Supplemental Information || Period Ended March 31, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brea (Los Angeles), California Oil, Oranges & Opportunities

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). BREA (LOS ANGELES), CALIFORNIA OIL, ORANGES & OPPORTUNITIES Brea Mall® is located in the heart of North Orange County, California, a few miles from California State University, Fullerton and their approximately 40,000 students and staff. — Brea and its surrounding communities are home to major corporations including American Suzuki Motor Corporation, Raytheon, Avery Dennison, Beckman Coulter and St. Jude Hospital. — The city’s Art in Public Places has integrated public art with private development. This nationally recognized collection features over 140 sculptures throughout the city including in Brea Mall. — The new master-planned communities of La Floresta and Blackstone, both in the city of Brea and less than four miles from Brea Mall, have added over 2,100 new luxury housing units to the area. — Brea City Hall and Chamber of Commerce offices are adjacent to the mall, located across the parking lot from Nordstrom and JCPenney. — One of the earliest communities in Orange County, Brea was incorporated in 1917 as the city of oil, oranges and opportunity. SOCAL STYLE Brea Mall has long served as a strategic fashion- focused shopping destination for the communities of North Orange County. The center continues in this tradition with a newly renovated property encompassing world-class shopping and dining. BY THE NUMBERS Anchored by Five Department Stores Nordstrom, Macy’s Women’s, Macy’s Men’s & Furniture Gallery, JCPenney Square Footage Brea Mall spans 1,319,000 square feet and attracts millions of visitors annually. -

Nordstrom to Open New Store at Santa Monica Place

Nordstrom to Open New Store at Santa Monica Place July 15, 2008 In Partnership with Macerich, Nordstrom also Announces New Plans for Two Existing Stores in California SEATTLE, July 15, 2008 /PRNewswire-FirstCall/ -- Seattle-based Nordstrom, Inc. (NYSE: JWN), a leading fashion specialty retailer, announced it has signed a letter of intent with Macerich(R) (NYSE: MAC) to open a new Nordstrom store at Santa Monica Place in Santa Monica, Calif. The three-level, 122,000-square-foot store is scheduled to open in fall 2010. The company also announced plans to relocate its existing Cerritos store at Los Cerritos Center and complete a remodel and expansion for its Broadway Plaza store in Walnut Creek, Calif. Santa Monica Place "Santa Monica is a wonderful community and an exciting retail environment where many of our customers visit, live and work," said Erik Nordstrom, president of stores for Nordstrom. "We compliment Macerich on their vision for the new Santa Monica Place, which we anticipate to be an outstanding shopping experience." "We're very pleased to welcome Nordstrom to the new Santa Monica Place," said Randy Brant, executive vice president, real estate, for Macerich. "The extraordinary appeal of Nordstrom is a great match for this exceptional market, and for what we believe will be a one-of-a-kind retail project two blocks from the beach in downtown Santa Monica." Santa Monica Place is being completely transformed from an existing 1980s-era, enclosed shopping center to a three-level, open-air retail destination that will include a signature rooftop dining deck. Re-opening in fall 2009, the 550,000-square-foot Santa Monica Place is adjacent to the popular Third Street Promenade, three city blocks of retail stores, restaurants and entertainment. -

