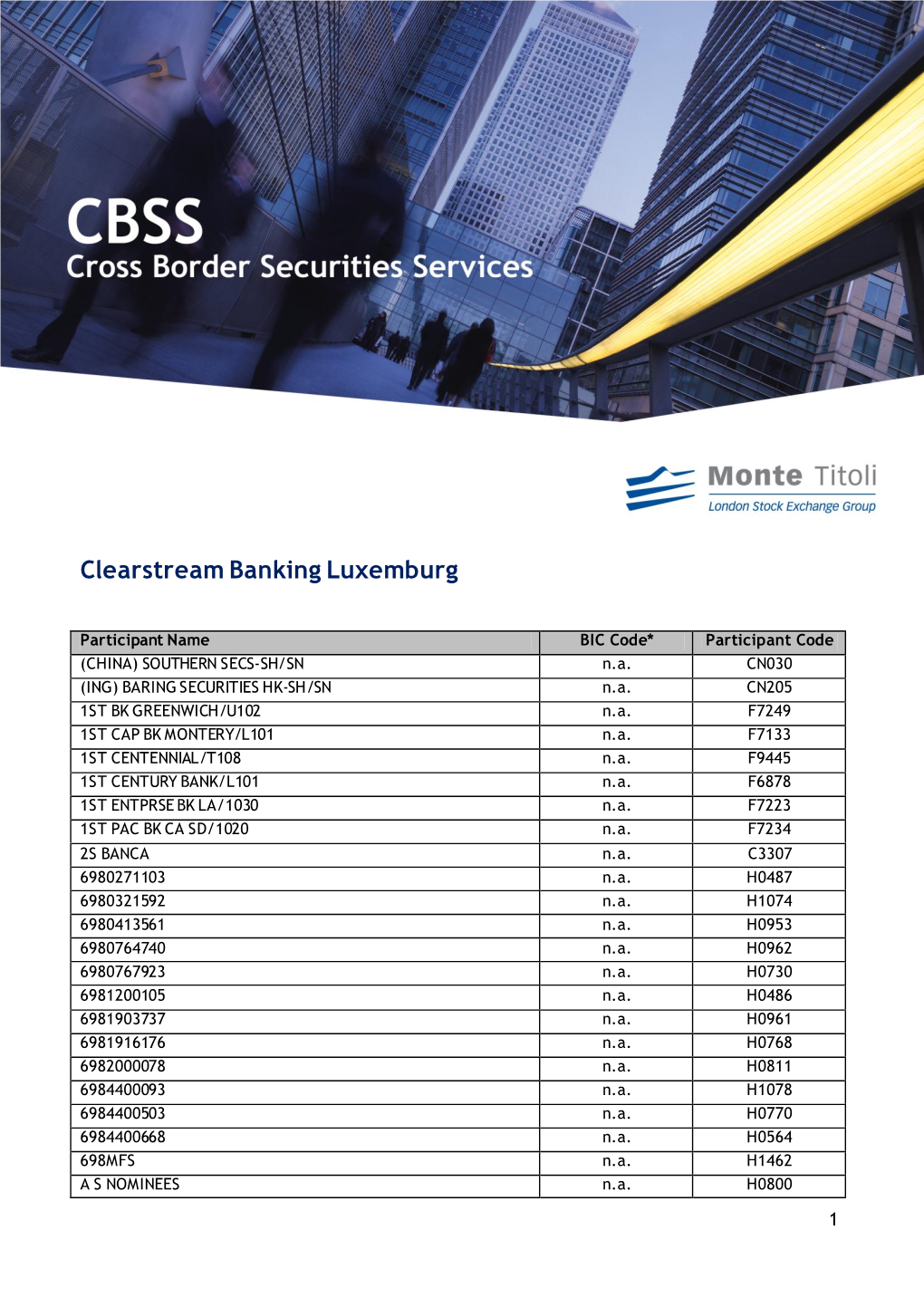

Clearstream Banking Luxemburg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brewin Dolphin Select Managers Fund

