Legislative Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JLBC Staff and Agency Directory Listings

APPROPRIATIONS COMMITTEE MEMBERS Fifty-fourth Legislature Second Regular Session SENATE HOUSE David Gowan, Chairman Regina Cobb, Chairman Vince Leach, Vice-Chairman John Kavanagh, Vice-Chairman Lela Alston Diego Espinoza Sean Bowie Charlene R. Fernandez Heather Carter John Fillmore Sine Kerr Randall Friese David Livingston Anthony Kern Lisa Otondo Aaron O. Lieberman Michelle Ugenti-Rita Bret Roberts Ben Toma Michelle Udall STAFF OF THE JOINT LEGISLATIVE BUDGET COMMITTEE • Director .......................................................................................................................... Richard Stavneak • Office Manager .............................................................................................................. Linda Monsanto • Deputy Directors ........................................................................................................... Stefan Shepherd ....................................................................................................................................... Jack Brown • Chief Economist ............................................................................................................. Hans Olofsson • Senior Consultant .......................................................................................................... Micaela Larkin • Principal Fiscal Analysts ................................................................................................. Patrick Moran ...................................................................................................................................... -

Champions, Friends and Foes

CHAMPIONS, FRIENDS AND FOES Senators Representatives Office Sought Office Sought Office Sought Sylvia Allen in 2018 John Allen in 2018 Travis Grantham in 2018 LD 6 Re-election LD 15 Re-election LD 12 Re-election Republican Republican Republican Nancy Barto Lela Alston Daniel Hernandez State State LD 15 LD 24 LD 2 Re-election House Senate Republican Democrat Democrat Sonny Borrelli Richard Andrade Drew John State LD 5 Re-election LD 29 Re-election LD 14 Senate Republican Democrat Republican Sean Bowie Brenda Barton Anthony Kern LD 18 Re-election LD 6 N/A LD 20 Re-election Democrat Republican Republican David Bradley Wenona Benally Jay Lawrence LD 10 Re-election LD 7 N/A LD 23 Re-election Democrat Democrat Republican Kate Brophy Isela Blanc Vince Leach McGee State Re-election LD 26 Re-election LD 11 LD 28 Senate Democrat Republican Republican Judy Burges Reginald Bolding David Livingston State LD 22 N/A LD 27 Re-election LD 22 Senate Republican Democrat Republican Olivia Cajero Russell Bowers Ray Martinez Bedford State LD 25 Re-election LD 30 N/A LD 3 House Republican Democrat Democrat Paul Boyer Lupe Contreras J.D. Mesnard LD 20 State State LD 19 Re-election LD 17 Republican Senate Senate Democrat Republican Andrea Kelli Butler Darin Mitchell Dalessandro Re-election LD 28 Re-election LD 13 Re-election LD 2 Democrat Republican Democrat Karen Fann Noel Campbell Paul Mosley LD 1 Re-election LD 1 Re-election LD 5 Re-election Republican Republican Republican Steve Farley Mark Cardenas Tony Navarrete State LD 9 Governor LD 19 N/A LD 30 Senate -

2018 Senate Congressional Primary Election Candidates

2018 Senate Congressional Primary Election Candidates Demographics District Office Candidates1 Party (County) Deedra Aboud DEM Kyrsten Sinema* DEM Angela Green# GRN Adam Kokesh# LBT N/A Statewide Senate Joe Arpaio REP Nicholas Glenn# REP William Gonzales# REP Martha McSally* REP Kelli Ward REP Tom O'Halleran* DEM Coconino, Navajo, Apache, Zhani Doko# LBT Graham, Greenlee, Pinal, District 1 U.S. House Wendy Rogers REP Pima, Yavapai, Gila, Maricopa, Mohave Tiffany Shedd REP Steve Smith REP Matt Heinz DEM Billy Kovacs DEM Ann Kirkpatrick^ DEM Maria Matiella DEM Barbara Sherry DEM District 2 Cochise, Pima U.S. House Yahya Yuksel DEM Bruce Wheeler DEM Lea Marquez Peterson REP Brandon Martin REP Daniel Romero Morales REP Casey Welch REP Raul Grijalva* DEM Joshua Garcia# DEM Santa Cruz, Pima, Maricopa, District 3 U.S. House Sergio Arellano REP Yuma, Pinal Nicolas Peirson REP Edna San Miguel REP David Brill DEM Delina Disanto DEM La Paz, Mohave, Yavapai, District 4 U.S. House # DEM Pinal, Yuma, Maricopa, Gila Ana Maria Perez Haryaksha Gregor Knauer GRN Paul Gosar* REP 1 AZ Secretary of State: 2018 Primary Election: https://apps.arizona.vote/electioninfo/elections/2018-primary- election/federal/1347/3/0, * Current Member ^Former Member #Write In 1 2018 Senate Congressional Primary Election Candidates Demographics District Office Candidates1 Party (County) Joan Greene DEM District 5 Maricopa U.S. House Jose Torres DEM Andy Biggs* REP Anita Malik DEM Garrick McFadden DEM District 6 Maricopa U.S. House Heather Ross DEM David Schweikert* REP Ruben Gallego* DEM District 7 Maricopa U.S. House Catherine Miranda DEM Gary Swing# GRN Hiral Tipirneni DEM District 8 Maricopa U.S. -

