NEERJA SHAH in the Matter of MR

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

24.04.2014 Notes

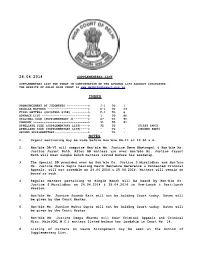

24.04.2014 SUPPLEMENTARY LIST SUPPLEMENTARY LIST FOR TODAY IN CONTINUATION OF THE ADVANCE LIST ALREADY CIRCULATED. THE WEBSITE OF DELHI HIGH COURT IS www.delhihighcourt.nic.in INDEX PRONOUNCEMENT OF JUDGMENTS ------------> J-1 TO 1 REGULAR MATTERS -----------------------> R-1 TO 49 FINAL MATTERS (ORIGINAL SIDE) ---------> F-1 TO 8 ADVANCE LIST --------------------------> 1 TO 86 ORIGINAL SIDE (SUPPLEMENTARY I)--------> 87 TO 90 COMPANY -------------------------------> 91 TO 91 APPELLATE SIDE (SUPPLEMENTARY LIST)----> 92 TO (FIRST PART) APPELLATE SIDE (SUPPLEMENTARY LIST)----> - TO - (SECOND PART) SECOND SUPPLEMENTARY-------------------> - TO - NOTES 1. Urgent mentioning may be made before Hon'ble DB-II at 10.30 a.m. 2. Hon'ble DB-VI will comprise Hon'ble Ms. Justice Reva Khetrapal & Hon'ble Mr. Justice Jayant Nath. After DB matters are over Hon'ble Mr. Justice Jayant Nath will hear single bench matters listed before his Lordship. 3. The Special DB presided over by Hon'ble Dr. Justice S.Muralidhar and Hon'ble Ms. Justice Mukta Gupta hearing Death Sentence Reference & Connected Criminal Appeals, will not assemble on 24.04.2014 & 25.04.2014. Matters will remain on board as such. 4. Regular Matters pertaining to Single Bench will be heard by Hon'ble Dr. Justice S.Muralidhar on 24.04.2014 & 25.04.2014 in Pre-Lunch & Post-Lunch Session. 5. Hon'ble Mr. Justice Suresh Kait will not be holding Court today. Dates will be given by the Court Master. 6. Hon'ble Ms. Justice Mukta Gupta will not be holding Court today. Dates will be given by the Court Master. 7. Hon'ble Ms. -

ED Arrests Agrigold Promoters for Money Laundering

Follow us on: RNI No. APENG/2018/764698 @TheDailyPioneer facebook.com/dailypioneer Established 1864 Published From ANALYSIS 7 MONEY 8 SPORTS 11 VIJAYAWADA DELHI LUCKNOW THE FUTURE ECONOMIC RECOVERY, DEMAND REVIVAL BIG CHALLENGE TO KEEP BHOPAL RAIPUR CHANDIGARH OF WORK SPARK 2021 HOPES FOR STEEL SECTOR PUJARA QUIET: LYON BHUBANESWAR RANCHI DEHRADUN HYDERABAD *Late City Vol. 3 Issue 44 VIJAYAWADA, THURSDAY DECEMBER 24, 2020; PAGES 12 `3 *Air Surcharge Extra if Applicable RASHMIKA'S B'WOOD DEBUT WITH AN ESPI- ONAGE THRILLER { Page 12 } www.dailypioneer.com ED arrests Agrigold promoters Cooperate with SEC, HC for money laundering tells govt on local body polls PNS n VIJAYAWADA SNV SUDHIR n VIJAYAWADA PERPETRATORS OPENED The Andhra Pradesh High OFFSHORE COS WITH HELP Court on Wednesday directed Enforcement Directorate (ED) the state government to extend has arrested three promoters of OF MOSSACK FONSENCA cooperation to the State the scam-tainted Andhra Vijayawada: Investigation Election Commission (SEC) People from UK being Pradesh-based Agrigold group. under PMLA also revealed that for holding elections to local rigorously traced; situa- ED arrested Agrigold group the accused started companies bodies. promoters Avva Venkata Rama abroad and diverted large Hearing a counter affidavit tion under control: Rao, Avva Venkata Seshu amounts of funds to off-shore filed by the State Election Satyendar Jain Narayana Rao, Avva Hema entities. Their names also figured Commission (SEC) on the Sundara Vara Prasad who are in the Paradise Leaks and they conduct of local body elec- the main accused in the PMLA had incorporated companies tions, the High Court stated investigation into the Rs 6,380 with the help of the infamous that the three top officials of crore Agri Gold Ponzi scam. -

