The Renouncers: Who Gave up U.S. Citizenship, and Why?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

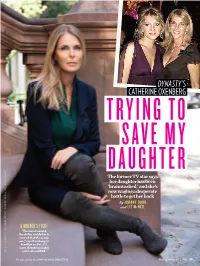

Dynasty's Catherine Oxenberg

DYNASTY’S CATHERINE OXENBERG TRYING TO SAVE MY DAUGHTER The former TV star says her daughter has been ‘brainwashed,’ and she’s now waging a desperate battle to get her back By JOHNNY DODD and LIZ McNEIL A MOTHER’S FIGHT “The more I learned, the darker and darker it seemed that this group was,” says Oxenberg (in Brooklyn on Oct. 21). Inset: Oxenberg (right) HAIR & MAKEUP: DAVID TIBOLLA/CHANEL LES BEIGES/EXCLUSIVE ARTISTS; INSET: COURTESY CATHERINE OXENBERG CATHERINE COURTESY INSET: ARTISTS; BEIGES/EXCLUSIVE LES TIBOLLA/CHANEL DAVID HAIR & MAKEUP: with India in 2008. Photographs by ALLISON MICHAEL ORENSTEIN PEOPLE November 6, 2017 69 1 or the past several years, Catherine Edmondson, 40, who, after being bank account of her inheritance. Oxenberg, who Oxenberg had been unable to shake the recruited for Nxivm’s secret sis- resisted confronting India despite her fears, says, feeling that something wasn’t quite right terhood, was branded last March “It was like, ‘Oh God, she’s getting more and more with her oldest daughter, India. Ever below her hip with what she later enmeshed in this.’ ” since the 26-year-old had become more found out were Raniere’s initials, Shewouldhardly be thefirst.“The generalization deeply involved in a controversial self- shortly before fleeing the group. is that people get into these groups because they improvement program called Nxivm This past May, after Oxenberg, want to improve themselves and help others,” (pronounced NEX-i-um), “she seemed 56, confronted her daughter says Steven Hassan, founder and director of the distant and burdened,” says Oxenberg, about Nxivm, India stopped Freedom of Mind Resource Center. -

Traditional and Non-Traditional Religiosity

TRADITIONAL AND NON-TRADITIONAL RELIGIOSITY PUBLISHED BY Institute of Social Sciences, Belgrade 2019 Yugoslav Society for the Scientific Study of Religion (YSSSR), Niš. PUBLISHER Goran Bašić, Ph.D. Dragan Todorović, Ph.D. REVIEWERS Nonka Bogomilova, Ph.D., Bulgarian Academy of Sciences, Sofia Prof. Pavel Sergeevich Kanevskiy, Faculty of Sociology, Lomonosov Moscow State University Prof. Zorica Kuburić, Faculty of Philosophy, University of Novi Sad SERIES Edited Volumes SERIES EDITOR Natalija Mićunović, Ph.D. Prepared as part of the project “Social Transformations in the European Integration Process: A Multidisciplinary Approach“ supported by the Ministry of Education, Science and Technological Development of the Republic of Serbia (III 47010) ISBN 978-86-7093-227-2 ISBN 978-86-86957-21-4 edited volumes edited TRADITIONAL AND NON-TRADITIONAL RELIGIOSITY (A Thematic Collection of Papers of International Significance) EDITED BY Mirko Blagojević, Ph.D. Dragan Todorović, Ph.D. Institute of Social Sciences and YSSSR | Belgrade and Niš 2019 Contents 6 156 Mirko Blagojević Kjell Magnusson Introduction: Religious Change – Religion and Nationalism in Bosnia, Traditional and Non-traditional Religiosity Croatia and Serbia – A Structural Equation Model 12 Dragoljub B. Đorđević 184 New Religious Movements: Typical Nada Novaković, Marijana Maksimović Characteristics of a Cult Social Development, Traditional Religion Movements and Migrants in Europe 26 Mijo Nikić, Marina Jurčić 206 The Challenge of New Religiosity Nataša Jovanović Ajzenhamer Max Weber on Russia and Orthodoxy: An 54 Analysis of the Collectivist Ethical Basis of Dragan Todorović Eastern Christianity Pentecostalism in Southeastern Serbia 226 76 Ольга Смолина Yuri Stoyanov Культурологические проблемы 5 Contemporary Alavi and Bektashi религиозной жизни украинских земель Religiosity in Turkey and Balkans- В Х – XVII ВВ. -

