Discussion of Statutory, Average, Marginal and Effective Tax Rates

Total Page:16

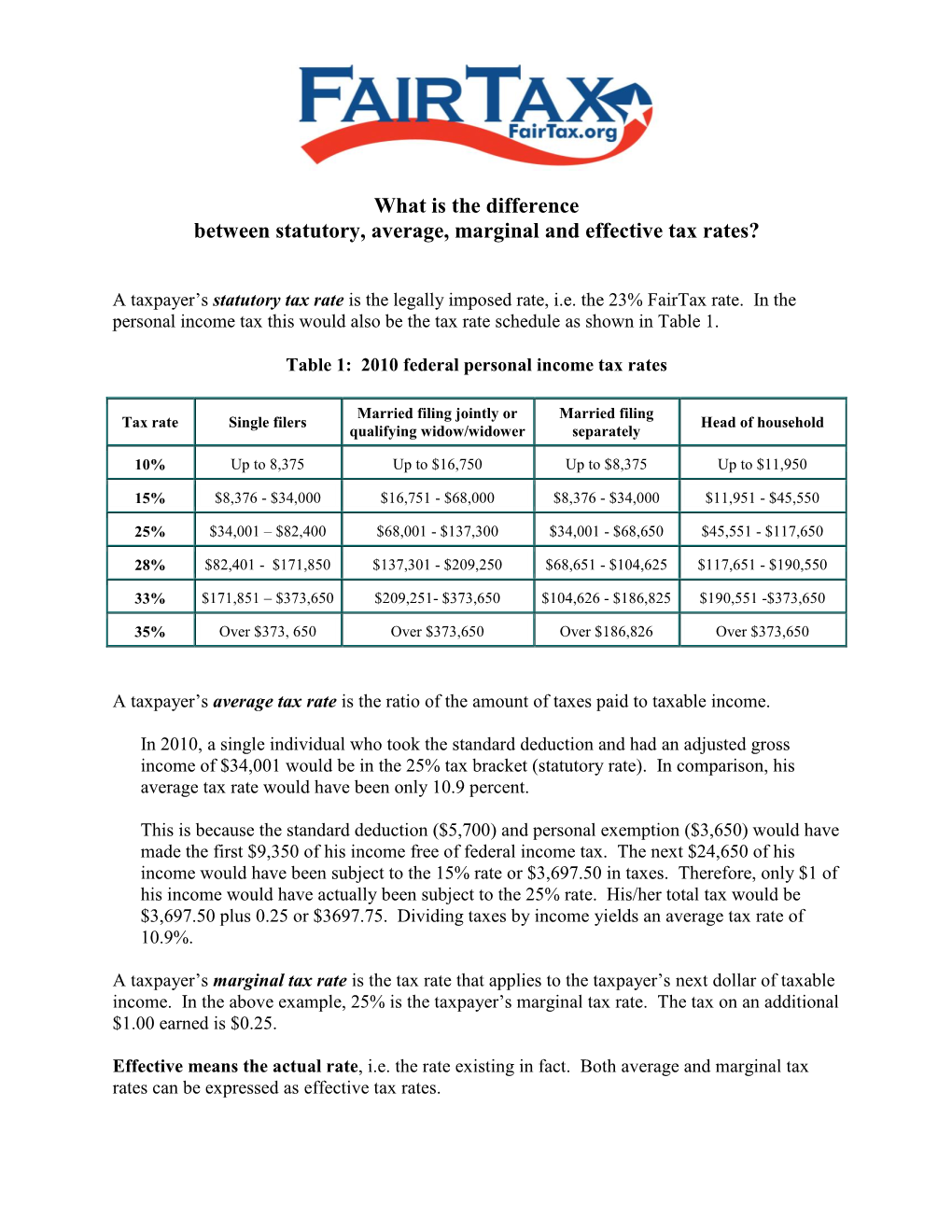

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Standard Deduction and Personal Exemption

The Standard Deduction and Personal Exemption Richard Auxier February 5, 2017 any households reduce their taxable income through the standard deduction and personal This year, Congress will consider what may M exemptions. Both President Donald Trump be the biggest tax bill in decades. This is one and House Republicans have proposed increasing the of a series of briefs the Tax Policy Center has standard deduction and eliminating personal exemptions. prepared to help people follow the debate. Each These changes would simplify tax filing but may benefit focuses on a key tax policy issue that Congress some households and hurt others. and the Trump administration may address. CURRENT STANDARD DEDUCTION AND PERSONAL EXEMPTION AMOUNTS When filing federal income taxes, a taxpayer may claim This is because the largest itemized deductions are for the standard deduction or itemize deductible expenses state and local taxes–which benefits higher earners–and from a list that includes state and local taxes paid, mortgage interest, which only benefits homeowners. mortgage interest, and charitable contributions. Both options lower the tax filer’s taxable income (and thus tax). The standard deduction amount varies by filing type, with married couples filing jointly and heads of households Most Americans (70 percent) use the standard deduction (single filers with dependents) receiving larger benefits because it is larger than the value of the deductions they than single filers (table 1). Filers who are ages 65 and can itemize. In particular, taxpayers with income below older or blind also receive an additional standard $100,000 typically use the standard deduction (figure 1). deduction ($1,250 in 2016). -