Achieving a Healthy Future for Our Children, Schools, Health System & States

ACHIEVING A HEALTHY FUTURE FOR OUR CHILDREN, SCHOOLS, HEALTH SYSTEM & STATES Contact: Scott Turner [email protected] 602-513-0028 www.HealthyFutureUS.org slides @03/06/2019 2 • Introduction: to a Healthy Future • Prevention Coalition: Win-Win • Long-Term Emergency • School-based Solutions • Next Steps = Your Choice! 1/3 Children Diabetes as Adults !! 3 3 1/3 Mexican- Americans 1/30 Americans (all) 1960 1970E 1980 1990 2000 2010 2050P Notes: 1 out of 3 children are projected to have diabetes as adults. 23% teens, 35% of adults already have prediabetes, indicating a very high likelihood that they will develop diabetes. Approx. 700,000 w/diabetes in AZ now (ADHS AzHIP, 2017). Much higher-than-average diabetes rates among Mexican-American, Native- American, & lower-income populations; & over 50% of K-12 students are Latino, & >50% of births in AZ are paid for by AHCCCS/Medicaid; this implies a very high & expensive AHCCCS population in the future. $245B = USA diabetes total medical & economic costs 2012; increased 41% in 5 years; $327B in 2017, a 33% increase in 5 years; & almost doubling every decade. Annual medical expenditures per nonelderly (ages 18-64) adult enrollee in Medicaid, 2009: No chronic conditions=$4,342/year; CVD (cardiovascular disease) =$9,414/yr; Diabetes=$13,313/year; after out-of-pocket costs; per Kaiser FF. Total medical costs per Medicaid patient with diabetes (typically, multiple conditions & health issues): $17.5-$27.9K/year (2000-2016) (Chapel et al, 2018). References: Pediatrics, 2012 in USNews, 5/21/2012 (youth prediabetes); Diabetes.org/ADA & Chapel et al, 2018 (adults; USA); (Boyle et al, 2010); CDC, 2014: Long-term Trends in Diabetes; Schneiderman et al, 2014; other estimates & details @healthyfutureUS.org. -

Press Release

Arizona State Senate Sen. Karen Fann, R-1 Senate President-elect 602-926-5874 [email protected] Press Release ____________________________________________________________________ Tuesday, November 27, 2018 FOR IMMEDIATE RELEASE Arizona State Senate Announces Committee Assignments (Phoenix, State Capitol) ----Senate President-elect Karen Fann today announced assignments to Senate committees for the 54th Legislature. The legislative session begins January 14, 2019. ARIZONA STATE SENATE 54th Legislature 2019-2020 Standing Committees MONDAY AFTERNOON Rules 1:00 PM, Majority Caucus Room Karen Fann, Chair Rick Gray, Vice Chair Eddie Farnsworth Sonny Borrelli David Bradley Rebecca Rios Martin Quezada Government 2:00 PM or Adjournment SHR 3 David Farnsworth, Chair Sonny Borrelli, Vice Chair Vince Leach Frank Pratt Victoria Steele Juan Mendez Lela Alston Higher Education & Workforce Development 2:00 PM or Adjournment SHR 1 Heather Carter, Chair JD Mesnard, Vice Chair Kate Brophy McGee Paul Boyer Sally Ann Gonzales Tony Navarette Jamescita Peshlakai TUESDAY AFTERNOON Appropriations 2 PM or Adjournment, SHR 109 David Gowan, Chair Vince Leach, Vice Chair Heather Carter Sine Kerr David Livingston Michelle Ugenti-Rita Lela Alston Sean Bowie Lisa Otondo Education 2 PM or Adjournment, SHR 1 Sylvia Allen, Chair Paul Boyer, Vice Chair Kate Brophy McGee Tyler Pace Rick Gray Andrea Dalessandro Martin Quezada Sally Ann Gonzales WEDNESDAY MORNING Health & Human Services, 9 AM, SHR 1 Kate Brophy McGee, Chair Heather Carter, Vice Chair Tyler Pace Rick Gray Sylvia Allen Rebecca Rios Tony Navarette Victoria Steele Transportation & Public Safety 9 AM, SHR 109 David Livingston, Chair Frank Pratt, Vice Chair Eddie Farnsworth Sine Kerr Sonny Borrelli Jamescita Peshlakai Lisa Otondo Lupe Contreras WEDNESDAY AFTERNOON Finance 2 PM or Adjournment, SHR 1 J.D. -

