November 26 in Zurich Corporate Taxes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

ANNUAL REPORT 2019 Table of Contents

ANNUAL REPORT 2019 Table of Contents Overview 3 Key figures 5 Performance Indicators 6 Editorial 8 Strategy 12 Business Review Group 18 Segment Sheet Metal Processing 20 Segment Chemical Specialties 22 Segment Outdoor 24 Responsibility 27 Corporate Governance 29 Report of the Human Resources Committee 31 Report of the Audit Committee 33 Corporate Governance Report 54 Compensation Report 66 Financial Report 67 Consolidated Financial Statements 106 Financial Statements of Conzzeta AG 116 Five-Year-Summary 118 Publication Details Conzzeta Geschäftsbericht 2019 2 Key figures - Group CHF m 2019 2018 Changes Net revenue 1,573.2 1,782.2 –11.7% on a comparable basis 1 –4.9% Total revenue 1,579.1 1,796.7 –12.1% Operating result (EBIT) 167.2 146.8 13.9% adjusted 2 137.3 146.8 –6.5% as a % of total revenue, adjusted 8.7% 8.2% 50 bp Group result 136.8 114.8 19.2% as a % of total revenue 8.7% 6.4% 230 bp Minority interests 11.1 18.2 –39.1% Operating free cash flow 40.6 83.4 –51.3% Cash, cash equivalents and securities 300.9 389.6 –22.8% Total assets 1,266.0 1,366.2 –7.3% Shareholders’ equity 880.1 926.9 –5.0% as a % of total assets 69.5% 67.8% 170 bp Net operating assets (NOA) 550.7 520.1 5.9% Return on net operating assets (RONOA) 2 20.0% 23.1% -310 bp Number of employees on December 31 5,026 5,259 –4.4% Earnings per class A share, in CHF 60.85 46.76 30.1% Dividend for class A shares, in CHF 42.00 3 18.00 133.3% Dividend for class B shares, in CHF 8.40 3 3.60 133.3% 1 At constant exchange rates and adjusted for changes in the scope of consolidation. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Annual Results, Press Release (2014, English)

Schindler Management Ltd. Schindler Management Ltd. Corporate Communications Annual Results 2014 Media release February 13, 2015 Solid growth and increased profit Schindler stayed on course with its growth strategy in 2014, recording a strong fourth quarter. For the reporting year orders received increased 7.8% in local currencies, with revenue up 7.3%. In Swiss francs, growth in orders received and revenue was 5.5% and 4.9% respectively. Operating profit (EBIT) was CHF 1 138 million, a rise of CHF 242 million from the previous year, giving an EBIT margin of 12.3%. Adjusted for exceptional items, operating profit in local currencies improved 7.4% to CHF 932 million, representing an EBIT margin of 10.1%. Net profit was CHF 902 million, significantly exceeding the previous year. Net profit before exceptional items was CHF 740 million, an improvement of 8.5% over the previous year. Strong orders received and backlog Schindler generated CHF 9 979 million in orders received in the reporting year, an increase of 5.5% (7.8% in local currencies). Growth was strongest in the Asia-Pacific region, led by China, India, and South-East Asia, where Schindler significantly exceeded market growth rates. The market recovery in the USA stimulated an encouraging increase in orders received for the Americas region. In Europe, despite declines in some markets, a small growth rate was recorded as a whole. In the fourth quarter of 2014, orders received reached an unprecedented CHF 2 569 million, an increase of 13.9% compared to the same period in the previous year (11.1% in local currencies). -

