Standard-Poor-Swiss-Re-Group-Rating

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2007

Annual Report 2007 hannover re R CONTENTS 1 Boards and officers 7 Management report 8 Economic climate 8 Business development 11 Development of the individual lines of business 17 Investments 19 Human resources 22 Sustainability report 24 Risk report 31 Forecast 35 Other information 37 Proposal for the distribution of profits 38 Accounts 38 Balance sheet 42 Profit and loss account 45 Notes 71 Auditors' report 72 Report of the Supervisory Board 76 Declaration of conformity 77 Glossary KEY FIGURES of Hannover Re +/- previous in Mio. EUR 2007 2006 2005 2004 2003 year Gross written premium 6,652.6 -13.0% 7,644.6 6,340.4 6,095.2 6,539.3 Net premium earned 4,979.3 -12.4% 5,685.3 4,383.8 4,030.8 3,695.3 Underwriting result 5) (111.1) -176.3% 145.6 (95.5) (42.8) 60.7 Allocation to the equalisation reserve and similar provisions (309.1) -312.6% 145.4 228.3 232.5 301.8 Investment result 451.2 -43.6% 799.9 895.7 584.7 578.2 Pre-tax profit 438.1 +69.3% 258.7 376.1 149.1 133.2 Profit or loss for the financial year 272.0 +38.8% 196.0 374.6 120.6 114.9 Investments 18,106.1 -2.1% 18,499.7 16,699.4 13,465.3 11,670.8 Capital and reserve 2,085.83) 2,085.83) 2,085.82)3) 1,215.8 1,292.51) Equalisation reserve and similar provisions 1,406.5 -18.0% 1,715.6 1,570.3 1,342.0 1,109.5 Net technical provisions 13,286.7 +2.0% 13,022.7 12,471.9 9,844.2 8,286.7 Total capital, reserves and technical provisions 16,779.0 -0.3% 16,824.1 16,128.0 12,402.0 10,688.7 Number of employees 660 +6 654 628 599 569 Retention 73.9% 74.2% 68.3% 67.8% 56.8% Loss ratio 4)5) 80.0% 72.7% 76.7% 79.6% 80.3% Expense ratio 4) 25.2% 25.4% 26.4% 20.1% 16.1% Combined ratio 4)5) 105.2% 98.1% 103.1% 99.7% 96.4% 1) including surplus debenture (Genussrechtskapital) 2) including allocation to reserves proposed by the Annual General Meeting 3) including subordinated liabilities 4) excluding life reinsurance 5) from the 2006 financial year onwards the option of including special allocations to the provisions for outstanding claims in the non-technical account rather than the technical account will no longer be exercised. -

Annual Report 2008

Annual Report 2008 hannover re R CONTENTS 1 Boards and officers 6 Management report 6 Economic climate 7 Business development 10 Development of the individual lines of business 15 Investments 17 Human resources 20 Sustainability report 22 Risk report 28 Forecast 33 Other information 35 Accounts 36 Balance sheet 40 Profit and loss account 43 Notes 69 Auditors' report 70 Report of the Supervisory Board 74 Declaration of conformity 75 Glossary KEY FIGURES of Hannover Re +/- previous Figures in EUR million 2008 2007 2006 2005 2004 year Gross written premium 7,328.7 +10.2% 6,652.6 7,644.6 6,340.4 6,095.2 Net premium earned 5,429.4 +9.0% 4,979.3 5,685.3 4,383.8 4,030.8 Underwriting result 1) 78.9 -171.0% (111.1) 145.6 (95.5) (42.8) Allocation to the equalisation 33.6 110.9% (309.1) 145.4 228.3 232.5 reserve and similar provisions Investment result 66.9 -85.2% 451.2 799.9 895.7 584.7 Pre-tax profit (104.2) -123.8% 438.1 258.7 376.1 149.1 Profit or loss for the financial year (209.6) -177.1% 272.0 196.0 374.6 120.6 Investments 17,885.1 -1.2% 18,106.1 18,499.7 16,699.4 13,465.3 Capital and reserve 1,878.82) -9.9% 2,085.82) 2,085.82) 2,085.82)3) 1,215.8 Equalisation reserve and similar provisions 1,440.1 +2.4% 1,406.5 1,715.6 1,570.3 1,342.0 Net technical provisions 14,145.0 +6.5% 13,286.7 13,022.7 12,471.9 9,844.2 Total capital, reserves and technical provisions 17,463.9 +4.1% 16,779.0 16,824.1 16,128.0 12,402.0 Number of employees 708 +48 660 654 628 599 Retention 75.2% 73.9% 74.2% 68.3% 67.8% Loss ratio 1)4) 74.0% 80.0% 72.7% 76.7% 79.6% Expense ratio 4) 24.5% 25.2% 25.4% 26.4% 20.1% Combined ratio 1)4) 98.5% 105.2% 98.1% 103.1% 99.7% 1) including allocation to reserves proposed by the Annual General Meeting 2) including subordinated liabilities 3) excluding life reinsurance 4) from the 2006 financial year onwards the option of including special allocations to the provisions for outstanding claims in the non-technical account rather than the technical account will no longer be exercised. -

