2015 Annual Report Notice of 2016 Annual Meeting & Proxy Statement Richard K

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Recent Enforcement Decisions Involving Technology Mergers and Acquisitions at MOFCOM

CPI Antitrust Chronicle Oct 2014 (2) Recent Enforcement Decisions Involving Technology Mergers and Acquisitions at MOFCOM Scott Sher & Daniel Kane Wilson Sonsini Goodrich & Rosati PC www.competitionpolicyinternational.com Competition Policy International, Inc. 2014© Copying, reprinting, or distributing this article is forbidden by anyone other than the publisher or author. CPI Antitrust Chronicle October 2014 (2) Recent Enforcement Decisions Involving Technology Mergers and Acquisitions at MOFCOM Scott Sher & Daniel Kane1 I. INTRODUCTION The Anti-Monopoly Bureau of China’s Ministry of Commerce (“MOFCOM”) is responsible for administration of the country’s Anti-Monopoly Law (“AML”), which was implemented on August 1, 2008.2 In this role, MOFCOM reviews mergers and acquisitions of assets where the parties meet statutorily defined thresholds. As of April 2014, the AML requires a filing with MOFCOM when: (1) the aggregate global turnover of the merging parties exceeded RMB 10 billion ($1.6 billion) during the previous financial year, with at least two parties each having a turnover of RMB 400 million (U.S. $64 million) or more within China during that time; or (2) the aggregate turnover within China of the merging parties exceeded RMB 2 billion (U.S. $320 million) in the previous financial year, with at least two parties each having a turnover of RMB 400 million (U.S. $64 million) or more within China during that time.3 Per the AML, China’s regime is mandatory and suspensory; as such, filing parties may not close their transaction without MOFCOM’s approval. MOFCOM has reviewed a number of high-profile technology transactions since 2008, and in many cases it has conditioned approval of these deals on the parties agreeing to a remedy. -

Get S.M.A.R.T. for Reliability

Seagate Technology 920 Disc Drive Scotts Valley, California 95066-4544 1999, Seagate Technology, Inc. (831) 438-6550 All trademarks referenced in this paper are the property of their respective owners. From: Seagate Product Marketing Date: Updated July 1999 Number: TP-67D Get S.M.A.R.T. for Reliability The Emergence of Reliability-Prediction Technology Disc drive manufacturers are dedicated to improving product reliability. This idea seems fitting. Reliability is a concept we seek in our daily lives. We want cars that are reliable. Reliable people make good friends and good employees. We naturally expect things to perform well. Although reliability cannot always be predicted in people or cars, disc drive manufacturers have taken a giant step toward predicting reliability in disc drives through Self- Monitoring, Analysis and Reporting Technology (S.M.A.R.T.). Computer users today have great expectations of data-storage reliability. Many users do not even consider the possibility of losing data due to a hard disc drive failure. Even though continual improvements in technology make data loss uncommon, it does occur. Reliability-prediction technology is a way to anticipate the failure of a disc drive with sufficient notice to allow a system, or user, to back up data prior to a drive’s failure. S.M.A.R.T. is reliability-prediction technology for both ATA and SCSI environments. Pioneered by Compaq, S.M.A.R.T. is under continued development by the top five disc drive manufacturers in the world: Seagate, IBM, Western Digital Corporation, Maxtor and Quantum Corporation. The Evolution of S.M.A.R.T. -

