Structured Products Building a Modern Portfolio Investing Is About Making Your Money Work for You, Protecting What You Have, Or Growing It

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ex-Post Structured Product Returns: Index Methodology and Analysis

Ex-post Structured Product Returns: Index Methodology and Analysis Geng Deng, PhD, CFA, FRM∗ Tim Dulaney, PhD, FRMy;z Tim Husson, PhD, FRMx;z Craig McCann, PhD, CFA{ Mike Yan, PhD, FRMk August 20, 2014 Abstract The academic and practitioner literature now includes numerous studies of the substantial issue date mispricing of structured products but there is no large scale study of the ex- post returns earned by US structured product investors. This paper augments the current literature by analyzing the ex-post returns of over 20,000 individual structured products issued by 13 brokerage firms since 2007. We construct our structured product index and sub- indices for reverse convertibles, single-observation reverse convertibles, tracking securities, and autocallable securities by valuing each structured product in our database each day. The ex-post returns of US structured products are highly correlated with the returns of large capitalization equity markets in the aggregate but individual structured products generally underperform simple alternative allocations to stocks and bonds. The observed underperformance of structured products is consistent with the significant issue date under- pricing documented in the literature. ∗Director of Research, Securities Litigation and Consulting Group. yFinancial Analyst, U.S. Securities and Exchange Commission, [email protected]. zThe Securities and Exchange Commission, as a matter of policy, disclaims responsibility for any private pub- lication or statement by any of its employees. The views expressed herein are those of the author and do not necessarily reflect the views of the Commission or of the author's colleagues upon the staff of the Commission. xFinancial Analyst, U.S. -

Analysis of Securitized Asset Liquidity June 2017 an He and Bruce Mizrach1

Analysis of Securitized Asset Liquidity June 2017 An He and Bruce Mizrach1 1. Introduction This research note extends our prior analysis2 of corporate bond liquidity to the structured products markets. We analyze data from the TRACE3 system, which began collecting secondary market trading activity on structured products in 2011. We explore two general categories of structured products: (1) real estate securities, including mortgage-backed securities in residential housing (MBS) and commercial building (CMBS), collateralized mortgage products (CMO) and to-be-announced forward mortgages (TBA); and (2) asset-backed securities (ABS) in credit cards, autos, student loans and other miscellaneous categories. Consistent with others,4 we find that the new issue market for securitized assets decreased sharply after the financial crisis and has not yet rebounded to pre-crisis levels. Issuance is below 2007 levels in CMBS, CMOs and ABS. MBS issuance had recovered by 2012 but has declined over the last four years. By contrast, 2016 issuance in the corporate bond market was at a record high for the fifth consecutive year, exceeding $1.5 trillion. Consistent with the new issue volume decline, the median age of securities being traded in non-agency CMO are more than ten years old. In student loans, the average security is over seven years old. Over the last four years, secondary market trading volumes in CMOs and TBA are down from 14 to 27%. Overall ABS volumes are down 16%. Student loan and other miscellaneous ABS declines balance increases in automobiles and credit cards. By contrast, daily trading volume in the most active corporate bonds is up nearly 28%. -

Structured Notes, Which Have Embedded Derivatives, Some of Them Very Complex

Structured note markets: products, participants and links to wholesale derivatives markets David Rule and Adrian Garratt, Sterling Markets Division, and Ole Rummel, Foreign Exchange Division, Bank of England Hedging and taking risk are the essence of financial markets. A relatively little known mechanism through which this occurs is the market in structured notes, which have embedded derivatives, some of them very complex. Understanding these instruments can be integral to understanding the underlying derivative markets. In some cases, dealers have used structured notes to bring greater balance to their market risk exposures, by transferring risk elsewhere, including to households, where the risk may be well diversified. But the positions arising from structured notes can sometimes leave dealers ‘the same way around’, potentially giving rise to ‘crowded trades’. In the past that has sometimes been associated with episodes of market stress if the markets proved less liquid than normal when faced with lots of traders exiting at the same time. FOR CENTRAL BANKS, understanding how the modern For issuers, structured notes can be a way of buying financial system fits together is a necessary options to hedge risks in their business. Most, foundation for making sense of market developments, however, swap the cash flows due on the notes with a for understanding how to interpret changes in asset dealer for a more straightforward set of obligations. prices and, therefore, for identifying possible threats In economic terms, the dealer then holds the to stability and comprehending the dynamics of embedded options. Sometimes they may hedge crises. Derivatives are an integral part of this, used existing exposures taken elsewhere in a dealer’s widely for the management of market, credit and business. -

