Exhaustion Gap: 7 Steps to Recognize and Trade the Pattern

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Test of Macd Trading Strategy

A TEST OF MACD TRADING STRATEGY Bill Huang Master of Business Administration, University of Leicester, 2005 Yong Soo Kim Bachelor of Business Administration, Yonsei University, 200 1 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Global Asset and Wealth Management MBA O Bill HuangIYong Soo Kim 2006 SIMON FRASER UNIVERSITY Fall 2006 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author. APPROVAL Name: Bill Huang 1 Yong Soo Kim Degree: Master of Business Administration Title of Project: A Test of MACD Trading Strategy Supervisory Committee: Dr. Peter Klein Senior Supervisor Professor, Faculty of Business Administration Dr. Daniel Smith Second Reader Assistant Professor, Faculty of Business Administration Date Approved: SIMON FRASER . UNI~ER~IW~Ibra ry DECLARATION OF PARTIAL COPYRIGHT LICENCE The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection (currently available to the public at the "lnstitutional Repository" link of the SFU Library website <www.lib.sfu.ca> at: ~http:llir.lib.sfu.calhandlell8921112~)and, without changing the content, to translate the thesislproject or extended essays, if .technically possible, to any medium or format for the purpose of preservation of the digital work. -

The Best Candlestick Patterns

Candlestick Patterns to Profit in FX-Markets Seite 1 RISK DISCLAIMER This document has been prepared by Bernstein Bank GmbH, exclusively for the purposes of an informational presentation by Bernstein Bank GmbH. The presentation must not be modified or disclosed to third parties without the explicit permission of Bernstein Bank GmbH. Any persons who may come into possession of this information and these documents must inform themselves of the relevant legal provisions applicable to the receipt and disclosure of such information, and must comply with such provisions. This presentation may not be distributed in or into any jurisdiction where such distribution would be restricted by law. This presentation is provided for general information purposes only. It does not constitute an offer to enter into a contract on the provision of advisory services or an offer to buy or sell financial instruments. As far as this presentation contains information not provided by Bernstein Bank GmbH nor established on its behalf, this information has merely been compiled from reliable sources without specific verification. Therefore, Bernstein Bank GmbH does not give any warranty, and makes no representation as to the completeness or correctness of any information or opinion contained herein. Bernstein Bank GmbH accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this presentation. This presentation may contain forward- looking statements of future expectations and other forward-looking statements or trend information that are based on current plans, views and/or assumptions and subject to known and unknown risks and uncertainties, most of them being difficult to predict and generally beyond Bernstein Bank GmbH´s control. -

The Four Most Reliable Technical Indicators

The Four Most Reliable Technical Indicators By Alan Bush ADM Investor Services New Historical Highs Indicate Follow Through Strength There is a rule of thumb that anytime a market makes new historical highs, there will probably be follow through to the upside. In some cases, the additional strength can be substantial. The best and most recent example of this is the record highs in stock index futures. The logic behind this is that, if the fundamentals are powerful enough to propel a market to new historical highs, they are probably strong enough to persist for a while longer and push prices even higher. Therefore, the probabilities of financial success are much greater when trading from the long side, when new historical highs have been registered, than by trading from the short side in an attempt to guess when a bull market of this magnitude may eventually top out. Looking at Double and Triple Bottoms and Tops in a Different Way First let’s start with the basics. The double bottom and double top patterns are common and easily recognizable chart patterns, which occur in all timeframes. The double bottom appears as two consecutive lows at approximately the same price and the double top pattern is formed when two consecutive peaks are registered at approximately the same level. Triple bottom and triple top formations are less common, although the rules for double bottoms and tops and triple bottoms and tops are the same. Double Bottom Double Top Triple Bottom Triple Top Traditional charting techniques tell us that it is a good idea to buy on a retest of multiple bottoms and sell on a retest of an area of multiple tops. -

