United States Securities and Exchange Commission Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

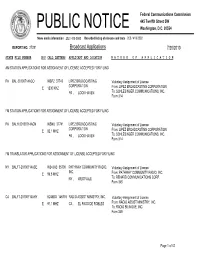

Federal Communications Commission Before the Federal

Federal Communications Commission Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Existing Shareholders of Clear Channel ) BTCCT-20061212AVR Communications, Inc. ) BTCH-20061212CCF, et al. (Transferors) ) BTCH-20061212BYE, et al. and ) BTCH-20061212BZT, et al. Shareholders of Thomas H. Lee ) BTC-20061212BXW, et al. Equity Fund VI, L.P., ) BTCTVL-20061212CDD Bain Capital (CC) IX, L.P., ) BTCH-20061212AET, et al. and BT Triple Crown Capital ) BTC-20061212BNM, et al. Holdings III, Inc. ) BTCH-20061212CDE, et al. (Transferees) ) BTCCT-20061212CEI, et al. ) BTCCT-20061212CEO For Consent to Transfers of Control of ) BTCH-20061212AVS, et al. ) BTCCT-20061212BFW, et al. Ackerley Broadcasting – Fresno, LLC ) BTC-20061212CEP, et al. Ackerley Broadcasting Operations, LLC; ) BTCH-20061212CFF, et al. AMFM Broadcasting Licenses, LLC; ) BTCH-20070619AKF AMFM Radio Licenses, LLC; ) AMFM Texas Licenses Limited Partnership; ) Bel Meade Broadcasting Company, Inc. ) Capstar TX Limited Partnership; ) CC Licenses, LLC; CCB Texas Licenses, L.P.; ) Central NY News, Inc.; Citicasters Co.; ) Citicasters Licenses, L.P.; Clear Channel ) Broadcasting Licenses, Inc.; ) Jacor Broadcasting Corporation; and Jacor ) Broadcasting of Colorado, Inc. ) ) and ) ) Existing Shareholders of Clear Channel ) BAL-20070619ABU, et al. Communications, Inc. (Assignors) ) BALH-20070619AKA, et al. and ) BALH-20070619AEY, et al. Aloha Station Trust, LLC, as Trustee ) BAL-20070619AHH, et al. (Assignee) ) BALH-20070619ACB, et al. ) BALH-20070619AIT, et al. For Consent to Assignment of Licenses of ) BALH-20070627ACN ) BALH-20070627ACO, et al. Jacor Broadcasting Corporation; ) BAL-20070906ADP CC Licenses, LLC; AMFM Radio ) BALH-20070906ADQ Licenses, LLC; Citicasters Licenses, LP; ) Capstar TX Limited Partnership; and ) Clear Channel Broadcasting Licenses, Inc. ) Federal Communications Commission ERRATUM Released: January 30, 2008 By the Media Bureau: On January 24, 2008, the Commission released a Memorandum Opinion and Order(MO&O),FCC 08-3, in the above-captioned proceeding. -

Townsquare Media Wichita Falls License, Llc. Knin-Fm

TOWNSQUARE MEDIA WICHITA FALLS LICENSE, LLC. KNIN-FM, KBZS-FM, KWFS-FM, KWFS-AM EEO PUBLIC FILE REPORT Covering the Period from April 1, 2017 -March 31, 2018 I. VACANCY LIST See Section II, the “Master Recruitment Source List” (“MRSL”) for recruitment source data Recruitment Sources (“RS”) Used to RS Referring Full Time Positions by Job Title Fill Vacancy Hiree Account Executive 1, 2, 3, 6, 7, 9 9 Traffic Coordinator 1, 2, 3, 7, 9 9 Assistant Business Manager 1, 2, 5, 6, 7, 9 9 Market President 7, 8, 9 8 II. MASTER RECRUITMENT SOURCE LIST (MRSL) No. of Source Interviewees Entitled RS Referred by RS Information to Vacancy Number RS over Notification? 12-month (Yes/No) period 1 Townsquare Media, Wichita Falls, LLC-internal posting NO 0 2525 Kell Blvd, Ste 200 Wichita Falls, TX 76308 2 Townsquare Media, Wichita Falls, LLC-external market posting NO 3 3 KNIN-KBZS-KWFS AM/FM On Air and On Line Announcements 2525 Kell Blvd Suite 200, Wichita Falls, TX NO 2 76308 (940) 763-1111 4 Indeed.com NO 0 5 Linkedin.com NO 0 6 Facebook.com NO 1 7 Townsquare Media, Corp Markets-Posts internally in all other NO 18 TSM Markets 8 Current Employee Recommendation NO 2 9 Greenhouse NO 15 TOTAL 41 III. RECRUITMENT INITIATIVES TYPE OF BRIEF DESCRIPTION OF ACTIVITY RECRUITME NT INITIATIVE (MENU SELECTION) 1 Participated in On 6/07/17 the stations hosted a group tour for Special Needs students from The Arc. tour for Arc Of This group is for people with developmental disabilities and their families to learn more Wichita County about different aspects of society. -

