Table of Contents – in Word

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

It Runs in the Family

TRENDS INTEL INDUSTRY REGION PURSUITS SUSTAINABLE BANKING STAWI PENSION EAST AFRICA TRAVEL GEMS NOT FOR SALE NOT Corporate Magazine | October2020 - January, 2021 A society in business It runs in Making Mulleys the Family Things cannot Secrets of building a great just fall family business into place Also in this issue, updates on the COVID 19 vaccine and how Biden will approach Africa The Ultimate Trade Finance Solutions 18 How Biden will approach Africa Biden has promised to “bring Our services include: to the presidency decades of • Pre-Shipment Finance/Pre-Export Finance foreign policy experience and a • LPO Financing/Supply Chain Financing demonstarted committment to Africa.” • Bills/Invoice Discounting Facilities • Stock Financing Facilities • Documentary Collections • Bank Guarantees/Bonds • Post-Import Finance 6 • Letters of Credit KCB bags major green finance deal CONTACT US TODAY: The bank is the first lender in Kenya and private sector entity Call: 0711 087 000 or 0732 187 000 to receive this accreditation Email: [email protected] cementing the sustainability Web: www.kcbgroup.com thought leadership efforts within the Group 44 Side-stepping the common pitfalls of family businesses The challenges of family businesses can be summed up to governance and succession 10 First annuity road paves way for more The road construction contract 12 was awarded to Intex Raf Construction Company at a cost Will Africa get the short end of the vaccine stick again? of KShs8 billion and financed by Kenya among countries in which trials -

Media Release

MEDIA RELEASE Sanlam Kenya maintains positive outlook ahead with Covid impact forecasted to dissipate …posts a Kshs 43 million pretax profit in its 2020 full year results 25/03… The Nairobi Securities Exchange (NSE) listed firm, Sanlam Kenya PLC, a leading non-bank financial services firm in Kenya, has posted a Kshs 43 million pretax profit in its just-released full-year 2020 trading results, a 92 % decline against the Kshs 550 million in 2019 primarily attributed to the Covid-19 pandemic impact on the local and international economies. Speaking when the firm’s approved and released the results, Sanlam Kenya Plc Group Chairman Dr. John Simba said the effects of the Covid-19 pandemic on the local economy and foreign exchange rates adversely impacted the Group’s net assets valuation. In response to the challenging operating environment, the Group CEO, Dr Tumbo said, management focused on securing the employees’ health and jobs, cost saving, new product development, innovation and delivery of sales and services online. As part of the business growth strategy, Sanlam Kenya’s Life insurance subsidiary, in conjunction with Minet Kenya recently unveiled an innovative post-retirement insurance plan branded RetireMed. This product is designed to assist Kenyans save for their medical expenses in retirement. Clients under the two Sanlam Kenya subsidiaries (Sanlam Life and Sanlam General Insurance) are also enjoying benefits under the recently unveiled Sanlam Assistance and the Sanlam Premium Rewards Loyalty Programme. The clients are enjoying exclusive rewards, including monthly discounts at local supermarkets, restaurants and pharmacies, and free round-the-clock access to Emergency support services. -

