Downtown Houston Market Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Major Lease Transactions Downtown Houston

MAJOR LEASE TRANSACTIONS DOWNTOWN HOUSTON This is a comprehensive list of publicly available leases in Downtown Houston, including new-to-Downtown, expansions and renewals. Year Company Type To From Square Feet 512,845 Enterprise Plaza 2020 Enterprise Products Partners Renewal (incl. 2019 (1100 Louisiana) expansion: 22,301) 2020 JP Morgan Chase New/Relocation 600 Travis 1111 Fannin 253,230 5 Houston Center 2020 Venture Global LNG Renewal/Expansion 58,514 (1401 McKinney) (Expansion: 29,257 2020 Summit Midstream Partners, LP New to Downtown/Sublease 910 Louisiana The Woodlands 48,632 LyondellBasell Tower 2020 Mitsubishi International Corporation Renewal 45,838 (1221 McKinney) Pennzoil Place – North Tower 2020 Cheniere Energy Expansion 33,127 (700 Milam) Texas Tower Wells Fargo Plaza 2020 DLA Piper Relocation/Expansion 31,843 (845 Texas) (1000 Louisiana) (Expansion: 6,836) Bank of America Tower 2020 Waste Management Expansion 31,750 (800 Capitol) USA: Office of the Comptroller and Fulbright Tower 2020 Renewal 27,223 Office of the Currency (1301 McKinney) One Allen Center 2020 TPC Group Renewal 24,803 (500 Dallas) Fulbright Tower 2020 AXIP Energy Services Renewal 24,657 (1301 McKinney) 2020 Chevron Expansion 1600 Smith 23,699 2020 Plains All American Refining, L.P. Expansion Three Allen Center (333 Clay) 23,172 Source: Central Houston, Inc. Updated 08-31-2020. 1 Year Company Type To From Square Feet 2020 Lone Star Legal Aid Renewal 500 Jefferson 20,020 2020 Squire Patton Boggs Renewal 600 Travis 15,641 2 Houston Center 2020 USA: Office of the Comptroller Renewal 14,624 (909 Fannin) 2020 Rockcliff Energy, LLC Renewal 1301 McKinney 14,403 (Short-Term) 2020 Enbridge, Inc. -

Downtown Houston Development Continues Despite Covid-19

MEDIA CONTACTS Angie Bertinot / Central Houston [email protected] / 713-650-3022 Whitney Radley / The CKP Group [email protected] / 832-930-4065 x 106 FOR IMMEDIATE RELEASE JANUARY 19, 2021 DOWNTOWN HOUSTON DEVELOPMENT CONTINUES DESPITE COVID-19 More than $1.9 billion in construction projects currently underway with more on the horizon HOUSTON, TX — While the Greater Houston Area begins to recover from the COVID-19 pandemic, Downtown Houston has shown its trademark resilience and grit in the face of the unexpected. Over the past year, office employees have adapted to working from home, hospitality groups have rolled out new services options and staycations, residential properties have adopted technology to conduct virtual space tours and the construction sector has continued grow. More than $1.9 billion in construction projects are currently underway in Downtown Houston, an area defined by IH-45 to the west and south, Highway 59 to the east and IH-10 to the north. “In recent years, Downtown Houston has transitioned from a central business district to a prime destination to live, work, play and stay,” said Bob Eury, president and CEO of the Houston Downtown Management District. “While the pandemic has resulted in some set- backs, we’re seeing confidence in the market: businesses and office employees have adapted to the new normal with agility, developers are leveraging the opportunity to maximize construction across all sectors and the area remains a culinary and cultural destination for Houstonians and visitors.” Office Projects Downtown Houston remains a dynamic business center with a workforce of approximately 158,000 employees and more than 51 million square feet of office space. -