MI Brewin Dolphin Select Managers Fund Annual Report 28 February 2019 MI Brewin Dolphin Select Managers Fund Contents Page Directory* . 1 Statement of the Authorised Corporate Director’s Responsibilities . 2 Certification of the Annual Report by the Authorised Corporate Director . 2 Statement of the Depositary’s Responsibilities . 3 Independent Auditor’s Report to the Shareholders . 4 MI Select Managers Bond Fund Investment Objective and Policy* . 6 Investment Adviser's Report* . 6 Portfolio Statement* . 8 Comparative Table* . 24 Statement of Total Return . 26 Statement of Change in Net Assets Attributable to Shareholders . 26 Balance Sheet . 27 Notes to the Financial Statements . 28 Distribution Table . 40 MI Select Managers North American Equity Fund Investment Objective and Policy* . 41 Investment Adviser's Report* . 41 Portfolio Statement* . 43 Comparative Tables* . 49 Statement of Total Return . 51 Statement of Change in Net Assets Attributable to Shareholders . 51 Balance Sheet . 52 Notes to the Financial Statements . 53 Distribution Tables . 60 MI Select Managers UK Equity Fund Investment Objective and Policy* . 61 Investment Adviser's Report* . 61 Portfolio Statement* . 63 Comparative Tables* . 72 Statement of Total Return . 74 Statement of Change in Net Assets Attributable to Shareholders . 74 Balance Sheet . 75 Notes to the Financial Statements . 76 Distribution Tables . 83 MI Select Managers UK Equity Income Fund Investment Objective and Policy* . 84 Investment Adviser's Report* . 84 Portfolio Statement* . 86 Comparative Tables* . 92 Statement of Total Return . 94 Statement of Change in Net Assets Attributable to Shareholders . 94 Balance Sheet . 95 Notes to the Financial Statements . 96 Distribution Tables . 103 General Information* . 104 *These collectively comprise the Authorised Corporate Director’s Report. -

Annual Reports and Accounts 2011

AnnuA l RepoR ts A nd Accounts 2011 • Elgin • Inverness Aberdeen • Aberdeen Dorchester Hereford Marlborough Stoke-on-Trent Blenheim House Hamilton House 35 Bridge Street Woodstock Court Highpoint Fountainhall Road 6 Nantillo Street Hereford Blenheim Road Festival Park Aberdeen, AB15 4DT Poundbury, Dorchester HR4 9DG Marlborough Stoke-on-Trent Dundee • T 01224 267900 Dorset, DT1 3WN T 01432 364 300 Wiltshire, SN8 4AN ST1 5BG T 01305 215770 T 01672 519600 T 01782 210250 Belfast Inverness Waterfront Plaza Dublin Lyle House Newcastle Swansea 8 Laganbank Road Tilman Brewin Dolphin Fairways Business Park Time Central Axis 6 • Edinburgh Belfast 3 Richview Office Park Inverness 30-34 Gallowgate Axis Court Glasgow • BT1 3LY Clonskeagh IV2 6AA Newcastle upon Tyne Mallard Way T 028 9044 6000 Dublin 14 T 01463 225 888 NE1 4SR Swansea Vale T +353 (0) 1 260 0080 T 0191 279 7300 Swansea SA7 0AJ Birmingham W www.tam.ie Jersey T 01792 763960 9 Colmore Row Kingsgate House Norwich Birmingham Dumfries 55 The Esplanade Jacquard House Taunton B3 2BJ 43 Buccleuch Street St Helier Old Bank of England Court Ashford Court Dumfries • T 0121 710 3500 Dumfries, DG1 2AB Jersey, JE2 3QB Queen Street Blackbrook Business Park • Newcastle T 01387 252361 T 01534 703 000 Norwich, NR2 4SX Blackbrook Park Avenue Bradford T 01603 767776 Taunton • Penrith Auburn House Dundee Leeds Somerset Belfast • 8 Upper Piccadilly 31-32 City Quay 34 Lisbon Street Nottingham TA1 2PX • Teesside Bradford Camperdown Street Leeds Waterfront House T 01823 445750 BD1 3NU Dundee, DD1 3JA LS1 4LX Waterfront Plaza T 01274 728 866 T 01382 317200 T 0113 245 9341 Nottingham, NG2 3DQ Teesside T 0115 852 5580 Progress House • York Brighton Edinburgh Leicester Fudan Way • Leeds Invicta House PO Box No. -

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

List of Supervised Entities (As of 1 September 2020)

