Utv Software Communications Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2014-2015.Pdf

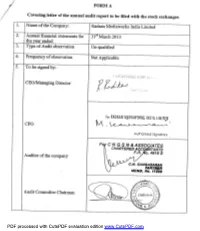

ANNUAL REPORT 2014 - 2015 CORPORATE INFORMATION CIN: L92111TN1999PLC043163 BOARD OF DIRECTORS REGISTERED OFFICE : 1R3DXO$SSDVDP\6WUHHW 71DJDU&KHQQDL R. RADIKAA SARATHKUMAR 3K Chairperson & Managing Director )D[ R. SARATHKUMAR :HEVLWHZZZUDGDDQWY Director - Operations (PDLOLQIR#UDGDDQWY STATUTORY AUDITORS : A. KRISHNAMOORTHY &1*61 $662&,$7(6//3 Director &KDUWHUHG$FFRXQWDQWV $JDVW\DU0DQRU 1HZ1R2OG1R J. KRISHNA PRASAD 5DMD6WUHHW Director 71DJDU&KHQQDL V. SELVARAJ INTERNAL AUDITORS : Director $-'HRUD $VVRFLDWHV &KDUWHUHG$FFRXQWDQWV 6),,QG)ORRU *ROGHQ(QFODYH 1R3RRQDPDOOHH+LJK5RDG &KHQQDL LEGAL ADVISOR : +DULVKDQNDU0DQL M KAVIRIMANI $GYRFDWH &KLHI)LQDQFLDO2I¿FHU 1HZ1R)LUVW)ORRU /X]&KUXFK5RDG K C SAHU 0\ODSRUH&KHQQDL Company Secretary BANKERS : ,QGLDQ2YHUVHDV%DQN SUBHAA VENKAT 6DLGDSHW&KHQQDL &KLHI2SHUDWLQJ2I¿FHU&UHDWLYH REGISTRARS & SHARE TRANSFER AGENT : &DPHR&RUSRUDWH6HUYLFHV/LPLWHG B SHAKTHIVEL 6XEUDPDQLDQ%XLOGLQJ9WK)ORRU &KLHI2SHUDWLQJ2I¿FHU3URGXFWLRQ 0DUNHWLQJ 1R&OXE+RXVH5RDG &KHQQDL R RAYANE 3K OLQHV )D[*UDPV&$0(2 +HDG1HZ0HGLD (0DLOFDPHR#FDPHRLQGLDFRP CONTENTS Notice to the Shareholders 2 Standalone Financial Statement 31 Directors' Report 7 Auditors’ Report on Consolidated Financial Statement 46 Management Discussion and Analysis 17 Consolidated Financial Statement 49 Report on Corporate Governance 21 Proxy Form 59 Auditors' Report on Standalone Financial Statement 29 Attendance Slip 61 1 ANNUAL REPORT 2014 - 2015 NOTICE TO THE SHAREHOLDERS 1RWLFH LV KHUHE\ JLYHQ WKDW WKH 6L[WHHQWK $QQXDO *HQHUDO 7R FRQVLGHU DQG LI WKRXJKW ¿W WR SDVV -

