Hong Kong Hong Kong Prime Office

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DDC Location Plan Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 Team

WWF - DDC Location Plan Jun-2021 Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 Team A Mei Foo MTR Station Star Ferry, Tsim Sha Tsui (Near McDonlad) Pacific Place Tower 3, Admiralty Theatre Lane, Central Lido Garden, Sham Tseng (Near HSBC) Team B Western Market, Sheung Wan Prince Building, Central Hopewell Centre, Wan Chai Dragon Centre, Sham Shui Po Belvedere Garden, Tsuen Wan (Near Fountain) Team C Kwai Hing MTR Station St Paul Convent School, Causeway Bay AIA Building, Fortressn Hill Apple Arcade, Causeway Bay Home Suqare, Sha Tin Team D Whampoa MTR Station Cheung Sha Wan Plaza 1, Lai Chi Kok Plaza Hollywood, Diamond Hill Heng Fa Chuen MTR Station Exit D,Shek Mun MTR Station Shun Tak Centre, Sheung Wan Team E University MTR Station Tuen Mun MTR Station YOHO, Yuen Long Bus Terminial, Siu Sai Wan (Near Footbridge) Team F Kowloon Tong MTR Station Qurray Bay MTR Station Tai Wan MTR Station Tai Shui Hang MTR Station Ocean Walk, Tuen Mun Prince Edward Road, Kowloon City Team G Tin Hau MTR Station Home Suqare,Sha Tin Skyline Plaza, Tsuen Wan (Near AEON) South Horizon MTR Station (Near Hang Seng Bank) Team H Central Library, Causeway Bay South Horizon MTR Station Hoi Fu Court,Mongkok Kennedy Town MTR station Aberdeen Centre Shun Tak Centre, Sheung Wan Shun Tak Centre, Sheung Wan Team I Day-Off Shun Lee Commercial Centre, Kwun Tong Shun Lee Commercial Centre, Kwun Tong (Near Footbridge) (Near Footbridge) Infinitus Plaza, Sheung Wan Infinitus Plaza, Sheung Wan Shun Tak Centre, Sheung Wan Shun Tak Centre, Sheung Wan Team J Day-Off (Near Footbridge) (Near -

Directors and Parties Involved in the Share Offer

DIRECTORS AND PARTIES INVOLVED IN THE SHARE OFFER DIRECTORS Name Address Nationality Executive Directors Room 401 Chinese (Mr. Jiang Quanlong) No.32 Duifangxincun Yicheng Street Yixing City Jiangsu Province the PRC No.81 Shugu Chinese (Mr. Fan Yajun) Xiwang Village Dingshu Town Yixing City Jiangsu Province the PRC No.16 Yindingxu Chinese (Mr. Fang Guohong) Fangjia Village Dingshu Town Yixing City Jiangsu Province the PRC Room 12 Chinese (Mr. Gan Yi) No.43 Lane 136 Pudong Avenue Pudong New District Shanghai the PRC Room 301 Chinese (Mr. Jiang Lei) No.13 Lane 3329 Hongmei Road Minhang District Shanghai the PRC −40− DIRECTORS AND PARTIES INVOLVED IN THE SHARE OFFER Independent non-executive Directors Room 3004 Chinese (Mr. Lai Wing Lee) Hong Ting House Hong Yat Court Lamtin Kowloon Hong Kong No.11 Floor 6 Chinese (Professor Wang Guozhen) Block 9 No.12 Fuxing Road Haidian District Beijing the PRC Room H, Floor 19 Chinese (Mr. Leung Shu Sun, Sunny) Block 23A South Horizons Ap Lei Chau Hong Kong −41− DIRECTORS AND PARTIES INVOLVED IN THE SHARE OFFER PARTIES INVOLVED Sponsor Taifook Capital Limited 25th Floor, New World Tower 16-18 Queen’s Road Central Hong Kong Sole Bookrunner and Taifook Securities Company Limited Sole Lead Manager 25th Floor, New World Tower 16-18 Queen’s Road Central Hong Kong Placing Underwriter Taifook Securities Company Limited 25th Floor, New World Tower 16-18 Queen’s Road Central Hong Kong Public Offer Underwriters Taifook Securities Company Limited 25th Floor, New World Tower 16-18 Queen’s Road Central Hong Kong China Merchants Securities (HK) Co., Ltd. -