Permian Basin Media List TELEVISION KMID P.O

Permian Basin Media List TELEVISION KMID P.O. Box 60230 Albert Gutierrez, General Manager [email protected] ABC Midland, TX 79711 Kim Delapena, General Sales Manager [email protected] Phone: (432) 563-2222 Carl Rundgren, News Director [email protected] Fax: (432) 563-4421 Jeremy Steel, Promotions Manager [email protected] KOSA 4101 E. 42nd Street J7 Barry Marks, General Manager [email protected] CBS Odessa, TX 79762 Randy Roberts, General Sales Manager [email protected] Phone: (432) 580-5672 Jose Gaona, News Director [email protected] Fax: (432) 580-8010 or (432) 580-9802 Molla Maytubby, Promotions/Public Service [email protected] Pete Aranda, Talk Show Bookings [email protected] KPEJ P.O. Box 11009 Kyle King, Station Manager FOX Odessa, TX 79760 Phone: (432) 580-0024 Fax: (432) 337-3707 KWES P.O. Box 60150 Scott Thomas, General Manager [email protected] NBC Midland, TX 79711 Richard Esparza, General Sales Manager [email protected] Phone: (432) 567-9999 Mark Kurtz, News Director [email protected] Fax: (432) 567-9994 Michael Miranda, Promotions/Assignment Manager [email protected] Abby Reed, Talk Show Bookings [email protected] [email protected] Noticia Oeste de Texas P.O. Box 61907 Letticia Martinez, General Manager [email protected] UNIVISION Phone: (432) 563-1826 Fax: (432) 563-0215 TELEMUNDO P.O. Box 60150 Richard Esparza, Station Manager [email protected] Midland, TX 79711 Luiz Carlos, Anchor Phone: (432) 567-9999 Fax: (432) 567-9994 CABLETIME 4305 N. Garfield, Suite 230 Midland, TX 79705 (432) 570-1401 RADIO CLEARCHANNEL BROADCASTING KFZX 102.1 ROCK KCHX 106.7 Oldies KMRK 96.1 Hip Hop KCRS 103.3 ADULT CONTEMP. -

