Concept Note & Agenda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Seylan Bank PLC 12 Analysis of Loans & Advances , Commitments, Contingencies and Impairment

Seylan Bank PLC Interim Financial Statements For the 03 Months Ended 31st March 2020 Commentary on Financials Q1- 2020 Seylan recorded a Profit after tax of Rs. 902 Million in Q1 despite challenging market conditions. Net interest income increased by 7.28% during the 1Q 2020 while net fee and commission income from core banking activities witnessed an increase of 2% to reach Rs. 986 Million in 1Q 2020 as compared to Rs. 966 Million for the comparative period. Other income captions comprising of net gains from trading activities, fair value changes of financial instruments, gains on foreign exchange transactions and other operating income was reported as a net gain of Rs. 415 Million compared to net gain of Rs. 368 Million in 1Q 2019. Impairment charges for the period reached Rs. 1,116 Million, which is 89.41% increase as compared to a charge of Rs. 589 Million in Q1 2019. Total Expenses recorded an increase of 5.27% from Rs. 3,098 Million in the 1Q of the previous year to Rs. 3,261 Million during the period under review. Gross Loans and advances portfolio of the Bank recorded a marginal growth of Rs. 613 Million during the 1Q 2020 and the net position recorded a negative growth of Rs. 228 Million. The overall deposit base recorded a marginal growth of 1.56% to Rs. 407,002 Million by 1Q 2020 while Bank’s CASA ratio (Current and Savings) stood 28%. Further, the total Time Deposits increased slightly from 71.61% by end of year 2019 to 72.06% as at 31st March 2020 of the total deposits base. -

TAX UPDATE for Clients of KPMG in Sri Lanka Extension of VAT

TAX UPDATE For clients of KPMG in Sri Lanka Extension of VAT deferment facility and temporary registration The Department of Inland Revenue (“DIR”) had issued a notice (PN/VAT/2020-03) dated 26th March 2020 informing all tax payers that due to the prevailing situation in the country consequent to the outbreak of COVID-19, an extension of validity periods for VAT deferment facility related letters and Temporary VAT registration has been granted, which we have notified via our tax alert dated 27th March 2020. The DIR has now issued the attached notice (PN/VAT/2020-05) dated 28th April 2020, granting a further extension of the validity periods for VAT deferment facility related letters and Temporary VAT registration up to 30th June 2020. You may click on the link below to access the notice published by the DIR: http://www.ird.gov.lk/en/Lists/Latest%20News%20%20Notices/Attachments/242/VAT280420 20_E.pdf Online tax payments The DIR has via the previous notice (PN/PMT/2020-1) dated 8th April 2020 intimated the availability of an online tax payment method. They have now updated this notice informing that if a taxpayer uses the Real Time Gross Settlement System (“RTGS”), the taxpayer should contact an officer of the DIR, using the contact details provided in the notice, to obtain instructions for performing same. You may click on the link below to access the updated notice published by the DIR: http://www.ird.gov.lk/en/Lists/Latest%20News%20%20Notices/Attachments/236/PYMT0804 2020_E.pdf Follow us on, KPMG Sri Lanka @kpmgsl www.home.kpmg/lk The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. -

Zcrds7bwnaxnnr6retzcgvpz

This paradox in airline jargon truly describes the year Contents gone by for Seylan Bank. In a year of challenge for the Bank and the industry, the saying illustrates the premise of opportunity that lies within challenge. 1 About 2 About Seylan The Bank dug deep, propelled by the strength this Report of its core values and ethos to remain strong and Financial Our Value Annual Report 2019 4 Highlights 6 Creation Strategy Headwinds resilient for the years ahead. 6... Letter from the Chairman 8... Letter from the Director/CEO Seylan Bank PLC Seylan Bank PLC Events Our Value 11 of the Year 12 Creation Model 14... How We Create Value 15... Why We Create Value 16... What Creates Value Headwinds Our Value Sustainable 23 Creation Story 76 Stewardship 23... The Context 76... Board of Directors 26... Financial Value Creation 80... Senior Management in 36... Sustainability Assurance Report 84... Corporate Governance Tailwinds 38... Informed Investors 123... Risk Management 42... Satised Customers 50... Motivated Employees 61... Trusted Partners 64... Responsible Corporate Citizenship 70... Environmental Stewardhip Annual Report 2019 Sustainable Annexes 148 Results 245 149... Financial Calendar 246... Ten Years at a Glance 150... Statement of Directors' Responsibility 247... Summary of Performance Indicators for Financial Reporting 248... Statement of Comprehensive Income in USD 151... Chief Executive Ofcer's and Chief 249... Statement of Financial Position in USD Financial Ofcer's responsibility Statement 250... Investor Information 152... Independent Auditors’ Report 254... Seylan Bank - Debentures 155... Income Statement 255... Branch and ATM Network 156... Statement of Prot or Loss and Other Comprehensive Income 256.. -

