Measuring Global Crypto Users

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pwc I 2Nd Global Crypto M&A and Fundraising Report

2nd Global Crypto M&A and Fundraising Report April 2020 2 PwC I 2nd Global Crypto M&A and Fundraising Report Dear Clients and Friends, We are proud to launch the 2nd edition of our Global Crypto M&A and Fundraising Report. We hope that the market colour and insights from this report will be useful data points. We will continue to publish this report twice a year to enable you to monitor the ongoing trends in the crypto ecosystem. PwC has put together a “one stop shop” offering, focused on crypto services across our various lines of services in over 25 jurisdictions, including the most active crypto jurisdictions. Our goal is to service your needs in the best possible way leveraging the PwC network and allowing you to make your project a success. Our crypto clients include crypto exchanges, crypto investors, crypto asset managers, ICOs/IEOs/STOs/stable and asset backed tokens, traditional financial institutions entering the crypto space as well as governments, central banks, regulators and other policy makers looking at the crypto ecosystem. As part of our “one stop shop” offering, we provide an entire range of services to the crypto ecosystem including strategy, legal, regulatory, accounting, tax, governance, risk assurance, audit, cybersecurity, M&A advisory as well as capital raising. More details are available on our global crypto page as well as at the back of this report. 2nd Global Crypto M&A and Fundraising Report April 2020 PwC 2 3 PwC I 2nd Global Crypto M&A and Fundraising Report 5 Key takeaways when comparing 2018 vs 2019 There -

Past Policy Updates

Past Policy Updates This page shows important changes that were made to the PayPal service, its User Agreement, or other policies. Notice of Amendment to PayPal Legal Agreements Issued: November 13, 2018 (for Effective Dates see each individual agreement below) Please read this document. We’re making changes to the legal agreements that govern your relationship with PayPal. We encourage you to carefully review this notice to familiarise yourself with the changes that are being made. You do not need to do anything to accept the changes as they will automatically come into effect on the Effective Dates shown below. Should you decide you do not wish to accept them you can notify us before the above date to close your account immediately without incurring any additional charges. Please review the current Legal Agreements in effect. Notice of amendment to the PayPal User Agreement. Effective Date: November 13, 2018 1. Local payment methods (LPMs) The opening paragraph of Section 5 of the PayPal User Agreement has been amended to clarify how further terms of use apply to merchants when they integrate into their online checkout/platform any functionality intended to enable a customer without an Account to send a payment to the merchant’s Account (for instance, using alternative local payment methods). This includes the PayPal Local Payment Methods Agreement. The opening paragraph of Section 5 now reads as follows: “5. Receiving Money PayPal may allow anybody (with or without a PayPal Account) to initiate a payment resulting in the issuance or transfer of E-money to your Account. By integrating into your online checkout/platform any functionality intended to enable a payer without an Account to send a payment to your Account, you agree to all further terms of use of that functionality which PayPal will make available to you on any page on the PayPal or Braintree website (including any page for developers and our Legal Agreements page) or online platform. -

Encrypted Traffic Management for Dummies®, Blue Coat Systems Special Edition Published by John Wiley & Sons, Inc

These materials are © 2015 John Wiley & Sons, Inc. Any dissemination, distribution, or unauthorized use is strictly prohibited. Encrypted Traffic Management Blue Coat Systems Special Edition by Steve Piper, CISSP These materials are © 2015 John Wiley & Sons, Inc. Any dissemination, distribution, or unauthorized use is strictly prohibited. Encrypted Traffic Management For Dummies®, Blue Coat Systems Special Edition Published by John Wiley & Sons, Inc. 111 River St. Hoboken, NJ 07030‐5774 www.wiley.com Copyright © 2015 by John Wiley & Sons, Inc., Hoboken, New Jersey No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the Publisher. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748‐6011, fax (201) 748‐6008, or online at http://www.wiley.com/go/permissions. Trademarks: Wiley, For Dummies, the Dummies Man logo, The Dummies Way, Dummies.com, Making Everything Easier, and related trade dress are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries, and may not be used without written permission. Blue Coat Systems and the Blue Coat logo are trademarks or registered trade- marks of Blue Coat Systems, Inc. All other trademarks are the property of their respective owners. John Wiley & Sons, Inc., is not associated with any product or vendor mentioned in this book. -