Federal Communications Commission DA 05-686 Before the Federal

Federal Communications Commission DA 05-686 Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Amendment of Section 73.202(b), ) Table of Allotments, ) MB Docket No. 03-144 FM Broadcast Stations. ) RM-10733 (Gunnison, Crawford, and Olathe, Breckenridge, ) RM-10788 Eagle, Fort Morgan, Greenwood Village, ) RM-10789 Loveland, and Strasburg, Colorado, and Laramie, ) Wyoming) ) MEMORANDUM OPINION AND ORDER (Proceeding Terminated) Adopted: March 14, 2005 Released: March 16, 2005 By the Chief, Audio Division, Media Bureau: 1. The Audio Division has before it a Petition for Reconsideration filed by Dana J. Puopolo (“Petitioner”) directed to the Report and Order in this proceeding.1 KAGM, LLC, licensee of Station KAGM(FM), Channel 272A, Strasburg, Colorado, On-Air Family, LLC, licensee of Station KBRU-FM, Channel 268C, Fort Morgan, Colorado, Regent Broadcasting of Ft. Collins, Inc., licensee of Station KTRR(FM), Channel 273C2, Loveland, Colorado, NRC Broadcasting, Inc., licensee of Station KSMT(FM), Channel 272A, Breckenridge, Colorado and Station KTUN(FM), Channel 269C1, Eagle, Colorado, and AGM-Nevada, LLC, licensee of Station KARS-FM, Channel 275C1, Laramie, Wyoming (collectively “Joint Reconsideration Petitioners”) also filed a Petition for Reconsideration.2 Mayflower-Crawford Broadcasters (“MCB”) filed a Request for Approval of Withdrawal (“Request”). 2. Background. The Notice proposed the allotment of Channel 299C3 at Gunnison, Colorado, as that community’s fourth local service. In response to the Notice, MCB timely filed a counterproposal requesting the allotment of Channel 272C2 to Crawford, Colorado, as its first local service. To accommodate the allotment at Crawford, MCB also requested the substitution of Channel 299A for Channel 272A at Gunnison, Colorado, the conforming modification of the Station KVLE-FM license; and a change in reference coordinates for vacant Channel 270C2 at Olathe, Colorado. -

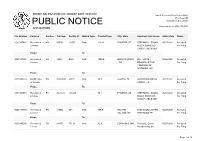

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-1-210601-01 | PUBLISH DATE: 06/01/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000147482 Renewal of AM KXEG 10975 Main 1280.0 PHOENIX, AZ STEPHAN C. SLOAN, 05/27/2021 Accepted License MEDIA SERVICES For Filing GROUP, RECEIVER From: To: 0000147360 Renewal of AM KRKK 5301 Main 1360.0 ROCK SPRINGS BIG THICKET 05/26/2021 Accepted License , WY BROADCASTING For Filing COMPANY OF WYOMING, INC. From: To: 0000147638 Modification FM KLBJ-FM 65792 Main 93.7 AUSTIN, TX WATERLOO MEDIA 05/27/2021 Accepted of License GROUP, L.P. For Filing From: To: 0000147483 Renewal of FX K241CS 156046 96.1 PHOENIX, AZ STEPHAN C. SLOAN, 05/27/2021 Accepted License MEDIA SERVICES For Filing GROUP, RECEIVER From: To: 0000147485 Renewal of FM KRNO 204 Main 106.9 INCLINE AMERICOM LIMITED 05/27/2021 Accepted License VILLAGE, NV PARTNERSHIP For Filing From: To: 0000147590 Renewal of FM KYBR 73118 Main 92.9 ESPANOLA, NM Richard L. Garcia 05/27/2021 Accepted License Broadcasting, Inc. For Filing Page 1 of 29 REPORT NO. PN-1-210601-01 | PUBLISH DATE: 06/01/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status From: To: 0000147610 License To LPD K21OB-D 125172 Main 21 LAKE CHARLES WINDSONG 05/27/2021 Accepted Cover , LA COMMUNICATIONS, For Filing INC From: To: 0000147443 Renewal of AM KXEQ 57445 Main 1340.0 RENO, NV AZTECA 05/27/2021 Accepted License BROADCASTING For Filing CORPORATION From: To: 0000147536 Renewal of FM KLEA 2870 Main 95.7 HOBBS, NM NOALMARK 05/27/2021 Accepted License BROADCASTING For Filing CORPORATION From: To: 0000147386 Renewal of FX K239BR 157876 95.7 POCATELLO, ID RADIO BY GRACE, 05/26/2021 Accepted License INC. -

EEO PUBLIC FILE REPORT Townsquare Media Odessa License, LLC KBAT-FM, KZBT-FM, KMND-AM, KODM-FM, KNFM-FM 04/01/19 – 03/31/20 Section 1

