Financial System Stability Review 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Word Portrait Global 160517

s FINAL REPORT | FORENSIC REPORT | RFP 5 EXAMINATION ON CONDUCT OF SUPERVISORY AND REGULATORY ROLE BY THE SUPERINTENDENT OF PUBLIC DEBTParliament / DIRECTOR, SUPERVISION Copy OF NON-BANK FINANCIAL INSTITUTIONS PERTAINING TO SELECTED PRIMARY DEALERS FROM 1 JANUARY 2009 TO 31 DECEMBER 2017 THE CENTRAL BANK OF SRI LANKA 8 NOVEMBER 2019 Copy Parliament FINAL REPORT | RFP 5 | EXAMINATION ON THE CONDUCT OF THE SUPERVISORY AND REGULATORY ROLE BY THE SUPERINTENDENT OF PUBLIC DEBT / DIRECTOR, SUPERVISION OF NON-BANK FINANCIAL INSTITUTIONS PERTAINING TO SELECTED PRIMAY DEALERS FROM 01 JANUARY 2009 TO 31 DECEMBER 2017 CONTENTS 1. INTRODUCTION ................................................................................... 11 1.1. BACKGROUND ............................................................................... 11 2. OBJECTIVE AND SCOPE .......................................................................... 18 2.1. THE OBJECTIVE AND SCOPE ............................................................... 18 3. WORK PERFORMED ............................................................................... 20 3.1. OPERATIONS OF REGULATION AND SUPERVISION FUNCTION.......................... 20 3.2. MAPPING THE DEPARTMENTAL PROCEDURES WITH APPLICABLE LEGISLATIONS .... 22 3.3. THE CBSL INTERNAL REPORTS ............................................................. 23 3.4. REVIEW OF DEPARTMENTAL PROCEDURE ................................................ 23 3.5. DIGITAL FORENSICS ........................................................................ -

Arjuna Mahendran: Central Bank of Sri Lanka's 65Th Anniversary

Arjuna Mahendran: Central Bank of Sri Lanka’s 65th anniversary Speech by Mr Arjuna Mahendran, Governor of the Central Bank of Sri Lanka, at the commemorating ceremony of the Central Bank of Sri Lanka’s 65th anniversary, Central Bank of Sri Lanka, Colombo, 28 August 2015. * * * Today is a very important day for all of us. 65 years is not a small period in the life of an institution and first and foremost I must thank all of you who have kept the torch of central banking alive and well in Sri Lanka over the last 65 years. I know most of you haven’t been here for that length of time but certainly those traditions have been passed on to you and you are I think preserving them very well and making sure that they are moving on into the next generations’ hands in good condition. At this point, we should take a step back and look at what we have achieved in those 65 years. First of all, when we were established in 1950, the statute that enabled the establishment of this institution was very clear, in-terms of its objectives and that statute has more or less remained unchanged in that whole period, which I think in Sri Lankan terms is quite a record. There haven’t been significant amendments to the Monetary Law Act in that period and our objectives still remain the same; the control of inflation, the promotion of financial stability and banking sector and financial system stability and the thrust for a broader economic development of the whole country, that in a nutshell is what our objectives are, which is very clear, its unambiguous and it has kept us on the straight and narrow path through some fairly challenging periods. -

Topads.Lk VISIT Polls Cost Over Rs

A DIVIDED HAMBANTOTA PORT LEASE OPPOSITION BILLIONS OFF GEARS FOR FINANCIAL POLLS RECORDS RS. 80.00 PAGES 64 / SECTIONS 6 VOL. 02 – NO. 38 SUNDAY, JUNE 14, 2020 ALOYSIUS TRYING SPECIAL CRICKET TO ‘RECLAIM’ PRICE CAMPUS MENDIS Rs. 60.00 STUMPED? »SEE PAGES 8 & 9 »SEE BUSINESS PAGE 1 »SEE PAGE 7 »SEE PAGE 5 COVID-19 LOCAL CASES COVID-19 CASES For verified information on the GENERAL PREVENTIVE GUIDELINES coronavirus (Covid-19) contact any of the IN THE WORLD following authorities ACTIVE CASES TOTAL CASES 1999 TOTAL CASES Health Promotion Bureau 1877 7,667,394 Suwasariya Quarantine Unit 0112 112 705 Ambulance Service Epidemiology Unit 0112 695 112 Wash hands with soap Wear a commercially Maintain a minimum Use gloves when shopping, Use traditional Sri Lankan Always wear a mask, avoid DEATHS RECOVERED Govt. coronavirus hotline 0113071073 for 40-60 seconds, or rub available mask/cloth mask distance of 1 metre using public transport, etc. greeting at all times crowded vehicles, maintain DEATHS RECOVERD 1990 hands with alcohol-based or a surgical mask if showing from others, especially in and discard into a lidded instead of handshaking, distance, and wash hands 11 1196 425,788 3,882,805 PRESIDENTIAL SPECIAL TASK FORCE FOR ESSENTIAL SERVICES handrub for 20-30 seconds respiratory symptoms public places bin lined with a bag hugging, and/or kissing before and after travelling Telephone 0114354854, 0114733600 Fax 0112333066, 0114354882 670 Hotline 0113456200-4 Email [email protected] THE ABOVE STATISTICS ARE CONFIRMED UP UNTIL 2.00 P.M. ON 12 JUNE 2020 CENTRAL BANK REFINANCING SCHEME Private banks given only Rs. -

