2018 Annual Report Is Fair, Balanced and Understandable and Recommended the Adoption of the Report and Accounts to the Board

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Spec Pharma M&A Transaction Multiples

SECTOR REPORT FOURTH QUARTER 2016 Disclaimer All information set forth in this report (the “Overview”) has been synthesized by Bourne Capital Partners, L.L.C. (“BP”) or was obtained from publicly available sources. BP makes no express or implied representation or warranty as to the accuracy or completeness of the information contained herein. BP expressly disclaims any and all liability that may be based on all information set forth in the Overview, errors therein, or omissions therefrom. This Overview includes certain statements, estimates and projections provided by BP with respect to anticipated future performance. Such statements, estimates and projections reflect various assumptions made by BP concerning anticipated results, which reflect significant subjective judgments made by BP and as a result, may or may not prove to be correct. There can be no assurance that such projected results are attainable or will be realized. No express or implied representations or warranties are made as to the accuracy of such statements, estimates or projections. In furnishing the Overview, BP does not undertake any obligation to provide the recipient with access to any additional information, to correct any inaccuracies that may become apparent or to update or otherwise revise this Overview. This Overview is not an offer to sell or a solicitation of an offer to purchase securities or to engage in any other transaction. BP is a North Carolina (USA) limited liability company doing business as Bourne Partners with divisions in Healthcare Merchant Banking, Alternative Assets, Management Consulting and Investment Banking. Investment Banking services are offered by Bourne Partners Securities, LLC, a registered broker dealer, Member FINRA and SIPC. -

We Deliver Accurate, High-Quality and Timely Information to All Stakeholders with the Utmost Integrity and Efficiency

We deliver accurate, high-quality and timely information to all stakeholders with the utmost integrity and efficiency. 107 Independent auditors’ report 115 Consolidated financial statements 120 Notes to the Consolidated financial statements 168 Company financial statements 170 Notes to the Company financial statements Financial statements 106 Hikma Pharmaceuticals PLC | Annual Report 2019 Independent auditors’ report to the members of Hikma Pharmaceuticals PLC Report on the audit of the financial statements Separate opinion in relation to IFRSs as issued by the IASB Opinion As explained in note 2 to the financial statements, the Group, in In our opinion: addition to applying IFRSs as adopted by the European Union, has also applied IFRSs as issued by the International Accounting Standards — Hikma Pharmaceuticals PLC ’s Group financial statements and Board (IASB). Company financial statements (the “financial statements”) give a true and fair view of the state of the Group’s and of the Company’s affairs In our opinion, the Group financial statements have been properly as at 31 December 2019 and of the Group’s profit and cash flows for prepared in accordance with IFRSs as issued by the IASB. the year then ended; — the Group financial statements have been properly prepared in Basis for opinion accordance with International Financial Reporting Standards (IFRSs) We conducted our audit in accordance with International Standards on as adopted by the European Union; Auditing (UK) (“ISAs (UK)”) and applicable law. Our responsibilities — the Company financial statements have been properly prepared in under ISAs (UK) are further described in the Auditors’ responsibilities accordance with United Kingdom Generally Accepted Accounting for the audit of the financial statements section of our report. -

CDP Climate Change Report 2016 United Kingdom Edition

CDP Climate Change Report 2016 United Kingdom Edition Written on behalf of 827 investors with US$100 trillion in assets CDP Report | October 2016 2 Contents 4 CDP foreword 28 The UK Climate A List 2016 Paul Simpson 32 UK Snapshot: 6 Executive summary from CDP’s Renewable energy global climate change report 33 UK Snapshot: 12 Communicating progress Price on carbon 14 2016 key trends 34 Appendix I Investor signatories and members 18 Investor perspectives 36 Appendix II FTSE 350 scores 24 We Mean Business: 56 Appendix III Commit to action Responding FTSE SmallCap climate change companies 26 Natural capital Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2016 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

