Black Sun Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017 Annual Report & Accounts 2017 & Accounts Annual Report to Information Presented in the Financial Statements

Annual report & accounts 2017 Redefining Packaging Contents Our business Strategic report DS Smith is a leading provider of 1 Redefining packaging 8 2017 operational and financial highlights corrugated packaging in Europe 9 Chairman’s statement and of specialist plastic packaging 10 2017 at a glance 12 Our customers worldwide. We create sustainable 14 In conversation with the Group value by working in balance, to Chief Executive 16 Our markets develop our business, our people 18 Our business model and our environment. 20 What we do 21 Our key differentiators 22 Our strategic goals and KPIs 24 Our people Our vision 28 Group Chief Executive’s review 31 Operating review 32 Financial review 36 Sustainability review To be the leading supplier of 39 Principal risks sustainable packaging solutions. 41 Viability statement Governance 46 Introduction to corporate governance Our culture 48 Nomination Committee report 50 Our leadership team 52 Role and responsibilities of the Board 54 Board activities We have a clear set of values that we 56 Effectiveness expect all of our employees to own 57 Relations with stakeholders 58 Directors’ report and live by. 61 Audit Committee report 64 Remuneration Committee report 80 Directors’ responsibilities statement Be caring Financial statements We take pride in what we do and we care about our customers, 81 Independent Auditor’s report our people and the world around us. 85 Consolidated income statement Be challenging 86 Consolidated statement of comprehensive income We are not afraid to constructively challenge each other and ourselves to find a better way forward. 87 Consolidated statement of financial position Be trusted 88 Consolidated statement of changes in equity We can always be trusted to deliver on our promises. -

Building Excellence

Barratt Developments PLC Building excellence Annual Report and Accounts 2017 Annual Report and Accounts 2017 Inside this report 1 45 113 175 Strategic Report Governance Financial Statements Other Information 1 Key highlights 46 The Board 114 Independent Auditor’s Report 175 KPI definitions and why we measure 2 A snapshot of our business 48 Corporate governance report 119 Consolidated Income Statement 176 Glossary 4 Our performance and financial highlights 60 Nomination Committee report 119 Statement of Comprehensive Income 177 Other Information 6 How we create and preserve value 65 Audit Committee report 120 Statement of Changes in 8 Chairman’s statement 74 Safety, Health and Environment Shareholders’ Equity – Group 10 Key aspects of our market Committee report 121 Statement of Changes in 76 Remuneration report Shareholders’ Equity – Company 12 Chief Executive’s statement Notice regarding limitations on Directors’ liability under 106 Other statutory disclosures 122 Balance Sheets English law 17 Our Strategic priorities Under the Companies Act 2006, a safe harbour limits the 112 Statement of Directors’ 123 Cash Flow Statements liability of Directors in respect of statements in, and omissions from, the Strategic Report contained on pages 1 to 44 and the Our principles Responsibilities 124 Notes to the Financial Statements Directors’ Report contained on pages 45 to 112. Under English Law the Directors would be liable to the Company (but not to 34 Keeping people safe any third party) if the Strategic Report and/or the Directors’ Report contains errors as a result of recklessness or knowing 35 Being a trusted partner misstatement or dishonest concealment of a material fact, 36 Building strong but would not otherwise be liable. -

Investment Portfolio (UNAUDITED) | 01.31.2021 CARILLON CLARIVEST INTERNATIONAL STOCK FUND COMMON STOCKS - 96.4% Shares Value Australia - 6.4% Austal Ltd