Structured Note Programme Base Prospectus Dated 24 March 2016

Structured Note Programme Base Prospectus dated 24 March 2016 CITIGROUP GLOBAL MARKETS HOLDINGS INC. (a corporation duly incorporated and existing under the laws of the State of New York) the issuer under the Citi U.S.$10,000,000,000 Global Structured Note Programme Notes issued by Citigroup Global Markets Holdings Inc. will be unconditionally and irrevocably guaranteed by CITIGROUP INC. (incorporated in Delaware) Under the Citi U.S.$10,000,000,000 Global Structured Note Programme (the Programme) described in this Base Prospectus, Citigroup Global Markets Holdings Inc. (CGMHI or the Issuer) may from time to time issue Notes, subject to compliance with all relevant laws, regulations and directives. The aggregate principal amount of securities outstanding under the Programme will not at any time exceed U.S.$10,000,000,000 (or the equivalent in other currencies), subject to any increase or decrease described herein. The payment and delivery of all amounts due in respect of Notes issued by CGMHI will be unconditionally and irrevocably guaranteed by Citigroup Inc. (the CGMHI Guarantor) pursuant to a deed of guarantee dated 24 March 2016 (such deed of guarantee as amended and/or supplemented and/or replaced from time to time, the CGMHI Deed of Guarantee) executed by the CGMHI Guarantor. The Issuer and the CGMHI Guarantor have a right of substitution as set out in the Terms and Conditions of the Notes set out herein. Notes may be issued on a continuing basis to Citigroup Global Markets Limited and/or Citigroup Global Markets Inc. and/or any additional dealer appointed under the Programme from time to time by the Issuer (each a Dealer and together the Dealers) which appointment may be for a specific issue or on an ongoing basis. -

RETAIL Structured Solutions. You Have a Right to Expect Stability and Excellence from Product Providers

RETAIL STRUCTURED SOLUTIONS RETAIL Structured Solutions. You have a right to expect stability and excellence from product providers. Since 1995 we have managed all aspects of structured products. This is the expertise we bring to WE would reallY liKE to worK witH looking after over 250,000 customers. You and APPreciate Your FeedBacK. This is not a consumer advertisement. It is intended for professional financial advisers and should not be relied Our team are always on hand to talk to you about your needs, with a dedicated upon by private investors or any other persons. Structured Solutions team to support your strategy and future goals. We appreciate that turbulent markets have meant that professional investors such as yourselves are keener than ever to work with a stable, established company, who can offer you the assurance you need. CONTACT US Please contact your Legal & General representative or the Retail Structured Solutions team at [email protected]. Details of our latest products can be found at www.landgstructuredproducts.com This document should not be taken as an invitation to deal in any Legal & General investment including the stated investment. If investors cash in any or all of their investment early then they may get back less than they invest. Legal & General (Portfolio Management Services) Limited Registered in England No. 2457525 Registered office: One Coleman Street, London EC2R 5AA Authorised and regulated by the Financial Conduct Authority. CW4018 07/13 H142530 2 RETAIL STRUCTURED SOLUTIONS LEGal & General GrouP. Legal & General is a leading provider of risk, savings thriving and that Legal & General’s double-digit sales and investment management products in the UK. -

USD Callable Daily Range Accrual Note

USD Callable Daily Range Accrual Note Issued by UBS AG, Jersey Branch SSPA: Capital Protection with Coupon (1140) Valor: 19065479 / ISIN: CH0190654795 Private Placement Final Termsheet This Product does not represent a participation in any of the collective investment schemes pursuant to Art. 7 ff of the Swiss Federal Act on Collective Investment Schemes (CISA) and thus does not require an authorisation of the Swiss Financial Market Supervisory Authority (FINMA). Therefore, investors in this Product are not eligible for the specific investor protection under the CISA (this paragraph is relevant to public offerings in Switzerland only). 1. Description of the Product Information on Underlying Underlying 3 month USD LIBOR Rate as determined by the Calculation Agent by referring to the Reuters Page LIBOR01 at 11:00 a.m. London time on each Business Day. Product Details Security Numbers Valor: 19065479 / ISIN: CH0190654795 / Common Code: 082861661 Issue Size USD 1,000,000 Specified Denomination / Nominal USD 1,000 (traded in nominal) Issue Price 100% of the Specified Denomination (percentage quotation, subject to market conditions) Quotation The Products are trading DIRTY. Accrued Interest is included in the secondary market price. Settlement Currency USD Interest Interest Rate x (n/N) x Specified Denomination x Day Count Fraction N = the number of calendar days in the Interest Period n = the number of calendar days in the Interest Period that the Underlying is within the following range at fixing (inclusive): Period Interest Rate p.a. Day Count Range on Fraction Underlying Year 1-Year 2 3.00% p.a. 30/360 0.00 – 2.50% Year 3-Year 10 3.00% p.a. -

