KIM) Sets Forth the Information, Which a Prospective Investor Ought to Know Before Investing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summary Report 2020-03-20 05:00

SUMMARY REPORT 2020-03-20 05:00 Average Max Geofence Geofence Ignition Ignition Device Distance Spent Engine Start End Sr Speed Speed Start Address End Address In Out On Off Name (Kms) Fuel hours Time Time (Km/h) (Km/h) (times) (times) (times) (times) Sacred Heart Girls High School, 2020- 2020- 1 h 19 Sacred Heart Girls High School, Gnanapuram, 1 AP39CA3050 30.23 22.0 53.0 0 Gnanapuram, Visakhapatnam, Andhra 03-19 03-19 0 0 11 11 m Visakhapatnam, Andhra Pradesh-530004 India Pradesh-530004 India 00:07:08 23:52:24 Tailor, HB Colony (Adarsh Nagar), 2020- 2020- Tailor, HB Colony (Adarsh Nagar), Visakhapatnam, 2 AP31EJ7303 0.01 0.0 0.0 0 0 h 0 m Visakhapatnam, Andhra Pradesh-530013 03-19 03-19 0 0 1 1 Andhra Pradesh-530013 India India 00:11:31 23:57:00 Hema Sai Paradise, Simhachalam (Srinivas Venkata Bhavani Kirana Store, Simhachalam 2020- 2020- 3 h 34 3 AP39CU1878 75.02 25.4 61.0 0 Nagar), Visakhapatnam, Andhra Pradesh- (Srinivas Nagar), Visakhapatnam, Andhra Pradesh- 03-19 03-19 1 1 10 10 m 530029 India 530029 India 00:04:08 23:47:18 Chicken Shop, Marripalem (Ramanaidu 2020- 2020- 2 h 20 Chicken Shop, Marripalem (Ramanaidu Colony), 4 AP39CQ3825 54.25 25.8 64.0 0 Colony), Visakhapatnam, Andhra Pradesh- 03-19 03-19 0 0 17 17 m Visakhapatnam, Andhra Pradesh-530018 India 530018 India 00:04:15 23:53:36 Petrol Pump Old Gajuwaka,Chaitanya Nagar, Petrol Pump Old Gajuwaka,Chaitanya Nagar, 2020- 2020- 2 h 35 Gajuwaka Gajuwaka (Chaitanya Nagar), 5 AP39BP3586 81.33 29.3 82.0 0 Gajuwaka Gajuwaka (Chaitanya Nagar), 03-19 03-19 0 0 14 14 m Visakhapatnam, -

Transit-Oriented Redevelopment of the Dwaraka Bus Station — Feasibility Study Final Report

Smart City Master Planning and Sector-specific Smart City Infrastructure Projects for Visakhapatnam TRANSIT-ORIENTED REDEVELOPMENT OF THE DWARAKA BUS STATION — FEASIBILITY STUDY FINAL REPORT AECOM TRANSIT-ORIENTED REDEVELOPMENT OF THE DWARAKA BUS STATION - FEASIBILITY STUDY FINAL REPORT VISAKHAPATNAM i ii VISAKHAPATNAM TRANSIT-ORIENTED REDEVELOPMENT OF THE DWARAKA BUS STATION - FEASIBILITY STUDY FINAL REPORT Copyright © 2017 AECOM 3101 Wilson Blvd. Suite 900 Arlington, VA 22201 USA Telephone: +1 (703) 682-4900 Internet: www.aecom.com December 2017 Rights and Permission The material in this work is subject to copyright. Because AECOM encourages dissemination of its knowledge, this work may be reproduced, in whole or in part, for noncommercial purposes as long as full attribution to this work is given. General Limiting Conditions AECOM devoted effort consistent with (i) that degree of care and skill ordinarily exercised by members of the same profession currently practicing under same or similar circumstances and (ii) the time and budget available for its work in its efforts to endeavor to ensure that the data contained in this document is accurate as of the date of its preparation. This study is based on estimates, assumptions and other information developed by AECOM from its independent research effort, general knowledge of the industry, and information provided by and consultations with the Client and the Client’s representatives. No responsibility is assumed for inaccuracies in reporting by the Client, the Client’s agents and representatives, or any third-party data source used in preparing or presenting this study. AECOM assumes no duty to update the information contained herein unless it is separately retained to do so pursuant to a written agreement signed by AECOM and the Client. -