Schindler-Case-Study.Pdf

CASE STUDY LOGITECH VIDEO COLLABORATION SOLUTIONS HELP SCHINDLER TO ACCELERATE DECISION MAKING AMONG THE LEADERSHIP TEAM. Schindler is one of the world’s leading providers of elevators, escalators, and moving walks, as well as maintenance and modernization services. Schindler uses Logitech GROUP & Logitech CONNECT in 10 locations across India to increase the frequency of meetings among key decision-makers, thereby boosting productivity. CHALLENGE Schindler Group has over 1000 branch oces in more than 100 countries, as well as production sites and R&D facilities in the US, Brazil, Europe, China, and India. In India, they have a presence in more than 50 cities with 13 major branches. Managing such a widely distributed workforce was one of the major challenges faced by the senior management. Loss of valuable time due to management travelling for meetings was increasing. Accelerating decision-making INDUSTRY across functions and conveying the decisions to all levels in the organization quickly and eciently was Manufacturing another challenge. PRODUCTS USED SOLUTION Schindler was looking for a solution that was economical Logitech and simple to use, because their existing equipment was CONNECT expensive and complicated. They evaluated Logitech because they had recently migrated to Microsoft O365 Logitech GROUP with Skype for Business and they knew we were certied by Microsoft. Logitech GROUP & Logitech CONNECT are now helping the top management to conduct business reviews, the sales team to conduct sales reviews, the support teams for knowledge-sharing & training & HR for doing interviews. “ We are satised with Logitech’s product Arikrishnan S quality, service & support and we will go DGM for more installations in the future. -

Business News No

Talacker 41, 8001 Zurich, Switzerland, Phone: +41 43 443 72 00, Fax: +41 43 497 22 70, [email protected], www.amcham.ch, October 2020 / No. 400 Last quarter of a very special year: What is ahead? The latest events (more pictures on pages 4/5) Dear members and friends 2020 started with a boom and had a strongly positive outlook. 20/20 vision is the perfect vision, after all! But as we all know, the year turned out differently. The Swiss-American business relationship had a roaring start. After Q4, 2019, the first quarter of 2020 again saw the US market #1 for Swiss exports, ahead of the German market! Exports to the US grew CHF 974 mio, four times the growth to the EU, while exports to the BRIC countries posted a negative growth of CHF 470 mio. Again, the exports to the USA proved to be the locomotive of the Swiss export industry. As we all know, Q2 Lugano, Annual Dinner, September 17: Franco Polloni Zurich, September 29: J. Erik Fyrwald, saw exports to the US crashing down 22% (EFG Bank / former Ticino Chapter Board Chairman), CEO, Syngenta Group and Board due to the Covid crisis in general and logistics Silvio Napoli (Schindler Holding / Swiss Amcham Member Swiss Amcham [MS] problems as a specific issue. But in the last Chairman), Demis Stucki (EFG Bank / Ticino Chapter months, progress came much faster than Board Chairman) expected and in August, the US market was again the top export market for Switzerland. The Swiss-US Business relationship has everything to flourish in the future. -

Dufry Annual Report 2014 2014 R DUFRY Ann R Epo U Al T

DUFRY dufry annual report 2014 annUal RepoRt 2014 ANNUAL REPORT 2014 CONTENT MANAGEMENT REPORT 1 Dufry at a Glance 4–5 Highlights 2014 6–7 Message from the Chairman of the Board of Directors 8–10 Statement of the Chief Executive Officer 12–15 Organizational structure 15 Board of Directors 16–17 Group Executive Committee 18–19 Dufry Investment Case 20–21 Dufry Business Model 22–49 Dufry Regions 42–49 SUSTAINABILITY REPORT 2 Environment 50–51 Employees 52–55 Social Responsibility 56–59 FINANCIAL REPORT 3 Report of the Chief Financial Officer 60–64 Financial Statements 65–156 Consolidated Financial Statements 68–143 Financial Statements Dufry AG 146–153 GOVERNANCE REPORT 4 Corporate Governance 157–174 Remuneration Report 175–183 Information for Investors and Media 186–187 Address Details of Headquarters 187 3 1 Management Report DUFRY ANNUAL REPORT 2014 DUFRY AT A GLANCE TURNOVER GROSS PROFIT IN MILLIONS OF CHF IN MILLIONS OF CHF MARGIN 4,800 2,400 70 % 4,400 2,200 68 % 4,000 2,000 66 % 3,600 1,800 64 % 3,200 1,600 62 % 2,800 1,400 60 % 2,400 1,200 58 % 2,000 1,000 56 % 1,600 800 54 % 1,200 600 52 % 800 400 50 % 400 200 48 % 0 0 46 % 201020112012 2013 2014 20102011 2012 2013 2014 EBITDA¹ NET EARNINGS IN MILLIONS OF CHF IN MILLIONS OF CHF 600 240 + 13 % 550 220 + 8 % 500 200 + 28 % 450 180 400 160 + 8 % 350 + 14 % 140 300 120 250 100 200 80 150 60 100 40 50 20 0 0 2010 2011 2012 2013 2014 20102011 2012 2013 2014 ¹ EBITDA before other operational result Adjusted net earnings without other operational result 4 NET SALES BY PRODUCT CATEGORY -

