Federated Hermes Equity Income Fund, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federated Hermes Adviser Series Form N-CSRS Filed 2021-04-26

SECURITIES AND EXCHANGE COMMISSION FORM N-CSRS Certified semi-annual shareholder report of registered management investment companies filed on Form N-CSR Filing Date: 2021-04-26 | Period of Report: 2021-02-28 SEC Accession No. 0001623632-21-000518 (HTML Version on secdatabase.com) FILER Federated Hermes Adviser Series Mailing Address Business Address 4000 ERICSSON DRIVE 4000 ERICSSON DRIVE CIK:1707560| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 WARRENDALE PA WARRENDALE PA Type: N-CSRS | Act: 40 | File No.: 811-23259 | Film No.: 21854128 15086-7561 15086-7561 1-800-341-7400 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document United States Securities and Exchange Commission Washington, D.C. 20549 Form N-CSR Certified Shareholder Report of Registered Management Investment Companies 811-23259 (Investment Company Act File Number) Federated Hermes Adviser Series ______________________________________________________________ (Exact Name of Registrant as Specified in Charter) Federated Hermes Funds 4000 Ericsson Drive Warrendale, PA 15086-7561 (Address of Principal Executive Offices) (412) 288-1900 (Registrant's Telephone Number) Peter J. Germain, Esquire 1001 Liberty Avenue Pittsburgh, Pennsylvania 15222-3779 (Name and Address of Agent for Service) (Notices should be sent to the Agent for Service) Date of Fiscal Year End: 08/31/21 Date of Reporting Period: Six months ended 02/28/21 Item 1. Reports to Stockholders Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Semi-Annual Shareholder Report February 28, 2021 Share Class | Ticker Institutional | FHCOX Federated Hermes Conservative Microshort Fund Fund Established 2021 A Portfolio of Federated Hermes Adviser Series Dear Valued Shareholder, I am pleased to present the Semi-Annual Shareholder Report for your fund covering the period from February 3, 2021 through February 28, 2021. -

Federated Hermes Investment Funds Public Limited Company

Federated Hermes Investment Funds Public Limited Company (An umbrella investment company with variable capital and having segregated liability between its Sub-Funds incorporated with limited liability in Ireland) Interim Report and Unaudited Financial Statements For the financial period ended 30 June 2020 Company Registration Number: 463628 Federated Hermes Investment Funds Public Limited Company Contents Management and Administration ������������������������������������������������������������������������������������������������������������������������������� 3 Manager Information ������������������������������������������������������������������������������������������������������������������������������������������������� 4 Investment Manager’s Report ����������������������������������������������������������������������������������������������������������������������������������� 6 Unaudited Portfolio Statements ������������������������������������������������������������������������������������������������������������������������������� 41 Unaudited Balance Sheet �������������������������������������������������������������������������������������������������������������������������������������� 191 Unaudited Income Statement �������������������������������������������������������������������������������������������������������������������������������� 201 Unaudited Statement of Changes in Net Assets Attributable to Holders of Redeemable Participating Shares ���� 210 Unaudited Cash Flow Statement ��������������������������������������������������������������������������������������������������������������������������� -

Federated Hermes Clover Small Value Fund Vs. Russell 2000 Value Index (Benchmark) 3/31/2021 - 6/30/2021 Sector Summary

