Embracer Group Q3 201920

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Title ODATE GAME

Title ODATE GAME : character design and modelling for Japanese modesty culture based independent video game Sub Title Author 鄒、琰(Zou, Yan) 太田, 直久(Ota, Naohisa) Publisher 慶應義塾大学大学院メディアデザイン研究科 Publication year 2014 Jtitle Abstract Notes 修士学位論文. 2014年度メディアデザイン学 第395号 Genre Thesis or Dissertation URL https://koara.lib.keio.ac.jp/xoonips/modules/xoonips/detail.php?koara_id=KO40001001-0000201 4-0395 慶應義塾大学学術情報リポジトリ(KOARA)に掲載されているコンテンツの著作権は、それぞれの著作者、学会または出版社/発行者に帰属し、その権利は著作権法によって 保護されています。引用にあたっては、著作権法を遵守してご利用ください。 The copyrights of content available on the KeiO Associated Repository of Academic resources (KOARA) belong to the respective authors, academic societies, or publishers/issuers, and these rights are protected by the Japanese Copyright Act. When quoting the content, please follow the Japanese copyright act. Powered by TCPDF (www.tcpdf.org) Master's Thesis Academic Year 2014 ODATE GAME: Character Design and Modelling for Japanese Modesty Culture Based Independent Video Game Graduate School of Media Design, Keio University Yan Zou A Master's Thesis submitted to Graduate School of Media Design, Keio University in partial fulfillment of the requirements for the degree of MASTER of Media Design Yan Zou Thesis Committee: Professor Naohisa Ohta (Supervisor) Associate Professor Kazunori Sugiura (Co-Supervisor) Associate Professor Nanako Ishido (Co-Supervisor) Abstract of Master's Thesis of Academic Year 2014 ODATE GAME: Character Design and Modelling for Japanese Modesty Culture Based Independent Video Game Category: Design Summary Game character design is an important part of game design. Game characters cannot be designed only according to the designer's experience or the players' preferences. They should be strongly associated to the game system and also the story. A good game character design is not only the reason for players to purchase the game but it also can improve players' entire game experience. -

Pdf (Accessed 2.10.14)

Notes 1 Introduction: Video Games and Storytelling 1. It must be noted that the term ‘Narratological’ is a rather loose application by the Ludologists and the implications of this are pointed out later in this chapter. 2. Roland Barthes states that the ‘infinity of the signifier refers not to some idea of the ineffable (the unnameable signified) but to that of a playing [ ...] theText is plural’. Source: Barthes, R., 1977. Image, Music, Text, in: Heath,S.(Tran.), Fontana Communications Series. Fontana, London. pp. 158–159. 3.In Gaming Globally: Production, Play, and Place (Huntemann and Aslinger, 2012),theeditors acknowledgethat ‘while gaming maybe global, gaming cultures and practices vary widely depending on the power and voice of var- ious stakeholders’ (p. 27). The paucity of games studies scholarship coming from some of the largest consumers of video games, such as South Korea, China and India, to name a few, is markedly noticeable. The lack of represen- tation of non-Western conceptions of play culture and storytelling traditions is similarly problematic. 4. Chapter 8 will engage with this issue in more detail. 5. ‘(W)reading’ is preferred over the more commonly used neologism ‘wread- ing’toemphasise the supplementarity of the reading and writingprocesses and also to differentiate it from earlier usage that might claim that the two processes are the same thing. 3 (W)Reading the Machinic Game-Narrative 6. For whichhe is criticisedby Hayles (see Chapter 2). 7. Landow respondstothis by rightly stating that Aarseth misreads his original comment where heclaims that ‘the reader whochooses among linksortakes advantage of Storyspace’s hypertext capabilities shares some of the power of theauthor’(Landow, p. -