PDF Processed with Cutepdf Evaluation Edition 14Th Annual Report 2012 - 2013

PDF processed with CutePDF evaluation edition www.CutePDF.com 14th Annual Report 2012 - 2013 Visit at www.youtube.com/RadaanMedia www.youtube.com/RadaanTVTamil www.youtube.com/RadaanTVTelugu www.youtube.com/RadaanTVKannada If Undeliverd, Please return to: www.youtube.com/RadaanTVMalayalam RADAAN MEDIAWORKS INDIA LIMITED No.10, Paul Appasamy Street, T.Nagar, Chennai 600 017, Tamil Nadu, India. (P) +91 44 2834 5032 / 33 / 40 www.radaan.tv | E-mail: [email protected] Intenseandpersonalizedactinginstruction Internationalstandard|Moderntechniques&tools RadaanFilmandTelevisionAcademy Voice,Speech&Diction|Grooming|PersonalityDevelopment|Dance www.rafta.in CORPORATE INFORMATION BOARD OF DIRECTORS REGISTERED OFFICE : No. 10, Paul Appasamy Street T. Nagar, Chennai - 600 017 R. RADIKAA SARATHKUMAR Ph : + 91 44-28345032 / 28345033 / Chairperson & Managing Director 28345037 / 28345038 / 28345040 Fax : + 91 44-28345031 R. SARATHKUMAR Website : www.radaan.tv Director - Operations email : [email protected] STATUTORY AUDITORS : A. KRISHNAMOORTHY CNGSN & ASSOCIATES Director Chartered Accountants "Agastyar Manor" New No. 20, Old No. 13, J. KRISHNA PRASAD Raja Street, Director T. Nagar, Chennai - 600 017. V. SELVARAJ INTERNAL AUDITORS : Director A J Deora & Associates Chartered Accountants SF-6, IInd Floor, ' Golden Enclave' No. 275/184, Poonamallee High Road, Chennai - 600 010. LEGAL ADVISOR : Harishankar Mani V MURALI RAAMAN Advocate Chief Executive Officer New No. 115, First Floor, Luz Chruch Road, Mylapore, Chennai - 600 004. M KAVIRIMANI Chief Financial Officer -

Business Overview RADAAN MEDIA WORKS INDIA LIMITED

Business Overview RADAAN MEDIA WORKS INDIA LIMITED Business Description Source: Annual Report Radaan Mediaworks India Limited is an India-based media and Key Employees entertainment company. The Company operates in the area of producing content for tele-serials, events, game shows and others; producing films; undertaking distribution activities, theatrical plays, Name Designation and setting up of training course consisting of acting, dance, martial Age Since arts, yoga and others. Its products and services include motion picture, video and television program activities. It has approximately 8,000 television production houses covering over 30 languages. It telecasts approximately 500 daily and over 200 weekly television programs. It telecasts programs on various channels in South India, such as Sun TV, KTV, Gemini, Surya, Udaya, ETV and Zee. It telecasts serials in Tamil, Telugu, Malayalam, Hindi, Kannada and Gujarati languages. Its programs include Vaani Rani, Thamarai, Shiva Shankari, Chinna Pappa Periya PappaSss, Snehajalakam, Aakasamantha, Idhi Okka Prema Katha, Nadigavelin Rajapattai and Sangeetha Urchavam. Latest News and Press Releases Radaan Mediaworks India Limited is an India-based media and entertainment company. The Company operates in the area of producing content for tele-serials, events, game shows and others; producing films; undertaking distribution activities, theatrical plays, and setting up of training course consisting of acting, dance, martial arts, yoga and others. Its products and services include motion picture, video and television program activities. It has approximately 8,000 television production houses covering over 30 languages. It telecasts approximately 500 daily and over 200 weekly television programs. It telecasts programs on various channels in South India, such as Sun TV, KTV, Gemini, Surya, Udaya, ETV and Zee. -