Federated Hermes Clover Small Value Fund vs. Russell 2000 Value Index (Benchmark) 3/31/2021 - 6/30/2021 Sector Summary Base Currency: USD FCSVF Benchmark Variance Base Base Average GICS Sector / Industry Group Average Return Average Return Weight Net Stock Group Weight (%) Contrib Weight (%) Contrib Diff Contrib Selection Weight Total Broad Equity Index 1.55 4.80 0.06 0.00 0.00 0.00 1.55 0.06 0.00 0.00 0.00 Index 1.55 4.80 0.06 0.00 0.00 0.00 1.55 0.06 0.00 0.00 0.00 Comm. Services 2.28 17.54 0.45 3.07 53.57 1.35 -0.79 -0.90 -0.37 -0.52 -0.89 Media & Entertainment 1.84 5.80 0.12 2.51 64.30 1.31 -0.67 -1.19 -0.88 -0.33 -1.21 Telecommunication Services 0.45 45.88 0.34 0.57 9.08 0.04 -0.12 0.29 0.32 0.00 0.32 Consumer Disc 10.55 4.25 0.52 13.96 5.65 0.84 -3.41 -0.33 -0.09 0.05 -0.04 Automobiles & Components 0.82 -1.64 0.00 1.42 3.23 0.06 -0.60 -0.06 -0.03 0.00 -0.03 Consumer Durables & Apparel 2.44 15.92 0.36 3.35 4.44 0.17 -0.92 0.19 0.25 0.01 0.25 Consumer Services 3.17 1.20 0.10 3.86 -0.95 0.03 -0.69 0.07 0.14 0.03 0.16 Retailing 4.12 0.97 0.05 5.32 11.09 0.59 -1.20 -0.53 -0.42 -0.02 -0.44 Consumer Staples 3.05 2.01 0.09 3.34 -2.57 -0.08 -0.29 0.17 0.16 0.02 0.17 Food & Staples Retailing 0.00 0.00 0.00 1.09 -8.50 -0.09 -1.09 0.09 0.00 0.14 0.14 Food Beverage & Tobacco 3.05 2.01 0.09 1.85 -0.50 0.00 1.19 0.10 0.10 -0.06 0.03 Household & Personal Products 0.00 0.00 0.00 0.39 5.50 0.02 -0.39 -0.02 0.00 0.00 0.00 Energy 6.08 18.70 0.97 5.21 20.04 0.89 0.87 0.08 -0.11 0.16 0.04 Energy 6.08 18.70 0.97 5.21 20.04 0.89 0.87 0.08 -0.11 0.16 0.05 -

Palumbo-Donahue School of Business 2019-2020 Graduate Outcomes Employment Information AUGUST 2019, DECEMBER 2019 and MAY 2020 GRADUATES

Innovative Manufacturers Center Palumbo-Donahue 2019-2020 Jared the Galleria of Jewelry School of Business Graduate Outcomes Keener Management Average Annual Income KeyBank Kingsbury Inc. Mean $56,403 KPMG RESPONDENTS NUMBER OF EMPLOYED RESPONDENTS ATTENDING AVERAGE MAJOR TOP EMPLOYERS Median $53,500 Leukemia and Lymphoma Society RESPONDENTS Full-Time, Part-Time, Military, GRADUATE SCHOOL SALARY Mode Luttner Financial Group Service Year Volunteer $55,000 M&T Bank Manzella Manzella Bachelors Degree The average signing bonus Meaden and Moore reported was $4,620. Accounting 48 42% 46% $52,364 BNY Mellon, Cohen & Company, EY LLP, Medici Real Estate PNC Financial Services, PwC, Metal Fortress Radio Swagelok Company Miele Amusements Mount Saint Mary Academy Economics 12 42% 50% BNY Mellon, Continuing Care Actuaries, Paychex Matthews International Internship/Experiential Pittsburgh Int’l Airport Pittsburgh Penguins Entrepreneurship 16 56% 38% Alloy Oxygen Welding and Supply Education Information Pittsburgh Steelers Co., Amos Enterprises, Bobby Rahal PLS Logistics Automotive Group, Vibes by Chico LLC PNC Financial Services PPG Finance 74 78% 12% $53,299 BNY Mellon, Citizen’s Bank, Dick’s 79% of our graduates reported taking at least one internship PricewaterhouseCoopers Sporting Goods, Duquesne University, or career related work experience. The median number of Protiviti McAdam Financial, PNC Financial Prudential Financial Services, PwC internships was two. Reliable Contracting Rivers Casino General Business 4 50% Citizens Bank, Duquesne University A sampling of the most relevant Internship Employers as reported rue21 by graduates: Schneider Downs Information Systems 24 75% 21% $55,750 Amazon, BNY Mellon, Duquesne Light, SEI Investments CO. Management Federated Investors, PNC Financial #1 Cochran Services, PPG, PwC 535 Media Shipley Energy Solenture, LLC Ace Wires Spring & Form Co. -

Intermediate Corporate Bond Fund (IS and SS Shares)