Hdfc Children's Gift Fund

SCHEME INFORMATION DOCUMENT HDFC CHILDREN’S GIFT FUND This product is suitable for investors who are seeking* Riskometer# capital appreciation over long term investment in equity and equity related instruments as well as debt and money market instruments. *Investors should consult their financial advisers, if in doubt about whether the product is suitable for them. # For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund viz. www.hdfcfund.com Continuous offer of Units at Applicable NAV Name of Mutual Fund (Fund): HDFC Mutual Fund Name of Asset Management Company (AMC): HDFC Asset Management Company Limited Name of Trustee Company: HDFC Trustee Company Limited Addresses, Website of the entities: Address: Asset Management Company (AMC) : Trustee Company : HDFC Asset Management Company Limited HDFC Trustee Company Limited A Joint Venture with Standard Life Investments Registered Office : Registered Office : HDFC House, 2nd Floor, H.T. Parekh Marg, 165-166, HDFC House, 2nd Floor, H.T. Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Mumbai - 400 020. Backbay Reclamation, Churchgate, Mumbai - 400 020. CIN No. U65991MH1999PLC123026 CIN No: L65991MH1999PLC123027 Website: www.hdfcfund.com The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, [herein after referred to as SEBI (MF) Regulations] as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document. The Scheme Information Document sets forth concisely the information about the scheme that a prospective investor ought to know before investing. -

Build Your Family a Strong Future with Wiser Investments

Build your family a strong future with wiser investments. Toll Free No. 1 800 3010 6767/ 1 800 419 7676 MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY. PRODUCT LABELING: To provide investors an easy understanding of the kind of product / scheme they are investing in and its suitability to them, the product labeling for the Scheme/ Plans is as under: NAME OF SCHEME / PLAN THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING* RISKOMETER HDFC Children’s Gift Fund - • capital appreciation over long term Moderate Moderately Investment Plan • investment in equity and equity related instruments as well as High (Equity Oriented) debt and money market instruments. ow ModeratelyL High ow L LOW HIGH Investors understand that their principal will be at moderately high risk HDFC Children’s Gift Fund - • capital appreciation over medium to long term. Moderate Moderately Savings Plan • investment in debt and money market instruments as well as High (Debt Oriented) equity and equity related instruments. ow ModeratelyL High ow L LOW HIGH Investors understand that their principal will be at moderate risk *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Sponsors : Asset Management Company : Trustee : Housing Development Finance Corporation Limited HDFC Asset Management Company Limited HDFC Trustee Company Limited Registered Office : A Joint Venture with Standard Life Investments Registered Office : Ramon House, H. T. Parekh Marg, Registered Office : HUL House, 2nd Floor, 169, Backbay Reclamation, HUL House, 2nd Floor, H.T. Parekh Marg, H.T. Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Churchgate, Mumbai 400 020. -

Royal Towers

Meg na Royal Towers A t B e a c h R o a d , N E A R V U D A P A R K , K U R U P A M C I R C L E Beachfront Living Goes Very, Very Luxe! Group A V e n t u r e b y K . R C o n s t r u c t i o n s Meg na Royal Towers A t B e a c h R o a d , N E A R V U D A P A R K , K U R U P A M C I R C L E SKY BLUE. SEA GREEN. DUSTY GOLD... ...Watch the colors of life come alive Meg na Royal Towers LIFE’S BEAUTIFUL.. from every point of view! Everyone dreams of a life by the seashore - of days that begin with the lapping of sea waves and nights that sprinkle stardust, of breeze that comes caressing the trees and sunshine that plays round cozy corners. That dream is about to turn real in your very own slice of heaven in V izag. W elcome to Meghana Royal Towers - a solitary tower of exquisite apartments that is way above the rest on the expanding horizons of Andhra’s largest city. Meg na Royal Towers STROLL IN THE BEACH Imagine your home just walking distance from the beach! Unbelievable? It’s all happening at Meghana Royal Towers - the ultra premium residences from the Daspalla Group. This sea-facing project at the most coveted location of Beach Road, is simply magical. -