Obras Audiovisuales En La India

Oficina Económica y Comercial de la Embajada de España en Mumbai El mercado de las obras audiovisuales en la India 1 Estudios de Mercado Mercado de Estudios El mercado de las obras audiovisuales en la India Este estud io ha sido realizado por Mar Mart ínez García bajo la supervisión de la Oficina Económica 2 Estudios de Mercado Mercado de Estudios y Comercial de España en Mumbai Septiembre 2011 EL MERCADO DE LA OBRAS AUDIOVISUALES EN LA INDIA ÍNDICE RESUMEN Y PRINCIPALES CONCLUSIONES 5 I. INTRODUCCIÓN 8 Definición y Características del Sector y Subsectores Relacionados 8 II. ANÁLISIS DE LA OFERTA 11 1. Análisis cuantitativo 11 1.1. Tamaño de la oferta 11 1.2. Tamaño de los mercados conexos 15 1.3. Tamaño de subsectores punteros 17 1.4. Análisis de los componentes de la oferta de contenidos audiovisuales 18 2. Análisis cualitativo 29 2.1. Fases y servicios de producción 29 2.2. Modelos de negocio 30 2.3. Rasgos generales de las obras audiovisuales en la India 31 2.4. Costes de las obras audiovisuales 32 2.5. Perspectivas en la producción audiovisual 34 2.6. Obstáculos comerciales 34 2.7. Entorno competitivo: dominio local y apertura a las empresas anglosajonas 43 III. ANÁLISIS DEL COMERCIO 45 1. Análisis cuantitativo general 45 1.1. Canales de distribución y estadios de la comercialización 45 1.2. Esquema de la distribución 47 1.3. Ventas de algunos destacados productores indios de contenidos 48 1.4. Principales distribuidores o comercializadores 49 2. Análisis cualitativo general 53 2.1. Entrada en el mercado indio 53 2.2. -

Annual Report 2017

ANNUAL REPORT 2016 - 2017 &25325$7(,1)250$7,21 &,1/713/& BOARD OF DIRECTORS REGISTERED OFFICE : No.14, Jayammal Road, Teynampet, Chennai - 600018 R. RADIKAA SARATHKUMAR Tel: +91 - 44 - 2431 3001 Chairperson & Managing Director Fax: +91 - 44 - 2431 3008 :HEVLWHZZZUDGDDQWY_(PDLOLQIR#UDGDDQWY R. SARATHKUMAR Director - Operations STATUTORY AUDITORS : &1*61 $662&,$7(6//3 Chartered Accountants "Agastyar Manor" A. KRISHNAMOORTHY New No. 20, Old No. 13, Director Raja Street, T. Nagar, Chennai - 600 017. INTERNAL AUDITORS : J. KRISHNA PRASAD A J Deora & Associates Director Chartered Accountants 6),,QG)ORRU *ROGHQ(QFODYH V. SELVARAJ 1R3RRQDPDOOHH+LJK5RDG Director Chennai - 600 010. LEGAL ADVISOR : +DULVKDQNDU0DQL$GYRFDWH 1HZ1R)LUVW)ORRU/X]&KUXFK5RDG Mylapore, Chennai - 600 004. BANKERS : M KAVIRIMANI ,QGLDQ2YHUVHDV%DQN &KLHI)LQDQFLDO2I¿FHU Saidapet, Chennai - 600 015. K C SAHU &DQDUD%DQN Habibullah Road, Chennai - 600 017. Company Secretary REGISTRARS & SHARE TRANSFER AGENT : SUBHAA VENKAT &DPHR&RUSRUDWH6HUYLFHV/LPLWHG &KLHI2SHUDWLQJ2I¿FHU&UHDWLYH 6XEUDPDQLDQ%XLOGLQJ9WK)ORRU No. 1, Club House Road, Chennai - 600 002. R RAYANE 3K OLQHV Head - New Media )D[*UDPV&$0(2 (0DLOFDPHR#FDPHRLQGLDFRP CONTENTS Notice to the Shareholders 3 Standalone Financial Statement 33 Directors' Report 6 Auditors’ Report on Consolidated Financial Statement 49 Management Discussion and Analysis 17 Consolidated Financial Statement 52 Report on Corporate Governance 22 Proxy Form 63 Auditors' Report on Standalone Financial Statement 29 Attendance Slip 65 1 ANNUAL REPORT 2016 - 2017 285%2$5'2)',5(&7256 Mrs. R.Radikaa Sarathkumar 0UV5DGLNDDLVDQDFFRPSOLVKHGEXVLQHVVSHUVRQDOLW\DQGDUROHPRGHOLQ0HGLD HQWHUWDLQPHQW,QGXVWU\KDYLQJ WKHULJKWEOHQGRIPDQDJHULDOWDOHQWULFKH[SHULHQFHLQ$FWLQJDQGFUHDWLYHDELOLW\LQFRQFHSWXDOL]LQJVWUDWHJL]LQJ GLUHFWLQJDQGLPSOHPHQWLQJVXFFHVVIXOO\YDULRXVHQWHUWDLQPHQWFRQWHQWVFRQWULEXWLQJWRWKHFRQVLVWHQWJURZWKRI the company right from inception. She is a degree holder in Home Science. -

