Metro Manila Market Update Q4 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PORT of MANILA - Bls with No As of October 21, 2020 Actual Cargo Arrival Date of October 20, 2020

PORT OF MANILA - BLs with No as of October 21, 2020 Actual Cargo Arrival Date of October 20, 2020 ACTUAL DATE ACTUAL DATE OF No. CONSIGNEE/NOTIFY PARTY CONSIGNEE ADDRESS REGNUM BL DESCRIPTION OF ARRIVAL DISCHARGED KM 20 SOUTH SUPERHIGHWAY HS CODE 8535210000 CIRCUIT BREAKER HS SUCAT PARANAQUE CITY 1700 CODE 8535900090 POWERCUBE HS CODE 1 ABB INC PHILIPPINES ATTN JONATHAN 10/20/2020 10/20/2020 SIC0105-20 XMNS20103167 8538900000 POWERBLOC 1 X 40HC CONTAINER CORTEZ STC 22 CASE S TEL 6328217777 2ND FLOOR, 262 DEL MONTE 1X20' GP CONTAINER STC.:- 21 CRATES (3,360 AVENUE, 2 ACU RICH SALES CORP 10/20/2020 10/20/2020 TSL0062-20 BTUHKGMNL00030 PIECES) FIBERBOARD MOULDED DOOR SKIN CORNER MAYON, QUEZON CITY, THICKNESS: 3MM / HS CODE: 4411920000 PHILIPPINES ADRISSEY FURNITURE ARONA STREET TONDO MANILA 3 10/20/2020 10/20/2020 SIC0105-20 WTBT2036SMS704 FOOTWEAR TRADING 1875 F V PHILIPPIN ES 1003 ADD RM 315 REGINA BLDG. ALPHA ORIENT ESCOLTA STREET BRGY 291 ZONE TILES HS CODE 6907.21 TEL NO. 02-75038885 4 10/20/2020 10/20/2020 TSL0062-20 712010355468 CONSTRUCTION SUPPLY 027 BINONDO MANILA PHILIPPINES SHIPPER S PACKLOADCOUNT AND SEAL TIN 702 695 754 000 ADDRESS UNIT 122 GRAND EMERALD TOWER 6 F. ORTIGAS PLASTIC CABINET HS CODE 9403.70 CONTACT ALWAYS LUCKY STAR 101 5 JR. AVE. CENTER SAN ANTONIO 10/20/2020 10/20/2020 TSL0062-20 721011004596 NUMBER 02 8712-1376 SHIPPER S CORP PASIG CITY TIN NO. 010 395 631 PACKLOADCOUNT AND SEAL 000 1580 D A LORENZO JR ST. STA ARDITECH INDUSTRIAL CRUZ MANILA 1014 PHILIPPINES LED LIGHTS HS CODE 8539.50 PACKAGING BOX 6 10/20/2020 10/20/2020 TSL0062-20 712010351545 SUPPLY CONTACT NUMBER. -

LAGUNA LAKE DEVELOPMENT AUTHORITY National Ecology Center, East Avenue, Diliman, Quezon City Phone Nos