F E a T U R E S Summer 2021

FEATURES SUMMER 2021 NEW NEW NEW ACTION/ THRILLER NEW NEW NEW NEW NEW 7 BELOW A FISTFUL OF LEAD ADVERSE A group of strangers find themselves stranded after a tour bus Four of the West’s most infamous outlaws assemble to steal a In order to save his sister, a ride-share driver must infiltrate a accident and must ride out a foreboding storm in a house where huge stash of gold. Pursued by the town’s sheriff and his posse. dangerous crime syndicate. brutal murders occurred 100 years earlier. The wet and tired They hide out in the abandoned gold mine where they happen STARRING: Thomas Nicholas (American Pie), Academy Award™ group become targets of an unstoppable evil presence. across another gang of three, who themselves were planning to Nominee Mickey Rourke (The Wrestler), Golden Globe Nominee STARRING: Val Kilmer (Batman Forever), Ving Rhames (Mission hit the very same bank! As tensions rise, things go from bad to Penelope Ann Miller (The Artist), Academy Award™ Nominee Impossible II), Luke Goss (Hellboy II), Bonnie Somerville (A Star worse as they realize they’ve been double crossed, but by who Sean Astin (The Lord of the Ring Trilogy), Golden Globe Nominee Is Born), Matt Barr (Hatfields & McCoys) and how? Lou Diamond Phillips (Courage Under Fire) DIRECTED BY: Kevin Carraway HD AVAILABLE DIRECTED BY: Brian Metcalf PRODUCED BY: Eric Fischer, Warren Ostergard and Terry Rindal USA DVD/VOD RELEASE 4DIGITAL MEDIA PRODUCED BY: Brian Metcalf, Thomas Ian Nicholas HD & 5.1 AVAILABLE WESTERN/ ACTION, 86 Min, 2018 4K, HD & 5.1 AVAILABLE USA DVD RELEASE -

Traditional and Non Traditional

TRADITIONAL AND NON-TRADITIONAL RELIGIOSITY PUBLISHED BY Institute of Social Sciences, Belgrade 2019 Yugoslav Society for the Scientific Study of Religion (YSSSR), Niš. PUBLISHER Goran Bašić, Ph.D. Dragan Todorović, Ph.D. REVIEWERS Nonka Bogomilova, Ph.D., Bulgarian Academy of Sciences, Sofia Prof. Pavel Sergeevich Kanevskiy, Faculty of Sociology, Lomonosov Moscow State University Prof. Zorica Kuburić, Faculty of Philosophy, University of Novi Sad SERIES Edited Volumes SERIES EDITOR Natalija Mićunović, Ph.D. Prepared as part of the project “Social Transformations in the European Integration Process: A Multidisciplinary Approach“ supported by the Ministry of Education, Science and Technological Development of the Republic of Serbia (III 47010) ISBN 978-86-7093-227-2 ISBN 978-86-86957-21-4 edited volumes edited TRADITIONAL AND NON-TRADITIONAL RELIGIOSITY (A Thematic Collection of Papers of International Significance) EDITED BY Mirko Blagojević, Ph.D. Dragan Todorović, Ph.D. Institute of Social Sciences and YSSSR | Belgrade and Niš 2019 Contents 6 156 Mirko Blagojević Kjell Magnusson Introduction: Religious Change – Religion and Nationalism in Bosnia, Traditional and Non-traditional Religiosity Croatia and Serbia – A Structural Equation Model 12 Dragoljub B. Đorđević 184 New Religious Movements: Typical Nada Novaković, Marijana Maksimović Characteristics of a Cult Social Development, Traditional Religion Movements and Migrants in Europe 26 Mijo Nikić, Marina Jurčić 206 The Challenge of New Religiosity Nataša Jovanović Ajzenhamer Max Weber on Russia and Orthodoxy: An 54 Analysis of the Collectivist Ethical Basis of Dragan Todorović Eastern Christianity Pentecostalism in Southeastern Serbia 226 76 Ольга Смолина Yuri Stoyanov Культурологические проблемы 5 Contemporary Alavi and Bektashi религиозной жизни украинских земель Religiosity in Turkey and Balkans- В Х – XVII ВВ. -