Candlestick Patterns

INTRODUCTION TO CANDLESTICK PATTERNS Learning to Read Basic Candlestick Patterns www.thinkmarkets.com CANDLESTICKS TECHNICAL ANALYSIS Contents Risk Warning ..................................................................................................................................... 2 What are Candlesticks? ...................................................................................................................... 3 Why do Candlesticks Work? ............................................................................................................. 5 What are Candlesticks? ...................................................................................................................... 6 Doji .................................................................................................................................................... 6 Hammer.............................................................................................................................................. 7 Hanging Man ..................................................................................................................................... 8 Shooting Star ...................................................................................................................................... 8 Checkmate.......................................................................................................................................... 9 Evening Star .................................................................................................................................... -

Identifying Chart Patterns with Technical Analysis

746652745 A Fidelity Investments Webinar Series Identifying chart patterns with technical analysis BROKERAGE: TECHNICAL ANALYSIS BROKERAGE: TECHNICAL ANALYSIS Important Information Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. Investing involves risk, including risk of loss. Past performance is no guarantee of future results Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in pe riods of market volatility. Stop loss orders could be triggered by price swings and could result in an execution well below your trigg er price. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Trailing stop orders are held on a separat e, internal order file, place on a "not held" basis and only monitored between 9:30 AM and 4:00 PM Eastern. Technical analysis focuses on market action – specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Past performance is no guarantee of future results. -

On-Line Manual for Successful Trading

On-Line Manual For Successful Trading CONTENTS Chapter 1. Introduction 7 1.1. Foreign Exchange as a Financial Market 7 1.2. Foreign Exchange in a Historical Perspective 8 1.3. Main Stages of Recent Foreign Exchange Development 9 The Bretton Woods Accord 9 The International Monetary Fund 9 Free-Floating of Currencies 10 The European Monetary Union 11 The European Monetary Cooperation Fund 12 The Euro 12 1.4. Factors Caused Foreign Exchange Volume Growth 13 Interest Rate Volatility 13 Business Internationalization 13 Increasing of Corporate Interest 13 Increasing of Traders Sophistication 13 Developments in Telecommunications 14 Computer and Programming Development 14 FOREX. On-line Manual For Successful Trading ii Chapter 2. Kinds Of Major Currencies and Exchange Systems 15 2.1. Major Currencies 15 The U.S. Dollar 15 The Euro 15 The Japanese Yen 16 The British Pound 16 The Swiss Franc 16 2.2. Kinds of Exchange Systems 17 Trading with Brokers 17 Direct Dealing 18 Dealing Systems 18 Matching Systems 18 2.3. The Federal Reserve System of the USA and Central Banks of the Other G-7 Countries 20 The Federal Reserve System of the USA 20 The Central Banks of the Other G-7 Countries 21 Chapter 3. Kinds of Foreign Exchange Market 23 3.1. Spot Market 23 3.2. Forward Market 26 3.3. Futures Market 27 3.4. Currency Options 28 Delta 30 Gamma 30 Vega 30 Theta 31 FOREX. On-line Manual For Successful Trading iii Chapter 4. Fundamental Analysis 32 4.1. Economic Fundamentals 32 Theories of Exchange Rate Determination 32 Purchasing Power Parity 32 The PPP Relative Version 33 Theory of Elasticities 33 Modern Monetary Theories on Short-term Exchange Rate Volatility 33 The Portfolio-Balance Approach 34 Synthesis of Traditional and Modern Monetary Views 34 4.2. -