List of supervised entities Cut-off date for changes: 1 September 2020 Number of significant entities directly supervised by the ECB: 114 This list displays the significant supervised entities, which are directly supervised by the ECB (part A) and the less significant supervised entities which are indirectly supervised by the ECB (Part B). Based on Article 2(20) of Regulation (EU) No 468/2014 of the European Central Bank of 16 April 2014 establishing the framework for cooperation within the Single Supervisory Mechanism between the European Central Bank and national competent authorities and with national designated authorities (OJ L 141, 14.5.2014, p. 1 - SSM Framework Regulation) a ‘supervised entity’ means any of the following: (a) a credit institution established in a participating Member State; (b) a financial holding company established in a participating Member State; (c) a mixed financial holding company established in a participating Member State, provided that the coordinator of the financial conglomerate is an authority competent for the supervision of credit institutions and is also the coordinator in its function as supervisor of credit institutions (d) a branch established in a participating Member State by a credit institution which is established in a non-participating Member State. The list is compiled on the basis of significance decisions which have been adopted and notified by the ECB to the supervised entity and that have become effective up to the cut-off date. A. List of significant entities directly supervised by the ECB Country of LEI Type Name establishment Grounds for significance MFI code for branches of group entities Belgium Article 6(5)(b) of Regulation (EU) No 1 LSGM84136ACA92XCN876 Credit Institution AXA Bank Belgium SA ; AXA Bank Belgium NV 1024/2013 CVRWQDHDBEPUUVU2FD09 Credit Institution AXA Bank Europe SCF France 2 549300NBLHT5Z7ZV1241 Credit Institution Banque Degroof Petercam SA ; Bank Degroof Petercam NV Significant cross-border assets 54930017BFF0C5RWQ245 Credit Institution Banque Degroof Petercam France S.A. -

Clearstream: General Court Confirms Commission Decision

Antitrust Clearstream: General Court confirms Commission Decision Rosalind Bufton and Eduardo Martínez Rivero (1) 1 On 9 September 2009 the Court of First Instance and settlement services. Clearstream Banking AG is (now the General Court) dismissed the action for Germany’s only CSD. annulment (2) brought by Clearstream Banking AG (also known as Clearstream Banking Frankfurt or 1.2. The 2004 Decision CBF) and Clearstream International SA against the 2 June 2004 Commission decision in the Clearstream The Commission decision found that Clearstream case. The decision had found that Clearstream Banking AG enjoyed a dominant position in the Banking AG and its parent company Clearstream market for the provision of ‘primary’ clearing and International SA violated Article 82 EC (now Art- settlement services for securities issued under Ger- icle 102 TFEU) by refusing to supply certain clear- man law to CSDs in other Member States and to ing and settlement services to one of its customers international central securities depositories (IC- 3 (Euroclear Bank SA), and by applying discrimina- SDs) ( ). For certain categories of companies seek- tory prices to that same customer. ing to provide efficient and less costly services to their customers, the decision found that the use of 1. Background ‘secondary’ clearing and settlement through an in- termediary could not be a substitute for access to ‘primary’ clearing and settlement services as it does 1.1. Clearing and settlement not offer the same level of service. It also found Clearing and settlement services are necessary steps that Clearstream Banking AG, together with its par- for a securities trade to be completed. -

Instructions and Methods of Completing Payment Orders

1 INSTRUCTIONS AND METHODS OF COMPLETING The Payer shall enter the following data into the fields marked with the »Payer« inscription: PAYMENT ORDERS - IBAN, which is Payer’s account number, I. Purpose - Reference, The Instructions and methods of completing payment orders form part of the - Name and address, General Terms and Conditions and are intended for the user of payment - The purpose code, which is published and available on the web page services. The main function of payment services is fast and quality transfer of http://www.zbs-giz.si/news.asp?StructureId=886&ContentId=1889 funds. Speed and quality of conducting payment services depend on a large - Purpose of payment/Deadline for payment and extent on accuracy of data, contained in payment orders. Incomplete data do - Payer’s signature and optionally a stamp if the Payer decides to use the not ensure enough information for booking and processing payment orders, stamp. at the same time they cause additional costs due to longer procedure of acquiring additional information, processing claims and consequently time The Recipient shall enter the following data into the fields marked with the delays at booking. »Recipient« inscription: - Amount, Within the Bank Association of Slovenia, technical standards for the UPN – Universal Payment Order (hereinafter referred to as: UPN) have been prepared. - Date of payment in the DDMMLLLL form, For conducting domestic internal, cross-border and other international - BIC of the Recipient’s bank - optional, payment transactions, internal forms are also in use at the Bank. In - IBAN (SI56 is denomination for Slovenia, for cross-border payments continuation, instructions and methods of correct completing of payment appropriate code shall be used), which is Recipient’s account number, orders and forms are provided. -

Orient Securities Co. (3958.HK)