Two Coalitions in North Tonawanda YOU Need to Know About

FREE September 12th, 2018 - September 18th, 2018 NiagaraReporter.com Vol. 19, No. 18 FREE Niagara Reporter Recognized by Proclamation at North Tonawnada Council Meeting By: Nicholas D. D'Angelo Upon taking over as Man- aging Editor of this newspa- per in January, 2018, it was clear there was much work to do in terms of building the pa- per into something bigger (and better). In the months that fol- lowed, we made some meaning- ful and much-needed changes. We changed the name. Alderman Berube, Clerk/Treasurer Quinn, Mayor Pappas, Managing Editor Nicholas D. We changed the layout. We D'Angelo, Council President Zadzilka, AldermanPecoraro & Alderman Braun. changed our writers. We began es, albeit an exciting one for us, ly basis, in addition to the City printing on a weekly basis. All was the decision to begin cover- of Niagara Falls, back in March. in all, we changed our focus. ing North Tonawanda on a week- (Cont. on pg. 8) 2QHRIWKHOHVVÁDVK\FKDQJ- Saving the Day: PAGES 4 & 5 Pecoraro: Two Coalitions PAGES 4 & 5 Robert Restaino's in North Tonawanda YOU Donation to 'Baby Need to Know About Shawn' Puts Walk By: Bob Pecoraro for Pediatric North Tonawanda Alderman-at-Large Cancer Across the Becoming an elected rep- Council informed on daily $20,000 Mark resentative came from my de- happenings in the city. I am sire to serve my fellow North most fond of the coalition By: Nicholas D. D'Angelo Tonawanda residents. This is work I have accomplished The Third Annual Pe- a continuation of my 30 years with two organizations in diatric Cancer Awareness of active duty in the United particular: The Community Walk led by ‘Baby Shawn’ States Air Force. -

{TEXTBOOK} Frozen Fear

FROZEN FEAR PDF, EPUB, EBOOK H I Larry,Ash Oswald | 91 pages | 28 Oct 2008 | St Martin's Press | 9780312346560 | English | New York, United States Frozen Fear by H.I. Larry What is it that keeps me from moving forward and taking action? And, more importantly, is it true? Rehearse to yourself affirmations, visualizations, and new emotions that align with a new belief about yourself. Also meditate on future successes like where you will be, what you will be doing, who you will meet. Bring all you senses to the scene — what do you see, feel, hear, taste, and smell? Creating an action plan of what you will do to move forward. You can take control over it instead of it taking control of you. Please share with me by posting in the comment field what has gripped you with fear and what can you do right now to dethrone it? She specializes in helping women thrive after divorce, as opposed to merely surviving. Divorce affects every area of our lives - financially, emotionally, spiritually, physically, and the family dynamics. Our lives feel shattered and we need someone to help put the pieces back together again. Shan is an expert in providing guidance, support and direction. She does this by designing customized tools, techniques, and strategies in order to help ease the difficult challenge of change and uncertainty. Katherine hires Director: Paul Lynch. Writer: William Bigelow screenplay. Added to Watchlist. Paul Lynch Movies. Share this Rating Title: Frozen with Fear 4. Use the HTML below. You must be a registered user to use the IMDb rating plugin. -