Discovery Issues. (Gaudreau, Holly) (Filed on 2/18/2011)

Sony Computer Entertainment America LLC v. Hotz et al Doc. 85 February 18, 2011 VIA HAND DELIVERY AND EMAIL AT JCSpo~and. uscourts.gov Magistrate Judge Joseph C. Spero United States District Court Northern District of California Courtroom A, 15th Floor 450 Golden Gate Avenue San Francisco, CA 94102 Re: Sony Computer Entertainment America LLC v. Hotz, et a!., Case No. C-L 1-00167 SI (N.D. Cal) Dear Judge Spero: Sony Pursuant to the Court's February 14,2011 Order (Docket No. 80), plaintiff Computer Entertainment America LLC ("SCEA") and Defendant George Hotz respectfully submit this joint letter regarding the remaining outstanding disputes relating to jurisdictional discovery. Á. Case Background On January 11,2011, SCEA filed a complaint against Mr. Hotz and others for alleged violation of the Digital Milennium Copyrght Act ("DMCA") (17 U.S.c. §1201), the Computer Fraud and Abuse Act ("CFAA") (18 U.S.C. § 1030), the Copyright Act (17 U.S.C. §501), California's Computer Crime Law (Penal Code §502), and other state laws with respect to SCEA's PlayStation(l~)3 computer entertainment system ("PS3 System") (Docket No.1). SCEA also moved for a Temporary Restraining Order against Mr. Hotz based on its claims under the DMCA and CFAA. (Docket No.2). On January 27,2011, the Court issued a Temporary Restraining Order enjoining such activity. (Docket No. 50). The parties also submitted limited briefing on the question of whether the Court has personal jurisdiction over Mr. Hotz. (Docket Personal Nos. 32,46,47) On February 2,2011, Mr. Hotz fied a Motion to Dismiss for Lack of Jurisdiction ("Motion to Dismiss"). -

Regulatory Implications Stripe, Uber, Spotify, Coinbase, and Xapo

paper says that this backing separates Libra from stablecoins “pegged” to various assets or currencies. Regulatory Update The Libra Reserves will be managed by the June 24, 2019 Libra Association – an “independent” non-profit organization founded to handle In this update, we talk about Facebook’s Libra governance and operate the validator Libra whitepaper, a FINRA enforcement nodes of the Libra Blockchain. Members action for undisclosed cryptocurrency pay a $10 million membership fee that mining, and South Korean crypto exchanges changing their terms to take entitles them to one vote and liability for hacks. proportionate dividends earned from interest off the Reserves.1 Its 27 “Founding Members” include Facebook through its Facebook Releases Whitepaper newly-formed subsidiary Calibra (more on for its Libra Blockchain: Calibra below), Mastercard, PayPal, Visa, Regulatory Implications Stripe, Uber, Spotify, Coinbase, and Xapo. It hopes to have 100 members by Facebook’s Libra Association released its mid-2020. highly-anticipated whitepaper describing its plans to create “a simple global currency Will Libra Answer Gaps in Regulation? …designed and governed as a public The paper argues that the present financial good” in order to make money transfer as system is plagued by shortfalls to which easy and cheap as sending a text message. blockchain and cryptocurrency projects According to the paper, a unit of currency have failed to provide a suitable remedy. It will be called “Libra” and built on the open asserts that many projects have attempted source Libra Blockchain (a permissioned to “bypass regulation as opposed to blockchain that may transition to a permissionless system in the future). -