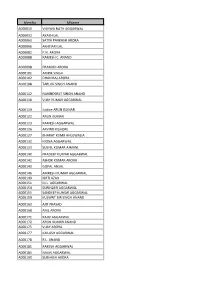

LIST of ORDINARY MEMBERS S.No

LIST OF ORDINARY MEMBERS S.No. MemNo MName Address City_Location State PIN PhoneMob F - 42 , PREET VIHAR 1 A000010 VISHWA NATH AGGARWAL VIKAS MARG DELHI 110092 98100117950 2 A000032 AKASH LAL 1196, Sector-A, Pocket-B, VASANT KUNJ NEW DELHI 110070 9350872150 3 A000063 SATYA PARKASH ARORA 43, SIDDHARTA ENCLAVE MAHARANI BAGH NEW DELHI 110014 9810805137 4 A000066 AKHTIARI LAL S-435 FIRST FLOOR G K-II NEW DELHI 110048 9811046862 5 A000082 P.N. ARORA W-71 GREATER KAILASH-II NEW DELHI 110048 9810045651 6 A000088 RAMESH C. ANAND ANAND BHAWAN 5/20 WEST PATEL NAGAR NEW DELHI 110008 9811031076 7 A000098 PRAMOD ARORA A-12/2, 2ND FLOOR, RANA PRATAP BAGH DELHI 110007 9810015876 8 A000101 AMRIK SINGH A-99, BEHIND LAXMI BAI COLLEGE ASHOK VIHAR-III NEW DELHI 110052 9811066073 9 A000102 DHAN RAJ ARORA M/S D.R. ARORA & C0, 19-A ANSARI ROAD NEW DELHI 110002 9313592494 10 A000108 TARLOK SINGH ANAND C-21, SOUTH EXTENSION, PART II NEW DELHI 110049 9811093380 11 A000112 NARINDERJIT SINGH ANAND WZ-111 A, IInd FLOOR,GALI NO. 5 SHIV NAGAR NEW DELHI 110058 9899829719 12 A000118 VIJAY KUMAR AGGARWAL 2, CHURCH ROAD DELHI CANTONMENT NEW DELHI 110010 9818331115 13 A000122 ARUN KUMAR C-49, SECTOR-41 GAUTAM BUDH NAGAR NOIDA 201301 9873097311 14 A000123 RAMESH CHAND AGGARWAL B-306, NEW FRIENDS COLONY NEW DELHI 110025 989178293 15 A000126 ARVIND KISHORE 86 GOLF LINKS NEW DELHI 110003 9810418755 16 A000127 BHARAT KUMR AHLUWALIA B-136 SWASTHYA VIHAR, VIKAS MARG DELHI 110092 9818830138 17 A000132 MONA AGGARWAL 2 - CHURCH ROAD, DELHI CANTONMENT NEW DELHI 110010 9818331115 18 A000133 SUSHIL KUMAR AJMANI F-76 KIRTI NAGAR NEW DELHI 110015 9810128527 19 A000140 PRADIP KUMAR AGGARWAL DISCO COMPOUND, G.T. -

Office of the Chief Commissioner of CGST& Central Excise (Chandigarh Zone), Central Revenue Building, Sector 17-C Chandigarh

