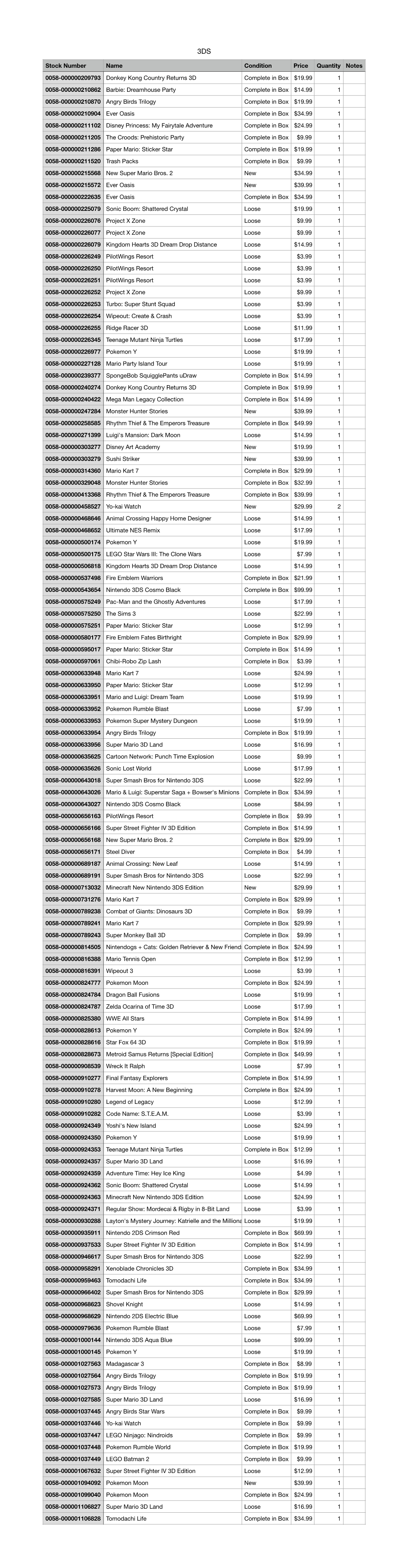

Stock Number Name Condition Price Quantity Notes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manual-3DS-Animal-Crossing-Happy

1 Important Information Basic Information 2 amiibo 3 Information-Sharing Precautions 4 Online Features 5 Note to Parents and Guardians Getting Started 6 Introduction 7 Controls 8 Starting the Game 9 Saving and Erasing Data Designing Homes 10 The Basics of Design 11 Placing Furniture 12 Unlockable Features Things to Do in Town 13 Nook's Homes 14 Visiting Houses and Facilities 15 Using amiibo Cards Internet Communication 16 Posting to Miiverse 17 Happy Home Network Miscellaneous 18 SpotPass 19 Paintings and Sculptures Troubleshooting 20 Support Information 1 Important Information Please read this manual carefully before using the software. If the software will be used by children, the manual should be read and explained to them by an adult. Also, before using this software, please select in the HOME Menu and carefully review content in "Health and Safety Information." It contains important information that will help you enj oy this software. You should also thoroughly read your Operations Manual, including the "Health and Safety Information" section, before using this software. Please note that except where otherwise stated, "Nintendo 3DS™" refers to all devices in the Nintendo 3DS family, including the New Nintendo 3DS, New Nintendo 3DS XL, Nintendo 3DS, Nintendo 3DS XL, and Nintendo 2DS™. CAUTION - STYLUS USE To avoid fatigue and discomfort when using the stylus, do not grip it tightly or press it hard against the screen. Keep your fingers, hand, wrist, and arm relaxed. Long, steady, gentle strokes work just as well as many short, hard strokes. Important Information Your Nintendo 3DS system and this software are not designed for use with any unauthorized device or unlicensed accessory. -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for Fiscal Year Ended March 2013 (Briefing Date: 4/25/2013) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Consolidated Statements of Income Transition million yen FY3/2009 FY3/2010 FY3/2011 FY3/2012 FY3/2013 Net sales 1,838,622 1,434,365 1,014,345 647,652 635,422 Cost of sales 1,044,981 859,131 626,379 493,997 495,068 Gross profit 793,641 575,234 387,965 153,654 140,354 (Gross profit ratio) (43.2%) (40.1%) (38.2%) (23.7%) (22.1%) Selling, general and administrative expenses 238,378 218,666 216,889 190,975 176,764 Operating income 555,263 356,567 171,076 -37,320 -36,410 (Operating income ratio) (30.2%) (24.9%) (16.9%) (-5.8%) (-5.7%) Non-operating income 32,159 11,082 8,602 9,825 48,485 (of which foreign exchange gains) ( - ) ( - ) ( - ) ( - ) (39,506) Non-operating expenses 138,727 3,325 51,577 33,368 1,592 (of which foreign exchange losses) (133,908) (204) (49,429) (27,768) ( - ) Ordinary income 448,695 364,324 128,101 -60,863 10,482 (Ordinary income ratio) (24.4%) (25.4%) (12.6%) (-9.4%) (1.6%) Extraordinary income 339 5,399 186 84 2,957 Extraordinary loss 902 2,282 353 98 3,243 Income before income taxes and minority interests 448,132 367,442 127,934 -60,877 10,197 Income taxes 169,134 138,896 50,262 -17,659 3,029 Income before minority interests - - 77,671 -43,217 7,168 Minority interests in income -91 -89 50 -13 68 Net income 279,089 228,635 77,621 -43,204 7,099 (Net income ratio) (15.2%) (15.9%) (7.7%) (-6.7%) (1.1%) - 1 - Nintendo Co., Ltd. -