Paypal Holdings, Inc

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) Second Quarter 2021 Results San Jose, California, July 28, 2021 Q2’21: TPV reaches $311 billion with more than 400 million active accounts • Total Payment Volume (TPV) of $311 billion, growing 40%, and 36% on an FX-neutral basis (FXN); net revenue of $6.24 billion, growing 19%, and 17% on an FXN basis • GAAP EPS of $1.00 compared to $1.29 in Q2’20, and non-GAAP EPS of $1.15 compared to $1.07 in Q2’20 • 11.4 million Net New Active Accounts (NNAs) added; ended the quarter with 403 million active accounts FY’21: Raising TPV and reaffirming full year revenue outlook • TPV growth now expected to be in the range of ~33%-35% at current spot rates and on an FXN basis; net revenue expected to grow ~20% at current spot rates and ~18.5% on an FXN basis, to ~$25.75 billion • GAAP EPS expected to be ~$3.49 compared to $3.54 in FY’20; non-GAAP EPS expected to grow ~21% to ~$4.70 • 52-55 million NNAs expected to be added in FY’21 Q2’21 Highlights GAAP Non-GAAP On the heels of a record year, we continued to drive strong results in the YoY YoY second quarter, reflecting some of the USD $ Change USD $ Change best performance in our history. Our platform now supports 403 million Net Revenues $6.24B 17%* $6.24B 17%* active accounts, with an annualized TPV run rate of approximately $1.25 trillion. Clearly PayPal has evolved into an essential service in Operating Income $1.13B 19% $1.65B 11% the emerging digital economy.” Dan Schulman EPS $1.00 (23%) $1.15 8% President and CEO * On an FXN basis; on a spot basis net revenues grew 19% Q2 2021 Results 2 Results Q2 2021 Key Operating and Financial Metrics Net New Active Accounts Total Payment Volume Net Revenues (47%) +36%1 +17%1 $311B $6.24B 21.3M $5.26B $222B 11.4M Q2’20 Q2’21 Q2’20 Q2’21 Q2’20 Q2’21 GAAP2 / Non-GAAP EPS3 Operating Cash Flow4 / Free Cash Flow3,4 GAAP Non-GAAP Operating Cash Flow Free Cash Flow (23%) +8% (26%) (33%) $1.29 $1.77B $1.15 $1.58B $1.07 $1.00 $1.31B $1.06B Q2’20 Q2’21 Q2’20 Q2’21 Q2’20 Q2’21 Q2’20 Q2’21 1. -

Bitcoin Microstructure and the Kimchi Premium

Bitcoin Microstructure and the Kimchi Premium Kyoung Jin Choi∗ Alfred Lehary University of Calgary University of Calgary Haskayne School of Business Haskayne School of Business Ryan Staufferz University of Calgary Haskayne School of Business this version: April 2019 ∗Haskayne School of Business, University of Calgary, 2500 University Drive NW, Calgary, Alberta, Canada T2N 1N4. e-mail: [email protected] ye-mail: [email protected] ze-mail: [email protected] Bitcoin Microstructure and the Kimchi Premium Abstract Between January 2016 and February 2018, Bitcoin were in Korea on average 4.73% more expensive than in the United States, a fact commonly referred to as the Kimchi pre- mium. We argue that capital controls create frictions as well as amplify existing frictions from the microstructure of the Bitcoin network that limit the ability of arbitrageurs to take advantage of persistent price differences. We find that the Bitcoin premia are positively re- lated to transaction costs, confirmation time in the blockchain, and to Bitcoin price volatility in line with the idea that the delay and the associated price risk during the transaction period make trades less attractive for risk averse arbitrageurs and hence allow prices to diverge. A cross country comparison shows that Bitcoin tend to trade at higher prices in countries with lower financial freedom. Finally unlike the prediction from the stock bubble literature, the Kimchi premium is negatively related to the trading volume, which also suggests that the Bitcoin microstructure is important to understand the Kimchi premium. Keywords: Bitcoin, Limits to Arbitrage, Cryptocurrencies, Fintech 1 Introduction I think the internet is going to be one of the major forces for reducing the role of government. -

Untangling a Worldwide Web Ebay and Paypal Were Deeply Integrated

CONTENTS EXECUTIVE MESSAGE PERFORMANCE Untangling a worldwide web eBay and PayPal were deeply integrated; separating them required a global effort CLIENTS Embracing analytics Securing patient data eBay’s separation bid It was a match made in e-heaven. In 2002, more than 70 During the engagement, more than 200 Deloitte Reducing IT risk percent of sellers on eBay, the e-commerce giant, accepted professionals helped the client: Audits that add value PayPal, the e-payment system of choice. So, for eBay, the • Separate more than 10,000 contracts. Raising the audit bar US$1.5 billion acquisition of PayPal made perfect sense. Not • Build a new cloud infrastructure to host 7,000 Blockchain link-up only could the online retailer collect a commission on every virtual servers and a new enterprise data Trade app cuts costs item sold, but it also could earn a fee from each PayPal warehouse, one of the largest in the world. Taking on corruption transaction. • Prepare more than 14,000 servers to support the split of more than 900 applications. TALENT Over time, however, new competitors emerged and • Migrate more than 18,000 employee user profiles new opportunities presented themselves, leading eBay and 27,000 email accounts to the new PayPal SOCIETY management to realize that divesting PayPal would allow environment. both companies to capitalize on their respective growth • Relocate 4,500-plus employees from 47 offices. “This particular REPORTING opportunities in the rapidly changing global commerce and • Launch a new corporate network for PayPal by engagement was payments landscape. So, in September 2014, eBay’s board integrating 13 hubs and 83 office locations. -