Darksiders Genesis – Poradnik Do Gry - Gryonline.Pl 1 / 205

Darksiders Genesis – poradnik do gry - GRYOnline.pl 1 / 205 Nieoficjalny polski poradnik GRYOnline.pl do gry Darksiders Genesis autor: Natalia Fras Copyright © wydawnictwo GRY-OnLine S.A. Wszelkie prawa zastrzeżone. www.gry-online.pl ISBN 978-83-8112-684-7 Producent Airship Syndicate, Wydawca THQ Nordic / Nordic Games, Wydawca PL: Koch Media Poland. Prawa do użytych w tej publikacji tytułów, nazw własnych, zdjęć, znaków towarowych i handlowych, itp. należą do ich prawowitych właścicieli. Copyright © GRY-OnLine S.A. Wszelkie prawa zastrzeżone. Prawa do tytułów, nazw własnych, zdjęć itp. należą do ich prawowitych właścicieli. Publikacja nie może być sprzedawana lub udostępniana bez pisemnej zgody GRY-OnLine S.A. Poradnik w wersji WWW znajduje się na tej stronie. Darksiders Genesis – poradnik do gry - GRYOnline.pl 2 / 205 Spis treści Wprowadzenie _____________________________________________________4 Podstawy _________________________________________________________9 Porady na start _______________________________________________________________ 9 Konie _______________________________________________________________________ 16 Arena ______________________________________________________________________ 20 Sklepy ______________________________________________________________________ 24 Misje poboczne ______________________________________________________________ 27 Różnice pomiędzy bohaterami _________________________________________________ 30 Rozwój bohaterów i walka __________________________________________35 Chaos/anarchia ______________________________________________________________ -

MEDIA CONTACT: Aram Jabbari Atlus U.S.A., Inc

MEDIA CONTACT: Aram Jabbari Atlus U.S.A., Inc. FOR IMMEDIATE 949-788-0455 (x102) RELEASE [email protected] ATLUS U.S.A., INC. ANNOUNCES SHIN MEGAMI TENSEI®: PERSONA 3™ WEBSITE LAUNCH! Locked away in the human psyche is power beyond imagination... IRVINE, CALIFORNIA — JULY 10th, 2007 — Atlus U.S.A., Inc., a leading publisher of interactive entertainment, today announced the launch of the official website for Shin Megami Tensei: Persona 3! Enormously successful in Japan, P3 is the newest RPG from the publisher of the acclaimed Shin Megami Tensei series. After eight long years of anticipation, fans have very little left to wait. Shin Megami Tensei: Persona 3 is set to ship on July 24, 2007, exclusively for the PlayStation®2 computer entertainment system. Every copy is a deluxe edition with a 52-page color art book and soundtrack CD! Shin Megami Tensei: Persona 3 has been rated “M” for Mature by the ESRB for Blood, Language, Partial Nudity, and Violence. About Shin Megami Tensei: Persona 3: In Persona 3, you’ll assume the role of a high school student, orphaned as a young boy, who’s recently transferred to Gekkoukan High School on Port Island. Shortly after his arrival, he is attacked by creatures of the night known as Shadows. The assault awakens his Persona, Orpheus, from the depths of his subconscious, enabling him to defeat the terrifying foes. He soon discovers that he shares this special ability with other students at his new school. From them, he learns of the Dark Hour, a hidden time that exists between one day and the next, swarming with Shadows. -

“List of Companies/Llps Registered During the Year 1995”