EEO PUBLIC FILE REPORT Townsquare Media Odessa License, LLC KBAT-FM, KZBT-FM, KMND-AM, KODM-FM, KNFM-FM 04/01/19 – 03/31/20 Section 1. Vacancy List: Job Title All Recruitment Sources Number of RS that Referred (RS) Used to Fill Vacancy Interviewees the hire Referred by Each RS Account Executive 03, 05, 06 01-00 02-00 03-00 04 – 1 hired (October 19) 04-01 05-03 06-04 Account Executive 03, 05, 06 01-00 02-00 03-00 05 – 1 hired (November 19) 04-00 05-03 06-02 Director of Sales 03, 05, 06 01-00 02-00 03-00 06 – 1 hired (July 19) 04-00 05-00 06-01 Market President 03, 05, 06 01-00 02-00 03-00 04 – 1 hired (June 19) 04-01 05-00 06-00 Section 2. Recruitment Source List: RS Number RS Information RS Entitled to Vacancy No. of Interviews Notification? (Yes/No) Referred by RS over 12-month period On Air KZBT-FM, KNFM-FM, KODM-FM, KBAT-FM and 01 KMND-AM N 0 02 KBAT/KNFM/KZBT/KODM/KMND N 11300 State Hwy 191 Bldg. 2 0 Midland, TX 79707 Walk In – at main office 03 Facebook.com N 0 04 Referrals N 2 05 Indeed.com (via Greenhouse) N 6 06 Linked in (via Greenhouse) N 7 Total Number of Interviews over 12-month period: 15 TOWNSQUARE MEDIA MIDLAND-ODESSA LICENSE, LLC KBAT-FM, KODM-FM, KNFM-FM, KZBT-FM KMND-AM EEO PUBLIC FILE REPORT st April 1,2019-March 31 , 2020 III. -

Minnesota Emergency Alert System Statewide Plan 2016

Minnesota Emergency Alert System Statewide Plan 2016 MINNESOTA EAS STATEWIDE PLAN Revision 9 Basic Plan 11/9/2016 I. REASON FOR PLAN The State of Minnesota is subject to major emergencies and disasters, natural, technological and criminal, which can pose a significant threat to the health and safety of the public. The ability to provide citizens with timely emergency information is a priority of emergency managers statewide. The Emergency Alert System (EAS) was developed by the Federal Communications Commission (FCC) to provide emergency information to the public via television, radio, cable systems and wire line providers. The Integrated Public Alert and Warning System, (IPAWS) was created by FEMA to aid in the distribution of emergency messaging to the public via the internet and mobile devices. It is intended that the EAS combined with IPAWS be capable of alerting the general public reliably and effectively. This plan was written to explain who can originate EAS alerts and how and under what circumstances these alerts are distributed via the EAS and IPAWS. II. PURPOSE AND OBJECTIVES OF PLAN A. Purpose When emergencies and disasters occur, rapid and effective dissemination of essential information can significantly help to reduce loss of life and property. The EAS and IPAWS were designed to provide this type of information. However; these systems will only work through a coordinated effort. The purpose of this plan is to establish a standardized, integrated EAS & IPAWS communications protocol capable of facilitating the rapid dissemination of emergency information to the public. B. Objectives 1. Describe the EAS administrative structure within Minnesota. (See Section V) 2. -

Tattler Master

presented in story form! What is the price for all this learning and Volume XXXI • Number 37 • September 16, 2005 fun? Just $49 ($39 if you’re part of a group of 4 or more from the THE same station/cluster who register at the same time!), but these special tuition rates end soon. A limited number of hotel rooms MAIN STREET are also available at the Holiday Inn Select for $89! Call the hotel Communicator Network at 216-241-5100 to reserve your room! For more information and to register now for Conclave TalenTrak 2004 call 952-927-4487 or TT AA TT TT LL EE RR register on-line at www.theconclave.com. The Tattler reported last week on 2005 Conclave Keynoter Al Publisher: Tom Kay Associate Publisher/Editor • Claire Sather Franken’s alleged knowledge of shady financing at Air America. Another week, another name added to right-wing blogger Michelle “Overwhelmingly Confirmed by the Senate!” Malkin’s ever-lengthening list of wrong doers in the Air America/ Gloria Wise Boys and Girls Club/ Evan Cohen/Al Franken TALENTRAK 2005 ANNOUNCES AGENDA DETAILS! A critical debacle: Sinohe Terrero, VP of Finance for Air America. While agenda and killer faculty has been lined up to participate at the holding that title alone is hardly an indictment, Terrero’s past 10th edition of TalenTrak – the industry’s most unique and exclusive involvement with the financials at Gloria Wise seems cause for air talent seminar – in Cleveland on Saturday, October 15, 2005 concern from Malkin and collaborator Brian Maloney, who point at the Holiday Inn Select/ City Centre Lakeside in Cleveland, Ohio! out that Terrero happened to be handling money for the Boys and The day’s impressive agenda begins with an off-the-wall but Girls club from 2000-2002—years that coincide with Evan Cohen’s TOTALLY meaningful presentation about how NOT to get a job, ill-fated rein as head of AAR. -