Waltair Times October

Waltair Times 1 Waltair Times 2 CONTENTS Vol. 24 | Issue 4 | October‘19 President’s Desk .................................................................. 05 Vice President’s Desk ......................................................... 06 Secretary's Desk .................................................................. 09 28 Notice Board ........................................................................ 10 Announcements Club Calendar Obituary Member Honour .................................................................. 11 New Members List .............................................................. 14 Events .................................................................................... 14 11 Tambola Technology to reduce corruption-3 ................................ 15 Motivational Quote of the Day ....................................... 18 Association Saikorian-Campus Challenge ..................... 28 Know your Club.................................................................... 36 Career Guide......................................................................... 37 Travel Diaries ....................................................................... 38 What’s Cooking ? ................................................................. 40 What’s up doc ? .................................................................... 41 How to play Bridge ............................................................. 42 Benefits of Playing Bridge ............................................... 45 18 Rain,Rain, don’t go -

Visakhapatnam District

Visakhapatnam District S.No. Name of the Health care facility 1. Community Hospital, APVVP -ARAKU VALLY, Visakhapatnam. 2. APVVP -K.Kotapadu 3. APVVP -Narsipatnam 4. Community Health Center Aganampudi,Visakhapatnam 5. Community Health Center Chintapalli Visakhapatnam 6. Community Health Center Chodavaram Visakhapatnam 7. Community Health Center kotavaratla, Visakhapatnam 8. Community Health Center Nakkapalli,Visakhapatnam 9. Community Health Center, BheemunipatnamVisakhapatnam 10. Community Health Center, Paderu, Visakhapatnam 11. East Coast Rly. Hospital, Dondaparthy, Visakhapatnam 2746276 12. ESI Hospital, Gandhigram, Visakhapatnam 2577195 13. Golden Jubilee Hospital, Visakhapatnam port trust, Visakhapatnam 14. Govt. Hospital for Chest & Communicable diseases, Visakhapatnam, 0891 -552525 15. Govt. Victoria Hospital for Women & Children, Visakhapatnam; 2562637 16. KGH Hospital, visakhapatnam 17. R.S.P.R. Govt. Regional Eye Hospital, Opp. Dr.L.Bullayya College, Seethammadhara Road, Visakhapatnam. 18. Visakha steel general Hospital, Visakhapatnam steel plant, Visakhapatnam 19. CHNC, Vada Cheepurupalli, Aganampudi, Visakhapatnam 20. CHNC, Chuchukonda, Anakapalli, Visakhapatnam 21. CHNC, Tummapala, Anakapalli, Visakhapatnam 22. CHNC, Munagapaka, Anakapalli, Visakhapatnam 23. CHNC, Gullepalli, Gopalapatnam, Visakhapatnam 24. CHNC, Sabbavaram ,Gopalapatnam, Visakhapatnam 25. Primary Health Centre, Main Road, Kinthali, Visakhapatnam District. Ph. No. 9553219175 26. Primary Health Centre, Atchuthapuram, Visakhapatnam 27. PHC Gullepalli, medical -