Hy 2020 Results

HY 2020 RESULTS 1 CUSTOMERS 24.6 MILLION OUR REGIONAL PRESENCE 359 BRANCHES 1,082 ATMS, Banking Businesses: 23,192 AGENTS & MERCHANTS •KCB Bank Kenya •KCB Bank Tanzania STAFF •KCB Bank South Sudan 7,814 •KCB Bank Rwanda •KCB Bank Uganda •KCB Bank Burundi KCB BANK KENYA (ETHIOPIA •National Bank of Kenya KCB BANK REPRESENTATIVE •Ethiopia Rep. Office SOUTH SUDAN OFFICE ) KCB BANK KENYA Other Investments: KCB BANK NATIONAL BANK OF KENYA UGANDA • KCB Capital Limited KCB INSURANCE AGENCY KCB FOUNDATION • KCB Insurance Agency KCB CAPITAL KCB BANK • KCB Foundation RWANDA • Kencom House Limited KCB BANK KCB BANK BURUNDI TANZANIA 2 OUR FOOTPRINT Branches 12 Ethiopia South ATMs 3 Sudan Agents 42 (Representative Office Staff 118 with 1 staff) Touch Points: Branches 15 Uganda ATMs 18 Agents 530 Branches 300 Staff 271 ATMs 357 Kenya Agents 13,412 Branches 12 Staff 6,774 ATMs 25 Rwanda Agents 415 Staff 249 Branches 14 ATMs 15 Branches 6 Tanzania Agents 172 ATMs 7 Staff 274 Burundi Agents 185 Staff 127 3 CREDIT RATINGS RATING AGENCY SOVEREIGN KCB BANK KENYA Credit Ratings at par with the Sovereign Rating B2 (Negative) B2 (Negative) B+/B B+/B (Negative) (Negative) 4 KCB 2JIAJIRI 2JIAJIRI BENEFICIARIES AGRIBUSINESS PROGRAMME 19,080 PER SECTOR BUILDING AND HIGHLIGHTS CONSTRUCTION BEAUTY AND 9,910 PERSONAL CARE AUTOMOTIVE 3,480 ENGINEERING 2,083 FUTURE OF 2JIAJIRI DOMESTIC Catalyze job and wealth SERVICES creation for at least 1,638 36,706 2,000,000 ICT youth engaged in the informal BENEFICIARIES TO 515 DATE sector within Eastern Africa 5-year investment of over KShs 50 billion Male : Female Ratio to nurture and grow youthful and Kenya 35,949 SME entrepreneurs Tanzania ‘Young Africa Works’ 54:46 357 Rwanda KShs 10 billion funding 300 from the MasterCard Foundation Uganda to scale up the Bank’s 2jiajiri job 100 creation programme 5 KCB FOUNDATION Peter Kanyi, Owner, D-DEKX Autocare, Nairobi CASE STUDIES • Studied mechanical and electrical engineering at Eastlands College of Technology under 2jiajiri. -

The Effect of Dividend Policy on Market Capitalization for Firms Listed at the Nairobi Securities Exchange

THE EFFECT OF DIVIDEND POLICY ON MARKET CAPITALIZATION FOR FIRMS LISTED AT THE NAIROBI SECURITIES EXCHANGE SYLVIA MURUGI WAGIO A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION (FINANCE OPTION) SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI NOVEMBER, 2018 DECLARATION ii ACKNOWLEDGEMENT iii DEDICATION iv TABLE OF CONTENTS DECLARATION......................................................................................................... ii ACKNOWLEDGEMENT ......................................................................................... iii DEDICATION............................................................................................................ iv TABLE OF CONTENTS ............................................................................................v LIST OF TABLES ................................................................................................... viii LIST OF FIGURES ................................................................................................... ix LIST OF ABBREVIATIONS .....................................................................................x ABSTRACT ................................................................................................................ xi CHAPTER ONE: INTRODUCTION ........................................................................1 1.1 Background ....................................................................................................... -

The Relationship Between Performance And

THE RELATIONSHIP BETWEEN PERFORMANCE AND EXECUTIVE COMPENSATION OF FIRMS LISTED ON THE NAIROBI SECURITIES EXCHANGE BY: ANDREW NJAGI MACHARIA A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE MASTER OF SCIENCE DEGREE IN FINANCE AND ACCOUNTING AT THE UNIVERSITY OF NAIROBI NOVEMBER 2017 i DECLARATION I, declare that this is my original work and has not been submitted to any other college, institution or university other than the University of Nairobi for an academic credit. Signed: ___________________________ Date: _______________________ Macharia Andrew Njagi D63/82069/2015 This research project has been submitted for examination with my approval as the University Supervisor. Signed: _____________________________ Date: ____________________ Abdulatif Essajee Lecturer, Department of Finance and Accounting School of Business, University of Nairobi. ii ACKNOWLEDGEMENTS I would like to first and foremost thank the Almighty God for His strength and care throughout my research. Secondly, I would like to express sincere gratitude and appreciation to my supervisor Mr. Abdulatif Essajee for his invaluable and continuous support and guidance throughout my research study. He showed lots of patience, motivation, enthusiasm, and was helpful in imparting me with helpful knowledge from his extensive experience in academia that was crucial in making this a success. This work would also not be possible without the immense support of my colleague Kevin Andalya and family members who have shown lots of faith in me and given me -

