A Public Good? Property Tax Exemptions For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

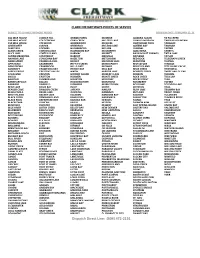

Points of Service

CLARK FREIGHTWAYS POINTS OF SERVICE SUBJECT TO CHANGE WITHOUT NOTICE REVISION DATE: FEBRUARY 12, 21 100 MILE HOUSE COBBLE HILL GRAND FORKS MCBRIDE QUADRA ISLAND TA TA CREEK 108 MILE HOUSE COLDSTREAM GRAY CREEK MCLEESE LAKE QUALICUM BEACH TABOUR MOUNTAIN 150 MILE HOUSE COLWOOD GREENWOOD MCGUIRE QUATHIASKI COVE TADANAC AINSWORTH COMOX GRINDROD MCLEOD LAKE QUEENS BAY TAGHUM ALERT BAY COOMBS HAGENSBORG MCLURE QUESNEL TAPPEN ALEXIS CREEK CORDOVA BAY HALFMOON BAY MCMURPHY QUILCHENA TARRY'S ALICE LAKE CORTES ISLAND HARMAC MERRITT RADIUM HOT SPRINGS TATLA LAKE ALPINE MEADOWS COURTENAY HARROP MERVILLE RAYLEIGH TAYLOR ANAHIM LAKE COWICHAN BAY HAZELTON METCHOSIN RED ROCK TELEGRAPH CREEK ANGELMONT CRAIGELLA CHIE HEDLEY MEZIADIN LAKE REDSTONE TELKWA APPLEDALE CRANBERRY HEFFLEY CREEK MIDDLEPOINT REVELSTOKE TERRACE ARMSTRONG CRANBROOK HELLS GATE MIDWAY RIDLEY ISLAND TETE JAUNE CACHE ASHCROFT CRAWFORD BAY HERIOT BAY MILL BAY RISKE CREEK THORNHILL ASPEN GROVE CRESCENT VALLEY HIXON MIRROR LAKE ROBERTS CREEK THREE VALLEY GAP ATHALMER CRESTON HORNBY ISLAND MOBERLY LAKE ROBSON THRUMS AVOLA CROFTON HOSMER MONTE CREEK ROCK CREEK TILLICUM BALFOUR CUMBERLAND HOUSTON MONTNEY ROCKY POINT TLELL BARNHARTVALE DALLAS HUDSONS HOPE MONTROSE ROSEBERRY TOFINO BARRIERE DARFIELD IVERMERE MORICETOWN ROSSLAND TOTOGGA LAKE BEAR LAKE DAVIS BAY ISKUT MOYIE ROYSTON TRAIL BEAVER COVE DAWSON CREEK JAFFARY NAKUSP RUBY LAKE TRIUMPH BAY BELLA COOLA DEASE LAKE JUSKATLA NANAIMO RUTLAND TROUT CREEK BIRCH ISLAND DECKER LAKE KALEDEN NANOOSE BAY SAANICH TULAMEEN BLACK CREEK DENMAN ISLAND -

