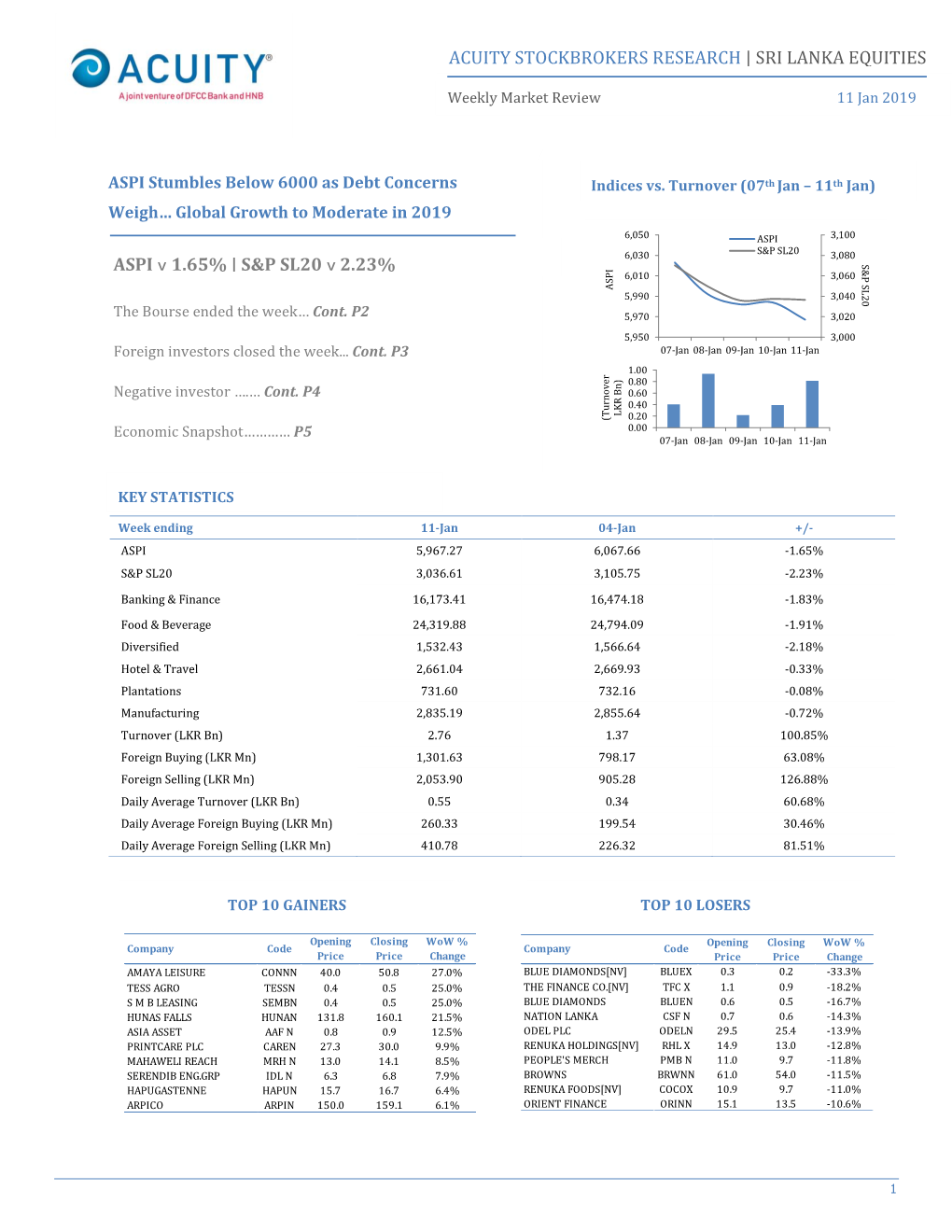

Acuity Stockbrokers Research | Sri Lanka Equities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2012/2013