/ Office of the Chief Commissioner of Department of Excise and Taxation CGST& Central Excise Additional Town hall Building (Chandigarh Zone), Sector-17-C, UT Chandigarh Central Revenue Building, Sector 17-C Chandigarh-160017 Order 03/2017 Dated 20.12.2017 Subject: Division of Taxpayers base between the Central Government and Union Territory of Chandigarh In accordance with the guidelines issued by the GST Council Secretariat vide Circular No. 01/2017, issued vide F. No. 166/Cross Empowerment/GSTC/2017 dated 20.09.2017, with respect to the division of taxpayer base between the Central Government and Union Territory of Chandigarh to ensure single interface under GST, the State Level Committee comprising Ms. Manoranjan Kaur Virk, Chief Commissioner, Central Tax and Central Excise, Chandigarh Zone and Shri Ajit Balaji Joshi, Commissioner, Excise and Taxation Department, UT Chandigarh has hereby decided to assign the taxpayers registered in Union Territory of Chandigarh in the following manner: 1. Taxpayers with turnover above Rs l.S Crores. a) Taxpayers falling under the jurisdiction of the Centre (List of 2166 Taxpayers enclosed as Annexure- 'lA') SI. NO. Trade Name GSTIN 1 BANK OF BARODA 04AAACB1534F1ZE 2 INDIAN OVERSEAS BANK 04AAACI1223J2Z3 ---------- 2166 DASHMESH TRADING COMPANY 04AAAFD7732Q1Z7 b) Taxpayers falling under the jurisdiction of Union Territory of Chandigarh (List of 2162 Taxpayers enclosed as Annexure- 'lB') SI. NO. Trade Name GSTIN 1 IBM INDIA PRIVATE LIMITED 04AAACI4403L1ZW 2 INTERGLOBE AVIATION LIMITED 04AABCI2726B1ZA ---------- 2162 HARJINDER SINGH 04ABXPS8524P1ZK Taxpayers with Turnover less than Rs. 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre (List of 1629 Taxpayers enclosed as Annexure- '2A') 51. -

Memno Mname A000010 VISHWA NATH AGGARWAL A000032 AKASH LAL A000063 SATYA PARKASH ARORA A000066 AKHTIARI LAL A000082 P.N

MemNo MName A000010 VISHWA NATH AGGARWAL A000032 AKASH LAL A000063 SATYA PARKASH ARORA A000066 AKHTIARI LAL A000082 P.N. ARORA A000088 RAMESH C. ANAND A000098 PRAMOD ARORA A000101 AMRIK SINGH A000102 DHAN RAJ ARORA A000108 TARLOK SINGH ANAND A000112 NARINDERJIT SINGH ANAND A000118 VIJAY KUMAR AGGARWAL A000119 Justice ARUN KUMAR A000122 ARUN KUMAR A000123 RAMESH AGGARWAL A000126 ARVIND KISHORE A000127 BHARAT KUMR AHLUWALIA A000132 MONA AGGARWAL A000133 SUSHIL KUMAR AJMANI A000140 PRADEEP KUMAR AGGARWAL A000142 ASHOK KUMAR ARORA A000143 GOPAL ANSAL A000146 AMRESH KUMAR AGGARWAL A000149 KIRTI AZAD A000151 M.L. AGGARWAL A000154 SURINDER AGGARWAL A000155 SANDEEP KUMAR AGGARWAL A000159 KULWNT BIR SINGH ANAND A000163 AJIT PRASAD A000168 ANIL ARORA A000171 RAJIV AGGARWAL A000172 ARUN KUMAR ANAND A000175 VIJAY ARORA A000177 KAILASH AGGARWAL A000178 R.L. ANAND A000181 RAKESH AGGARWAL A000185 NALIN AGGARWAL A000190 SUBHASH ARORA A000192 A.K. DEV A000193 LALIT AHLUWALIA A000194 S.K. ARORA A000196 SUDHIR ARORA A000197 ASHOK KUMAR AHLUWALIA A000203 RAKESH ARORA A000204 SANTOSH AULUCK A000205 VINAY KUMAR ARORA A000207 AJIT SINGH A000211 ASHOK KUMAR A000212 L.M. AGGARWAL A000214 MADAN MOHAN AGGARWAL A000218 ASHOK ANAND A000223 JANAK RAJ ARORA A000226 DINESH AGNANI A000227 M.K. ARORA A000230 ASHOK KUMAR A000231 D.K. AGGARWAL A000236 RAM AVTAR AGGARWAL A000244 NAVEEN ANAND A000245 PARVEEN ANAND A000247 MADAN LAL ANAND A000250 JASPAl. S. ARORA A000251 ARVINDER SING ARORA A000253 MANJIT SINGH ARORA A000254 RAJPAL SINGH ARORA A000257 TRILOK NATH ANAND A000258 -