Atlantic News

This Page © 2004 Connelly Communications, LLC, PO Box 592 Hampton, NH 03843- Contributed items and logos are © and ™ their respective owners Unauthorized reproduction 12 of this page or its contents for republication in whole or in part is strictly prohibited • For permission, call (603) 926-4557 • AN-Mark 9A-EVEN- Rev 12-16-2004 PAGE 12A | ATLANTIC NEWS | MARCH 24, 2006 | VOL 31, NO 11 ATLANTICNEWS.COM . Play prepares a child’s TALON VIEWS mind for life Learning how to live in the moment BY KATIE CORCORAN a goal or decreasing my nor- grass on the other side, if look back on past experiences Open 7 Days (603) 772-4923 TALON EDITOR-IN-CHIEF mal day to day activities. I you know what I mean. I live and, instead of complaining 107 Water Street, Downtown Exeter, NH SPECIAL TO 16 VOICES basically just choose that reso- today waiting for tomorrow about events that happened, I As the tradition has stood lution to rid myself of failing and tomorrow waiting for will look back and appreciate COPYING at the beginning of each New or not living up to my word. next week and next week the memories created. Year, people have been and So my dilemma was this: waiting for vacation and so So who’s to say this whole Copying to 36” • Laminating to 24” • Canon® 4000 Color Laser Copies What would be a plausible on. But what I realized after “living in the moment” reso- Fax Service • Binding/Padding/Folding • Resumes are still faced with the chal- Business Cards • Rubber Stamps • Carbonless Forms lenge to decide what their resolution for me to acquire talking to my dad is how can lution will really alter my Printed Envelopes • Engraved • Plastic Name Pins/Door Signs, etc. -

Title Catalog Link Section Call # Summary Starring 28 Days Later

Randall Library Horror Films -- October 2009 Check catalog link for availability Title Catalog link Section Call # Summary Starring 28 days later http://uncclc.coast.uncwil. DVD PN1995.9. An infirmary patient wakes up from a coma to Cillian Murphy, Naomie Harris, edu/record=b1917831 Horror H6 A124 an empty room ... in a vacant hospital ... in a Christopher Eccleston, Megan Burns, 2003 deserted city. A powerful virus, which locks Brendan Gleeson victims into a permanent state of murderous rage, has transformed the world around him into a seemingly desolate wasteland. Now a handful of survivors must fight to stay alive, 30 days of night http://uncclc.coast.uncwil. DVD PN1995.9. An isolated Alaskan town is plunged into Josh Hartnett, Melissa George, Danny edu/record=b2058882 Horror H6 A126 darkness for a month each year when the sun Huston, Ben Foster, Mark Boone, Jr., 2008 sinks below the horizon. As the last rays of Mark Rendall, Amber Sainsbury, Manu light fade, the town is attacked by a Bennett bloodthirsty gang of vampires bent on an uninterrupted orgy of destruction. Only the town's husband-and-wife Sheriff team stand 976-EVIL http://uncclc.coast.uncwil. VHS PN1995.9. A contemporary gothic tale of high-tech horror. Stephen Geoffreys, Sandy Dennis, edu/record=b1868584 Horror H6 N552 High school underdog Hoax Wilmoth fills up Lezlie Deane 1989 the idle hours in his seedy hometown fending off the local leather-jacketed thugs, avoiding his overbearing, religious fanatic mother and dreaming of a date with trailer park tempress Suzie. But his quietly desperate life takes a Alfred Hitchcock's http://uncclc.coast.uncwil. -