Legal Digest August & September 2018

LEGAL DIGEST AUGUST & SEPTEMBER 2018 Preamble The Legal Division continues to play its very important role of disseminating relevant legal knowledge to the University community through the bi-monthly Legal Digest. In this Digest we will highlight the subject of amendment to the Constitution of Kenya which is a topic currently under discussion in the political arena. There are several proposed amendments which have not yet been formalized in a Bill of Parliament but are being discussed among the leaders. Some leaders are proposing amendments to reduce the number of constituencies and counties and subsequently Senators and Governors. Some are also proposing reduction of the powers of the President and re-creation of the office of the Prime Minister. Others are calling for a referendum and terming it as part of the Building Bridges to a new Kenyan Nation initiative by President Uhuru Kenyatta and ODM Leader Raila Odinga. The Digest will also look at recent judgments both local and international that are of significance. Amendment to the Constitution The Constitution of Kenya was passed in 2010 and since then there have been attempts to amend the Constitution through Constitution (Amendment) Bills. Chapter 16 of the Constitution provides the ways in which the Constitution can be legally amended, that is: i). Through a referendum-under Article 255 as read together with Article 256 a proposed amendment to the Constitution shall be enacted by Parliament through a Bill and approved through a referendum if the proposed amendment relates to: the supremacy of the Constitution; the territory of Kenya; the sovereignty of the people; the national values and principles of governance under Article 10(2) of the Constitution; the Bill of Rights; the term of office of the President; the independence of the Judiciary and the commissions and independent offices; the functions of Parliament; the objects, principles and structure of devolved government; or 1 the manner in which the Constitution shall be amended. -

Table of Contents

Weekly report - Week 35 Market Perfomance P revious T oday %Change Market Summary Shares traded 125,158,500 358,870,700 186.7% It was a mixed bag for the NSE Last week. After a very tumultuous week in the banking industry that Equity Turnover (KES) 2,670,283,939 6,726,668,014 151.9% saw banking stocks lose over 40bn on the market, Banks bounced back mainly due to investors who Market Cap (KES Bill) 1,944 1,931 -0.7% were keen to take advantage of the low entry levels for banks stocks. Most activity was seen on Market Cap (USD Mil) 19 19 -0.6% Safaricom where investors were rushing to lock in the ordinary and special dividend before book NSE-20 Share Index 3,217 3,188 -0.9% closure. Other counters that registered elevated activity were KCB Group, Equity bank and Co- NSE All Share Index 135 134 -0.7% 3,552 3,485 operative bank that witnessed activity mostly from investors that were taking advantage of the low NSE 25 Share Index -1.9% 91-day Treasury Bills 8.607 8.258 -4.1% banking valuations as well as investors fleeing to value. 182-day Treasury Bills 11.182 11.125 -0.5% All the main indices closed the week in the red.The Alsi, NSE 20 and NSE 25 shed 0.67%, 0.89% and 364-day Treasury Bills 11.982 11.502 -4.0% 1.87% respectively to close at 134.6, 3,187.87 and 3,485.42. Top Gainers & Losers Top gainers W eek Close w-o-w % Shares Traded Gainers Following news that Kuramo Capital had agreed to acquire about 25% percent of Transcentury’s Trans-Century Ltd 6.6 45.6% 52,500 Housing Finance Group Ltd 16.7 19.4% 312,300 shareholding in exchange for 2.0bn cash injection (a big premium on the price of Kes 4.50), NIC Bank Ltd 27.8 15.6% 486,900 Transcentury’s share prices soared 45.5% to close the week at Kes 6.60 from Kes 4.50 the previous Eveready East Africa Ltd 2.2 13.2% 14,200 Barclays Bank of Kenya Ltd 9.7 12.9% 5,925,700 Friday. -