2011-2012.Pdf

CORPORATE INFORMATION BOARD OF DIRECTOR REGISTERED OFFICE : No. 10, Paul Appasamy St., T. Nagar, Chennai - 600 017 R. RADIKAA SARATHKUMAR Ph : + 91 44-28345032 / 28345033 / Chairperson & Managing Director 28345037 / 28345038 / 28345040 Fax : + 91 44-28345031 R. SARATHKUMAR Website : www.radaan.tv Director - Operations email : [email protected] STATUTORY AUDITORS : A. KRISHNAMOORTHY CNGSN & ASSOCIATES Director Chartered Accountants "Agastyar Manor" New No. 20, Old No. 13, J. KRISHNA PRASAD Raja Street, Director T. Nagar, Chennai - 600 017. V. SELVARAJ INTERNAL AUDITORS : Director A J Deora & Associates Chartered Accountants SF-6, IInd Floor, ' Golden Enclave' No. 275/184, Poonamallee High Road, Chennai - 600 010. LEGAL ADVISOR : Harishankar Mani V MURALI RAAMAN Advocate Chief Executive Officer New No. 115, First Floor, Luz Chruch Road, Mylapore, Chennai - 600 004. M KAVIRIMANI Chief Financial Officer BANKERS : Indian Overseas Bank K C SAHU Saidapet, Chennai - 600 015. Company Secretary REGISTRARS & SHARE TRANSFER AGENT : Cameo Corporate Services Limited SUBHAA VENKAT Subramanian Building V th Floor Chief Operating Officer - Creative No. 1, Club House Road, Chennai - 600 002. Ph. : 044-2846 0390(5 lines) B SHAKTHIVEL Fax : 044-28460219 Grams : "CAMEO" Chief Operating Officer - Production & Marketing E-Mail : [email protected] CONTENTS Notice to the Shareholders 2 Balance Sheet 32 Directors' Report 6 Profit and Loss Statement 33 Management Discussion and Analysis 10 Cash Flow Statements 34 Report on Corporate Governance 16 Accounting Policies and Notes to Accounts 35 Auditors' Report 29 Attendance Slip and Proxy Form 51 Annual Report 2011 - 12 1 NOTICE TO THE SHAREHOLDERS Notice is hereby given that the Thirteenth Annual General Meeting of the company will be held on Monday, the 17th September 2012 at 10.00 a.m. -