THE PURSUIT OF EXCELLENCE One hundred years of passion, hard work and perseverance have brought to where we are today: a highly respected, fast growing blue chip conglomerate with interests in several key growth industry sectors: beverages, telecommunications, plantations, hotels, textiles, finance, insurance, power genaration, media and logistics. And yet, we will not rest. Our story is far from over. Indeed, it has only just begun. Look to us for even greater achievements as we step into the next century of our lifetime, to build further upon our current successes. DCSL. 100 years in the passionate pursuit of excellence. Distilleries Company of Sri Lanka PLC | Annual Report 2012/13 1 Financial Highlights 2013 2012 2013 2012 Group Group Company Company Summary of Results Gross Turnover Rs Mn 65,790 63,125 51,549 49,136 Excise Duty Rs Mn 37,024 36,150 34,088 33,860 Net Turnover Rs Mn 28,766 26,975 17,461 15,276 Profit After Tax Rs Mn 5,258 6,052 6,873 4,297 Shareholders Funds Rs Mn 47,978 41,576 39,155 32,597 Working Capital Rs Mn (1,298) (3,234) (6,139) (21,374) Total Assets Rs Mn 78,245 73,355 55,942 62,563 Staff Cost Rs Mn 3,194 3,155 1,039 1,080 No. of Employees 18,674 18,158 1,343 1,389 Per Share Basic Earnings* Rs. 17.13 18.45 10.68 11.85 Net Assets Rs. 159.93 138.59 130.52 108.66 Dividends Rs. 3.00 3.00 3.00 3.00 Market Price - High Rs. -

TEEJAY LANKA PLC - ANNUAL REPORT 2017/18 Scan the QR Code with Your Smart Device to View This Report Online

POISED FOR THE FUTURE TEEJAY LANKA PLC - ANNUAL REPORT 2017/18 Scan the QR Code with your smart device to view this report online. www.teejay.com Teejay Lanka is an aggressively expanding company that has grown to have DVLJQL½FDQWLPSDFWRQWKHORFDOIDEULFPDQXIDFWXULQJLQGXVWU\2YHUWKH \HDUVWKH&RPSDQ\KDVEHFRPHDEHQFKPDUNRITXDOLW\DQGYDOXHZKLOH WKHFKDUDFWHULVWLFVRILQWHJULW\DQGVXVWDLQDELOLW\WKDWOLHDWWKHKHDUWRIRXU VWUDWHJLHVFRQWLQXHWRVHUYHXVZHOOLQWKHIDVWFKDQJLQJEXVLQHVVHQYLURQPHQW ZHZRUNZLWKLQWRGD\ 7KHGLI½FXOWLHVZHIDFHGGXULQJWKHSUHYLRXV\HDUFRQWLQXHWRLPSDFWRXUERWWRP OLQHDVWKH½QDQFLDOUHVXOWVLQWKLVUHSRUWZLOOVKRZ<HW\RXUFRPSDQ\UHPDLQV VWURQJDQGIRFXVHGRQDVWUDWHJ\RIFRQVROLGDWLRQGHVLJQHGWRGHOLYHUVWDELOLW\ DQGJURZWKRYHUWKHORQJWHUP:HDUHDOVRJRLQJDKHDGZLWKRXUH[LVWLQJSODQV IRUH[SDQVLRQZLWKRQJRLQJLQYHVWPHQWVLQWRWHFKQRORJ\WDOHQWDFTXLVLWLRQDQG LQFUHDVLQJFDSDFLW\ 7KLVLVKRZZHSODQWRUHDOL]HRXUYLVLRQWREHWKHUHJLRQµVOHDGLQJPDQXIDFWXUHU IRUZHIWNQLWIDEULFVROXWLRQVDVZHJRVWHDGLO\IRUZDUGSURJUHVVLYHDPELWLRXV DQGSRLVHGIRUWKHIXWXUH Content Our Philosophy and Direction 3 MANAGEMENT DISCUSSION FINANCIAL STATEMENTS Milestones 4 & ANALYSIS 21 Statement of the Directors’ Financial Highlights 6 Overview 22 Responsibility for Financial Reporting 68 Chairman’s Message 8 Financial Capital 28 Independent Auditor’s Report 69 CEO’s Message 10 Manufactured Capital 32 Income Statement 72 Board of Directors 12 Human Capital 33 Statement of Comprehensive Income 73 Executive Committee 15 Intellectual Capital 41 Statement of Financial Position 74 Group Leadership Team 16 Social & Relationship Capital -