Xbox 360 Total Size (GB) 0 # of Items 0

Done In this Category Xbox 360 Total Size (GB) 0 # of items 0 "X" Title Date Added 0 Day Attack on Earth July--2012 0-D Beat Drop July--2012 1942 Joint Strike July--2012 3 on 3 NHL Arcade July--2012 3D Ultra Mini Golf July--2012 3D Ultra Mini Golf Adventures 2 July--2012 50 Cent: Blood on the Sand July--2012 A World of Keflings July--2012 Ace Combat 6: Fires of Liberation July--2012 Ace Combat: Assault Horizon July--2012 Aces of Galaxy Aug--2012 Adidas miCoach (2 Discs) Aug--2012 Adrenaline Misfits Aug--2012 Aegis Wings Aug--2012 Afro Samurai July--2012 After Burner: Climax Aug--2012 Age of Booty Aug--2012 Air Conflicts: Pacific Carriers Oct--2012 Air Conflicts: Secret Wars Dec--2012 Akai Katana July--2012 Alan Wake July--2012 Alan Wake's American Nightmare Aug--2012 Alice Madness Returns July--2012 Alien Breed 1: Evolution Aug--2012 Alien Breed 2: Assault Aug--2012 Alien Breed 3: Descent Aug--2012 Alien Hominid Sept--2012 Alien vs. Predator Aug--2012 Aliens: Colonial Marines Feb--2013 All Zombies Must Die Sept--2012 Alone in the Dark Aug--2012 Alpha Protocol July--2012 Altered Beast Sept--2012 Alvin and the Chipmunks: Chipwrecked July--2012 America's Army: True Soldiers Aug--2012 Amped 3 Oct--2012 Amy Sept--2012 Anarchy Reigns July--2012 Ancients of Ooga Sept--2012 Angry Birds Trilogy Sept--2012 Anomaly Warzone Earth Oct--2012 Apache: Air Assault July--2012 Apples to Apples Oct--2012 Aqua Oct--2012 Arcana Heart 3 July--2012 Arcania Gothica July--2012 Are You Smarter that a 5th Grader July--2012 Arkadian Warriors Oct--2012 Arkanoid Live -