Lankaclear (Private) Limited Annual Report 2020/21 Annual Report 2020/21 Lankaclear (Private) Limited 1 Lankaclear (Private) Limited Annual Report 2020/21 2

LankaClear (Private) Limited Annual Report 2020/21 Annual Report 2020/21 LankaClear (Private) Limited 1 LankaClear (Private) Limited Annual Report 2020/21 2 To revolutionize the transport sector in the country, we unveiled the 2in1 payment card technology to enable ‘Tap and Go’ payment capability in public transport. Ensuring a Quantum Leap in the Transport Sector, this is a pioneering effort to introduce an innovative technology of a single payment card with online and offline capabilities to provide convenience to commuters of public transport. You may get a glimpse of the Sri Lanka Transit Card experience by enabling NFC access in your Smart Phone and tapping the phone on the LankaPay card on the cover page of this year’s annual report. LankaClear has always been in the forefront of understanding consumer needs to make their lives and work seamless by providing real-time and secure transactions. In fact, we are well on our way to integrate THEďLATESTďȶNANCIALďSERVICEďINNOVATIONďTHATďWILLďPOSITIVELYď impact the lives of a majority of Sri Lankans via our 2 INďď0AYMENTď#ARDď7ITHďAďDYNAMICďSHIȺďINďCONSUMERď behaviour and how companies analyse the metrics of online engagement, our services have become indispensable. Our enviable track record shows that we have always strived to bring world-class technology, speed and convenience to a new breed of digital consumers to meet THEIRďDEMANDINGďEXPECTATIONSďINďACCESSINGďȶNANCIALď services. Similarly, we are making traditional brick mortar business a piece of history by bringing the future ever -

Downloaded from the Website of the Bank ( Or from the Web Site of the CSE (

PROSPECTUS AN INITIAL ISSUE OF UP TO FIFTY MILLION (50,000,000) DEBENTURES OF BASEL III COMPLIANT TIER 2 LISTED RATED UNSECURED SUBORDINATED REDEEMABLE FIVE YEAR DEBENTURES (2021/2026) WITH NON-VIABILITY CONVERSION OF THE PAR VALUE OF SRI LANKAN RUPEES ONE HUNDRED (LKR 100/-) EACH BY SEYLAN BANK PLC WITH AN OPTION TO ISSUE UP TO A FURTHER TEN MILLION (10,000,000) OF THE SAID DEBENTURES IN THE EVENT OF AN OVERSUBSCRIPTION OF THE INITIAL ISSUE TO RAISE UPTO A MAXIMUM OF SIXTY MILLION (60,000,000) OF SAID DEBENTURES IN TOTAL TO BE LISTED ON THE COLOMBO STOCK EXCHANGE Rated “BBB+(lka)” BY FITCH RATINGS LANKA LIMITED ISSUE IS LIMITED FOR “QUALIFIED INVESTORS” AS DEFINED HEREIN ISSUE OPENS ON 05 APRIL 2021 JOINT MANAGERS TO THE ISSUE SEYLAN BANK PLC - DEBENTURE ISSUE 2021 i By acquiring any Debentures, each Debenture Holder who applied for such debentures irrevocably consents to the principal amount of the Debenture and any accrued and unpaid interest thereon being deemed paid in full by the issuance of ordinary voting shares upon occurrence of a Trigger Event and the resulting Non- viability Conversion required to be effected by the the Issuer, Seylan Bank PLC (“The Bank”). Upon a Non-Viability Conversion; i. The Trustee shall not be required to take any further directions from holders/ beneficial owners of the Debentures under the Trust Deed and ii. The Trust Deed shall impose no duties upon the Trustee whatsoever with respect to conversion of the Debentures into ordinary voting shares upon a Trigger Event iii. Upon the occurrence of a Trigger Event, each outstanding Debenture of this issue will be converted, on a full and permanent basis We advise you to read the contents of the Prospectus carefully prior to investment. -

