Global Android Smartphone Market: Strategy Recommendations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Код Товараназвание Позиции Цена Валюта Единица Измерения 7941 Футболка-Поло, 21Th Skon 1040 Rub Шт

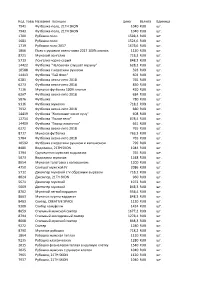

Код_товараНазвание_позиции Цена Валюта Единица_измерения 7941 Футболка-поло, 21TH SKON 1040 RUB шт. 7943 Футболка-поло, 21TH SKON 1040 RUB шт. 1700 Рубашка поло 1598,4 RUB шт. 1681 Рубашка поло 1524,6 RUB шт. 1719 Рубашка поло 2017 1678,6 RUB шт. 1866 Поло с рукавом осень-зима 2017 100% хлопок 1120 RUB шт. 8721 Мужской лонгслив 718,2 RUB шт. 5713 Лонгслив черно-серый 848,3 RUB шт. 14422 Футболка "Человечек слушает музыку" 628,2 RUB шт. 10588 Футболка с коротким рукавом 593 RUB шт. 14413 Футболка "Гай Фокс" 603 RUB шт. 6281 Футболка весна-лето 2018 765 RUB шт. 6273 Футболка весна-лето 2018 850 RUB шт. 7116 Мужская футболка 100% хлопок 420 RUB шт. 6267 Футболка весна-лето 2018 684 RUB шт. 5876 Футболка 780 RUB шт. 9316 Футболка мужская 718,2 RUB шт. 7932 Футболка весна-лето 2018 880 RUB шт. 14419 Футболка "Космонавт косит луну" 608 RUB шт. 12714 Футболка "Голое тело" 878,4 RUB шт. 14409 Футболка "Город-лампочки" 661 RUB шт. 6272 Футболка весна-лето 2018 765 RUB шт. 8717 Мужская футболка 763,3 RUB шт. 5784 Футболка весна-лето 2018 765 RUB шт. 10592 Футболка с коротким рукавом и капюшоном 799 RUB шт. 8480 Водолазка, 21TH SKON 1044 RUB шт. 3794 Однотонная мужская водолазка 765 RUB шт. 5673 Водолазка мужская 1248 RUB шт. 8654 Мужская толстовка с капюшоном 1200 RUB шт. 4750 Свитшот мужской IV 2086 RUB шт. 5712 Джемпер мужской с V-образным вырезом 718,2 RUB шт. 8024 Джемпер, 21TH SKON 960 RUB шт. 5671 Джемпер мужской 1072 RUB шт. -

Galaxy S20 | S20+ | S20 Ultra 5G

Galaxy S20 | S20+ | S20 Ultra 5G Supercharge your work with the next generation of Galaxy. Introducing Galaxy S20 Series. Do more than ever before with the next generation of Galaxy smartphone, the S20 Series. Filled with professional-level features designed for business, they’ll enable you to harness the blazing speed of 5G to further your digital transformation. They’re the most productive, most connected and most trusted business tools yet. The most productive. Work seamlessly. The Galaxy S20 Series integrates seamlessly with Microsoft Office. With Microsoft OneDrive and Office, there’s no need to download additional apps.1 Sync files and photos across devices. Outlook is pre-loaded and optimized, and Link to Windows lets you access your Windows 10 desktop. Powerful enough to replace your PC. With Samsung DeX for PC, your Galaxy S20 Series connects to a monitor, keyboard and mouse to access mobile and web apps on an intuitive desktop interface,2 with multiple resizable windows, standard keyboard shortcuts and drag-and-drop convenience. Samsung DeX for PC also supports VDI solutions.3 All-day intelligent battery.4 The Galaxy S20 5G’s battery isn’t just powerful, it’s intelligent. It optimizes your app usage to deliver the power to outlast your business hours. Then when you need a recharge, Super Fast Charging5 and fast Wireless Charging 2.0 give you power in a flash. And Wireless PowerShare charges your buds, smartwatch and even a colleague’s phone.6 A bigger space for working. See and do more than ever before with the Galaxy S20 5G’s Dynamic AMOLED 2.0, a 120Hz display for a smoother scroll and precise touch.7 It’s perfect for viewing and editing documents and makes it easy to multitask across different apps. -