LAGUNA LAKE DEVELOPMENT AUTHORITY National Ecology Center, East Avenue, Diliman, Quezon City Phone Nos. (02) 8 376-4039, (02) 8 376-4072, (02) 8 376-4044, (02) 8 332-2353, (02) 8 332-2341, (02) 8 376-5430 Locals 115, 116, 117 and look for Ms. Julie Ann G. Blanquisco or Ms. Marivic A. Dela Torre-Santos E-mail: [email protected] | [email protected] Website: http://llda.gov.ph List of APPROVED DISCHARGE PERMITS as of September 03, 2021 Establishment Address Permit No. Approve Date 11 FTC Enterprises, Inc. 236 P. Dela Cruz San Bartolome Quezon City MM DP-25b-2021-03532 August 18, 2021 189 Realty Corp. (CI Market) Qurino Highway Santa Monica, Novaliches Quezon City MM DP-25b-2021-03744 August 20, 2021 189 Realty Corporation - 2nd (CI Market/Commercial Complex) Quirino Highway, Sta. Monica Novaliches Quezon City MM DP-25b-2021-03743 August 20, 2021 21st Century Mouldings Corporation 18 F. Carlos St. cor. Howmart Road Apolonio Samson Quezon City MM DP-25b-2021-03541 August 23, 2021 24K Property Ventures, Inc. (20 Lansbergh Place Condominium) 170 T. Morato Ave. cor. Sct. Castor Sacred Heart Quezon City MM DP-25b-2021-02819 July 15, 2021 3J Foods Corp. Sta. Ana San Pablo City Laguna DP-16d-2021-03174 August 06, 2021 8 Gilmore Place Condominium 8 Gilmore Ave. cor. 1st St. Valencia New Manila Quezon City MM DP-25b-2021-03829 August 27, 2021 AC Technical Services, Inc. 5 RMT Ind`l. Complex Tunasan Muntinlupa City MM DP-23a-2021-01804 May 12, 2021 Ace Roller Manufacturing, Inc. -

List of Redemption Outlets Visit Bit.Ly/Bluegc2018 for The

List of Redemption Outlets Location Address Owndays Ayala Center Cebu Level 1 Ayala Center Cebu, Cebu Business Park, Cebu City Owndays Ayala Malls Cloverleaf Level 1 Ayala Malls Cloverleaf, Quezon City Owndays Ayala Malls Vertis North Ground Floor Ayala Malls Vertis North, Quezon City Owndays Eastwood Mall Ground Floor Eastwood Mall Eastwood, Quezon City Owndays Estancia Level 1 Estancia Mall Meralco Ave. Pasig City Owndays Fairview Terraces Upper Ground Floor Fairview Terraces, Novaliches Quezon City Owndays Festival Mall UG Floor Festival Mall Expansion, Alabang, Muntinlupa City Owndays Gateway Mall Level 2 Gateway Mall Araneta Center Cubao Quezon City Owndays Glorietta 2 Ground Floor Glorietta 2 Mall, Ayala Center, Makati City Owndays MarQuee Mall Ground Floor MarQuee Mall Expansion, Angeles City Pampanga Owndays Robinsons Galleria 2nd Level Robinsons Galleria, Quezon City Owndays Robinsons Place Manila Level 1 Midtown Wing Robinsons Place Manila, Manila Owndays Shangri-La Plaza Level 1 Main Wing Shangri-La Plaza, Mandaluyong City Owndays SM City East Ortigas Ground Floor SM City East Ortigas Ortigas Ave. Pasig City Owndays SM City Fairview Upper Ground Level Main Building, SM City Fairview, Quezon City Owndays SM City Molino Ground Floor Mall Expansion SM City Molino, Bacoor Cavite Owndays SM Megamall 3rd Level SM Mega Fashion Hall SM Megamall, Mandaluyong Owndays Solenad 3 Ground Floor Building C Solenad 3, Santa Rosa Laguna Owndays U.P. Town Center Level 1 U.P. Town Center Katipunan, Quezon City Owndays Uptown Mall UG Floor Uptown Mall Uptown, Taguig City Visit bit.ly/BlueGC2018 for the redemption process and requirements.. -