38 Studios: Rhode Island Economic Development Corp

38 Studios: Rhode Island Economic Development Corp. (“RIEDC”) Discussion Materials June 14, 2010 Public Session – Private and Confidential Interactive Entertainment Industry Overview Interactive Entertainment Market Opportunity Growth in the Interactive Entertainment Market will be Primarily Driven by Software Sales . Worldwide revenue representing retail value of shipments of videogame consoles, dedicated handheld gaming devices, and packaged software for consoles and handhelds reached a record high of $71.7 billion in 2008, up 15% from 2007’s record high of $62.4 billion. The worldwide market is expected to reach $124.1 billion in 2013, a projected compounded annual growth rate of 11.0%. While hardware revenue is projected to decline and then rise again in 2012 and 2013 due to the console cycle, the retail value of software shipments is expected to increase at a compounded annual growth rate of 14.3% in the projected years, reaching $101.8 billion in 2013. Worldwide Interactive Entertainment Revenue by Component ($ in Billions) Hardware Software '09E-'13E $150.0 CAGRs: $124.1 11.0% $108.7 $96.8 $100.0 $91.5 $81.9 $71.7 14.3% $62.4 $101.8 $89.8 $80.0 $59.7 $71.1 $50.0 $39.1 $46.6 $40.7 $25.4 $21.6 $25.1 $22.2 $22.3 $13.7 $20.3 $16.8 $18.9 0.1% $0.0 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E Source: IDC, May 2009 38 Studios: Rhode Island Economic Development Corp. 2 Market Opportunity by Geography North America and Western Europe Each Currently Represent 40% of Total Market Share . -

Art Academy™: Home Studio Once It Has Been Exported and Converted to JPEG Format

1 Importan t Informati on Setup 2 Internet Enhancemen ts 3 Note to Par ents and Guardi ans Gtget in Srdta te 4 Mnai Muen 5 BiCas c orsnt ol 6 Saving an d Deleting D ata Miak ng Awrt or k 7 Lessons 8 Fer e Pita n Srgha in Awrt or k 9 Rcre o dni g s 10 Mvii eers 11 Ptor fooli WUP-P-BXAE-00 12 Gallery Abou t T his Produ ct 13 Legal Nostice Tuero bl shtgoo in 14 Supp ort Inform ati on 1 Importan t Informati on Please read this manual carefully before using this software. If the software will be used by children, the manual should be read and explained to them by an adult. Also, before using this software, please read the content of the Health and Safety Information application on the Wii U™ Menu. It contains important information that will help you enjoy this software. 2 Internet Enhancemen ts Connect to the Internet to enjoy these features. Post You can post your artwork as well as video recordings showing how you made it 9 11 . ◆ Artwork will be posted to Miiverse™, and video recordings will be posted to YouTube™. View Other Artists' Artwork and Video Recordings You can see artwork and video recordings from artists from around the world. You can also save other people's artwork and then use it as reference images 9 10 . ◆ You can view submitted artwork on Miiverse and video recordings on YouTube. ◆ It is necessary to carry out the initial settings for Miiverse and connect to the Internet. -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for the Nine-Month Period Ended December 2013 (Briefing Date: 1/30/2014) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Consolidated Statements of Income Transition million yen FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 Apr.-Dec.'09 Apr.-Dec.'10 Apr.-Dec.'11 Apr.-Dec.'12 Apr.-Dec.'13 Net sales 1,182,177 807,990 556,166 543,033 499,120 Cost of sales 715,575 487,575 425,064 415,781 349,825 Gross profit 466,602 320,415 131,101 127,251 149,294 (Gross profit ratio) (39.5%) (39.7%) (23.6%) (23.4%) (29.9%) Selling, general and administrative expenses 169,945 161,619 147,509 133,108 150,873 Operating income 296,656 158,795 -16,408 -5,857 -1,578 (Operating income ratio) (25.1%) (19.7%) (-3.0%) (-1.1%) (-0.3%) Non-operating income 19,918 7,327 7,369 29,602 57,570 (of which foreign exchange gains) (9,996) ( - ) ( - ) (22,225) (48,122) Non-operating expenses 2,064 85,635 56,988 989 425 (of which foreign exchange losses) ( - ) (84,403) (53,725) ( - ) ( - ) Ordinary income 314,511 80,488 -66,027 22,756 55,566 (Ordinary income ratio) (26.6%) (10.0%) (-11.9%) (4.2%) (11.1%) Extraordinary income 4,310 115 49 - 1,422 Extraordinary loss 2,284 33 72 402 53 Income before income taxes and minority interests 316,537 80,569 -66,051 22,354 56,936 Income taxes 124,063 31,019 -17,674 7,743 46,743 Income before minority interests - 49,550 -48,376 14,610 10,192 Minority interests in income -127 -7 -25 64 -3 Net income 192,601 49,557 -48,351 14,545 10,195 (Net income ratio) (16.3%) (6.1%) (-8.7%) (2.7%) (2.0%) - 1 - Nintendo Co., Ltd. -