Itep Guide to Fair State and Local Taxes: About Iii

THE GUIDE TO Fair State and Local Taxes 2011 Institute on Taxation and Economic Policy 1616 P Street, NW, Suite 201, Washington, DC 20036 | 202-299-1066 | www.itepnet.org | [email protected] THE ITEP GUIDE TO FAIR STATE AND LOCAL TAXES: ABOUT III About the Guide The ITEP Guide to Fair State and Local Taxes is designed to provide a basic overview of the most important issues in state and local tax policy, in simple and straightforward language. The Guide is also available to read or download on ITEP’s website at www.itepnet.org. The web version of the Guide includes a series of appendices for each chapter with regularly updated state-by-state data on selected state and local tax policies. Additionally, ITEP has published a series of policy briefs that provide supplementary information to the topics discussed in the Guide. These briefs are also available on ITEP’s website. The Guide is the result of the diligent work of many ITEP staffers. Those primarily responsible for the guide are Carl Davis, Kelly Davis, Matthew Gardner, Jeff McLynch, and Meg Wiehe. The Guide also benefitted from the valuable feedback of researchers and advocates around the nation. Special thanks to Michael Mazerov at the Center on Budget and Policy Priorities. About ITEP Founded in 1980, the Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan research organization, based in Washington, DC, that focuses on federal and state tax policy. ITEP’s mission is to inform policymakers and the public of the effects of current and proposed tax policies on tax fairness, government budgets, and sound economic policy. -

ACTEC 2018 Pocket Tax Tables

Pocket Tax Tables Revised through March 1, 2018 SELECTIVE TAX RETURN DUE DATES September 17, 2018 Third estimated installment. October 1, 2018 2017 1041s with 5½ month extension. October 15, 2018 2017 1040s with 6 month extension. January 15, 2019 Fourth estimated installment. April 15, 2019 1040s, fourth estimated installments, calendar year 1041s. May 15, 2019 Form 990. June 17, 2019 Second estimated installment. September 16, 2019 Third estimated installment. October 1, 2019 2018 1041s with 5½ month extension. October 15, 2019 2018 1040s with 6 month extension. January 15, 2020 Fourth estimated installment. POCKET TAX TABLES Revised through March 1, 2018 Although care was taken to make these Pocket Tax Tables an accurate, handy reference, they should not be relied upon as the final basis for action. Neither the College nor the individual editors and advisors (who have volunteered their time and experience in the preparation of the tables) assume any responsibility for the accuracy of the information contained in the tables. Compiling Editors Susan T. Bart Lawrence P. Katzenstein The American College of Trust and Estate Counsel 901 15th Street, N.W. Suite 525 Washington, D.C. 20005 Phone: (202) 684-8460 • Fax: (202) 684-8459 Email: [email protected] • Web Page: actec.org © 2018 ACTEC®. All Rights Reserved. ACTEC is a registered trademark of The American College of Trust and Estate Counsel. CONTENTS Item Page Income Tax Married Filing a Joint Return (or surviving spouse) 4 Head of Household 5 Single Individual 6 Married Filing a -

Your Federal Tax Burden Under Current Law and the Fairtax by Ross Korves

A FairTaxSM White Paper Your federal tax burden under current law and the FairTax by Ross Korves As farmers and ranchers prepare 2006 federal income tax returns or provide income and expense information to accountants and other tax professionals, a logical question is how would the tax burden change under the FairTax? The FairTax would eliminate all individual and corporate income taxes, all payroll taxes and self-employment taxes for Social Security and Medicare, and the estate tax and replace them with a national retail sales tax on final consumption of goods and services. Payroll and self-employment taxes The starting point in calculating the current tax burden is payroll taxes and self-employment taxes. Most people pay more money in payroll and self-employment taxes than they do in income taxes because there are no standard deductions or personal exemptions that apply to payroll and self-employment taxes. You pay tax on the first dollar earned. While employees see only 7.65 percent taken out of their paychecks, the reality is that the entire 15.3 percent payroll tax is part of the cost of having an employee and is a factor in determining how much an employer can afford to pay in wages. Self-employed taxpayers pay both the employer and employee portions of the payroll tax on their earnings, and the entire 15.3 percent on 92.35 percent of their self-employed income (they do not pay on the 7.65 percent of wages that employees do not receive as income); however, they are allowed to deduct the employer share of payroll taxes against the income tax. -

