Notice of 2018 Annual Meeting of Shareholders • Management Information Circular

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

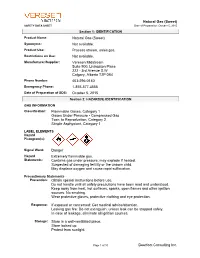

Natural Gas (Sweet) SAFETY DATA SHEET Date of Preparation: October 5, 2015 Section 1: IDENTIFICATION Product Name: Natural Gas (Sweet) Synonyms: Not Available

Natural Gas (Sweet) SAFETY DATA SHEET Date of Preparation: October 5, 2015 Section 1: IDENTIFICATION Product Name: Natural Gas (Sweet) Synonyms: Not available. Product Use: Process stream, sales gas. Restrictions on Use: Not available. Manufacturer/Supplier: Veresen Midstream Suite 900, Livingston Place 222 - 3rd Avenue S.W. Calgary, Alberta T2P 0B4 Phone Number: 403-296-0140 Emergency Phone: 1-855-577-4555 Date of Preparation of SDS: October 5, 2015 Section 2: HAZARD(S) IDENTIFICATION GHS INFORMATION Classification: Flammable Gases, Category 1 Gases Under Pressure - Compressed Gas Toxic to Reproduction, Category 2 Simple Asphyxiant, Category 1 LABEL ELEMENTS Hazard Pictogram(s): Signal Word: Danger Hazard Extremely flammable gas. Statements: Contains gas under pressure; may explode if heated. Suspected of damaging fertility or the unborn child. May displace oxygen and cause rapid suffocation. Precautionary Statements Prevention: Obtain special instructions before use. Do not handle until all safety precautions have been read and understood. Keep away from heat, hot surfaces, sparks, open flames and other ignition sources. No smoking. Wear protective gloves, protective clothing and eye protection. Response: If exposed or concerned: Get medical advice/attention. Leaking gas fire: Do not extinguish, unless leak can be stopped safely. In case of leakage, eliminate all ignition sources. Storage: Store in a well-ventilated place. Store locked up. Protect from sunlight. Page 1 of 10 Deerfoot Consulting Inc. Natural Gas (Sweet) SAFETY DATA SHEET Date of Preparation: October 5, 2015 Disposal: Dispose of contents/container in accordance with applicable regional, national and local laws and regulations. Hazards Not Otherwise Classified: Not applicable. Ingredients with Unknown Toxicity: None. -

CALGARY, ALBERTA October 6, 2015 – Veresen Inc

FOR IMMEDIATE RELEASE Veresen Announces Approval of the $860 Million Sunrise Gas Plant CALGARY, ALBERTA October 6, 2015 – Veresen Inc. (“Veresen” or the “Company”) (TSX: VSN) is pleased to announce that the Cutbank Ridge Partnership (“CRP”), a partnership between Encana Corporation (“Encana”) and Cutbank Dawson Gas Resources Ltd., a subsidiary of Mitsubishi Corporation, has sanctioned the 400 million cubic feet per day (“mmcf/d”) Sunrise gas plant, to be located in the Montney region near Dawson Creek in northeastern British Columbia. In late 2014, Veresen Midstream Limited Partnership (“Veresen Midstream”), owned 50% by Veresen and 50% by affiliates of Kohlberg Kravis Roberts & Co. L.P. (“KKR”), entered into a fee-for-service arrangement with Encana and CRP to undertake up to $5 billion of new midstream expansion for those parties in the Montney region, with the Sunrise gas plant being the first newly sanctioned project under the agreement. The estimated capital cost for the project (plant and ancillary facilities) is $860 million. Veresen Midstream will fund approximately 60% of the Sunrise gas plant’s construction costs with its existing $1.275 billion credit facility, which is largely undrawn, with the balance to be contributed over time by Veresen and KKR. Veresen intends to fund its share of future contributions to Veresen Midstream with ongoing proceeds received from equity issued in connection with Veresen’s Premium DividendTM and Dividend Reinvestment Plan. Encana will oversee the project management and construction of the facility on behalf of Veresen Midstream. Construction of the Sunrise gas plant has commenced, with the facility expected to be in-service in late 2017. -