KCB Group Plc – Q1'2021

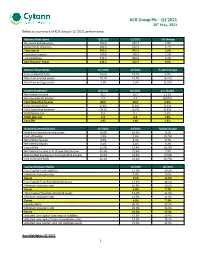

KCB Group Plc – Q1’2021 28th May, 2021 Below is a summary of KCB Group’s Q1’2021 performance: Balance Sheet Items Q1'2020 Q1'2021 y/y change Net Loans and Advances 553.9 597.1 7.8% Government Securities 202.6 212.1 4.7% Total Assets 947.1 977.5 3.2% Customer Deposits 740.4 749.4 1.2% Total Liabilities 811.5 830.0 2.3% Shareholders’ Funds 135.5 147.5 8.8% Balance Sheet Ratios Q1'2020 Q1'2021 % point change Loan to Deposit Ratio 74.8% 79.7% 4.9% Return on average equity 20.1% 13.9% (6.2%) Return on average assets 3.1% 2.0% (1.1%) Income Statement Q1'2020 Q1'2021 y/y change Net Interest Income 15.1 16.7 11.1% Net non-Interest Income 7.9 6.3 (20.0%) Total Operating income 23.0 23.0 0.4% Loan Loss provision (2.90) (2.86) (1.3%) Total Operating expenses (14.0) (13.9) (0.8%) Profit before tax 8.9 9.1 2.2% Profit after tax 6.3 6.4 1.8% Core EPS 1.95 1.98 1.8% Income Statement Ratios Q1'2020 Q1'2021 %point change Yield from interest-earning assets 10.8% 10.9% 0.1% Cost of funding 2.8% 2.6% (0.2%) Net Interest Spread 8.0% 8.3% 0.3% Net Interest Margin 8.1% 8.4% 0.3% Cost of Risk 12.6% 12.4% (0.2%) Net Interest Income as % of operating income 65.6% 72.6% 7.0% Non-Funded Income as a % of operating income 34.4% 27.4% (7.0%) Cost to Income Ratio 61.1% 60.4% (0.7%) Capital Adequacy Ratios Q1'2020 Q1'2021 Core Capital/Total Liabilities 17.1% 19.2% Minimum Statutory ratio 8.0% 8.0% Excess 9.1% 11.2% Core Capital/Total Risk Weighted Assets 17.1% 18.2% Minimum Statutory ratio 10.5% 10.5% Excess 6.6% 7.7% Total Capital/Total Risk Weighted Assets 19.0% 21.8% Minimum Statutory ratio 14.5% 14.5% Excess 4.5% 7.3% Liquidity Ratio 40.1% 37.3% Minimum Statutory ratio 20.0% 20.0% Excess 20.1% 17.3% Adjusted core capital/ total deposit liabilities 17.5% 19.4% Adjusted core capital/ total risk weighted assets 17.5% 18.3% Adjusted total capital/ total risk weighted assets 19.4% 21.9% Key Highlights Q1’2021 1 KCB Group Plc – Q1’2021 28th May, 2021 KCB Group’s restructured loan book stands at Kshs 102.5 bn, representing 18.8% of its loan book which stood at Kshs 597.1 bn as at Q1’2021. -

Business Units at 31 December 2017 (100% Unless Otherwise Indicated)

Business units at 31 December 2017 (100% unless otherwise indicated) Sanlam Personal Finance Sanlam Emerging Markets Sanlam Sky Investment management: Recurring premium sub cluster Sanlam Investments, Kenya (57%) via Sanlam Glacier Kenya PLC1 Strategic Business Development SIM Namibia (86%) Sanlam Investments East Africa Limited (74%) Botswana Insurance Fund Management (59%) via BIHL1 Sanlam Emerging Markets General insurance (including Santam’s Retail and Group life insurance and related participation): business: NICO Malawi (direct 49% and 8% indirect via Botswana Life, Botswana (59%) via Botswana NICO Holdings1) Insurance Holdings (BIHL1) Sanlam General Insurance – Tanzania, Tanzania Sanlam Life, Namibia (direct 47% and 3% indirect via NICO Holdings1) Sanlam Namibia Holdings, Namibia (direct 54% Sanlam General Insurance – Uganda, Uganda and 5% indirect via Capricorn Investment (direct 79% and 3% indirect via NICO Holdings1) Holdings) Lion Assurance Company (94%) NICO Life, Malawi (direct 49% and 8% indirect via NICO Zambia, Zambia (direct 49% and 8% NICO Holdings1) indirect via NICO Holdings1) Sanlam Life, Kenya (57%) via Sanlam Kenya PLC1 Shriram General Insurance, India (direct 23% Sanlam Life, Tanzania (64%) and 20% via Shriram Capital) Sanlam Life, Zambia (70%) Pacific & Orient, Malaysia (49%) Sanlam Life, Uganda (99%) Legal Guard, Botswana (59%) via BIHL1 FBN Life, Nigeria (35%) FBN General Insurance, Nigeria (35%) via Shriram Life Insurance, India (direct 23% and FBN Life 19% indirect via Shriram Capital) Soras Assurance General, -