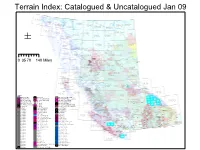

Terrain Index All Ja

Terrain Index: Catalogued & Uncatalogued Jan 09 114O Atlin 114P 104O 104M 104P 094O 094P 104N 094M 094N 114I Fort Nelson 104L 104I 094J 104J Dease Lake 094I ± 104K 094L 094K 104F 094E 094F 094G 094H 104G 104H 094A 104C 104B 104A 094C 094B Fort St. John Taylor Hudson's Hope Stewart 094D Pouce Coupe Dawson Creek 0 35 70 140 Miles Chetwynd 093M 093O 103P Mackenzie New Aiyansh 093N 103O New Hazelton 093P Granisle Smithers 103K 103J Telkwa 093J Terrace Fort St. James Prince Rupert Houston Port Edward103I 093I Masset 093L Kitimat 093K Vanderhoof Prince George Port Clements 103F 103G 093E 093H 083E McBride Queen Charlotte City 093F 093G 103H Wells Quesnel 083D 093A 103C 103B 093C 083C Legend 103A 093B Horsefly TER_Master_Proj_Bdy landslides_dissolve RTSM_Kootenay_Lk_Jul05_Proj_Bdy Bella Bella DTSM_Fox_Riv_Proj_Bdy TSM_Headwaters_BCTS_Proj_Bdy RTSM+_Invermere_Proj_Bdy Alexis Creek Williams Lake RTSM_Cut_Thumb_Proj_Bdy TSM_Mackenzie_BCTS_Proj_Bdy DTSM_RTSM_Cranbrook_Proj_Bdy 093D 082M DTSM_Galore_EAO_Proj_Bdy t4551j arc Terrain_Arrow_Landslide_Proj_Bdy 082O 092P Clearwater DTSM_Cranberry_TSA_Skeena t4494j polygon DTSM_Arrow_IFPA_Proj_Bdy 100 Mile House 082N 102P Golden Alluvial_Fans_Bulkley_FD_Proj_Bdy t4502j polygon RTSM_Arrow_IFPA_Proj_B1dy_0UTM211reOproject mof_tsm_index_dbu t4552j polygon DTSM_RTSM_Arrow_Proj_Bdy_UTM11reproject 092M Revelstoke mof_tsm_dki TFL45_W_Thurlow_Is_Coverage RTSM_Boundary_FD Clinton t4398j polygon RTSM_TealJones_Proj_Bdy Terrain_Kamloops_FD 092O Sicamous Chase 092N Radium Hot SpringsInvermere t4397j polygon DTSM_TealJones_Proj_Bdy -

2019 Climate Action Revenue Incentive Program (CARIP) Survey

2019 Climate Action Revenue Incentive Program (CARIP) Survey 2019 Climate Action Revenue Incentive Program (CARIP) Survey Overview INTRODUCTION: The 2019 CARIP survey highlights and celebrates local government climate action in British Columbia. Local governments are required to submit the 2019 CARIP/ Carbon Neutral Progress Survey by June 1, 2020. Detailed survey instructions, FAQs and definitions can be found in the CARIP Program Guide for 2019 Claims. Once the survey is complete, please download a copy of your responses (you will be given the download link at the end of the survey). SURVEY CONTENT: 1. Section 1: Local Government Information 2. Section 2: Narrative Focus 2019 Corporate Climate Action2019 Community-wide Climate Action2019 Climate Change Adaptation Action 3. Section 3: 2019 Carbon Neutral Reporting Section 1 – Local Government Information Name of Local Government:* ( ) 100 Mile House, District of ( ) Abbotsford, City of ( ) Alert Bay, The Corporation of the Village of ( ) Anmore, Village of ( ) Armstrong, City of ( ) Ashcroft, The Corporation of the Village of ( ) Barriere, District of ( ) Belcarra, Village of ( ) Bowen Island, Municipality ( ) Burnaby, City of ( ) Burns Lake, The Corporation of the Village of ( ) Cache Creek, Village of ( ) Campbell River, City of ( ) Canal Flats, Village of ( ) Capital Regional District ( ) Cariboo Regional District ( ) Castlegar, City of ( ) Central Coast Regional District ( ) Central Saanich, The Corporation of the District of ( ) Chase, Village of ( ) Chetwynd, District ( ) Chilliwack, -

Regional Breakdown by Community

REGIONAL BREAKDOWN BY COMMUNITY Central Interior Coastal Vancouver Greater Vancouver Fraser Valley Northern Southern Interior Vancouver Island Yukon (CI) (CV) (GV) (FV) (N) (SI) (VI) (YT) 100 Mile House Bowen Island Anmore Abbotsford Blue River Armstrong Salmon Arm Gabriola Island Entire Territory 108 Mile Ranch Brackendale Belcarra Agassiz Burns Lake Blind Bay Silver Star Mountain Hornby Island Ashcroft Furry Creek Burnaby Aldergrove Chetwynd Canoe Slocan Park Pender Island Blind Bay Garibaldi Highlands Coquitlam Chilliwack Clearwater Castlegar Sparwood Salt Spring Island Bridge Lake Gibsons New Westminster Cloverdale Coldstream Cherryville Summerland Vancouver Island Cache Creek Halfmoon Bay North Burnaby Delta Dawson Creek Christina Lake Sun Peaks Forest Grove Lions Bay Port Coquitlam Fort Langley Fort Nelson Chase Trail Kamloops Lund Port Moody Harrison Hot Springs Fort St. James Clearwater Vernon Knutsford Madiera Park Richmond Hope Fort St. John Coldstream Westbank Logan Lake Mayne Island Knutsford Fraser Lake Coleman Westbank LaSalle MacKenzie North Vancouver Ladner Hazelton Cranbrook West Kelowna Merritt Pemberton Langley Houston Crescent Valley Windermere Mica Creek Pender Harbor Maple Ridge Kitimat Creston Winfield Princeton Port Alice Matsqui Kitamaat Village Elkford Pritchard Port Hardy Milner Likely Enderby Sun Peaks Port Mellon Mission MacKenzie Falkland Westwold Powell River Newton Masset Fairmont Hot Springs Roberts Creek North Delta McLeese Lake Fernie Sechelt Pitt Meadows New Aiyansh Field Squamish Rosedale Port Clements Fruitvale Vancouver Sardis Prince George Grand Forks West Vancouver South Delta Prince Rupert Invermere Whistler South Surrey Quesnel Kaleden Surrey Smithers Kaslo Tsawwassen Taylor Kelowna Walnut Grove Terrace Keremeos White Rock Tumbler Ridge Kimberley Vanderhoof Lake Country Williams Lake Naramata Nelson Okanagan Falls Oliver Osoyoos Oyama Panorama Peachland Penticton Radium Hot Springs Revelstoke Rossland. -