CL King Market Maker List

CL King Market Maker List AABA Altaba Inc. CPRT Copart, Inc. HAIN Hain Celestial Group Inc. MSFT Microsoft Corporation SMSI Smith Micro Software, Inc. AAXN Axon Enterprise, Inc. CRAI Charles River Associates International, Inc. HCSG Healthcare Services Group MU Micron Technology, Inc. SNBR Sleep Number Corporation ABAX Abaxis Inc. CRMT America's Car-Mart, Inc. HELE Helen of Troy Limited NEOG Neogen Corporation SONC SONIC Corporation ADBE Adobe Systems Inc. CRNT Ceragon Networks, Inc. HIBB Hibbett Sports, Inc. NLST Netlist, Inc. SQBG Sequential Brands Group, Inc. ADSK Autodesk, Inc CROX Crocs, Inc. HLIT Harmonic Inc. NXTM Nxstage Medical Inc. SRDX SurModics, Inc. ADTN ADTRAN, Inc. CSCO Cisco Systems, Inc HSIC Henry Schein Inc. NYNY Empire Resorts, Inc. STAF Staffing 360 Solutions, Inc. AGNC American Capital Agency Corp CSOD Cornerstone OnDemand, Inc. HSII Heidrick & Struggles ON ON Semiconductor Corp. STLY Stanley Furniture Company, Inc. AIMC Altra Holdings Inc. CTAS Cintas Corp HSKA Heska Corporation OSUR OraSure Technologies, Inc. STX Seagate Technology LLC ALGT Allegiant Travel Co. CTSH Cognizant Techology Solutions, Inc. HSON Hudson Global Inc. OXBR Oxbridge Realty Holdings Ltd. SWKS Skyworks Solutions, Inc. AMZN Amazon.com CVLT CommVault Systems Inc. IART Integra LifeSciences HoldingsHoldings PACB Pacific Biosciences of California, Inc. SYKE Sykes Enterprises, Inc. ANDE The Andersons Inc. CY Cypress Semiconductor Corp. ICON Iconix Brand Group PATK Patrick Industries, Inc. SYMC Symantic Corporation ANGO AngioDynamics Inc. DAKT Daktronics Inc. IDTI Integrated Device Technology, Inc. PDCO Patterson Companies, Inc. TIVO TiVo Inc. ANSS Ansys Inc. DAVE Famous Dave's of America, Inc. IDXX IDEXX Laboratories Inc. PDLI PDL BioPharma, Inc. TRNS Transcat, Inc. -

Insight Notes Linked to the J.P. Morgan Quest 5G Thematic Basket (Jan 2021) Due February 18, 2022 Fully and Unconditionally Guaranteed by Jpmorgan Chase & Co

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to completion dated December 15, 2020 January , 2021 Registration Statement Nos. 333-236659 and 333-236659-01; Rule 424(b)(2) JPMorgan Chase Financial Company LLC Structured Investments Insight Notes Linked to the J.P. Morgan Quest 5G Thematic Basket (Jan 2021) due February 18, 2022 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. The notes are designed for investors who seek exposure to the performance of the J.P. Morgan Quest 5G Thematic Basket (Jan 2021) of 32 unequally weighted Reference Stocks, which we refer to as the Basket, as reduced by the Basket Deduction of 1.50%. The Reference Stocks in the Basket represent the common stocks / common shares / American depositary shares / ordinary shares of 32 U.S.-listed companies associated with the ongoing roll-out of fifth-generation wireless technologies (“5G”). Investors should be willing to forgo interest and dividend payments and, if the Basket is flat, declines or does not increase by at least 1.50%, be willing to lose some or all of their principal amount at maturity. The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. -

Seagate® Exos® AP 4U100 Has the Datasphere’S Highest Density of Compute and Storage in a Single System