Acuity Stockbrokers Research | Sri Lanka Equities

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 22 May 2020 ASPI Gains 361 Points amid Heavy Local Buying Indices vs. Turnover (18th May – 22nd May) Interest… S&P Downgrades Credit Rating to 'B- Stable' 5,000 ASPI 2,300 ASPI ^ 8.13% | S&P SL20 ^ 15.89% S&P SL20 4,900 2,200 S&P SL20 S&P 4,800 2,100 ASPI The Bourse ended the week… Cont. P2 4,700 2,000 4,600 1,900 Foreign investors closed the week... Cont. P3 4,500 1,800 18-Mar19-Mar20-Mar21-Mar22-Mar 2.50 Sri Lankan equities reversed ….… Cont. P4 2.00 1.50 1.00 LKR Bn) LKR (Turnover 0.50 Economic Snapshot………… P5 0.00 18-Mar 19-Mar 20-Mar 21-Mar 22-Mar KEY STATISTICS Week ending 22-May 15-May +/- ASPI 4,799.89 4,439.04 8.13% S&P SL20 2,034.38 1,755.51 15.89% Banks 507.01 435.44 16.44% Capital Goods 613.52 528.92 15.99% Food, Beverage & Tobacco 704.89 667.23 5.64% Consumer Durables & Apparel 649.76 583.51 11.35% Materials 514.33 483.50 6.38% Diversified Financials 711.04 654.33 8.67% Turnover (LKR Bn) 8.05 9.61 -16.24% Foreign Buying (LKR Mn) 593.11 1,588.91 -62.67% Foreign Selling (LKR Mn) 3,996.15 5,098.28 -21.62% Daily Average Turnover (LKR Bn) 1.61 1.92 -16.24% Daily Average Foreign Buying (LKR Mn) 118.62 317.78 -62.67% Daily Average Foreign Selling (LKR Mn) 799.23 1,019.66 -21.62% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change TEA SMALLHOLDER TSMLN 20.0 32.5 62.5% INDUSTRIAL ASPH.* ASPHNN 388.4 0.2 -99.9% BROWNS INVSTMNTS BIL N 2.1 3.2 52.4% BLUE DIAMONDS[NV] BLUEX 0.3 0.2 -

Making Strides

Teejay Lanka PLC - Annual Report 2018/19 - Annual Report PLC Lanka Teejay MAKING STRIDES Teejay Lanka PLC Block D8-D14, Seethawaka Export Processing Zone Avissawella, Sri Lanka www.teejay.com TEEJAY LANKA PLC - ANNUAL REPORT 2018/19 CORPORATE INFORMATION Name Auditors Teejay Lanka PLC PricewaterhouseCoopers, Chartered Accountants Legal Form A public quoted Company with limited Attorneys liability, incorporated on 12 July 2000. F J & G de Saram Attorneys-at-Law Company Registration No. 216, de Saram Place, PV 7617 PB/PQ Colombo 10. Sri Lanka Stock Exchange Listing The issued Ordinary Shares of the Bankers Company was listed on the Main Board Bank of Ceylon of the Colombo Stock Exchange of Commercial Bank of Ceylon PLC Sri Lanka on 9 August 2011. The Hongkong and Shanghai Banking Corporation Limited Registered Office Block D8 – D14, Seethawaka Standard Chartered Bank Export Processing Zone, People’s Bank Avissawella Deutsche Bank AG DFCC Bank PLC Directors Mr. Wing Tak Bill Lam – Chairman Investor Relations Mr. Mohamed Ashroff Omar Shrihan Perera Mr. Hasitha Premaratne Salman Nishtar Mr. Amitha Lal Gooneratne Teejay Lanka PLC Prof. Malik Kumar Ranasinghe Mr. Wai Loi Wan Mr. Kit Vai Tou Secretaries Corporate Services (Private) Limited 216, de Saram Place, Colombo 10. Sri Lanka. Scan the QR Code with your smart device to view this report online Our Annual Report is also available Designed & produced by online. Please visit our website at www.teejay.com to access the Digital Plates & Printing by Printage (Pvt) Ltd report MAKING STRIDES 18 years ago our journey began with the bold ambition to become the region’s preferred fabric solutions provider for branded clothing. -

Browns-Beach-Hotels-PLC-Annual

CONTENTS Notice of Meeting ......................................................................................................................................... 02 Corporate Information ................................................................................................................................ 04 Chairman’s Review ...................................................................................................................................... 05 The Board of Directors................................................................................................................................. 06 Risk Management ........................................................................................................................................ 09 Corporate Governance ................................................................................................................................ 08 Remuneration Committee Report ............................................................................................................. 23 Audit Committee Report ............................................................................................................................ 25 Annual Report of the Board of Directors .................................................................................................. 27 Statement of Directors’ Responsibilities ................................................................................................... 33 Independent Auditors’ Report .................................................................................................................. -