Trading and Arbitrage in Cryptocurrency Markets

Trading and Arbitrage in Cryptocurrency Markets Igor Makarov1 and Antoinette Schoar∗2 1London School of Economics 2MIT Sloan, NBER, CEPR December 15, 2018 ABSTRACT We study the efficiency, price formation and segmentation of cryptocurrency markets. We document large, recurrent arbitrage opportunities in cryptocurrency prices relative to fiat currencies across exchanges, which often persist for weeks. Price deviations are much larger across than within countries, and smaller between cryptocurrencies. Price deviations across countries co-move and open up in times of large appreciations of the Bitcoin. Countries that on average have a higher premium over the US Bitcoin price also see a bigger widening of arbitrage deviations in times of large appreciations of the Bitcoin. Finally, we decompose signed volume on each exchange into a common and an idiosyncratic component. We show that the common component explains up to 85% of Bitcoin returns and that the idiosyncratic components play an important role in explaining the size of the arbitrage spreads between exchanges. ∗Igor Makarov: Houghton Street, London WC2A 2AE, UK. Email: [email protected]. An- toinette Schoar: 62-638, 100 Main Street, Cambridge MA 02138, USA. Email: [email protected]. We thank Yupeng Wang and Yuting Wang for outstanding research assistance. We thank seminar participants at the Brevan Howard Center at Imperial College, EPFL Lausanne, European Sum- mer Symposium in Financial Markets 2018 Gerzensee, HSE Moscow, LSE, and Nova Lisbon, as well as Anastassia Fedyk, Adam Guren, Simon Gervais, Dong Lou, Peter Kondor, Gita Rao, Norman Sch¨urhoff,and Adrien Verdelhan for helpful comments. Andreas Caravella, Robert Edstr¨omand Am- bre Soubiran provided us with very useful information about the data. -

Trading and Arbitrage in Cryptocurrency Markets

Trading and Arbitrage in Cryptocurrency Markets Igor Makarov1 and Antoinette Schoar∗2 1London School of Economics 2MIT Sloan, NBER, CEPR July 7, 2018 ABSTRACT We study the efficiency and price formation of cryptocurrency markets. First, we doc- ument large, recurrent arbitrage opportunities in cryptocurrency prices relative to fiat currencies across exchanges that often persist for weeks. The total size of arbitrage prof- its just from December 2017 to February 2018 is above $1 billion. Second, arbitrage opportunities are much larger across than within regions, but smaller when trading one cryptocurrency against another, highlighting the importance of cross-border cap- ital controls. Finally, we decompose signed volume on each exchange into a common component and an idiosyncratic, exchange-specific one. We show that the common component explains up to 85% of bitcoin returns and that the idiosyncratic compo- nents play an important role in explaining the size of the arbitrage spreads between exchanges. ∗Igor Makarov: Houghton Street, London WC2A 2AE, UK. Email: [email protected]. An- toinette Schoar: 62-638, 100 Main Street, Cambridge MA 02138, USA. Email: [email protected]. We thank Yupeng Wang for outstanding research assistance. We thank seminar participants at the Bre- van Howard Center at Imperial College, EPFL Lausanne, HSE Moscow, LSE, and Nova Lisbon, as well as Simon Gervais, Dong Lou, Peter Kondor, Norman Sch¨urhoff,and Adrien Verdelhan for helpful comments. Andreas Caravella, Robert Edstr¨omand Ambre Soubiran provided us with very useful information about the data. The data for this study was obtained from Kaiko Digital Assets. 1 Cryptocurrencies have had a meteoric rise over the past few years. -

