Reckitt Benckiser Group PLC ADR RBGLY Rating As of Jun 19, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rb-Annual-Report-2012.Pdf

Reckitt Benckiser Group plc Reckitt Benckiser Group Healthier Happier Annual Report and Financial Statements 2012 Stronger Reckitt Benckiser Group plc Annual Report and Financial Statements 2012 Contents 1 Chairman’s Statement 2 Chief Executive’s Statement 10 Business Review 2012 18 Board of Directors and Executive Committee 19 Report of the Directors 22 Chairman’s Statement on Corporate Governance 24 Corporate Governance Report 30 Statement of Directors’ Responsibilities 31 Directors’ Remuneration Report 38 Independent Auditors’ Report to the members of Reckitt Benckiser Group plc 39 Group income statement 39 Group statement of comprehensive income 40 Group balance sheet 41 Group statement of changes in equity 42 Group cash flow statement 43 Notes to the financial statements 75 Five-year summary 76 Parent Company – Independent Auditors’ Report to the members of Reckitt Benckiser Group plc 77 Parent Company balance sheet 78 Notes to the Parent Company financial statements 84 Shareholder information Chairman’s Statement largest consumer health care category in The Board conducted its regular reviews the world with the acquisition of Schiff of the Company’s brands, geographic area Nutrition International, Inc. (Schiff) and and functional performance together with its leading US brands in the vitamins, detailed reviews of its human resources. minerals and supplements market. There The Board also completed its annual were also a few disposals of non core assessment of corporate governance assets. Net debt at the end of 2012, after including Board performance, corporate paying for dividends, net acquisitions and responsibility, and reputational and organisation restructuring, stood at business risk. £2,426m (2011: £1,795m). AGM Resolutions Your Board proposes an increase in the final The resolutions, which will be voted dividend of +11%, taking it to 78p per upon at our AGM of 2 May 2013 are share, and bringing the total dividend for fully explained in the Notice of Meeting. -

RB and Mead Johnson Donate RMB 50 Million (£5.5 Million) in Cash & Antibacterial Products to Combat the Coronavirus Outbreak in China

RB and Mead Johnson donate RMB 50 million (£5.5 million) in cash & antibacterial products to combat the Coronavirus outbreak in China 27 January 2020, Guangzhou, China and Slough, UK - RB, the makers of Dettol and Lysol, the global leading antibacterial and disinfectant brands, is working with relevant healthcare authorities and NGOs in China to provide essential disinfectant products and funds to combat the outbreak of Coronavirus. In the early stages of the outbreak, RB immediately coordinated RMB 600,000 worth of soap and sanitizer products to help meet the cleaning and disinfection requirements in Wuhan’s hospitals. In response to the latest needs of the epidemic prevention, RB is now in contact with local healthcare authorities to upgrade our support. An additional RMB 20,000,000 worth of disinfectant supplies has been arranged to help to minimise the further spread of the virus. A further RMB 30 million in cash will be donated to support frontline health workers in the promoting of hand washing as an effective method to break the chain of infection. Commenting on the outbreak, RB CEO Laxman Narasimhan said: “We immediately mobilised our experts in China and beyond as soon as the outbreak was identified. In addition to the moral responsibility we feel, we also have an important functional role to play in enhancing personal disinfection through providing enhanced access to products which can break the chain of infection. Simple steps such as frequent hand washing will aid the many efforts the Chinese government is already putting in place to protect citizens across the region.” About RB RB* is a leading global health, hygiene and home company inspired by a vision of the world where people are healthier and live better. -