A Macroeconomic Analysis of the Fairtax Proposal Arduin, Laffer & Moore Econometrics

A MACROECONOMIC ANALYSIS OF THE FAIRTAX PROPOSAL July 2006 www.arduinlaffermoore.com ©2006 Arduin, Laffer & Moore Econometrics. All rights reserved. No portion of this report may be reproduced in any form without prior consent. The information has been compiled from sources we believe to be reliable, but we do not hold ourselves responsible for its correctness. Opinions are presented without guarantee. A Macroeconomic Analysis of the FairTax Proposal Arduin, Laffer & Moore Econometrics A MACROECONOMIC ANALYSIS OF THE FAIRTAX PROPOSAL Incentives drive all economic behavior. Taxes are a negative incentive. People do not work, invest, or engage in entrepreneurial activities in order to pay taxes. They engage in such economic activities in order to earn after-tax income. When the government increases its share of the income earned by its citizens, the incentive to engage in growth-enhancing economic activities falls; alternatively, the disincentive to these activities rises. The higher the tax on the next dollar earned (the marginal tax rate) the larger the disincentive. However, without taxes the government cannot operate. From an economic efficiency perspective, the appropriate goal for tax policy is to establish a tax system that minimizes the tax disincentives on economic activities, given the revenue needs of the government.1 Costs of the Current Tax System Based on this criterion, the current tax code is an abysmal failure. First, the compliance costs are too large. Studies estimate the costs of compliance with the current tax system to be around $200 billion annually.2 And, compliance costs are only one of the current system’s difficulties. More importantly, decisions to invest, save, and consume are all distorted due to the complexity, numerous loopholes, exemptions, and social engineering prevalent throughout our current tax code. -

(Unofficial Compilation) INCOME TAX LAW

INCOME TAX LAW CHAPTER 235 INCOME TAX LAW Part I. General Provisions Section 235-1 Definitions 235-2 Repealed 235-2.1 Repealed 235-2.2 Repealed 235-2.3 Conformance to the federal Internal Revenue Code; general application 235-2.35 Operation of certain Internal Revenue Code provisions not operative under section 235-2.3 235-2.4 Operation of certain Internal Revenue Code provisions; sections 63 to 530 235-2.45 Operation of certain Internal Revenue Code provisions; sections 641 to 7518 235-2.5 Administration, adoption, and interrelationship of Internal Revenue Code and Public Laws with this chapter 235-3 Legislative intent, how Internal Revenue Code shall apply, in general 235-4 Income taxes by the State; residents, nonresidents, corporations, estates, and trusts 235-4.2 Persons lacking physical presence in the State; nexus presumptions 235-4.3 Repealed 235-4.5 Taxation of trusts, beneficiaries; credit 235-5 Allocation of income of persons not taxable upon entire income 235-5.5 Individual housing accounts 235-5.6 Individual development account contribution tax credit 235-6 Foreign manufacturing corporation; warehousing of products 235-7 Other provisions as to gross income, adjusted gross income, and taxable income 235-7.3 Royalties derived from patents, copyrights, or trade secrets excluded from gross income 235-7.5 Certain unearned income of minor children taxed as if parent’s income 235-8 Repealed 235-9 Exemptions; generally 235-9.5 Stock options from qualified high technology businesses excluded from taxation 235-10, 11 Repealed 235-12 -

Section 5 Explanation of Terms

Section 5 Explanation of Terms he Explanation of Terms section is designed to clarify Additional Standard Deduction the statistical content of this report and should not be (line 39a, and included in line 40, Form 1040) T construed as an interpretation of the Internal Revenue See “Standard Deduction.” Code, related regulations, procedures, or policies. Explanation of Terms relates to column or row titles used Additional Taxes in one or more tables in this report. It provides the background (line 44b, Form 1040) or limitations necessary to interpret the related statistical Taxes calculated on Form 4972, Tax on Lump-Sum tables. For each title, the line number of the tax form on which Distributions, were reported here. it is reported appears after the title. Definitions marked with the symbol ∆ have been revised for 2015 to reflect changes in Adjusted Gross Income Less Deficit the law. (line 37, Form 1040) Adjusted gross income (AGI) is defined as total income Additional Child Tax Credit (line 22, Form 1040) minus statutory adjustments (line 36, (line 67, Form 1040) Form 1040). Total income included: See “Child Tax Credit.” • Compensation for services, including wages, salaries, fees, commissions, tips, taxable fringe benefits, and Additional Medicare Tax similar items; (line 62a, Form 1040) Starting in 2013, a 0.9 percent Additional Medicare Tax • Taxable interest received; was applied to Medicare wages, railroad retirement com- • Ordinary dividends and capital gain distributions; pensation, and self-employment income that were more than $200,000 for single, head of household, or qualifying • Taxable refunds of State and local income taxes; widow(er) ($250,000 for married filing jointly, or $125,000 • Alimony and separate maintenance payments; for married filing separately). -