13 Corp Info EPHIP154898 51..52

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED ‘‘WARNING’’ ON THE COVER OF THIS DOCUMENT. CORPORATE INFORMATION Registered office PO Box 1350 Clifton House 75 Fort Street Grand Cayman KY1-1108 Cayman Islands Headquarters and principal place of Suite 2105–2, 2/F business in Macau The Boulevard City of Dreams Cotai Macau Principal place of business in Hong Kong Room 1505, 15/F., Shun Tak Centre West Tower registered under Part 16 of the 168–200 Connaught Road Central Companies Ordinance Sheung Wan Hong Kong Company website www.lukhing.com (information contained in this website does not form part of this document) Company secretary Ms.LiOiLai(李愛麗) (ACIS, ACS, FCPA, FAIA) 18/F, Tesbury Centre 28 Queen’sRoadEast Wanchai, Hong Kong Compliance officer Mr. Choi Siu Kit (蔡紹傑) Flat B, 27/F Kingsford Height 17 Babington Path Mid-Levels, Hong Kong Authorised representatives Mr. Choi Siu Kit (蔡紹傑) Flat B, 27/F Kingsford Height 17 Babington Path Mid-Levels, Hong Kong Ms.LiOiLai(李愛麗) (ACIS, ACS, FCPA, FAIA) 18/F, Tesbury Centre 28 Queen’sRoadEast Wanchai, Hong Kong – 51 – THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED ‘‘WARNING’’ ON THE COVER OF THIS DOCUMENT. CORPORATE INFORMATION Audit Committee Mr.ChanTingBondMichael(陳定邦) (chairman) Mr. Lam Wai Chin Raymond (林偉展) Mr. Au Wai Pong Eric (區偉邦) Remuneration Committee Mr. Lam Wai Chin Raymond (林偉展) (chairman) Mr. Tse Kar Ho Simon (謝嘉豪) Mr. -

Service & Rental

CORPORATE PROFILE MILESTONES FINANCIAL HIGHLIGHTS CHAIRMAN’S STATEMENT BOARD OF DIRECTORS CORPORATE GOVERNANCE HUMAN CAPITAL REPORT Project Key Facts and Figures SERVICE & RENTAL Facilities • HKCEC (Management) Rental • ATL Logistics Centre Hong Kong (56%) • ATL Logistics Centre Yantian (46.17%) Contracting • Hip Hing Construction • NWS Engineering Group • Vibro (99.83%) • Young’s Engineering • Ngo Kee Construction • Majestic Engineering • Barbican Construction • Far East Engineering • Extensive Trading • NWS Engineering • Team Deco • Millennium Engineering (90.4%) • Kentfull Contracting • Quon Hing (50%) • Wai Kee (26.97%) • Build King (22.24%) Transport • New World First Bus (50%) • Citybus (50%) • New World First Bus (China) (50%) • New World First Ferry (50%) • New World First Ferry (Macau) (50%) • New World First Travel (50%) • Kwoon Chung Bus (14.95%) Others • Urban Property • New China Laundry • International Property (99%) • Sky Connection • Kiu Lok • Care & Services • Kiu Lok (China) • CiF Solutions • Urban Parking • New World Insurance • General Security • Hong Kong Island Landscape • Uniformity • Tricor Holdings (24.39%) • Pollution & Protection Services • Taifook Securities (22.22%) • Wai Hong Cleaning As at 30 June 2006 154 NWS Holdings Limited CORPORATE CITIZENSHIP MANAGEMENT DISCUSSION REPORTS AND FINANCIAL GLOSSARY OF TERMS FIVE-YEAR FINANCIAL PROJECT KEY FACTS CORPORATE INFORMATION AND ANALYSIS STATEMENTS SUMMARY AND FIGURES FACILITIES RENTAL Hong Kong Convention and ATL Logistics Centre Hong Kong Limited Exhibition Centre (Management) Limited Attributable Interest 56% Services Offered Management and operation of venues for Form of Investment Equity exhibitions, conventions, meetings, Lettable Area 5.9 million sq ft entertainment, special events, banquets Location Berth 3, Kwai Chung Container and catering events, etc Terminals, Hong Kong Gross Rentable Space 70,086 sq m* Operation Dates Phase I: February 1987 No. -