August 29, 2016 EARNINGS REVIEW Orient Securities Co. (3958.HK) Neutral Equity Research In line with expectations: Sequential recovery led by trading, IB improved What surprised us Investment Profile DFZQ reported 2Q16 NPAT of Rmb860mn, 28%/17% of GSe/Bloomberg Low High consensus for 2016E NPAT. 1H profits are consistent with preliminary Growth Growth disclosure in August. 2Q16 profit declined -78% yoy, but sequentially grew Returns * Returns * 103% qoq, led by trading. ROE/ROA recovered to 10.3%/1.8% annualized in Multiple Multiple Volatility Volatility 2Q. Key positives: 1) IB income up 28% yoy to Rmb290bn, led by growth Percentile 20th 40th 60th 80th 100th in both ECM and DCM underwriting. Coupled with a strong 1Q, first-half IB Orient Securities Co. (3958.HK) income has been the strongest in the past few years. 2) Trading income Asia Pacific Banks Peer Group Average up 90% qoq from a very low base in 1Q16 on recovering investment yield, * Returns = Return on Capital For a complete description of the investment profile measures please refer to the even though still down 85% yoy. Revenue contribution from trading disclosure section of this document. decreased to 27% in 1H16, vs. 65% on average for FY13 to FY15. Principal investment book was flat at Rmb 49bn hoh with equity down to Rmb 6.2bn Key data Current Price (HK$) 8.21 and bond investment up; 3) Stock pledged lending balance rose 20% hoh 12 month price target (HK$) 9.20 Market cap (HK$ mn / US$ mn) 35,153.1 / 4,532.4 to Rmb 29bn despite weaker margin finance as the company shifts its Foreign ownership (%) -- focus to corporate client financing. -

Composición Consejo De Administración Y Comisiones

Composición Consejo de Año: 2018 Administración y Comisiones Delegadas Pág: 1 de 8 A continuación, se describe la composición del Consejo de Administración de Kutxabank, así como de sus Comisiones Delegadas: 1) Consejo de Administración: a) D. Gregorio Villalabeitia Galarraga: a. Presidente Ejecutivo del Consejo de Administración. Carácter ejecutivo. b. Designado por la Junta General de Accionistas, por primera vez, con fecha 28 de noviembre de 2014 y renovado en fecha 30 de noviembre de 2018. c. No desempeña otros puestos ni realiza otras actividades significativas. d. Desde el año 1977 ha venido ocupando cargos de responsabilidad en diferentes entidades de crédito (Banco de Vizcaya, Caja de Ahorros Vizcaína, Banco Cooperativo Español, Argentaria y BBVA). b) D. Xabier Gotzon Iturbe Otaegi: a. Vicepresidente Primero del Consejo de Administración. Carácter ejecutivo. b. Designado por la Junta General de Accionistas, a propuesta del accionista Fundación Bancaria Kutxa-Kutxa Banku Fundazioa, por primera vez, con fecha 1 de enero de 2012, y renovado con fecha 30 de junio de 2016. c. Desde abril de 2008 (i) ha sido Gerente de Finanzas y Director de Finanzas y Control (1998-2008) en Euskaltel, S.A., (ii) anteriormente, durante 8 años, fue responsable de diversos departamentos en HSBC (entre ellos, Director de Mercado de Capitales) y (iii) ha ostentado y ostenta el cargo de miembro del Consejo de Administración de diversas entidades de diferentes ámbitos. c) D. Joseba Mikel Arieta-araunabeña Bustinza: a. Vocal del Consejo de Administración. Carácter dominical. b. Designado por la Junta General de Accionistas, a propuesta del accionista Bilbao Bizkaia Kutxa Fundación Bancaria-Bilbao Bizkaia Kutxa Banku Fundazioa, por primera vez, con fecha 1 de enero de 2012, y renovado con fecha 30 de junio de 2016. -

Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership

Directorate-General for Internal Policies Directorate A - Economic and Scientific Policy Policy Department A.: Economic and Scientific Policy and Quality of Life Unit Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership Briefing Note IP/A/ECON/NT/2008-10 PE 408.550 Only published in English. Author: Josina KAMERLING Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L046 B-1047 Brussels Tel: +32 (0)2 283 27 86 Fax: +32(0)2 284 69 29 E-mail: [email protected] Arttu MAKIPAA Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L042 B-1047 Brussels Tel: +32 (0)2 283 26 20 Fax: +32(0)2 284 69 29 E-mail: [email protected] Manuscript completed in August 2008. The opinions expressed in this document do not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposes are authorised provided the source is acknowledged and the publisher is given prior notice and receives a copy. Rue Wiertz – B-1047 Bruxelles - 32/2.284.43.74 Fax: 32/2.284.68.05 Palais de l‘Europe – F-67000 Strasbourg - 33/3.88.17.25.56 Fax: 33/3.88.36.92.14 E-mail: [email protected] IP/A/ECON/NT/2008-10 PE 408.550 Table of Contents 1. The Data on Financial Institutions in EU27 ......................................................................1 2. Largest Financial Institutions in Europe (Tables 1-5) .......................................................2 -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Türk Eximbank Uygulamalarinda Risk