Bab Iii Metodologi Penelitian

BAB III METODOLOGI PENELITIAN A. Tujuan Penelitian Berdasarkan masalah-masalah yang telah peneliti rumuskan, maka tujuan penelitian ini adalah untuk mendapatkan pengetahuan yang benar (sahih / valid) dan dapat dipercaya (reliabel) mengenai: 1. Hubungan antara fitur produk dengan keputusan pembelian 2. Hubungan antara harga dengan keputusan pembelian 3. Hubungan antara fitur produk dan harga dengan keputusan pembelian. B. Tempat dan Waktu Penelitian 1. Tempat Penelitian Penelitian ini dilaksanakan di Fakultas Ekonomi Universitas Negeri Jakarta yang beralamat di Jalan Rawamangun Muka, Jakarta 13220. Tempat tersebut menarik bagi peneliti dikarenakan sebagian besar mahasiswa Fakultas Ekonomi Universitas Negeri Jakarta adalah pengguna smartphone Samsung Galaxy J series dan didalamnya terdapat masalah, dimana hal ini akan memudahkan peneliti selama melakukan penelitian. 2. Waktu Penelitian Waktu penelitian dilaksanakan sejak bulan Februari 2018 – Juli 2018. Waktu tersebut merupakan waktu yang tepat untuk melaksanakan penelitian karena jadwal perkuliahan peneliti sudah tidak padat dalam jangka waktu tersebut dan dirasa cukup untuk peneliti mendapatkan data guna menunjang kebutuhan penelitian. 41 42 C. Metode Penelitian 1. Metode Metode penelitian yang digunakan adalah metode survei, dengan pendekatan korelasional, yaitu untuk mengetahui tingkat hubungan antar variabel yang sedang diteliti yaitu variabel bebas dengan variabel terikat. Variabel bebas dalam penelitian ini adalah fitur produk dan harga sedangkan variabel terikatnya adalah keputusan pembelian. Jenis dan sumber data yang digunakan dalam penelitian ini adalah data primer untuk masing-masing variabel bebas dan variabel terikat yang berasal dari penyebaran angket (kuesioner). Angket ini merupakan suatu daftar pertanyaan tentang topik tertentu yang diberikan kepada subjek, baik secara individual atau kelompok, untuk mendapatkan informasi mengenai fitur produk, harga, dan keputusan pembelian smartphone Samsung Galaxy J series yang diperoleh dari mahasiswa Fakultas Ekonomi di Universitas Negeri Jakarta. -

The Harder Your Phone Works, the Easier the Workday Will Be

The harder your phone works, the easier the workday will be. Introducing the Galaxy S20 FE 5G. It delivers industry- leading tech that enables you to more easily tackle your business challenges. It’s all you need to get it all done. Be more productive. This is a phone whose every feature is geared to simplifying your workday. Keep connected. The more efficiently you can access and share data, the more efficiently you can work. Work with trust. If you can work knowing your phone and data are protected, you can work worry-free. samsung.com/S20forwork Every feature makes work better. Be more productive. Keep connected. Work with trust. Smooth 120Hz display The speed of 5G IP68 rating • Smooth motion and fluid scrolling on the 120Hz 6.5" • Upload and download huge files, stream video over a • The Galaxy S20 FE 5G is built to withstand dust, dirt, sand Infinity-O display.1 conference call, create a private, secure 5G hotspot.5 and water,7 for worry-free mobility. HyperFast processor Quick Share data sharing Keep up to date • HyperFast processing power and faster graphic rendering • The Galaxy S20 FE 5G can share with up to 5 other • The Galaxy S20 FE 5G includes support for three with less lag will transform how you work, collaborate compatible Galaxy devices simultaneously using Bluetooth generations of OS upgrades beginning with Android 11,8 and multi-task. and Wi-Fi, with no limits on content or file size.6 as well as regular security updates.9 All-day intelligent battery Defense-grade security • All-day intelligent battery learns from how you work to • Samsung Knox defense-grade platform helps protect optimize power.2 data the moment the device is powered on. -