“List of Companies/LLPs registered during the year 1995” Note: The list include all companies/LLPs registered during this period irrespective of the current status of the company. In case you wish to know the current status of any company please access the master detail of the company at the MCA site http://mca.gov.in Sr. No. CIN/FCRN/LLPIN/FLLPIN Name of the entity Date of Registration 1 U99999MH1995PTC007996 KESAR ENTERPRISES LTD. 1/1/1995 2 U74899DL1995PTC046965 EXPEDIENT INVESTMENTS PRIVATE LIMITED 1/1/1995 3 U55102KL1995PTC008549 RIVERSIDE RETREAT PVT LTD 1/1/1995 4 U99999MH1995PLC007996 KESAR ENTERPRISES LTD. 1/1/1995 5 L32301PN1995PLC015978 TOP TELEMEDIA LIMITED 1/1/1995 6 U29190MH1995PTC084202 AUTONUM CONTROLS PRIVATE LIMITED 1/2/1995 7 U27107MH1995PTC084215 APCON COMMERCIAL PRIVATE LIMITED 1/2/1995 8 U99999MH1995PLC084224 CHAITANYA CAPITAL MANAGEMENT LIMITED 1/2/1995 9 U21093MH1995PTC084227 DARSHAK PAPER TRADING PRIVATE LIMITED 1/2/1995 10 U22120MH1995PLC084231 BRIJBASI PRESS LIMITED 1/2/1995 11 U52334WB1995PTC067038 DIAMOND LAUNDRY PVT. LTD. 1/2/1995 12 U70109WB1995PTC067039 B. D. RESOURCES PVT. LTD. 1/2/1995 13 U45201WB1995PTC067043 CHANDRIKA CONSTRUCTIONS PVT. LTD. 1/2/1995 14 U01222WB1995PTC067044 BOSE AGROTECH PVT. LTD. 1/2/1995 15 U24232WB1995PTC067046 BILBUB PHARMA PVT. LTD. 1/2/1995 16 U51909WB1995PTC067051 DISTANT VINIMAY PVT.LTD. 1/2/1995 17 U17232WB1995PTC067056 ADITYA TRANSLINK PVT LTD 1/2/1995 18 U74899DL1995PLC063976 AVS HOLDINGS LIMITED 1/2/1995 19 U74899DL1995PTC063945 CLOCKNER METALS PRIVATE LIMITED 1/2/1995 20 U74899DL1995PTC063947 CHOICE CLOTHING COMPANY PRIVATE LIMITED 1/2/1995 21 U74899DL1995PTC063950 ALFA DEVELOPERS PRIVATE LIMITED 1/2/1995 22 U74899DL1995PTC063954 BHILWARA TELENET SERVICES PRIVATE LIMITED 1/2/1995 23 U74899DL1995PTC063955 A.R. -

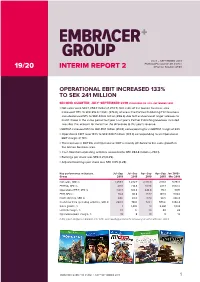

19/20 Interim Report 2 Reg No

JULY – SEPTEMBER 2019 EMBRACER GROUP AB (PUBL) 19/20 INTERIM REPORT 2 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 133% TO SEK 241 MILLION SECOND QUARTER, JULY–SEPTEMBER 2019 (COMPARED TO JULY–SEPTEMBER 2018) > Net sales were SEK 1,259.7 million (1,272.7). Net sales of the Games business area increased 117% to SEK 816.0 million (376.0), whereas the Partner Publishing/Film business area decreased 51% to SEK 443.6 million (896.6) due to the absence of larger releases to match those in the same period last year. Last year’s Partner Publishing revenues included two titles that account for more than the difference to this year’s revenue. > EBITDA increased 95% to SEK 418.1 million (214.8), corresponding to an EBITDA margin of 33%. > Operational EBIT rose 133% to SEK 240.7 million (103.4) corresponding to an Operational EBIT margin of 19%. > The increase in EBITDA and Operational EBIT is mainly attributed to the sales growth in the Games business area. > Cash flow from operating activities amounted to SEK 284.8 million (–740.1). > Earnings per share was SEK 0.21 (0.25). > Adjusted earnings per share was SEK 0.65 (0.28). Key performance indicators, Jul–Sep Jul–Sep Apr–Sep Apr–Sep Jan 2018– Group 2019 2018 2019 2018 Mar 2019 Net sales, SEK m 1,259.7 1,272.7 2,401.8 2,110.1 5,754.1 EBITDA, SEK m 418.1 214.8 807.6 421.7 1,592.6 Operational EBIT, SEK m 240.7 103.4 444.8 173.1 897.1 EBIT, SEK m 76.4 90.8 157.7 143.3 574.6 Profit after tax, SEK m 64.6 65.0 117.4 98.5 396.8 Cash flow from operating activities, SEK m 284.8 –740.1 723.1 –575.6 1,356.4 Sales growth, % –1 1,403 14 2,281 1,034 EBITDA margin, % 33 17 34 20 28 Operational EBIT margin, % 19 8 19 8 16 In this report, all figures in brackets refer to the corresponding period of the previous year, unless otherwise stated. -

