Predictability Power of Interest Rate and Exchange Rate Volatility on Stock Market Return and Volatility: Evidence from Bursa Malaysia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

22 March 2019 FINAL TERMS the REPUBLIC of GHANA Legal Entity Identifier (LEI): 213800PP4399SNNXZ126 Issue of U.S.$1,000,000,000

22 March 2019 FINAL TERMS THE REPUBLIC OF GHANA Legal entity identifier (LEI): 213800PP4399SNNXZ126 Issue of U.S.$1,000,000,000 8.950 per cent. Amortising Notes due 2051 under the Global Medium Term Note Programme PART A – CONTRACTUAL TERMS MIFID II product governance / Professional investors and ECPs only target market – Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties and professional clients only, each as defined in Directive 2014/65/EU (as amended, “MiFID II”); and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturers' target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels. In connection with Section 309B of the Securities and Futures Act (Chapter 289) of Singapore (the “SFA”) and the Securities and Futures (Capital Markets Products) Regulations 2018 of Singapore (the “CMP Regulations 2018”), the Issuer has determined the classification of the Notes as prescribed capital markets products (as defined in the CMP Regulations 2018) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12: Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products). -

Smes and Public Equity Financing: a New Dataset of SME Boards in Emerging-Market and Developing Economies

SMEs and Public Equity Financing: A New Dataset of SME Boards in Emerging-Market and Developing Economies John Schellhase and Jim Woodsome August 2017 Introduction In recent years, a number of stock exchanges in emerging-market and developing economies have established dedicated market segments for small and medium-sized enterprises (SMEs). The main purpose of these SME boards, as they are often called, is to expand access to equity finance for relatively small but growing firms with the potential, as a group, to significantly contribute to economic growth and employment. In some cases, SME boards also serve as feeder exchanges, incubating firms for later graduation to a stock exchange’s main board. Today, there around 30 dedicated SME boards in emerging-market and developing economies, the majority of which have been established in the last decade or so. Due to the role these firms can play in creating jobs and diversifying economies, improving access to finance for SMEs is a long-standing policy goal in developed and developing countries alike. As banks have curbed their lending to SMEs in the wake of the global financial crisis, policymakers and industry bodies are now increasingly emphasizing non-bank financing alternatives for SMEs. Public equity financing is one option that may be suitable for fast-growing SMEs with the capacity to meet the listing requirements. SME boards may contribute to expanding financial access for SMEs both directly, by facilitating access to public equity financing, and indirectly, by incentivizing listing firms to improve their financial reporting and corporate governance practices, which may, in turn, make them more appealing to credit-based lenders. -

ASHESI UNIVERSITY COLLEGE HOW the GHANA STOCK EXCHANGE (GSE) CAN BE IMPROVED by CHARLES ANTWI AGYEMAN Dissertation Submitted To

ASHESI UNIVERSITY COLLEGE HOW THE GHANA STOCK EXCHANGE (GSE) CAN BE IMPROVED By CHARLES ANTWI AGYEMAN Dissertation submitted to the Department of Business Administration Ashesi University College In partial fulfillment of the requirements for the award of Bachelor of Science degree in Business Administration APRIL 2010 DECLARATION I hereby declare that this dissertation is the result of my own original work and that no part of it has been presented for another degree in this university or elsewhere. Candidate‟s Signature: ……………………………….……………………………………………………… Candidate‟s Name: ……………………………………………………………………………………………. Date: …………………………………………………………………………………………………………………… I hereby declare that the preparation and presentation of the thesis were supervised in accordance with the guidelines on supervision of thesis laid down by Ashesi University College. Supervisor‟s Signature: ……………………………………………………………………………………… Supervisor‟s Name: …………………………………………………………………………………………… Date: …………………………………………………………………………………………………………………… i ACKNOWLEDGEMENTS My profound gratitude goes to God Almighty, most gracious, most merciful, who gives wisdom, knowledge and understanding and makes all things beautiful in His time. I would like to thank my supervisor, Mr. Anthony Essel-Anderson, who made it possible for me to finish my research work. I am also grateful to the Head of Department, Dr. Esi Ansah for her valuable help and support throughout this thesis. I dedicate this work to my mum, Margaret Ofosua and my dad, Maxwell Agyeman for their love and unwavering support both financially and emotionally throughout my years of education to this level. I express my heartfelt gratitude to all my siblings- Augustine, Mavis, Isaac and Prince Agyeman for their love, unflinching support and prayers. I will also like to acknowledge Miss Joyce R. Aryee, Mr. J. D. Mpere, Rev. Isaac Akyirefi, Edem Dewotor and Pastor Joshua Amissah for being my coaches, mentors and spiritual parents. -

