holding SE 60,537 4,285,737 flatexDEGIRO AG(1) 59,710 6,280,375 Hypoport SE(1) 4,400 3,088,479 LPKF Laser & Electronics AG 95,125 2,974,651 ProSiebenSat.1 Media SE(1) 308,262 6,310,982 TeamViewer AG(1) 49,535 2,658,324 25,598,548 Hong Kong — 0.9% Man Wah Holdings Ltd. -

Utskriftsdato 28.8.2021 Link Mobility Group ASA OLD Innsendt Dato: 02.07.2018 08:30 Utstederid: LINKOLD Meldingsid: 454885 Instr

Link Mobility Group ASA_OLD Innsendt dato: 02.07.2018 08:30 UtstederID: LINKOLD MeldingsID: 454885 Instrument: - Marked: XOSL Kategori: INNSIDEINFORMASJON Informasjonspliktig: Ja Lagringspliktig: Ja Vedlegg: Link_Mobility_Group_ASA_Statement_from_the_board_of_ director.pdf, Victory_announcement_incl_Board_statement.pdf Tittel: Recommended voluntary cash offer to acquire all shares in LINK Mobility Group ASA by Victory Partners VIII Norway AS Recommended voluntary cash offer to acquire all shares in LINK Mobility Group ASA by Victory Partners VIII Norway AS · Voluntary cash offer at NOK 225.0 per issued and outstanding share ("Shares") in LINK Mobility Group ASA ("LINK Mobility" or the "Company"), valuing the total share capital of LINK Mobility at approximately NOK 3,396 million. · Premium of 27.4% over the closing price of the shares on June 29th, 2018 and 44.5%, 51.7%, and 71.5% over the volume weighted average price ("VWAP") of the Company's Shares for the three, six and twelve month periods prior to this announcement, respectively. · The Board of Directors of LINK Mobility unanimously recommends the voluntary cash offer. · Offer to be made by Victory Partners VIII Norway AS (the "Offeror"), a company which will be indirectly owned by funds managed by ABRY Partners II, LLC ("Abry") and certain members of management and shareholders of the Company (the "Management Investors"). · Combined, including shares held by the Management Investors and pre -acceptances from shareholders, a total of approximately 54% of the issued share capital of LINK Mobility has committed to sell their Shares to the Offeror. The Offeror and Link Mobility today announced that they had entered into a transaction agreement (the "Transaction Agreement"), whereby the Offeror on certain conditions will launch a recommended voluntary cash offer (the "Offer") to acquire the entire issued share capital of LINK Mobility for NOK 225.0 per share (the "Offer Price"). -

Holdings As of June 30, 2021

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 97.27% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 4,781 10,939 11,257 ACCENT GROUP LTD 3,078 2,769 6,447 ADBRI LTD 224,863 495,699 588,197 AFTERPAY LTD 18,765 1,319,481 1,662,401 AGL ENERGY LTD 3,897 48,319 23,926 ALTIUM LTD 11,593 214,343 319,469 ALUMINA LTD 10,311 14,655 12,712 AMP LTD 18,515 29,735 15,687 APA GROUP 2,659 20,218 17,735 APPEN LTD 20,175 310,167 206,065 ARENA REIT 2,151 5,757 5,826 ASX LTD 678 39,359 39,565 ATLAS ARTERIA LTD 5,600 25,917 26,787 AURIZON HOLDINGS LTD 10,404 32,263 29,075 AUSNET SERVICES LTD 9,482 10,386 12,433 AUSTRALIA & NEW ZEALAND BANKIN 22,684 405,150 478,341 AVENTUS GROUP 2,360 4,894 5,580 BANK OF QUEENSLAND LTD 2,738 17,825 18,706 BEACH ENERGY LTD 5,466 6,192 5,108 BEGA CHEESE LTD 1,762 6,992 7,791 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 20,211 BHP GROUP LTD 9,407 243,370 341,584 BHP GROUP PLC 75,164 1,584,327 2,212,544 BLUESCOPE STEEL LTD 2,905 24,121 47,797 BORAL LTD 4,848 16,859 26,679 BRAINCHIP HOLDINGS LTD 5,756 2,588 2,112 BRAMBLES LTD 153,566 1,133,082 1,318,725 BRICKWORKS LTD 375 4,689 7,060 BWP TRUST 2,988 8,177 9,530 CARSALES.COM LTD 466 6,896 6,916 CENTURIA INDUSTRIAL REIT 2,943 6,264 8,191 CENTURIA OFFICE REIT 190,589 261,156 334,222 CHALICE MINING LTD 464 3,129 2,586 CHALLENGER LTD 3,038 15,904 12,335 CHARTER HALL LONG WALE REIT 3,600 12,905 12,793 CHARTER HALL RETAIL REIT 148,478 395,662 422,150 CHARTER HALL SOCIAL INFRASTRUC 2,461 5,340 6,404 CIMIC GROUP LTD 409 6,668 6,072 COCHLEAR LTD 2,492 -

