Consensus Revenue Estimates Are Based on Current Federal and State Laws and Their Current Interpretation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NOVEMBER 6, 1979 WASHINGTON, D.Cl THME DAY 8:35 A.M

THE WHITE HOUSE WASHINGTON, D.C. 5:30 a.m. TUESDAY From 1 To 5:30 The President received a wake up call from the White House signal board operator. 6:02 The President went to the Oval Office. 6:46 6:50 The President talked with Secretary of State Cyrus R. Vance. The President telephoned Secretary. Vance. The call was not completed. 7:ll The President talked with Secretary Vance. 7:ll 7:12 The President talked with his Press Secretary, Joseph L. "Jody" Powell. IA6 7:22 The President talked with Coretta Scott King, President of the Martin Luther King, Jr. Center for Social Change, Atlanta, Georgia. The President met with: 7:30 7:50 Zbigniew Brzezinski, Assistant for National Security Affairs 7:45 ’ 7:50 Walter F. Mondale, Vice President I 7:46 1 7:47 The President talked with his Personal Assistant and Secretary, Susan S. Clough. 7:56 The President talked with Secretary of Defense Harold Brown. The President met to discuss the situation in Iran with: 8:OO 8:30 Secretary Vance 8:00 8:30 Mr. Brzezinski 8:00 I 8:30 1 David D. Newsom, Under Secretary of State for Political Affairs 8:00 8:30 Gary Sick, Staff Member, National Security Council (NSC) 8:32 Mr. Powell 8:30 Secretary Brown 8:25 1 8:30 I Hamilton Jordan, Chief of Staff i The President met with: 8:35 Mr. Jordan 5:35 Charles H. Kirbo, partner with King and Spalding Law firm, Atlanta, Georgia 8:35 It Robert H. Strauss, Ambassador at Large - designate continued THE DAlL’f DCARY OF PRESIDENT .llhAMY CARTER OATE WI. -

The Langston Letter October 28 - November 6, 1971 Langston University

Langston University Digital Commons @ Langston University Langston Letter Archives 10-28-1971 The Langston Letter October 28 - November 6, 1971 Langston University Follow this and additional works at: http://dclu.langston.edu/archives_langston_letter Recommended Citation Langston University, "The Langston Letter October 28 - November 6, 1971" (1971). Langston Letter. Paper 153. http://dclu.langston.edu/archives_langston_letter/153 This Article is brought to you for free and open access by the Archives at Digital Commons @ Langston University. It has been accepted for inclusion in Langston Letter by an authorized administrator of Digital Commons @ Langston University. For more information, please contact [email protected]. -detten. PUBLIC RELATIONS DEPT. Waitgston, (§klat|oma October 28-November 6, 1971 FROM THE DESK OF THE PRESIDENT; We will have our first faculty and staff meeting of this school year on Monday, November 1, 1971, 4:00 p. m. , in the Hargrove Music HalL Please be present and on time. Thursday, October 28, 1971 2:00 p. m. Live in Outdoor Concert, "The faddist 5" will present a Benefit Concert for Langston university students as part of the 1971-72 Fine Arts Series, There is no admission charge. The concert is open to all guests of the University, NOTE: In case of inclement weather, the concert will be held in the L W. Young Auditorium, 2:00 p. m„ All Business majors are requested to attend a Phi Beta Lambda meeting in Moore Hall in room-302, Payment of dues will be discussed and tutoring service in accounting will follow the meeting. 4:00 p„ m. Social Science Club meeting will be conducted in Moore HalL The club will discuss Black Her age Week and reading dynamics. -