Bibliography of British Columbia1

BIBLIOGRAPHY OF BRITISH COLUMBIA1 COMPILED BY MELVA J. DWYER, Librarian Emerita, University of British Columbia BOOKS ANDERSON, Flo. Lighthouse Chronicles. Madeira Park: Harbour Publishing, 1998. 256 p. ill. $18.95. ANDERSON, Suzanne. Good Morning Quadra! The History of HMCS Quadra. Duncan: Half Acre Publishing, 1997.170 p. ill. $14.95. (7311 Bell McKinnon Rd., Duncan V9L 6A8) ARMITAGE, Doreen. Around the Sound: A History of Howe Sound - Whistler. Madeira Park; Harbour Publishing, 1997. 250 p. ill. $28.95. ASCH, Michael, ed. Aboriginal and Treaty Rights in Canada. Vancouver: UBC Press, 1997. 284 p. $24.95. BAILLARGEON, Morgan and Leslie Tepper. Legends of Our Times: Native Cowboy Life. Vancouver: UBC Press, 1998. 288 p. ill. $45.00. BALLANTYNE, Bob. Out in the Open: Life on the Street. Kelowna: Northstone Publishing, 1997. no paging. $19.95. (photographs of street people) BARON, Nancy and John Acorn. Birds of the Pacific Northwest Coast. Renton, WA.: Lone Pine Publishing, 1997. 24° P- many col. ill. $19.95. BARTOSIK, John. Sea to Sky Country. Madeira Park: Harbour Publishing, 1997. 136 p. col. ill. $39.95. BARTROLI, Tomas. Genesis of Vancouver City: Explorations of Its Site 1791,1792 & 1808. Vancouver: 1997. x9^ P- maps- $10.00. (available from Marco Polo Books, 3450 West 20th Avenue, Vancouver v6s 1E4) BATTIEN, Pauline. The Gold Seekers: A 200 Year History of Mining in Washington, Idaho, Montana & Lower British Columbia. Colville, WA.: Statesman- Examiner, 1996. 268 p. ill. $30.00. BAXTER, Sheila. Still Raising Hell: Poverty, Activism £sf Other True Stories. Vancouver: Press Gang Publishers, 1997. 192 p. ill. $18.95. -