Houston's Office Market Weakens Over the Quarter and Braces Itself Moving

Research & Forecast Report HOUSTON | OFFICE Q1 2020 Houston’s office market weakens over the quarter and braces itself moving forward amid $20 oil Lisa Bridges Director of Market Research | Houston Commentary by Patrick Duffy MCR Market Indicators Annual Quarterly Quarterly Colliers generally uses this space to discuss the trends we see Relative to prior period Change Change Forecast* in market data and in conversations we have with our clients, prospects and friendly competitors. We take that data and attempt VACANCY to project activity going forward. The bulk of the first quarter was, NET ABSORPTION for all practical purposes, pre-COVID. Net “move-in” data, as well as new leases signed, were likely unimpacted for Q1 based on the DELIVERIES virus or only marginally impacted. Our industry has a lead time of UNDER CONSTRUCTION at least 4-6 months before a lease is signed or space made ready for occupancy. The real impact of this COVID crisis will not present *Projected in the data until later in Q2. Inertia will carry us for a few more weeks. The world is focused on the COVID driven economic slowdown. Houston has two issues to watch – COVID and a collapse in oil prices. The oil issue is driven by Saudi Arabia and Russia failing to reach an agreement on production and by the severe decline of oil and gas demand driven by the COVID shutdown. Oil has been Summary Statistics Houston Office Market Q1 2019 Q4 2019 Q1 2020 in the low 20’s since the collision of these two events. The Energy Information Administration is projecting that supply will continue to Vacancy Rate 19.4% 19.8% 20.0% outpace demand for the balance of this year by approximately 10MM barrels per day. -

Downtown Houston Market Update

Q 3 2019 Downtown Houston Market Update Central Houston and Houston Downtown Management District Downtown had a busy summer particularly with hotel openings and property ren- ovations. The AC Hotel by Marriott opened in July in the 105-year-old renovated Houston Bar Center and is the first AC-branded property in Houston and the second in Texas. The European-themed hotel is 10 stories, has 195 guest rooms, spans a total 92,833 square feet and features a 3,650-square-foot Zoe Ballroom, formerly the site of a silent movie theater. Cambria Hotel Houston Downtown Convention Center opened shortly afterwards in early-August. The historic building, built in 1926, is formerly known as the Great Southwest Building and the Petroleum Building and features 226 rooms, a fitness center, ballroom and multifunction meeting spaces. Downtown Houston Market Report Q3 2019 1 EXEcuTIVE SummARY (CONTINUED) This is also the first Houston location for Cambria Hotel & Suites, part of Choice Hotels International Inc. Lastly, the 354-room C. Baldwin Hotel will officially debut its property-wide remake in October under Hilton’s Curio Collection, a franchise based on its own historic hotel-themed identity. Located in the C. Baldwin is celebrity chef Chris Cosentino’s 145-seat restaurant, Rosalie Italian, that will serve rustic, Italian American fare including breakfast, lunch, dinner and a Sunday brunch featuring its Sunday Gravy dinners. Meanwhile, several large renovation projects were in the headlines during the third quarter. The Four Seasons Hotel Houston announced in September it is proceed- ing with a $16.6 million upgrade and is presently finalizing plans and timeline. -

Houston's Office Market Closes out 2018 with Positive Net Absorption

Research & Forecast Report HOUSTON | OFFICE Q4 2018 Houston’s office market closes out 2018 with positive net absorption Lisa Bridges Director of Market Research | Houston Houston’s office market continues to take baby steps towards filling vacant space emptied during the energy downturn. In Q4 2018, the market posted positive absorption of 1.9 million SF, a substantial Market Indicators Annual Quarterly Quarterly increase from the negative 0.4 million SF of absorption recorded Relative to prior period Change Change Forecast* one year ago. Leasing activity remained steady over the quarter at VACANCY 3.5M SF pushing the year-end total to 14M SF. Houston’s overall vacancy rate fell slightly from 20.6% to 20.0% over the quarter, NET ABSORPTION but it is still well above Houston’s 5-year average vacancy rate of NEW CONSTRUCTION 16.4%. UNDER CONSTRUCTION Construction activity decreased in Q4 2018 from 3.2M SF to 2.5M SF as several new buildings were delivered. HP’s and ABS’s new *Projected CityPlace buildings in The Woodlands submarket delivered during Q4 2018. Houston’s job growth increased by 3.7% over the year, according to recent data released by the US Bureau of Labor Statistics. The Houston MSA created 114,400 jobs (not seasonally adjusted) between November 2017 and November 2018, growing faster than Summary Statistics the U.S. during the same time period. Employment sectors with the Houston Office Market Q4 2017 Q3 2018 Q4 2018 most substantial growth include support activities for mining which Vacancy Rate 19.9% 20.6% 20.0% grew by 11.7% over the year, construction increased by 10.8% and durable goods manufacturing was up by 9.0% over the year. -