Punjab Medical Council Electoral Rolls Upto 31-01-2018

Punjab Medical Council Electoral Rolls upto 31-01-2018 S.No. Name/ Father Name Qualification Address Date of Registration Validity Registration Number 1. Dr. Yash Pal Bhandari S/o L.M.S.F. 1948 81, Vijay Nagar, Jalandhar 12.04.1948 45 22.10.2018 Sh. Ram Krishan M.B.B.S. 1961 M.D. 1965 2. Dr. Balwant Singh S/o LSMF 1952 1814, Maharaj nagar, Near Gate No.3, 28.10.1952 3266 17.03.2021 Sh. Suhawa Singh M.B.B.S. 1964 of P.A.U., Ludhiana 3. Dr. Kanwal Kishore Arora S/o M.B.B.S. 1952 392, Adarsh Nagar Jalandhar 15.12.1952 3312 09.03.2019 Sh. Lal Chand Pasricha 4. Dr. Gurbax Singh S/o LSMF 1952 B-5/442, Kulam Road, Tehsil 11.03.1953 3396 23.04.2019 Sh. Mangal Singh M.B.B.S. 1956 Nawanshahr Distt. SBS Nagar D.O. 1957 5. Dr. Jawahar Lal Luthra L.S.M.F. 1953 H.No.44, Sector 11-A, Chandigarh 27.10.1953 3555 07.10.2018 M.B.B.S. 1956 M.S. (Ophth.) 1970 6. Dr. Kirpal Kaur M.B.B.S. 1953 490, Basant Avenue, Amritsar 09.12.1953 3599 31.03.2019 M.D. 1959 7. Dr. Harbans Kaur Saini L.S.M.F. 1954 Railway Road, Nawan Shahr Doaba 31.05.55 4092 29.01.2019 8. Dr. Baldev Raj Bhateja L.S.M.F. 1955 Raj Poly Clinic and Nursing Home, Pt. 08-06-1955 4106 09.10.2018 Jai Dayal St., Muktsar. -

Brief Facts: 1

I { CENTRAL INFORMATION COMMISSION. File No, ClClLSl Cl 20721 0007 74 Appellant Shri Subhash Chandra Agrawal Public Authorlty i R.espondents Delni & District Cricket Association Date of Decision 13.04.2015 Brief Facts: 1. Sri Subhash Chandra Agrawal filed a complaint on 8.6.2012 stating that there was no response from respondents to his RTI petition dated 30.4,2012 seeking details about a) land provided to stadium of DDCA at Feroz Shah Kotla Ground, b) title, ownership/lease/freehold/rent, rate of rent, subsidy given, other facilities, security, etc. provided by Government or state resources, c) activities undertaken, eligibility criterion for enrolment of membership of Association, total number, various categories, d) number of voters, e) powers and facilities available to office bearers, f) number of mailed envelopes containing proxy-forms returned undelivered, g) number votes received at elections held last, h) system of distribution of complimentary tickets,/passes during several matches conducted by BCCI ant IPL etc, i) number of envelops with such passes for matches held till 30th April 2012, along with, j) envelopes returned undelivered, kj utillzation of seats fell vacant due to return of complimentary tickets, l) relationship of DDCA with BCCi, etc and m) any other related information along with file-notings on movement of the RTI petition as well. 2. The complainant sought a direction to provide documents free of cost as per S 7(6) and compensation under S 19(8)(b) besides invoking the penal provisions. On reference from the Hon'ble Commissioner Shri M.L Sharma, a . full bench of the Commission was constituted. -

Cabinet Nod for Revised DTH Service Guidelines

CENTRAL CC PAGE 09 PAGE 11 https://www.facebook.com/centralchronicle Raipur, Thursday, December 24, 2020 I Pages 12 I Price R 3.00 I City Edition I Fastest growing English Daily of Chhattisgarh www. centralchronicle.in Money-laundering case More farm reforms in offing Cabinet nod for revised ‘Won’t bow before anyone’ ‘Hopeful farm unions will Srinagar, Dec 23 (PTI): discuss govt’s request’ National DTH service guidelines Conference New Delhi, Dec 23 (PTI): has been the case always Ready to talk if govt License to be now lines for providing DTH “Regulatory Framework for (NC) president in history and urged the services in the country. Platform Services” for DTH Farooq Agriculture Minister protesting unions to fix a scraps agri laws: Farmers Abdullah, who issued for 20 yrs Now, DTH license to be is- and multi-system operators Narendra Singh date and time for the As the farmers' protest is facing an ED sued for 20 years, the license (MSOs) services in 2014 Tomar on Wednesday next round of talks. entered its 27th day on probe in con- New Delhi, Dec 23: fee will be collected quarter- which were referred back said the government Protesting farmer Wednesday, Bhartiya Kisan nection with ly,”the Union minister said. by the broadcast ministry will continue with re- unions, who have Union (BKU) spokesperson the Jammu and Kashmir Union information and Earlier, the TRAI issued a in October 2020. MSO is de- forms in the farm stuck to their de- Rakesh Tikait on Wednesday Cricket Association (JKCA) broadcasting (I&B) minister consultation paper on fined as an authorised serv- sector as they are mand for a complete said a solution will come out money-laundering case, Prakash Javadekar on December 7 seeking views ice provider that provides still due in many repeal of all three through dialogue and his asserted on Wednesday that Wednesday said that the and comments with regard cable TVservices to its sub- areas, even as he reit- agri-laws, have not organisation is ready for it. -