RB Full Year 2017 Results Presentation

RB Full Year 2017 Results Presentation 191919 ththth February 2018 Disclaimer Cautionary note concerning forwardforward----lookinglooking statements This presentation contains statements with respect to the financial condition, results of operations and business of RB (the “Group”) and certain of the plans and objectives of the Group that are forward-looking statements. Words such as ‘‘intends’, ‘targets’, or the negative of these terms and other similar expressions of future performance or results, and their negatives, are intended to identify such forward-looking statements. In particular, all statements that express forecasts, expectations and projections with respect to future matters, including targets for net revenue, operating margin and cost efficiency, are forward-looking statements. Such statements are not historical facts, nor are they guarantees of future performance. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements, including many factors outside the Group’s control. Among other risks and uncertainties, the material or principal factors which could cause actual results to differ materially are: the general economic, business, political and social conditions in the key markets in which the Group operates; the ability of the Group to manage regulatory, tax and legal matters, including changes thereto; the reliability of the Group’s technological infrastructure or that of third parties on which the Group relies; interruptions in the Group’s supply chain and disruptions to its production facilities; the reputation of the Group’s global brands; and the recruitment and retention of key management. -

Laxman Narasimhan, CEO of Reckitt Benckiser, on Corporate Purpose During a Crisis

Strategy & Corporate Finance Practice Laxman Narasimhan, CEO of Reckitt Benckiser, on corporate purpose during a crisis Reckitt Benckiser’s CEO reflects on his experience transitioning into the leadership role and driving strategic change during the global pandemic. November 2020 Sean Brown: From McKinsey’s Strategy and that’s really what our purpose was about. And Corporate Finance practice, I’m Sean Brown and we articulated why we exist: to protect, heal, and welcome to Inside the Strategy Room. As part of nurture in the relentless pursuit of a cleaner and our exploration of corporate purpose and resilience healthier world. We did actually articulate that in through the COVID-19 crisis, senior partner Celia October. We tested it with customers, and there Huber recently held a discussion with Reckitt were several of our employees and some of our Benckiser CEO Laxman Narasimhan. Reckitt younger people came back and said, “That’s great. Benckiser is a UK-based global consumer products We love this purpose, we’re extremely energized by company with more than 40,000 employees. The it, but we also want to put on the table a fight.” And majority of its products are in health, hygiene, and they really articulated what we should stand for. It’s home categories, including such well-known brands a fight. A fight for access. A fight for access to high- as Lysol and Clearasil. We hope you enjoy the quality products, or information that drives behavior discussion. Here’s Celia. change. And for availability. So, we articulated this fight. And at the end of February, we announced to Celia Huber: Laxman, welcome. -

Rejuvenating RB Plc Group Benckiser Reckitt Annual Report and Financial Statements 2019 Statements Financial and Report Annual

Rejuvenating RB Reckitt Benckiser Group plc Annual Report and FinancialStatements 2019 Reckitt Benckiser Group plc Annual Report and Financial Statements 20192018 INTRODUCTION CONTENTS Strategic Report Welcome 01 Financial highlights 02 Health and Hygiene Home – at a glance 04 Chairman’s statement 06 Chief Executive’s statement 10 Our business model Our purpose 12 How purpose drives our performance We exist to protect, heal and nurture in the relentless pursuit of a cleaner 14 Mapping what matters to our stakeholders and healthier world. 18 KPIs 20 Consumers Our fight 24 Customers We have a fight on our hands. A fight to make access to the highest quality 28 People hygiene, wellness and nourishment a right and not a privilege. 32 Partners 36 Communities 40 Environment 46 s172 statement 48 Health operating review 52 Hygiene Home operating review 56 Non-financial information statement 58 Financial review 64 Risk management Health 77 Viability statement Governance 78 Board of Directors 84 Executive Committee 86 Corporate Governance – Chairman’s statement 88 Corporate Governance statement 97 Nomination Committee Report 103 Audit Committee Report 111 CRSEC Committee Report 117 Directors’ Remuneration Report 138 Report of the Directors Page 48 141 Statement of Directors’ Responsibilities Financial Statements 143 Independent Auditors Report Chief Executive’s Statement 152 Financial Statements 223 Shareholder Information Hygiene Home Page 06 Page 52 STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS FINANCIAL HIGHLIGHTS Net Revenue Health Hygiene -