Branch List English

Telephone Name of Branch Address Fax No. No. Central District Branch 2A Des Voeux Road Central, Hong Kong 2160 8888 2545 0950 Des Voeux Road West Branch 111-119 Des Voeux Road West, Hong Kong 2546 1134 2549 5068 Shek Tong Tsui Branch 534 Queen's Road West, Shek Tong Tsui, Hong Kong 2819 7277 2855 0240 Happy Valley Branch 11 King Kwong Street, Happy Valley, Hong Kong 2838 6668 2573 3662 Connaught Road Central Branch 13-14 Connaught Road Central, Hong Kong 2841 0410 2525 8756 409 Hennessy Road Branch 409-415 Hennessy Road, Wan Chai, Hong Kong 2835 6118 2591 6168 Sheung Wan Branch 252 Des Voeux Road Central, Hong Kong 2541 1601 2545 4896 Wan Chai (China Overseas Building) Branch 139 Hennessy Road, Wan Chai, Hong Kong 2529 0866 2866 1550 Johnston Road Branch 152-158 Johnston Road, Wan Chai, Hong Kong 2574 8257 2838 4039 Gilman Street Branch 136 Des Voeux Road Central, Hong Kong 2135 1123 2544 8013 Wyndham Street Branch 1-3 Wyndham Street, Central, Hong Kong 2843 2888 2521 1339 Queen’s Road Central Branch 81-83 Queen’s Road Central, Hong Kong 2588 1288 2598 1081 First Street Branch 55A First Street, Sai Ying Pun, Hong Kong 2517 3399 2517 3366 United Centre Branch Shop 1021, United Centre, 95 Queensway, Hong Kong 2861 1889 2861 0828 Shun Tak Centre Branch Shop 225, 2/F, Shun Tak Centre, 200 Connaught Road Central, Hong Kong 2291 6081 2291 6306 Causeway Bay Branch 18 Percival Street, Causeway Bay, Hong Kong 2572 4273 2573 1233 Bank of China Tower Branch 1 Garden Road, Hong Kong 2826 6888 2804 6370 Harbour Road Branch Shop 4, G/F, Causeway Centre, -