Acuity Stockbrokers Research | Sri Lanka Equities

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 22 May 2020 ASPI Gains 361 Points amid Heavy Local Buying Indices vs. Turnover (18th May – 22nd May) Interest… S&P Downgrades Credit Rating to 'B- Stable' 5,000 ASPI 2,300 ASPI ^ 8.13% | S&P SL20 ^ 15.89% S&P SL20 4,900 2,200 S&P SL20 S&P 4,800 2,100 ASPI The Bourse ended the week… Cont. P2 4,700 2,000 4,600 1,900 Foreign investors closed the week... Cont. P3 4,500 1,800 18-Mar19-Mar20-Mar21-Mar22-Mar 2.50 Sri Lankan equities reversed ….… Cont. P4 2.00 1.50 1.00 LKR Bn) LKR (Turnover 0.50 Economic Snapshot………… P5 0.00 18-Mar 19-Mar 20-Mar 21-Mar 22-Mar KEY STATISTICS Week ending 22-May 15-May +/- ASPI 4,799.89 4,439.04 8.13% S&P SL20 2,034.38 1,755.51 15.89% Banks 507.01 435.44 16.44% Capital Goods 613.52 528.92 15.99% Food, Beverage & Tobacco 704.89 667.23 5.64% Consumer Durables & Apparel 649.76 583.51 11.35% Materials 514.33 483.50 6.38% Diversified Financials 711.04 654.33 8.67% Turnover (LKR Bn) 8.05 9.61 -16.24% Foreign Buying (LKR Mn) 593.11 1,588.91 -62.67% Foreign Selling (LKR Mn) 3,996.15 5,098.28 -21.62% Daily Average Turnover (LKR Bn) 1.61 1.92 -16.24% Daily Average Foreign Buying (LKR Mn) 118.62 317.78 -62.67% Daily Average Foreign Selling (LKR Mn) 799.23 1,019.66 -21.62% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change TEA SMALLHOLDER TSMLN 20.0 32.5 62.5% INDUSTRIAL ASPH.* ASPHNN 388.4 0.2 -99.9% BROWNS INVSTMNTS BIL N 2.1 3.2 52.4% BLUE DIAMONDS[NV] BLUEX 0.3 0.2 -

Assessment of Auction Mechanism

Additional Financing of Small and Medium-Sized Enterprises Line of Credit Project (RRP SRI 49273-002) ASSESSMENT OF AUCTION MECHANISM A. Introduction 1. The original project introduced an auction to allocate the funds among the participating banks. The auctions created a framework where banks made a disbursement commitment and incurred a financial penalty if that disbursement was not achieved. 2. The project conducted two auctions. In the first, National Development Bank (NDB) won the entire $12.5 million available. In the second, the funds were evenly divided among three institutions. 3. The project had planned to review the auction mechanism after the second auction, at which time Asian Development Bank (ADB) and the government would decide whether to continue with the auction or to introduce a more conventional allocation system. Following this review, the government requested the latter so that more banks could participate. 4. Although appreciating the government’s reasons for requesting the cancellation, the project team was overall pleased with the auction’s performance, and the objective of this appendix is to capture any lessons that could be applied to future auction systems. B. Lessons 1. Dominance by a Subset of Banks 5. The government was correct that the auction limited participation. After NDB won all the funds during the first auction, ADB and the government agreed to cap the amount any bank could win to a third of available funds. 6. Despite these changes, the bidding pattern of the first two auctions suggested that a subset of banks would dominate the auctions. Indeed, the same four banks finished in the top five of both rounds (Table 1). -