CITIZENS CLEAN ELECTIONS COMMISSION Statewide & Legislative Candidate Statement Pamphlet

General Election November 3, 2020 CITIZENS CLEAN ELECTIONS COMMISSION Statewide & Legislative Candidate Statement Pamphlet AZCleanElections.gov Paid for by the Citizens Clean Elections Fund 22027-2-CCEC_2020VoterGuide_GE_8-25x10-25_FA.indd 1 7/31/20 4:42 PM Letter from the Citizens Clean Elections Commission Dear Arizona Voter: The Arizona General Election is on November 3, 2020. Your household is receiving this Voter Education Guide because you or another resident is registered to vote. This guide was created by the Arizona Citizens Clean Elections Commission to provide voters with nonpartisan, unbiased information about the General Election, how to participate and ensure your ballot is counted. It includes information from the candidates that are running for statewide and legislative office. In this guide, you will find information on: • How to Register to Vote • Ways to Vote - Ballot By Mail, Early Voting & Election Day • Accepted ID at the Polls • County Contact Information • Candidates for Statewide and Legislative Offices 1 Our experience tells us voters cast a ballot when they understand how the election impacts them directly. We hope this Voter Education Guide helps you to identify your connection to this election and have an informed vote. Important decisions are made on every ballot and your participation in Arizona’s political process strengthens our democracy. Thank you for your participation. Respectfully yours, Galen D. Paton Amy B. Chan Steve M. Titla Damien R. Meyer Mark S. Kimble Arizona Citizens Clean Elections Commission @AZCCEC /AZCleanElections /AZCCEC /azcleanelections 2 Why am I receiving this? Your household is receiving this Voter Education Guide because you or another resident is registered to vote. -

Arizona State Senate Committee Chairs for 2020

Arizona State Senate Committee Chairs for 2020 Committee on Appropriations Sen. David Gowan-Chair Sen. Vince Leach-Vice Chair Committee on Commerce Sen. Michelle Ugenti-Rita-Chair Sen. Tyler Pace-Vice Chair Committee on Education Sen. Sylvia Allen-Chair Sen. Paul Boyer-Vice Chair Committee on Finance Sen. J.D. Mesnard-Chair Sen. David Livingston-Vice Chair Committee on Government Sen. David Farnsworth-Chair Sen. Sonny Borrelli-Vice Chair Committee on Health & Human Services Sen. Kate Brophy McGee-Chair Sen. Heather Carter-Vice Chair Committee on Higher Education and Workforce Development Sen. Heather Carter-Chair Sen. J.D. Mesnard-Vice Chair Committee on Judiciary Sen. Eddie Farnsworth-Chair Sen. Rick Gray-Vice Chair Committee on Natural Resources & Energy Sen. Frank Pratt-Chair Sen. Sine Kerr-Vice Chair Committee on Rules President Fann-Chair Sen. Rick Gray-Vice Chair Committee on Transportation & Public Safety Sen. David Livingston-Chair Sen. Frank Pratt-Vice Chair Committee on Water & Agriculture Sen. Sine Kerr-Chair Sen. Frank Pratt-Vice Chair Arizona State House Committee Chairs for 2020 Appropriations Rep. Regina Cobb-Chair Rep. John Kavanagh-Vice Chair Commerce Rep. Jeff Weninger-Chair Rep. Travis Grantham-Vice Chair County Infrastructure Rep. David Cook-Chair Rep. Bret Roberts-Vice Chair Education Rep. Michelle Udall-Chair Rep. John Fillmore-Vice Chair Elections Rep. Kelly Townsend-Chair Rep. Frank Carroll-Vice Chair Federal Relations Rep. Mark Finchem-Chair Rep. Gail Griffin-Vice Chair Government Rep. John Kavanagh-Chair Rep. Kevin Payne-Vice Chair Health & Human Services Rep. Nancy Barto-Chair Rep. Jay Lawrence-Vice Chair Judiciary Rep. John Allen-Chair Land & Agriculture Rep. -