Acuity Stockbrokers Research | Sri Lanka Equities

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 09 Nov 2018 th th Political Uncertainty Dominates Sentiment … Indices vs. Turnover (05 Nov – 09 Nov) Foreign Outflows from Capital Markets Continue 6,300 3,500 ASPI Increases 6,200 S&P SL20 3,400 S&P SL20 S&P ASPI ˅ 1.86% | S&P SL20 ˅ 3.56% 6,100 3,300 ASPI 6,000 3,200 The Bourse ended the week… Cont. P2 5,900 3,100 5,800 3,000 05-Nov 07-Nov 08-Nov 09-Nov Foreign investors closed the week... Cont. P3 5.00 4.00 3.00 Domestic political uncertainty ….… Cont. P4 2.00 LKR Bn) LKR (Turnover 1.00 0.00 Economic Snapshot………… P5 05-Nov 07-Nov 08-Nov 09-Nov KEY STATISTICS Week ending 09-Nov 02-Nov +/- ASPI 5,978.63 6,092.21 -1.86% S&P SL20 3,094.21 3,208.43 -3.56% Banking & Finance 15,807.90 16,242.78 -2.68% Food & Beverage 24,413.03 24,368.96 0.18% Diversified 1,537.10 1,591.90 -3.44% Hotel & Travel 2,644.00 2,677.50 -1.25% Plantations 744.24 749.11 -0.65% Manufacturing 2,874.97 2,963.05 -2.97% Turnover (LKR Bn) 7.80 9.92 -21.33% Foreign Buying (LKR Mn) 1,450.20 2,656.24 -45.40% Foreign Selling (LKR Mn) 5,370.52 6,519.96 -17.63% Daily Average Turnover (LKR Bn) 1.95 1.98 -1.66% Daily Average Foreign Buying (LKR Mn) 362.55 531.25 -31.76% Daily Average Foreign Selling (LKR Mn) 1,342.63 1,303.99 2.96% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change ADAM INVESTMENTS AINVN 0.1 0.2 100.0% EDEN HOTEL LANKA EDENN 14.5 12.1 -16.6% S M B LEASING SEMBN 0.4 0.5 25.0% SOFTLOGIC FIN CRL N 29.9 25.0 -16.4% SOFTLOGIC LIFE AAICN 31.3 34.8 11.2% LANKA ALUMINIUM LALUN 62.3 54.1 -13.2% UDAPUSSELLAWA UDPL 29.6 32.9 11.1% LIGHTHOUSE HOTEL LHL N 33.0 28.8 -12.7% RENUKA CITY HOT. -

Melstacorp Limited Introductory Document

MELSTACORP LIMITED INTRODUCTORY DOCUMENT Listing of 1,165,397,072 Voting Ordinary Shares To be Listed on the Main Board of the Colombo Stock Exchange At a Reference Price of LKR 69.00 Financial Advisors and Managers to the Introduction: CT CLSA Capital (Pvt) Ltd (A CT Holdings Group and CLSA Group Company) # 4-15A, Majestic City, 10, Station Road, Colombo 04. Tel : +94 11 250 3523 : +94 11 258 4843 Fax : +94 11 258 0181 i Registration of the Introductory Document A copy of this Introductory Document has been delivered to the Registrar General of Companies in Sri Lanka for registration. The following documents were also attached to the copy of the Introductory Document delivered to the Registrar General of Companies. 1) The written consent of the Financial Advisors and Managers to the Introduction The Financial Advisors and Managers to the Introduction have given and have not before the delivery of a copy of the Introductory Document for registration withdrawn their written consent for the inclusion of their name as Financial Advisors and Managers to the Introduction and for the inclusion of their statements/declarations in the form in which it is included in the Introductory Document. 2) The written consent of the Auditors and Reporting Accountants to the Company The Auditors and Reporting Accountants to the Company have given and have not before the delivery of a copy of the Introductory Document for registration withdrawn their written consent for the inclusion of their name as Auditors and Reporting Accountants to the Company and for the inclusion of their report/statements in the form and context in which it included in the Introductory Document. -