Investment Portfolio (UNAUDITED) | 01.31.2021 CARILLON CLARIVEST INTERNATIONAL STOCK FUND COMMON STOCKS - 96.4% Shares Value Australia - 6.4% Austal Ltd. 15,217 $ 29,697 BHP Group Ltd. 1,577 52,591 Coles Group Ltd. 10,814 149,701 CSL Ltd. 365 75,673 Fortescue Metals Group Ltd. 8,456 139,285 Northern Star Resources Ltd. 6,204 60,038 Resolute Mining Ltd.* 26,683 13,891 Sandfire Resources Ltd. 10,113 36,637 Sonic Healthcare Ltd. 1,960 51,223 Belgium - 0.6% Euronav N.V. 3,933 31,516 UCB S.A. 230 23,817 Denmark - 2.7% AP Moeller-Maersk A/S, Class B 57 117,088 Novo Nordisk A/S, Class B 1,512 105,338 Scandinavian Tobacco Group A/S 2,069 37,460 France - 6.3% BNP Paribas S.A.* 1,287 61,719 Cie Generale des Etablissements Michelin 698 96,189 Constellium SE* 2,500 30,825 Eiffage S.A.* 844 76,608 ENGIE S.A.* 5,396 83,742 Fnac Darty S.A.* 726 40,811 Sanofi 1,307 122,921 Sartorius Stedim Biotech 99 41,449 Societe Generale S.A.* 2,369 44,165 Germany - 8.1% Bayer AG 947 57,315 Daimler AG 2,116 148,615 Deutsche Post AG 2,892 142,850 Deutsche Telekom AG 4,660 82,867 HeidelbergCement AG 980 72,441 Hornbach Holding AG & Co. KGaA 183 17,322 Merck KGaA 816 136,002 Muenchener Rueckversicherungs-Gesellschaft AG 195 51,706 TAG Immobilien AG* 2,175 66,787 Hong Kong - 1.5% CK Hutchison Holdings Ltd. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

DWS CROCI International

Investment Portfolio as of March 31, 2021 (Unaudited) DWS CROCI® International VIP Shares Value ($) Common Stocks 96.0% Australia 9.1% Australia & New Zealand Banking Group Ltd. 84,659 1,814,028 BHP Group Ltd. 110,251 3,815,874 Commonwealth Bank of Australia 4,288 280,930 National Australia Bank Ltd. 62,344 1,234,218 Newcrest Mining Ltd. 15,865 297,603 (Cost $5,536,400) 7,442,653 Belgium 1.6% UCB SA (Cost $1,072,787) 13,795 1,312,687 Denmark 3.0% AP Moller - Maersk AS “B” 870 2,024,140 Novo Nordisk AS “B” 7,052 474,954 (Cost $1,948,110) 2,499,094 Finland 1.0% Fortum Oyj 12,738 340,652 Nokia Oyj* 121,910 486,937 (Cost $695,418) 827,589 France 14.1% Atos SE* 22,260 1,739,792 BNP Paribas SA* 53,894 3,290,488 Credit Agricole SA* 118,678 1,721,985 Engie SA* 79,187 1,127,334 Sanofi 30,370 3,003,484 Television Francaise 1* 80,739 737,194 (Cost $9,733,297) 11,620,277 Germany 8.4% Beiersdorf AG 12,876 1,355,372 Brenntag SE 13,966 1,193,987 Deutsche Boerse AG 4,043 672,742 Deutsche Post AG (Registered) 23,524 1,291,802 Fresenius Medical Care AG & Co. KGaA 7,353 542,699 Fresenius SE & Co. KGaA 10,857 484,249 HeidelbergCement AG 5,007 455,278 Merck KGaA 3,152 539,013 SAP SE 2,641 324,172 (Cost $6,246,907) 6,859,314 Hong Kong 0.7% CLP Holdings Ltd. -