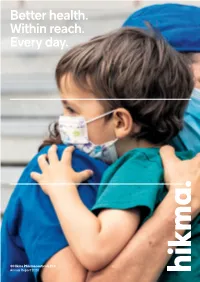

Better Health. Within Reach. Every Day

Better health. Within reach. Every day. © Hikma Pharmaceuticals PLC Annual Report 2020 Welcome to our 2020 Annual Report Our performance Revenue Operating profit Hikma puts ($m) ($m) better health $2,341m $579m 4 Executive Chairman’s 26 Business and +6% +17% within reach, statement financial review We are delivering results and investing Achieved strong organic growth in the future to drive sustainable over our three business segments. every day. 1 2 long-term growth and create value Core operating profit EBITDA for stakeholders. ($m) ($m) $566m $670m +11% +13% By creating high-quality products and making them accessible to those who need Profit to shareholders Basic earnings per share ($m) (cents) them we are helping to shape a healthier world that enriches $431m 182.6c all our communities. 6 Chief Executive 38 Sustainability (11)% (9)% Officer’s statement We have a duty of care towards patients, communities, our people The resilience and commitment and the environment. of our people in a challenging year enabled us to maintain supply Core basic earnings per share3 Dividend per share of vital medicines for patients. (cents) (cents) Strategic report Corporate governance 2 What we do 63 Message from our Executive Chairman 4 Executive Chairman’s statement 64 Corporate governance at a glance 172.9c 50c 6 Chief Executive Officer’s statement 66 Board of Directors 9 Investment case 68 Executive Committee 10 Our response to COVID-19 70 Governance report Deliver +15% +14% 12 Our strategy 74 Committee reports 14 Our progress 90 Remuneration report 16 Our markets 105 Directors’ report 18 Our business model Better health. -

Hikma Pharmaceuticals PLC Hikma Pharmaceuticals PLC Hikma Pharmaceuticals PLC 13 Hanover Square London W1S 1HW Annual Report 2005 UK Annual Report 2005

Hikma Pharmaceuticals PLC Hikma Pharmaceuticals PLC Hikma Pharmaceuticals PLC 13 Hanover Square London W1S 1HW Annual Report 2005 UK www.hikma.com Annual Report 2005 A strategy for growth Hikma Pharmaceuticals PLC Contents 02 Group at a glance 43 Statement of Directors’ 04 Chairman and responsibilities Chief Executive’s review 44 Independent auditor’s report 06 Our strengths 46 Consolidated income statement 14 Business and financial review 47 Consolidated statement of 28 Board of Directors and recognised income and expenses senior management 48 Consolidated balance sheet 30 Report of the Directors 49 Consolidated cash flow statement 32 Board report on corporate 50 Notes to the consolidated financial governance statements 35 Audit Committee report 81 Hikma Pharmaceuticals PLC accounts 37 Board report on remuneration 87 Shareholder information 88 Company information Financial highlights Revenue Operating profit Profit attributable ($ million) ($ million) to shareholders ($ million) 43.9 +23.5% +10.3% 69.2 +17.1% 262.2 62.7 37.5 212.4 05 05 04 04* 05 04* Diluted earnings R&D costs per share (cents) ($ million) 16.5 +14.1% 28.3 +70.7% 24.8 9.7 05 05 04 04 *2004 figures restated to reflect a change in the presentation of the results of our associate, IPO costs and Medicaid rebates. Further information is given in Note 2 to the consolidated financial statements. Designed and produced by Radley Yeldar. Photography by Edward Webb. Printed by CTD Printers. Hikma Pharmaceuticals PLC 01 Hikma is a multinational pharmaceutical group dedicated to improving -

A Numerical Simulator for Modeling the Coupling Processes of Subsurface Fluid Flow and Reactive Transport Processes in Fractured Carbonate Rocks

water Article A Numerical Simulator for Modeling the Coupling Processes of Subsurface Fluid Flow and Reactive Transport Processes in Fractured Carbonate Rocks Tao Yuan 1,2 , Chenji Wei 3,*, Chen-Song Zhang 4 and Guan Qin 1,* 1 Department of Petroleum Engineering, University of Houston, Houston, TX 77204, USA; [email protected] 2 Department of Reactive Transport, Institute of Resource Ecology, Helmholtz-Zentrum Dresden-Rossendorf, 04318 Leipzig, Germany; [email protected] 3 Research Institute of Petroleum Exploration & Development (RIPED), PetroChina Company Limited, Beijing 100083, China 4 NCMIS & LSEC, Academy of Mathematics and Systems Science, Beijing 100190, China; [email protected] * Correspondence: [email protected] (C.W.); [email protected] (G.Q.); Tel.: +1(832)496-1688 (G.Q.); Fax: +1(713)743-4323 (G.Q.) Received: 26 August 2019; Accepted: 16 September 2019; Published: 20 September 2019 Abstract: Water–rock interactions can alter rock properties through chemical reactions during subsurface transport processes like geological CO2 sequestration (GCS), matrix acidizing, and waterflooding in carbonate formations. Dynamic changes in rock properties cause a failure of waterflooding and GCS and could also dramatically affect the efficiency of the acidizing. Efficient numerical simulations are thus essential to the optimized design of those subsurface processes. In this paper, we develop a three-dimensional (3D) numerical model for simulating the coupled processes of fluid flow and chemical reactions in fractured carbonate formations. In the proposed model, we employ the Stokes–Brinkman equation for momentum balance, which is a single-domain formulation for modeling fluid flow in fractured porous media. We then couple the Stokes–Brinkman equation with reactive-transport equations. -