Cennik Produktów Na Raty

Cennik produktów na raty ${E:Cennik produktów na raty} ${BEZPODPISU} ${BEZARCH} Cennik na raty dla oferty Abonament Komórkowy obowiązuje klientów, którzy przedłużają umowę na 24 miesiące, obowiązujący od 23-09- 2021 r. Wszystkie ceny podane są w złotych i zawierają podatek od towarów i usług (VAT) Opłaty za urządzenia dla Planów Komórkowych z 24 miesięcznym czasem spłaty Nazwa planu komórkowego Plan 40 Plan 50 Plan 60 Plan 80 Całkowity Pierwsza Całkowity Pierwsza Całkowity Pierwsza Całkowity Pierwsza Rodzaj urządzenia koszt wpłata + rata koszt wpłata + rata koszt wpłata + rata koszt wpłata + rata urządzenia miesięczna urządzenia miesięczna urządzenia miesięczna urządzenia miesięczna Urządzenia dostępne indywidualnie Acer Nitro 5 AN 515 45 5 399,00 5399 + 0/mc 5 400,09 0 + 225/mc 5 351,97 0 + 223/mc 5 160,09 0 + 215/mc Acer Laptop Nitro 5 AN515 53M3 4 799,00 4799 + 0/mc 4 680,10 0 + 195/mc 4 631,98 0 + 193/mc 4 440,10 0 + 185/mc Acer Laptop Nitro 5 AN515 54LN 4 598,99 4599 + 0/mc 4 464,01 0 + 186/mc 4 415,89 0 + 184/mc 4 224,01 0 + 176/mc Acer Nitro 5 AN517 41 5 599,00 5599 + 0/mc 5 591,97 0 + 233/mc 5 543,85 0 + 231/mc 5 351,97 0 + 223/mc Alcatel 1B (2020) 2/32GB 329,00 329 + 0/mc 312,02 0 + 13/mc 263,90 0 + 11/mc 144,05 0 + 6/mc HP 15S - EQ1082NW 2 239,01 2239 + 0/mc 2 232,00 0 + 93/mc 2 183,88 0 + 91/mc 1 992,00 0 + 83/mc HP 15S FQ2009 3 198,98 3199 + 0/mc 3 072,14 0 + 128/mc 3 024,02 0 + 126/mc 2 831,85 0 + 118/mc LAPTOP HP 15s-fq2011nw 2 898,99 2899 + 0/mc 2 784,03 0 + 116/mc 2 784,03 0 + 116/mc 2 591,85 0 + 108/mc HP 250 G8 2 049,00 -

Wireless Phone Protection Insurance Policy Terms and Conditions

Wireless Phone Protection Insurance Policy Terms and Conditions Not applicable in New York or to New York customers 1 * For information about your smartphone model Tier, see the “Deductible Wireless Phone Protection1 (WPP) Amounts” table in this document, go to phoneclaim.com/Verizon or call 1.888.881.2622. 1 Lost, stolen or damaged device replacements are provided by Wireless $7.25 Smartphones (Tier 1)* Phone Protection (WPP), which is insurance coverage underwritten in Georgia, by LM General Insurance Company (Boston, MA); in Indiana, by Monthly and Watches Indiana Insurance Company (Boston, MA); in New Jersey, by Liberty Mutual Charge $4.25 Smartphones (Tier 2),* Mid-Atlantic Insurance Company (Boston, MA), and in all other states, Basic Phones and Tablets Liberty Insurance Underwriters Inc. (New York, NY) or one of its insurance company affiliates; in Florida, WPP includes coverage for post-warranty defects (device replacement deductible and claim limit apply). Asurion Insurance Services, Inc. (in California, Agent License #0B35141; in Iowa, Max of 3 insurance claims in Agent License #1001000131), is the Agent and provides the claims 12 months (excluding cracked servicing under this program. Number of 2 screen repair claims) Select smartphones that only have a front cracked screen are eligible; claims Device claim maximum – $400 or $3,000, damage beyond this is not eligible for cracked screen repair. Subject to parts availability and available in select locations, which are subject to depending on device. change at any time. Availability of same-day repair depends on criteria such as claim approval time and technician availability. Repairs are performed by an Asurion-certified technician and come with a 12-month warranty. -