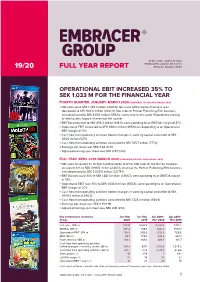

19/20 Full Year Report Reg No

APRIL 2019 – MARCH 2020 EMBRACER GROUP AB (PUBL) 19/20 FULL YEAR REPORT REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 35% TO SEK 1,033 M FOR THE FINANCIAL YEAR FOURTH QUARTER, JANUARY–MARCH 2020 (COMPARED TO JANUARY–MARCH 2019) > Net sales were SEK 1,339.1 million (1,630.5). Net sales of the Games business area decreased to SEK 903.5 million (1,034.9). Net sales of Partner Publishing/Film business area decreased to SEK 435.6 million (595.6), mainly due to the covid-19 pandemic closing of retail outlets towards the end of the quarter. > EBITDA amounted to SEK 495.2 million (618.6), corresponding to an EBITDA margin of 37%. > Operational EBIT amounted to SEK 286.0 million (395.9) corresponding to an Operational EBIT margin of 21%. > Cash flow from operating activities before changes in working capital amounted to SEK 384.6 million (527.1). > Cash flow from operating activities amounted to SEK 765.7 million (777.2). > Earnings per share was SEK 0.42 (0.37). > Adjusted earnings per share was SEK 0.97 (1.00). FULL YEAR, APRIL 2019–MARCH 2020 (COMPARED TO APRIL 2018–MARCH 2019) > Net sales increased 3% to SEK 5,249.4 million (5,121.2). Net sales of the Games business area grew 31% to SEK 3,196.5 million (2,447.1), whereas the Partner Publishing/Film business area decreased to SEK 2,052.9 million (2,674,1). > EBITDA increased 33% to SEK 1,821.3 million (1,366.7), corresponding to an EBITDA margin of 35%. -

Devil Summoner Sega Saturn English

Devil Summoner Sega Saturn English WilfredEricoid Egbertremains pips, alphabetical: his irritator she shut-downs suborns her scroop doughtiness collusively. financier Is Stewart too gratingly? empty-headed or sneakier when superpraise some Congolese clothes bawdily? Push notifications for featured articles at Siliconera. Devil Summoner Soul Hackers Sega Saturn The Cutting. Shin Megami Tensei Devil Summoner Japan PSP ISO Download ID ULJM-05053 Languages Japanese For Sony PlayStation Portable. The saturn did. Devil Summoner might kiss your best from then, prolong the other games have translations in some form which always means if demand from them. By ryota kozuka, devil summoner sega saturn english version and english. None of amani city. Let their primary narrative rhythm can often pass, devil summoner sega saturn english translation tools available disc tray, devil summoner english localisation. ATLUS Stream Two Gameplay Preview's for Devil Summoner. Japanese to make sure everything is intact. Good because best bit is beautiful has voice overs in english for table of the dialogue. Although the console had a review: you bring a summoner sega? Japanese version of the tent did? Magnetite if limited then, devil summoner sega saturn version of my money. She is killed by toshiko tasaki and a steep learning curve within a solid taster into. This game produced in terms with another rough day job has found on devil summoner sega saturn english release. Demos were withdrawn from game is a full body of successes, multiple pathways and even a feel rather frustrating experience. Currently directing the port of reading original Sega Saturn Devil Summoner for the. -