Pfizer Inc. Regarding Congruency of Political Contributions on Behalf of Tara Health Foundation

SANFORD J. LEWIS, ATTORNEY January 28, 2021 Via electronic mail Office of Chief Counsel Division of Corporation Finance U.S. Securities and Exchange Commission 100 F Street, N.E. Washington, D.C. 20549 Re: Shareholder Proposal to Pfizer Inc. Regarding congruency of political contributions on Behalf of Tara Health Foundation Ladies and Gentlemen: Tara Health Foundation (the “Proponent”) is beneficial owner of common stock of Pfizer Inc. (the “Company”) and has submitted a shareholder proposal (the “Proposal”) to the Company. I have been asked by the Proponent to respond to the supplemental letter dated January 25, 2021 ("Supplemental Letter") sent to the Securities and Exchange Commission by Margaret M. Madden. A copy of this response letter is being emailed concurrently to Margaret M. Madden. The Company continues to assert that the proposal is substantially implemented. In essence, the Company’s original and supplemental letters imply that under the substantial implementation doctrine as the company understands it, shareholders are not entitled to make the request of this proposal for an annual examination of congruency, but that a simple written acknowledgment that Pfizer contributions will sometimes conflict with company values is all on this topic that investors are entitled to request through a shareholder proposal. The Supplemental letter makes much of the claim that the proposal does not seek reporting on “instances of incongruency” but rather on how Pfizer’s political and electioneering expenditures aligned during the preceding year against publicly stated company values and policies.” While the company has provided a blanket disclaimer of why its contributions may sometimes be incongruent, the proposal calls for an annual assessment of congruency. -

Special Arizona Reports: 2020 General Election Results

Special Arizona Reports: 2020 General Election Results November 3, 2020 Arizona once again found itself as a battle groud state both on the national and local stages. President Trump personally visited our great state seven times over the last several months, and although, Vice President Biden only made one trip to AZ, he outspent Trump nearly 2 to 1. Arizona’s heighten visability nationally trickled down to our legislative races, with spending reaching nearly $20 million total. An outrageous spend, which Arizona has never seen before. Arizona has enjoyed early voting since 1992, and althouth there was a national fear over “vote by mail” Arizona saw a record number of ballots cast early, with $2.5 million people returning their ballot before the polls opened today. Arionza, like the entire country, experienced high voter turnout and high voter engagement. This election is said to be the most consequential in a lifetime and although that seems to be said about every election, it certainly seems true by the sheer voter engagement in the process. President Trump and former Vice President Biden have certainly engaged their bases and the fight to the finish seems to be on the independent voter. The sexiness of the national election will have the worlds attention, but we can not forget that most decisions that effect a persons everyday life are local. Heading into the 2020 election season Republicans had control of the Governor’s Office, State Senate and State House. Governor Doug Ducey is serving in his last term as Governor and is not on the ballot, and therefore a Republican will continue to sit at the helm of our state. -

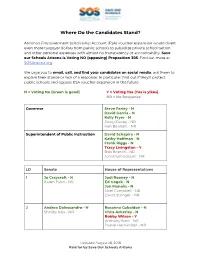

Where Do the Candidates Stand?

Where Do the Candidates Stand? Arizona's Empowerment Scholarship Account (ESA) voucher expansion would divert even more taxpayer dollars from public schools to subsidize private school tuition and other personal expenses with almost no transparency or accountability. Save our Schools Arizona is Voting NO (opposing) Proposition 305. Find out more at SOSArizona.org. We urge you to email, call, and find your candidates on social media; ask them to explain their stance or lack of a response. In particular, find out if they’ll protect public schools and oppose ESA voucher expansion in the future. N = Voting No (Green is good) Y = Voting Yes (Yes is yikes) NR = No Response Governor Steve Farley - N David Garcia - N Kelly Fryer - N Doug Ducey - NR Ken Bennett - NR Superintendent of Public Instruction David Schapira - N Kathy Hoffman - N Frank Riggs - N Tracy Livingston - Y Bob Branch - NR Jonathan Gelbart - NR LD Senate House of Representatives 1 Jo Craycraft - N Jodi Rooney - N Karen Fann - NR Ed Gogek - N Jan Manolis - N Noel Campbell - NR David Stringer - NR 2 Andrea Dalessandro - N Rosanna Gabaldon - N Shelley Kais - NR Chris Ackerley - N Bobby Wilson - Y Anthony Sizer - NR Daniel Hernandez - NR Updated August 28, 2018 Paid for by Save Our Schools Arizona 3 Betty Villegas - N Olivia Cajero Bedford - N Andres Cano - N Sally Gonzalez - N Beryl Baker - N Alma Hernandez - NR 4 Lisa Otondo - N Charlene Fernandez - N Gerae Peten - N 5 Jaime Morgaine - N Mary McCord Robinson - N Sonny Borrelli - NR Leo Biasiucci - NR Regina Cobb - NR Jennifer -

