Copyrighted Material

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SBAI Annual Report (2017)

Annual Report 2017 Table of Contents Contents 1. Foreword ............................................................................................................................................. 4 2. SBAI Mission ........................................................................................................................................ 7 3. The Alternative Investment Standards ............................................................................................... 8 Why are the Standards important? .................................................................................................... 8 4. The SBAI Toolbox .............................................................................................................................. 10 5. Overview of SBAI’s Activities in 2017/2018 ...................................................................................... 11 Key Highlights .................................................................................................................................... 11 Rebranding .................................................................................................................................... 11 North American Committee .......................................................................................................... 11 SBAI Toolbox ................................................................................................................................. 12 New SBAI Initiatives ..................................................................................................................... -

Hedge Fund Standards Board

Annual Report 2018 Established in 2008, the Standards Board for Alternative Investments (Standards Board or SBAI), (previously known as the Hedge Fund Standards Board (HFSB)) is a standard-setting body for the alternative investment industry and custodian of the Alternative Investment Standards (the Standards). It provides a powerful mechanism for creating a framework of transparency, integrity and good governance to simplify the investment process for managers and investors. The SBAI’s Standards and Guidance facilitate investor due diligence, provide a benchmark for manager practice and complement public policy. The Standards Board is a platform that brings together managers, investors and their peers to share areas of common concern, develop practical, industry-wide solutions and help to improve continuously how the industry operates. 2 Table of Contents Contents 1. Message from the Chairman ............................................................................................................... 5 2. Trustees and Regional Committees .................................................................................................... 8 Board of Trustees ................................................................................................................................ 8 Committees ......................................................................................................................................... 8 3. Key Highlights ................................................................................................................................... -

Starting a Hedge Fund in the Sophomore Year

FEATURING:FEATURING:THETHE FALL 2001 COUNTRY CREDIT RATINGSANDTHE WORLD’S BEST HOTELS SEPTEMBER 2001 BANKING ON DICK KOVACEVICH THE HARD FALL OF HOTCHKIS & WILEY MAKING SENSE OF THE ECB PLUS: IMF/WorldBank Special Report THE EDUCATION OF HORST KÖHLER CAVALLO’S BRINKMANSHIP CAN TOLEDO REVIVE PERU? THE RESURGENCE OF BRAZIL’S LEFT INCLUDING: MeetMeet The e-finance quarterly with: CAN CONSIDINE TAKE DTCC GLOBAL? WILLTHE RACE KenGriffinKenGriffin GOTO SWIFT? Just 32, he wants to run the world’s biggest and best hedge fund. He’s nearly there. COVER STORY en Griffin was desperate for a satellite dish, but unlike most 18-year-olds, he wasn’t looking to get an unlimited selection of TV channels. It was the fall of 1987, and the Harvard College sophomore urgently needed up-to-the-minute stock quotes. Why? Along with studying economics, he hap- pened to be running an investment fund out of his third-floor dorm room in the ivy-covered turn- of-the-century Cabot House. KTherein lay a problem. Harvard forbids students from operating their own businesses on campus. “There were issues,” recalls Julian Chang, former senior tutor of Cabot. But Griffin lobbied, and Cabot House decided that the month he turns 33. fund, a Florida partnership, was an off-campus activity. So Griffin’s interest in the market dates to 1986, when a negative Griffin put up his dish. “It was on the third floor, hanging out- Forbes magazine story on Home Shopping Network, the mass side his window,” says Chang. seller of inexpensive baubles, piqued his interest and inspired him Griffin got the feed just in time. -