Sri Lanka Equities Aspi ^ 4.46% | S&P Sl20 ^ 7.04%

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 02 Nov 2018 th nd ASPI Hits 2-Month High Amid Higher Volatility… LKR Indices vs. Turnover (29 Oct – 02 Nov) Falls as Foreign Sell-Off of Assets Increases… 6,300 3,500 ASPI Increases 6,200 S&P SL20 3,400 S&P SL20 S&P ASPI ^ 4.46% | S&P SL20 ^ 7.04% 6,100 3,300 ASPI 6,000 3,200 The Bourse ended the week… Cont. P2 5,900 3,100 5,800 3,000 29-Oct 30-Oct 31-Oct 01-Nov02-Nov Foreign investors closed the week... Cont. P3 5.00 4.00 3.00 Equity market volatility ….… Cont. P4 2.00 LKR Bn) LKR (Turnover 1.00 0.00 Economic Snapshot………… P5 29-Oct 30-Oct 31-Oct 01-Nov 02-Nov KEY STATISTICS Week ending 02-Nov 26-Oct +/- ASPI 6,092.21 5,831.96 4.46% S&P SL20 3,208.43 2,997.33 7.04% Banking & Finance 16,242.78 15,368.05 5.69% Food & Beverage 24,368.96 24,096.79 1.13% Diversified 1,591.90 1,482.33 7.39% Hotel & Travel 2,677.50 2,642.53 1.32% Plantations 749.11 725.44 3.26% Manufacturing 2,963.05 2,742.56 8.04% Turnover (LKR Bn) 9.92 3.15 215.37% Foreign Buying (LKR Mn) 2,656.24 1,959.06 35.59% Foreign Selling (LKR Mn) 6,519.96 2,403.48 171.27% Daily Average Turnover (LKR Bn) 1.98 0.79 152.29% Daily Average Foreign Buying (LKR Mn) 531.25 489.76 8.47% Daily Average Foreign Selling (LKR Mn) 1,303.99 600.87 117.02% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change MTD WALKERS KAPIN 8.0 12.9 61.3% KELSEY KDL N 35.0 29.5 -15.7% BLUE DIAMONDS[NV] BLUEX 0.2 0.3 50.0% UDAPUSSELLAWA UDPL 35.0 29.6 -15.4% AMANA LIFE ATLLN 9.0 12.9 43.3% MERC. -

DFCC Bank PLC Annual Report 2016.Pdf

Going beyond conventional reporting, we have implemented a About this Report more current format for reporting and have upgraded our corporate website with a focus on investor relations, supplemented by an investor relations app for smart phones and other devices. This is an integrated annual report and is a compact Reporting Period disclosure on how our strategy, governance, performance and prospects have resulted in the The DFCC Bank Annual Report for 2016 covers the 12 month period from 01 January 2016 to 31 December 2016 and is reflective of the creation of sustainable value within our operating change in the financial year-end implemented in 2015. The previous environment. annual report covered the nine month period from 01 April 2015 to 31 December 2015 and is available on the company website Value Creation and Capital Formation (www.dfcc.lk). Some of the Group entities have a 31 March financial year-end and they are consolidated with DFCC Bank’s reporting The ability of an organisation to create sustainable value for itself period with a three month time lag. A summary of the accounting depends on the value it creates for its stakeholders, making value periods covered by the Statement of Profit and Loss and Other creation essentially a two-way process. In fact, the more value an Comprehensive Income in the Bank and the Group columns is given organisation creates, the more value it is able to create for itself. in the Financial Report (page 136). Therefore firms spend substantial resources on creating and maintaining relationships with their stakeholders. Value creation leads to capital formation. -