Wfaa-Tv Eeo Public File Report I. Vacancy List

Page: 1/17 WFAA-TV EEO PUBLIC FILE REPORT March 21, 2018 - March 20, 2019 I. VACANCY LIST See Section II, the "Master Recruitment Source List" ("MRSL") for recruitment source data Recruitment Sources ("RS") RS Referring Job Title Used to Fill Vacancy Hiree 1-2, 4-5, 7-10, 12-16, 18-20, 24, 26-27, Broadcast & Digital Sports Content Producer 15 30, 33-36, 38, 40-54, 56, 58 2, 4, 7-10, 12-14, 16, 18-20, 24, 26-27, Social Media Reporter 40 30, 33-36, 38, 40-54, 56, 58 1-2, 4-5, 7-10, 12-14, 16, 18-20, 24, 26, Marketing Producer 40 33-36, 38, 40-54, 56, 58 2, 4-5, 7-10, 12-14, 16, 18-20, 24, 26, Digital Sales Specialist 40 33-36, 38, 40-54, 56, 58 2, 4-5, 7-10, 12-14, 16, 18-20, 22, 24, CASH/ ACCOUNT RECEIVABLES SPECIALIST 22 26, 33-36, 38, 41-54, 56, 58 2, 4-5, 7-10, 12-16, 18-20, 22, 24, 26, Chief Photographer 40 33-36, 38, 40-54, 56, 58 2, 4-5, 7-10, 12-14, 16, 18-20, 24, 26, Content Coordinator 40 33-36, 38, 40-54, 56-58 2, 4-5, 7-10, 12-14, 16, 18-20, 24, 26, Content Coordinator 40 33-36, 38, 40-54, 56-58 2, 4-5, 7-10, 12-14, 16, 18-20, 24, 26, Digital/ Broadcast Editor 40 33-36, 38, 40-54, 56, 58 1-2, 4-5, 7-10, 12-14, 16, 18-20, 26, 33- Integrated Account Executive 2 36, 38, 41-54, 56, 58 1-2, 4-5, 7-10, 12-14, 16, 18-20, 26, 33- Integrated Account Executive 2 36, 38, 41-54, 56, 58 2, 4-5, 7-10, 12-14, 16, 18-20, 26, 33- Digital Content Reporter/Producer 2 36, 38, 41-54, 56, 58 2, 4-5, 7-10, 12-14, 16, 18-20, 22, 26, Good Morning Texas Producer/Photographer 22 33-36, 38, 41-54, 56, 58 2, 4-5, 7-10, 12-14, 16, 18-20, 22, 26, Good Morning -

Editorial: a Tale of Two Banks

1 Complimentary to churches ft/if* < / V // and community groups priority ©jijwrtumttj Jim* 2730 STEMMONS FRWY STE. 1202 TOWER WEST, DALLAS, TEXAS 75207 ©ov VOLUME 5, NO. 6 June, 1996 TPA Dallas Cowboys' star receiver Michael irvin joins a long list of other prominent African American sports stars flayed by the media. Are they unfair targets? Holiday with a Difference: Our annual Editorial: The reasons for and against bachelor of A tale of celebrating Juneteenth the year two banks vary within the community entry form From The Editor Chris Pryer ^ photo by Derrtck Walters Tike real issue . Just when it seemed that the bank statement of intent is called accountabil extol the virtues of our religious leaders The African American community ing community had gotten about as ity. Once you open your mouth, then and the on-going commitment to the continues to feel powerless, disenfran strange as possible, the paradox in styles everyone knows when you succeed or African American Museum; there has chised and second class when it comes to that exists between two of our larger fail Also, the size of the goal reflects a real been very little work done within the the educational performance of its chil financial institutions struck. While most level of thought and consideration of the lending arena by the bank. While the sup dren. Its inherent distrust of Whites of the banks still have a way to go before real need and capacity to handle this level port of the clergy and the museum are makes for the kind of polarization we are reaching perfection, there has been a of credit activity. -

Shop California Insider Tips 2020

SHOP CALIFORNIA INSIDER TIPS 2020 ENJOY THE ULTIMATE SHOPPING AND DINING EXPERIENCES! Exciting Shopping and Dining Tour Packages at ShopAmericaTours.com/shop-California Purchase with code ShopCA for 10% discount. Rodeo Drive 2 THROUGHOUT CALIFORNIA From revitalizing beauty services, to wine, spirits and chocolate tastings, DFS offers unexpected, BLOOMINGDALE’S complimentary and convenient benefits to its See all the stylish sights – starting with a visit to shoppers. Join the DFS worldwide membership Bloomingdale’s. Since 1872, Bloomingdale’s has program, LOYAL T, to begin enjoying members- been at the center of style, carrying the most only benefits while you travel.DFS.com coveted designer fashions, shoes, handbags, cosmetics, fine jewelry and gifts in the world. MACERICH SHOPPING DESTINATIONS When you visit our stores, you’ll enjoy exclusive Explore the U.S.’ best shopping, dining, and personal touches – like multilingual associates entertainment experiences at Macerich’s shopping and special visitor services – that ensure you feel destinations. With centers located in the heart welcome, pampered and at home. These are just of California’s gateway destinations, immerse a few of the things that make Bloomingdale’s like yourself in the latest fashion trends, hottest no other store in the world. Tourism services cuisine, and an unrivaled, engaging environment. include unique group events and programs, Macerich locations provide a variety of benefits special visitor offers and more, available at our to visitors, including customized shopping, 11 stores in California including San Francisco experiential packages, visitor perks and more. Centre, South Coast Plaza, Century City, Beverly To learn more about Macerich and the exclusive Center, Santa Monica Place, Fashion Valley and visitor experiences, visit macerichtourism.com. -

Mall Area Redevelopment Tif District (Reinvestment Zone Number Twenty)