Baden-Baden 2019 Day 1

Insight and Intelligence on the European and International (Re)insurance Markets 20 OCTOBER 2019 SUNDAY BADEN-BADEN Reinsurers brace for squeezed returns as retro costs set to bite uropean property catastrophe Reinsurance underwriters added that Etreaty reinsurers fear a second year Key points the trend seen in the US and Japan of of squeezed returns as they face being increasingly specific pricing, with rate caught between flat inwards pricing c European loss experience has been increases strongly tied to loss-affected and steepening retrocession costs at benign and globally 2019 does not regions, risks or individual clients, is the 1 January renewal. look to have been an above-average increasingly evident within Europe. Insurers on the continent have experienced cat year Even European cedants with some losses another relatively benign year for cat events. c Hagibis, Faxai and Dorian will put are likely to argue that they have paid Globally, despite creep on Typhoon Jebi some pressure on retro capital, enough in premiums in loss-free years to losses in the first half, as well as Hurricane driving up prices justify a flat renewal rate this year, sources Dorian and typhoons Faxai and Hagibis, c Increasing retro costs plus said. 2019 does not yet appear to be an above- anticipated flat European property Reinsurers, on the other hand, are arguing average cat loss year. cat treaty rates will squeeze for increases after a decade-long downward This 2019 loss record, coupled with a long reinsurers’ returns trend in European property cat treaty benign period for cat claims in Europe and c Some cedants are starting rates which has left pricing at levels many a continued abundance of capacity, means negotiations early in a bid to lock in consider unsustainable. -

Insurance Companies Axa, Zurich, and Swiss Re: Divestment in Canadian Oil and Gas Compared with Their Investments in “Not Free” Countries

Insurance Companies Axa, Zurich, and Swiss Re: Divestment in Canadian Oil and Gas Compared with Their Investments in “Not Free” Countries CEC Research Brief Ten Lennie Kaplan and Mark Milke Table of contents Page Executive Summary 1 Introduction 4 Overview of the Worldwide Insurance Industry 5 Key Findings 6 Axa, Zurich, and Swiss Re investments in “Not Free” countries 6 Axa, Zurich, and Swiss Re Property and Casualty (P&C) insurance 6 premiums in “Not Free countries Breakdowns by company 8 Axa 8 Zurich Insurance 9 Swiss Re 10 Summary 12 References 12 About CEC Research Briefs 13 About the authors 13 Acknowledgements 13 Insurance Companies Axa, Zurich, and Swiss Re: Divestment in Canadian Oil & Gas Compared with Their Investments in “Not Free” Countries Executive summary Insurance companies Axa, Swiss Re, and While these companies have apparently bowed to pressure Zurich versus Canadian oil and gas from some anti-oil and gas activists to curtail their investments in Canadian oil and gas, they continue to invest Property and casualty (P&C) insurance allows oil and gas in other countries, including those considered “Not Free.” companies to protect themselves against such events as This report profiles the investments and insurance coverage damage to property, accidents and other incurred liabilities. of these three insurers in Not Free countries2, where civil and other rights, labour standards and environmental According to HTF Market Intelligence, the size of the oil and performances are often far below those of Free countries. gas property and casualty (P&C) insurance premiums market was about $17.3 billion in 2018. -