Playstation 4

PLAYSTATION 4 7 DAYS TO DIE DRAGONBALL XENOVERSE 2 LEGO DC SUPERVILLAINS A WAY OUT DRAGONS DAWN OF NEW RID LEGO MARVEL AVENGERS AC EZIO COLLECTION DYNASTY WARRIORS 8 XTRE LEGO MARVEL SUPERHERO 2 AC ODYSSEY DYNASTY WARRIORS 9 LEGO MOVIE 2 ACCEL WORLD VS SWORD AR EARTH DEFENSE FORCE 4.1 LEGO THE INCREDIBLES ACE COMBAT 7 EARTHFALL DE LOST SPHEAR AIR CONFLICTS SECRET ELEX MEGADIMENSION NEPTU VII AKIBAS TRIP UNDEAD & UN ELITE DANGEROUS METRO EXODUS ALL STAR FRUIT RACING F1 18 MONSTER ENERGY SUPERC 2 AMAZING SPIDERMAN 2 FAIRY FENCER F ADF MONSTER ENERGY SUPERCRO ANTHEM FAR CRY NEW DAWN MONSTER HUNTER WORLD AO INTERNATIONAL TENNIS FATE EXTELLA LINK MORTAL KOMBAT XL ARK SURVIVAL EVOLVED FIFA 19 MOTO GP 18 ASSASSINS CREED 3 REMAS FINAL FANTASY X/X MX VS ATV ALL OUT ASSETTO CORSA UE FIRE PRO WRESTLING WORL MXGP PRO ASTROBOT RESCUE MISSION VR FISHING SIM WORLD MY HERO ONES JUSTICE ATELIER SOPHIE ALCHEMIS FIST OF THE NORTH STAR NARUTO SUNS TRILOGY ATTACK ON TITAN 2 FLAT OUT 4 TI NARUTO TO BORUTO SHIN S ATTACK ON TITAN GALGUN 2 NBA LIVE 18 BATTLEFIELD 5 GENERATION ZERO NELKE & THE LEG ALCHEM BLAZBLUE CROSS TAG BATT GENERATION ZERO XB1 NHL 19 BLOODBORNE GOTY GENESIS ALPHA ONE NIER AUTOMATA CALL OF CTHULHU GHOSTBUSTERS NIOH CARS 3 DRIVEN GOAT SIMULATOR NO HEROES ALLOWED VR COD BLACK OPS 4 GOD EATER 3 ODIN SPHERE LEIFTH COD MW REMASTERED GOD OF WAR OMEGA LABYRINTH Z CONSTRUCTOR HD GOD WARS FUTURE PAST ONE PIECE BURNING CRASH BANDICO NSANE TRI GRAND AGES MEDIEVAL ONE PIECE WORLD SEEKER CYBERDIMENSION NEPTUN 4 GRIP OUTLAST TRINITY DAKAR 18 GUILTY GEAR -