1 Candlestick Patterns Version 30 Description

Candlestick Patterns Version 30 Description: The Candlestick Pattern ShowMe analysis technique for RadarScreen®, Chart Analysis, and the Scanner shows when certain candlestick patterns occur for stocks, ETFs, Forex, etc. The indicator can be used to search for the following candlestick patterns: doji, bullish engulfing, bearish engulfing, hammer, dark cloud, piercing pattern, morning star, evening star, inverse hammer, bullish harami, bearish harami, bullish kicker, bearish kicker, shooting star, bullish railroad tracks, bearish railroad tracks, tweezer bottom, tweezer top, island reversal bottom, island reversal top, bullish marubozu and bearish marubozu, rally-base-rally, drop-base-drop, rally-base and drop-base, inside bar, three crows, three soldiers. You can have the indicator look for all the patterns or just the ones you are interesting in analyzing. This indicator will work on any time frame as well as tick charts. Alerts, if enable, will be generated for all enabled candlestick patterns. Inputs: doji_enabled = enables(true) or disables(false) the indicator to look for the doji candlestick pattern. The default is “true”. doji_text = Allows you to customize the display text. The default is “D”. doji_color = Allows you to customize the display text’s color. The default is yellow. doji_body_percent = Allows you to customize the body size of the doji with respect to the total candlestick size from high to low. The default is “5” for 5%. bull_engulf_enabled = enables(true) or disables(false) the indicator to look for the bullish engulfing candlestick pattern. The default is “true”. bull_engulf _text = Allows you to customize the display text. The default is “E”. bull_engulf _color = Allows you to customize the display text’s color. -

Rising Wedge, Falling Wedge (PDF)

RISING WEDGE, FALLING WEDGE Rewarding patterns…provided you stay disciplined! Introduction The wedge is a very usual chartist pattern which is made of two converging trendlines that go in the same direction, both upwards or both downwards. As such, it can be immediately distinguished from a triangle. This pattern can be found on every timeframe, from the monthly charts to intraday price action. There are two sorts of wedges that have opposite consequences: Falling wedges, mostly completed following a sharp slump and which have a bullish implication, Rising wedges, which foreshadow a violent, downwards reversal phase. Their bearish bias is all the more pronounced since they are completed after a long period of time, and following a clear uptrend. But regarding most wedges as reversal patterns are just an opinion on our own. Many authors, however, consider that following the examples of triangles, pennants and flags, wedges are essentially continuation patterns, sloped against the trend. True, you can find falling wedges just in the middle of a bullish trend, or rising wedges within a bearish trend. A perfect example of continuation rising wedge made on the Japanese Topix index in 2007 is shown on the chart below. 1 Setting up precise figures on the continuation or reversal nature of wedges is hard and useless, we think. What is of more interest is that continuation wedges tend to complete in a generally shorter lapse of time than reversal wedges. Furthermore, the debate over the reversal/continuation nature of wedges is of minor importance as these patterns are overwhelmingly broken in the "natural" sense: downwards for a rising wedge, upwards for a falling wedge. -

Bearish Belt Hold Line

How to Day Trade using the Belt Hold Line Pattern Belt Hold Line Definition The belt hold line candlestick is basically the white marubozu and black marubozu within the context of a trend. The bullish belt hold candle opens on the low of the day and closes near the high. This candle presents itself in a downtrend and is an early sign that there is a potential bullish reversal. Conversely the bearish belt candle opens at the high of the day and closes near the low. This candle presents itself in an uptrend and is an early sign that there is a potential bearish reversal. These candles are reliable reversal bars, but lose their importance if there are a number of belt hold lines in close proximity. Not to complicate the matter further, but the pattern can also act as a continuation pattern, which we will cover later in this post. Bullish Belt Hold Line The bullish belt hold line gaps down on the open of the bar, which represents the low of the bar, and then rallies higher. Shorts who entered positions on the open of the bar are now underwater, which adds to the buying frenzy. Bullish Belt Hold Line You are now looking at a chart which shows the bullish belt hold line candlestick pattern. As you see, the trading day starts with a big bearish gap, which is the beginning of the pattern. The price action then continues with a big bullish candle. The candle has no lower candle wick and closes at its high. This price action confirms both a bullish marubozu and bullish belt hold line pattern. -