Townsquare Media Wichita Falls License, Llc. Knin-Fm

TOWNSQUARE MEDIA WICHITA FALLS LICENSE, LLC. KNIN-FM, KBZS-FM, KWFS-FM, KWFS-AM EEO PUBLIC FILE REPORT Covering the Period from April 1, 2018 -March 31, 2019 I. VACANCY LIST See Section II, the “Master Recruitment Source List” (“MRSL”) for recruitment source data Recruitment Sources (“RS”) Used to RS Referring Full Time Positions by Job Title Fill Vacancy Hiree Account Executive 1, 2, 3, 4, 5, 6, 7 3 Account Executive 1, 2, 3, 4, 5, 6, 7 8 II. MASTER RECRUITMENT SOURCE LIST (MRSL) No. of Source Interviewees Entitled RS Referred by RS Information to Vacancy Number RS over Notification? 12-month (Yes/No) period 1 Townsquare Media, Wichita Falls, LLC-internal posting NO 0 2525 Kell Blvd, Ste 200 Wichita Falls, TX 76308 2 KNIN-KBZS-KWFS AM/FM On Air and On Line Announcements 2525 Kell Blvd Suite 200, Wichita Falls, TX NO 2 76308 (940) 763-1111 3 Indeed.com NO 21 4 Linkedin.com NO 5 5 Facebook.com NO 6 6 Townsquare Media, Corp Markets-Posts internally in all other NO 0 TSM Markets 7 Current Employee Recommendation NO 1 8 Job Fair NO 5 TOTAL 40 III. RECRUITMENT INITIATIVES TYPE OF BRIEF DESCRIPTION OF ACTIVITY RECRUITME NT INITIATIVE (MENU SELECTION) 1 Hosted tour for On 5/16/18 the stations hosted a group tour for students from the 1 local Elementary Wichita Falls School. This group of pre-teens visited the stations to learn more about radio in the Youth perspective of their age group. They talked to the operations manager, production Leadership director and brand managers about functions of the station. -

2019 Annual Conservation Plan - Washington

2019 Annual Conservation Plan - Washington November 15, 2018 0 Contents Executive Summary ....................................................................................................................................... 2 2018‐2019 Budget and Savings by Program ................................................................................................. 3 Changes to the 2018‐2019 Biennial Savings and Budget projections .......................................................... 5 Direct Benefits to Customers ........................................................................................................................ 8 Pilots ............................................................................................................................................................ 10 Staff Areas of Interest ................................................................................................................................. 13 Residential Program Details ........................................................................................................................ 17 Home Energy Savings (Schedule 118) ..................................................................................................... 17 Home Energy Reports ............................................................................................................................. 33 Low Income Residential Program Details ................................................................................................... 35 Low Income -