African Markets Review

AFRICAN MARKETS REVIEW Tuesday, July 07, 2020 Exchange rates, as of Highlights Monday July 6th, 2020 Exchange rates Currency Last Market Data in USD USD EUR 1 MAD 0.10365 0.09163 Data in USD Market 1 TND 0.35348 0.31247 Volume (in m) Market Cap. (in bn) 1 XOF 0.00172 0.00152 Morocco 7.0 54.4 1 EGP 0.06227 0.05505 Tunisia 1.5 8.0 1 TZS 0.00043 0.00038 West Africa 0.2 6.9 1 MUR 0.02515 0.02223 Egypt 27.5 37.7 1 KES 0.00938 0.00829 Tanzania 0.6 6.5 1 NGN 0.00259 0.00229 Mauritius 0.7 8.5 1 GHS 0.17212 0.15215 Kenya 5.2 19.8 Nigeria 4.8 32.8 Source: Six Financial Information Ghana 0.0 9.1 Cryptocurrency, as of Source: Six Financial Information Monday July 6th, 2020 Exchange rates Bitcoin In Morocco, overall compensation expense down 6% to MAD 5.6bn at the end of May Rate Day ch. 2020 year-on-year; USD 9,125 0.7% In Tunisia, THE COMMONWEALTH DEVELOPMENT CORPORATION and FINFUND have injected USD 70m into the Fund, bringing its present value to USD 202m; Egypt’s state-owned automotive manufacturing company and China’s DONGFENG Source: Six Financial Information MOTOR signed an agreement on June 18 to produce electric cars for the first time in Egypt; Commodities, as of Poor performances all around among the covered African markets, except for the Monday July 6th, 2020 Kenyan Stock Exchange which recorded an increase of 1.13%. -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Over 100 Exchanges Worldwide 'Ring the Bell for Gender Equality in 2021' with Women in Etfs and Five Partner Organizations

OVER 100 EXCHANGES WORLDWIDE 'RING THE BELL FOR GENDER EQUALITY IN 2021’ WITH WOMEN IN ETFS AND FIVE PARTNER ORGANIZATIONS Wednesday March 3, 2021, London – For the seventh consecutive year, a global collaboration across over 100 exchanges around the world plan to hold a bell ringing event to celebrate International Women’s Day 2021 (8 March 2020). The events - which start on Monday 1 March, and will last for two weeks - are a partnership between IFC, Sustainable Stock Exchanges (SSE) Initiative, UN Global Compact, UN Women, the World Federation of Exchanges and Women in ETFs, The UN Women’s theme for International Women’s Day 2021 - “Women in leadership: Achieving an equal future in a COVID-19 world ” celebrates the tremendous efforts by women and girls around the world in shaping a more equal future and recovery from the COVID-19 pandemic. Women leaders and women’s organizations have demonstrated their skills, knowledge and networks to effectively lead in COVID-19 response and recovery efforts. Today there is more recognition than ever before that women bring different experiences, perspectives and skills to the table, and make irreplaceable contributions to decisions, policies and laws that work better for all. Women in ETFs leadership globally are united in the view that “There is a natural synergy for Women in ETFs to celebrate International Women’s Day with bell ringings. Gender equality is central to driving the global economy and the private sector has an important role to play. Our mission is to create opportunities for professional development and advancement of women by expanding connections among women and men in the financial industry.” The list of exchanges and organisations that have registered to hold an in person or virtual bell ringing event are shown on the following pages. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

THE REPUBLIC of GHANA Global Medium Term Note Programme

THE REPUBLIC OF GHANA Global Medium Term Note Programme Under this Global Medium Term Note Programme (the “Programme”), the Republic of Ghana (the “Issuer”) may from time to time issue notes (the “Notes”) denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). Notes may be issued in bearer or registered form (respectively “Bearer Notes” and “Registered Notes”). The Notes may be issued on a continuing basis to one or more of the Dealers specified under “Overview of the Programme” and any additional Dealer appointed under the Programme from time to time by the Issuer (each a “Dealer” and together the “Dealers”), which appointment may be for a specific issue or on an ongoing basis. References in this Base Prospectus to the “relevant Dealer” shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see “Risk Factors”. This Base Prospectus has been approved as a base prospectus by the Financial Conduct Authority (the "FCA") as competent authority under Regulation (EU) 2017/1129 (the "Prospectus Regulation"). The FCA only approves this Base Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Approval by the FCA should not be considered as an endorsement of the Issuer or of the quality of the Notes that are the subject of this Base Prospectus. Investors should make their own assessment as to the suitability of the Notes. -