Alumni Service 2019

Università della Svizzera italiana Alumni Service Building a lifelong relationship 2019 Alumni Placement Survey Activities for Alumni 2018 The Careers and Alumni Service carries Through its Alumni Service, the University manages relations with its alumni and seeks in particular to support the professional out annually, since 2002, a survey on the development and networking of the alumni community thus professional outcomes of USI graduates contributing to the growth of USI. at 1 year and 5 years after graduation. USI Alumni can benefit of the following services and activities: The aim of the survey is to gather insight Events Alumni Reunions on employment access, and tailor the Chapter Meetings Service offer and activities accordingly. Career events The 2018 survey (the 16th carried out by Careers Job offers databank the Service) involved over 650 graduates Career counselling of the 4 faculties (Architecture, Communi- Alumni placement survey cation, Economics and Informatics) who Benefits Continuous learning finished in 2013 (at 5 years) and in 2017 Scholarships (at 1 year), with a response rate of 50%. Access to USI Sport USI Shop Email forwarding Involvement Testimonials Career Stories Visiting Alumni Key 1 year a 5 years Results (2017) (2013) Network Alumni yearbook Chapters/Point of Contact Alumni Surveyed 779 562 Alumni on Social Media Employed News Alumni Newsletter and News 94.5% 96.1% USI Flash Employed in CH 61.4% 59.2% Annual Average Income 56.800 72.700 See more at: www.usi.ch/alumni (in CHF) Time spent to find initial 2.6 – occupation (in months) Job Satisfaction 93.9% 96.1% USI Alumni USI Alumni Today around the world USI has more than 9,000 alumni, reflecting USI’s international USI Alumni work in 100+ different countries around the world in character, both in terms of country of origin and of destination for different sectors, both private and public, and in academia. -

2019 Switzerland Spencer Stuart Board Index

2019 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. Spencer Stuart is one of the world’s leading executive search consulting firms. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning more than 60 offices, over 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2020 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword -

2018 Compensation Report to a Principles Applicable to Performance-Related Pay and to the Consultative Vote at the 2019 Annual General Meeting

84 Givaudan – 2018 Integrated Annual Report 85 Compensation report In this section 86 Compensation governance 87 Compensation principles 88 Compensation of Givaudan executives 93 Compensation of the Executive Committee 94 Compensation of the Board of Directors 96 Share ownership guidelines 96 Ownership of Givaudan securities 97 Report of the statutory auditor Givaudan – 2018 Integrated Annual Report 86 Compensation report Compensation report Attract, motivate and retain performance targets and related payouts under the annual incentives and share-based long-term incentives, while the Givaudan aims to attract, applicable performance criteria are set by the Board. motivate and retain a diverse The Compensation Committee is also responsible for pool of highly talented people to reviewing and approving individual compensation and benefits of each Executive Committee member as well as sustain its leadership position recommending compensation for the Board. within the flavour and fragrance The Compensation Committee consists of three independent industry. The Company’s members of the Board and is currently chaired by Prof. Dr-Ing. Werner Bauer. The Chief Executive Officer is regularly invited to compensation policies are an Compensation Committee meetings. The Head of Global Human Resources acts as secretary of the Compensation Committee. essential component of this The Chairman of the Compensation Committee may invite other strategy, and as such a key driver executives as appropriate. However, executives do not participate in discussions regarding their own compensation. of organisational performance. The Compensation Committee meets three to five times a year Our compensation programmes are aligned to our strategy and and informs the Board of its deliberations, recommendations and reflect the performance of the business and of individuals. -