EXHIBIT A MALL AREA REDEVELOPMENT TIF DISTRICT (REINVESTMENT ZONE NUMBER TWENTY) ANNUAL REPORT FY 2018-2019 Office of Economic Development 1500 Marilla Street, 2CN Dallas, Texas 75201 (214) 670-1691 https://www.dallasecodev.org/ October 1, 2018 to September 30, 2019 Mall Area Redevelopment TIF District FY 2018-2019 Annual Report Table of Contents District Map ..................................................................................................................... 3 Mission Statement ........................................................................................................... 4 FY 2018-2019 District Accomplishments ......................................................................... 5 Mixed-Income Housing Summary……………………………………………………………..8 Value and Increment Revenue Summary ........................................................................ 9 Objectives, Programs, and Success Indicators ............................................................. 10 Year-End Summary of Meetings and Council Items………………………………….…...11 Budget and Spending Status ......................................................................................... 14 FY 2019-2020 Work Program ....................................................................................... 15 Appendix A: Financials .................................................................................................. 16 Appendix B: Financial Obligations…………………...………………………………….......19 Appendix C: Sub-District-Wide Set Aside Funds…………………………………………..20 -

School Cents Sweepstakes

School CentsTM Program Lakewood, Los Cerritos, Stonewood Center Program Rules Overview School CentsTM is a grassroots community program that allows participating schools in the program to earn points from qualified purchases. Under the School CentsTM program, school families, staff and other supporters submit receipts from sponsoring businesses to earn points for their school. Extra points are offered for participating in special events, advertising the School CentsTM program on campus, and more. Based on the total points, each school receives a share of a fund, based on their final points ranking, as compared with other participating schools. The School CentsTM program is sponsored by Macerich Management Company (“Sponsor”) Becoming a Participating School In order to participate in the School CentsTM program, a representative of a school (a “Participating School”) must use a link provided by School CentsTM or request a link at [email protected] and complete the application following the online instructions which includes submitting receipts to earn rewards on behalf of the Participating School. Participating Schools shall meet the following eligibility requirements: (i) a dedicated coordinator to manage the program on the local school level; (ii) the Participating School must be located within 10 miles of a Participating Mall; (iii) the Participating School must be a full time school (not a home school); and (iv) Participating School must be a K-5, 6-8, 9-12, K-8, 6-12 or K-12 public, private and charter full time schools with enrollment -

Renovation Last Fall

Going Places Macerich Annual Report 2006 It’s more than the end result—it’s the journey. At Macerich®, what’s important isn’t just the destination. It’s the bigger picture, the before and after...the path we take to create remarkable places. For retailers, it’s about collaboration and continual reinvestment in our business and theirs. For the communities we serve, it’s about working together to create destinations that reflect their wants and needs. For investors, it’s about long-term value creation stemming from a clear vision. For consumers, it’s about the total experience our destinations deliver. 0 LETTER TO STOCKHOLDERS Letter to Our Stockholders Macerich continued to create significant value in 2006 by elevating our portfolio and building a sizeable return for our stockholders. Total stockholder return for the year was 33.9%, contributing to a three-year total return of 121.5% and a five-year total return of 326.2%. In 2006, the company increased dividends for the 13th consecutive year. As a company that considers its pipeline a tremendous source of strength BoulderTwenty Ninth is a prime Street example is a prime of howexample 2006 of was how indeed 2006 awas remarkable indeed a yearremark of - and growth, Macerich reached an important milestone in 2006 with the buildingable year netof building asset value net for asset Macerich. value for We Macerich. also completed We also the completed redevelop the- re- opening of Twenty Ninth Street in Boulder, Colorado. Not only is this a mentdevelopment of Carmel of CarmelPlaza in Plaza Northern in Northern California, California, another another excellent excellent model of model terrific new asset in an attractive, affluent community—it represents a sig- valueof value creation, creation, where where we we realized realized a significant a significant return return on onour our investment. -

Annotated Agenda City Council Meeting April 23, 2014 City of Dallas 1500 Marilla Council Chamber, City Hall Dallas, Texas 75201 9:05 A.M