Risk Arbitrage Strategies

Risk/Arbitrage Strategies: A New Concept for Asset/Liability Management, Optimal Fund Design and Optimal Portfolio Selection in a Dynamic, Continuous-Time Framework Part III: A Risk/Arbitrage Pricing Theory Hans-Fredo List Swiss Reinsurance Company Mythenquai 50/60, CH-8022 Zurich Telephone: +41 1285 2351 Facsimile: +411285 4179 Mark H.A. Davis Tokyo-Mitsubishi International plc 6 Broadgate, London EC2M 2AA Telephone: +44 171 577 2714 Facsimile: +44 171 577 2888 Abstract. Asset/Liability management, optimal fund design and optimal portfolio selection have been key issues of interest to the (re)insurance and investment banking communities, respectively, for some years - especially in the design of advanced risk- transfer solutions for clients in the Fortune 500 group of companies. Building on the new concept of limited risk arbitrage investment management in a diffusion type securities and derivatives market introduced in our papers Risk/Arbitrage Strategies: A New Concept for Asset/Liability Management, Optimal Fund Design and Optimal Portfolio Selection in a Dynamic, Continuous-Time Framework Part I: Securities Markets and Part II: Securities and Derivatives Markets, AFIR 1997, Vol. II, p. 543, we outline here a corresponding risk/arbitrage pricing theory that is consistent with an investor’s overall risk management objectives and takes into account drawdown control and limited risk arbitrage constraints on admissible contingent claim replication/hedging strategies. The mathematical framework used is that related to the optimal control of Markov diffusion processes in R” with dynamic programming and continuous-time martingale representation techniques. Key Words and Phrases. Risk/Arbitrage pricing theory (R/APT), risk/arbitrage contingent claim replication strategies, optimal financial instruments, LRA market indices, utility-based hedging, risk/arbitrage price, R/A-attainable, partial replication strategies. -

Short Selling Risk and Hedge Fund Performance.Pdf

Short Selling Risk and Hedge Fund Performance Lei (Matthew) Ma* This Draft: December 2019 Abstract: Hedge funds, on average, outperform other actively managed funds. However, hedge fund managers often use trading strategies that are not used by other managed portfolios, and thus they bear unique risks. In particular, many hedge funds use short selling. I construct an option- based measure of short selling risk as the return spread between the decile of stocks with low option-implied short selling fees and the decile of those with high fees. I find that hedge funds that are significantly exposed to short selling risk outperform low-exposure funds by 0.45% per month on a risk-adjusted basis. However, there is no such relation for mutual funds that invest primarily on the long side. The results highlight that a significant proportion of abnormal performance of hedge funds is compensation for the risk they take on their short positions. JEL classification: G23; G11 Keywords: hedge funds, mutual funds, short selling risk, short risk exposure *Contact: Matthew Ma, Cox School of Business, Southern Methodist University, e-mail: [email protected]; I am grateful to Jonathan Brogaard, Jeff Coles, Mike Cooper, Mike Gallmeyer, Pab Jotikasthira, Matthew Ringgenberg, Mehrdad Samadi, Steve Stubben, Kumar Venkataraman, Kelsey Wei, Ingrid Werner, Julie Wu, Feng Zhang, Feng Zhao, and conference and seminar participants at the University of Utah, the University of Texas at Dallas, and Northern Finance Association Conference 2018 for insightful and helpful comments. All remaining errors are my own. 1 There is no “alpha.” There is just beta you understand and beta you do not understand, and beta you are positioned to buy versus beta you are already exposed to and should sell. -