Canada Capital Markets Review

Canada Capital Markets Review FIRST HALF 2019 | MANAGING UNDERWRITERS Canada Capital Markets Review First Half 2019 | Managing Underwriters Global Deals Intelligence Canada Debt Capital Markets Issuance (C$bil) $200 350 Canadian Debt Capital Markets $180 Overall Canadian DCM issuance (excluding self-funded deals) totaled C$91.5 billion in the first half of 300 2019, a 4% decrease from the year prior. On a quarter-over-quarter basis, proceeds fell by 3% and the $160 number of issues fell by 7% and 10% on a year-over-year and quarter-over-quarter basis respectively. $140 250 Government and Agency debt led the market, with a 59% share of overall issuance at the end of the first six months. Financials and Energy & Power followed, with 21% and 10% market shares, $120 respectively. 200 $100 RBC placed first in nearly all Canadian rankings in the first half, including Canadian All Debt (including 150 & excluding self-funded), Canadian Domestic Corporate Debt (including and excluding self-funded), $80 Canadian Domestic Government Debt (True Economics), and Canadian Cross Border transactions. National Bank placed first in Canadian Domestic Government Debt (Full Credit). $60 100 Overall, the top corporate deals list for the first six months, exclusive of self-funded issues, was led by $40 Hydro One with C$1.5 billion of issuance, followed by Enbride Pipelines with $1.2 billion, and 50 Northwestern Hydro with C$1.1 billion. $20 Canadian Equity Capital Markets $0 0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Canadian Equity & Equity-Related issuance (excluding self-led issuance) totaled C$11.6 billion from Q1 Q2 Q3 Q4 H1 # of Deals 137 issues in the first half, representing a 33% decrease in total proceeds from the previous year, but a 46% climb from the previous quarter. -

Interim Report Q2

Pembina Pipeline Corporation 2017 INTERIM REPORT Q2 Building Something Extraordinary News Release Pembina Pipeline Corporation Reports Solid Second Quarter 2017 Results Announced $9.7 billion transformational combination with Veresen and placed $2.8 billion of projects into service safely and reliably All financial figures are in Canadian dollars unless noted otherwise. CALGARY, AB, August 1, 2017 – Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX: PPL; NYSE: PBA) announced today its financial and operating results for the second quarter of 2017. Operational and Financial Overview 3 Months Ended 6 Months Ended June 30 June 30 ($ millions, except where noted) (unaudited) (unaudited) 2017 2016 2017 2016 Conventional Pipelines revenue volumes (mbpd)(1)(2) 692 648 692 659 Oil Sands & Heavy Oil contracted capacity (mbpd)(1) 975 880 975 880 Gas Services revenue volumes net to Pembina (mboe/d)(2)(3) 172 133 171 123 Midstream Natural Gas Liquids ("NGL") sales volumes (mbpd)(1) 124 132 148 136 Total volume (mboe/d)(3) 1,963 1,793 1,986 1,798 Revenue 1,166 1,027 2,651 2,044 Net revenue(4) 451 429 1,005 823 Operating margin(4) 355 327 762 642 Gross profit 276 248 657 485 Earnings 124 113 339 215 Earnings per common share – basic and diluted (dollars) 0.26 0.25 0.75 0.48 Adjusted EBITDA(4) 303 291 666 560 Cash flow from operating activities 362 273 688 544 Cash flow from operating activities per common share – basic (dollars)(4) 0.90 0.70 1.72 1.42 Adjusted cash flow from operating activities(4) 275 235 583 444 Adjusted cash flow from -

Deerfoot Consulting Inc. Natural Gas (Sour)