ANNOTATED AGENDA CITY COUNCIL MEETING APRIL 23, 2014 CITY OF DALLAS 1500 MARILLA COUNCIL CHAMBER, CITY HALL DALLAS, TEXAS 75201 9:05 A.M. – 1:15 P.M. Invocation and Pledge of Allegiance (Council Chamber) [14-0650] Agenda Item/Open Microphone Speakers [14-0651] VOTING AGENDA 1. Approval of Minutes of the April 9, 2014 City Council Meeting [14-0652; APPROVED] CONSENT AGENDA [14-0653; APPROVED] Aviation 2. Authorize an amendment to the Interlocal Agreement with the North Texas Tollway Authority, effective April 1, 2014, to extend the contract for a period of twelve months for the installation, maintenance, upgrading and clearinghouse functions of the automated vehicle identification system equipment for tolltag exit lanes in the parking facilities, and tolltag readers for ground transportation vehicles throughout the roadways at Dallas Love Field - Not to exceed $250,000 - Financing: Aviation Current Funds [14-0654; APPROVED] Business Development & Procurement Services 3. Authorize a one-year construction services contract to provide micro-surfacing and slurry seal for Street Services - Intermountain Slurry Seal, Inc., lowest responsible bidder of four - Not to exceed $4,118,575 - Financing: Current Funds (subject to appropriations) [14-0655; APPROVED] OFFICE OF THE CITY SECRETARY CITY OF DALLAS, TEXAS Annotated Agenda City Council Meeting April 23, 2014 Page 2 CONSENT AGENDA (Continued) Business Development & Procurement Services (Continued) 4. Authorize a six-year service contract for elevator and escalator maintenance and repair at the Kay Bailey Hutchison Convention Center Dallas and Union Station - EMR Elevator, Inc., lowest responsible bidder of three - Not to exceed $1,539,000 - Financing: Convention and Event Services Current Funds (subject to annual appropriations) [14-0656; APPROVED] City Attorney's Office 5. -

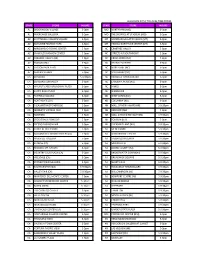

State Store Hours State Store Hours Al Brookwood

ALL HOURS APPLY TO LOCAL TIME ZONES STATE STORE HOURS STATE STORE HOURS AL BROOKWOOD VILLAGE 5-9pm MO NORTHPARK (MO) 5-9pm AL RIVERCHASE GALLERIA 5-9pm MO THE SHOPPES AT STADIUM (MO) 5-9pm AZ SCOTTSDALE FASHION SQUARE 5-9pm MT BOZEMAN GALLATIN VALLEY (MT) 5-9pm AZ BILTMORE FASHION PARK 5-9pm MT HELENA NORTHSIDE CENTER (MT) 5-9pm AZ ARROWHEAD TOWNE CENTER 5-9pm NC CRABTREE VALLEY 5-9pm AZ CHANDLER FASHION CENTER 5-9pm NC STREETS AT SOUTHPOINT 5-9pm AZ PARADISE VALLEY (AZ) 5-9pm NC CROSS CREEK (NC) 5-9pm AZ TUCSON MALL 5-9pm NC FRIENDLY CENTER 5-9pm AZ TUCSON PARK PLACE 5-9pm NC NORTHLAKE (NC) 5-9pm AZ SANTAN VILLAGE 5-9pm NC SOUTHPARK (NC) 5-9pm CA CONCORD 5-9:30pm NC TRIANGLE TOWN CENTER 5-9pm CA CONCORD SUNVALLEY 5-9pm NC CAROLINA PLACE (NC) 5-9pm CA WALNUT CREEK BROADWAY PLAZA 5-9pm NC HANES 5-9pm CA SANTA ROSA PLAZA 5-9pm NC WENDOVER 5-9pm CA FAIRFIELD SOLANO 5-9pm ND WEST ACRES (ND) 5-9pm CA NORTHGATE (CA) 5-9pm ND COLUMBIA (ND) 5-9pm CA PLEASANTON STONERIDGE 5-9pm NH MALL OF NEW HAMPSHIRE 5-9:30pm CA MODESTO VINTAGE FAIR 5-9pm NH BEDFORD (NH) 5-9pm CA NEWPARK 5-9pm NH MALL AT ROCKINGHAM PARK 5-9:30pm CA STOCKTON SHERWOOD 5-9pm NH FOX RUN (NH) 5-9pm CA FRESNO FASHION FAIR 5-9pm NH PHEASANT LANE (NH) 5-9:30pm CA SHOPS AT RIVER PARK 5-9pm NJ MENLO PARK 5-9:30pm CA SACRAMENTO DOWNTOWN PLAZA 5-9pm NJ WOODBRIDGE CENTER 5-9:30pm CA ROSEVILLE GALLERIA 5-9pm NJ FREEHOLD RACEWAY 5-9:30pm CA SUNRISE (CA) 5-9pm NJ MONMOUTH 5-9:30pm CA REDDING MT. -