Houston's Office Market Recovery Hits a Speed Bump in Q2

Research & Forecast Report HOUSTON | OFFICE Q2 2019 Houston’s office market recovery hits a speed bump in Q2 Lisa Bridges Director of Market Research | Houston Over the last two quarters, Houston’s office market has shown signs of a slow recovery from the energy downturn, but it hit a Market Indicators Annual Quarterly Quarterly speed bump in Q2. During the quarter, the market posted negative Relative to prior period Change Change Forecast* net absorption of 842,200 SF, a substantial reversal from the positive absorption of 492,000 SF recorded in Q1. The newest VACANCY trend of vacating older spaces for modern/creative, efficient interior NET ABSORPTION designs has tenants effectively leasing less space without reducing NEW INVENTORY head count. Unless the tenant is in an expansion mode, this trend will lead to a reduction in the amount of office space leased. UNDER CONSTRUCTION Leasing activity has trended down in the first half of 2019. The majority of the leasing activity is a result of horizontal movement *Projected (existing tenants in the market relocating). Houston’s overall vacancy rate rose from 19.1% to 19.8% over the quarter and is still well above Houston’s pre-downturn average vacancy rate in 2014 of 11.6%. An additional constraint to recovery is a very tight labor market, not just in Houston, but nationally. Companies wanting to increase head count and expand are finding it difficult to fill the available job openings. Given these conditions, Colliers estimates, in Summary Statistics the most optimistic scenario, it will take six to seven years of steady Houston Office Market Q2 2018 Q1 2019 Q2 2019 absorption to reach a pre-recession vacancy rate. -

Downtown Houston Market Report

Q1 2019 Downtown Houston Market Report Q1 KEY HIGHLIGHTS 5 new retailers added in Q1 MassChallenge Press Conference Downtown concluded the first quarter of 2019 with sound fundamentals, and a slew of office leases, renovations, and new construction activity, thanks to improving indus- try trends. Rebounding from its plunge at the end of last year, WTI crude increased steadily throughout the first quarter, settling at $61 per barrel at the end of March (a 40 percent increase over a 3-month period). Despite looming uncertainty as geo- political tensions weigh on global and national demand outlook, the Downtown and Houston economy continue to experience robust labor market and economic growth, albeit lower than initially forecasted. Houston unemployment is at its lowest in two decades (3.7 percent in March 2019), supported by strong manufacturing employ- ment. Stable oil prices are likely to translate to increased production, but less so to energy sector job growth, due to the growing technological efficiencies in the indus- try. In the midst of this, the Downtown market is bustling, as developers and landlords continue to implement innovative offerings and experiences for employees, residents and visitors. Cranes continue to dot the Downtown skyline, as a plethora of new and redevelopment projects are underway in all of Downtown’s major submarkets—office, multifamily, hospitality and retail. Downtown Houston Market Report Q1 2019 1 Q1 2019 in Review BUILDING YEAR Kinder Morgan Tower 2011 601 Travis 2011 (CONTINUED) SUMMARY 919 Milam 2012 On the office front, according to CBRE, top leasing trans- Pennzoil Place 2013 actions in the region in Q1 2019 were 36 percent more 811 Louisiana/Two Shell 2015 square feet than in Q1 2018; and of this, 31 percent of the leasing activity was concentrated in Downtown.1 1001 McKinney 2015 Downtown recorded over 774,000-SF in leasing activ- Esperson 2016 ity, of which 238,000-SF were signed by firms new to Downtown, and three leases were over 100,000- 1000 Main 2016 SF (Direct Energy, Calpine, Hunton Andrews Kurth). -