Best Practices for Structured Products Designed for Individual Investors

ISDA® LIBA Structured Products: Principles for Managing the Distributor- Individual Investor Relationship The distributor-individual investor relationship should deliver fair treatment of the individual investor. Individual investors need to take responsibility for their investment goals and to stay informed about the risks and rewards of their investments. Distributors can play a key role in helping them achieve these objectives. In this document, an "investor" means a retail investor who is not an institution, a professional, or a sophisticated investor, and a "distributor" refers to any institution or entity that markets or sells retail structured products directly to an individual investor. This will include an issuer of a retail structured product that markets or sells the same directly to individual investors. In light of the increased interest in structured products as part of individual investors’ investment and asset allocation strategies, it is important for firms to keep these principles in mind in their dealings with individual investors in structured products. These principles complement and should be read in conjunction with our recently released, “Retail Structured Products: Principles for Managing the Provider-Distributor Relationship,” available at the websites of the five sponsoring associations1, which focus on the relationship between manufacturers and distributors. These principles apply to the relationship between the distributor and the individual investor. Although these principles are non-binding (being intended -

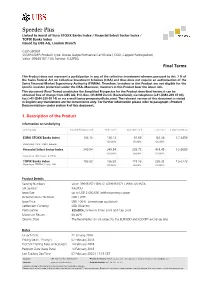

Speeder Plus Linked to Worst of Euro STOXX Banks Index / Financial Select Sector Index / TOPIX Banks Index Issued by UBS AG, London Branch

Speeder Plus Linked to worst of Euro STOXX Banks Index / Financial Select Sector Index / TOPIX Banks Index Issued by UBS AG, London Branch Cash settled SVSP/EUSIPA Product Type: Bonus Outperformance Certificate (1330, Capped Participation) Valor: 39945157 / SIX Symbol: KAZPDU Final Terms This Product does not represent a participation in any of the collective investment schemes pursuant to Art. 7 ff of the Swiss Federal Act on Collective Investment Schemes (CISA) and thus does not require an authorisation of the Swiss Financial Market Supervisory Authority (FINMA). Therefore, Investors in this Product are not eligible for the specific investor protection under the CISA. Moreover, Investors in this Product bear the issuer risk. This document (Final Terms) constitutes the Simplified Prospectus for the Product described herein; it can be obtained free of charge from UBS AG, P.O. Box, CH-8098 Zurich (Switzerland), via telephone (+41-(0)44-239 47 03), fax (+41-(0)44-239 69 14) or via e-mail ([email protected]). The relevant version of this document is stated in English; any translations are for convenience only. For further information please refer to paragraph «Product Documentation» under section 4 of this document. 1. Description of the Product Information on Underlying Underlying(s) Initial Underlying Level Strike Level Kick-Out Level Cap Level Conversion Ratio EURO STOXX Banks Index 136.13 136.13 81.68 163.36 1:7.3459 100.00% 60.00% 120.00% Bloomberg: SX7E / Valor: 846500 Financial Select Sector Index 349.54 349.54 209.72 419.45 -

Structured Alternatives to Structured Notes

Masterclass: Structured Alternatives to Structured Notes Tuesday, February 23, 2016 8:30 AM – 9:30 AM EST Seminar Presenter: Anna T. Pinedo, Partner, Morrison & Foerster LLP 1. Presentation 2. Morrison & Foerster FAQ Guide: “Frequently Asked Questions about Unit Investment Trusts” 3. Morrison & Foerster FAQ Guide: “Frequently Asked Questions about Closed-End Funds” 4. Morrison & Foerster Newsletter: “Structured Thoughts – Volume 7, Issue 2” 5. Morrison & Foerster Newsletter: “MoFo Tax Talk – January 2016” Masterclass: Structured Alternatives to Structured Notes © 2009 Morrison & Foerster LLP All Rights Reserved Attorney Advertising NY2-657166 NY2 766600 © 2010 Morrison & Foerster LLP All Rights Reserved | mofo.com Rights | All Reserved mofo.com & LLP Morrison MorrisonLLP | Foerster & Foerster Rights© 2010 © 2016 All Reserved Agenda Addressing TLAC through finance sub issuances Basic repackaging concepts Repackaging through a trust on an exempt basis Repackaging in reliance on Reg ABII 40 Act vehicles This is MoFo. | 2 TLAC and New Issuance Programs This is MoFo. | 3 TLAC and new issuance programs US G-SIB issuers of structured notes already are making plans to prepare to comply with the requirements of the Federal Reserve Board’s proposed long-term debt (LTD), total loss-absorbing capacity (TLAC), and clean holding company rules For structured products that reference asset classes other than rates, and without addressing the 5% excluded liabilities provision, it is likely that US G-SIB issuers of structured notes will establish finance company subsidiaries that will be the issuers of structured products. If the G-SIB issuer establishes a new subsidiary that is a finance company, the issuer’s SEC disclosure obligations are reduced (as opposed to issuing through a subsidiary that is an operating company This is MoFo. -