The Viability of the Fair Tax

The Fair Tax 1 Running head: THE FAIR TAX The Viability of The Fair Tax Jonathan Clark A Senior Thesis submitted in partial fulfillment of the requirements for graduation in the Honors Program Liberty University Fall 2008 The Fair Tax 2 Acceptance of Senior Honors Thesis This Senior Honors Thesis is accepted in partial fulfillment of the requirements for graduation from the Honors Program of Liberty University. ______________________________ Gene Sullivan, Ph.D. Thesis Chair ______________________________ Donald Fowler, Th.D. Committee Member ______________________________ JoAnn Gilmore, M.B.A. Committee Member ______________________________ James Nutter, D.A. Honors Director ______________________________ Date The Fair Tax 3 Abstract This thesis begins by investigating the current system of federal taxation in the United States and examining the flaws within the system. It will then deal with a proposal put forth to reform the current tax system, namely the Fair Tax. The Fair Tax will be examined in great depth and all aspects of it will be explained. The objective of this paper is to determine if the Fair Tax is a viable solution for fundamental tax reform in America. Both advantages and disadvantages of the Fair Tax will objectively be pointed out and an educated opinion will be given regarding its feasibility. The Fair Tax 4 The Viability of the Fair Tax In 1986 the United States federal tax code was changed dramatically in hopes of simplifying the previous tax code. Since that time the code has undergone various changes that now leave Americans with over 60,000 pages of tax code, rules, and rulings that even the most adept tax professionals do not understand. -

State Individual Income Tax Rates

STATE INDIVIDUAL INCOME TAXES (Tax rates for tax year 2021 -- as of January 1, 2021) TAX RATE RANGE Number FEDERAL (in percents) of INCOME BRACKETS PERSONAL EXEMPTIONS STANDARD DEDUCTION INCOME TAX Low High Brackets Lowest Highest Single Married Dependents Single Married DEDUCTIBLE ALABAMA 2.0 - 5.0 3 500 (b) - 3,001 (b) 1,500 3,000 500 (e) 2,500 (y) 7,500 (y) Yes ALASKA No State Income Tax ARIZONA (a) 2.59 - 8.0 (aa) 4 27,272 (b) - 163,633 (b) -- -- 100 (c) 12,400 24,800 ARKANSAS (a) 2.0 - 5.9 (f) 3 4,000 - 79,300 29 (c) 58 (c) 29 (c) 2,200 4,400 CALIFORNIA (a) 1.0 12.3 (g) 9 8,932 (b) - 599,012 (b) 124 (c) 248 (c) 383 (c) 4,601 (a) 9,202 (a) COLORADO 4.55 1 -----Flat rate----- -- (d) -- (d) -- (d) 12,550 (d) 25,100 (d) CONNECTICUT 3.0 - 6.99 7 10,000 (b) - 500,000 (b) 15,000 (h) 24,000 (h) 0 -- (h) -- (h) DELAWARE 0.0 - 6.6 7 2,000 - 60,001 110 (c) 220 (c) 110 (c) 3,250 6,500 FLORIDA No State Income Tax GEORGIA 1.0 - 5.75 6 750 (i) - 7,001 (i) 2,700 7,400 3,000 4,600 6,000 HAWAII 1.4 - 11.0 12 2,400 (b) - 200,000 (b) 1,144 2,288 1,144 2,200 4,400 IDAHO (a) 1.125 - 6.925 7 1,568 (b) - 11,760 (b) -- (d) -- (d) -- (d) 12,550 (d) 25,100 (d) ILLINOIS (a) 4.95 1 -----Flat rate----- 2,325 4,650 2,325 -- -- INDIANA 3.23 1 -----Flat rate----- 1,000 2,000 2,500 (j) -- -- IOWA (a) 0.33 - 8.53 9 1,676 - 75,420 40 (c) 80 (c) 40 (c) 2,130 (a) 5,250 (a) Yes KANSAS 3.1 - 5.7 3 15,000 (b) - 30,000(b) 2,250 4,500 2,250 3,000 7,500 KENTUCKY 5.0 1 -----Flat rate----- -----------None----------- 2,690 2,690 LOUISIANA 2.0 - 6.0 3 12,500 (b) - 50,001(b) 4,500 -