Annual Shareholder Report April 30, 2021 Share Class | Ticker Institutional | FIIFX Service | INISX Federated Hermes Intermediate Corporate Bond Fund Fund Established 1993 A Portfolio of Federated Hermes Income Securities Trust Dear Valued Shareholder, I am pleased to present the Annual Shareholder Report for your fund covering the period from May 1, 2020 through April 30, 2021. While the pandemic continues to present challenges to our lives, families and businesses, I want you to know that Federated Hermes remains dedicated to helping you successfully navigate the markets ahead. You can count on us for the insights, investment management knowledge and client service that you have come to expect. Please refer to our website, FederatedInvestors.com, for timely updates on this and other economic and market matters. Thank you for investing with us. I hope you find this information useful and look forward to keeping you informed. Sincerely, J. Christopher Donahue, President Not FDIC Insured ▪ May Lose Value ▪ No Bank Guarantee CONTENTS Management’s Discussion of Fund Performance ........................................ 1 Portfolio of Investments Summary Table .................................................. 6 Portfolio of Investments ....................................................................... 7 Financial Highlights............................................................................. 23 Statement of Assets and Liabilities.......................................................... 25 Statement of Operations..................................................................... -

DFA Canada US Vector Equity Fund- Class F (USD)

DFA Canada U.S. Vector Equity Fund- Class F (USD) As of August 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

View, a Private Real Estate Investment Manager Focused Primarily on Private Real Estate Debt Strategies

FOCUS Ranan Z. Well Corporate & Securities Mergers & Acquisitions Chair, Investment Management M&A Private Equity Co-Chair, Private Equity Investment Management Mergers & Acquisitions Washington, DC Insurance Transactional & Regulatory 202.419.8404 Solutions Financial Services [email protected] Investment Management Private Investment Funds Institutional Investors Health Law Ranan Well represents public and private companies, private equity firms and Special Situations other financial services firms and investors in a broad range of corporate and BAR ADMISSIONS transactional matters, including mergers and acquisitions, joint ventures and strategic transactions, equity investments and restructurings. District of Columbia Maryland As chair of Stradley Ronon’s Investment Management Mergers & Acquisitions Practice, Ranan works within the firm’s premier Investment Management EDUCATION Group in representing asset management, wealth management, private equity J.D., Boston University School of Law and other financial services firms and investors in purchases and sales of B.A., Yeshiva University registered investment advisers, mutual fund adoptions and mergers of registered investment companies, joint ventures and strategic transactions, and equity investments. In addition, Ranan advises institutional investors in their investments into hedge funds and private equity funds, including the negotiation and execution of side letter agreements, and has successfully negotiated more than 45 investments, totaling in excess of $3.9 billion. He further counsels sponsors in connection with the structuring and formation of private investment funds. Ranan earned a certificate in FinTech from Harvard’s Office of the Vice Provost for Advances in Learning (VPAL), and previously served as a member of the Law360 Mergers & Acquisitions Editorial Advisory Board. RESULTS Ranan’s experience includes the representation of:* Investment Management . -

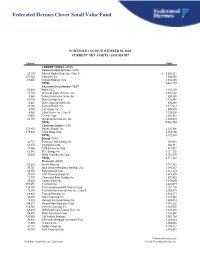

Federated Hermes Clover Small Value Fund

Federated Hermes Clover Small Value Fund PORTFOLIO AS OF NOVEMBER 30, 2020 CURRENT NET ASSETS - $151,820,887 Shares Value COMMON STOCKS—97.7% Communication Services—3.7% 25,105 Nexstar Media Group, Inc., Class A $ 2,642,301 277,160 1 Orbcomm, Inc. 1,585,355 111,625 1 Vonage Holdings Corp. 1,435,498 TOTAL 5,663,154 Consumer Discretionary—10.3% 58,495 1 Adient PLC 1,830,309 75,750 American Eagle Outfitters, Inc. 1,362,742 8,465 1 Asbury Automotive Group, Inc. 954,598 81,135 Boyd Gaming Corp. 3,122,886 10,640 Dick’s Sporting Goods, Inc. 604,458 34,260 Kontoor Brands, Inc. 1,427,614 9,055 1 LGI Homes, Inc. 978,393 4,560 Lithia Motors, Inc., Class A 1,319,208 10,955 1 Visteon Corp. 1,323,912 62,735 Wyndham Destinations, Inc. 2,638,634 TOTAL 15,562,754 Consumer Staples—3.3% 171,800 1 Hostess Brands, Inc. 2,327,890 179,920 Primo Water Corp. 2,704,198 TOTAL 5,032,088 Energy—3.3% 42,770 1 Bonanza Creek Energy, Inc. 943,934 83,075 1 Championx Corp. 986,931 71,565 1 CNX Resources Corp. 673,427 82,045 1 PDC Energy, Inc. 1,371,792 35,235 World Fuel Services Corp. 1,001,379 TOTAL 4,977,463 Financials—28.3% 50,220 Ameris Bancorp 1,707,982 55,761 Argo Group International Holdings Ltd. 2,185,273 84,855 BancorpSouth Bank 2,151,074 78,835 CNO Financial Group, Inc. -