Peoria Unified School District 6-Day Rotation Schedule

Peoria Unified School District 2020 – 2021 School Year Six-Day Rotation Schedule August 2020 January 2021 Day 1: August 17, 19 AM, 26 PM and 27 Day 1: January 6 PM, 11 and 22 Day 2: August 18 and 28 Day 2: January 12, 13 AM, 20 PM and 25 Day 3: August 23 and 31 Day 3: January 4, 14, 26 and 27 AM Day 4: August 21 Day 4: January 5, 15 and 28 Day 5: August 24 Day 5: January 7, 19 and 29 Day 6: August 25 Day 6: January 8 and 21 September 2020 February 2021 Day 1: September 8, 18 and 29 Day 1: February 2, 12 and 25 Day 2: September 2 AM, 9 PM, and 21 Day 2: February 4, 16 and 26 Day 3: September 11, 16 AM and 23 PM Day 3: February 3 PM, 5 and 18 Day 4: September 1, 14, 24 and 30 AM Day 4: February 8, 10 AM, 17 PM and 19 Day 5: September 3, 15 and 25 Day 5: February 9, 22 and 24 AM Day 6: September 4, 17 and 28 Day 6: February 1, 11 and 23 October 2020 March 2021 Day 1: October 9 and 22 Day 1: March 8, 25 and 31 AM Day 2: October 1, 13 and 23 Day 2: March 9 and 26 Day 3: October 2, 15 and 26 Day 3: March 1, 11 and 29 Day 4: October 5, 7 PM, 16 and 27 Day 4: March 2, 12 and 30 Day 5: October 6, 14 AM, 21 PM and 29 Day 5: March 3 PM, 4 and 22 Day 6: October 8, 20, 28 AM and 30 Day 6: March 5, 10 AM, 23 and 24 PM November 2020 April 2021 Day 1: November 2, 12 and 20 Day 1: April 5, 7 PM, 15 and 27 Day 2: November 3, 13 and 30 Day 2: April 6, 14 AM, 16, 21 PM and 29 Day 3: November 5 and 16 Day 3: April 8, 19, 28 AM and 30 Day 4: November 6 and 17 Day 4: April 9 and 20 Day 5: November 9 and 18 Day 5: April 1, 12 and 22 Day 6: November 4 PM, 10 and 19 Day 6: April 2, 13 and 26 December 2020 May 2021 Day 1: December 7, 15 and 16 AM Day 1: May 7 and 18 Day 2: December 8 and 17 Day 2: May 10 and 19 Day 3: December 1 and 9 Day 3: May 5 PM, 11 and 20 Day 4: December 2 and 10 Day 4: May 3, 12 AM, 13 Day 5: December 3 and 11 Day 5: May 4 and 14 Day 6: December 4 and 14 Day 6: May 6 and 17 EARLY RELEASE or MODIFIED WEDNESDAY • Elementary schools starting at 8 a.m. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

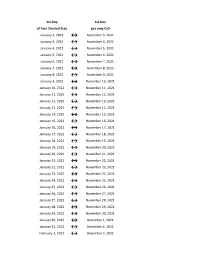

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 2, 2022 ↔ November 3, 2021 January 3, 2022 ↔ November 4, 2021 January 4, 2022 ↔ November 5, 2021 January 5, 2022 ↔ November 6, 2021 January 6, 2022 ↔ November 7, 2021 January 7, 2022 ↔ November 8, 2021 January 8, 2022 ↔ November 9, 2021 January 9, 2022 ↔ November 10, 2021 January 10, 2022 ↔ November 11, 2021 January 11, 2022 ↔ November 12, 2021 January 12, 2022 ↔ November 13, 2021 January 13, 2022 ↔ November 14, 2021 January 14, 2022 ↔ November 15, 2021 January 15, 2022 ↔ November 16, 2021 January 16, 2022 ↔ November 17, 2021 January 17, 2022 ↔ November 18, 2021 January 18, 2022 ↔ November 19, 2021 January 19, 2022 ↔ November 20, 2021 January 20, 2022 ↔ November 21, 2021 January 21, 2022 ↔ November 22, 2021 January 22, 2022 ↔ November 23, 2021 January 23, 2022 ↔ November 24, 2021 January 24, 2022 ↔ November 25, 2021 January 25, 2022 ↔ November 26, 2021 January 26, 2022 ↔ November 27, 2021 January 27, 2022 ↔ November 28, 2021 January 28, 2022 ↔ November 29, 2021 January 29, 2022 ↔ November 30, 2021 January 30, 2022 ↔ December 1, 2021 January 31, 2022 ↔ December 2, 2021 February 1, 2022 ↔ December 3, 2021 1st Day 1st Day of Your Desired Stay you may Call February 2, 2022 ↔ December 4, 2021 February 3, 2022 ↔ December 5, 2021 February 4, 2022 ↔ December 6, 2021 February 5, 2022 ↔ December 7, 2021 February 6, 2022 ↔ December 8, 2021 February 7, 2022 ↔ December 9, 2021 February 8, 2022 ↔ December 10, 2021 February 9, 2022 ↔ December 11, 2021 February 10, 2022 ↔ December 12, 2021 February -