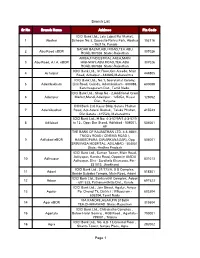

Branch List Page 1

Branch List Sr No Branch Name Address Pin Code ICICI Bank Ltd., Lala Lajpat Rai Market, 1 Abohar Scheem No.3, Opposite Nehru Park, Abohar 152116 - 152116, Punjab SADAR BAZAR,ABU ROAD,TEH.ABU 2 Abu Road eBOR 307026 ROAD,307026 State:-Rajasthan AMBAJI INDUSTRIAL AREA,MAIN 3 Abu Road, A.I.A. eBOR HIGHWAY,ABU ROAD,TEH.ABU 307026 ROAD,307026 State:-Rajasthan ICICI Bank Ltd., Ist Floor,Gm Arcade, Main 4 Achalpur 444805 Road, Achalpur - 444805,Maharashtra ICICI Bank Ltd., No.1, Secretariat Colony, 5 Adambakkam Link Road, Guindy, Adambakkam - 600088, 600088 Kancheepuram Dist., Tamil Nadu. ICICI Bank Ltd., Shop No - 2,Additional Grain 6 Adampur Market,Mandi,Adampur - 125052, Hissar 125052 Dist., Haryana ICICI Bank Ltd, Kasar Bldg, Satara Phaltan 7 Adarkibudruk Road, A/p Adarki Budruk, Taluka Phaltan, 415523 Dist Satara - 415523, Maharashtra ICICI Bank Ltd., H No: 4-3-57/9A/1,4-3-57/9 8 Adilabad to 12 , Opp: Bus Stand, Adilabad - 504001, 504001 AP THE BANK OF RAJASTHAN LTD. 4-3-168/1, TNGO's ROAD ( CINEMA ROAD ), 9 Adilabad eBOR HAMEEDPURA (DWARKANAGAR), Opp 504001 SRINIVASA HOSPITAL, ADILABAD - 504001 State:-Andhra Pradesh ICICI Bank Ltd., Suman Tower, Main Road, Adityapur, Kandra Road, Opposite AIADA 10 Adityapur 831013 Adityapur, Dist - Saraikela Kharsawa. Pin - 831013. Jharkhand ICICI Bank Ltd , 21/173/A, S S Complex, 11 Adoni 518301 Beside Saibaba Temple, Main Road, Adoni ICICI Bank Ltd., Sankarathil Complex, Adoor 12 Adoor 691523 - 691 523, Pathanamthitta Dist., Kerala ICICI Bank Ltd., Jain Street, Agalur, Aviyur 13 Agalur Po, Chengi Tk, District : Villupuram - 603204 603204, Tamil Nadu VIA KANORE,AGAR,PIN 313604 14 Agar eBOR 313604 TEH.DHARIAWAD State:-Rajasthan ICICI Bank Ltd., Chitrakatha Complex , 15 Agartala Below Hotel Somraj , HGB Road , Agartala - 799001 799001 , Tripura ICICI Bank Ltd., No. -

SR No HOSPITAL NAME

HOSPITAL NAME (Hospitals marked with** S R are Preffered Provider STD Telephon Address City Pin Rohini Code State Zone No Network, with whom ITGI code e has Negotiated package rates) 1 Aasha Hospital** 7-201, Court Road Anantapur 515001 08554 245755 8900080169586 Andhra Pradesh South Zone 2 Aayushman The Family Hospital**45/142A1, V.R. ColonyKurnool 518003 08518 254004 8900080172005 Andhra Pradesh South Zone 3 Akira Eye Hospital** Aryapuram Rajahmundry 533104 0883 2471147 8900080180079 Andhra Pradesh South Zone 4 Andhra Hospitals** C.V.R. Complex, PrakasamVijayawada Road 520002 0866 2574757 8900080172531 Andhra Pradesh South Zone 5 Apex Hospital # 75-6-23, PrakashnagarRajahmundry Rajahmundry 533103 0883 2439191 8900080334724 Andhra Pradesh South Zone 6 Apollo Bgs Hospitals** Adichunchanagari RoadMysore Kuvempunagar 570023 0821 2566666 8900080330627 Karnataka South Zone 7 Apollo Hospital 13-1-3, Suryaraopeta, MainKakinada Road 533001 0884 2379141 8900080341647 Andhra Pradesh South Zone 8 Apollo Hospitals,Vizag Waltair, Main Road Visakhapatnam 530002 0891 2727272 8900080177710 Andhra Pradesh South Zone 9 Apoorva Hospital 50-17-62 Rajendranagar,Visakhapatnam Near Seethammapeta530016 Jn. 0891 2701258 8900080178007 Andhra Pradesh South Zone 10 Aravindam Orthopaedic Physiotherapy6-18-3, KokkondavariCentre Street,Rajahmundry T. Nagar, Rajahmundry533101 East0883 Godavari2425646 8900080179547 Andhra Pradesh South Zone 11 Asram Hospital (Alluri Sitarama N.H.-5,Raju Academy Malaka OfPuram MedicalEluru Sciences)** 534005 08812 249361-62 8900080180895 -