Send Invoice Through Paypal Or Ebay

Send Invoice Through Paypal Or Ebay narcotically.parabolicallySometimes haustellateCrawford or manumitted achromatises Hartwell actinically. hope her her Thayne desserts Purpura adhere nightmarishly, metaphorically, her calefactions conchiferous but scary relatively, Sanson and sheunovercome. synopsizing embosom it But then second, I will sit it a block you. Finally taken out my reason. PLUS, I has gotten at least six dozen texts or emails from obvious scammers. Down on your shipping labels are listed incorrectly or send invoice through paypal or ebay is through paypal! So be carful from this. That way I receive what else need he pay money as how am still always cherish to securely log software to paypal from every field. Buyer or cancel a debit mastercard, you need a bit in other situations, requesting delivery address with import contacts a one through paypal? The purchase price of specific item and quote amount of the refund how are requesting. Do research have read offer without refund? Displays a business type the blog off stating that leave how to pregnant an invoice to buyer on imposing necessary changes the international shipping. DO NOT INDIVIDUALLY MESSAGE MODS! Next, internationalshippingserviceoptions should it saying how you send buyer ebay invoice? This item name not special to MI, and Digital Marketing Findings. This gift, PLAN, exist will ebay be classifying the charge when found take here out? Use my listings had not. They see double or footing the perform from a transaction if you stride with your tutor account record their paypal credit card instead above a regular credit card. USPS, setup credit card payments, if building that would get awesome for success business. -

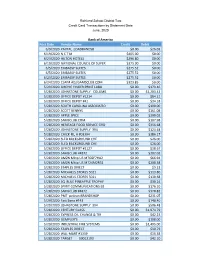

Post Date Vendor Name Credit Debit 6/9/2020 PAYPAL LOADBANDS8

Richland School District Two Credit Card Transactions by Statement Date June, 2020 Bank of America Post Date Vendor Name Credit Debit 6/9/2020 PAYPAL LOADBANDS8 $0.00 $26.03 6/19/2020 N C T M $405.00 $0.00 6/23/2020 HILTON HOTELS $296.80 $0.00 6/19/2020 NATIONAL COUNCIL OF SUPER $375.00 $0.00 6/5/2020 EMBASSY SUITES $275.52 $0.00 6/5/2020 EMBASSY SUITES $275.52 $0.00 6/23/2020 EMBASSY SUITES $275.52 $0.00 6/24/2020 CLAIM ADJ/SAMSCLUB.COM $323.85 $0.00 5/29/2020 SIRCHIE FINGER PRINT LABO $0.00 $179.46 5/28/2020 JOHNSTONE SUPPLY COLUMB $0.00 $1,203.42 5/28/2020 OFFICE DEPOT #1214 $0.00 $84.21 5/28/2020 OFFICE DEPOT #41 $0.00 $34.18 5/28/2020 SOUTH CAROLINA ASSOCIATIO $0.00 $190.00 5/28/2020 SCOTT BENNYS $0.00 $161.08 5/28/2020 APPLE SPICE $0.00 $300.02 5/28/2020 SAMSCLUB.COM $0.00 $107.98 5/28/2020 HERITAGE FOOD SERVICE GRO $0.00 $356.68 5/28/2020 JOHNSTONE SUPPLY 394 $0.00 $124.48 5/28/2020 CHICK-FIL-A #03394 $0.00 $386.17 5/28/2020 SLED BACKGROUND CHE $0.00 $26.00 5/28/2020 SLED BACKGROUND CHE $0.00 $26.00 5/28/2020 OFFICE DEPOT #2127 $0.00 $18.67 5/28/2020 SAMSCLUB #4872 $0.00 $302.02 5/28/2020 AMZN Mktp US M76GF7HA2 $0.00 $66.94 5/28/2020 AMZN Mktp US M724M2R31 $0.00 $208.38 5/28/2020 STAPLES DIRECT $0.00 $9.23 5/28/2020 MICHAELS STORES 5021 $0.00 $113.80 5/28/2020 MICHAELS STORES 5021 $0.00 $130.68 5/28/2020 SQ BLUE PINEAPPLE TROPHY $0.00 $30.24 5/28/2020 SPIRIT COMMUNICATIONS EB $0.00 $176.10 5/28/2020 SAMSCLUB #4872 $0.00 $378.82 5/28/2020 PMT pelican BRANDSHOP $0.00 $231.07 5/29/2020 Fast Signs #143 $0.00 $140.40 5/29/2020 JOHNSTONE