The Kangra Co-Operative Bank Ltd

The Kangra Co-operative Bank Ltd LIST OF UNCLAIMED DEPOSITS AS ON 31/12/2017 Sr. No. Name of Account Holder Address 1 A. K.MALIK RETURNING OFFICER KANGRA CO-OP BANK1 NEW DELHI 2 A.K.RAZDAN S O SH S.K.RAZDAN 47/1151 DDA FLATS KALKAJI NEW DELHI 3 AAKASH GULATI S O SH.O.P.GULATI C-600, AVANTIKA, SEC-1,ROHINI, DELHI 4 AAN SINGH S O SH PAN SINGH 1957 PILLANJI VIL KHAN PUR NEW DELHI 5 AARTI MAIHOTRA D O DILBAGH MALHOTRA 1447/13 GVP NEW DELHI 6 AASHISH S O SH SAGAR SINGH 1418G/13 GVP KALKA JI NEW DELHI 7 AASISH GULERIA U G SH. JAGAT RAM B-258,AVANTIKA, ROHINI DELHI 8 AAYUSH KR BABY APPORVA U G MRS NEETA K C-1/150, SEC-16 ROHINI, DELHI 9 ABDUL AZIZ S O ABDUL KADIR G 1/283 BLOCK G 1 GALI NO 8 SANGAM NEW DELHI 10 ABDUL BARIK S O SH. ABDUL RASHID SD-16 SANJAY COLONY OKHLA PHASE-II NEW DELHI 11 ABDUL JAMIL S O SH IQRAMUDDIN 155 HOUGH RANI MALVIYA NAGAR NEW DELHI 12 ABDUL KADIR S O SHAKIR ALI B-387 TRANSIT CAMP GOVINDPURI NEW DELHI 13 ABDUL WAKEEL S O MR ABDUL AZIZ ANSARI 14, JOHARI FARM JAMIA NAGAR NEW DELHI 14 ABHAY RAJ S O SH. DOODH NATH JUGGI NO C-32 314 GOLE MA ELWARD SQNEW DELHI 15 ABIDA W O MD.NIYAZ AHMED C-137,EKTA VIHAR JAITPUR NEW DELHI 16 ACHHAR SINGH 17 ADITAY KUMAR JASWAL S O SH RAJINDER D-178 GALI NO8 LAXMI NAGAR , NEW DELHI 18 ADITI SHARMA U G MRS. -

13TOIDC COL 01R3.QXD (Page 1)

OID‰‹‰†‰KOID‰‹‰†‰OID‰‹‰†‰MOID‰‹‰†‰C New Delhi, Saturday,September 13, 2003www.timesofindia.com Capital 38 pages* Invitation Price Rs. 1.50 International India Sport French politicians suffer Mulayam shifts Pakistan canter from anti-US neurosis, gear, puts new ally to victory in says Jack Straw Sonia on hold 2nd One-dayer Page 13 Page 9 Page 19 WIN WITH THE TIMES Established 1838 Bennett, Coleman & Co., Ltd. Freedom is when the people SC has ‘no faith’ in Gujarat Govt can speak, democracy is when the government By Rakesh Bhatnagar What else is ‘raj dharma’? You ment’s appeal before the high not be silent spectators. We do listens. TIMES NEWS NETWORK quit if you cannot prosecute court in the Bakery case and not have any trust left in your the guilty,’’ Chief Justice V N doubted the government’s in- prosecution agency. There ap- Surely not Best — Alastair Farrugia New Delhi: Short of suggesting Khare said. tentions on punishing the pears to be some collusion be- I have no faith left in the dismissal of the Narendra The state government’s coun- guilty, observing that ‘‘it tween the government and the NEWS DIGEST Modi government in Gujarat for sel and additional solicitor-gen- should quit if it cannot punish prosecution. It is a case where the prosecution and its failure to get the accused in- 14 persons were burnt alive and CII counters EU: The Confedera- eral Mukul Rohatgi said it was the rioters’’. the Gujarat government. I volved in murders and rioting no longer the system that a CM The court took a serious view is this the way prosecution is tion of Indian Industry countered a punished, the Supreme Court am not saying Article 356. -