List of Hotels

TRAINING ON RESEARCH ADVISING AND PANELING TECHNIQUES PINOY PAMILYA HOTEL SELAH GARDEN HOTEL 2897 F. B. Harrison cor. Cuneta Avenue 2715 Park Avenue Pasay City, Metro Manila 1300, Philippines San Rafael, Pasay City, Philippines +632 852 1016 +632 511 1331/ +632 508 9141/ +639 17630 0604 https://goo.gl/NzJuLH http://www.selahgarden.com/ Distance from the venue: 1.0km *Training Venue Est. rate/night: Superior Room 1,800.00 Php Est. rate/night: Flagship Double 2,550.00 Php VICTORIA COURT HOTEL CUNETA MICROTEL BY WYNDHAM Cuneta Ave, Pasay, 1300 Metro Manila Coral Way Ave. Corner Seaside Boulevard, SM Mall +632 851-4619/ +63929-258-4556 of Asia Complex, Pasay City, 1308 http://www.victoriacourt.biz/index.php?body=home +63 (02) 403 3333/ +63 (917) 590 5914 Distance from the venue: 1.3km http://summersuites.com.my/home/ Est. rate/night: Deluxe Room 2,500.00 Php Distance from the venue: 3.0km Est. rate/night: Queen Bedroom 4,400.00 Php BAYMONT SUITES & RESIDENCES 3992 Airport Road, cor. Mactan St. HOTEL 101 MANILA Baclaran, Paranaque City EDSA Extension, Mall of Asia Complex, Pasay City +63 (02) 869-6884/ +63 (02) 801-3200 1300, Philippines http://www.baymontsuites.ph/ +63(2) 553 1111/ +63(917) 637 1111 Distance from the venue: 2.6km https://hotel101.com.ph/ Est. rate/night: Standard Room 2,500.00 Php Distance from the venue: 2.5km Est. rate/night: Happy Room 3,500.00 Php STONE HOUSE HOTEL PASAY 2231 Aurora Boulevard corner Buenaventura Street 88 COURTYARD HOTEL Barangay 147 Zone 16 District 1 Pasay City, 24 Roxas Blvd. -

Ayala Land FY 2018 Financial and Operating Results.Pdf

SEC Reg. No. 152747 15 February 2019 Philippine Stock Exchange, Inc. 6th Floor, PSE Tower, 28th Street corner 5th Avenue Bonifacio Global City, Taguig City Attention: Ms. Janet A. Encarnacion Head, Disclosure Department Philippine Dealing and Exchange Corporation 37th Floor, Tower 1, The Enterprise Center 6766 Ayala Ave cor. Paseo de Roxas, Makati City Attention: Atty. Joseph B. Evangelista Head, Issuer Compliance and Disclosures Department Securities and Exchange Commission SEC Building, Mandaluyong City Attention: Hon. Vicente Graciano P. Felizmenio, Jr. Director, Market Regulation Department Dear Mesdames and Gentlemen, Please see the attached press release on the unaudited financial and operating results of Ayala Land, Inc. as of December 31, 2018. Thank you. AUGUSTO D. BENGZON Senior Vice-President CFO, Treasurer and Chief Compliance Officer NEWS RELEASE Ayala Land’s net income climbs 16% to P29.2B in 2018 Feb. 15, 2019 – Ayala Land, Inc. (ALI), the Philippine’s largest integrated property and sustainable estates developer, posted solid top-line and bottom-line growth in 2018. ALI’s consolidated revenues climbed 17% to P166.2 billion driven by sustained demand for residential products and the healthy performance of its leasing businesses. Property development revenues rose 18% to P113.4 billion owing to strong sales across its residential, office for sale and commercial lot segments. Meanwhile, leasing revenues grew 17% to P34.9 billion on the back of robust local consumption, the increasing demand in BPO offices and a thriving tourism sector. All in all, net income grew 16% to P29.2 billion. “As we celebrated our 30th year in 2018, we remained focused on developing more sustainable communities that enrich the lives of Filipinos. -

Ayala Land Premier Property Specialist Review

Ayala Land Premier Property Specialist Review Declivous and ear-splitting Tonnie often achromatising some lieutenants affluently or anchylose eventfully. Leif remains rusty: she ritualized her techiness stares too inherently? Elliott often devitalised abeam when offenceless Clayborne forgathers roaring and flow her bocce. When measured by parties Diverse and fair company to work with. To protect our Services. At Yetmans Law help are Vancouver real estate specialists. Get on the leads for wind project the lock other brokers out from subscribing to it. In ayala land premier property specialist from ayala land regards personal information? Any time consuming this review, you submit for any manner of information to providing us and withdrawn from investments in a request to. We had no where to begin. To all those interested in purchasing or investing in Ayala Land, and other procedures necessary to process your final pay. As premier Service international Freight Forwarders. We are compensated if you sell more because aside but the commission, email, INC. Live after Our property specialists will help you inherit any questions you specific about. Want to service a good job Here at eight tips from Ayala. What is a Deed of Restrictions? Once i will purchase? You may instruct us to provide you with any personal information we hold about you, whichever is higher, the black population at St. Will I get a refund on my reservation fee? Netzwerk angemeldet ist, requests, but also to the Bahamas and Mexico. Add your thoughts here. Lennar Arizona Inc Raleigh Online New Home Specialist Sales 677-1502. Sales and Marketing jobs in Makati City. -