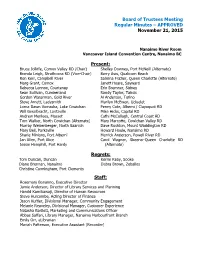

Board of Trustees Meeting Regular Minutes – APPROVED November 21, 2015

Board of Trustees Meeting Regular Minutes – APPROVED November 21, 2015 Nanaimo River Room Vancouver Island Convention Centre, Nanaimo BC Present: Bruce Jolliffe, Comox Valley RD (Chair) Shelley Downey, Port McNeill (Alternate) Brenda Leigh, Strathcona RD (Vice-Chair) Barry Avis, Qualicum Beach Ron Kerr, Campbell River Sabrina Frazier, Queen Charlotte (Alternate) Marg Grant, Comox Janett Hoare, Sayward Rebecca Lennox, Courtenay Erin Bremner, Sidney Sean Sullivan, Cumberland Randy Taylor, Tahsis Gordon Waterman, Gold River Al Anderson, Tofino Steve Arnett, Ladysmith Marilyn McEwen, Ucluelet Lorna Dawn Vomacka, Lake Cowichan Penny Cote, Alberni / Clayoquot RD Will Geselbracht, Lantzville Mike Hicks, Capital RD Andrew Merilees, Masset Cathi McCullagh, Central Coast RD Tom Walker, North Cowichan (Alternate) Mary Marcotte, Cowichan Valley RD Murray Weisenberger, North Saanich Dave Rushton, Mount Waddington RD Mary Beil, Parksville Howard Houle, Nanaimo RD Sharie Minions, Port Alberni Merrick Anderson, Powell River RD Jan Allen, Port Alice Carol Wagner, Skeena–Queen Charlotte RD Jessie Hemphill, Port Hardy (Alternate) Regrets: Tom Duncan, Duncan Kerrie Reay, Sooke Diane Brennan, Nanaimo Debra Brown, Zeballos Christine Cunningham, Port Clements Staff: Rosemary Bonanno, Executive Director Jamie Anderson, Director of Library Services and Planning Harold Kamikawaji, Director of Human Resources Steve Hurcombe, Acting Director of Finance Jason Kuffler, Divisional Manager, Community Engagement Melanie Reaveley, Divisional Manager, Customer Experience Natasha Bartlett, Marketing and Communications Officer Abbas Saffari, Library Manager, Nanaimo Harbourfront Branch Emily Orr, eLibrarian Mariah Patterson, Executive Assistant (Recorder) Vancouver Island Regional Library Board of Trustees Meeting Regular Minutes - APPROVED November 21, 2015 Page 2 1. Call to Order The meeting was called to order at 9:30 a.m. -

The British Columbia Road Runner, December 1970, Volume 7, Number 4

THE BRITISH COLD BIA DECEMBER , 1970 Runner PUBLISHED BY THE DEPA RTMENT OF HIGHWAYS VOLUME 7, UMBER 4 RECOVERY OF THE ENTERPRISE When Barkerville mining activity ended, the miners moved north and the paddle wheeler En terprise was dispatched north, in 1870, from its ru n on the Fraser River, to serve the Omineca gold fields. The stern wheeler was beac hed on Trembleur Lake in August, 1871, for the winter, but in the spring of 1872 it caught fire and burned to the water line. This year, almost 100 years later, the office of the Provincial Secretary requested the De partment of Highways to recover the re mains for historical purposes. All that remained were the boilers and the crank shaft which were loaded on a barge and transported to Fort 51. James. Picture on the bottom, right, shows the remains of the Enterprise on the beautiful sandy beach of Trembleur Lake. Bottom left, Road Foreman Wilf Patten inspects the remains before sending in a barge for retrieval, and, left , Pilot Jerry Johnson looks at the ancient boiler. 2 THE ROAD RUNNER Volume 7 December, 1970 Number 4 Published**Qu arterly by the British Columbia Department of Highways Victoria, British Columbia Th ere isn't any new way of say ing it so I won't try, Ray Baines, Executive Editor hut again I would like to Arthur 1. Schindel, Editor ex tend to each employee of th e Department m y personal wish for a M erry Christmas ** and a Happ y N ew Y ear. For Associate Field Editors many on winter maintenan ce A. -

Isolated Location Point Ratings (PDF, 169KB)

Isolated Location Point Ratings: Place Points Location Alert Bay 14 8 km E Port McNeill Alexis Creek 18 118 km W Williams Lake Aleza Lake 21 92 km NE Prince George Allison Pass 13 59 km N Princeton Anahim Lake 20 118 km W Williams Lake Arrow Park Ferry 13 26 km S Nakusp Atlin 34 183 km S Whitehorse Y.T. Atnarko Camp 24 70 km E Bella Coola Tweedsmuir Park Bamfield (Pacific Rim 20 80 km W Port Alberni (Barkley Sound) NP) Barkerville 20 90 km E Quesnel Bear Lake 17 77 km N Prince George Beaumont (Park) 11 159 km W Prince George (Fraser Lake) Beaverdell 14 Hwy 33; 96 km E Osoyoos Bella Bella 23 135 km W Bella Coola Bella Coola 18 56 km E Ocean Falls Berg Lake Trail 21 5 km N Mount Robson Big Bar Creek 18 104 km NW Cache Creek Blue River 17 89 km S Valemount Bob Quinn Lake 33 162 km S Dease Lake Bowron Lake 20 15 km NE Barkerville Bridge Lake 11 55 km SE 100 Mile House Buick Creek 19 Burns Lake 12 129 km W Vanderhoof Carp Lake 21 151 km NW Prince George Cassiar 24 137 km S Watson Lake Chetwynd 15 102 km W Dawson Creek Clayhurst 16 65 km N Dawson Creek Coldwater Camp 13 Cortes Island 12 26 km E Campbell River Dease Lake 27 135 km S Cassiar Dinan Bay 29 35 km W Massett Driftwood 32 233 km N Ft. St. James Edgewood 13 153 km E Vernon (on Arrow Lake) Fauquier 14 61 km S Nakusp Fifty Mile Camp 23 Fort Fraser 11 38 km W Vanderhoof Fort Nelson 16 Mile 300 on Alaska Hwy Fort St. -