An Overview of Hedge Funds and Structured Products: Issues in Leverage and Risk

An Overview of Hedge Funds and Structured Products: Issues in Leverage and Risk Adrian Blundell-Wignall With their high share of trading turnover, hedge funds play a critical role in providing liquidity for mis-priced assets, particularly when large volumes are traded in thin markets – thereby reducing volatility. This activity is particularly important, given the rapid growth in volume of new-generation structured products issued by investment banks. Hedge fund leverage estimated via an induction technique suggests a leverage ratio that must be above 3 (versus total AUM of USD 1.4 trillion). Gearing is required to boost returns where low risk and low return styles are implemented. Investment banks are well capitalised against hedge fund exposure. “Structured products” are one of the fastest growing areas in the financial services industry, and may already be over half of the notional size of the hedge fund industry (AUM plus leverage). These products, constructed by investment banks, are extremely complex using synthetic option replication techniques, and offering a variety of guarantees in returns. They are sold to retail, private banking and institutional clients. Hedge funds help reduce volatility risk for investment banks in supplying these products. Structured products are passive in nature (unlike hedge fund active styles), focusing on providing returns for different risk profiles of clients. These products have not been tested when major anomalies in volatility arise. They are highly exposed to downward price gaps in the „risky‟ assets used in their construction. Considering the potential for such a crisis scenario, two major policy conclusions emerge: The importance of (1) stress testing of investment banks‟ balance sheets; and, (2) given the large retail market segment, consumer education and protection. -

Structured Products: Overview and Performance”

UNIVERSITY OF PIRAEUS Department of Banking & Financial Management Postgraduate part-time programme in Financial Analysis “Interest rate, Equity, FX and Commodity linked Structured Products: Overview and Performance” Submitted by Smaro – Michaela Balta Supervisor: G. Skiadopoulos September 2007 - 1 - Table of Contents Chapter 1: Introduction.......................................................................................................- 4 - 1.1 What are Structured Products...............................................................................- 4 - 1.2 The Origin of Structured Products........................................................................- 4 - 1.3 The Structure of the study.....................................................................................- 6 - Chapter 2: How Structured Products are designed...............................................................- 7 - 2.1. Risk-free asset element.........................................................................................- 7 - 2.2. Option element.....................................................................................................- 9 - Chapter 3: Classification of Structured Products...............................................................- 13 - 3.1 Classification based on the existence of principal protection:..............................- 13 - 3.2 Classification based on the Underlying benchmark their performance is linked to:- 13 - 3.2.1 Interest rate-linked Notes...........................................................................- -

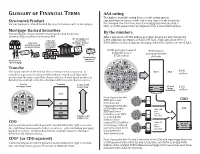

GLOSSARY of FINANCIAL TERMS

GLOSSARY oF FINANCIAL TERMS AAA rating The highest available rating from a credit rating agency, Structured Product representing the lowest credit risk of any class of debt securities. For our purposes, a bond backed by a pool of assets, such as mortgages. For example, the AAA tranches of a mortgage-backed security, a CDO, or a CDO squared are the highest rated, lowest risk tranches. Mortgage-Backed Securities The mortgages are pooled into Mortgage-Backed Securities. By the numbers Investors buy tranches of the securities Take a hypothetical $750 million mortgage-backed security backed by The mortgages are Financial pooled into 5,000 subprime mortgages of $150,000 each. Typically, about 80% or Financial institution Mortgage-Backed $600 million of these subprime mortgage-backed securities are rated AAA. institutions fund holds many Securities home purchases mortgages AA 5,000 mortgage loans of $750 million $150,000 each = mortgage-backed $750 million Investors buy security tranches of Homeowners securites sign mortgage Tranche The word tranche is French for slice, section, series, or portion. A 80% AAA $600 tranche is a portion of a structured product created such that each million divided into multiple tranches that have different risk characteristics. portion hasPool the of same cash �low characteristics.Tranches A structuredLower product yield is mortgage loans Lower risk AA and $150 20% lower tranches million AAA Now, if you take the CDO BBB and lower AAA AA tranches and repackage them into AAA A a CDO with other other AA BBB and lower and BBB tranches, over 83% AAA lower BB- Higher yield tranches unrated Higher risk or nearly $630 million of the CDO original $750 million other AA AA and A structured product which gives the bond holders the right to receive in mortgage-related and lower lower tranches the assets has now been AAA tranches backed securities.