The Impact of Financial Indicators Towards Stock Returns of Finance

International Journal of Academic Research in Accounting, Finance and Management Sciences Vol. 8, No.3, July 2018, pp. 128–140 E-ISSN: 2225-8329, P-ISSN: 2308-0337 © 2018 HRMARS www.hrmars.com To cite this article: De Kai, K. Bin Abd Rahman, I. (2018). The Impact of Financial Indicators towards Stock Returns of Finance Companies Listed on Bursa Malaysia, International Journal of Academic Research in Accounting, Finance and Management Sciences 8 (3): 128-140. http://dx.doi.org/10.6007/IJARAFMS/v8-i3/4546 (DOI: 10.6007/IJARAFMS/v8-i3/4546) The Impact of Financial Indicators towards Stock Returns of Finance Companies Listed on Bursa Malaysia Khoo De Kai1, Ismail Bin Abd Rahman2 1Azman Hashim International Business School, Universiti Teknologi Malaysia/Asian Institute of Chartered Bankers, Malaysia, 1E-mail: [email protected] (Corresponding author) 2Azman Hashim International Business School, Universiti Teknologi Malaysia, 2E-mail: [email protected] Abstract This research was conducted to examine the relationship between financial indicators which are Earning per Share growth (EPS), Return on Equity growth (ROE) and Dividend per Share growth (DPS) against stock returns of finance companies. The targeted population consists of 31 out of 32 finance companies listed on Bursa Malaysia. Financial indicators and stock returns data are collected within the period from year 2011 to 2016. The data were analyzed by Pearson Correlation method through SPSS software. The finding of the research indicates that there are 5 finance companies show a significant relationship between EPS growth and stock returns, followed by 5 finance companies show a significant relationship between ROE growth and stock return. -

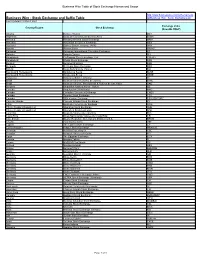

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

Testing the Conditional Volatility of Saudi Arabia

Academy of Accounting and Financial Studies Journal Volume 25, Issue 2, 2021 TESTING THE CONDITIONAL VOLATILITY OF SAUDI ARABIA STOCK MARKET: SYMMETRIC AND ASYMMETRIC AUTOREGRESSIVE CONDITIONAL HETEROSKEDASTICITY (GARCH) APPROACH Jumah Ahmad Alzyadat, Dar Aluloom University Ala’a Adden Abuhommous, Mutah University Huthaifa Alqaralleh, Mutah University ABSTRACT The study aims to investigate the presence of conditional volatility in the Saudi Arabia stock market returns. The daily closing equity market price indices for Saudi stock exchange (Tadawul) covered the period Sep. 2017 to Sep. 2020. The sample was carefully chosen to present only the significant event affecting the stock market, specifically, the COVID-19 pandemic. The study applies the nonlinear GARCH-class models along with the best fitting distribution accounting for the skewness and excess kurtosis in return modeling. The estimation results reveal evidence of an inverted asymmetric effect during the calm time before COVID-19 pandemic. However, strong evidence of news effect was detected as the health crisis began. Keywords: Saudi Stock Market, Conditional Volatility, GARCH, COVID-19 Pandemic, Stock Market Returns. INTRODUCTION The issue of stock market volatility has always been a great importance to financial market participants, researchers and even the public, volatility is often associated with the concept of risk. In the context of a financial crisis, terms such as forecasting volatility or managing risk are among the most important topics in the financial world today. Financial market volatility has historically played a critical role in financial decision-making and volatility forecasts have important applications in areas such as asset pricing, risk management, hedging strategies, and portfolio allocation, as well as forecasting of value at risk (VaR) and optimum capital charges (Miron & Tudor, 2010). -

CTM Common Reference Data Document

CTM™ COMMON REFERENCE DATA AUGUST 22, 2021 © 2021 DTCC. All rights reserved. DTCC, DTCC (Stylized), ADVANCING FINANCIAL MARKETS. TOGETHER, and the Interlocker graphic are registered and unregistered trademarks of The Depository Trust & Clearing Corporation. The services described herein are provided under the “DTCC” brand name by certain affiliates of The Depository Trust & Clearing Corporation (“DTCC”). DTCC itself does not provide such services. Each of these affiliates is a separate legal entity, subject to the laws and regulations of the particular country or countries in which such entity operates. Please see www.dtcc.com for more information on DTCC, its affiliates and the services they offer.Certain DTCC ITP LLC services are subject to regulation by the U.S. Securities and Exchange Commission (“SEC”) and are offered by DTCC ITP Matching (US) LLC (“DTCC Matching”), which is set out in SEC Release No. 34-44188; File No. 600-32; 66 FR 20494 (April 17, 2001). TradeSuite ID and CTM are services of DTCC Matching and are subject to SEC regulation when used for trades in which either the broker-dealer or its institutional customer is a U.S. entity and the securities in the trade are issued by a U.S. issuer. No other services offered by DTCC ITP LLC are regulated. Publication Date: August 22, 2021 Publication Code: CT940 Title: Common Reference Data CONTENTS CONTENTS 3 PREFACE 6 Audience 6 Changes in This Version of the Document 6 Related Documents and Training 6 Questions? 6 1. COMMON REFERENCE DATA 7 Overview 7 Introduction 7 Relation of This Manual to Other Documentation 7 How to Use the Tables 7 Tables That Refer to ISO and SMPG Standards 7 Tables That Refer to ALERT Codes 8 2.