Integrated Report & Financial Statements

INTEGRATED REPORT & 2019 FINANCIAL STATEMENTS Regulated by the Central Bank of Kenya 2 2019 Integrated Report & Financial Statements INTEGRATED REPORT & 2019 FINANCIAL STATEMENTS About this report he KCB Group Plc. Integrated Report and Financial Statement 2019 provides a balanced and Tcomprehensive view of the Group’s performance as part of our continuous efforts to enhance disclosure and keep our stakeholders well informed. The Report has been prepared for the period of January 1, 2019 to December 31, 2019 and covers the business activities of the KCB Group. Framework The report has been prepared in compliance with global best practice and prudent accounting frameworks for existing and prospective investors. It is aligned to the provisions of the Companies Act, 2015, Capital Markets Authority (CMA) guidelines, the Nairobi Securities Exchange (NSE) Listings Manual, and Central Bank of Kenya (CBK) Prudential Guidelines. This report is also in compliance with the International Integrated Reporting Council (IIRC) Guidelines. The Group’s Annual Financial Statements were prepared in accordance with the International Financial Reporting Standards (IFRS). The report is part of our commitment to be transparent and accountable to our stakeholders. Assurance The Annual Financial Statements for the Group, KCB Bank Kenya, KCB Bank South Sudan, KCB Bank Rwanda and KCB Bank Burundi were audited by KPMG. KCB Bank Tanzania was audited by PwC while KCB Bank Uganda was audited by EY. The Annual Financial Statements of National Bank of Kenya were audited -

Sanlam Kenya Results Audited Financial Statements for the Period Ended 31St December 2016

Sanlam Kenya Results Audited Financial statements for the period ended 31st December 2016 1. Introduction STATEMENT OF COMPREHENSIVE INCOME The Board of Directors of Sanlam Kenya PLC (“Sanlam”) is pleased to announce the Group’s audited results for the year ended 31st December 2016. Statement of Group Financials Year to Year to 31 Dec 2016 31 Dec 2015 2. Key Features KShs'000 KShs'000 • Profit before tax at KShs. 317m (2015: KShs. 54m) • Total assets up by 5% to KShs. 28.4b (2015: KShs. 27.1b) Gross written premium 5,224,546 5,181,614 • Group Embedded Value is at KShs. 4.7b (2015: KShs. 5.2b) Outward reinsurance premium (392,341) (384,628) • Value of New Business is at KShs. -88m (2015: KShs. 108m) • Group Capital Adequacy Requirement (Solvency) covered 2.60 times (2015: 2.83 times) Net written premium 4,832,205 4,796,986 3. Accounting policies The Group’s accounting policies comply with International Financial Reporting Standards (IFRS) as well as the Kenya Companies Investment income 2,518,645 2,388,531 Act. Thesepolicies are consistent with those applied in prior years. Fair value gains (450,341) (637,144) Fee and commissions earned 74,955 80,220 4. The Economic Environment The Kenya National Bureau of Statistics data indicates the economy grew by 5.7% in the third quarter of 2016, slower than the 2015 Other operating income(Including property) 178,610 608,591 GDP growth rate of 6.0%. The decline in the GDP growth rate was reflected in slower growth in gross premiums in the insurance Other revenue 2,321,869 2,440,198 industry of 7.3% from 12.8% in 2015. -

Cytonn Report a Product of Cytonn Technologies

Public-Private Partnerships (PPPs) in the Real Estate Industry in Kenya, & Cytonn Weekly #19/2021 Equities Markets Performance During the week, the equities market recorded mixed performance, with NSE 20 recording a marginal gain of 0.04% respectively, while NASI and NSE 25 declined by 3.1% and 3.7%. This week’s performance took their YTD performance to gains of 9.0% and 5.2%, for NASI and NSE 25, respectively, and a loss of 0.5% for NSE 20. The equities market performance was driven by gains recorded by stocks such as DTB-K and BAT which gained by 1.2% and 0.7%, respectively. The gains were however weighed down by losses recorded by stocks such as Safaricom and Co-operative Bank which declined by 3.4% and 1.2%, respectively. Equities turnover increased by 14.7% to USD 28.6 mn, from USD 24.9 mn recorded the previous week, taking the YTD turnover to USD 433.5 mn. Foreign investors turned net sellers during the week, with a net selling position of USD 5.4 mn, from a net buying position of USD 6.8 mn recorded the previous week, taking the YTD net selling position to USD 7.9 mn. The market is currently trading at a price to earnings ratio (P/E) of 12.7x, which is 1.5% below the historical average of 12.9x, and a dividend yield of 3.6%, 0.5% points below the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 1.4x, an indication that the market is trading at a premium to its future earnings growth.