Annual Report 2013

Oppenheimer Holdings Inc. Annual Report 2013 BY THE NUMBERS $1B Gross Revenue $38.77 Book Value/Share 43% Increase in Share Price 12/31/12 – 12/31/13 t 5ISPVHIJUTQSJODJQBM TVCTJEJBSJFT 0QQFOIFJNFS $P*OD B64CSPLFSEFBMFS BOE0QQFOIFJNFS"TTFU .BOBHFNFOU*OD 0QQFOIFJNFS PGGFSTBXJEFSBOHFPG JOWFTUNFOUCBOLJOH TFDVSJUJFT JOWFTUNFOUNBOBHFNFOUBOE XFBMUINBOBHFNFOUTFSWJDFT GSPNPGmDFTJOTUBUFTBOE UISPVHIMPDBMJOWFTUNFOUmSNT JOmWFGPSFJHOKVSJTEJDUJPOT t 01:$SFEJU$PSQPGGFST TZOEJDBUJPOBTXFMMBTUSBEJOHPG JTTVFEDPSQPSBUFMPBOT t 0QQFOIFJNFSFNQMPZTPWFS QFPQMF t 0QQFOIFJNFSPGGFSTUSVTU BOEFTUBUFTFSWJDFTUISPVHI 0QQFOIFJNFS5SVTU$PNQBOZPG %FMBXBSF t 0QQFOIFJNFS.VMUJGBNJMZ )PVTJOH)FBMUIDBSF'JOBODF *ODJTB$PNNFSDJBM.PSUHBHF #BOLJOH'JSNUIBUPSJHJOBUFT BOETFSWJDFTMPBOT t 5ISPVHIJUTTVCTJEJBSZ 'SFFEPN *OWFTUNFOUT *ODBOEUIF #6:BOE)0-%EJWJTJPOPG 'SFFEPN 0QQFOIFJNFSPGGFST POMJOFEJTDPVOUCSPLFSBHFBOE EPMMBSCBTFEJOWFTUJOHTFSWJDFT FINANCIAL HIGHLIGHTS"OOVBM3FQPSU (In thousands of dollars except per share amounts) 2013 2012 2011 2010 2009 Gross Revenue $1,019,714 $952,612 $958,992 $1,036,273 $990,480 Profit (loss) before income taxes $43,909 ($527) $17,848 $67,991 $37,067 Net profit (loss)* $25,061 ($3,613) $10,316 $38,532 $20,824 Basic earnings (loss) per share* $1.85 ($0.27) $0.76 $2.89 $1.59 Total assets $2,952,720 $2,678,020 $3,527,439 $2,515,062 $2,162,582 Shareholders’ equity* $522,518 $500,740 $508,070 $504,330 $461,012 Book value per share* $38.77 $36.80 $37.16 $37.73 $34.88 Total shares outstanding 13,478 13,608 13,672 13,368 13,218 Number of employees 3,517 3,521 3,576 -

April 13 2021 Investment Committee Meeting Public Packet

INVESTMENT COMMITTEE MEETING VIRTUAL April 13, 2021 at 9:00 AM MT COMMITTEE MEMBERS Steve Neel, Chair Paula Fisher, Vice-Chair Lawrence Davis Loretta Naranjo-Lopez Diana Rosales-Ortiz AGENDA 1. Roll Call 2. Approval of Agenda 3. Approval of Consent Agenda 4. Current Business ITEM PRESENTER A Performance & Risk Update Thomas Toth Wilshire 1. Information Item: February 2021 Preliminary Flash Performance B Active Risk Budget Update Part II Thomas Toth Wilshire 1. Information Item: Portable Alpha Review James Walsh Albourne Dominic Garcia Chief Investment Officer C Asset Class Review & Update Thomas Toth Wilshire 1. Information Item: Risk Reduction & Mitigation Dominic Garcia Chief Investment Officer 5. Adjournment Consent Agenda Approval of minutes of March 25, 2021 Investments Committee meeting. Any person with a disability who needs a reader, amplifier, qualified sign language interpreter, or any other form of auxiliary aid or service to attend or participate in the hearing or meeting, please contact Trish Winter at (505) 476-9305 at least one week prior to the meeting, or as soon as possible. Public documents, including the agenda and minutes, can be provided in various accessible formats. Please contact Trish Winter if a summary or other type of accessible format is needed. Francis Page P: (505) 476-9300 Acting Board Chair, Retiree Member F: (505) 476-9401 Toll Free: Greg Trujillo 1(800) 342-3422 Acting Executive Director TUESDAY, APRIL 13, 2021 9:00AM MT INVESTMENT COMMITTEE 9:00AM MT AUDIT & BUDGET COMMITTEE FOLLOWING INVESTMENT COMMITTEE -