Natural Gas (Sour) SAFETY DATA SHEET Date of Preparation: October 5, 2015 Section 1: IDENTIFICATION Product Name: Natural Gas (Sour) Synonyms: Not available. Product Use: Process stream, sales gas. Restrictions on Use: Not available. Manufacturer/Supplier: Veresen Midstream Suite 900, Livingston Place 222 - 3rd Avenue S.W. Calgary, Alberta T2P 0B4 Phone Number: 403-296-0140 Emergency Phone: 1-855-577-4555 Date of Preparation of SDS: October 5, 2015 Section 2: HAZARD(S) IDENTIFICATION GHS INFORMATION Classification: Flammable Gases, Category 1 Gases Under Pressure - Compressed Gas Acute Toxicity - Inhalation, Category 2 Eye Irritation, Category 2A Toxic to Reproduction, Category 2 LABEL ELEMENTS Hazard Pictogram(s): Signal Word: Danger Hazard Extremely flammable gas. Statements: Contains gas under pressure; may explode if heated. Fatal if inhaled. Causes serious eye irritation. Suspected of damaging fertility or the unborn child. Precautionary Statements Prevention: Obtain special instructions before use. Do not handle until all safety precautions have been read and understood. Keep away from heat, hot surfaces, sparks, open flames and other ignition sources. No smoking. Do not breathe gas. Wash thoroughly after handling. Use only outdoors or in a well-ventilated area. Wear protective gloves, protective clothing and eye protection. Wear respiratory protection. Page 1 of 11 Deerfoot Consulting Inc. Natural Gas (Sour) SAFETY DATA SHEET Date of Preparation: October 5, 2015 Response: IF INHALED: Remove person to fresh air and keep comfortable for breathing. IF IN EYES: Rinse cautiously with water for several minutes. Remove contact lenses, if present and easy to do. Continue rinsing. Immediately call a POISON CENTER or doctor. -

Bank of Montreal Canadian Pipelines Autocallable Principal at Risk Notes, Series 560 (CAD), Due November 9, 2022 (Unsecured) Maximum $10,000,000

This pricing supplement and the short form base shelf prospectus dated May 17, 2016 to which it relates, as amended or supplemented (the “Base Shelf Prospectus”) and each document incorporated by reference into the Base Shelf Prospectus, constitutes a public offering of securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities. No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. The Notes to be offered hereunder have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and, except as stated under “Plan of Distribution”, may not be offered, sold or delivered, directly or indirectly, in the United States of America, its territories, its possessions and other areas subject to its jurisdiction or to, or for the account or benefit of, a U.S. person (as defined in Regulation S under the U.S. Securities Act). Information has been incorporated by reference in this pricing supplement from documents filed with the securities commissions or similar regulatory authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary, Bank of Montreal, 100 King St. West, 1 First Canadian Place, 21st Floor, Toronto, Ontario, M5X 1A1, telephone: (416) 867-6785 and are also available electronically at www.sedar.com. Pricing Supplement No. 752 dated October 17, 2017 (to the short form base shelf prospectus dated May 17, 2016) Bank of Montreal Canadian Pipelines AutoCallable Principal At Risk Notes, Series 560 (CAD), Due November 9, 2022 (Unsecured) Maximum $10,000,000 This pricing supplement qualifies the distribution of Bank of Montreal Canadian Pipelines AutoCallable Principal At Risk Notes, Series 560 (CAD) (the “Notes”) issued by Bank of Montreal (the “Bank”) and scheduled to mature on November 9, 2022 (“Maturity” or “Maturity Date”). -

Q4 2020 Annual Report

ANNUAL REPORT 2020 Pembina Pipeline Corporation REPORT TO SHAREHOLDERS Year ended December 31, 2020 MANAGEMENT'S DISCUSSION AND ANALYSIS Table of Contents 1. About Pembina..................................................................................................................................................................... 2 2. Financial & Operating Overview........................................................................................................................................... 3 3. Segment Results.................................................................................................................................................................... 7 4. Liquidity & Capital Resources................................................................................................................................................ 21 5. Capital Investments.............................................................................................................................................................. 26 6. Dividends.............................................................................................................................................................................. 27 7. Selected Quarterly Information............................................................................................................................................ 28 8. Selected Equity Accounted Investee Information ............................................................................................................... -