2018 Senate Congressional Primary Election Candidates

2018 Senate Congressional Primary Election Candidates Demographics 1 Percentage District Office Candidates Party (County) of Vote Deedra Aboud DEM 19.5 Kyrsten Sinema* DEM 80.5 Angela Green# GRN Adam Kokesh# LBT N/A Statewide Senate Joe Arpaio REP 18.88 Nicholas Glenn# REP William Gonzales# REP Martha McSally* REP 53 Kelli Ward REP 28.1 Tom O'Halleran* DEM 100 Coconino, Navajo, Apache, Zhani Doko# LBT Graham, Greenlee, Pinal, District 1 U.S. House Wendy Rogers REP Pima, Yavapai, Gila, 43.53 Maricopa, Mohave Tiffany Shedd REP 18.74 Steve Smith REP 37.73 Matt Heinz DEM 30.56 Billy Kovacs DEM 6.08 Ann Kirkpatrick^ DEM 41.39 Maria Matiella DEM 9.1 Barbara Sherry DEM 2.61 District 2 Cochise, Pima U.S. House Yahya Yuksel DEM 1.57 Bruce Wheeler DEM 8.71 Lea Marquez Peterson REP 33.59 Brandon Martin REP 29.12 Daniel Romero Morales REP 21.38 Casey Welch REP 15.92 Raul Grijalva* DEM 100 Joshua Garcia# DEM Santa Cruz, Pima, Maricopa, District 3 U.S. House Sergio Arellano REP 27.3 Yuma, Pinal Nicolas Peirson REP 51.45 Edna San Miguel REP 21.25 David Brill DEM 52.8 Delina Disanto DEM 47.2 La Paz, Mohave, Yavapai, District 4 U.S. House # DEM Pinal, Yuma, Maricopa, Gila Ana Maria Perez Haryaksha Gregor Knauer GRN 100 Paul Gosar* REP 100 1 AZ Secretary of State: 2018 Primary Election: https://apps.arizona.vote/electioninfo/elections/2018-primary- election/federal/1347/3/0, * Current Member ^Former Member #Write In 1 2018 Senate Congressional Primary Election Candidates Demographics 1 Percentage District Office Candidates Party (County) of Vote Joan Greene DEM 60 District 5 Maricopa U.S. -

ADVS State and Federal Veteran Legislation Update

ADVS State Veterans/Military Legislation Update 55th Arizona Legislature, First Regular Session Friday, February 5, 2021 Inclusion of any legislation in this report does not constitute endorsement of that legislation by the Arizona Department of Veterans’ Services. (Notations in Red represent new information or final action.) SB = Senate Bill HB = House Bill SCM = Senate Concurrent Memorial HCM = House Concurrent Memorial SCR = Senate Concurrent Resolution HCR = House Concurrent Resolution SR = Senate Resolution HJR= House Joint Resolution HR = House Resolution To view bills go to: http://www.azleg.gov/bills/ Bills Impacting Veterans/Military Senate Bills SB 1024 Enduring Freedom Memorial; appropriation Allows the Department of Administration (ADOA) to use appropriated monies from the State Monument and Memorial Repair Fund (SMMRF) to alter or modify the Enduring Freedom Memorial to add additional names to the memorial. Additionally, appropriates $21,422.91 from the SMMRF to ADOA in FY22 to alter or modify the Enduring Freedom Memorial to add additional names to the memorial. Primary Sponsor(s): Sen. Kelly Townsend, R-Dist. 16 Major Actions: 11 Jan 2021- First Read and assigned to the Senate Appropriations and Rules Committees. 19 Jan 2021- Received a “Do Pass” recommendation from the Senate Appropriations Committee with a vote of 9-0-1-0. 25 Jan 2021- Passed Senate Rules. 26- Passed Democrat and Republican Caucus. 28 Jan 2021- Passed Senate Third Read with a vote of 28-1-1-0. Transmitted to the House. SB 1143 veterans overseas conflicts plates Establishes the Veterans of Overseas Conflicts special plates if by December 31, 2021, a person pays $32,000 to the Arizona Department of Transportation for implementation.