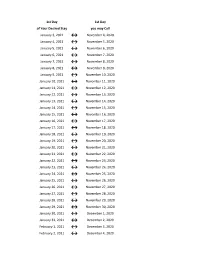

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

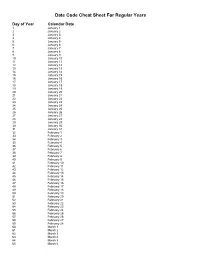

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

Dates for Student-Run Credit Unions 15-16 Northville Schools Northern Schools Novi & Livonia Schools

Dates for Student-Run Credit Unions 15-16 Northville Schools Northern Schools Novi & Livonia Schools Plymouth-Canton Elementary Schools: Bentley Bird Dodson Eriksson Credit Union Credit Union Credit Union Credit Union Tuesdays: Thursdays: October 6 Wednesdays: Tuesdays: October 13 October 20 October 7 October 20 October 27 November 10 October 28 November 10 November 17 November 24 November 18 December 1 December 8 December 8 December 16 December 15 January 5 January 12 January 5 January 6 January 19 January 26 January 19 January 27 February 2 February 9 February 2 February 10 February 23 March 1 February 23 March 2 March 8 March 15 March 8 March 23 March 22 April 5 March 22 April 13 April 12 April 5 May 4 April 19 April 26 April 19 May 25 May 3 May 10 May 17 May 3 Farrand Field Gallimore Hoben Credit Union Credit Union Credit Union Credit Union Wednesdays: Tuesdays: Thursdays: Thursdays: October 21 October 20 October 8 October 15 November 11 November 17 October 22 November 12 December 9 December 1 November 12 December 10 January 6 December 15 December 3 January 14 February 3 January 12 January 7 February 11 February 24 January 26 March 10 March 16 February 4 February 9 April 14 April 6 February 25 February 23 May 12 May 4 March 8 March 10 March 22 April 7 April 12 April 28 April 26 May 12 May 10 June 2 Hulsing Isbister Credit Miller Smith Credit Union Union Credit Union Credit Union Thursdays: Wednesdays: October 1 Thursdays: Thursdays: September 30 October 15 October 8 October 1 October 14 November 19 November 5 October 22 October 28 -

2021 Calendar Campaign

One Tail at a Time 2021 Calendar Pets Date Status Date Status Date Status Date Status Date Status Date Status Date Status Date Status Friday, January 1 Not Available Saturday, February 20 Not Available Sunday, April 11 Available Monday, May 31 Not Available Tuesday, July 20 Available Wednesday, September 8 Not Available Thursday, October 28 Available Thursday, December 16 Available Saturday, January 2 Available Sunday, February 21 Available Monday, April 12 Not Available Tuesday, June 1 Available Wednesday, July 21 Not Available Thursday, September 9 Available Friday, October 29 Available Friday, December 17 Available Sunday, January 3 Available Monday, February 22 Available Tuesday, April 13 Available Wednesday, June 2 Available Thursday, July 22 Not Available Friday, September 10 Not Available Saturday, October 30 Available Saturday, December 18 Not Available Monday, January 4 Not Available Tuesday, February 23 Available Wednesday, April 14 Available Thursday, June 3 Available Friday, July 23 Available Saturday, September 11 Available Sunday, October 31 Not Available Sunday, December 19 Available Tuesday, January 5 Available Wednesday, February 24 Available Thursday, April 15 Not Available Friday, June 4 Available Saturday, July 24 Available Sunday, September 12 Available Monday, November 1 Available Monday, December 20 Available Wednesday, January 6 Available Thursday, February 25 Available Friday, April 16 Not Available Saturday, June 5 Available Sunday, July 25 Available Monday, September 13 Available Tuesday, November 2 Available -