Acuity Stockbrokers Research | Sri Lanka Equities

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 20 Feb 2020 Indices vs. Turnover (17th Feb – 20th Feb) ASPI Closes Flat Amid Market Volatility… Sri Lanka Records a B-o-P Surplus in 2019… 5,900 2,950 ASPI 5,880 S&P SL20 2,910 S&P SL20 S&P ASPI ^ 0.02% | S&P SL20 ^ 0.54% 5,860 2,870 ASPI 5,840 2,830 The Bourse ended the week… Cont. P2 5,820 2,790 5,800 2,750 17-Feb 18-Feb 19-Feb 20-Feb Foreign investors closed the week... Cont. P3 0.75 0.60 0.45 Sri Lankan equities gained ….… Cont. P4 0.30 LKR Bn) LKR (Turnover 0.15 0.00 Economic Snapshot………… P5 17-Feb 18-Feb 19-Feb 20-Feb KEY STATISTICS Week ending 20-Feb 14-Feb +/- ASPI 5,830.51 5,829.21 0.02% S&P SL20 2,788.31 2,773.26 0.54% Banks 664.54 653.93 1.62% Capital Goods 830.26 831.53 -0.15% Food, Beverage & Tobacco 861.41 856.63 0.56% Consumer Durables & Apparel 921.80 969.00 -4.87% Materials 634.67 638.78 -0.64% Diversified Financials 872.01 885.14 -1.48% Turnover (LKR Bn) 1.80 2.21 -18.89% Foreign Buying (LKR Mn) 242.15 499.50 -51.52% Foreign Selling (LKR Mn) 364.62 851.01 -57.15% Daily Average Turnover (LKR Bn) 0.45 0.44 1.39% Daily Average Foreign Buying (LKR Mn) 60.54 99.90 -39.40% Daily Average Foreign Selling (LKR Mn) 91.15 170.20 -46.44% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change TESS AGRO[NON-VOTING] TESSX 0.4 0.5 25.0% S M B LEASING SEMBN 0.5 0.4 -20.0% CITRUS LEISURE REEFN 9.7 11.5 18.6% SINGHE HOSPITALS SERVN 1.7 1.5 -11.8% RADIANT GEMS RGEM 18.0 21.2 17.8% TANGERINE -

John Keells Holdings Plc | Annual Report 2018/19

GOING FORW RD JOHN KEELLS HOLDINGS PLC | ANNUAL REPORT 2018/19 GOING FORW RD For over 149 years, John Keells has built and managed a diverse industry portfolio including several industry sectors strategically selected to represent key growth areas of the economy. We are known as an entrepreneurial company constantly seeking new business opportunities to explore, innovate and make our own. That is how we have maintained an even trajectory of expansion and growth throughout every decade of our long history. Over the past few years, we have been investing in several enterprises that we identified as potentially value enhancing, such as the "Cinnamon Life" project, which will be an iconic landmark transforming the city of Colombo. Today, the Group moves into the next phase as our major investments begin to yield results. Yet the road has not always been an easy one and there were times when we had to dig deep, leveraging on our financial strength, operational expertise, business leadership and corporate resilience to withstand the challenges we have had to face. The Easter Sunday attacks of April 2019 will be long remembered for the tragedy and turmoil we all experienced. Yet, we have every confidence in our nation’s proven resilience and capacity to move ahead and prosper, united as one. Going forward, we will continue to harness the value created by our investment strategies; evolving our standards of governance while ensuring that our digital capabilities and innovative approach will drive your Company’s progress to the next level. JOHN -

Download Annual Report (2020)

Re-Engineering for Tomorrow for Re-Engineering Annual Report 2019/20 ACCESS ENGINEERING PLC Access Towers, Re-Engineering 278, Union Place, Colombo 02, Sri Lanka for Tomorrow +94 11 7606606 +94 11 7606605 Annual Report 2019/20 [email protected] www.accessengsl.com Semi dispatchable wind farm in Mannar Island Re-Engineering for Tomorrow The current climate of unprecedented chaos and upheaval is challenging the business plans and models of virtually every enterprise across the world. It has forced them to relook at how differently “doing business” will look in the future. It has forced them, without exception, to undertake Business Process Re-engineering across all parameters and functions towards evolving successful business management strategies to fit the times. This is true of Access Engineering as well and as one of Sri Lanka’s premier engineering entities, we have got a head start on the process! Contents 03-16 182-282 THIS IS ACCESS FINANCIAL REPORTS ENGINEERING 182 Annual Report of the Board of Directors on the Affairs of 03 About Us the Company 04 About this Report 188 Statement of Directors’ Responsibility 05 Milestones 189 Directors’ Statement on 06 Our Group Structure Internal Control 08 Highlights 190 Independent Auditors’ Report 10 A Message from the Chairman 196 Statement of Profit or Loss and 13 Joint Statement from the Managing Director and the Chief Operating Officer Other Comprehensive Income 197 Statement of Financial Position 198 Statement of Changes in Equity 199 Statement of Cash Flows 18-70 201 Index to the Financial Statements OUR STRATEGY 202 Notes to the Financial Statements 18 Operating Environment 25 Stakeholder Engagement 33 Materiality 284-292 37 Strategic Direction ANNEXES 39 Capital Trade-offs 40 Our Value Creation Model 284 Operating Structure 42 Our Business Portfolio 285 Nine Year Summary 286 Our Story 288 Awards and Accolades 289 Abbreviations 291 Directors of Subsidiary Companies 292 Notice of Meeting Enclosed..