Head of E-Commerce

LINK Mobility Group AS is Europe's leading provider within mobile communications, specializing in mobile messaging services and mobile solutions. The Group offers a wide range of scalable services and solutions across industries and sectors due to a growing demand for digital convergence between businesses and customers, platforms and users. The Group is headquartered in Oslo/Norway and fully owned by private equity company ABRY located in Boston, US. LINK Mobility continues to experience strong organic growth with a high degree of recurring revenue, as customers tend to move more business activities onto the mobile platforms. In 2019, LINK Mobility had a total turnover of 3.1 billion NOK with offices in 18 different countries. Head of E-Commerce @LINK Mobility we live by three core values that drive our business and people: Innovative, Trustworthy and Committed. When working @LINK you appreciate diversity, cross-border collaboration and solving complex challenges in a high growth environment. Our people are knowledgeable, curious and agile team players whom strive to consistently deliver the best mobile messaging solutions for our customers. Position overview As LINK’s Head of E-Commerce, you will be fully responsible for our Self-Sign-Up (SSU) business line, which is one of the three business lines in LINK’s Go-To-Market strategy. This business line will solely focus on pure online acquisition. In addition to this, you will be responsible for the global coordination of the SSU initiatives across LINK’s footprint, including launches in selected markets, sharing of best practice, and reporting of KPIs. This position could be placed in UK, Germany, France, Netherlands, or Sweden. -

2017 Annual Report LINK Mobility Group AS

LINK Mobility Group ASA Annual financial report 2017 Mobilizing Your Business Report from the Board of Directors LINK Mobility Group ASA is the parent company of the Link Mobility Group, and owns 100 per cent of the subsidiaries Link Mobility AS and Vianett AS in Norway, Link Mobility AB in Sweden, Link Mobility SIA in the Baltics, LINK Mobility A/S and LINK Mobile A/S in Denmark, LINK Mobility GmbH, and GfMB Gesellschaft für Mobiles Bezahlen mbH in Germany, LINK Mobility Oy and Labyrintti International Oy in Finland, LINK Mobility Spain S.L.U and Global Messaging Solutions S.L.U in Spain, Voicecom AD in Bulgaria, Comvision Sp.z.o.o in Poland and Netmessage SAS in France. Link Mobility Group (LINK), with its 308 employees, is headquartered in Oslo and have offices in Oslo, Bergen, Stockholm, Malmö, Kolding, Tallinn, Copenhagen, Hamburg, Tampere, Helsinki, Gliwice, Sofia, Madrid and Paris. LINK has more than 15 years of experience in providing mobile messaging services and mobile solutions for companies, public services and organizations. After a year of substantial and profitable growth, LINK has taken the #1 position within mobile messaging and solutions in Europe. This is an excellent foundation for LINK to leverage on market position and operational scale in a large European market with strong potential for far greater penetration levels and usage of LINK´s mobile messaging and solutions services. LINK is now the leading provider of B2C mobile messaging and mobile solutions in the Nordic, Polish, Bulgarian, Spanish and German markets. LINK has become one of Europe’s leading, and fastest growing companies within the industry. -

LINK Mobility Group ASA

LINK Mobility Group ASA Den store selskapskvelden 6.juni 2018 Arild E.Hustad CEO What does Link do? Link makes businesses mobile across all LINK Mobility messaging platforms How? Linking businesses to consumers, – the undisputed, sending 6 billion B2C messages in 2017, reaching +200 million unique mobile users on behalf of more than market leading mobile 16,500 customers Where? Link is in 15 European countries, and the market leader in in the Nordics, messaging and solution Germany, Spain and Poland What next? Execute ambitious M&A and organic growth strategy, attain scaling synergies provider and drive profitability Copyright 2017 LINK Mobility 2 LINK Mobility key figures 2018 outlook 15 revenue countries with 2.7bn (54% growth) … 18 leading positions … 1 EBITDA … acquisitions 1 (14.8% margin) 400m since 2014 … 1 1 … … 1 1 320 >17,000 24% 1 customers average 1 employees organic 1 across 15 growth L8Q countries 1) Pro forma guidance for 2018 revenue and EBITDA, including full year effect of acquisitions. Revenue growth relates to growth versus 2017 pro forma figures. The above outlook for 2018 is calculated on LINK’s best estimate based on information available to LINK, and views and assessment of LINK, as of the date of this report. LINK’s growth assumptions may deviate from the outcome resulting in material or immaterial deviations from the outlook. Further, LINK’s assumption relating to successfully acquire further businesses during 2018 is to a great extent outside the control of LINK. LINK’s ability to successfully acquire new businesses at fair value, or at all, could materially affect the outlook figures correspondingly. -

Development Manager

LINK Mobility Group AS is Europe's leading provider within mobile communications, specializing in mobile messaging services, mobile solutions and mobile data intelligence. The Group offers a wide range of scalable services and solutions across industries and sectors due to a growing demand for digital convergence between businesses and customers, platforms and users. The Group is headquartered in Oslo/Norway and fully-owned by private equity company ABRY located in Boston, US. LINK Mobility continues to experience strong organic growth with a high degree of recurring revenue as customers tend to move more business activities onto the mobile platforms. In 2018, LINK Mobility had a total turnover of 2.6 billion NOK with offices in Norway, Sweden, Denmark, Finland, Estonia, Latvia, Bulgaria, Germany, Spain, Poland, France, Switzerland, Austria, Italy, UK, Romania and Hungary. Development Manager @LINK Mobility we live by three core values that drive our business and people: Innovative, Trustworthy and Committed. When working @LINK you appreciate diversity, cross-border collaboration and solving complex challenges in a high growth environment. Our people are knowledgeable, curious and agile team players whom strive to consistently deliver the best mobile messaging solutions for our customers. Position overview As a Development Manager you will be responsible for the technical resources working on the Common Service Platform (CSP), UX, and BI teams. This position reports to the Director Solutions Development within the corporate (Group) technology team. The position will be based in Oslo and some travel to our offices throughout our footprint is to be expected. Responsibilities: • Overall responsible for efficient technical production and operations of messaging services for LINK Mobility Group’s markets.