T.C İSTANBUL TİCARET ÜNİVERSİTESİ DIŞ TİCARET ENSTİTÜSÜ ULUSLARARASI TİCARET HUKUKU VE AB ANABİLİM DALI TÜRK EXİMBANK UYGULAMALARINDA RİSK YÖNETİMİ YÜKSEK LİSANS TEZİ SILANUR ÇIRAK Danışman Dr. Öğr. Üyesi V. Ferhan BENLİ İstanbul, 2018 ÖNSÖZ Çalışmalarım sırasında benden manevi desteklerini esirgemeyen sevgili babam Hayati ÇIRAK'a, annem Şükran ÇIRAK'a, kardeşim Emrah ÇIRAK'a ve arkadaşım Gökhan ÖZEN'e en içten teşekkürlerimi sunmayı bir borç bilirim. ÖZET Risk Yönetimi temel olarak işletmelerin varlığını sürdürmeye yönelik olası tehditleri tespit edip değerlendirerek önlemeyi veya minimize etmeyi amaçlayan bir sistemler bütünüdür. Bu kavram hayatımıza, 2001 yılında ülkemizde yaşanan Bankacılık Krizi ile girmiş ve Bankacılık Düzenleme ve Denetleme Kurulu'nun(BDDK) benimsediği uluslararası Basel Kriterleri ile tanınır hale gelmiştir. Türk Eximbank'ın ana hedef kitlesi Türkiye'de yerleşik ihracatçılar, ihracat odaklı üretim yapan imalatçılar ile yurtdışında etkinlik gösteren müteahhitler ve girişimciler olmakla birlikte Banka, ilgili gruplara kredi, sigorta ve garanti hizmetleri vermektedir. Bu çerçevede geniş yelpazede hizmet sunan Türk Eximbank'ta olası risklere karşı bütüncül ve uluslararası normlara uygun politikalar belirlenerek banka faaliyetleri ile ilgili riskler yönetilmeye çalışılmaktadır. Bu çalışmada ilk bölümde; Eximbank'ların Dünya Ticaret Finansmanındaki Rolü ve Önemi, Türk Eximbank’ı ticari bankalardan ayıran ve iş modeli ile risk yönetimi politikasını doğrudan etkileyen özellikleri ve Basel prensipleri incelenmiştir. Ayrıca -

FINANCIAL SERVICES.Pdf

INTERNATIONAL REFERENCES FINANCIAL SERVICES Algeria Bank of Algeria, Société Générale Algérie, BNP, Salama Bank of Blida Australia Bank of Scotland international Austria “Creditanstalt AG”, National Savings, “Oberbank”, “Raiffeisenkasse” banks France Barclay’s, Banque de France, Credit Lyonnais, Citibank, Credi Mutuel, CIAL of CIC group, Commerzbank Paris Germany Deutsche Bank, Berliner Bank, Commerzbank, Dresdner Bank Hungary National Bank (KFKI) Budapest Hong Kong Hong Kong bank Indonesia BNT Jakarta Italia Banks, Banca popolare di Bescia, Banca commerciale Italiana, Instituto bancario S. Paolo Torno, Banca popolare di Crema Ivory Coast Société Générale de Banque Morocco Banque Centrale Populaire, Commercial Bank of Morocco New Zealand Deutsche Bank Auckland Niger Banque Centrale des Etats d’Afrique de l’Ouest au Niger Norway Oslo Bank of Norway, Bank of Scotland international Philippines Zambales Subic Financial building corporation, Manilla Bangkok bank Portugal Banks Portugal, Pinto & Sotto Mayor, Portugues do Atlantico, Fonsecas & Burnay, Do Fomento, Acores, Uniao de bancos Portugueses, Caixa Geral de depositos, Stock exchange Lisbon Senegal Bank B.C.E.A.O. Dakar Serbia National Bank of Serbia Singapore City Bank South Africa South African Reserve Bank in Durban Spain Caja Rural de Granada, Cajamar, Banco BBVA, Banco Popular, Banca March, Bankinter, Caja Laboral, Unicaja, Caja de Ahorros de Ávila Thailand Bangkok Thai Farmers bank head office, Bangkok bank head office, Bangkok Bank of Ayudhya head office, Chiangmai Central bank of Thailand, Bank of Thailand, BTS Depot United Arab Emirates Abu Dhabi Barclays Bank, National bank of Abu Dhabi United Kingdom Barclays Bank London, Northern Trust London, Bank of England, Lloyds, Blue Crest, HSBC, Schroders. .