Hutchison China Meditech ("Chi-Med") (AIM: HCM)

Press Cutting Publication: FT.com Date: 13 February 2013 Reckitt gets taste for Chinese remedy By Adam Jones Reckitt Benckiser has bought a manufacturer of traditional Chinese sore-throat remedies as part of a drive to add more holistic treatments to its stable of western healthcare brands. The UK-headquartered maker of Nurofen painkillers, Strepsils lozenges and Durex condoms on Wednesday said it had acquired Oriental Medicine Company for an undisclosed sum. Reckitt said the cost was modest as it announced the deal in annual results, featuring a 2 per cent increase in pre-tax profits compared with 2011 and a 7 per cent rise in the dividend. However, it still represents an eye-catching diversification for a western consumer goods group and comes in the wake of Reckitt’s purchase of Schiff Nutrition International, a US vitamin company, for $1.4bn late last year. Rakesh Kapoor, chief executive, said Reckitt had to keep up with changing consumer behaviour: “People think about their health in much more holistic terms. It is about how do you lead a more balanced life.” Oriental Medicine’s main remedy was a sore-throat powder, he said. The company makes all its sales in China, the group added. Western companies have been showing growing interest in China’s traditional medicine sector. In November Nestlé agreed a tie-up with a traditional Chinese medicine company controlled by Hong Kong billionaire Li Ka-shing. Although Reckitt one day hopes to use Oriental Medicine as a sales platform for its western healthcare products in China, Mr Kapoor said it was too early to say if Reckitt would seek to sell traditional Chinese remedies outside China. -

Read Laxman's

23 April 2021 LAXMAN NARASIMHAN – CEO OF RECKITT Laxman became CEO of Reckitt, a FTSE 15 company, in September 2019. As a global leader in Health, Hygiene and Nutrition, Reckitt’s brands are found in more than 190 countries. It has annual revenues over £13BN and employs 42,000 colleagues globally. 20 million times a day Reckitt’s brands are selected by consumers, who rely on the company’s 200-year strong heritage. This stable of trusted global brands includes: Enfamil, Nutramigen, Nurofen, Strepsils, Gaviscon, Mucinex, Durex, Scholl, Clearasil, Lysol, Dettol, Veet, Harpic, Cillit Bang, Mortein, Finish, Vanish, Calgon, Woolite, Air Wick and more. Under Laxman’s leadership, Reckitt’s purpose is to protect, heal and nurture in a relentless pursuit of a cleaner, healthier world. Reckitt fights to make access to the highest-quality hygiene, wellness and nourishment a right, not a privilege, for everyone. Laxman is a member of the UK Government’s private sector advisory group, the Build Back Better Council, which is chaired by the Prime Minister and Chancellor and advises on innovation, skills and infrastructure. Prior to joining the company, Laxman held various roles at PepsiCo from 2012 to 2019. He was previously Global Chief Commercial Officer, with responsibility for R&D, categories, e-commerce, design, go-to-market, global customers and strategy. Before this, Laxman served as the Chief Executive Officer of PepsiCo’s Latin America, Europe and Sub- Saharan Africa operations, where he ran the company's food and beverage businesses across over 100 countries. He also spent time as CEO of PepsiCo Latin America and as the CFO of PepsiCo Americas Foods, which was responsible for half of the company’s profits. -

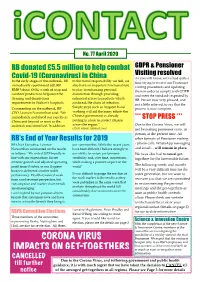

Contact 77 to See the Results for the “Brand Search”That Was Published in the Last Magazine