This Is the Message

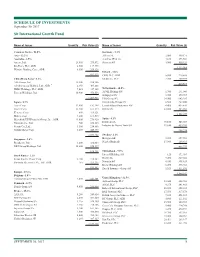

SCHEDULE OF INVESTMENTS (Unaudited) March 31, 2020 Sit International Growth Fund Investments are grouped by geographic region. Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 97.0% Germany - 5.3% Asia - 30.6% adidas AG 1,630 361,905 Australia - 4.5% Allianz SE 2,250 383,170 Amcor, Ltd. 12,100 96,873 Aurelius SE & Co. 4,660 84,819 Atlassian Corp., PLC * 2,500 343,150 Siemens AG 2,225 186,311 Macquarie Group, Ltd. 2,600 138,471 1,016,205 Rio Tinto, PLC, ADR 4,400 200,464 Westpac Banking Corp., ADR 8,300 85,075 Ireland - 2.3% CRH, PLC, ADR 6,100 163,724 864,033 STERIS, PLC 1,950 272,942 China/Hong Kong - 11.8% 436,666 AIA Group, Ltd. 32,200 288,339 Alibaba Group Holding, Ltd., ADR * 2,350 457,028 Netherlands - 3.5% Baidu, Inc., ADR * 1,525 153,705 ASML Holding NV 1,700 444,788 China Tower Corp., Ltd. 1,136,000 252,420 Koninklijke Philips NV 5,750 230,920 CSPC Pharmaceutical Group, Ltd. 88,000 173,104 675,708 ENN Energy Holdings, Ltd. 18,400 178,245 Spain - 4.7% Ping An Insurance Group Co. of China, Cellnex Telecom SA 6,123 277,755 Ltd. 33,500 327,170 Iberdrola SA 45,900 448,949 Tencent Holdings, Ltd. 9,000 444,849 Industria de Diseno Textil SA 6,900 178,804 2,274,860 905,508 Japan - 10.1% Sweden - 0.8% Astellas Pharma, Inc. 17,700 272,710 Hexagon AB 3,800 160,684 Keyence Corp. -

Broker Upgrades and Downgrades & Key Uk

Shard Capital Stockbrokers T +44 (0) 207 186 9950 rd 23 Floor, F +44 (0) 207 186 9979 20Fenchurch St, E [email protected] London, EC3M 3BY W shardcapitalstockbrokers.com BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS 23 January 2018 UK Broker Upgrades / Downgrades Please contact us for more information Code Company Broker Recomm. From Recomm. To Price From Price To Upgrades AHT Ashtead Group Plc Peel Hunt Buy Buy 2200 2300 BAB Babcock International Group Plc Peel Hunt Hold Hold 751 785 BBY Balfour Beatty Plc Peel Hunt Buy Buy 340 350 COB Cobham Plc Investec Securities Hold Buy CRDA Croda International Plc Berenberg Hold Buy 4150 5000 DCC DCC Plc Peel Hunt Add Add 7247 8149 EZJ easyJet Plc RBC Capital Markets Sector Perform Outperform 1450 1700 FERG Ferguson Plc Peel Hunt Hold Hold 5220 5360 MNZS John Menzies Plc Peel Hunt Add Buy 758 809 NCC NCC Group Plc Berenberg Sell Hold 155 195 RM. RM Plc Peel Hunt Buy Buy 203 213 RPS RPS Group Plc Peel Hunt Hold Hold 252 280 https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS Code Company Broker Recomm. From Recomm. To Price From Price To Downgrades AGK Aggreko Plc Peel Hunt Reduce Reduce 800 750 CNCT Connect Group Plc JP Morgan Cazenove Overweight Neutral 83 CPI Capita Group Plc/The Peel Hunt Hold Hold 423 391 DMGT Daily Mail & General Trust Plc Goldman Sachs Neutral Sell HSV Homeserve Plc Peel Hunt Add Hold 850 850 IMI IMI Plc Credit Suisse Outperform Neutral 1340 1270 MTO Mitie Group Plc Peel Hunt Hold Reduce RMV Rightmove Plc Goldman Sachs Neutral Sell 3959 4280 RST Restore Plc Peel Hunt Buy Add RTO Rentokil Initial Plc Peel Hunt Buy Add SRP Serco Group Plc Peel Hunt Hold Reduce UBM UBM Plc Goldman Sachs Buy Neutral 963 827 VP. -