Active SAP License Management @ Hannover Re

Active SAP License Management @ hannover re Dr. Uwe Vehlies ([email protected]) Senior IT Coordinator ITAM 2017 Copenhagen, 22 June 2017 Agenda 01 – 05 | Key facts about hannover re 06 – 08 | hannover re's SAP CCOE 09 – 10 | SAP licenses at hannover re 11 – 13 | SAP license management at hannover re 14 | Conclusion from procedure at hannover re Key facts about hannover re Key facts about about hannover hannover re re hannover re's SAP CCOE SAP licenses at hannover re SAP lic.mgmt. @ HR Conclusion Key facts about hannover re Today Majority shareholder: 50.2% held by Talanx AG* 18 Feb 2004 Second Public Offering More than 100 subsidiaries, branches and representative offices worldwide 30 Nov 1994 Total staff of roughly 2,500 employees Initial Public Offering More than 5,000 insurance clients in about 1990 150 countries Life & Health reinsurance as a strategic growth segment 1966 Foundation by HDI as a subsidiary Property & Casualty reinsurance * Majority shareholder HDI V.a.G. 1 Key facts about about hannover hannover re re hannover re's SAP CCOE SAP licenses at hannover re SAP lic.mgmt. @ HR Conclusion From in-house reinsurer to global player >100 subsidiaries, branches/representative offices in ~20 countries 2009: Opening of an office in Shanghai China 2007: Branches and representative offices in Brazil, Colombia, Korea and Shanghai 2006: Hannover Re Takaful B.S.C., Bahrain 2001: Hannover Re (Bermuda) Ltd., Bermuda 2000: Clarendon Insurance Group, USA 1997: Selected portfolios of Skandia International Insurance Company (locations -

Invitation to the Annual General Meeting 2019

Invitation to the Annual General Meeting 2019 Key figures +/- previous Figures in EUR million 2018 year 2017 2016 1 2015 2014 Results Gross written premium 19,176.4 +7.8 % 17,790.5 16,353.6 17,068.7 14,361.8 Net premium earned 17,289.1 +10.6 % 15,631.7 14,410.3 14,593.0 12,423.1 Net underwriting result -51.1 -488.5 115.9 93.8 -23.6 Net investment income 1,530.0 -13.7 % 1,773.9 1,550.4 1,665.1 1,471.8 Operating profit (EBIT) 1,596.6 +17.0 % 1,364.4 1,689.3 1,755.2 1,466.4 Group net income 1,059.5 +10.5 % 958.6 1,171.2 1,150.7 985.6 Balance sheet Policyholders´ surplus 11,035.1 +2.4 % 10,778.5 11,231.4 10,267.3 10,239.5 Equity attributable to sharehol- ders of Hannover Rück SE 8,776.8 +2.9 % 8,528.5 8,997.2 8,068.3 7,550.8 Non-controlling interests 765.2 +0.9 % 758.1 743.3 709.1 702.2 Hybrid capital 1,493.1 +0.1 % 1,492.0 1,490.8 1,489.9 1,986.5 Investments (excl. funds with- held by ceding companies) 42,197.3 +5.3 % 40,057.5 41,793.5 39,346.9 36,228.0 Total assets 64,508.6 +5.4 % 61,196.8 63,594.5 63,214.9 60,457.6 Share Earnings per share (basic and diluted) in EUR 8.79 +10.5 % 7.95 9.71 9.54 8.17 Book value per share in EUR 72.78 +2.9 % 70.72 74.61 66.90 62.61 Dividend 633.1 +5.0 % 603.0 603.0 572.8 512.5 Dividend per share in EUR 3.75 + 1.50 2, 3 +5.0 % 3.50 + 1.50 3 3.50 + 1.50 3 3.25 + 1.50 3 3.00 + 1.25 3 Share price at year-end in EUR 117.70 +12.2 % 104.90 102.80 105.65 74.97 Market capitalisation at year-end 14,194.3 +12.2 % 12,650.6 12,397.4 12,741.1 9,041.2 Ratios Combined ratio (property and casualty reinsurance) 4 96.5 % 99.8 % 93.7 % 94.4 % 94.7 % Large losses as percentage of net premium earned (property and casualty reinsurance) 5 7.9 % 12.3 % 7.8 % 7.1 % 6.1 % Retention 90.7 % 90.5 % 89.3 % 87.0 % 87.6 % Return on investment (excl. -