DATA SHEET Efficient. Intelligent. Scalable. Exos AP 4U100 Seagate® Exos® AP 4U100 has the datasphere’s highest density of compute and storage in a single system. Key Advantages Reduce Data Center Footprint. The growth of the private cloud means enterprises of all sizes need storage solutions. Dedicated space is often limited and expensive. With the Exos AP 4U100, the data center footprint is dramatically reduced, saving real estate investment and reducing heating and cooling costs. Other storage center racks must house both storage and servers. This system’s unique design and precision engineering allow both the intelligent compute of a server and a whopping 1.6PB1 of data storage. Deliver Reliable Building Blocks for the Modern Cloud. Integrated appliances are more reliable and less costly due to fewer cables and connectors, typically the lowest MTBF components in the system. The Exos AP 4U100 future-proofs our modular data center Product Highlights systems for even greater density with next-generation Seagate media. Upgrading a system is as simple as hot-swapping drives. And because it shares design and multiple FRUs with Maximize your investment with this Exos E 4U106, any data center can easily create an entire serviceable ecosystem. Four low-TCO compute and high-density optional 4 × 2.5-in carriers give users SSD performance along with HDD capacity. integrated storage system Retain valuable space with a 4U Ensure Applications Have Access to Critical Data. Safeguard your data with dual Intel® rack height that offers 96 × 3.5-in Xeon® Scalable CPUs in two controllers per Exos AP 4U100, providing powerful drive and 4 × 2.5-in drive capacity redundancy and multi-node capability. -

Evault Software

EVault Software Data Sheet Key Benefits Get professional-grade data protection and • Superior performance anytime, anywhere access. and reliability EVault® Software from Seagate® is a proven, reliable, disk-to-disk backup • End-to-end data security and recovery solution trusted by customers globally to protect mission- • Automated, scalable critical data and keep their businesses running. Advanced, patented deployment technology ensures you can securely protect a growing, heterogeneous • Regulatory compliance and geographically dispersed network using one simple solution. • Ensured disaster recovery Ensured Data Availability and Recoverability • Broad platform support EVault Software ensures that you can meet your growing business and regulatory • Easy data center demands for data availability and recoverability. There’s broad support for operating and network edge systems and platforms, and it’s easy to back up and recover critical data within protection individual databases, mailboxes, or cluster nodes using EVault agents for Microsoft Exchange, Microsoft SQL Server, Microsoft SharePoint, Microsoft Cluster Services, and Oracle. EVault Software’s single-pass technology rebuilds backups dynamically, so there’s no need to restore from multiple incremental backups. Scalable and Efficient EVault Software readily scales to accommodate your company’s growth, and provides a compelling ROI. You can easily and efficiently manage multiple terabytes of backup data. EVault delta block-level processing technology speeds your backup operations and dramatically reduces storage costs by backing up only new and changed data blocks. All data is compressed using EVault’s industry-leading Adaptive Compression technology before being transferred, dramatically reducing your storage footprint and backup windows. Data deduplication decreases this further by eliminating duplicate data within storage. -

Western Digital Corporation

Western Digital Corporation Patent Portfolio Analysis September 2019 ©2019, Relecura Inc. www.relecura.com +1 510 675 0222 Western Digital – Patent Portfolio Analysis Introduction Western Digital Corporation (abbreviated WDC, commonly known as Western Digital and WD) is an American computer hard disk drive manufacturer and data storage company. It designs, manufactures and sells data technology products, including storage devices, data centre systems and cloud storage services. Western Digital has a long history in the electronics industry as an integrated circuit maker and a storage products company. It is also one of the larger computer hard disk drive manufacturers, along with its primary competitor Seagate Technology.1 In this report we take a look at Western Digital’s patent assets. For the report, we have analyzed a total of 20,025 currently active published patent applications in the Western Digital portfolio. Unless otherwise stated, the report displays numbers for published patent applications that are in force. The analytics are presented in the various charts and tables that follow. These include the following, • Portfolio Summary • Top CPC codes • Published Applications – Growth • Top technologies covered by the high-quality patents • Key Geographies • Granular Sub-technologies • Top Forward Citing (FC) Assignees • Competitor Comparison • Technologies cited by the FC Assignees • Portfolio Taxonomy • Evolution of the Top Sub-Technologies Insights • There is a steady upward trend in the year-wise number of published applications from 2007 onwards. There’s a decline in growth in 2017 that again surges in 2018. • The home jurisdiction of US is the favored filing destination for Western Digital and accounts for more than half of its published applications. -