Game Console Rating

Highland Township Public Library - Video Game Collection Updated January 2020 Game Console Rating Abzu PS4, XboxOne E Ace Combat 7: Skies Unknown PS4, XboxOne T AC/DC Rockband Wii T Age of Wonders: Planetfall PS4, XboxOne T All-Stars Battle Royale PS3 T Angry Birds Trilogy PS3 E Animal Crossing, City Folk Wii E Ape Escape 2 PS2 E Ape Escape 3 PS2 E Atari Anthology PS2 E Atelier Ayesha: The Alchemist of Dusk PS3 T Atelier Sophie: Alchemist of the Mysterious Book PS4 T Banjo Kazooie- Nuts and Bolts Xbox 360 E10+ Batman: Arkham Asylum PS3 T Batman: Arkham City PS3 T Batman: Arkham Origins PS3, Xbox 360 16+ Battalion Wars 2 Wii T Battle Chasers: Nightwar PS4, XboxOne T Beyond Good & Evil PS2 T Big Beach Sports Wii E Bit Trip Complete Wii E Bladestorm: The Hundred Years' War PS3, Xbox 360 T Bloodstained Ritual of the Night PS4, XboxOne T Blue Dragon Xbox 360 T Blur PS3, Xbox 360 T Boom Blox Wii E Brave PS3, Xbox 360 E10+ Cabela's Big Game Hunter PS2 T Call of Duty 3 Wii T Captain America, Super Soldier PS3 T Crash Bandicoot N Sane Trilogy PS4 E10+ Crew 2 PS4, XboxOne T Dance Central 3 Xbox 360 T De Blob 2 Xbox 360 E Dead Cells PS4 T Deadly Creatures Wii T Deca Sports 3 Wii E Deformers: Ready at Dawn PS4, XboxOne E10+ Destiny PS3, Xbox 360 T Destiny 2 PS4, XboxOne T Dirt 4 PS4, XboxOne T Dirt Rally 2.0 PS4, XboxOne E Donkey Kong Country Returns Wii E Don't Starve Mega Pack PS4, XboxOne T Dragon Quest 11 PS4 T Highland Township Public Library - Video Game Collection Updated January 2020 Game Console Rating Dragon Quest Builders PS4 E10+ Dragon -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for the Six-Month Period Ended September 2013 (Briefing Date: 10/31/2013) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Semi-Annual Consolidated Statements of Income Transition million yen FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 Apr.-Sept.'09 Apr.-Sept.'10 Apr.-Sept.'11 Apr.-Sept.'12 Apr.-Sept.'13 Net sales 548,058 363,160 215,738 200,994 196,582 Cost of sales 341,759 214,369 183,721 156,648 134,539 Gross profit 206,298 148,791 32,016 44,346 62,042 (Gross profit ratio) (37.6%) (41.0%) (14.8%) (22.1%) (31.6%) Selling, general, and administrative expenses 101,937 94,558 89,363 73,506 85,321 Operating income 104,360 54,232 -57,346 -29,159 -23,278 (Operating income ratio) (19.0%) (14.9%) (-26.6%) (-14.5%) (-11.8%) Non-operating income 7,990 4,849 4,840 5,392 24,708 (of which foreign exchange gains) ( - ) ( - ) ( - ) ( - ) (18,360) Non-operating expenses 1,737 63,234 55,366 23,481 180 (of which foreign exchange losses) (664) (62,175) (52,433) (23,273) ( - ) Ordinary income 110,613 -4,152 -107,872 -47,248 1,248 (Ordinary income ratio) (20.2%) (-1.1%) (-50.0%) (-23.5%) (0.6%) Extraordinary income 4,311 190 50 - 1,421 Extraordinary loss 2,306 18 62 23 18 Income before income taxes and minority interests 112,618 -3,981 -107,884 -47,271 2,651 Income taxes 43,107 -1,960 -37,593 -19,330 2,065 Income before minority interests - -2,020 -70,290 -27,941 586 Minority interests in income 18 -9 -17 55 -13 Net income 69,492 -2,011 -70,273 -27,996 600 (Net income ratio) (12.7%) (-0.6%) (-32.6%) (-13.9%) (0.3%) - 1 - Nintendo Co., Ltd. -