E HR GRI 20150929 Jl.Indd

GRI Report 2014 Company Portrait Hannover Re, with gross premium of more than EUR 14 billion, is the third-largest reinsurer in the world. We transact all lines of property & casualty and life & health rein- surance and are present on all continents with roughly 2,500 staff. The German business of the Hannover Re Group is transacted by our subsidiary E+S Rück. The rating agencies most relevant to the insurance industry have awarded both Hannover Re and E+S Rück very good financial strength ratings: Standard & Poor’s “AA-” (Very Strong) and A.M. Best “A+” (Superior). Our vision: Long-term success in a competitive business. Content Company Portrait 2 Category “Economic” (EC) (Management Approach and Indicators EC1 – 9) 50 Foreword by the Chairman of the Executive Board 6 Category “Environmental” (EN) (Management Approach and Indicators EN 1 – 30) 54 Executive Board of Hannover Re 8 Category “Labour Practices and Decent Work” (LA) Our Vision 10 (Management Approach and Indicators LA1 – 14, LA15) 67 Review of the Goals and Measures of our Sustainability Strategy 2012 – 2014 14 Category “Human Rights” (HR) (Management Approach and Indicators HR1 – 11) 79 Our Sustainability Strategy 2015 – 2017 16 Category “Society” (SO) GRI Report: Profile (Management Approach and Indicators SO1 – 10, FS13 – 14) 83 1. Strategy and Analysis 20 2. Organisational Profile 23 Appendix: Support for Research, 3. Report Parameters 27 Art and Culture at Hannover Re 87 4. Governance, Commitments and Engagement 29 Imprint 89 GRI Report: Management and Performance Category “Financial Services Sector Indicators” (FS) (Management Approach and Indicators FS1 – 12) 37 Category “Product Responsibility” (PR) (Management Approach and Indicators FS15, PR1 – 9, FS16) 46 Degree of Fulfilment of Individual GRI Disclosures and Indicators In accordance with the Guidelines G3.1 of the Global Reporting Initiative (GRI), we report 1. -

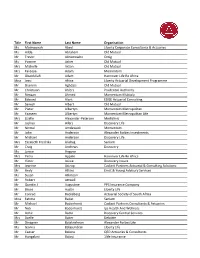

2020 Convention Attendee List 201007.Xlsx

Title First Name Last Name Organisation Ms Maimoonah Abed Liberty Corporate Consultants & Actuaries Ms Hilda Abraham Old Mutual Mr Trevor Abromowitz Omig Ms Yvonne Acker Old Mutual Mrs Michelle Acton Old Mutual Mrs Fareeya Adam Momentum Mr Obaidullah Adam Hannover Life Re Africa Miss Jessi Africa Liberty Actuarial Development Programme Mr Shamim Aghdasi Old Mutual Mr Christiaan Ahlers Prudential Authority Mr Rimaan Ahmed Momentum Multiply Mr Edward Alant EDGE Actuarial Consulting Mr Sanesh Albert Old Mutual Mr Pieter Albertyn Momentum Metropolitan Mr Yaaseen Albertyn Momentum Metropolitan Life Mrs Lizelle Alexander‐Petersen Mediclinic Mr Joshua Allers Discovery Life Mr Nirmal Amdawadi Momentum Mr John Anderson Alexander Forbes Investments Mr Michael Anderson Discovery Life Mrs Elizabeth Fredrika Andrag Sanlam Mr Craig Andrews Discovery Ms Janice Angove Mrs Petro Appelo Hannover Life Re Africa Mr Victor Asiwe Discovery Insure Mrs Jeanine Astrup Cadiant Partners Actuarial & Consulting Solutions Mr Andy Atkins Ernst & Young Advisory Services Ms Susan Atkinson Mr Robert Attwell Mr Quintin J Augustine PPS Insurance Company Mr Bruce Austin Liberty Life Mr Conrad Backeberg Actuarial Society of South Africa Miss Fatima Badat Sanlam Mr Michael Badenhorst Cadiant Partners Consultants & Actuaries Mr Nick Badenhorst Ips Health And Wellness Mr Adhir Badul Discovery Central Services Mrs Azelle Baker Deloitte Mr Dinagren Balakrishnan Alexander Forbes Life Ms Gavina Balasundran Liberty Life Mr Caesar Balona QED Actuaries & Consultants Mr Hungalani Baloyi -