Pn/Pmt/2020-1 08.04.2020

PN/PMT/2020-1 08.04.2020 INLAND REVENUE DEPARTMENT Notice to Taxpayers Alternative Tax Payment System (ATPS) through Online Fund Transfer Facility Taking in to account of the Covid -19 Endemic situation currently prevailing in the country, the Inland Revenue Department (IRD) has introduced an Alternative Tax Payment System (ATPS) for making tax payments through Online Fund Transfer Facility, with the collaboration of specific banks, with effect from 08-04-2020. Hence, all taxpayers are hereby informed to adhere to the following instructions in making tax payments until further notice. The ATPS is available only with the online banking facilities of the banks designated in the below Table 01. The respective banks will provide to include relevant information for making online fund transfers for tax payments. Therefore, taxpayers are kindly requested to refrain from making online fund transfers in respect of tax payments through any other bank other than those listed below. In case you attempt to make online tax payments through any other bank, such payments will not be posted to your ledger in IRD’s RAMIS. Table – 01 - Banks providing Online Banking Facility for ATPS 01. Bank of Ceylon (BOC) 02. People’s Bank 03. Commercial Bank of Ceylon PLC 04. Nations Trust Bank PLC (NTB) 05. Sampath Bank PLC 06. HSBC 07. Cargills Bank Limited 08. National Development Bank (NDB) 09. Standard Chartered Bank (SCB) 10. Seylan Bank PLC 11. Hatton National Bank PLC (HNB) 12. Citibank 13. Deutsche Bank 14. Pan Asia Bank PLC 15. DFCC Bank PLC 1 Steps to follow in making online fund transfers in respect of tax payments 1. -

View Annual Report 2020

NATIONS TRUST BANK PLC – ANNUAL REPORT 2020 creating velocity of value www.nationstrust.com contents OUR BUSINESS AND LEADERSHIP CAPITAL MANAGEMENT FINANCIAL STATEMENTS About Us ..............................................................................................2 Financial Capital ........................................................................31 Directors’ Responsibility for Overview ..............................................................................................3 Digital Capital ............................................................................. 33 Financial Reporting .......................................................83 Performance Highlights .......................................................4 Manufactured Capital.........................................................35 Independent Auditors’ Report ......................................84 Non-Financial Highlights ...................................................5 Intellectual Capital..................................................................36 Statement of Financial Position ................................88 Chairman’s Message...............................................................8 Human Capital ........................................................................... 37 Statement of Profit or Loss .......................................... 89 Chief Executive Officer’s Review .................................10 Social and Relationship Capital ...................................41 Statement of Comprehensive Income -

1610452082-Seylan-Bank-PLC -Interim-Financials-For-Q3-2020.Pdf

Seylan Bank PLC Interim Financial Statements For the 09 Months Ended 30th September 2020 Seylan Bank records a Rs. 2.2Bn Profit after Tax (PAT) Q3 2020 - YoY reduction 12% Seylan Bank recorded Profit after Tax of Rs. 2,222 Million for the 9 months ended 30th September 2020 against Rs. 2,524 Million reported in the corresponding period of 2019, a decrease of approximately 12%. The decline in profitability is attributed to adverse market conditions brought about largely by the impact of Covid-19 on the economy. Although the Bank’s Net Interest Income increased from Rs. 13,774 Million in 2019 to Rs. 14,872 Million, a 7.98% increase for the 9 months ended 30th September 2020 due to lower interest costs, the net fee-based income (including commission income) decreased by 15.04% from Rs. 3,082 Million in 2019 to Rs. 2,618 Million in 2020 mainly due to Covid-19 induced restrictions on Trade Finance and related activities, as well as lower volumes in bank guarantees. The fees from card related businesses too declined with numerous waivers granted to consumers under relief measures. Other income comprising of net gains from trading activities, fair value changes of financial assets, gains on foreign exchange transactions and other operating income increased by 57.78 % a net gain from Rs. 1,144 Million in 2019 to a net gain of Rs. 1,805 Million in 2020. Total Expenses recorded a marginal increase of 0.25 % from Rs 9,496 Million in Q3 of the previous year to Rs 9,520 Million for the 9 months ended 30th September 2020. -