No. 77 April 2020 RB donated £5.5 million to help combat GDPR & Pensioner Visiting resolved Covid-19 (Coronavirus) in China As you will know, we’ve had quite a In the early stages of the outbreak, RB to the moral responsibility we feel, we time trying to review our Pensioner immediately coordinated 600,000 also have an important functional role visiting procedures and updating RMB (about £60k) worth of soap and to play in enhancing personal them in order to comply with GDPR sanitizer products to help meet the disinfection through providing and meet the standards expected by cleaning and disinfection enhanced access to products which RB. We are now very pleased, and requirements in Wuhan’s hospitals. can break the chain of infection. not a little relieved, to say that the Commenting on the outbreak, RB Simple steps such as frequent hand process is now complete. CEO Laxman Narasimhan said: “We washing will aid the many efforts the immediately mobilised our experts in Chinese government is already *** STOP PRESS *** China and beyond as soon as the putting in place to protect citizens outbreak was identified. In addition across the region.” Due to the Corona Virus, we will (Press release: www.rb.com) not be making pensioner visits, in person, at the present time. All RB’s End of Year Results for 2019 other formats of Pensioner visiting RB Chief Executive, Laxman our communities. While the recent years - phone calls, WhatsApp messaging Narasimhan commented on the results have been difficult, I believe strongly in and emails - will remain in place. -

Rb Announces Changes to Executive Team

RB ANNOUNCES CHANGES TO EXECUTIVE TEAM 17 January, 2020 – Reckitt Benckiser Group plc, (“RB”) today announces a series of management changes which will focus on delivering performance and the next phase of transformation for the company. After 27 years with the company, Gurveen Singh, Chief Human Resources Officer, has decided to retire. Ranjay Radhakrishnan will join RB as Chief Human Resources Officer and a member of the company’s executive committee with effect from 1st March 2020. Ranjay is currently Chief Human Resources Officer at InterContinental Hotels Group (IHG plc). Prior to IHG, Ranjay spent 23 years at Unilever, in a range of senior leadership roles at global, regional and country levels. Mike Duijser, Chief Supply Officer, has decided to leave RB to return to the US for personal reasons. A successor will be appointed in due course and Frederick Dutrenit, SVP Manufacturing Health, will be covering this role in the interim. Group CEO Laxman Narasimhan said about the changes: “Gurveen has made a significant contribution to RB during her long and distinguished career with the company and I wish her all the very best for the future. Under her leadership, the HR function has flourished and delivers sustained positive impact to the business. I would also like to thank Mike for his contribution to RB and wish him success for his future endeavours.” Laxman added: “I am delighted to announce the appointment of Ranjay as Gurveen’s successor. This announcement follows the appointment of Jeff Carr, Harold van den Broek and Kris Licht to the executive team and I look forward to working with this exceptional group of leaders as we continue to drive performance to transform the business.” Reckitt Benckiser Group plc’s LEI code is 5493003JFSMOJG48V108 About RB RB is the global leading consumer health, hygiene and home company. -

RB Enhances Consumer Health Position with the Completion of Its Acquisition of the Mead Johnson Nutrition Company

Contacts: Lynn Kenney – Communications Director, RB North America P: +1 201-953-5348 [email protected] UK +44 (0)1753 217 800 Richard Joyce – SVP, Investor Relations Patty O’Hayer - Director, External Relations and Government Affairs RB enhances consumer health position with the completion of its acquisition of the Mead Johnson Nutrition Company Parsippany, NJ – June 15, 2017 – RB is pleased to announce the completion of the acquisition of the Mead Johnson Nutrition Company (“Mead Johnson”). The transaction takes RB into a global market leadership position in consumer health and hygiene. Mead Johnson brings the addition of two infant and child nutrition Powerbrands Enfa and Nutramigen, and is a natural extension of RB’s existing health portfolio which is trusted around the globe by millions of consumers. Rakesh Kapoor, RB chief executive, said: “The closure of the acquisition marks an inflection point in RB’s evolution to become a leader in consumer health care. By combining the best of RB’s global scale with MJN’s science-based innovation, RB is well positioned to deliver further value for all stakeholders. We continue to execute on our strategy of providing innovative health solutions for healthier lives and happier homes to millions of people around the world.” Mead Johnson will initially operate as a separate division within RB and be led by Aditya Sehgal, who joins RB’s Executive Committee. Aditya’s previous roles included responsibility for RB’s operations in China and North Asia, RB’s global health care division and RB’s North American business. The Mead Johnson division will continue its mission to nourish the world’s children for the best start in life. -