We Love What We Do 2014 Annual Report 2014 Annual Report Annual 2014

We love what we do 2014 Annual Report 2014 Annual Report Annual 2014 Straumann Holding AG Peter Merian-Weg 12 4002 Basel Switzerland www.straumann.com 00_00_STR_GB2014_GB_Umschlag_en.indd 1 09.03.2015 16:44:50 About Straumann Straumann is a global leader in tooth replacement solu- tions including dental implants, prosthetics and regener- ative products. Headquartered in Basel, Switzerland, the Group is present in more than 70 countries through its broad network of distribution subsidiaries and partners. 1 Rebecca Hesse SAP Coordinator 2 Susan-Ann Welzbacher Corporate Safety Officer 3 Julia Hirtle Spend Coordinator 4 Roland Scacchi Administrator 5 Alessandro Annicchiarico IT Support 4 7 1 2 3 5 6 8 9 6 Heather Stanton Web Editor IMPRINT Published by: Institut Straumann AG, Basel 7 Dave Koster Lab Business Development Concept and realization: PETRANIX Corporate and Financial Communications AG, Adliswil/Zurich 8 Raul Perez Talent Management Photography: AMX Studio, Alex Stiebritz, Karlsruhe Consultant on sustainability: sustainserv, Zurich and Boston 9 Sandra Schürmann Events Coordinator Certain design elements by Eclat, Erlenbach/Zurich Print: Neidhart + Schön AG, Zurich Basel, 26 February 2015 We have a global culture with more than 28 nationalities represented at our headquarters alone. The front cover shows a few examples. ©2015, Straumann Holding AG 00_00_STR_GB2014_GB_Umschlag_en.indd 2 09.03.2015 16:45:02 We love what we do 2014 Annual Report Highly motivated, creative employees, together with innovative products, solutions and commercial ap- proach es are the keys to Straumann’s ambition of being the provider of choice in tooth replacement. The theme photographs in this report all feature products that we introduced or rolled out in 2014 alongside some of the talented people who have been involved in bringing them to customers and patients. -

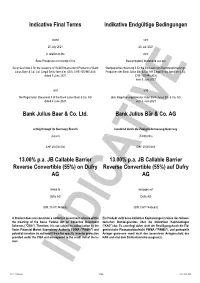

111443663 | 13.00% P.A. JB Callable

Indicative Final Terms Indikative Endgültige Bedingungen dated vom 20 July 2021 20. Juli 2021 in relation to the zum Base Prospectus consisting of the Basisprospekt, bestehend aus der Securities Note II for the issuance of Yield Enhancement Products of Bank Wertpapierbeschreibung II für die Emission von Renditeoptimierungs- Julius Baer & Co. Ltd. (Legal Entity Identifier (LEI): CHE-105.940.833) Produkten der Bank Julius Bär & Co. AG (Legal Entity Identifier (LEI): dated 9 June 2021 CHE-105.940.833) vom 9. Juni 2021 and und the Registration Document II of the Bank Julius Baer & Co. AG dem Registrierungsformular II der Bank Julius Bär & Co. AG dated 4 June 2021 vom 4. Juni 2021 Bank Julius Baer & Co. Ltd. Bank Julius Bär & Co. AG acting through its Guernsey Branch handelnd durch die Zweigniederlassung Guernsey (Issuer) (Emittentin) CHF 20,000,000 CHF 20'000'000 13.00% p.a. JB Callable Barrier 13.00% p.a. JB Callable Barrier Reverse Convertible (55%) on Dufry Reverse Convertible (55%) auf Dufry AG AG linked to bezogen auf Dufry AG Dufry AG ISIN: CH1114436632 ISIN: CH1114436632 A Product does not constitute a collective investment scheme within Ein Produkt stellt keine kollektive Kapitalanlage im Sinne des Schwei- the meaning of the Swiss Federal Act on Collective Investment zerischen Bundesgesetzes über die kollektiven Kapitalanlagen Schemes ("CISA"). Therefore, it is not subject to authorisation by the ("KAG") dar. Es unterliegt daher nicht der Bewilligung durch die Eid- Swiss Financial Market Supervisory Authority FINMA ("FINMA") and genössische Finanzmarktaufsicht FINMA ("FINMA"), und potenzielle potential investors do not benefit from the specific investor protection Anleger geniessen somit nicht den besonderen Anlegerschutz des provided under the CISA and are exposed to the credit risk of the Is- KAG und sind dem Emittentenrisiko ausgesetzt.