Device VOLTE SUNRISE VOWIFI SUNRISE Apple Iphone 11

Device VOLTE_SUNRISE VOWIFI_SUNRISE Apple iPhone 11 (A2221) Supported Supported Apple iPhone 11 Pro (A2215) Supported Supported Apple iPhone 11 Pro Max (A2218) Supported Supported Apple iPhone 5c (A1532) NotSupported Supported Apple iPhone 5S (A1457) NotSupported Supported Apple iPhone 6 (A1586) Supported Supported Apple iPhone 6 Plus (A1524) Supported Supported Apple iPhone 6S (A1688) Supported Supported Apple iPhone 6S Plus (A1687) Supported Supported Apple iPhone 7 (A1778) Supported Supported Apple iPhone 7 Plus (A1784) Supported Supported Apple iPhone 8 (A1905) Supported Supported Apple iPhone 8 Plus (A1897) Supported Supported Apple iPhone SE (A1723) Supported Supported Apple iPhone SE 2020 (A2296) Supported Supported Apple iPhone X (A1901) Supported Supported Apple iPhone XR (A2105) Supported Supported Apple iPhone XS (A2097) Supported Supported Apple iPhone XS Max (A2101) Supported Supported Apple Watch S3 (38mm) (A1889) Supported Supported Apple Watch S3 (42mm) (A1891) Supported Supported Apple Watch S4 (40mm) (A2007) Supported Supported Apple Watch S4 (44mm) (A2008) Supported Supported Apple Watch S5 (40mm) (A2156) Supported Supported Apple Watch S5 (44mm) (A2157) Supported Supported Caterpillar CAT B35 Supported Supported Huawei Honor 10 Supported Supported Huawei Honor 20 (YAL-L21) Supported Supported Huawei Honor 7x (BND-L21) Supported Supported Huawei Honor V10 Supported Supported Huawei Mate 10 Lite (RNE-L21) Supported Supported Huawei Mate 10 pro (BLA-L29) Supported Supported Huawei Mate 20 lite (SNE-LX1) Supported Supported -

SAM:Samsung-Galaxy-S20-FE-5G-SM-G7810 Datasheet Overview

SAM:Samsung-Galaxy-S20-FE-5G-SM-G7810 Datasheet Get a Quote Overview Samsung Galaxy S20 FE 5G has features tailored for everyone, whether you like photography, games or add everything that can inspire you, 5G technology will bring you an unprecedented network speed. Quick Spec Table 1 shows the Quick Specs. Product Code Samsung Galaxy S20 FE 5G SM-G7810 Dimensions 159.8 x 74.5 x 8.4 mm (6.29 x 2.93 x 0.33 in) Build Glass front, plastic back, aluminum frame SIM Single SIM (Nano-SIM) or Hybrid Dual SIM (Nano-SIM, dual stand-by) Samsung Pay (Visa, MasterCard certified) IP68 dust/water resistant (up to 1.5m for 30 mins) Display Super AMOLED, 120Hz, HDR10+ Size 6.5 inches, 101.0 cm2 (~84.8% screen-to-body ratio) Resolution 1080 x 2400 pixels, 20:9 ratio (~407 ppi density) Always-on display OS Android 10, One UI 2.5 Chipset Qualcomm SM8250 Snapdragon 865 (7 nm+) CPU Octa-core (1x2.84 GHz Kryo 585 & 3x2.42 GHz Kryo 585 & 4x1.8 GHz Kryo 585) GPU Adreno 650 Product Details Samsung Galaxy S20 FE 5G SM-G7810 provides these features: Meet Galaxy S20 FE 5G This is the phone made for people who want it all. It's packed with features tailor-made for fans on all kinds—whether you love photography, gaming or filling your feed with all that inspires you. This is the phone that leaves compromise behind, delivering the innovations of Galaxy S20 5G to make incredible technology available to all. -

Device Compatibility

Device compatibility Check if your smartphone is compatible with your Rexton devices Direct streaming to hearing aids via Bluetooth Apple devices: Rexton Mfi (made for iPhone, iPad or iPod touch) hearing aids connect directly to your iPhone, iPad or iPod so you can stream your phone calls and music directly into your hearing aids. Android devices: With Rexton BiCore devices, you can now also stream directly to Android devices via the ASHA (Audio Streaming for Hearing Aids) standard. ASHA-supported devices: • Samsung Galaxy S21 • Samsung Galaxy S21 5G (SM-G991U)(US) • Samsung Galaxy S21 (US) • Samsung Galaxy S21+ 5G (SM-G996U)(US) • Samsung Galaxy S21 Ultra 5G (SM-G998U)(US) • Samsung Galaxy S21 5G (SM-G991B) • Samsung Galaxy S21+ 5G (SM-G996B) • Samsung Galaxy S21 Ultra 5G (SM-G998B) • Samsung Galaxy Note 20 Ultra (SM-G) • Samsung Galaxy Note 20 Ultra (SM-G)(US) • Samsung Galaxy S20+ (SM-G) • Samsung Galaxy S20+ (SM-G) (US) • Samsung Galaxy S20 5G (SM-G981B) • Samsung Galaxy S20 5G (SM-G981U1) (US) • Samsung Galaxy S20 Ultra 5G (SM-G988B) • Samsung Galaxy S20 Ultra 5G (SM-G988U)(US) • Samsung Galaxy S20 (SM-G980F) • Samsung Galaxy S20 (SM-G) (US) • Samsung Galaxy Note20 5G (SM-N981U1) (US) • Samsung Galaxy Note 10+ (SM-N975F) • Samsung Galaxy Note 10+ (SM-N975U1)(US) • Samsung Galaxy Note 10 (SM-N970F) • Samsung Galaxy Note 10 (SM-N970U)(US) • Samsung Galaxy Note 10 Lite (SM-N770F/DS) • Samsung Galaxy S10 Lite (SM-G770F/DS) • Samsung Galaxy S10 (SM-G973F) • Samsung Galaxy S10 (SM-G973U1) (US) • Samsung Galaxy S10+ (SM-G975F) • Samsung -