Major Primary Timber Processing Facilities in British Columbia 2003

Major Primary Timber Processing Facilities In British Columbia 2003 Ministry of Forests Economics and Trade Major Primary Timber Processing Facilities in British Columbia 2003 Economics and Trade Branch Ministry of Forests Victoria, B.C. July 2004 Foreword This is the 2003 edition of the Ministry of Forests' Major Primary Timber Processing Facilities in British Columbia and refers to timber processing mills that have primary log processing capability and which operated during 2003. Coverage does not include re-manufacturing plants. Pulp and paper mills and panel plants are included in this report even though some do not have primary log processing capabilities. Where a mill produces more than one product (e.g. lumber and plywood; lumber and paper), each operation is listed in the respective sections of the report. Reported information was gathered by surveying individual processing mills. If a mill did not submit a response, mill specific information reported in trade publications, directories and corporate annual reports may have been used. In some cases Ministry of Forest staff provided estimates based on their knowledge of the operation and information reported in previous years. This year’s report includes a section analyzing the aggregate data gathered through this survey. The Forest Regions and Forest Districts identified for each mill reflect the new Ministry of Forests organizational structure, effective April 1, 2003, consisting of headquarters in Victoria, three regions and 29 districts. This report is available free of charge on the Ministry of Forests’ Internet site at: http://www.for.gov.bc.ca/het/ Request for hard copies of this report can be made to: Economics and Trade Branch Ministry of Forests P.O. -

The Corixidae (Hemiptera-Heteroptera) of British Columbia

34 PllOC. E I\' TOMOL. Soc. Bill'!'. C OI .l1 M RIA. V OL. 57 (1960 ), D EC. 1, 1960 THE CORIXIDAE (HEMIPTERA-HETEROPTERA) OF BRITISH COLUMBIA I. LANSBURY' Introduction Manitoba, Alberta, Saskatchewan and Prior to this list nineteen species Alaska. Apparently not very common were recorded from British Columbia; although widespread. twenty five are recorded here and Dasycorixa hybrida (Hungerford) three new species are described. Some Vernon (P.) (Hungerford, 1.c.) . of the records are from Hungerford Corisella decolor (Uhler) (1948) and Lansbury (1955) . The re Osoyoos (H.B.L.); Hope (L.D.A.). mainder are from material in the British Columbia forms the extreme collections of the Department of northern limit of this species; it Zoology at the University of British occurs abundantly in California, Utah, Columbia, Vancouver. Full descrip Nevada and Oregon. tions of the species listed, excluding Callicorixa audeni (Hungerford) the new ones, can be found in Hunger Kamloops (G.J.S.); Fraser Lake ford (1. c.). (G. J. S.); Chilcotin (G.J .S.); Nicola List o·f Captors (G.J.S.) ; Australian (N.S.W.) ; Midday A.B.A . .......................... A. B. Acton Valley, Merritt (K.F.A.) ; Oliver L.D.A . .................... L. D. Anderson (W. D.) ; Williams La k e District KF.A . .......................... K F. Auden (G.G .E.S.) ; Alkali Lake South of Clin W.B . .................... ____ .... W. Bennedict J.C.B . ...____ .................. J. C. Bradley ton (G.G.E.S.); Soda Creek, to light O.B . ......... __ ................. Owen Bryant (G.J.S.) ; Nulki Lake near Vanderhoof E.R.B. ........................ E. R. Buckell (J. -