Television Academy Awards

2021 Primetime Emmy® Awards Ballot Outstanding Picture Editing For A Nonfiction Program All In: The Fight For Democracy All In: The Fight For Democracy follows Stacey Abrams’s journey alongside those at the forefront of the battle against injustice. From the country’s founding to today, this film delves into the insidious issue of voter suppression - a threat to the basic rights of every American citizen. Nancy Novack, Editor Krystalline Armendariz, Editor Allen v. Farrow Episode 1 Series premiere. Mia Farrow recounts her relationship with Woody Allen, once a beloved father figure to her seven children. While their adopted daughter, Dylan, chronicles an often idyllic childhood, she describes the escalating discomfort she felt from Woody’s intense attention - a growing concern for Mia and her inner circle. Mikaela Shwer, Editor Parker Laramie, Editor Sara Newens, Editor Amend: The Fight For America Citizen After escaping slavery, Frederick Douglass becomes a pivotal voice calling for citizenship for Black Americans, a dream realized in the 14th Amendment. Doyle Esch, Editor Carlos Haynes, Editor Mark Imgrund, Editor Frederick Shanahan, Editor American Masters Amy Tan: Unintended Memoir Born to Chinese-immigrant parents, the writer of "The Joy Luck Club" draws from her family history, Asian American experience, and generational trauma to create best-selling works in both fiction and non-fiction. Jeff Boyette, Editor American Masters Michael Tilson Thomas: Where Now Is Michael Tilson Thomas reflects on his tenure as a renowned music director, conductor, and composer who continues to mentor the next generation of classical musicians. Deborah Dickson, Editor American Masters Twyla Moves Choreographer Twyla Tharp takes us into rehearsal on a new piece featuring dance stars like Misty Copeland and Herman Cornejo. -

Case 1:18-Cr-00204-NGG-VMS Document 925 Filed 09/18/20 Page 1 of 86 Pageid #: 16118

Case 1:18-cr-00204-NGG-VMS Document 925 Filed 09/18/20 Page 1 of 86 PageID #: 16118 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF NEW YORK 18-cr-204 (NGG) UNITED STATES OF AMERICA -against- KEITH RANIERE, Defendant. SENTENCING MEMORANDUM ON BEHALF OF KEITH RANIERE BRAFMAN & ASSOCIATES, P.C. Attorney for Defendant Keith Raniere 767 Third Avenue New York, NY 10017 Tel: (212) 750-7800 Fax: (212) 750-3906 MARC A. AGNIFILO Of Counsel DEROHANNESIAN & DEROHANNESIAN 677 Broadway – Ste. 707 Albany, NY 12207 Tel: (518) 465-6420 Fax: (518) 427-0614 PAUL DEROHANNESIAN II Of Counsel Case 1:18-cr-00204-NGG-VMS Document 925 Filed 09/18/20 Page 2 of 86 PageID #: 16119 1. Introduction Keith Raniere continues to assert his complete innocence to these charges. He does, of course, recognize that a jury convicted him of very serious crimes, ironically crimes that he and others in NXIVM have been seeking to prevent others from committing for many years. The jury’s verdict, however, did not reflect the quality of the evidence, but rather was a product of a media campaign involving witnesses who were motivated to testify falsely, a heavy-handed prosecution that threatened potential defense witnesses and, most respectfully, an unfair trial where, we believe, the Court was not provided with full, candid information from the prosecution. Therefore, Mr. Raniere objects to this Court moving this matter on to sentencing because of these significant violations of his due process rights, as well as perjury by critical witnesses1 and threatening actions taken by the Government toward potential defense witnesses,2 events that individually and in combination defeated his right to a fair trial. -