This Is the Message

SCHEDULE OF INVESTMENTS September 30, 2017 Sit International Growth Fund Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 96.0% Germany - 5.3% Asia - 22.2% Allianz SE 2,000 449,171 Australia - 2.5% Aurelius SE & Co. 4,160 273,564 Amcor, Ltd. 23,400 279,872 Siemens AG 3,900 550,324 Rio Tinto, PLC, ADR 2,500 117,975 1,273,059 Westpac Banking Corp., ADR 8,300 209,326 Ireland - 1.8% 607,173 CRH, PLC, ADR 5,800 219,588 China/Hong Kong - 6.2% Medtronic, PLC 2,700 209,979 AIA Group, Ltd. 32,200 238,386 429,567 Alibaba Group Holding, Ltd., ADR * 2,350 405,868 HSBC Holdings, PLC, ADR 7,025 347,105 Netherlands - 10.5% Tencent Holdings, Ltd. 10,900 476,556 ASML Holding NV 1,700 291,040 Galapagos NV * 3,725 379,717 1,467,915 ING Groep NV 34,900 643,285 Japan - 8.7% Koninklijke Philips NV 6,500 267,800 Asics Corp. 12,900 192,398 LyondellBasell Industries NV 4,400 435,820 Daicel Corp. 13,400 161,574 RELX NV 22,800 485,033 Keyence Corp. 600 319,121 2,502,695 Makita Corp. 4,200 169,515 Mitsubishi UFJ Financial Group, Inc., ADR 43,000 276,920 Spain - 4.1% Nintendo Co., Ltd. 700 258,113 Iberdrola SA 70,100 545,069 Secom Co., Ltd. 3,500 254,886 Industria de Diseno Textil SA 11,650 439,205 Suzuki Motor Corp. 8,400 440,875 984,274 2,073,402 Sweden - 2.1% Singapore - 2.6% Hexagon AB 5,200 257,962 Broadcom, Ltd. -

Factsheet Blackrock UK Equity Fund Class I ACCU

BLACKROCK FUND MANAGERS LTD BlackRock UK Equity Fund Class I ACCU GBP JUNE 2021 QUARTERLY FACTSHEET Unless otherwise stated, Performance, Portfolio Breakdowns and Net Asset information as at: 30-Jun-2021. All other data as at 16-Jul-2021. For Investors in the UK. For Professional Investors Only. Defined Benefit. Capital at risk. All financial investments involve FUND OVERVIEW an element of risk. Therefore, the value of your investment and the income from it will vary and The Fund aims to provide a return on your investment (generated through an increase to the your initial investment amount cannot be value of the assets held by the Fund and/or income received from those assets). The Fund will guaranteed. invest at least 80% of its total assets in the equity securities (e.g. shares) of United Kingdom companies. The Fund may invest in all economic sectors within the United Kingdom. The Fund KEY FACTS is actively managed and the investment adviser has discretion to select the Fund's investments Umbrella BlackRock Fund Managers Ltd and in doing so may take into consideration the FTSE All-Share TR Index. Domicile United Kingdom Legal Structure UCITS Fund Launch Date 15-Oct-1971 12 MONTH PERFORMANCE PERIODS - TO LAST QUARTER END Unit Class Launch Date 15-Oct-1971 Unit Class Currency GBP 2020 30/6/2016- 30/6/2017- 30/6/2018- 30/6/2019- 30/6/2020- Benchmark FTSE All-Share Index Calendar 30/6/2017 30/6/2018 30/6/2019 30/6/2020 30/6/2021 Total Fund Size (M) 557.78 GBP Year Number of Holdings 145 Fund 24.84% 11.27% 1.89% -6.82% 21.49% -3.77% ISIN GB0005803530 Benchmark 18.12% 9.02% 0.57% -12.99% 21.45% -9.82% SEDOL 0580353 Bloomberg Ticker BUKEAACC Share Class performance is calculated on a Net Asset Value (NAV) basis, with income reinvested, in British Minimum Subsequent Investment 50 Units Pound, net of fees. -