Store Address City State Zip Muscle Beach - S.M

Store Address City State Zip Muscle Beach - S.M. 1633 Ocean Front Santa Monica CA 90401 Westfield Fox Hills 6000 S. Sepulveda Blvd #2286 Culver City CA 90230 Santa Maria Town Center 197 Santa Maria Town Center East Santa Maria CA 93454 Westfield Parkway 713 Parkway Plaza El Cajon CA 92020 Glendale Galleria 1146 Glendale Galleria Glendale CA 91210 Vintage Fair Maill 3401 Dale Road, #443 Modesto CA 95356 Puente Hills Mall 1600 S. Azusa Avenue, Unit #169G City Of Industry CA 91748-1617 The Oaks Shopping Center 382 W. Hillcrest Drive, Suite 6 Thousand Oaks CA 91360 The Shops at Mission Viejo 1005 The Shops at Mission Viejo, Sp. VC-05 Mission Viejo CA 92691 South Bay Pavilion at Carson 463 Carson Mall Carson CA 90746 Westfield Plaza Bonita 3030 Plaza Bonita Road, Space FC-9 National City CA 91950 Santa Rosa Plaza 2103 Santa Rosa Plaza Santa Rosa CA 95401 Serramonte Center 80-B Serramonte Center Daly City CA 94015 Brea Mall 2153 Brea Mall Brea CA 92821 Westfield Palm Desert 72-840 Highway 111, Space 357 Palm Desert CA 92260 The Galleria at South Bay 1815 Hawthorne Boulevard, #309 Redondo Beach CA 90278 Southland Mall 13 Southland Mall Dr. Hayward CA 94545 Montebello Town Center 1644 Montebello Town Center Montebello CA 90640 Montclair Plaza 2022 Montclair Plaza Lane Montclair CA 91763 Fashion Fair Mall 521 East Shaw Avenue, #101 Fresno CA 93710 Westfield North County 200 Via Rancho Parkway, Space #435 Escondido CA 92025 Los Cerritos Center 121 Los Cerritos Center Cerritos CA 90703 NewPark Mall #2073 NewPark Mall Newark CA 94560 The Mall at Victor -

Effective 5/4/08 Macy's West SMALL TICKET DEPARTMENTS Store/DC List As of May 4, 2008

Macy's West SMALL TICKET DEPARTMENTS Store/DC List as of May 4, 2008 Current Current New New DC Division Store Division Store DC Alpha Effective Name Number Name Number Name Code Mall Name / Store Name Address City State Zip Date Macy's Northwest 0001 MCW 0301 Tukwila TU SEATTLE (DOWNTOWN) Third and Pine Seattle WA 98181 5/4/2008 Macy's Northwest 0002 MCW 0302 Tukwila TU NORTHGATE (WA) 401 NE Northgate Way Space 602 Seattle WA 98125 5/4/2008 Macy's Northwest 0003 MCW 0303 Tukwila TU TACOMA 4502 South Steele #700 Tacoma WA 98409 5/4/2008 Macy's Northwest 0004 MCW 0304 Tukwila TU WENATCHEE VALLEY 445 Valley Mall Pkwy E. Wenatchee WA 98802 5/4/2008 Macy's Northwest 0005 MCW 0305 Tukwila TU BELLIS FAIR (BELLINGHAM) 50 Bellis Fair Pkwy Bellingham WA 98226 5/4/2008 Macy's Northwest 0006 MCW 0306 Tukwila TU SPOKANE (DOWNTOWN) Main and Wall St Spokane WA 99201 5/4/2008 Macy's Northwest 0008 MCW 0308 Tukwila TU SOUTH CENTER (WA) 500 Southcenter Mall Tukwila WA 98188 5/4/2008 Macy's Northwest 0009 MCW 0309 Tukwila TU THREE RIVERS 331 Three Rivers Dr Kelso WA 98626 5/4/2008 Macy's Northwest 0010 MCW 0310 Tukwila TU WALLA WALLA (DOWNTOWN) 54 East Main St Walla Walla WA 99362 5/4/2008 Macy's Northwest 0011 MCW 0311 Tukwila TU COLUMBIA CENTER (WA) 1321 N.Columbia Center BLVD. Suite 400 Kennewick WA 99336 5/4/2008 Macy's Northwest 0012 MCW 0312 Tukwila TU NORTHTOWN (WA) N.