Art Academy™: Atelier

Art Academy™: Atelier 1 Infor maçõ es Impor tant es Cgonfi uoraçã 2 Funci onal idades Onli ne 3 Contro lo Parent al Primei ros Passos 4 Muren P iilnc pa 5 Contro los Básic os 6 Guard ar e Apagar Dados Como C riar Obr as 7 Aulas 8 Printu a Livre Pthar il arbs O ra 9 Gvra açsõe 10 Mvii eers 11 Ptor fóoli WUP-P-BXAP-00 12 Galeria Inform açõe s sobre o Prod uto 13 Ionfõbrçma ess oer Deiristo dAe urto 14 Assi stê ncia Técni ca 1 Infor maçõ es Impor tant es Leia este manual com atenção antes de utilizar a aplicação. Se a aplicação se destinar a ser utilizada por crianças pequenas, o manual deverá ser-lhes lido e explicado por um adulto. Saúde e Segurança Leia também as Informações sobre Saúde e Segurança no Menu Wii U, pois estas contêm informações importantes que o ajudarão a usufruir desta aplicação. Seleção de Idioma O idioma da aplicação dependerá daquele que estiver definido na consola. Este título suporta oito idiomas diferentes: inglês, alemão, francês, espanhol, italiano, neerlandês, português e russo. Pode alterar o idioma da aplicação modificando as definições de idioma da consola. Pode alterar o idioma da consola nas Definições da Consola. ♦ As capturas de ecrã presentes neste manual são retiradas da versão inglesa da aplicação. ♦ Em certas ocasiões poderá ser necessário fazer referência a partes específicas de uma captura de ecrã. Nesses casos, as referências incluem o texto inglês entre parênteses retos. Classificação Etária Para obter informações sobre a classificação etária desta e de outras aplicações, consulte a página web de referência sobre o sistema de classificação etária da sua região: PEGI (Europa): www.pegi.info USK (Alemanha): www.usk.de Classification Operations Branch (Austrália): www.classification.gov.au OFLC (Nova Zelândia): www.classificationoffice.govt.nz Rússia: minsvyaz.ru/ru/doc/index.php?id_4=883 2 Funci onal idades Onli ne Estabeleça ligação à Internet para usufruir destas funcionalidades. -

A Portable Deep Learning Model for Modern Gaming AI

The Game Imitation: A Portable Deep Learning Model for Modern Gaming AI Zhao Chen Darvin Yi Department of Physics Department of Biomedical Informatics Stanford University, Stanford, CA 94305 Stanford University, Stanford, CA 94305 zchen89[at]Stanford[dot]EDU darvinyi[at]Stanford[dot]EDU Abstract be able to successfully play in real time a complex game at the level of a competent human player. For comparison pur- We present a purely convolutional model for gaming poses, we will also train the same model on a Mario Tennis AI which works on modern games that are too com- dataset to demonstrate the portability of our model to dif- plex/unconstrained to easily fit a reinforcement learning ferent titles. framwork. We train a late-integration parallelized AlexNet Reinforcement learning requires some high bias metric on a large dataset of Super Smash Brothers (N64) game- for reward at every stage of gameplay, i.e. a score, while play, which consists of both gameplay footage and player many of today’s games are too inherently complex to eas- inputs recorded for each frame. Our model learns to mimic ily assign such values to every state of the game. Not human behavior by predicting player input given this visual only that, but pure enumeration of well-defined game states gameplay data, and thus operates free of any biased infor- would be an intractable problem for most modern games; mation on game objectives. This allows our AI framework DeepMind’s architecture, which takes the raw pixel val- to be ported directly to a variety of game titles with only mi- ues as states, would be difficult in games with 3D graph- nor alterations. -

Spend up to 25O/O of Their Time on Smaftphones Using Whatsapp. As

OASIS February 26,2014 Mr. Satoru Iwata President and CEO, Nintendo Co., Ltd. CEO, Nintendo of America 1 I -l Kamitoba-hokotate-cho, Minami-ku Kyoto 60 I -850 I Japan Dear Mr. Iwata, Oasis, a private investment fund management company, is an advisor to entities that are the beneficial owners of shares of Nintendo Co. Ltd. I am following up on my letter to you dated June I1,2013, in which Iwrote to you that as both customers and shareholders, Oasis would like to see Nintendo develop and sell games for the iOS and Android platforms, and that as shareholders, we look forward to participating in your current business and your future success. I was prompted to write this follow up, open letter to you after analyzing Facebook's purchase of WhatsApp for $19 billion. We believe that Facebook's decision demonstrates the value placed on maintaining supremacy in the Iimited pool of mobile social interaction. lt is the battle for consumer attention on the smartphone. According to media repofts, users in many countries spend up to 25o/o of their time on smaftphones using WhatsApp. As the holder of what is arguably the largest library of casual games, Nintendo is well placed to make an immediate entry into mobile. Adapting the Nintendo library for smartphones could profoundly alter the complexion of the "attention share" currently occupied by Facebook, WhatsApp, and mobile games developers. The same people who spent hours playing Super Mario, Donkey Kong, and Legend of Zelda as children are now a demographic whose engagement on the smartphone is valued by the market at well over $100 billion if we look at the aggregate value of all companies competing for attention on mobile.