2012-2013.Pdf

CORPORATE INFORMATION BOARD OF DIRECTORS REGISTERED OFFICE : No. 10, Paul Appasamy Street T. Nagar, Chennai - 600 017 R. RADIKAA SARATHKUMAR Ph : + 91 44-28345032 / 28345033 / Chairperson & Managing Director 28345037 / 28345038 / 28345040 Fax : + 91 44-28345031 R. SARATHKUMAR Website : www.radaan.tv Director - Operations email : [email protected] STATUTORY AUDITORS : A. KRISHNAMOORTHY CNGSN & ASSOCIATES Director Chartered Accountants "Agastyar Manor" New No. 20, Old No. 13, J. KRISHNA PRASAD Raja Street, Director T. Nagar, Chennai - 600 017. V. SELVARAJ INTERNAL AUDITORS : Director A J Deora & Associates Chartered Accountants SF-6, IInd Floor, ' Golden Enclave' No. 275/184, Poonamallee High Road, Chennai - 600 010. LEGAL ADVISOR : Harishankar Mani V MURALI RAAMAN Advocate %JKGH'ZGEWVKXG1HſEGT New No. 115, First Floor, Luz Chruch Road, M KAVIRIMANI Mylapore, Chennai - 600 004. %JKGH(KPCPEKCN1HſEGT BANKERS : Indian Overseas Bank K C SAHU Saidapet, Chennai - 600 015. Company Secretary REGISTRARS & SHARE TRANSFER AGENT : Cameo Corporate Services Limited Subramanian Building V th Floor No. 1, Club House Road, Chennai - 600 002. Ph. : 044-2846 0390(5 lines) Fax : 044-28460219 Grams : "CAMEO" E-Mail : [email protected] CONTENTS Notice to the Shareholders 2 Balance Sheet 22 Directors' Report 4 2TQſVCPF.QUU5VCVGOGPV Management Discussion and Analysis 6 Cash Flow Statements 24 Report on Corporate Governance 11 Accounting Policies and Notes to Accounts 25 Auditors' Report 19 Attendance Slip and Proxy Form 39 Annual Report 2012 - 13 1 NOTICE TO THE SHAREHOLDERS NOTES: Notice is hereby given that the Fourteenth Annual General 1. A MEMBER ENTITLED TO ATTEND AND Meeting of the company will be held on Friday, the 27th VOTE IS ENTITLED TO APPOINT A PROXY TO September 2013 at 10.00 a.m., at Madras Race Club, ATTEND AND VOTE INSTEAD OF HIMSELF Guindy, Chennai - 600032 to transact the following business: AND THE PROXY NEED NOT BE A MEMBER OF THE COMPANY. -

Utv Software Communications Limited

PROSPECTUS Dated March 04, 2005 Please read Section 60 of the Companies Act, 1956 100% Book Building Issue UTV SOFTWARE COMMUNICATIONS LIMITED (Originally incorporated as ‘United Software Communications Private Limited’ on June 22, 1990 in Mumbai under the Companies Act, 1956. The Company became a deemed Public Limited Company and the word ‘Private’ was deleted on November 27, 1995. The Company amended its Articles of Association at the Extra-Ordinary General Meeting held on May 8, 2000 after which the Company became a Public Limited Company. The name was changed to ‘UTV Software Communications Limited’ with effect from March 19, 1998, hereinafter referred to as (“UTV/The Company/The Issuer”) Registered Office & Corporate Office: Paarijaat House, 1076, Dr. E.Moses Road, Worli Naka, Mumbai 400 018 (Formerly located at ‘A’ Block, Shivsagar Estate, Dr. A.B.Road, Worli, Mumbai 400 018 and subsequently shifted to UTV House,#7 Marwah Estate’ Krishanlal Marwah Marg, Saki Naka, Andheri (E), Mumbai – 400 072, India)Phone: +91 22 2490 5353; Fax: +91 22 2490 5370 Website: www.utvnet.com; Email: [email protected] Public Issue of 6,999,950 equity shares comprising fresh issue of 4,500,000 equity shares of Rs.10 each at a price of Rs.130 for cash aggregating Rs.5,850 lakhs and offer for sale of 2,499,950 equity shares of Rs.10 each at a price of Rs.130 for cash aggregating Rs.3,249.94 lakhs (hereinafter referred to as the “Issue”) comprising reservation of 349,950 equity shares for employees on a competitive basis; net issue to public of 6,650,000 equity shares . -