Major Film Festival Comes to NF Wednesday

FREE September 26th, 2018 - October 2nd, 2018 NiagaraReporter.com Vol. 19, No. 20 FREE Major Film Festival Comes to NF Wednesday; Public Invited By: John Wildman The Niagara Falls Interna- tional Film Festival will make LWVGHEXWRQ:HGQHVGD\6HS- tember 26 at The Rapids The- atre (1711 Main Street) with a red carpet gala celebrating WLPH$FDGHP\$ZDUGZLQ- QLQJ&RVWXPH'HVLJQHU0DUN %ULGJHV 7+($57,67 3+$17207+5($' DQG 2VFDUZLQQLQJ9LVXDO(IIHFWV $UWLVW&UDLJ%DUURQ 7+(&8- Niagara Falls native and 2-time Academy Award Winner Mark 5,286&$6(2)%(1-$0,1 Bridges will be honored %87721 PAGES 4 & 5 6RPHWKLQJ 5RWWHQ LQ-RE6KXIÁLQJIRU PAGES 4 & 5 Mayoral Hopeful Seth Piccirillo Dyster seeks to ‘illegally’ create job for his protégé so he can legally run for mayor. By: Frank Parlato At a meeting of the Municipal Civil Service Commission on Sept. 20, some- ´&RPPXQLW\'HYHORSPHQW0DQDJHUµ thing odd happened. There were some 26 DQGD´'LUHFWRURI&RGH(QIRUFHPHQWDQG items on the agenda – most of them about &LYLO&RQVWUXFWLRQµ VSHFLÀFDWLRQVIRUYDULRXVFLYLOVHUYLFHMREV ,WZDVFXULRXVWKDWWKHQHZMREVSHF- DQGZKRZDVFKRVHQWRÀOOWKHP LÀFDWLRQVIRUWKHVHQHZMREVZHUHVODWHG %XWWKHUHZHUHWZRMREV²QHZRQHV² for discussion and possible approval when to be created - that caught our attention. VXGGHQO\WKHMRERI´'LUHFWRURI&RGH(Q- 7KHMREVZHUHOLVWHGXQGHU´SURSRVHG QHZMREVSHFLÀFDWLRQVµ²IRUWZRMREVD (Cont. on pg. 2) 2 NIAGARA REPORTER SEPTEMBER 26, 2018 - OCTOBER 2, 2018 Piccirillo Cont. IRUFHPHQWDQG&LYLO&RQVWUXFWLRQµ VDU\LWVHHPVWR'\VWHUEHFDXVHKH 'LUHFWRURI&RGH(QIRUFHPHQWDQG SD\HUVLQRUGHUWRSDYHWKHZD\IRU was -

These Five Young Adults May Have Famous Parents, but Are Forging Their Own Way

Milo Gibson Grace Van Dien India Oxenberg Ben Hogestyn Delilah Hamlin The Next Generation These five young adults may have famous parents, but are forging their own way. FALL 2015 | 47 GRACE VAN DIEN DELILAH HAMLIN BY MELONIE MAGRUDER | PHOTOGRAPHY BY ROXANNE Mc CANN BY MELONIE MAGRUDER | PHOTOGRAPHY BY ROXANNE Mc CANN aroline Dorothy Grace Van Dien—Grace profession- Grace said. “He’s an actor, so he really understands how to hen Delilah Belle Hamlin was still a young teen- of her daughter’s modeling career, feeling it was more ally, and just “Gracie” to her friends and family— talk to an actor. He’s been in it for so long; he just knew the ager, she told her parents, actors Lisa Rinna and important to focus on school. Cthought she’d take a gap year after graduating from Malibu right things to say at the right moment.” WHarry Hamlin, that she wanted to be a model. They were “But she’s ready now,” Lisa said. “I was blown away High School in 2014. She had a lot to think about. She had The professional admiration was mutual. supportive—as long as she waited until she was at least by her beauty and confidence in her first photo shoot. grown up on film sets—her parents Casper Van Dien and “Working with Gracie and her sisters was a blast,” 17 years old before she started pursuing a career profes- When you wait for the right time, it can all open up. stepmother Catherine Casper said. “They were the sionally. She’s like a rosebud now.” Oxenberg are successful best part of the film.