Corporate Information

ANNUAL REPORT 2006 • HOPEFLUENT GROUP HOLDINGS LIMITED Corporate Information BOARD OF DIRECTORS JOINT AUDITORS Executive Directors Deloitte Touche Tohmatsu Mr. FU Wai Chung (Chairman) Certified Public Accountants Ms. NG Wan 35th Floor, One Pacific Place Ms. FU Man 88 Queensway Mr. Lo Yat Fung Hong Kong Zhong Yi (Hong Kong) C.P.A. Company Limited Independent Non-Executive Directors 9th Floor, Chinachem Hollywood Centre 1-13 Hollywood Road Mr. LAM King Pui Central, Hong Kong Mr. NG Keung Mrs. WONG Law Kwai Wah, Karen LEGAL ADVISERS Stevenson, Wong & Co. MEMBERS OF AUDIT COMMITTEE 4/F & 5/F, Central Tower Mr. LAM King Pui AHKSA, CPA, FCCA, ACS, ACIS 28 Queen’s Road Central Mr. NG Keung Hong Kong Mrs. WONG Law Kwai Wah, Karen PRINCIPAL BANKERS MEMBERS OF REMUNERATION COMMITTEE Industrial and Commercial Bank of China Mr. LAM King Pui AHKSA, CPA, FCCA, ACS, ACIS Room 358, Citic Plaza Mr. NG Keung 233 Tian Ho Bei Road Mrs. WONG Law Kwai Wah, Karen Guangzhou, PRC Agricultural Bank of China COMPANY SECRETARY 1/F Guangzhou International Trade Centre 1 Linhe Xi Lu Mr. LO Hang Fong, solicitor, Hong Kong Guangzhou, PRC AUTHORISED REPRESENTATIVES PRINCIPAL SHARE REGISTRAR AND Mr. FU Wai Chung TRANSFER OFFICE Mr. LO Yat Fung Bank of Butterfield International (Cayman) Ltd. Butterfield House, 68 Fort Street P.O. Box 705 REGISTERED OFFICE George Town, Grand Cayman Cricket Square Cayman Islands Hutchins Drive British West Indies P.O. Box 2681 Grand Cayman KY1-1111 Cayman Islands HONG KONG BRANCH SHARE REGISTRAR AND TRANSFER OFFICE 26th Floor HEAD OFFICE AND PRINCIPAL PLACE OF BUSINESS Tesbury Centre 8th Floor, International Trade Center 28 Queen’s Road East 1 Linhe Xi Lu Wanchai, Hong Kong Tianhe District Guangzhou PRC STOCK CODE 733 PLACE OF BUSINESS IN HONG KONG Room 3411, 34th Floor HOME PAGE Shun Tak Centre West Tower www.hopefluent.com 200 Connaught Road Central Hong Kong 02. -

When Is the Best Time to Go to Hong Kong?

Page 1 of 98 Chris’ Copyrights @ 2011 When Is The Best Time To Go To Hong Kong? Winter Season (December - March) is the most relaxing and comfortable time to go to Hong Kong but besides the weather, there's little else to do since the "Sale Season" occurs during Summer. There are some sales during Christmas & Chinese New Year but 90% of the clothes are for winter. Hong Kong can get very foggy during winter, as such, visit to the Peak is a hit-or-miss affair. A foggy bird's eye view of HK isn't really nice. Summer Season (May - October) is similar to Manila's weather, very hot but moving around in Hong Kong can get extra uncomfortable because of the high humidity which gives the "sticky" feeling. Hong Kong's rainy season also falls on their summer, July & August has the highest rainfall count and the typhoons also arrive in these months. The Sale / Shopping Festival is from the start of July to the start of September. If the sky is clear, the view from the Peak is great. Avoid going to Hong Kong when there are large-scale exhibitions or ongoing tournaments like the Hong Kong Sevens Rugby Tournament because hotel prices will be significantly higher. CUSTOMS & DUTY FREE ALLOWANCES & RESTRICTIONS • Currency - No restrictions • Tobacco - 19 cigarettes or 1 cigar or 25 grams of other manufactured tobacco • Liquor - 1 bottle of wine or spirits • Perfume - 60ml of perfume & 250 ml of eau de toilette • Cameras - No restrictions • Film - Reasonable for personal use • Gifts - Reasonable amount • Agricultural Items - Refer to consulate Note: • If arriving from Macau, duty-free imports for Macau residents are limited to half the above cigarette, cigar & tobacco allowance • Aircraft crew & passengers in direct transit via Hong Kong are limited to 20 cigarettes or 57 grams of pipe tobacco. -