Fund Holdings As of 06/30/2021 MM S&P® Mid Cap Index Fund Northern Trust

Fund Holdings As of 06/30/2021 MM S&P® Mid Cap Index Fund Northern Trust Fund Shares or Par Position Market Security Name Ticker CUSIP Weighting (%) Amount Value ($) Future on S&P MidCap 400 PR Sep21 0 0 1.00 1,800 4,846,320 Bio-Techne Corp TECH 09073M104 0.73 7,864 3,540,845 Cognex Corp CGNX 192422103 0.62 35,763 3,005,880 Molina Healthcare Inc MOH 60855R100 0.62 11,826 2,992,688 Fair Isaac Corp FICO 303250104 0.60 5,814 2,922,582 SolarEdge Technologies Inc SEDG 83417M104 0.60 10,527 2,909,347 XPO Logistics Inc XPO 983793100 0.59 20,563 2,876,558 Signature Bank SBNY 82669G104 0.59 11,650 2,861,822 Camden Property Trust CPT 133131102 0.54 19,774 2,623,417 Fixed Inc Clearing Corp.Repo 0 0 0.54 2,616,203 2,616,203 Graco Inc GGG 384109104 0.54 34,316 2,597,721 FactSet Research Systems Inc FDS 303075105 0.53 7,646 2,566,074 Ceridian HCM Holding Inc CDAY 15677J108 0.53 26,540 2,545,717 Brown & Brown Inc BRO 115236101 0.52 47,253 2,511,024 Masimo Corp MASI 574795100 0.51 10,220 2,477,839 Williams-Sonoma Inc WSM 969904101 0.51 15,399 2,458,450 Lennox International Inc LII 526107107 0.50 6,960 2,441,568 Steel Dynamics Inc STLD 858119100 0.50 40,629 2,421,488 Nordson Corp NDSN 655663102 0.50 10,916 2,396,171 Medical Properties Trust Inc MPW 58463J304 0.49 118,811 2,388,101 Trex Co Inc TREX 89531P105 0.49 23,300 2,381,493 The Toro Co TTC 891092108 0.49 21,624 2,376,045 RPM International Inc RPM 749685103 0.48 26,159 2,319,780 RH RH 74967X103 0.48 3,404 2,311,316 Axon Enterprise Inc AXON 05464C101 0.48 13,061 2,309,185 Cree Inc CREE 225447101 0.47 -

FEDERATED HERMES, INC. Form 13F-HR Filed

SECURITIES AND EXCHANGE COMMISSION FORM 13F-HR Initial quarterly Form 13F holdings report filed by institutional managers Filing Date: 2021-08-16 | Period of Report: 2021-06-30 SEC Accession No. 0001623632-21-000931 (HTML Version on secdatabase.com) FILER FEDERATED HERMES, INC. Mailing Address Business Address 1001 LIBERTY AVENUE 1001 LIBERTY AVENUE CIK:1056288| IRS No.: 251111467 | State of Incorp.:PA | Fiscal Year End: 1231 PITTSBURGH PA 15222 PITTSBURGH PA 15222 Type: 13F-HR | Act: 34 | File No.: 028-04375 | Film No.: 211174955 4122881900 SIC: 6282 Investment advice Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE OMB Number: 3235-0006 COMMISSION Expires: July 31, 2015 Washington, D.C. 20549 Estimated average burden hours per response: 23.8 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: 06-30-2021 Check here if Amendment: ☐ Amendment Number: This Amendment (Check only one.): ☐ is a restatement. ☐ adds new holdings entries. Institutional Investment Manager Filing this Report: Name: FEDERATED HERMES, INC. Address: 1001 LIBERTY AVENUE Pittsburgh, PA 15222 Form 13F File Number: 028-04375 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Megan Dolan Title: Senior Investment Management Compliance Officer Phone: 412-288-6518 Signature, Place, and Date of Signing: /s/Megan Dolan Pittsburgh, PENNSYLVANIA 08-16-2021 [Signature] [City, State] [Date] Report Type (Check only one.): ☒ 13F HOLDINGS REPORT. -