Q4 2012 Earnings Call YTD Change(%): +17.762 Bloomberg Estimates - Sales Current Quarter: 2452.000 Current Year: 10080.417

Company Name: Reckitt Benckiser Market Cap: 32,863.50 Bloomberg Estimates - EPS Company Ticker: RB/ LN Current PX: 4568.00 Current Quarter: N.A. Date: 2013-02-13 YTD Change($): +689.00 Current Year: 2.618 Event Description: Q4 2012 Earnings Call YTD Change(%): +17.762 Bloomberg Estimates - Sales Current Quarter: 2452.000 Current Year: 10080.417 Q4 2012 Earnings Call Company Participants • Rakesh Kapoor • Adrian N. Hennah • Heather Allen Other Participants • Rosie A. Edwards • Jeremy D. Fialko • Celine Pannuti • Harold P. Thompson • James Edwardes Jones • Eduardo Santos • Robert R. Waldschmidt MANAGEMENT DISCUSSION SECTION Rakesh Kapoor Right. Are we ready to start? So good morning, everyone, and thank you very much for coming for our 2012 full-year results presentation. I have two people on the stage with me. I'd like to first introduce Heather Allen, who's been with Reckitt Benckiser for 17 years, with a very illustrious career spanning many general management assignments in category also. And now she's heading our global category organization, a job that she took over from me nearly two years ago and one that she's going to show the passion for our innovation as she talks about it later in the presentation. I also have Adrian Hennah, who's obviously not very new to many of you people, although he's new of course in Reckitt Benckiser. When he came into the company in January, first day of January, I said, Adrian, you know, don't worry too much about the full-year results presentation. I'll lead with the whole thing, including the financial parts, and he very bravely but at the same time very worried looked on his face when I told him I'll look up to the financial side, also looked very, very worried. -

Tata Cash India

WELCOME TO TATA CASH INDIA TATA CASH INDIA Fast payouts, Secure and Stable.. www.tatacashindia.com ABOUT THE TATA CASH INDIA About The TATA CASH INDIA Leading Business & IT Consulting company founded with an aim to aid clients boosting IT management capacities of companies. Backed with unmatched quality consultation solutions. We work over the past year is the software and Websites. Out of which we have good profit. TATA CASH INDIA Services encompass value and growth equities, blend strategies, fixed income, alternatives and asset allocation. It also provides independent investment research, trading and brokerage-related services to Institutional clients through INDIAN-based affiliate. www.tatacashindia.com Why Choose Us? Fast Transaction, Progressive Growth, 10 Am to 5 Pm Secure and Stable Professional Team Support All requests and transactions Due to the financial capacity We are using one of the most are processed automatically of clients, we make the most professional and trusted DDoS and instantly. We are using reliable and profitable ways of Protection and mitigation one of the most sophisticated, making a profit. Our Portfolio provider. We Will Give You encrypted and trusted is diversified and taken care of Always Best Services. We Protection against every by the most skilled crypto Create Safe And Powerful possible aspect analyst and traders. Calulation With Lots of Earning Method. www.tatacashindia.com PASSION COMITTED IN HEART & MR. RAKESH KAPOOR Founder, TATA CASH INDIA MIND www.tatacashindia.com Rakesh Kapoor is an Indian businessman. He was born 4 August 1958 From Jamshedpur, Jharkhand. He was until September 2019, chief executive (CEO) of Reckitt Benckiser plc, a UK FTSE-listed multinational consumer goods company, a major producer of health, hygiene and home products.