Samsung Galaxy J7 J5 Leaked

Samsung Galaxy J7 J5 Leaked. Samsung Galaxy J7 J5 Leaked. 1 / 4 2 / 4 A partir da próxima semana, a nova série Samsung Galaxy J vai chegar às lojas portuguesas. São sem dúvida equipamentos interessantes e .... The Samsung Galaxy J5 (2017) edition is nearing its launch and had recently ... Today, we receive some Samsung Galaxy J5 2017 image leaks as well. ... Next articleSamsung Galaxy J7 (2016) started receiving April security ... 1. samsung galaxy leaked 2. samsung galaxy s11 leaked 3. samsung galaxy s21 leaked After several leaks, the Samsung Galaxy J7 (2016) and Galaxy J5 (2016) have finally been made official. Both devices are now listed on the South Korean ... samsung galaxy leaked samsung galaxy leaked, samsung galaxy s5 unlock code leaked, samsung galaxy s11 leaked, samsung galaxy s20 leaked, samsung galaxy s21 leaked, samsung galaxy note 20 leaked, samsung galaxy s7 leaked, leaked samsung galaxy s9, samsung galaxy note leaked, samsung galaxy note 7 leaked Soccer Manager 2020 – Top Football Management Game 1.0.8 Apk for android The Galaxy J7 (2017) to feature a 5.5” and the Galaxy J5 (2017) 5.2” display. Both device will be running on the latest Android 7.0 Nougat with .... Galaxy J5 (2016) and Galaxy J7 (2016) Specs and Images Leaked. By ... Of those devices, the Samsung Galaxy J5 (2016) and Galaxy J7 (2016) have already been ... It comes with the same camera setup as the J5 (2016). Datadog launches Watchdog to help you monitor your cloud apps So you think you can Cook TAP residents face off in cooking competition samsung galaxy s11 leaked 3 / 4 Advanced SystemCare 7 Ultimate Serial Keys are Here ! Samsung will be releasing two devices to add to its Galaxy J low-range smartphone series - the Galaxy J5 and the Galaxy J7: according to ... -