18/12/2013 Supplementary List

18/12/2013 SUPPLEMENTARY LIST SUPPLEMENTARY LIST FOR TODAY IN CONTINUATION OF THE ADVANCE LIST ALREADY CIRCULATED. THE WEBSITE OF DELHI HIGH COURT IS www.delhihighcourt.nic.in INDEX PRONOUNCEMENT OF JUDGMENTS ---------> J-1 TO J-1 REGULAR MATTERS --------------------> R-1 TO R-56 FINAL MATTERS (ORIGINAL SIDE) ------> F-1 TO F-8 ADVANCE LIST -----------------------> 1 TO 62 APPELLATE SIDE (SUPPLEMENTARY LIST)-> 63 TO 79 (FIRST PART) APPELLATE SIDE (SUPPLEMENTARY LIST)-> 82 TO 90 (SECOND PART) COMPANY ----------------------------> 91 TO 91 ORIGINAL SIDE (SUPPLEMENTARY I)-----> 92 TO 100 SECOND SUPPLEMENTARY ---------------> 101 TO NOTICE IN VIEW OF THE ENSUING WINTER VACATION 2013, FRESH MATTERS AND APPLICATIONS WILL ALSO BE LISTED ON THURSDAY, THE 19th DECEMBER, 2013. NOTES 1. LPA matters being listed before Hon'ble DB-VIII in Part-D of Regular matters list will be taken up on every working day. 2. Regular matters will not be taken up for hearing by Hon'ble Mr. Justice Rajiv Sahai Endlaw from 18.12.2013 to 20.12.2013. Hence Regular matters list is not being published. However, RFA 158/2007 which is a Part-Heard matter, will be taken up on Thursday i.e. 19.12.2013. 3. Hon'ble Mr.Justice R.V. Easwar will not be holding Court today. Dates will be given by the Court Master. DELETIONS 1. W.P.(C) 7918/2011 listed before Hon'ble DB-II at item No.2 is deleted as the same is fixed for 18.02.2014. 2. CM 16993/2013 in W.P.(C) 7843/2013 listed before Hon'ble DB-III at item No.1 is deleted. -

Fodder Sep-Dec. 2015

This edition of the FODDER We Wish our Readers is sponsor ed by Paisley Achche Din Export Throughout Pvt. Ltd. DDDE 2016 Hari Nagar, New Delhi-110064 D E F O RR OD FFO -Team FOD Vol 7 No 3 Newsletter of Family of Disabled September-December 2015 For Private Circulation Only Contents A Dream Come True - Rehab Centre On this page Unnati is a Reality Now Dream Come True Novelist Langston Hughes has this to says: 'Hold fast to dreams, for if dream die, life is a broken winged Beyond Limits 2015... bird that cannot fly. We must be aware that life is what we make of it. It is all rosy if we approach it with Motorcycle Donated To FOD hope and positive action; and it becomes thorny if we fail to dream and act.’ 2 hen FOD was launched in Vihar, Najafgarh, South West Delhi, as a Mileposts Newspace 1992 it did not have even testimony of people’s faith and trust in September 2011: Bought land measuring WRs.1000 for opening a bank FOD serving the people with different 338 sq yds from savings and borrowings 3 account, mandatory for registered social disabilities. Though, the Centre might June 2012: Donations followed after FOD The Last Four Months voluntary organization. Due to paucity of have taken long to come but the Divine was portrayed in Satyamev Jayate space, idea to build a rehab centre power saw us through nevertheless. April 2013: Foundation stone laid germinated around 2005 with an aim to Rajinder Johar Augus t 2015: Bhavan puja 4 handle bigger number of welfare October 2015: Builder hands over the My Wish Fulfilled programmes as well as people with structure to FOD November 2015: Centre becomes disabilities (PWDs).