9Th September 2008 at 10.00A.M

www.sansco.net & www.reportjunction.com TH 9 AnnuaA l Report 2007-21 www.reportjunction.com www.reportjunction.com www.sansco.net & www.reportjunction.com Radaan Mediaworks (I) Limited, CORPORATE INFORMATION REGKTEREBOFFICE: BOARD OF DIRECTORS No. 10, Paul Appasamy St., T. Nagar, Chennai - 600 017 R.RADKAA Ph: + 9144-28345032 / 28345033 / Chairperson & Managing Director 28345037/28345038/28345040 Fax: + 9144-28345031 Website : www.radaan.tv P.K.RAGHU KUMAR email: [email protected] Director AUDITORS: HARSHDALMIA CNGSN&ASOCIATES Director Chartered Accountants "Agastyar Manor" New No. 20, Old No. 13, R.SARATHKUMAR Raja Street, Director - Production T. Nagar, Chennai - 600 017. R.SANTHANAM LEGAL ADVISOR: Director - Finance P.H. ARVINDH PANDIAN Adocate New No. 115, First Floor, MJCSINHA Luz Chruch Road, Director Mylapore, Chennai - 600 004 S.PRIYABARSHAN BANKERS: Director INDIAN OVERSEAS BANK Saidapet, Chennai - 600 015 EM. VENKATASUBRAMANIAN REGISTRARS & SHARE TRANSFER AGENT: Director Cameo Corporate Services Limited Subramanian Building V th Floor M.KAVIRIMANI No. 1, Club House Road, Chief Financial Officer Chennai-600 002 Ph: 044-2846 0390(5 lines) P.KRISHNASAMY Fax: 044-28460219 Grams: "CAMEO" Company Secretary E-Mail : [email protected] CONTENTS Corporate Information 1 Auditor's Report 20 Notice to the Shareholders 2 Annexure to the Auditors' Report 21 Directors' Report 5 Balance Sheet 24 Managemet Discussion and Analysis 7 Profit and Loss Account 25 Report on Corporate Governance 10 Schedules to the Accounts 26 Auditor's Certificate on Cash Flow Statements 34 Corporate Governance 19 Balance Sheet Abstract 35 Radaan Mediaworks (I) Limited Annual Report 2007 - 2008 www.reportjunction.com www.sansco.net & www.reportjunction.com Notice to the Shareholders Notice is hereby given that the Ninth Annual General Meeting of the members of Radaan Mediaworks (I) Limited, will be held at Guindy Lodge, Madras Race Club, Guindy, Chennai on Monday, the 29th September 2008 at 10.00A.M. -

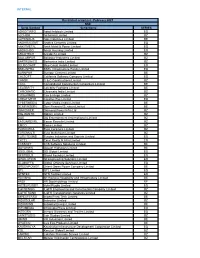

INTERNAL# Scrip Symbol Scrip Name SERIES ADROITINFO Adroit

INTERNAL# Restricted scrip List - February 2021 NSE Scrip Symbol Scrip Name SERIES ADROITINFO Adroit Infotech Limited EQ ALCHEM Alchemist Limited BZ ALPSINDUS Alps Industries Limited BE ANDHRACEMT Andhra Cements Limited EQ ANKITMETAL Ankit Metal & Power Limited EQ ANSALHSG Ansal Housing Limited EQ ARCOTECH Arcotech Limited BZ BALLARPUR Ballarpur Industries Limited BZ BARTRONICS Bartronics India Limited BZ BLUECOAST Blue Coast Hotels Limited EQ BSELINFRA BSEL Infrastructure Realty Limited EQ BURNPUR Burnpur Cement Limited BE CALSOFT California Software Company Limited EQ CANDC C & C Constructions Limited BZ CCCL Consolidated Construction Consortium Limited BE CELEBRITY Celebrity Fashions Limited BE CHROMATIC Chromatic India Limited BZ COX&KINGS Cox & Kings Limited BZ CREATIVEYE Creative Eye Limited EQ CYBERMEDIA Cyber Media (India) Limited BE DCMFINSERV Dcm Financial Services Limited BE DIAPOWER Diamond Power Infra Ltd BZ DIGJAMLTD Digjam Limited BZ DQE DQ Entertainment (International) Limited BZ EASUNREYRL Easun Reyrolle Limited BZ EMCO Emco Limited BZ EUROCERA Euro Ceramics Limited BZ EUROMULTI Euro Multivision Limited BZ EUROTEXIND Eurotex Industries and Exports Limited EQ EXCEL Excel Realty N Infra Limited EQ FCSSOFT FCS Software Solutions Limited BE GAYAHWS Gayatri Highways Limited BE GBGLOBAL GB Global Limited EQ GFSTEELS Grand Foundry Limited EQ GISOLUTION GI Engineering Solutions Limited EQ GLOBOFFS Global Offshore Services Limited EQ GREENPOWER Orient Green Power Company Limited BE GTL GTL Limited EQ GTNTEX GTN Textiles Limited -