5N Plus 5N Plus A&W Revenue Royalties Aberdeen Asia-Pacific Inc

Toronto Stock Exchange - The Globe and Mail - June 29, 2018 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield 5N Plus VNP.DB 100.500 101.750 98.400 2.29 7109 558.33 0.0 5N Plus VNP 3.350 3.710 2.220 10.20 7980 18.61 0.0 A&W Revenue Royalties AW.UN 32.000 36.830 28.360 -7.94 1781 17.58 5.2 Aberdeen Asia-Pacific Inc Inve FAP 3.950 4.800 3.920 -17.21 5728 13.62 9.9 Aberdeen International Inc. AAB 0.130 0.210 0.115 .00 9673 1.30 0.0 Absolute Software ABT 6.930 8.820 6.060 -10.08 7393 na 4.6 Acadian Timber Corp. ADN 19.900 20.240 18.050 3.03 782 11.85 5.7 Acasta Enterprises AEF.WT 0.015 0.950 0.005 -98.08 13110 na 0.0 Acasta Enterprises AEF 1.510 7.850 1.400 -79.73 8328 na 0.0 Accord Financial ACD 9.180 9.800 8.220 4.57 99 12.75 3.9 Acerus Pharmaceuticals Corp. ASP.WT 0.045 0.045 0.030 - 986 na 0.0 Acerus Pharmaceuticals Corp. ASP 0.240 0.520 0.095 108.33 31783 na 0.0 ACTIVEnergy Income Fund AEU.UN 4.230 4.230 4.230 .00 0 na 5.7 ADF Group DRX 1.610 2.840 1.590 -40.37 331 na 1.3 Advantage Oil & Gas AAV 4.110 9.240 3.480 -51.22 174191 12.45 0.0 Advantaged Cdn High Yd Bond AHY.UN 7.870 8.000 7.440 -1.79 146 na 5.0 Aecon Group ARE 15.460 20.060 14.130 -3.63 42006 32.89 3.2 Aecon Group ARE.DB.B 100.980 104.500 100.000 -2.28 32496 214.85 0.0 AEterna Zentaris (D) AEZS 2.570 4.170 1.240 94.66 2157 na 0.0 Africa Oil Corp. -

The Mig Report April 2014

The MiG Report April 2014 Going Public* Count: 80 (TSXV:42 TSX:38) BY THE NUMBERS (*Includes New Listings, IPOs, CPC IPOs, QTs, RTOs, Graduates and Other) $18.7 billion Equity Capital Raised 51 Companies+4 CPCs+22 ETFs+3 Structured Products listed on TSX Venture Exchange (42) and TSX (38) YTD April 2014 on TSXV and TSX YTD April 2014 6 New International Listings YTD April 2014 $3.0 million TSXV: Average financing size on TSXV Australia: West African Resources Limited, Mining, Australia USA: OneRoof Energy Group, Inc., Clean Technology & Renewable Energy, San Diego, CA $80.4 million TSX: Average financing size on TSX Africa: Atlatsa Resources Corporation, Mining, South Africa Australia: Champion Iron Limited, Mining, Australia UK/Europe: Endo International plc, Life Sciences, Ireland USA: Northern Power Systems Corp., Clean Technology & Renewable Energy, Barre, VT Equity Capital Raised by Sector TSX | TSXV Mining, $4.4B Utilities & Pipelines, $3.6B Check out our Daily Trading Reports Oil & Gas, $3.4B http://www.tmx.com/en/trading/reports/ Financial Services, $2.6B Each morning, a daily report is available that summarizes the previous day’s trading activity on TSXV and TSX. Diversified Industries, $1.7B ETFs & Structured Products, $1.1B Check out our Listing Statistics Website Clean Technology & Renewable Energy, $663M http://www.tmx.com/mig Life Sciences, $636M Follow us on Twitter: Technology, $310M http://twitter.com/tmxgroup Real Estate, $272M Register here to receive the monthly MiG Report in your inbox http://tmx.com/en/mig/register.html Contact: This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the accuracy or completeness of Gina Pappano, Head, Market Intelligence / 416‐947‐4272 / [email protected] the information contained in this document and we are not responsible for any errors or omissions in your use of, or reliance on, the information provided. -