Hedge Funds: a Dynamic Industry in Transition

NBER WORKING PAPER SERIES HEDGE FUNDS: A DYNAMIC INDUSTRY IN TRANSITION Mila Getmansky Peter A. Lee Andrew W. Lo Working Paper 21449 http://www.nber.org/papers/w21449 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 August 2015 We thank Vikas Agarwal, George Aragon, Guillermo Baquero, Monica Billio, Keith Black, Ben Branch, Nick Bollen, Stephen Brown, Jayna Cummings, Gregory Feldberg, Mark Flood, Robin Greenwood, David Hsieh, Hossein Kazemi, Bing Liang, Tarun Ramadorai, and two anonymous referees for helpful comments and suggestions. The views and opinions expressed in this article are those of the authors only and do not necessarily represent the views and opinions of any other organizations, any of their affiliates or employees, or any of the individuals acknowledged above. Research support from the MIT Laboratory for Financial Engineering is gratefully acknowledged. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. At least one co-author has disclosed a financial relationship of potential relevance for this research. Further information is available online at http://www.nber.org/papers/w21449.ack NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2015 by Mila Getmansky, Peter A. Lee, and Andrew W. Lo. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. -

P E R S P E C T I V

Kenneth G. Tropin Luke Ellis Graham Capital Management Man Group Dr Ray Carroll Robert S. Koenigsberger Andrew McCaffery Neuberger Berman Breton Hill Gramercy Funds Management Aberdeen Standard Investments Paul Sabourin Stuart Roden Polar Asset Management Partners Lansdowne Partners Sir Paul Marshall Marshall Wace Dr Robert C. Merton Massachusetts Institute Sir Michael Hintze of Technology CQS Dr Jane Buchan Dr Campbell Harvey PAAMCO, Duke University, PAAMCO Prisma Holdings National Bureau of Economic Research, Man Group Dr Leda Braga Seth Fischer Systematica Investments Oasis Capital Fiona Frick Unigestion PERSPECTIVES INDUSTRY LEADERS ON THE FUTURE OF THE HEDGE FUND INDUSTRY J. Kyle Bass Hayman Capital Management David C. Haley Philippe Jordan Danny Yong Anthony Kaiser HBK Capital Management Capital Fund Management Dymon Asia Capital Kaiser Trading Group Dr Jim Liew John Hopkins Carey Business School Dr Lasse H. Pedersen New York University Stern School of Business, Copenhagen Business School, AQR Global Asset Allocation Lee S. Ainslie Maverick Capital J. Tomilson Hill Blackstone Alternative Asset Management, Blackstone Omar Kodmani EnTrustPermal Dr Ray Carroll Dr Robert C. Merton Luke Ellis Chief Investment Officer, School of Management Distinguished Chief Executive Officer, Man Group Neuberger Berman Breton Hill Professor of Finance, Massachusetts Andrew McCaffery Institute of Technology Paul Sabourin Global Head of Client-Driven Chairman, Chief Investment Officer and Multi-Manager Solutions, Aberdeen Standard Investments and Portfolio -