Certain Semiconductor Devices and Consumer Audiovisual Products Containing the Same That Infringe U.S

UNITED STATES INTERNATIONAL TRADE COMMISSION Washington, D.C. In the Matter of CERTAIN SEMICONDUCTOR Investigation No. 337-TA-1047 DEVICES AND CONSUMER AUDIOVISUAL PRODUCTS CONTAINING THE SAME NOTICE OF COMMISSION DETERMINATION NOT TO REVIEW AN INITIAL DETERMINATION TERMINATING THE INVESTIGATION AS TO ONE RESPONDENT GROUP AGENCY: U.S. International Trade Commission. ACTION: Notice. SUMMARY: Notice is hereby given that the U.S. International Trade Commission has determined not to review an initial determination (“ID”) (Order No. 35) issued by the presiding administrative law judge (“ALJ”). FOR FURTHER INFORMATION CONTACT: Robert Needham, Office of the General Counsel, U.S. International Trade Commission, 500 E Street, SW., Washington, D.C. 20436, telephone (202) 708-5468. Copies of non-confidential documents filed in connection with this investigation are or will be available for inspection during official business hours (8:45 a.m. to 5:15 p.m.) in the Office of the Secretary, U.S. International Trade Commission, 500 E Street, SW., Washington, D.C. 20436, telephone (202) 205- 2000. General information concerning the Commission may also be obtained by accessing its Internet server (https://www.usitc.gov). The public record for this investigation may be viewed on the Commission's electronic docket (EDIS) at https://edis.usitc.gov. Hearing-impaired persons are advised that information on this matter can be obtained by contacting the Commission’s TDD terminal on (202) 205- 1810. SUPPLEMENTARY INFORMATION: The Commission instituted this investigation on April 12, 2017, based on a complaint filed by Broadcom Corporation (“Broadcom”) of Irvine, California. 82 FR 17688. The complaint alleges violations of section 337 of the Tariff Act of 1930, as amended, 19 U.S.C. -

Seagate Evault Cloud Backup and Offsite Replication Services for Microsoft Azure

Seagate EVault Cloud Backup and Offsite Replication Services for Microsoft Azure Data Sheet Key Benefits Simplified Cloud Backup and Recovery Services on • Protect data simply Microsoft Azure and automatically Seagate® EVault® Cloud Backup and Offsite Replication Services for Microsoft® • Continuously verify and Azure provides secure, scalable, trusted protection of your organization’s critical audit backups data, directly through the Internet, so you can safeguard your data without additional capital or IT expenses. It automatically backs up server data from • Access 24/7/365 expert help across your organization. You configure your desired retention schedule and • Reduce risk of data breaches with monitor backups via a web browser. Your data is deduplicated, compressed, end-to-end security encrypted, and then transmitted to one of Microsoft Azure’s top-tier data centers. • Leverage secure, redundant Azure With Seagate EVault Cloud Backup and Offsite Replication Services for Microsoft infrastructure and a team of data Azure, you know that your data is protected by industry experts, according to the protection experts highest standards of security and reliability. And it’s all at your fingertips whenever you need it. • Incremental backups of endpoint devices run without disrupting Improve Data Privacy While Leveraging the Public Cloud employees, and retrievals are instant Information security is a top IT priority, which is why all Seagate EVault Cloud Data • Leverage Microsoft Enterprise Protection Solutions offer end-to-end encryption: Data is encrypted before and Agreements (where applicable) during transmission, and while it is being stored. The only people who can unlock it are authorized personnel within your organization who have the encryption key. -