Broker Upgrades and Downgrades & Key Uk

Shard Capital Stockbrokers T +44 (0) 207 186 9950 rd 23 Floor, F +44 (0) 207 186 9979 20Fenchurch St, E [email protected] London, EC3M 3BY W shardcapitalstockbrokers.com BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS 17 January 2018 UK Broker Upgrades / Downgrades Please contact us for more information Code Company Broker Recomm. From Recomm. To Price From Price To Upgrades BLND British Land Co Plc Peel Hunt Add Add 675 700 BMY Bloomsbury Publishing Plc Peel Hunt Add Add 200 210 BYG Big Yellow Group Plc Berenberg Hold Buy 820 920 Euromoney Institutional Investor ERM Peel Hunt Buy Buy 1330 1420 Plc ETO Entertainment One Ltd Peel Hunt Hold Hold 260 300 GOCO Gocompare.com Group Plc Peel Hunt Buy Buy 125 140 RMV Rightmove Plc Peel Hunt Hold Hold 4000 4400 SAFE Safestore Holdings Plc Berenberg Buy Buy 465 550 Jefferies SPI Spire Healthcare Group Hold Buy 259 290 International UBM UBM Plc Peel Hunt Buy Buy 760 810 Zero Preference Growth Trust ZPG Peel Hunt Buy Buy 400 410 Plc/The Downgrades FERG Ferguson Plc RBC Capital Markets Outperform Sector Perform 5200 6000 HMSO Hammerson Plc Peel Hunt Hold 550 525 WMH William Hill Plc Peel Hunt Hold Reduce 290 290 https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS Code Company Broker Recomm. -

Ferguson Plc Annual Report and Accounts 2018 Welcome to Ferguson Plc the World’S Leading Specialist Distributor of Plumbing and Heating Products

Ferguson plc Annual Report and Accounts 2018 Ferguson plc Annual Report Accounts and 2018 More to Ferguson 01_FERG_AR18_Front_Cover_v29.indd 3 15.10.18 17:30 Welcome to Ferguson plc The world’s leading specialist distributor of plumbing and heating products Financial highlights Statutory financial results $20,752m $1,267m 515.7c Revenue Profit for the year Basic earnings per share +7.6% (2016/17: $19,284m) attributable to shareholders +40.9% (2016/17: 366.1c) +37.7% (2016/17: $920m) Alternative performance measures $1,507m 444.4c Ongoing trading profit1 Headline earnings per share1 +15.3% (2016/17: $1,307m) +21.4% (2016/17: 366.1c) IFC 2–49 50–96 97–149 150–158 Strategic report Governance Financials Other information IFC Contents 51 Governance overview 98 Group income statement 150 Five-year summary 01 There’s more to Ferguson 52 Board of Directors 99 Group statement of 152 Group companies comprehensive income 12 Highlights 54 Ferguson’s governance structure 154 Shareholder information 99 Group statement of 13 Chairman’s statement 55 What the Board has done 157 Group information changes in equity during the year 14 Ferguson at a glance 158 PwC limited assurance statement 100 Group balance sheet 56 How the Board operates for sustainability data 16 Group Chief Executive’s review 101 Group cash flow statement 58 Evaluating the performance 158 Forward-looking statements 21 Marketplace overview of the Board of Directors 102 Notes to the consolidated 22 Our business model financial statements 59 Relations with shareholders 24 Key resources and relationships and other stakeholders 140 Independent auditor’s report to the members of Ferguson plc 28 Key performance indicators 60 Nominations Committee (“KPIs”) 146 Company profit and loss account 62 Audit Committee 30 Financial and operating review 146 Company statement 67 Directors’ Report – of changes in equity 34 Regional performance other disclosures 147 Company balance sheet 40 Sustainability 70 Directors’ Remuneration Report 148 Notes to the Company 44 Principal risks and financial statements their management 1.