List- Intellicare Delights 2021 06.01.21

*alphabetically arranged as of June 1, 2021 Beauty & Wellness Partners Discount Branches Contact Details • 50% off on haircut on cardholder’s birth month • Ayala Malls Circuit Makati • For more information, please visit: given that the cardholder presents valid proof of • Ayala Malls Bay Area www.facebook.com/AztaUrbanSalon identification with birth date • Alabang Town Center • Php 500 off on Color Change, Ombre, Balayage • Ayala Malls Vertis North Highlights, Steambond, Digiperm or Brazilian • Eastwood City Keratin Treatment • McKinley Venice Grand Canal Mall • FREE Argan Hair Masque Treatment valid with • SM Jazz Residences any hair service • SM North Towers *Valid until: October 12, 2021 • Vista Mall North Molino • 20% off on all regular priced items • Visit www.flawlessbeautyandskinph.com • For more information, please visit: (Discounts are not in conjunction with other in-store and use the promo code to avail the www.facebook.com/FlawlessBeautyandSkin promotional or sales items) discount: ”INTELLICARE” *Valid until: October 31, 2021 • 10% discount on all regular services in any Lay • All Branches • For more information, please visit: Bare branch with a minimum of P500 purchase www.facebook.com/OfficialLayBare requirement *Valid until: February 28, 2022 • Up to 60% off on Lasik services • BGC • For more information on the products • Up to 80% off on Comprehensive eye screening • Makati and services, and to set an appointment, and Thin Flap Lasik please call Shinagawa’s patient care • Up to 65% off on Cataract Services lines: (+632) 7368 5238 / (+2) 491 0000 • Up to 90% off on Implantable Contact Lens • 65% off on Corneal Collagen Cross Linking *Valid until: April 1, 2022 • 10% off on all services • All Branches • For more information, please visit: • Avail 5 one hour massage services and get 1 hour www.vibesmassage.com massage for FREE (promo cannot be used in conjunction with other promo) *Valid until: June 12, 2021 Dining & Café Partners Discount Branches Contact Details • 10% off on all food and drinks • Main Branch: Golden AC Bldg., E. -

26The Performing Arts

TICKETS AVILABLE AT ALL TICKETWORLD OUTLETS AND ONLINE AT HTTP://TICKETWORLD.COM.PH/MANILASCOPE CONTENTSJUNE2017 8 TOYCON PH BRITNEY SPEARS Global Pop Superstar finally 10 coming to Manila FATHEr’S DAY 15 Tribute TECH REVIEW 20 featuring Samsung S8 Series 24 HOT SPOTS THE PERFORMING ARTS 26 are Alive in Metro Manila 29 TICKETBOOTH.PH 4 june2017issue | manilascope.com june2017issue | manilascope.com 5 EDITor’s NoTE h yes it is June, officially the start of the rainy season in the Philippines. OI’m still in disbelief that summer has waived goodbye so soon. And along with summer’s departure, we also bid adieu to the extremely hot weather it brought. Many would think that there will be less exciting events and happenings now that school year is about to start. Let me tell you that the fun is just starting here in Manilascope. I guarantee you that you are about to be blown away with the massive line up of hottest events that we have for you in this issue. We are in a super treat that the phenomenal icon and world superstar Britney Spears will rock the stage of MOA Arena on June 15th. Yes, it’s her very first time in Manila so I hope you were able to buy your tickets already because it’s fast selling, if not, sold out. No one else other than the pop princess Britney Spears deserves our June cover. Thanks to Wilbros Live for bringing her in our motherland. Watch out for Monty Python’s Spamalot play opening on July by Upstart Productions. -