Hikma Provides Update on Status of ANDA for Generic Advair Diskus®

Press Release Hikma provides update on status of ANDA for generic Advair Diskus® London, 22 September 2020 – Hikma Pharmaceuticals PLC (Hikma or the Group), the multinational pharmaceutical company, announces that it has received a minor complete response letter (CRL) from the US Food and Drug Administration (FDA) in relation to its abbreviated new drug application (ANDA) for its generic version of GlaxoSmithKline’s Advair Diskus®1 (fluticasone propionate and salmeterol inhalation powder). Hikma is working closely with the FDA to quickly address the small number of questions raised in the CRL. Once answered, Hikma can expect to receive a response from the FDA within 90 days. Hikma now expects to receive approval for its generic Advair Diskus® in early 2021. As a result, Generics revenue is now anticipated to be in the range of $710 million to $730 million and core operating margin to be in the range of 18% to 19% for 2020 full year. Hikma and its partner Vectura Group, are committed to bringing this important product to the US market and remain confident in the submission. - ENDS - Enquiries Hikma Pharmaceuticals PLC Susan Ringdal +44 (0)20 7399 2760/ +44 7776 477050 EVP, Strategic Planning and Global Affairs [email protected] Steve Weiss +1 732 720 2830/ +1 732 788 8279 David Belian +1 732 720 2814/+1 848 254 4875 US Communications and Public Affairs [email protected] Teneo (Press): Charles Armitstead / Camilla Cunningham +44 (0)7703 330 269/ +44 (0)7464 982 426 About Hikma (LSE: HIK) (NASDAQ Dubai: HIK) (OTC: HKMPY) (rated Ba1/stable Moody's and BBB-/stable S&P) Hikma helps put better health within reach every day for millions of people in more than 50 countries around the world. -

Case 20-32021 Document 908 Filed in TXSB on 01/06/21 Page 1 of 3

Case 20-32021 Document 908 Filed in TXSB on 01/06/21 Page 1 of 3 IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) 1 WHITING PETROLEUM CORPORATION, et al., ) Case No. 20-32021 (DRJ) ) ) (Jointly Administered) Reorganized Debtors. ) ) Re: Docket Nos. 886, 887, 888, 889, 890, 892 OMNIBUS CERTIFICATE OF NO OBJECTION Pursuant to the Procedures for Complex Chapter 11 Cases in the Southern District of Texas (the “Complex Case Procedures”), the undersigned counsel for the above-captioned reorganized debtors (collectively, the “Reorganized Debtors”) certifies as follows: 1. On December 1, 2020, the Reorganized Debtors filed the following objections (collectively, the “Omnibus Objections”): The Reorganized Debtors’ Eighth Omnibus Objection to Certain Proofs of Claim (Satisfied Claims) [Docket No. 886]; The Reorganized Debtors’ Ninth Omnibus Objection to Certain Proofs of Claim (Satisfied Claims) [Docket No. 887]; The Reorganized Debtors’ Tenth Omnibus Objection to Certain Proofs of Claim (Satisfied Claims) [Docket No. 888]; The Reorganized Debtors’ Eleventh Omnibus Objection to Certain Proofs of Claim (Satisfied Claims) [Docket No. 889]; The Reorganized Debtors’ Twelfth Omnibus Objection to Certain Proofs of Claim (Duplicate Bondholder Claims) [Docket No. 890]; and 1 The Reorganized Debtors in these chapter 11 cases, along with the last four digits of each debtor’s federal tax identification number, are: Whiting Canadian Holding Company Unlimited Liability Corporation (3662); Whiting Petroleum Corporation (8515); Whiting US Holding Company (2900); Whiting Oil and Gas Corporation (8829); and Whiting Resources Corporation (1218). The location of the debtors’ service address is: 1700 Lincoln Street, Suite 4700, Denver, Colorado 80203.