The Innovator's Dilemma

Part One WHY GREAT COMPANIES CAN FAIL CHAPTER ONE How Can Great Firms Fail? Insights from the Hard Disk Drive Industry When I began my search for an answer to the puzzle of why the best firms can fail, a friend offered some sage advice. “Those who study genetics avoid studying humans,” he noted. “Because new generations come along only every thirty years or so, it takes a long time to understand the cause and effect of any changes. Instead, they study fruit flies, because they are conceived, born, mature, and die all within a single day. If you want to understand why something happens in business, study the disk drive industry. Those companies are the closest things to fruit flies that the business world will ever see.” Indeed, nowhere in the history of business has there been an industry like disk drives, where changes in technology, market structure, global scope, and vertical integration have been so pervasive, rapid, and unrelenting. While this pace and complexity might be a nightmare for managers, my friend was right about its being fertile ground for research. Few industries offer researchers the same opportunities for developing theories about how different types of change cause certain types of firms to succeed or fail or for testing those theories as the industry repeats its cycles of change. This chapter summarizes the history of the disk drive industry in all its complexity. Some readers will be interested in it for the sake of history itself.1 But the value of understanding this history is that out of its complexity emerge a few stunningly simple and consistent factors that have repeatedly determined the success and failure of the industry’s best firms. -

Seagate Technology Plc

SEAGATE TECHNOLOGY PLC FORM 10-K (Annual Report) Filed 08/03/18 for the Period Ending 06/29/18 Telephone (353) (1) 234-3136 CIK 0001137789 Symbol STX SIC Code 3572 - Computer Storage Devices Industry Computer Hardware Sector Technology Fiscal Year 06/30 http://www.edgar-online.com © Copyright 2018, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 29, 2018 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-31560 SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY (Exact name of registrant as specified in its charter) Ireland 98-0648577 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 38/39 Fitzwilliam Square Dublin 2, Ireland (Address of principal executive offices) Registrant’s telephone number, including area code: (353) (1) 234-3136 Securities registered pursuant to Section 12 (b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Ordinary Shares, par value $0.00001 per share The NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

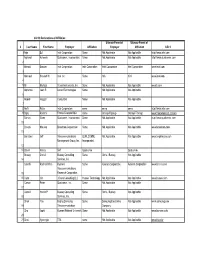

0 Last Name First Name Employer Affiliation Ultimate Parent Of

802.20 Declarations of Affiliation Ultimate Parent of Ultimate Parent of 0 Last Name First Name Employer Affiliation Employer Affiliation URL1 1 Agis Ed Intel Corporation Same Not Applicable Not Applicable http://www.intel.com Agrawal Avneesh Qualcomm, Incorporated Same Not Applicable Not Applicable http://www.qualcomm. com 2 Ahmadi Sassan Intel Corporation Intel Corporation Intel Corporation Intel Corporation www.intel.com 3 Alamouti Siavash M. Intel Inc. Same N/A N?A www.intel.com 4 5 Ali Murtaza Texas Instruments, Inc. Same Not Applicable Not Applicable www.ti.com Alphonse Jean R. Lucent Technologies Same Not Applicable Not Applicable 6 Alsaleh Haggar Consultant Same Not Applicable Not Applicable 7 8 Arefi Reza Intel Corporation same same same http://www.intel.com 9 Bajaj Rashmi France Telecom R&D same Orange Ftgroup OrangeFTGroup www.francetelecom.com/en Barriac Gwen Qualcomm, Incorporated Same Not Applicable Not Applicable http://www.qualcomm. com 10 Bavafa Moussa Broadcom Corporation Same Not Applicable Not Applicable www.broadcom.com 11 Bernstein Jeff Telecommunications QUALCOMM, Not Applicable Not Applicable www.tmgtelecom.com Management Group, Inc. Incorporated 12 13 Bravin Nancy Self Qualcomm Qualcomm Bussey Chris J. Bussey Consulting Same Chris J Bussey Not Applicable 14 Services, Inc. Canchi Radhakrishna Kyocera Same Kyocera Corporation. Kyocera Corporation www.ktrc-na.com Telecommunications 15 Research Corporation. 16 Carlo Jim J.Carlo Consulting LLC Huawei Technology Not Applicable Not Applicable www.huawei.com Carson Peter