Holdings Report

AI Powered International Equity ETF Schedule of Investments February 29, 2020 (Unaudited) Shares Security Description Value COMMON STOCKS - 99.7% Australia - 1.4% 253 Atlassian Corporation plc (a) $ 36,675 477 Australia & New Zealand Banking Group, Ltd. - ADR 7,642 1,749 Mesoblast, Ltd. - ADR (a) 12,400 1,574 National Australia Bank, Ltd. - ADR 12,781 69,498 Belgium - 0.8% 193 Galapagos NV - ADR (a) 40,792 Canada - 31.3% (b) 2,230 Algonquin Power & Utilities Corporation 33,272 2,287 Aurora Cannabis, Inc. (a) 3,065 9,434 Auryn Resources, Inc. (a) 11,415 2,640 B2Gold Corporation 10,534 3,135 Ballard Power Systems, Inc. (a) 27,902 438 BCE, Inc. 19,417 1,273 Brookfield Asset Management, Inc. - Class A 76,329 435 BRP, Inc. 17,818 1,605 CAE, Inc. 43,030 343 Canadian National Railway Company 29,124 1,329 Canadian Natural Resources Ltd. 34,288 86 Canadian Pacific Railway, Ltd. 21,394 1,640 Canadian Solar, Inc. (a) 33,456 1,591 Canopy Growth Corporation (a) 29,879 1,710 Cascades, Inc. 13,899 3,856 Celestica, Inc. (a) 24,370 25 Constellation Software, Inc. 25,469 1,882 Cronos Group, Inc. (a) 11,009 994 Descartes Systems Group, Inc. (a) 41,072 1,383 Eldorado Gold Corporation (a) 12,018 2,691 Enerplus Corporation 11,679 838 Fortis, Inc. 33,906 1,900 Gildan Activewear, Inc. 46,018 15,956 Hudbay Minerals, Inc. 39,092 5,196 IAMGOLD Corporation (a) 14,757 2,146 Kirkland Lake Gold, Ltd. 68,843 3,888 MAG Silver Corporation (a) 32,698 1,068 Northland Power, Inc. -

Notice of 2021 Annual Meeting of Shareholders March 19, 2021

Notice of 2021 annual meeting of shareholders March 19, 2021 WHAT’S INSIDE Message from the Chairman 2 Notice of our 2021 annual meeting of shareholders 4 Management information circular 5 About voting 6 Business of the meeting 10 About the nominated directors 13 Governance 25 Compensation discussion and analysis 51 Other information 100 Pembina Pipeline Corporation • 2021 Management Information Circular 1 Message from the Chairman Dear Fellow Shareholders, I am pleased to invite you to Pembina's 2021 annual meeting of shareholders to be held on Friday, May 7, 2021 at 2:00 p.m. (Mountain time). To mitigate the risks to the health and safety of our communities, shareholders, employees and other stakeholders in light of the COVID-19 pandemic, we are holding a virtual-only meeting. The meeting will be held by live audio webcast. Every shareholder and duly appointed proxyholder, regardless of geographic location and ownership, will have an equal opportunity to participate at the meeting and vote on the matters to be considered at the meeting. Information about how to join, vote, and ask questions at the meeting can be found in this document. This past year has been one of the most challenging in history and the ultimate test of our resilience, both at Pembina and across society as a whole. Strong communication and collaboration between management and the board was the foundation of Pembina's response to the COVID-19 pandemic. Our first priorities were to protect the health and safety of Pembina's staff and communities, ensure critical infrastructure continued to operate safely and reliably, and maintain our strong financial position. -

Pembina Pipeline Corporation

Pembina Pipeline Corporation 2018 INTERIM REPORT Q1 BuildingBuilding SomethingSomething ExtraordinaryExtraordinary WorldReginfo - b7dd2347-7209-46af-896a-a1709618d61f Management’s Discussion & Analysis WorldReginfo - b7dd2347-7209-46af-896a-a1709618d61f Pembina Pipeline Corporation MANAGEMENT'S DISCUSSION AND ANALYSIS The following Management's Discussion and Analysis ("MD&A") of the financial and operating results of Pembina Pipeline Corporation ("Pembina" or the "Company") is dated May 3, 2018 and is supplementary to, and should be read in conjunction with, Pembina's condensed consolidated unaudited financial statements for the period ended March 31, 2018 ("Interim Financial Statements") as well as Pembina's consolidated audited annual financial statements (the "Consolidated Financial Statements") and MD&A for the year ending December 31, 2017. All dollar amounts contained in this MD&A are expressed in Canadian dollars unless otherwise noted. Management is responsible for preparing the MD&A. This MD&A has been approved by Pembina's Board of Directors. This MD&A contains forward-looking statements (see "Forward-Looking Statements & Information") and refers to financial measures that are not defined by Generally Accepted Accounting Principles ("GAAP"). For more information about the measures which are not defined by GAAP, see "Non-GAAP Measures". Readers should refer to page 29 for a list of abbreviations that may be used in this MD&A. About Pembina Calgary-based Pembina Pipeline Corporation is a leading transportation and midstream service provider that has been serving North America's energy industry for over 60 years. Pembina owns an integrated system of pipelines that transport various hydrocarbon liquids and natural gas products produced primarily in western Canada.