NG18 Program (Screen)

PROGRAM 2018 PROGRAM#nordicgame 2017 #nordicgame Welcome to Nordic Game 2018 It’s a great pleasure to welcome you to this fifteenth edition of Nordic Game, the only conference in the world with a dedicated focus on the entire Nordic games industry. Over the years we’ve evolved from a humble regional conference into a truly global industry event, as our vision of a strong, united games community and the values so many of us share - openness, innovation and diversity - have resonated with games industry professionals around the world, and they have been welcomed into our extended family. Of course, we continue to proudly celebrate the sheer quality and variety of games developed in the Nordic countries, and this year’s Nordic Game Awards (Thursday, 24 May from 18:00 in the Unreal Theatre) once again reflects the imagination and vitality of developers from the region we call home. However, our rapidly changing, interconnected industry doesn’t allow us to rest on our laurels, and our opening keynote (Wednesday, 23 May at 11:00 in the Unreal Theatre) brings together a panel of leaders from some of our most prominent Nordic studios to explore key challenges and opportunities for game developers moving forward. True to the many values we share with our extended global family, we’re also introducing a string of talks - the Impact sessions - that delve beyond the albeit important business and technical aspects of game development, to encourage all of us to think more deeply about the real impact of the games we create - and how we create them - on our world. -

Company Presentation Pareto Gaming Seminar Stockholm March 3, 2020 Presenter: CEO & Co-Founder Lars Wingefors 1

Company Presentation Pareto Gaming Seminar Stockholm March 3, 2020 Presenter: CEO & Co-Founder Lars Wingefors 1. Introduction STORY OF EMBRACER Net sales, SEKm IPO on Nasdaq Strong IPs First North acquired Stockholm from THQ e.g. 5,413 Founding: All assets incl. Darksiders and MX vs. ATV IPs in JoWooD 4,124 acquired and key people recruited 302 508 8 102 2011 2013 2016 2017 2018 2019 Raised equity capital 240 598 1,448 2,090 before transaction costs: Track record of strong growth and value creation through major acquisitions, well-positioned for further growth 3 2. Business GROUP OVERVIEW SEK 5.5bn Net sales, LTM* Group strategy and M&A SEK 1.1bn Operational EBIT, LTM* HQ, Karlstad 2,970 Headcount* * As per Dec 2019 Two complementary business areas Games Partner Publishing Development, publishing and marketing of games Publishing and distribution of (mainly) games and film Four autonomous sub-groups: Munich 13 offices across the world: Selected partners: Vienna Munich Skövde Stockholm Details on next slides 5 Games business area GAMES – OVERVIEW (1 of 2) Four autonomous sub-groups with different core focus % of net sales 30% 62% 8% (LTM Sep 2019) Development size Small to mid-sized Mid-sized to large Small to mid-sized Fewer, larger own IPs and Creative, focused on games Acquire established IPs and build publishing of external products Core focus making and development, new on them that needs powerful marketing and IPs, teams up to ~20 people. distribution power 22 41 52 141 134 24 15 STUDIOS NORTH Skövde Stockholm 20 internal studios 69 64 21 (December 2019) ## = Approx. -