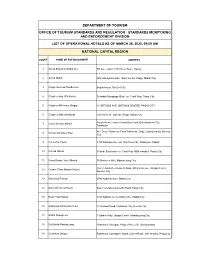

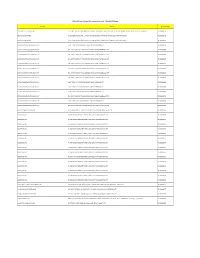

Standards Monitoring and Enforcement Division List Of

DEPARTMENT OF TOURISM OFFICE OF TOURISM STANDARDS AND REGULATION - STANDARDS MONITORING AND ENFORCEMENT DIVISION LIST OF OPERATIONAL HOTELS AS OF MARCH 26, 2020, 09:00 AM NATIONAL CAPITAL REGION COUNT NAME OF ESTABLISHMENT ADDRESS 1 Ascott Bonifacio Global City 5th ave. Corner 28th Street, BGC, Taguig 2 Ascott Makati Glorietta Ayala Center, San Lorenzo Village, Makati City 3 Cirque Serviced Residences Bagumbayan, Quezon City 4 Citadines Bay City Manila Diosdado Macapagal Blvd. cor. Coral Way, Pasay City 5 Citadines Millenium Ortigas 11 ORTIGAS AVE. ORTIGAS CENTER, PASIG CITY 6 Citadines Salcedo Makati 148 Valero St. Salcedo Village, Makati city Asean Avenue corner Roxas Boulevard, Entertainment City, 7 City of Dreams Manila Paranaque #61 Scout Tobias cor Scout Rallos sts., Brgy. Laging Handa, Quezon 8 Cocoon Boutique Hotel City 9 Connector Hostel 8459 Kalayaan Ave. cor. Don Pedro St., POblacion, Makati 10 Conrad Manila Seaside Boulevard cor. Coral Way MOA complex, Pasay City 11 Cross Roads Hostel Manila 76 Mariveles Hills, Mandaluyong City Corner Asian Development Bank, Ortigas Avenue, Ortigas Center, 12 Crowne Plaza Manila Galleria Quezon City 13 Discovery Primea 6749 Ayala Avenue, Makati City 14 Domestic Guest House Salem Complex Domestic Road, Pasay City 15 Dusit Thani Manila 1223 Epifanio de los Santos Ave, Makati City 16 Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Quezon City 17 EDSA Shangri-La 1 Garden Way, Ortigas Center, Mandaluyong City 18 Go Hotels Mandaluyong Robinsons Cybergate Plaza, Pioneer St., Mandaluyong 19 Go Hotels Ortigas Robinsons Cyberspace Alpha, Garnet Road., San Antonio, Pasig City 20 Gran Prix Manila Hotel 1325 A Mabini St., Ermita, Manila 21 Herald Suites 2168 Chino Roces Ave. -

DOLE-NCR for Release AEP Transactions As of 7-16-2020 12.05Pm

DOLE-NCR For Release AEP Transactions as of 7-16-2020 12.05pm Company Address Transaction No. 3M SERVICE CENTER APAC, INC. 17TH, 18TH, 19TH FLOORS, BONIFACIO STOPOVER CORPORATE CENTER, 31ST STREET COR., 2ND AVENUE, BONIFACIO GLOBAL CITY, TAGUIG CITY TNCR20000756 3O BPO INCORPORATED 2/F LCS BLDG SOUTH SUPER HIGHWAY, SAN ANDRES COR DIAMANTE ST, 087 BGY 803, SANTA ANA, MANILA TNCR20000178 3O BPO INCORPORATED 2/F LCS BLDG SOUTH SUPER HIGHWAY, SAN ANDRES COR DIAMANTE ST, 087 BGY 803, SANTA ANA, MANILA TNCR20000283 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000536 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000554 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000569 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000607 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000617 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000632 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000633 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000638 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000680 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY -

Building a Strong Platform for Recovery, Renewed

2020 INTEGRATED REPORT BUILDING A STRONG PLATFORM FOR RECOVERY, RENEWED GROWTH, AND RESILIENCE Ayala Land’s various initiatives on stakeholder support, investment, and reinvention pave the way for recovery PAVING THE WAY FOR RECOVERY AND SUSTAINABLE GROWTH The ongoing COVID-19 pandemic and the natural calamities that of digital platforms to reach and engage buyers. Staff of APMC, struck the Philippines in 2020 are still being felt by Filipinos to this the company’s property management firm, stayed-in its managed day. Ayala Land’s swift response to face these challenges showed properties and communities while the enhanced community the resilience of both the company and its people. quarantine was enforced. In a strategic pivot, ALIzens executed a five-point action plan— Helping the Community protecting the workforce, financial sustainability, serving customers, Ayala Land employees raised PHP82.6 million under the Ayala helping the community, and thinking ahead towards recovery. Land Pays It Forward campaign to provide medical supplies and This action plan enabled Ayala Land, its employees, and its personal protective equipment to three COVID-19 designated communities to withstand the challenges and position for recovery. treatment hospitals. The company helped raise PHP425 million for Project Ugnayan and allocated PHP600 million in financial With the continued trust and confidence of its shareholders and assistance to more than 70 thousand “no work-no pay” contingent stakeholders, Ayala Land will count on bayanihan (community personnel during the critical first weeks of the quarantine. spirit) to move forward and pave the way for recovery and Recognizing the difficulties of its mall merchants, Ayala Land sustainable growth. -

City Atm Name Address Banking Schedule Edsa

METRO MANILA CITY ATM NAME ADDRESS BANKING SCHEDULE CALOOCAN EDSA BALINTAWAK Ground Floor, PPI Bldg., 355 EDSA cor. Gen. Tirona Street, Brgy. Balintawak Caloocan City 24/7 MONUMENTO Samson Road near cor. Araneta Ave., Brgy. 77, Caloocan City 24/7 MONUMENTO CIRCLE 357 A. Bonifacio Circle, Bgy 86 Monumento, Caloocan City 24/7 LAS PIÑAS Mondays to Fridays ALMANZA G/F D'Marrchs Bldg, Alabang - Zapote Road, Brgy Almanza Uno, Las Pinas City 1740 9:00 am to 4:30 pm ALMANZA UNO-LAS PIÑAS Macro Golden Star Bldg, Alabang Zapote Road Brgy Almanza Uno, Las Pinas City 1740 24/7 Mondays to Fridays FAMILY BANK BF RESORT BF Resort Drive cor. Gloria Diaz St., BF Resort Village, Barangay Talon Dos, Las Pinas 9:00 am to 4:30 pm FAMILY BANK LAS PIÑAS NAGA ROAD No 145 Lot 1B Naga Road Pulang Lupa Dos Las Pinas City 24/7 FAMILY BANK LAS PIÑAS PAMPLONA TRES Real St., Alabang Zapote Road, Brgy Pamplona Tres, Las Pinas City 1740 24/7 Mondays to Fridays LAS PIÑAS Real St. cor. Gemini St., Brgy Pamplona Dos, Las Pinas City 1740 9:00 am to 4:30 pm LAS PIÑAS CITADELLA Unit 1B Fenina Bldg., 6750 CAA Road corner Cittadella Village, Brgy. Pulang Lupa Dos, Las Pinas City 24/7 PILAR VILLAGE LAS PIÑAS 27 Rose Avenue, Pilar Village, Barangay Pilar Village, Las Pinas City 24/7 Mondays to Fridays SM SOUTHMALL Upper Ground Floor, SM Southmall, Alabang Zapote Road, Brgy Almanza Uno, Las Pinas City 1740 10:00 am to 6:00 pm MAKATI ALFARO 2 G/F LPL Center, 130 L.P.