Robert E. Conner 1.8.21 Cv

ROBERT E. CONNER Thornapple Associates, Inc. 208 5th Avenue South Lake Worth Beach, FL 33460 Mobile: (908) 727-7007 [email protected] Over forty-three years’ experience in the securities industry since 1977. Clientele have included the Securities and Exchange Commission, the Internal Revenue Service, U.S. and state-level Attorneys General and Securities, Banking and Insurance Commissioners, both U.S. and foreign individual and institutional investors, banks and insurance companies, public and private financial and operating corporations and partnerships, brokerage firms, law firms, ERISA pension and profit-sharing plans, registered and non-registered investment managers and advisors, market-makers, hedge funds, non-profit organizations and foundations, bankruptcy trustees, trusts and estates, as well as both state and federal class-action litigation. Dec 2020 th Present H2-Industries, Inc., One World Trade Center, 85 Floor, New York, NY 10007: Chief Financial Officer (CFO) H2 is engaged in the production and commercial exploitation of Liquid Organic Hydrogen Carrier (LOHC), a low- CO2 renewable energy source that lends itself to a safe, scalable, carbon-neutral mechanism for efficient storage and transportation at ambient temperature which, upon reconversion of the Carrier to a hydrogen fuel, is a stable cost- effective source of green energy for a wide range of industrial and commercial applications. www.H2-Industries.com Oct-Dec H2-Industries, SE, Maximilianstrasse 2, 80537 Munich, Germany: Chief Financial Officer (CFO) 1983- Present Thornapple Associates, Inc., Naples, FL: Co-founding member of an expert witness firm engaged in litigation support for 36+ years in 1,500+ cases in connection with U.S. and international court, arbitration and regulatory proceedings related to the securities and commodities industries. -

Hedge Funds Questions and Answers

19.7 Hedge Fund Papers questions and answers 19.7.1 Mitchell and Pulvino 1. Biggest points: (a) Merger arbitrage looks like writing index put options — more likely to fail in down markets. Number one graph: Figure 2, 2143 and 4, 2157 . Thus, performance evaluation should compare MA to put option portfolios, and not count put premium as alpha. (b) Transactions costs — commissions, bid/ask, limited market depth, illiquidity, need to diversify, small size of deals, difficulty in shorting, whether you get interest on short positions — are really important in evaluating these kinds of strategies! (And hard to do with typical data) 2. What is risk arbitrage or merger arbitrage? Is this the same as buying when you hear rumors there might be a merger announcement? A: No Merger announced Merger completed Offer price Merger fails Buy Time (a) Strategy: For cash merger, (borrow and) buy the target. For stock merger, short acquirer stock too; less risk. (b) “Images of extraordinary profits and incredible implosions.” (c) Central point: More likely to fail in down markets. This is especially true of cash mergers. If you offer $150 for a company and everyone’s stock declines, it is a much worse deal. If you offer $150 of your own stock and both go down, so what. (d) Show Figure 1 2139 — of course you don’t know which one a particular deal is until it’s too late! (e) From a later paper “Merger arbitrage...essentially amounts to providing insurance to target firm shareholders against deal failures.” After announcement, you can sell to the arbitrageur to get the higher price for sure. -