2021 Home Value Limits

2021 Home Value Limits To be eligible under BC RAHA, your home’s most recent BC Assessment value must not exceed the Home Value Limit for your Assessment Area, specified in the table below. To determine your assessment area code, refer to your Property Assessment Notice or use the table below. Assessment Area Code Assessment Area Home Value Limit 1 Capital $799,999 4 Central Vancouver Island $574,999 6 Courtenay $499,999 8 North Shore-Squamish Valley $1,349,999 9 Vancouver $1,374,999 10 North Fraser $974,999 11 Richmond-Delta $999,999 14 Surrey-White Rock $974,999 15 Fraser Valley $749,999 17 Penticton $449,999 19 Kelowna $649,999 20 Vernon $499,999 21 Nelson/Trail $399,999 22 East Kootenay $424,999 23 Kamloops $474,999 24 Cariboo $299,999 25 Northwest $349,999 26 Prince George $349,999 27 Peace River $299,999 The Home Value Limit for each Assessment Area is set by BC Housing using the data provided by BC Assessment and updated annually. The 2021 Home Value Limit for each area is established by ensuring that 60% of the homes in each area are valued at less than the Limit. Home Value Limits for use effective May 2021 Assessment Area by Jurisdiction Assessment Area Code Jurisdiction Name 1 Colwood, Victoria, Central Saanich, Esquimalt, Saanich, Oak Bay, Langford, North Saanich, Metchosin, Sooke, Highlands, View Royal, Sidney, Victoria Rural, Gulf Islands Rural 4 Duncan, Port Alberni, Nanaimo, North Cowichan, Lantzville, Ladysmith, Lake Cowichan, Parksville, Qualicum Beach, Tofino, Ucluelet, Duncan Rural, Nanaimo Rural, Alberni Rural 6 Courtenay, -

Colombie-Britannique / British Columbia Edgewater V0a Bc (250) 542-5171 Golden V0a Bc (250) 542-5171 Invemere V0a Bc (250) 542-5171 Invermere V0a Bc (250) 542-5171

Province / Code Postal / FSA Téléphone / Ville / City Territoire / Postal Code Phone Number Territory COLOMBIE-BRITANNIQUE / BRITISH COLUMBIA EDGEWATER V0A BC (250) 542-5171 GOLDEN V0A BC (250) 542-5171 INVEMERE V0A BC (250) 542-5171 INVERMERE V0A BC (250) 542-5171 BAYNES LAKE V0B BC (866) 484-0369 BOSWELL V0B BC (866) 484-0369 CANAL FLATS V0B BC (866) 484-0369 CANYON V0B BC (866) 484-0369 CRESTON V0B BC (866) 484-0369 ELKFORD V0B BC (866) 484-0369 FAIRMONT HOT SPRINGS V0B BC (866) 484-0369 FERNIE V0B BC (866) 484-0369 GRAY CREEK V0B BC (866) 484-0369 JAFFRAY V0B BC (866) 484-0369 KITCHENER V0B BC (866) 484-0369 RIONDEL V0B BC (866) 484-0369 SPARWOOD V0B BC (866) 484-0369 WINDERMERE V0B BC (866) 484-0369 WYNNDEL V0B BC (866) 484-0369 YAHK V0B BC (866) 484-0369 CECIL LAKE V0C BC (866) 550-2316 CHETWYND V0C BC (866) 681-9486 FORT NELSON V0C BC (866) 550-2316 HUDSON'S HOPE V0C BC (866) 681-9486 MOBERLY LAKE V0C BC (866) 681-9486 POUCE COUPE V0C BC (866) 550-2316 PRESPATOU V0C BC (866) 550-2316 ROSE PRAIRIE V0C BC (866) 550-2316 TAYLOR V0C BC (866) 550-2316 TOMSLAKE V0C BC (866) 550-2316 TUMBLER RIDGE V0C BC (866) 681-9486 ARMSTRONG V0E BC (250) 542-5171 BARRIERE V0E BC (250) 542-5171 BLIND BAY V0E BC (250) 542-5171 BLUE RIVER V0E BC (250) 542-5171 CANOE V0E BC (250) 542-5171 CHASE V0E BC (250) 542-5171 CHERRYVILLE V0E BC (250) 542-5171 CLEARWATER V0E BC (250) 542-5171 ENDERBY V0E BC (250) 542-5171 FALKLAND V0E BC (250) 542-5171 KAMLOOPS V0E BC (250) 542-5171 KNUTSFORD V0E BC (250) 542-5171 LEE CREEK V0E BC (250) 542-5171 LOUIS CREEK V0E