News Round up 03.01.2019

NEWS ROUND UP Thursday, January 03, 2018 Contents Sri Lanka Central Bank refutes President’s bond claims ............................................................................... 2 Sri Lanka to be 'brutal' on finance companies that lose capital ................................................................... 2 Sri Lanka expecting US$400mn India swap line shortly: CB Governor ......................................................... 4 Sri Lanka to tighten ownership limits in banks ............................................................................................. 5 Sri Lanka Treasuries yields ease at auction................................................................................................... 6 Sri Lanka mulls extending IMF deal amid soft-peg trouble .......................................................................... 6 Tourist arrivals growth higher in 2018 with record haul in December ........................................................ 7 Taprobane Securities (Pvt) Ltd – Research + 94 11 5328200 [email protected] Sri Lanka Central Bank refutes President’s bond claims Sri Lanka’s Central Bank Wednesday rejected President Maithripala Sirisena’s allegation that over one thousand billion rupees had been stolen through controversial bond sales over a 14-year period ending 2016. Central Bank of Sri Lanka Senior Deputy Governor Nandalal Weerasinghe said he was at a meeting with President Sirisena on December 21 to discuss progress in investigating the alleged bond scams, but was surprised to read -

Central Bank of Sri Lanka

CENTRAL BANK OF SRI LANKA PRIMARY DEALER COMPANIES (RISK WEIGHTED CAPITAL ADEQUACY RATIO - AMENDMENT) DIRECTION NO.2 OF 2015 This direction is issued under Regulation 1 l(l)(o) of the Local Treasury Bills (Primary Dealers) Regulations No. 01 of 2009 dated 24.06.2009 and Regulation ll(l)(o) of the Registered Stock and Securities (Primary Dealers) Regulations No. 01 of 2009 dated 24.06.2015 made by the Minister of Finance under the Local Treasury Bills Ordinance No. 8 of 1923 and the Registered Stock and Securities Ordinance No. 7 of 1937, respectively, and shall be effective from 28.10.2015. Lakshman Arjuna Mahendran Chairman of the Monetary Board and Governor of the Central Bank of Sri Lanka Colombo. Date: 28.10.2015 1. This Direction may be cited as Primary Dealer Companies (Risk Weighted Capital Adequacy Ratio - Amendment) Direction No.2 of 2015. 2. Paragraph 1 of the Direction on Risk Weighted Capital Adequacy Framework (RWCAF) for Primary Dealers dated 22.06.2006 (herein referred to as 'the Direction') is hereby amended as follows: (i) Paragraph 1 (a): By repeal of words "the higher of Rs. 300 million" thereof and the substitution therefor, of "the higher of Rs. 1,000 million" (ii) Paragraph 1 (c): By repeal of words "A minimum risk weighted capital adequacy ratio (CAR) of 8%" thereof and the substitution therefor, of "A minimum risk weighted capital adequacy ratio (CAR) of 10%" 3. Paragraph 3 of the Direction is hereby amended as follows: (i) Paragraph 3.3: By repeal of words "minimum capital is Rs. -