5900700314.Pdf

ANNUAL REPORT 2013 - 2014 NOTICE TO THE SHAREHOLDERS Notice is hereby given that the Fifteenth Annual General “RESOLVED THAT pursuant to the provisions of Sections Meeting of the company will be held on Monday, the 29 th 149, 152 read with Schedule IV and any other applicable September 2014 at 10.00 a.m., at Madras Race Club, provisions of the Companies Act, 2013 and the Rules Guindy, Chennai - 600032 to transact the following business: framed thereunder (including any statutory modifi cation(s) or re-enactment thereof for the time being in force) and ORDINARY BUSINESS: Clause 49 of the Listing Agreement, Mr.A Krishnamoorthy 1. To receive, consider and adopt the audited Balance Sheet (DIN 00386122), Director of the Company whose period as at 31 st March 2014, Profi t & Loss Statement for the of offi ce is liable to retirement by rotation as per the year ended 31 st March 2014 together with the Reports of Companies Act, 1956 and who has submitted a declaration the Board of Directors and the Auditors thereon. that he meets the criteria of independence under Section 149(6) of the Companies Act, 2013 and who is eligible for 2. To appoint Auditors and in this regard to consider and appointment and in respect of whom the Company has if thought fi t, to pass with or without modifi cation(s), the received a notice in writing from a member proposing his following resolution as ORDINARY RESOLUTION . candidature for the offi ce of Director, be and is hereby appointed as an Independent Director of the Company, “RESOLVED that pursuant to the provisions of section 139 whose term shall not be subject to retirement by rotation, and other applicable provisions, if any, of the Companies to hold offi ce for a term of fi ve years from 29 th September Act, 2013 and the Rules framed thereunder, as amended 2014 to 28 th September 2019 (both days inclusive).” from time to time, CNGSN & Associates, Chartered Accountants (Firm Registration No.004915S), be and 5. -

Kollywood and the Indian Tamil Diaspora

USP Undergraduate Journal | 22 “culture of consumption.” “Culture of consumption” Kollywood and the is a phrase used to describe “any society in which the acquisition of material goods is viewed as a major Indian Tamil Diaspora defining feature of daily life” (Gordon 2001: 392- Representations of overseas Tamil 393). Yet, it is a consumerist modernity that the Tamil Diaspora family in Jeans is comfortable with, communities by India’s Tamil cinema as is established in the film’s exposition, situated in have undergone a significant change the characters’ suburbia homes and luxury cars. The since the late 1990s. How is this change “culture of consumption,” conspicuous and replete from parochialism to consumerist throughout the text, thus fashions a focal point of analysis for the shifting modes of representing the cosmopolitanism evident on screen and Tamil Diaspora by India’s Tamil cinema. what inspired it? The iconicity of Jeans lay as much in its immense Kumuthan Maderya commercial success, with the chart-busting music by Oscar-winning composer A. R. Rahman and aesthetic extravagance, as in its enunciation of difference in the portrayals of overseas Tamil communities. This is in comparison to other preceding films that Jeans and Society in the Diaspora showcase the Tamil Diaspora, such as the equally iconic Ninaithaalae Inikkum (“Sweet Memories,” he decision to send the blockbuster Tamil dir. K. Balachander 1979). Ninaithaalae Inikkum film Jeans (dir. S. Shankar 1998) to the 1999 is a campy musical comedy set in Singapore and Academy Awards as an entry under the Best follows the travails of a rock band on tour from Tamil TForeign Film category can be read as a conscious effort Nadu.