Downtown Houston Market Report

Year-End 2017 Downtown Houston Market Report Q4 2017 was a momentous year for Downtown Houston, with incredible highs and devastating KEY HIGHLIGHTS lows. The year kicked off with Downtown hosting over 1.3 million visitors for Super Bowl LIVE, a nine-day interactive fan festival leading up to Super Bowl LI. Against this backdrop, the office market continued to feel the effects of the deepest downturn in the energy industry 478 since the 1990s. Downtown started off the year with the highest concentration of sublease New hotel rooms space, not just in the Houston region, but in the nation. Shell’s departure from One Shell opened in Q4 Plaza (910 Louisiana) and BG Group Place (811 Main) left almost a million square feet on the sublease market, in addition to a milieu of factors that added large blocks of available space 10 in the first half of the year. These included major energy company mergers and consolida- new retailers tions (most recently, the Enbridge-Spectra merger), law firms downsizing office space to cut opened in Q4 costs, the delivery of the 1 million-SF 609 Main office tower in January, and construction of Capitol Tower in June. However, industry recovery gained momentum, with WTI Crude Oil trading between $40 and $50 in the first half of 2017, met with cautious optimism due to the lingering supply-demand imbalance and geopolitical uncertainty. Super Bowl LIVE Downtown Houston Market Report Year-End 2017 1 2017 Overview SUmmAry (CONTINUED) 2017 was a tenant market. Downtown saw a flight to qual- ity as tenants capitalized on the competitive rents from the excess available space, trading up to Class A and B sublease spaces offered at a discounted rate to direct space. -

Houston's Office Market Vacancy Rate Continues to Struggle Amid $50

Research & Forecast Report HOUSTON | OFFICE Q3 2017 Houston’s office market vacancy rate continues to struggle amid $50 crude prices Lisa Bridges Director of Market Research | Houston Houston’s office market continues to struggle as U.S. crude prices waiver around $50 per barrel. According to the U.S. Energy Market Indicators Annual Quarterly Quarterly Information Administration (EIA), they are expected to stay in Relative to prior period Change Change Forecast* this range through 2018. With no indication that prices will rise substantially over the next few years, vacant office space placed VACANCY on the market by firms in the energy industry will take longer NET ABSORPTION to absorb. Recent news articles indicate that some of the large energy giants reported profits in the second quarter. However, NEW CONSTRUCTION profits were largely driven by lean budgets and staff reductions. UNDER CONSTRUCTION Fortunately, most of the proposed projects that were in the *Projected construction pipeline when the oil slump hit were put on hold. Companies such as Bank of America, American Bureau of Shipping and HP, have signed leases in proposed buildings that have either recently begun construction or will begin in the very near future. Once these projects deliver, those companies will vacate their existing space, leaving more than 1.0 million square feet for Summary Statistics Houston Office Market Q3 2016 Q2 2017 Q3 2017 landlords to backfill. Vacancy Rate 16.9% 18.8% 19.1% During the third quarter of 2017, Houston faced one of the worst Net Absorption natural disasters in history. Hurricane Harvey, a Category 4 -0.4 -0.7 -0.7 hurricane, slammed the Texas coast and dumped over 50 inches of (Million Square Feet) New Construction rain in parts of Houston. -

Houston Office May 2016

MARKET WATCH HOUSTON OFFICE MAY 2016 RECENT OFFICE LEASES Westchase :: Lockton Office Market Indicators - All Space DIRECT OVERALL ASKING RENTAL Companies TOTAL SF AVAILABLE SF UNDER Q1 2016 NET SUBMARKET INVENTORY VACANCY VACANCY RATES (FSG) BLDGS IMMEDIATELY CONSTRUCTION ABSORPTION 120,000 SF prelease at Lockton RATE RATE CLASS A CLASS B Place Downtown (CBD & Midtown) 120 53,679,318 6,477,048 12.1% 13.8% 1,056,658 149,000 $41.82 $28.59 FM 1960 (FM 1960/I-45 N, FM 1960/ 77 8,527,532 1,275,646 15.0% 16.6% 165,754 (11,000) $26.92 $15.98 Westchase :: Neighbors Champions & FM 1960/Hwy 249) Health System Greenspoint/North Belt (North Belt West/Greenspoint & Greenspoint/IAH) 97 13,181,407 3,616,140 27.4% 30.1% - (34,000) $27.05 $14.31 100,000 SF new lease at 10800 Greenway Plaza 50 11,064,288 1,349,843 12.2% 12.3% 398,696 121,000 $35.90 $25.83 Richmond Gulf Freeway/Pasadena 34 2,597,502 400,015 15.4% 15.4% 102,000 (36,000) - $21.49 Galleria :: Citigroup Katy 43 3,259,094 514,937 15.8% 15.9% 124,017 3,000 $32.65 $24.28 49,730 SF new lease at Galleria Katy Frwy/Energy Corridor 205 36,110,960 3,963,361 11.0% 13.2% 1,179,475 (95,000) $37.00 $22.97 Tower I (Katy Freeway East & Katy Freeway West) Kingwood/Humble 9 1,025,047 84,054 8.2% 8.2% - 11,000 $32.00 $18.75 RECENT OFFICE SALES NASA/Clear Lake 63 7,051,599 849,013 12.0% 12.4% - 96,000 $25.04 $18.03 Greenspoint/N Belt West :: Northeast 16 1,665,562 206,530 12.4% 12.4% - 510,000 - $17.46 Greenspoint Park Northwest 73 8,883,138 1,436,160 16.2% 16.7% - (33,000) $22.37 $17.88 352,125 SF, three building -