DFCC Bank PLC Annual Report 2016.Pdf

Going beyond conventional reporting, we have implemented a About this Report more current format for reporting and have upgraded our corporate website with a focus on investor relations, supplemented by an investor relations app for smart phones and other devices. This is an integrated annual report and is a compact Reporting Period disclosure on how our strategy, governance, performance and prospects have resulted in the The DFCC Bank Annual Report for 2016 covers the 12 month period from 01 January 2016 to 31 December 2016 and is reflective of the creation of sustainable value within our operating change in the financial year-end implemented in 2015. The previous environment. annual report covered the nine month period from 01 April 2015 to 31 December 2015 and is available on the company website Value Creation and Capital Formation (www.dfcc.lk). Some of the Group entities have a 31 March financial year-end and they are consolidated with DFCC Bank’s reporting The ability of an organisation to create sustainable value for itself period with a three month time lag. A summary of the accounting depends on the value it creates for its stakeholders, making value periods covered by the Statement of Profit and Loss and Other creation essentially a two-way process. In fact, the more value an Comprehensive Income in the Bank and the Group columns is given organisation creates, the more value it is able to create for itself. in the Financial Report (page 136). Therefore firms spend substantial resources on creating and maintaining relationships with their stakeholders. Value creation leads to capital formation. -

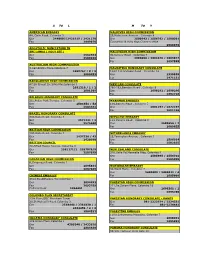

Lanka Mini Directory.Pdf

A TO L M TO Y AMERICAN EMBASSY MALDIVES HIGH COMMISSION 44, Galle Road. Colombo 3 25,Melbourne Avenue . Colombo 4 Gen 2448007/2421919 / 2421270 Gen 2500943 / 2586762 / 2500301 Fax 2449070 Counsellor & Actg High Comsr's office 2580076 APOSTOLIC NUNCIATURE IN SRI LANKA ( HOLY SEE ) MALAYSIAN HIGH COMMISSION Gen 2582554 92,Kynsey Road . Colombo 7 Fax 2580906 Gen 2686090 / 2692479 / 2693877 Fax 2697555 AUSTRALIAN HIGH COMMMISSION 3,Cambridge Place.Colombo 7 MAURITIUS HONORARY CONSULATE Gen 2698767 / 8 / 9 104/11,Grandpass Road . Colombo 14 Fax 2686453 Gen 2330859 Fax 2471131 BANGLADESH HIGH COMMISSION 47,Sir Ernest De Silva Mw.Colombo 7 MEXICAN CONSULATE Gen 2681310 / 1 / 2 760-762,Baseline Road . Colombo 9 Fax 2681309 Gen 2698292 / 2698296 Fax 2692728 BELGIUM HONORARY CONSULATE 3/1,Police Park Terrace. Colombo 5 MYANMAR EMBASSY Gen 2504351 / 53 108,Barnes Place . Colobmo 7 Fax 2504352 Gen 2681197 / 2672197 Fax 2681196 BRAZIL HONORARY CONSULATE 300,Galle Road. Colombo 3 NEPALESE EMBASSY Gen 2577431 / 2 153,Kynsey Road . Colombo 8 Fax 2575440 Gen 2689656 / 7 Fax 2689655 BRITISH HIGH COMMISSION 190,Galle Road. Colombo 3 NETHERLANDS EMBASSY Gen 2437336 / 43 25,Torrington Avenue . Colombo 7 Fax 2430308 Gen 2596914 BRITISH COUNCIL Fax 2502855 49,Alfred House Avenue. Colombo 3 Gen 2581171/2 2587078/9 NEW ZEALAND CONSULATE Fax 2587079 329,Galle Rd,Meewella Bldg. Colombo 4 Gen 2585995 / 2556701 CANADIAN HIGH COMMISSION Fax 2585995 6,Gregory;s Road. Colombo 7 Gen 2695841 NORWEGIAN EMBASSY Fax 2687049 34,Ward Place . Colobmo 7 Gen 2469609 / 2469611 / 4 CHINESE EMBASSY Fax 2695009 381A.Bauddhaloka Mw.Colombo 7 Gen 2694491 PAKISTAN HIGH COMMISSION Fax 2693799 211,De Saram Place.