Annual Report Key Figures I 06

Annual Report Key figures I 06 2017 + / – 2016 1 2015 2014 2013 previous Figures in EUR million year Results Gross written premium 17,790.5 +8.8% 16,353.6 17,068.7 14,361.8 13,963.4 Net premium earned 15,631.7 +8.5% 14,410.3 14,593.0 12,423.1 12,226.7 Net underwriting result (488.5) 115.9 93.8 (23.6) (83.0) Net investment income 1,773.9 +14.4% 1,550.4 1,665.1 1,471.8 1,411.8 Operating profit (EBIT) 1,364.4 -19.2% 1,689.3 1,755.2 1,466.4 1,229.1 Group net income 958.6 -18.2% 1,171.2 1,150.7 985.6 895.5 Balance sheet Policyholders´ surplus 10,778.5 -4.0% 11,231.4 10,267.3 10,239.5 8,767.9 Equity attributable to shareholders of Hannover Rück SE 8,528.5 -5.2% 8,997.2 8,068.3 7,550.8 5,888.4 Non-controlling interests 758.1 +2.0% 743.3 709.1 702.2 641.6 Hybrid capital 1,492.0 +0.1% 1,490.8 1,489.9 1,986.5 2,237.8 Investments (excl. funds with- held by ceding companies) 40,057.5 -4.2% 41,793.5 39,346.9 36,228.0 31,875.2 Total assets 61,196.8 -3.8% 63,594.5 63,214.9 60,457.6 53,915.5 Share Earnings per share (basic and diluted) in EUR 7.95 -18.2% 9.71 9.54 8.17 7.43 Book value per share in EUR 70.72 -5.2% 74.61 66.90 62.61 48.83 Dividend 603.0 – 603.0 572.8 512.5 361.8 Dividend per share in EUR 3.50 + 1.50 2, 3 – 3.50 + 1.50 3 3.25 + 1.50 3 3.00 + 1.25 3 3.00 Share price at year-end in EUR 104.90 +2.0% 102.80 105.65 74.97 62.38 Market capitalisation at year- end 12,650.6 +2.0% 12,397.4 12,741.1 9,041.2 7,522.8 Ratios Combined ratio (property and casualty reinsurance) 4 99.8% 93.7% 94.4% 94.7% 94.9% Large losses as percentage of net premium earned (proper- ty and casualty reinsurance) 5 12.3% 7.8% 7.1% 6.1% 8.4% Retention 90.5% 89.3% 87.0% 87.6% 89.0% Return on investment (excl. -

The Drivers of Value Creation in Reinsurance Reinsurers Have Outperformed Because of Cyclical Multiple Improvement

The Drivers of Value Creation in Reinsurance Reinsurers have outperformed because of cyclical multiple improvement Contribution to average annual TSR, 2015–2019 (%)1 14.6 6.5 7.1 9.5 3.8 8.2 8.8 TSR drivers 3.7 5.5 Cash flow contribution3 0.8 6.4 6.6 9.4 Growth in tangible equity 4.6 5.0 Price/TBV change 2.1 0.9 –1.9 0.3 –6.6 Global sector2 Reinsurance P&C Multiline L&H Sources: S&P Capital IQ; Refinitiv; BCG ValueScience Center. Note: Components of TSR are multiplicative but converted and shown here as additive with remainders assigned to the multiple change field. Aggregation based on market cap weights at the start of the year. TSR calculated in each company's reporting currency. 1 TSRs run from December 31, 2014, to December 31, 2019. 2 Total industry sample = 96, omitting brokers and companies with negative tangible book value. 3 Includes dividend contribution and share count change. In the long run, growth drives TSR for top performers sectorwide Percentage-point contribution to average annual TSR, 2015-20191 Top quartile, reinsurance (n=3)2 Top quartile, total industry sample (n=24)2 2.0 20.0 2.0 20.0 9.0 4.6 13.4 9.0 Growth in Price/TBV Cash flow 5-year Growth in Price/TBV Cash flow 5-year tangible equity change contribution3 TSR tangible equity change contribution3 TSR Sources: S&P Capital IQ; Refinitiv; BCG ValueScience Center. Note: Components of TSR are multiplicative but converted and shown here as additive with remainders assigned to the multiple change field. -

The Global Risk Landscape After COVID-19: What Role for Insurance?