Statement on LIBOR Transition

Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation Office of the Comptroller of the Currency Statement on LIBOR Transition November 30, 2020 The Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (collectively, the agencies) are issuing this statement to encourage banks to transition away from U.S. dollar (USD) LIBOR as soon as practicable.1 Background and Discussion The FFIEC’s “Joint Statement on Managing the LIBOR Transition”2 noted that the LIBOR transition is a significant event that banks should closely manage. The FFIEC statement further explained that new financial contracts should either utilize a reference rate other than LIBOR or have robust fallback language that includes a clearly defined alternative reference rate after LIBOR’s discontinuation. Separately, the agencies recently issued a statement that says a bank may use any reference rate for its loans that the bank determines to be appropriate for its funding model and customer needs.3 The administrator of LIBOR has announced it will consult on its intention to cease the publication of the one week and two month USD LIBOR settings immediately following the LIBOR publication on December 31, 2021, and the remaining USD LIBOR settings immediately following the LIBOR publication on June 30, 2023.4 Extending the publication of certain USD LIBOR tenors until June 30, 2023 would allow most legacy USD LIBOR contracts to mature before LIBOR experiences disruptions. Failure to prepare for disruptions to USD LIBOR, including operating with insufficiently robust fallback language, could undermine financial stability and banks’ safety and soundness.5 1 For purposes of this guidance, the term “bank” includes depository institutions under the Federal Deposit Insurance Act (12 U.S.C. -

November 6, 2020

NOVEMBER 6, 2020 HUMAN RESOURCES Employee Case On Monday, November 2 we were notified that an Accounting staff member’s relative tested positive for COVID-19 over the weekend. The staff member started experiencing light symptoms on Saturday, October 31. The last day this staff member was in the office was Friday, October 30. Immediately, upon learning of a suspected COVID-19 case, all staff members in the Finance and Business area (Accounting, Purchasing and Payroll) were asked to work remotely and seek testing. The staff member suspected to have COVID-19 was tested and received positive test results on Tuesday, November 3. As an immediate response to protect the health and safety of our workforce, the following preventative measures were taken: • We closed the Accounting office on Tuesday, November 3 through Wednesday, November 4, 2020. While the office was closed, an outside vendor thoroughly cleaned and sanitized the Finance and Business area with CDC approved disinfectants. Cleaning of the area was completed by Tuesday afternoon. • We actively worked with the Los Angeles County Department of Public Health (LACDPH) to facilitate their Contact Tracing protocols for identifying individuals who need to be assessed as possible contacts. We wish the affected employee a speedy recovery! Student Case On Wednesday, November 4, the District was informed that a student enrolled in an Advanced Officer Training Course tested positive for COVID-19. The student began developing symptoms on Tuesday, November 3 and was tested that same day. The student received positive test results on Wednesday, November 4. The Department immediately notified the students affected and two instructors who were teaching the course. -

November 6, 2020

VOLUME 46, NUMBER 31 • NOVEMBER 6, 2020 Trends in California Voters Weigh in on Taxes, Legislative Races This election Independent Contractors is one that seems like it Election Day California’s innovation economy and will never end. is over, but should be celebrated, not discouraged.” While a signif- ballot counting On other issues: icant number continues to • Voters rejected again an effort to of ballots are determine the expand governments’ authority to impose still left to be voters’ will on rent control; CalChamber-opposed counted—and perhaps many more remain issues ranging Proposition 21 was failing with 59.7% no in the hands of the U.S. Postal Service from California to 40.3% yes. that are eligible to be counted if they property taxes to supporting economic • Also failing was CalChamber- arrive in the local registrar’s office by diversity and flexibility for workers. opposed Proposition 23, an attempt to November 20—there are some notewor- As this article was prepared, California establish state requirements for kidney thy trends taking shape in California’s Chamber of Commerce-opposed Propo- dialysis clinics, 64% no to 36% yes. legislative races. sition 15, the $12.5 billion split roll prop- • Proposition 16, the CalChamber- At this point, the outcome in some of erty tax increase, appeared headed toward supported measure to promote diversity the key races for the California Assembly defeat with 51.7% no to 48.3% yes. in public employment and education, was and Senate is uncertain. These matchups CalChamber-supported Proposition 22, failing, 56% no to 44% yes. that attract big bucks from the various clarifying employment classification rules • Proposition 20, supported by interest groups will be some of the last for app-based drivers, was winning by a CalChamber because it included provi- ones called.