ABA Newsletter July 2016

ABA Newsletter July 2016 General Meeting and Conference Discover ABA Session to feature 4 member banks his year's ABA General Meeting and Conference will include "Discover ABA" session to be held on November 10, 2016. The session will feature special country presentations T by the host bank and banks from selected ABA member-countries. The members who have been invited for this session are Commerzbank, Bank of Bhutan, Bank Pasargad and host organization Bank of Foreign Trade of Vietnam (Vietcombank). The country presentations are intended for the delegates to obtain more information about the market conditions in the various ABA member countries. Each bank representative will be given about 20 minutes to present and another 10 minutes for question and answer session. The presentations will be focused on the member bank's profile; country references such as demographics, culture and GDP per capita; overview of financial and banking system; international trade and foreign investment policy; strong economic points; and economic challenges. About the 33 rd ABA General Meeting and Conference The 33rd ABA General Meeting and Conference will be held on November 10-11, 2016 in Ha Long City, Vietnam. It takes on the theme “Asian Banks: Towards Global Integration” and feature 3 plenary sessions on global macroeconomics, changing regulatory environment, and digital banking. It will also include a CEO forum in which top executives from both the banking and non-banking executives will share their knowledge on financial integration. 1 ABA Newsletter July 2016 Education and Training Temenos holds executive briefing for Taiwanese bankers on the Future of Digital Banking emenos, a Geneva-based software specialist for banking and finance, hosted a half-day Executive Briefing on “Succeeding Through the Digital Revolution – Are Taiwan Banks T Ready for Digital Banking?” held on June 23, at the Mandarin Hotel in Taipei, Taiwan. -

Asylum Seekrs

Issue No. 158 January - March 2018 LANKA READY TO TAKE IN ‘FAILED’ ASYLUM SEEKRS Some 3,000 lined up for deportation Govt. to provide relief package for returnees The Government will allow thousands of Sri Lankan refugees, who failed their asylum bid in Europe and elsewhere, to enter the country provided they arrive on a voluntary basis, a high ranking official with the Foreign Ministry said on 24/02/2018. -Ceylon Today - 25/02/2018 Human Rights Review : January - March Institute of Human Rights INSIDE THIS ISSUE: Editorial 03 05 The silent, suffering masses Corruption - Past & Present The Bond Scam 07 Unity Government Impaled By Bond Commission but Sri Lanka‟s track record on Commissions of Inquiry has been disappointing & dismal 08 A shameful saga of monumental corruption 09 President vows to recover the plundered Rs. 11.5 billion & punish the offenders 11 Two years are long enough time for the government to be born again or to die again “Nobody can find fault with how UNP ran economy” 12 A question of ethics Compromise on Audit Bill: Ministry Secretaries could impose surcharges Local Government Elections 13 Tsunami Alert 14 HEED THE MESSAGE OF THE ELECTORATE ...AND GET ON WITH GOVERNMENT! 15 Local Government Elections What went wrong? 16 LG elections are over; it‟s time to learn the lessons 17 Re-Shoveling the „Yahapalanya‟ Graveyard CB Governor makes clarion call for political stability OMP - Human Rights 18 Where are they ? 19 ITAK welcomes UNHRC report, wants govt. to honor commitments to int‟l community Containing -

Report of the Committee on Public Enterprises

Eighth Parliament of the Democratic Socialist Republic of Sri Lanka (First Session) Parliamentary Series No. 109 Report of the Committee on Public Enterprises which functioned as a Special Committee to look into financial irregularities which have occurred in issuing of Treasury Bonds from February 2015 to May 2016 by the Central Bank of Sri Lanka Presented to Parliament by Hon. Sunil Handunnetti Chairman of the Committee on Public Enterprises on 28 October 2016 i Parliamentary Series No. 109 ii Report of the Committee on Public Enterprises which functioned as a Special Committee to look into financial irregularities which have occurred in issuing of Treasury Bonds from February 2015 to May 2016 by the Central Bank of Sri Lanka Committee on Public Enterprises 1. Hon. Sunil Handunnetti (Chairman) 2. Hon. Rauff Hakeem 3. Hon. Anura Priyadarshana Yapa 4. Hon. Dayasiri Jayasekara 5. Hon. Lakshman Seneviratne 6. Hon. Ravindra Samaraweera 7. Hon. Sujeewa Senasinghe 8. Hon. Wasantha Aluvihare 9. Hon. Lasantha Alagiyawanna 10. Hon. Dr. Harsha De Silva 11. Hon. Ajith P. Perera 12. Hon. Ranjan Ramanayake 13. Hon. Ashok Abeysinghe 14. Hon. Anura Dissanayake 15. Hon. Chandrasiri Gajadheera 16. Hon. Mahindananda Aluthgamage 17. Hon. Bimal Rathnayake 18. Hon. Weerakumara Dissanayake 19. Hon. Mawai So. Senadhiraja 20. Hon. Abdullah Mahruf 21. Hon. S. Sritharan 22. Hon. M.A. Sumanthiran 23. Hon. Hector Appuhamy 24. Hon. (Dr.) Nalinda Jayathissa 25. Hon. Harshana Rajakaruna 26. Hon. Gnanamuttu Srinesan iii Parliamentary Series No. 109 iv Report of the Committee on Public Enterprises which functioned as a Special Committee to look into financial irregularities which have occurred in issuing of Treasury Bonds from February 2015 to May 2016 by the Central Bank of Sri Lanka Contents 1. -