Shun Tak Holdings Limited 信德集團有限公司

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SHUN TAK HOLDINGS LIMITED 信 德 集 團 有 限 公 司 (Incorporated in Hong Kong with limited liability) (Stock Code: 242) Website: http://www.shuntakgroup.com MAJOR TRANSACTION ACQUISITION OF THE SALE SHARES IN THE TARGET COMPANY THE ACQUISITION On 29 June 2020, the Buyer (an indirect wholly-owned subsidiary of the Company), the Company (as guarantor of the Buyer) and the Vendor entered into the Agreement, pursuant to which, amongst others, the Buyer conditionally agreed to acquire, and the Vendor conditionally agreed to sell, the Sale Shares and the Shareholder’s Loan for the Base Consideration of HK$2,361,195,928 (subject to the Post-Completion Adjustment) in accordance with the terms and conditions of the Agreement. The Sale Shares, being 450 A Shares and 450 B Shares, shall be entitled to a pro rata share of the profits and the net assets of the Target Group attributable to or comprised in the A Fund, which comprises the Properties situated in Central, Hong Kong, and the B Fund, respectively. LISTING RULES IMPLICATIONS As one of the applicable percentage ratios (as defined in Rule 14.07 of the Listing Rules) exceeds 25% but is less than 100%, the Agreement and the transactions contemplated thereunder constitute a major transaction for the Company, and are therefore subject to the reporting, announcement and shareholders’ approval requirements pursuant to Chapter 14 of the Listing Rules. -

Hong Kong Monthly Review and Commentary on Hong Kong’S Property Market

RESEARCH DECEMBER 2018 HONG KONG MONTHLY REVIEW AND COMMENTARY ON HONG KONG’S PROPERTY MARKET Office Residential Retail Early signs of Mainland firms Sellers slashed prices to Caution over Christmas sales retreating complete transactions performance PRIME OFFICE Hong Kong Island Kowloon The Grade-A office leasing market on As expected, trade war has a visible Hong Kong Island remained subdued impact on leasing activities on the as uncertainties in the global economy Kowloon side, with around 80 transactions loomed large. Overall rents dipped recorded compared to over 100 on slightly by 0.2% month on month (MoM) average in the past. Although this is a in November, the first drop in 29 months. slight improvement from October when Rents in Central declined by 0.3% MoM, there were only 70 deals. Demand mainly ending the rally that lasted for almost came from IT and electronics sectors. three years. A number of significant leasing Sentiment is weak but this is also a transactions, however, were recorded traditionally low season, so there was during the month, most of them in no large leasing transaction in Central Kowloon East. Two of them were in Neo, Office rents on Hong Kong during the month. The deals recorded a new building in Kwun Tong which is Island reached a turning ranged from 3,000 to 6,000 sq ft. scheduled to open in 2019. Each of the Meanwhile, under financial impact there deals involved two floors with an area of point amid trade war. were early signs of Mainland firms 63,000 sq ft, at a rent of between HK$37 retreating when a few small-sized office to HK$39 per sq ft. -

Shanghai & Hong Kong

1 SHANGHAI & HONG KONG Viaggio di Architettura 15-24 MARZO 2012 1° GIORNO: FIRENZE – HONG KONG Ritrovo dei partecipanti all’aeroporto di Firenze; disbrigo delle formalità doganali e partenza con volo di linea per Hong Kong via Francoforte. 2° GIORNO: HONG KONG Al mattino arrivo a Hong Kong. Incontro con la guida e trasferimento con bus privato in hotel, sistemazione nelle camere riservate. Tempo a disposizione. Pranzo libero. Nel pomeriggio inizio della visita della città con i seguenti edifici: • BANK OF CHINA TOWER, Ieoh Ming Pei, 1985 – 1989 • PEAK TOWER, Terry Farrell & Partners, 1995 • EXCHANGE SQUARE (building complex : ONE EXCHANGE SQUARE, TWO EXCHANGE SQUARE, THREE EXCHANGE SQUARE), Palmer & Turner, 1988 • COSCO TOWER, Hsin Yieh Architect & Associates, 1998 Cena libera. Rientro in hotel in serata. Pernottamento. 3° GIORNO: HONG KONG Prima colazione in hotel. Al mattino incontro con la guida e visita dei seguenti edifici: • 2IFC TWO INTERNATIONAL FINANCIAL CENTRE, Rocco Design Architect Limited, Cesare Pelli & Associated Archited, 1997 - 2003 • HONG KONG AND SHANGHAI BANK, Norman Foster, 1979 – 1985 • LEGISLATIVE COUNCIL BUILDING, Sir Aston Webb & Ingress Bell,1912 • ONE ISLAND EAST, Wong & Ouyang, 2006 - 2008 • CHEUNG KONG CENTER, Leo A. Daly, Cesare Pelli, 1999 SOGNARE INSIEME VIAGGI tel. 0967998744-998258-Fax. 096794914 [email protected] www.sognareinsiemeviaggi.com • HONG KONG CONVENTION & EXHIBITION CENTER, Dennis Lau and Ng Chun Man, 1995 - 1997 • MIDLEVELS ESCALATOR, ingegneri civili della Palmer & Turner Architetcts e engeneers, 1993 • SHANGRI – LA HOTEL, Wong & Ouyang (HK) Ltd., 1991 • HIGHCLIFF, Dennis Lau and Ng Chun Man, 2000 – 2003 Pranzo libero in corso d’escursione. Cena libera. Rientro in hotel in serata. -