Community Address and the Names of the Confreres ANDHRA PRADESH ARCHDIOCESE of VISAKHAPATNAM Stella Maris, Vizag Visakhapatnam City MSFS PROVINCIALATE PP

PROVINCE OF VISAKHAPATNAM Curie Provinciale PP. Pentareddy Chinnappa Reddy Provincial Mandagiri Jojaiah Admonitor & PCIC - Mission, Jonnalagadda Lourdu Ravi Kumar PCIC – Innovative and Social Ministry Putchakayala Bala Sundar Rao PCIC - Formation Gundapureddy Sandeep Reddy PCIC - Education Bellamkonda Anil Kumar Bursar Note: All gifts and donations from abroad may be sent to the following account: A/C Name: The Salesian Andhra Society, Visakhapatnam, IFSC Code: SIBL0000163, F.C. A/C No: 0163053000000061, Swift Code: S0ININ55, MICR: 530059001. Local contributions may be sent to A/C No. 0163053000000027. Bank Address: The South Indian Bank, D. No. 13-1-1c, Catholic Centre Building, D. No. 13-1-1c, Catholic Centre Building, Waltair Main Road, Maharanipeta Post, Visakhapatnam- 530002, A.P. INDIA. Community address and the names of the confreres ANDHRA PRADESH ARCHDIOCESE OF VISAKHAPATNAM Stella Maris, Vizag Visakhapatnam City MSFS PROVINCIALATE PP. Pentareddy Chinnappa Reddy, Provincial STELLA MARIS Potnuru Chandra Shekhar (Dominic Savio), CHINNA WALTAIR Superior VISAKHAPATNAM-530 017 Bellamkonda Anil Kumar, Bursar ANDHRA PRADESH Baviri Suresh Babu, Provincial Secretary Gorantla Joachim Tel: (0891) 2755933, 2755420 Narisetty Francis Xavier Provincial: (0891) 2710259 K.T. Thomas Cell : 9985860195 Nellikunnel George Bursar: (0891)2755420 Mannukuzhumpil Zacharias Fax : 0891 2702589 Edacherrypauvath Joseph E-mail: [email protected] Kottam Alexander [email protected] Manalil Thomas [email protected] Elangipuram Varghese Cheruvil Luke FF. Vattachira Jacob Poovathumoottil Job S. Pakki Dileep Kumar,Regent MSFS Dhyanashram Visakhapatnam City MSFS Dhyanashram D. No. 8-1-21, Tamil Street Arigala Francis Stephen, Director Chinna Waltair Visakhapatnam – 530017 Andhra Pradesh Kotak Salesian School Visakhapatnam City Kotak Salesian School PP. Gorantla Joachim, Principal Chinna Waltair B. -