Word Portrait Global 160517

FINAL REPORT| RFP 1| FORENSIC AUDIT / INVESTIGATION ON ISSUANCE OFParliament TREASURY BONDS Copy DURING THE PERIOD 1 JANUARY 2002 TO 28 FEBRUARY 2015 BY THE PUBLIC DEBT DEPARTMENT THE CENTRAL BANK OF SRI LANKA 8 November 2019 FINAL REPORT | RFP 1 | FORENSIC AUDIT / INVESTIGATION ON ISSUANCE OF TREASURY BONDS DURING THE PERIOD 1 JANUARY 2002 TO 28 FEBRUARY 2015 BY THE PUBLIC DEBT DEPARTMENT CONTENTS GLOSSARY ................................................................................................................... 5 TERMS FOR REFERENCE ................................................................................................... 7 NOTICE TO THE READER ................................................................................................... 9 LIMITATIONS ............................................................................................................... 11 1. INTRODUCTION ..................................................................................................... 14 1.1. BACKGROUND .............................................................................................. 14 1.2. SCOPE OF FORENSIC AUDIT .............................................................................. 16 2. EXECUTIVE SUMMARY OF OBSERVATIONS ........................................................................ 18 2.1. DEVIATIONS FROM THE LAWS, POLICIES AND GUIDELINES ........................................... 18 2.2. IRREGULARITIES IN DIRECT PLACEMENT ISSUES ...................................................... -

Preliminary Pages

CENTRAL BANK OF SRI LANKA ANNUAL REPORT OF THE MONETARY BOARD TO THE HON. MINISTER OF FINANCE FOR THE YEAR 2014 Price per copy Counter sales – Rs. 400 per copy Despatch by ordinary mail – Rs. 650 per copy Despatch by registered mail – Rs. 675 per copy Despatch abroad Air mail (1st Class) – US $ 40 per copy (Registered post) Air mail (2nd Class) – US $ 35 per copy (Registered post) Sea mail – US $ 25 per copy (Registered post) ISBN 978-955-575-304-3 ISSN 1391-359X Printed at Sharp Graphic House (Pvt.) Ltd. , No47, Old Kottawa Road, Pannipitiya, and published by the Central Bank of Sri Lanka, No:30, Janadhipathi Mawatha, Colombo 01. Arjuna Mahendran The Governor Central Bank of Sri Lanka 30, Janadhipathi Mawatha Colombo 1, Sri Lanka April 27, 2015 The Honorable Minister of Finance Ministry of Finance The Secretariat Colombo 01. Dear Sir Annual Report of the Monetary Board 2014 In terms of Section 35 of the Monetary Law Act (Chapter 422), within four months after the end of each financial year, the Monetary Board of the Central Bank of Sri Lanka is required to submit an Annual Report to the Honorable Minister of Finance on the condition of the Central Bank and a review of the policies and measures adopted by the Monetary Board during the financial year and an analysis of the economic and financial circumstances which prompted those policies and measures. The Sixty Fifth Annual Report of the Monetary Board of the Central Bank, in respect of the year 2014, is submitted herewith in fulfillment of this obligation. -