List of Smartphones Compatible with Airkey System

List of smartphones compatible with AirKey system Android Unlocking Maintenance tasks Unlocking Maintenance tasks Android smartphone Model number Media updates via NFC version via NFC via NFC via Bluetooth via Bluetooth Asus Nexus 7 (Tablet) Nexus 7 5.1.1 ✔ ✔ ✔ – – Blackberry PRIV STV100-4 6.0.1 ✔ ✔ ✔ ✔ ✔ CAT S61 S61 9 ✔ ✔ ✔ ✔ ✔ Doro 8035 Doro 8035 7.1.2 – – – ✔ ✔ Doro 8040 Doro 8040 7.0 – – – ✔ ✔ Google Nexus 4 Nexus 4 5.1.1 ✔ X ✔ – – Google Nexus 5 Nexus 5 6.0.1 ✔ ✔ ✔ ✔ ✔ Google Pixel 2 Pixel 2 9 X X X ✔ ✔ Google Pixel 4 Pixel 4 10 ✔ ✔ ✔ ✔ ✔ HTC One HTC One 5.0.2 ✔ ✔ X – – HTC One M8 HTC One M8 6.0 ✔ ✔ X ✔ ✔ HTC One M9 HTC One M9 7.0 ✔ ✔ ✔ ✔ ✔ HTC 10 HTC 10 8.0.0 ✔ X X ✔ ✔ HTC U11 HTC U11 8.0.0 ✔ ✔ ✔ ✔ ✔ HTC U12+ HTC U12+ 8.0.0 ✔ ✔ ✔ ✔ ✔ HUAWEI Mate 9 MHA-L09 7.0 ✔ ✔ ✔ ✔ ✔ HUAWEI Nexus 6P Nexus 6P 8.1.0 ✔ ✔ ✔ ✔ ✔ HUAWEI P8 lite ALE-L21 5.0.1 ✔ ✔ ✔ – – HUAWEI P9 EVA-L09 7.0 ✔ ✔ ✔ ✔ ✔ HUAWEI P9 lite VNS-L21 7.0 ✔ ✔ ✔ ✔ ✔ HUAWEI P10 VTR-L09 7.0 ✔ ✔ ✔ ✔ ✔ HUAWEI P10 lite WAS-LX1 7.0 ✔ ✔ ✔ ✔ ✔ HUAWEI P20 EML-L29 8.1.0 ✔ ✔ ✔ ✔ ✔ HUAWEI P20 lite ANE-LX1 8.0.0 ✔ X ✔ ✔ ✔ HUAWEI P20 Pro CLT-L29 8.1.0 ✔ ✔ ✔ ✔ ✔ HUAWEI P30 ELE-L29 10 ✔ ✔ ✔ ✔ ✔ HUAWEI P30 lite MAR-LX1A 10 ✔ ✔ ✔ ✔ ✔ HUAWEI P30 Pro VOG-L29 10 ✔ ✔ ✔ ✔ ✔ LG G2 Mini LG-D620r 5.0.2 ✔ ✔ ✔ – – LG G3 LG-D855 5.0 ✔ X ✔ – – LG G4 LG-H815 6.0 ✔ ✔ ✔ ✔ ✔ LG G6 LG-H870 8.0.0 ✔ X ✔ ✔ ✔ LG G7 ThinQ LM-G710EM 8.0.0 ✔ X ✔ ✔ ✔ LG Nexus 5X Nexus 5X 8.1.0 ✔ ✔ ✔ ✔ X Motorola Moto X Moto X 5.1 ✔ ✔ ✔ – – Motorola Nexus 6 Nexus 6 7.0 ✔ X ✔ ✔ ✔ Nokia 7.1 TA-1095 8.1.0 ✔ ✔ X ✔ ✔ Nokia 7.2 TA-1196 10 ✔ ✔ ✔ -

PENGARUH INOVASI, HARGA, DAN CITRA MEREK TERHADAP KEPUTUSAN PEMBELIAN PRODUK HANDPHONE SAMSUNG Studi Kasus Pada Mahasiswa/I Universitas Sanata Dharma

PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI PENGARUH INOVASI, HARGA, DAN CITRA MEREK TERHADAP KEPUTUSAN PEMBELIAN PRODUK HANDPHONE SAMSUNG Studi Kasus pada Mahasiswa/i Universitas Sanata Dharma Proposal Penelitian Diajukan dalam Rangka Menulis Skiripsi Program Studi Manajemen, Jurusan Manajemen Fakultas Ekonomi, Universitas Sanata Dharma Oleh : Martinus Yogas Pranoto NIM : 142214139 PROGRAM STUDI MANAJEMEN JURUSAN MANAJEMEN FAKULTAS EKONOMI UNIVERSITAS SANATA DHARMA YOGYAKARTA 2018 PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI MOTTO Kerahkan hati, pikiran, dan jiwamu ke dalam aksimu yang paling kecil sekalipun. Inilah rahasia kesuksesan. (Swami Sivananda) We will never know the real answer, before you try (Darwin Scot) Skripsi ini saya persembahkan untuk: Tuhan Yesus Kristus, atas berkat dan kasih-Nya Papa, Mama, dan keluarga, untuk seluruh kasih sayang dan dukungan baik moral dan materiil yang tak terbatas Sahabat-sahabatku tersayang atas hiburan, semangat, dan dukungan Almamater tercinta Universitas Sanata Dharma Yogyakarta iv PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI UNIVERSITAS SANATA DHARMA FAKULTAS EKONOMI JURUSAN MANAJEMEN-PROGRAM STUDI MANAJEMEN PERNYATAAN KEASLIAN KARYA TULIS Saya yang bertanda tangan di bawah ini, dengan ini menyatakan bahwa Skripsi dengan judul: PENGARUH INOVASI, HARGA DAN CITRA MEREK TERHADAP KEPUTUSAN PEMBELIAN PRODUK HANDPHONE SAMSUNG (Studi Kasus pada Mahasiswa/i Universitas Sanata Dharma Yogyakarta) dan diajukan untuk diuji pada tanggal