Technical Analysis Explained by Martin J

Contents Contents ........................................................................................................................................................ 1 Introduction .................................................................................................................................................. 3 Chapter I ........................................................................................................................................................ 4 What is Technical Analysis?....................................................................................................................... 4 1.1 Definition of Technical Analysis ...................................................................................................... 4 1.2. Philosophy of Technical Analysis .................................................................................................... 4 1.3. Technical Analysis vs. Fundamental Analysis ................................................................................. 5 1.4. Technician or Chartist? Is There Any Difference? .......................................................................... 6 1.5. Different Theories on Technical Analysis ....................................................................................... 6 Chapter II ....................................................................................................................................................... 8 Trend In Terms of Technical Analysis ....................................................................................................... -

Cup with Handle

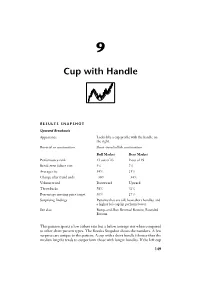

9 Cup with Handle RESULTS SNAPSHOT Upward Breakouts Appearance Looks like a cup profile with the handle on the right. Reversal or continuation Short-term bullish continuation Bull Market Bear Market Performance rank 13 out of 23 9 out of 19 Break-even failure rate 5% 7% Average rise 34% 23% Change after trend ends –30% –34% Volume trend Downward Upward Throwbacks 58% 42% Percentage meeting price target 50% 27% Surprising findings Patterns that are tall, have short handles, and a higher left cup lip perform better. See also Bump-and-Run Reversal Bottom; Rounded Bottom This pattern sports a low failure rate but a below average rise when compared to other chart pattern types. The Results Snapshot shows the numbers. A few surprises are unique to this pattern. A cup with a short handle (shorter than the median length) tends to outperform those with longer handles. If the left cup 149 150 Cup with Handle lip is higher than the right, the postbreakout performance is also slightly bet- ter. The higher left lip is a change from the first edition of this Encyclopedia where cups with a higher right lip performed better. I believe the difference is from the change in methodology and a larger sample size. Tour The cup-with-handle formation was popularized by William J. O’Neil in his book, How to Make Money in Stocks (McGraw-Hill, 1988). He gives a couple of examples such as that shown in Figure 9.1. The stock climbed 295% in about 2 months (computed from the right cup lip to the ultimate high). -

Eliminates Emotionsemotions

Candlestick Forum Boot Camp High Profit Patterns Why is it important to know the patterns? EliminatesEliminates emotionsemotions 1 Advanced Candlestick Patterns ¾ Fry Pan Bottom ¾ Dumpling Top ¾ Cradle Pattern ¾ Jay-Hook ¾ Scoop Pattern ¾ Belt Hold ¾ Breakout Patterns High Probabilty Patterns Pennants Channels Fibonacci Distance from MA’s Double Bottoms/Tops Fry Pan Bottom The downtrend starts waning with the appearance of small trading bodies As the trend starts slowly curling up, a gap up in price indicates that strong buying sentiment has now returned 2 Fry Pan Bottom Long Rounded Curved bottom Fry Pan Bottom – minutes, days, months The indecisive rounding bottom is the predominant factor Fry Pan Bottom - Past Analysis Big Percent move at top has a different meaning when a pattern can be identified 3 Fry Pan Bottom measuring point A dimple usually marks the Halfway point Fry pan bottom Fry Pan Bottom - Dollar analysis 4 Fry Pan Bottom expectations Should not have breached bottom curvature Fry pan Bottom – Failure Fry Pan Bottom – where to buy? 5 Fry Pan Bottom with MA confirmation Fry Pan Bottom - A Break Out or Failure? Easy identification of a failure, which makes for easy stop loss procedures Fry Pan Bottom can become a Cup and Handle CUP Handle Or a J-hook pattern 6 What shows a Fry Pan Bottom failure? Fry Pan Bottom – Exuberant buying Want to see break out buying Fry Pan Bottom –What to expect? 7 Fry Pan Bottom – What is expected? Opposite the Fry pan Bottom Dumpling Top The Dumpling Top- an identifiable characteristic Lousy trading atmosphere 8 Cradle Pattern • The Cradle Pattern is a symmetric bottom pattern that is easy to identify.