Annual Report 2015

ACU 1974 Asian Clearing Union ANNUAL REPORT 2015 Submitted to: The 45th Meeting of the ACU Board of Directors held by Central Bank of Myanmar Nay Pyi Taw- Myanmar June 04, 2016 ANNUAL REPORT 2015 Board of Directors at the 44th ACU Meeting June 13, 2015 Dhaka - Bangladesh II Board of Directors at the 44th ACU Meeting ANNUAL REPORT 2015 Participants at the 44th Meeting of the ACU Board of Directors June 13, 2015 Dhaka - Bangladesh III Participants at the 44th ACU Meeting ANNUAL REPORT 2015 Board of Directors Atiur Rahman Dasho Penjore* Raghuram Rajan Governor1, Governor, Governor, Bangladesh Bank Royal Monetary Reserve Bank of India Authority of Bhutan * From 07.12.2015 Valiollah Seif Azeema Adam Kyaw Kyaw Maung Governor, Governor, Governor, Central Bank of I.R. of Iran Maldives Monetary Central Bank of Myanmar Authority Chiranjibi Nepal* Ashraf Mahmood Arjuna Mahendran* Governor, Wathra Governor2, Nepal Rastra Bank Governor, Central Bank of Sri Lanka * From 19.03.2015 State Bank of Pakistan * From 26.01.2015 1 H.E. Mr. Fazle Kabir acts as Director since 20.03.2016. 2 H.E. Mr. Indrajith Coomaraswamy acts as Director since 04.07.2016. IV Board of Directors ANNUAL REPORT 2015 Alternate Directors Shitangshu Kumar Eden Dema Shri S.K. Bal Sur Chowdhury Deputy Governor, Chief General Manager1, Deputy Governor, Royal Monetary Authority Reserve Bank of India Bangladesh Bank of Bhutan Gholamali Kamyab Mariyam Hussein Didi Set Aung Vice Governor, Assistant Governor, Deputy Governor, Central Bank of I.R. of Iran Maldives Monetary Central Bank of Myanmar Authority Bhisma Raj Dhungana Saeed Ahmad R.A.S.M. -

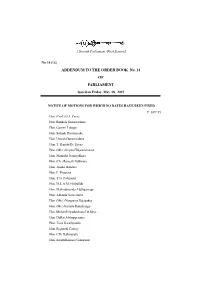

Addendum No. 14(1) of 08.05.2015

( ) [ Seventh Parliament -First Session] No. 14 (1).] ADDENDUM TO THE ORDER BOOK No. 14 OF PARLIAMENT Issued on Friday, May 08, 2015 NOTICE OF MOTIONS FOR WHICH NO DATES HAVE BEEN FIXED P. 307/’15 Hon. (Prof.) G.L. Peiris Hon. Bandula Gunawardane Hon. Gamini Lokuge Hon. Salinda Dissanayake Hon. Dinesh Gunawardena Hon. T. Ranjith De Zoysa Hon. (Mrs.) Sriyani Wijewickrama Hon. Manusha Nanayakkara Hon. (Dr.) Ramesh Pathirana Hon. Janaka Bandara Hon. P. Piyasena Hon. Y.G. Padmasiri Hon. M.L.A.M. Hizbullah Hon. Mahindananda Aluthgamage Hon. Athauda Seneviratne Hon. (Mrs.) Nirupama Rajapaksa Hon. (Ms.) Kamala Ranathunga Hon. Mohan Priyadarshana De Silva Hon. Dullas Alahapperuma Hon. Tissa Karalliyadda Hon. Reginold Cooray Hon. C.B. Rathnayake Hon. Sarath Kumara Gunaratne (2) Hon. Jayasinghe Bandara Hon. J. Sri Ranga Hon. Eric Prasanna Weerawardhana Hon. Susantha Punchinilame Hon. S.M. Chandrasena Hon. Nirmala Kotalawala Hon. Piyankara Jayaratne Hon. Lohan Ratwatte Hon. Namal Rajapaksa Hon. Tharanath Basnayaka Hon. Udith Lokubandara Hon. Thenuka Vidanagamage Hon. Sarana Gunawardena Hon. Sajin De Vass Gunawardena Hon. Kanaka Herath Hon. Johnston Fernando Hon. Gitanjana Gunawardena Hon. J.R.P. Suriyapperuma Hon. (Dr.) Sarath Weerasekara Hon. Roshan Ranasinghe Hon. A. M. Chamika Buddhadasa Hon. T.B. Ekanayake Hon. C.A. Suriyaarachchi Hon. Wimal Weerawansa Hon. Rohana Dissanayake Hon. Siripala Gamalath Hon. Victor Antony Hon. Mohan Lal Grero Hon. Vasudeva Nanayakkara Hon. Wijaya Dahanayake Hon. V.K. Indika Hon. Shehan Semasinghe Hon. Janaka Wakkumbura Hon. Hemal Gunasekera Hon. Lakshman Wasantha Perera (3) Hon. Neranjan Wickremasinghe Hon. Mahinda Yapa Abeywardena Hon. A.P. Jagath Pushpakumara Hon. Dilan Perera Hon. Lakshman Senewiratne Hon.