Broadcast Applications 7/20/2010

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27281 Broadcast Applications 7/20/2010 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING PA BAL-20100714ACO WBPZ 37740 LIPEZ BROADCASTING Voluntary Assignment of License CORPORATION E 1230 KHZ From: LIPEZ BROADCASTING CORPORATION PA , LOCK HAVEN To: SCHLESINGER COMMUNICATIONS, INC. Form 314 FM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING PA BALH-20100714ACN WSNU 37741 LIPEZ BROADCASTING Voluntary Assignment of License CORPORATION E 92.1 MHZ From: LIPEZ BROADCASTING CORPORATION PA , LOCK HAVEN To: SCHLESINGER COMMUNICATIONS, INC. Form 314 FM TRANSLATOR APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING NY BALFT-20100714ACE W243AB 55700 PATHWAY COMMUNITY RADIO, Voluntary Assignment of License INC. E 96.5 MHZ From: PATHWAY COMMUNITY RADIO, INC. NY , WESTVALE To: RENARD COMMUNICATIONS CORP. Form 345 CA BALFT-20100715AHY K246BO 146718 RADIO ASSIST MINISTRY, INC. Voluntary Assignment of License E 97.1 MHZ CA , EL PASO DE ROBLES From: RADIO ASSIST MINISTRY, INC. To: RADIO BILINGUE, INC. Form 345 Page 1 of 42 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27281 Broadcast Applications 7/20/2010 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N TV TRANSLATOR OR LPTV STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING TX BALTTL-20100714ACM K41CA 51472 PANHANDLE TELECASTING LP Voluntary Assignment of License E CHAN-41 TX , KRESS/TULIA From: PANHANDLE TELECASTING LIMITED PARTNERSHIP To: CITY OF TULIA Form 345 ID BALTTL-20100715AHT KTYJ-LP 15648 CHRISTIAN BROADCASTING OF Voluntary Assignment of License IDAHO, INC. -

Signaldries USI Station(A) and Location

APPENDIX A SIGNAlDRIES USI Licensee StatIon(a) and LocatIon Beech Tree Broadcasting Co. WLMI(FM), Kane, Pennsylvania BOMAR Broadcasting Company - lafayette, WEZW=M, BrooIcston, Indiana Inc. BOMAR Broadcasting Company -- Terre WLEZ-FM, Terre Haute, Indiana Haute, Inc. Broadcasters and Publishers, Inc. WJDQ(FM), Meridian, Mississippi WWKZ(FM), New Albany. Mississippi Burlington Broadcasters, Inc. WlZN(FM), Vergennes, Vermont Butternut Broadcasting Company. Inc. WKOP(AM) and WML(FM), Binghamton, N6W York Cardinal Communications Partners, LP. KTCK(AM), Dallas, Texas Catalyst Radio, L.P. KlXZ(AM), KQAC(FM) and KMML-FM, ArnarUlo, Texas East Kentucky Broadcasting Corporation WPKE(AM) and WDHR(FM), PIk6YUle, Kentucky Emerald City Radio Partners Ud. Partnership WMFX(FM), St..Andrews, South Carolina Fifth Estate, Inc. WLKZ(FM), Wolfeboro, N6W Hampshire Hampshire County Broadcasting Company W1TT(AM) and WRNX(FM), Amherst, Massachusetts Limited Partnership Hindman Broadcasting Corporation WKCB(AM) and WKCB-FM, Hindman, Kentucky Jan-Ol Broadcasting, Inc. KEKB(FM), Fruita, Colorado KBKL(FM), Grand Junction, Colorado KIA Karp. Communications, Inc. KWED(AM), SegUin, Texas KCCI Television, Inc. KCCI-TV, Des Moines, 10Ml (subsidiary of Pulitzer Broadcasting Company) KVEN Broadcasting Corporation KVEN(AM) and KHAY-FM, Ventura, California Lincoln Broadcasting Company KTSF(TV), San Francisco, California Media VI WAXE(AM) and WAIW(FM), Vero Beach, Aorlda Middle Market Broadcasting Company WK»Z(AM), Cincinnati, Ohio Montachusett Broadcasting, Inc. WXLD(FM), Fitchburg, Massachusetts Mustang Broadcasting Company KQIL(AM), KEXO(AM) and KQIX(FM), Grand Junction, Colorado, and KKlY(FM), Delta, Colorado New Century Radio, Inc. WARF(AM), Jasper; Alabama WFFN(FM), Cord<Ml, Alabama Pacific FM, Inc. KOFY(AM), San Mateo, california KOFY-TV, San Francisco, California Palmer Broadcast Group KFOR-TV, Oklahoma City, Oklahoma WHO-TV, WHO(AM), and KLYF(FM), Des Moines, IONS WCVU(FM), WNOG(AM) and WNOG-FM, Naples, Florida Paradise Broadcasting, Inc.