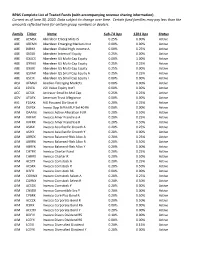

BPAS Complete List of Traded Funds (With Accompanying Revenue Sharing Information) Current As of June 30, 2020

BPAS Complete List of Traded Funds (with accompanying revenue sharing information) Current as of June 30, 2020. Data subject to change over time. Certain fund families may pay less than the amounts reflected here for certain group numbers or dealers. Family Ticker Name Sub‐TA bps 12b1 bps Status ABE AEMSX Aberdeen Emerg Mkts IS 0.25% 0.00% Active ABE ABEMX Aberdeen Emerging Markets Inst 0.00% 0.00% Active ABE BJBHX Aberdeen Global High Income A 0.00% 0.25% Active ABE GIGSX Aberdeen Internat'l Equity 0.25% 0.00% Active ABE GXXCX Aberdeen US Multi‐Cap Equity 0.00% 1.00% Active ABE GXXAX Aberdeen US Multi‐Cap Equity 0.25% 0.25% Active ABE GXXIX Aberdeen US Multi‐Cap Equity 0.25% 0.00% Active ABE GSXAX Aberdeen US Small Cap Equity A 0.25% 0.25% Active ABE GSCIX Aberdeen US Small Cap Equity I 0.00% 0.00% Active ACA AEMGX Acadian Emerging Markets 0.00% 0.00% Active ACA LSVEX LSV Value Equity Inst'l 0.00% 0.00% Active ACC ACSIX Accessor Small to Mid Cap 0.25% 0.25% Active ADV ATAFX American Trust Allegiance 0.00% 0.00% Active AIG FDSAX AIG Focused Div Strat A 0.20% 0.25% Active AIM OSPSX Invesc Opp StPth MLP Sel 40 R6 0.00% 0.00% Active AIM OAANX Invesco Active Allocation Fd R 0.20% 0.50% Active AIM VAFAX Invesco Amer Franchise A 0.20% 0.25% Active AIM VAFRX Invesco Amer Franchise R 0.20% 0.50% Active AIM ASIAX Invesco Asia Pacific Growth A 0.20% 0.25% Active AIM ASIYX Invesco Asia Pacific Growth Y 0.20% 0.00% Active AIM ABRZX Invesco Balanced‐Risk Alloc A 0.20% 0.25% Active AIM ABRRX Invesco Balanced‐Risk Alloc R 0.20% 0.50% Active AIM ABRYX -

United Like Never Before

United like never before. An unprecedented year of giving, responding and perseverance. REPORT TO THE 2020 COMMUNITY JULY 2019–JUNE 2020 Dear friends, There is no sugar-coating the events of this Our goal at United Way is to anticipate a year. We continue to be tested like never rapidly changing environment to meet human before, and most of us probably look forward needs in every corner of our region. We must to enthusiastically flipping the calendar. continue to respond to suffering and economic uncertainty, encourage recovery and reimagine But before we do, we need to pause and reflect what the new normal can look like for our most on where we are today, and how we must do vulnerable communities. better going forward. Because in truth, far too many of our neighbors were struggling before We must also address the financial health of COVID-19 and its economic consequences. our agency partners, as demand for human And the year ahead will present new and services continue to swell. Our agencies have deepening challenges for our entire region. been doing tireless work, and United Way has partnered with them to adapt and collaborate Here’s what inspires us most: In the first Bobbi Watt Geer, President and CEO to continue to provide essential services. few months of the pandemic, there was United Way of Southwestern Pennsylvania an unmistakable surge in empathy and So at this crucial point in time, what is the state compassion throughout our community. of United Way of Southwestern Pennsylvania? Perhaps it was because we all got an The network of generous corporate partners unpleasant taste of what it feels like to be we’ve built over the decades is stronger than isolated and cut-off from society and worried ever.