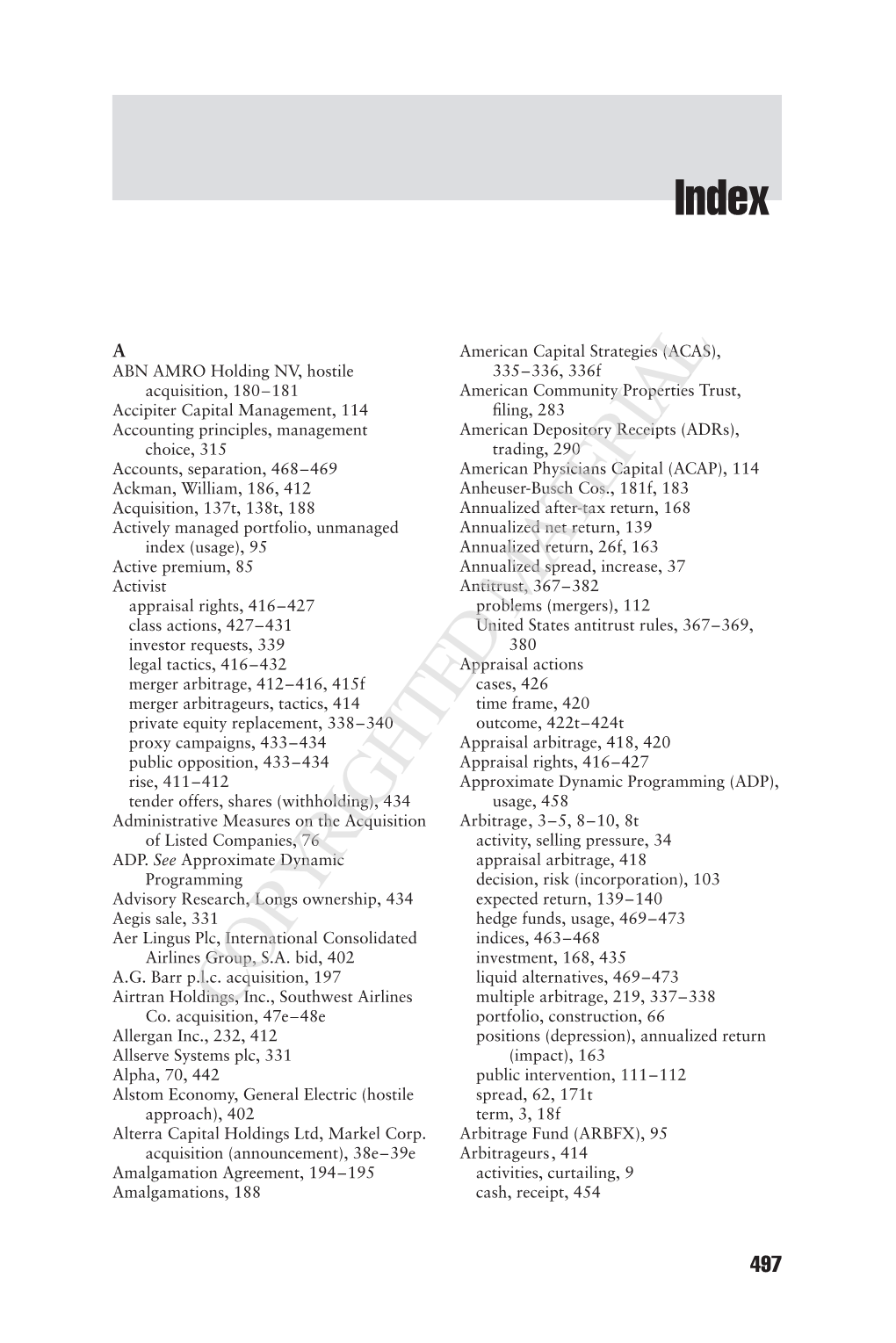

Risk Arbitrage Guy P. Wyser-Pratte

Finance/Investing Wiley Investment Classics Praise for RISK ARBITRAGE WYSER-PRATTE “Guy Wyser-Pratte’s timeless classic, Risk Arbitrage, continues to be a resource for the arbitrage community. The addition of a section on activism brings the original work into the modern day.” — Peter Schoenfeld, Chairman & CEO, P. Schoenfeld Asset Management LLC “[Wyser-Pratte is] the dean of the arbitrage community.” “Guy Wyser-Pratte’s classic MBA thesis provided a beacon of light to the murky —The Wall Street Journal world of arbitrage. It was a must-read for me when I fi rst started my business in 1976, and this updated book is a must-read today for a new generation of investors seeking absolute returns for all seasons.” —Mario J. Gabelli, Chairman, Gabelli Funds, Inc. Arbitrage—the act of buying an article in one market and selling it in another—has RISK ARBITRAGE been a popular investment strategy for as long as people have been trading. Originally published in 1971, Risk Arbitrage is the classic text on arbitrage strategies. Written by leading activist fund manager Guy Wyser-Pratte, also known as “the dean of the arbitrage community,” this book provides an unparalleled overview of risk arbi- RISK trage—with a clear focus on merger arbitrage—and how it has been used over the years, as well as in modern markets. Covering everything from average expected returns to corporate freeze-ins, this book also introduces a new chapter on “active arbitrage” that shows the morphing of activism and arbitrage. Illuminated by real-world examples and case studies, Risk Arbitrage is a must- ARBITRAGE ..........................have guide for every serious investment professional and savvy individual investor.