Downtown Houston Market Report

Q2 2018 Downtown Houston Market Report Central Houston, Inc. and Houston Downtown Management District The Houston economy continues to expand at a good pace. Supported by high oil prices and hurricane rebuilding activity, the Houston MSA led in job growth among the major metros in the first half of the year, with an unemployment rate of 4.2%, down from 5.4% in 2017. While energy continues its push forward, trading in the $70–$80 per barrel range, the direction of prices in the short to medium term is uncertain. Although oil prices are at their highest levels since 2014, and energy companies have begun hiring again (year-over-year energy employ- ment is up 2.7%), this has not significantly bolstered office occupancy. According to JLL’s 2018 North America Energy Outlook, over a third of tenants with active office space requirements in Houston are energy-related. Concerned with real estate exposure however, energy com- panies are taking a conservative and efficient approach to office leasing—taking on shorter, more flexible leases to mitigate risk, with greater reliance on flexible or co-working space as they cautiously emerge from the downturn. More, but smaller size deals, are being made. Downtown Houston Market Report Q2 2018 1 Q2 2018 Overview SUmmARY (CONTINUED) The Houston and Downtown office markets are likely lease renewal and expanded its offices in Wells Fargo to see a boost as upstream activity picks up, including Plaza by 60 percent, adding 30,000-SF to its existing recently announced offshore expansion projects. Job cre- 50,000-SF to accommodate its exceptional growth. -

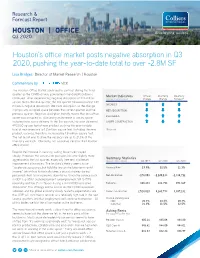

Houston's Office Market Posts Negative Absorption in Q3 2020, Pushing The

Research & Forecast Report HOUSTON | OFFICE Q3 2020 Houston’s office market posts negative absorption in Q3 2020, pushing the year-to-date total to over -2.8M SF Lisa Bridges Director of Market Research | Houston Commentary by Patrick Duffy MCR The Houston Office Market continued to contract during the third quarter as the COVID-driven, government-mandated lockdowns Market Indicators Annual Quarterly Quarterly continued. After experiencing negative absorption of 1.14 million Relative to prior period Change Change Forecast* square feet in the 2nd quarter, the 3rd quarter followed posting 1.33 million in negative absorption. We track absorption as the change VACANCY in physically occupied space between the current quarter and the NET ABSORPTION previous quarter. Negative absorption literally means that less office DELIVERIES space was occupied vs. discussing an increase in vacant space, including new space delivery. In the 3rd quarter, Houston delivered UNDER CONSTRUCTION 490,000 square feet of new product, pushing the year-to-date total of new inventory to 1.2 million square feet. Including the new *Projected product, vacancy, therefore, increased by 1.8 million square feet. The net result was to drive the vacancy rate up to 21.3% of the inventory we track. Obviously, not a positive trend for the Houston office market. Despite the increase in vacancy, asking lease rates stayed steady. However, the concession packages became slightly more Summary Statistics aggressive in the last quarter, especially free rent and tenant Houston Office Market Q3 2019 Q2 2020 Q3 2020 improvement allowances. The landlord’s theory seems to be “accelerate occupancy, but hold the line on the long-term rental Vacancy Rate 19.9% 20.5% 21.3% income,” which has historically been a sound strategy during perceived short-term economic downturns.