Figuring the Amount Exempt from Levy on Wages, Salary, and Other Income - Forms 668-W, 668-W(ACS) and 668-W(ICS)

Department of the Treasury Internal Revenue Service Notice 1439 (May 2018) Figuring the Amount Exempt from Levy on Wages, Salary, and Other Income - Forms 668-W, 668-W(ACS) and 668-W(ICS) On December 22, 2017, as part of the Tax Cut and Jobs Act, Congress added Section 6334(d)(4) to the Internal Revenue Code; exception for determining property exempt from levy when the personal exemption amount is zero. To implement this legislation the instructions below replace the instructions contained on the three versions of levy Form 668-W (revision date 01-2015). If Money Is Due This Taxpayer Give the taxpayer Parts 2, 3, 4 and 5, as soon as you receive this levy. Part of the taxpayer’s wages, salary, or other income is exempt from levy. To claim exemptions, the taxpayer must complete and sign the Statement of Dependents and Filing Status on Parts 3, 4, and 5 and return Parts 3 and 4 to you within 3 work days after you receive this levy. The taxpayer’s instructions for completing the Statement of Dependents and Filing Status are listed below. (Note: The Statement of Exemptions and Filing status is being renamed, Statement of Dependents and Filing Status. An example is provided at the end of these instructions.) There are three steps in figuring the amount exempt from this levy. 1. When you receive the completed Form 668-W Parts 3 and 4 from the taxpayer, use item 1 of the enclosed table (Publication 1494) to figure how much wages, salary, or other income is exempt from this levy. -

Instructions for Form N-11 Rev 2020

2020 N-11 STATE OF HAWAII — DEPARTMENT OF TAXATION Hawaii Resident Income Tax Instructions Caution: Part-Year Residents Must Use Form N-15 MESSAGE FROM THE DIRECTOR E-fi le Form N-11! I. Department of Taxation Welcomes your Feedback E-fi le Form N-11 through Hawaii At the Department of Taxation, we are committed to our mission to administer the tax laws of the State of Hawaii in a consistent, uniform, and fair manner. To help us with this commitment, we Tax Online, the Department’s welcome your feedback to assist our effort to improve our services and make voluntary compliance website. For more information, go to as easy as possible. Please address your written suggestions to the Department of Taxation, P.O. Box 259, Honolulu, HI, 96809-0259, or email them to Tax.Directors.Offi [email protected]. hitax.hawaii.gov II. Electronic Filing and Paying Advances Are Being Made or Each year, thousands of individuals fi le and pay their taxes electronically. You can e-fi le yourself or E-fi le Form N-11 and federal Form through your tax practitioner using commercially available software. For up to date information, visit 1040 using approved tax preparation our website at tax.hawaii.gov. software or authorized tax III. We are Here to Assist You professionals. For more information, Form N-11, Individual Income Tax Return (Resident Form), is due on or before April 20, 2021. For information and guidance in its preparation, we have helpful publications and other instructions on our go to tax.hawaii.gov website at tax.hawaii.gov. -

2019 IT-511 Individual Income Tax Booklet

IT 511 Rev. 07.22.20 Brian Kemp David M. Curry Governor Revenue Commissioner Georgia Department of Revenue 2019 Individual Income Tax 500 and 500EZ Forms and General Instructions WHAT'S INSIDE? ELECTRONIC FILING Charitable Contributions/Donations.....................................23 Filing Requirements..............................................................9 Form 500 Instructions.....................................................11-13 Free Electronic Filing ...........................................................4 General Information...........................................................7-8 Qualified taxpayers can file electronically for Georgia Tax Center..............................................................2 free! Georgia Tax Rate Schedule................................................21 Receive your refund by direct deposit! Low Income Tax Credit Worksheet.....................................20 File fast and securely from your home PC! Mailing Addresses................................................................5 Message from Commissioner Curry.................................1 Other State's Tax Credit Worksheet.................................. 19 ON-LINE PAYMENTS Part-year Resident and Nonresident Instructions.........17-18 Payment Options.................................................................4 The Georgia Department of Revenue accepts Visa, Penalty and Interest.............................................................7 American Express, MasterCard, and Discover credit Requesting an Extension