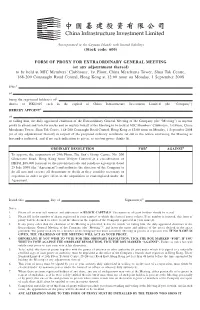

(Stock Code: 600) FORM of PROXY for EXTRAORDINARY GENERAL

(Incorporated in the Cayman Islands with limited liability) (Stock code: 600) FORM OF PROXY FOR EXTRAORDINARY GENERAL MEETING (or any adjournment thereof) to be held at MJC Members’ Clubhouse, 1st Floor, China Merchants Tower, Shun Tak Centre, 168-200 Connaught Road Central, Hong Kong at 12:00 noon on Monday, 1 September 2008 I/We1 of being the registered holder(s) of2 shares of HK$0.05 each in the capital of China Infrastructure Investment Limited (the “Company”) HEREBY APPOINT3 of or failing him, the duly appointed chairman of the Extraordinary General Meeting of the Company (the “Meeting”) as my/our proxy to attend and vote for me/us and on my/our behalf at the Meeting to be held at MJC Members’ Clubhouse, 1st Floor, China Merchants Tower, Shun Tak Centre, 168-200 Connaught Road Central, Hong Kong at 12:00 noon on Monday, 1 September 2008 (or at any adjournment thereof) in respect of the proposed ordinary resolution set out in the notice convening the Meeting as hereunder indicated, and if no such indication is given, as my/our proxy thinks fit. ORDINARY RESOLUTION FOR4 AGAINST4 To approve the acquisition of 29th Floor, The Sun’s Group Centre, No. 200 Gloucester Road, Hong Kong from Wellyet Limited at a consideration of HK$81,268,000 pursuant to the provisional sale and purchase agreement dated 25 July 2008 (the “Agreement”) and authorise the directors of the Company to do all acts and execute all documents or deeds as they consider necessary or expedient in order to give effect to the acquisition as contemplated under the Agreement. -

This Announcement Is for Information Purposes Only and Does Not Constitute an Invitation Or Offer to Acquire, Purchase Or Subscribe for Securities

This announcement is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for securities. The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”) and Hong Kong Securities Clearing Company Limited (“HKSCC”) take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. In connection with the Global Offering, Goldman Sachs (Asia) L.L.C. (“Goldman Sachs”), as stabilizing manager, and/or its affiliates and agents on behalf of the Underwriters, may over-allocate or effect transactions with a view to stabilising or maintaining the market price of the H Shares at a level higher than that which might otherwise prevail for a limited period commencing from the day on which the H Shares commence trading on the Stock Exchange. However, there is no obligation on Goldman Sachs or any person acting for it to conduct any such stabilizing action. Such stabilization may be effected in all jurisdictions where it is permissible to do so, in each case in compliance with all applicable laws and regulatory requirements, including the Securities and Futures (Price Stabilizing) Rules made under the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong). Such stabilization, if commenced, will be conducted at the absolute discretion of the stabilizing manager or any person acting for it and may be discontinued at any time, and must be brought to an end after a limited period.