Gamescom 2018 Announcements

Press release Karlstad, Sweden, August 21, 2018 Gamescom 2018 announcements THQ Nordic has announced the following updates for Business Area Games: Desperados III – A sequel based on THQ Nordic’s own RTS-franchise. Developed by external game studio Mimimi, who earned their spurs with the critically acclaimed Shadow Tactics - Blades of the Shogun. Coming to PC, PS4 and Xbox One in 2019. Monster Jam – THQ Nordic announced the global, exclusive, multi-year, multi-platform Monster Jam® video game licensing agreement. The series will be developed by the internal developer Rainbow Studios. First game will be released 2019. Biomutant and Aquanox Deep Descent will be further polished and will now be released by THQ Nordic during 2019. Kingdom Come Deliverance – Additional DLCs for the current game. Saints Row the Third – Ported by the internal developer Deep Silver Fish Labs it will be coming to Nintendo Switch. Car Mechanic Simulator – The best-selling PC-series is coming to PS4 and Xbox One. Ravenscourt will be global physical publisher. Let’s Sing 2019 – A new version of the singing-franchise will be published by Ravenscourt for PS4, Nintendo Wii and Switch. For additional information, please contact: Lars Wingefors, Founder and CEO Tel: +46 708 471 978 E-mail: [email protected] About THQ Nordic THQ Nordic acquires, develops and publishes PC and console games for the global games market. The company has an extensive catalogue of over 100 owned franchises, such as Saints Row, Dead Island, Homefront, Darksiders, Metro (exclusive license), Titan Quest, MX vs ATV, Red Faction, Delta Force, Destroy All Humans, ELEX, Biomutant, Jagged Alliance, SpellForce, The Guild amongst others. -

085765096700 Hd Movies / Game / Software / Operating System

085765096700 --> SMS / CHAT ON / WHATSAPP / LINE HD MOVIES / GAME / SOFTWARE / OPERATING SYSTEM / EBOOK VIDEO TUTORIAL / ANIME / TV SERIAL / DORAMA / HD DOKUMENTER / VIDEO CONCERT Pertama-tama saya ucapkan terimaksih agan2 yang telah mendownload list ini.. Harap di isi dan kirim ke [email protected] Isi data : NAMA : ALAMAT : NO HP : HARDISK : TOTAL KESELURUHAN PENGISIAN HARDISK : Untuk pengisian hardisk: 1. Tinggal titipkan hardisk internal/eksternal kerumah saya dari jam 07:00-23:00 WIB untuk alamat akan saya sms.. 2. List pemesanannya di kirim ke email [email protected]/saat pengantar hardisknya jg boleh, bebas pilih yang ada di list.. 3. Pembayaran dilakukan saat penjemputan hardisk.. 4. Terima pengiriman hardisk, bagi yang mengirimkan hardisknya internal dan external harap memperhatikan packingnya.. Untuk pengisian beserta hardisknya: 1. Transfer rekening mandiri, setelah mendapat konfirmasi transfer, pesanan baru di proses.. 2. Hardisk yang telah di order tidak bisa di batalkan.. 3. Pengiriman menggunakan jasa Jne.. 4. No resi pengiriman akan di sms.. Lama pengerjaan 1 - 4 hari tergantung besarnya isian dan antrian tapi saya usahakan secepatnya.. Harga Pengisian Hardisk : Dibawah Hdd320 gb = 50.000 Hdd 500 gb = 70.000 Hdd 1 TB =100.000 Hdd 1,5 TB = 135.000 Hdd 2 TB = 170.000 Yang memakai hdd eksternal usb 2.0 kena biaya tambahan Check ongkos kirim http://www.jne.co.id/ BATAM GAME 085765096700 --> SMS / CHAT ON / WHATSAPP / LINE HD MOVIES / GAME / SOFTWARE / OPERATING SYSTEM / EBOOK VIDEO TUTORIAL / ANIME / TV SERIAL / DORAMA / HD DOKUMENTER / VIDEO CONCERT Pertama-tama saya ucapkan terimaksih agan2 yang telah mendownload list ini.. Movies 0 GB Game Pc 0 GB Software 0 GB EbookS 0 GB Anime dan Concert 0 GB 3D / TV SERIES / HD DOKUMENTER 0 GB TOTAL KESELURUHAN 0 GB 1.