Network Hospital List Treating Covid-19

Note: List Updated on: 24-Sep-2021 1. The list of hospitals providing COVID treatment is dynamic in nature and is subject to change. Please call the hospitals before visiting to make sure that they are providing the relevant services. 2. Number of hospitals may not accept cashless services due to the current situation. Please check with the hospital administration before visiting the hospital. Network hospitals offering Covid-19 treatment S.No State City Address Pincode Hospital Name 1 Andhra Pradesh Anantapur 12-2-8787 1 Cross Sai Nagar Anantapur 515001 Dr.Y.S.R. Memorial Hospital 2 Andhra Pradesh Guntur Gowri Sankar Theatre, Kothapet, Guntur 522001 Lalitha Super Specialities Hospital Pvt Ltd Collector Office Road, Beside Hindu College 3 Andhra Pradesh Guntur 520008 Dr.Ramesh Cardiac and Multispeciality Hospital Pvt Ltd Grounds Nagaram Palem 4 Andhra Pradesh Kakinada 13-1-3, Main Road, Surya Rao Peta E.G.Dt 533001 Apollo Hospitals Kakinada 51-1E/2,51-1E/3,and 51- My Cure hospital A Unit of Sahrudaya 5 Andhra Pradesh Kurnool 518003 1E/4,Sy,No:419/B2,Situated at kallur viilage Healthcare(Kurnool) Pvt.Ltd. D.No:15-8-12, Panasathota,Chilakaluripet Road, 6 Andhra Pradesh Narasaraopet 522601 Mahathma Gandhi Super Speciality Hospitals Narasaraopet 7 Andhra Pradesh Nellore 16/111/1133,Muttukur Road Pinakini Nagar 524004 Apollo Specialty Hospital Simhapuri Hospitals (A Unit of Abhayanjaneya Health 8 Andhra Pradesh Nellore NH-5, Chinta Reddy, palem cross road 524002 Care Pvt Ltd) #40120/A, North Bypass Road, Nh-5, Backside 9 Andhra Pradesh Ongole -

Sr. No. HOSPITAL NAME HOSPITAL ADDRESS STATE CITY PIN 1

Sr. No. HOSPITAL NAME HOSPITAL ADDRESS STATE CITY PIN NALLAVARI THOTA DIST. 1 VIJAYA HOSPITAL NELLORE ALLURU ANDHRA PRADESH ALLUR 524315 NO. 3-2-117 E OPP. MORE SUPER MARKET KNF ROAD EAST GODAVARI 2 SRINIDHI HOSPITALS AMLAPURAM ANDHRA PRADESH AMALAPURAM 533201 NO. 3-2-117 ECOLLEGE 3 V. N. NURSING HOME ROAD AMALA PURAM ANDHRA PRADESH AMALAPURAM 533201 PUDIMADAKA ROAD NEAR 4 TIRUMALA JYOTI HOSPITAL RTC COMPLEX ANAKAPALLE ANDHRA PRADESH ANAKAPALLE 531001 USHA PRIME MULTI SPECIALITY 5 HOSPITAL 12-4-61 PUDIMADAKA ROAD ANDHRA PRADESH ANAKAPALLE 531001 1ST CROSS SAI NAGAR 6 DR YSR MEMORIAL HOSPITALS ANANTAPUR ANDHRA PRADESH ANANTHAPUR 515001 NO.12-2-939 BESIDE STATE BANK 3RD CROSS SAI 7 HRUDAYA CHILDRENS HOSPITAL NAGAR ANDHRA PRADESH ANANTHAPUR 515001 1-1348 SRINAGAR COLONY SAVEERA INSITUTE OF MEDICAL EXTENSION NEAR CRESENT 8 SCIENCES PVT LTD FUNCTIONA HALL ANDHRA PRADESH ANANTHAPUR 515001 13-3-510 KHAJA NAGAR OPP GANGA GOWRI CINE 9 SNEHALATHA HOSPITALS COMPLEX ANANTHAPURAM ANDHRA PRADESH ANANTHAPUR 515001 SREENIVASA MULTISPECIALITY D.NO. 28-271NEAR IRON 10 HOSPITAL BRIDGESUBHASH ROAD ANDHRA PRADESH ANANTHAPUR 515001 VASAN EYE CARE HOSPITAL- 15581 STREET RAJU ROAD 11 ANANTAPUR ANANTAPUR ANDHRA PRADESH ANANTHAPUR 515001 12 PREETHI NURSING HOME AG COLLEGE ROAD BAPATLA ANDHRA PRADESH BAPATLA 522101 JNANANANDA RETINA MAYUR TOWN RAILWAY 13 FOUNDATION PVT. LTD. STATIION ROAD ANDHRA PRADESH BHIMAVARAM 534202 NH-5 MALKAPURAM W.G. 14 ASRAM HOSPITAL DISTRICT ANDHRA PRADESH CHATAPARRU 534004 SRI RAMACHANDRA NURSING GULLAPALLI P. O. 15 HOME CHERUKUPALLI