The global risk landscape after COVID-19: What role for insurance? The global risk landscape after COVID-19: What role for insurance? Kai-Uwe Schanz, Deputy Managing Director and Head of Research & Foresight, The Geneva Association Acknowledgements Our many thanks to all the experts whose comments and contributions have benefited this publication: Edward Barron (AIG), Paul DiPaola (AIG), Kean Driscoll (AIG), Andreas Funke (Allianz), Maryam Golnaraghi, Gong Xinyu (PICC), Arne Holzhausen (Allianz), Kei Kato (Tokio Marine Holdings), Christian Kraut (Munich Re), Roman Lechner (Swiss Re), Ivo Menzinger (Swiss Re), Cameron Murray (Lloyd’s of London), Guillaume Ominetti (SCOR), Gisela Plassmann (ERGO), Olivier Poissonneau (AXA), Veronica Scotti (Swiss Re) and Lutz Wilhelmy (Swiss Re). The Geneva Association is very grateful to the following executives and academic experts who shared their perspectives through in-depth interviews: / Oliver Bäte, CEO, Allianz / Mark J. Browne, Professor and Chair of the Faculty of Risk Management, Insurance and Actuarial Science, Tobin College of Business at St John's University / Brian Duperreault, Executive Chair of the Board, AIG / Jan-Hendrik Erasmus, Chief Risk Officer, Aviva / Renaud Guidée, Chief Risk Officer, AXA / Jerome Haegeli, Chief Economist, Swiss Re / Jean-Jacques Henchoz, CEO, Hannover Re / Ekhosuehi Iyahen, Secretary General, Insurance Development Forum (IDF) / Paula Jarzabkowski, Professor of Strategic Management, The Business School (formerly Cass), City, University of London / JIANG Xing, CEO, ZhongAn Online P&C Insurance / Denis Kessler, Chairman & CEO, SCOR / LUO Xi, Chairman, People's Insurance Company of China (PICC) / Michael Menhart, Chief Economist, Munich Re / Tsuyoshi Nagano, Chairman of the Board, Tokio Marine / Eduardo Pérez de Lema, Chairman & CEO, MAPFRE RE / Richard Peter, Associate Professor of Finance, The Emmett J. -

Swiss Re Press Release

Press release ab Berkshire Hathaway acquires a 3% stake in Swiss Re Zurich, 23 January 2008 – Swiss Re announced today that Contact: Berkshire Hathaway has acquired a 3% stake in the company. Media Relations, Zurich Swiss Re has also entered into a reinsurance contract with Telephone +41 43 285 7171 Berkshire Hathaway. The capital released as a result of this Corporate Communications, London reinsurance contract will be used to buy back shares. Telephone +44 20 7933 3448 In compliance with the Swiss Federal Act on Stock Exchanges Corporate Communications, New York Telephone +1 212 317 5663 and Securities Trading, Berkshire Hathaway Inc., 3555 Farnam Street, Omaha, NE 68131, USA, notified Swiss Re on Corporate Communications, Asia Telephone +852 2582 3660 22 January 2008 that, as of the same day, it holds through its subsidiary Columbia Insurance Company, 3024 Harney Street, Investor Relations, Zurich Omaha, NE 68131, USA, 11 250 000 registered shares or Telephone +41 43 285 4444 3.03% of the voting rights of Swiss Re, which it acquired in the open market. Contact person of shareholder Marc Hamburg Berkshire Hathaway Inc. Swiss Re has also entered into a proportional reinsurance 3555 Farnam Street, contract with Berkshire Hathaway. Under this quota share Omaha, NE 68131 USA arrangement, Berkshire Hathaway will assume a 20% share of all Swiss Re's property and casualty business for the next five years. The contract is effective as of 1 January 2008. This will lead to a reduction in the capital deployed in Swiss Re's P&C business. Swiss Reinsurance Company Mythenquai 50/60 P.O.